444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States IT outsourcing market represents one of the most dynamic and rapidly evolving sectors in the global technology landscape. This comprehensive market encompasses a wide range of services including application development, infrastructure management, cloud services, cybersecurity, and digital transformation initiatives. American enterprises are increasingly leveraging IT outsourcing to enhance operational efficiency, reduce costs, and access specialized expertise that may not be available internally.

Market dynamics indicate robust growth driven by digital transformation initiatives across industries. The sector has experienced significant expansion with a compound annual growth rate (CAGR) of 8.2% over recent years, reflecting the increasing reliance on external technology partners. Cloud adoption has emerged as a primary catalyst, with organizations seeking specialized providers to manage complex cloud migrations and hybrid infrastructure environments.

Geographic distribution shows concentrated activity in major metropolitan areas including Silicon Valley, New York, Austin, and Seattle, while emerging tech hubs in cities like Denver, Atlanta, and Nashville are gaining prominence. The market demonstrates strong resilience and adaptability, particularly evident during recent global disruptions when remote work capabilities became essential for business continuity.

The United States IT outsourcing market refers to the comprehensive ecosystem where American businesses contract external service providers to handle various information technology functions, ranging from basic infrastructure management to complex digital transformation projects. This market encompasses both domestic and international service providers delivering technology solutions to US-based organizations across all industry verticals.

IT outsourcing in the United States context involves the strategic delegation of technology operations, development, and support functions to specialized third-party providers. These arrangements can include offshore, nearshore, and onshore delivery models, each offering distinct advantages in terms of cost optimization, talent access, and service quality. The market includes various engagement models such as project-based contracts, managed services, staff augmentation, and comprehensive technology partnerships.

Service categories within this market span application development and maintenance, infrastructure management, cloud services, cybersecurity, data analytics, artificial intelligence implementation, and emerging technology integration. The market serves organizations of all sizes, from startups seeking rapid scaling capabilities to large enterprises requiring comprehensive technology transformation support.

Strategic transformation defines the current state of the United States IT outsourcing market, with organizations increasingly viewing external technology partnerships as essential components of their competitive strategy. The market has evolved beyond traditional cost-reduction models to embrace innovation-driven partnerships that enable access to cutting-edge technologies and specialized expertise.

Digital acceleration initiatives represent the primary growth driver, with 72% of organizations reporting increased outsourcing investments to support cloud migration, artificial intelligence implementation, and cybersecurity enhancement. The market demonstrates strong momentum across multiple service categories, with cloud services and cybersecurity showing particularly robust demand patterns.

Competitive landscape features a diverse mix of global technology giants, specialized boutique providers, and emerging niche players. Market consolidation through strategic acquisitions continues to reshape the provider ecosystem, while new entrants focus on emerging technologies such as artificial intelligence, machine learning, and blockchain implementation services.

Regional dynamics show sustained growth across all major US markets, with technology hubs experiencing accelerated demand for specialized services. The market benefits from strong domestic economic conditions, continued technology investment, and favorable regulatory environments that support innovation and digital transformation initiatives.

Technology evolution drives fundamental changes in outsourcing requirements, with organizations seeking partners capable of delivering advanced capabilities in artificial intelligence, machine learning, and automation. The following key insights define the current market landscape:

Market maturation reflects in sophisticated service delivery models that combine multiple technologies and delivery approaches. Organizations increasingly seek comprehensive technology partners capable of supporting end-to-end digital transformation journeys rather than point solutions for specific technology challenges.

Digital transformation imperatives serve as the primary catalyst for IT outsourcing growth in the United States market. Organizations across industries recognize the need for rapid technology modernization to maintain competitive positioning and meet evolving customer expectations. This transformation requires access to specialized expertise and advanced technology capabilities that may not be economically feasible to develop internally.

Cost optimization strategies continue to influence outsourcing decisions, though the focus has evolved from simple labor arbitrage to value-based partnerships that deliver measurable business outcomes. Organizations seek providers that can demonstrate clear return on investment through improved operational efficiency, reduced time-to-market, and enhanced service quality.

Talent scarcity in critical technology areas drives outsourcing adoption, particularly for emerging technologies such as artificial intelligence, cybersecurity, and cloud architecture. The competitive talent market makes it challenging for organizations to recruit and retain specialized professionals, making external partnerships an attractive alternative for accessing required capabilities.

Scalability requirements support outsourcing growth as organizations need flexible capacity management to handle varying workloads and project demands. External providers offer the ability to scale resources up or down based on business requirements without the fixed costs associated with internal team expansion.

Innovation acceleration motivates partnerships with providers that bring cutting-edge technologies and best practices from across their client base. Organizations benefit from exposure to innovative approaches and proven methodologies that accelerate their own digital transformation initiatives.

Security concerns represent the most significant challenge facing the IT outsourcing market, with organizations expressing heightened sensitivity about data protection and intellectual property security. High-profile security breaches and increasing regulatory requirements create additional complexity in vendor selection and contract management processes.

Quality control challenges emerge when organizations struggle to maintain service standards across distributed delivery models. Communication gaps, cultural differences, and varying quality standards can impact project outcomes and client satisfaction, particularly in complex technology implementations.

Vendor dependency risks concern organizations that become overly reliant on external providers for critical technology functions. This dependency can limit flexibility, increase switching costs, and create potential business continuity risks if provider relationships deteriorate or service quality declines.

Regulatory compliance complexity increases in regulated industries where organizations must ensure that outsourcing arrangements meet strict compliance requirements. Industries such as healthcare, financial services, and government face additional challenges in managing regulatory obligations across outsourcing relationships.

Hidden costs can emerge through contract management, transition expenses, and ongoing governance requirements that may not be fully anticipated during initial vendor selection processes. These additional costs can erode the expected financial benefits of outsourcing arrangements.

Emerging technology integration presents substantial opportunities for IT outsourcing providers to differentiate their services through specialized capabilities in artificial intelligence, machine learning, blockchain, and Internet of Things implementations. Organizations seek partners with proven expertise in these advanced technologies to accelerate their innovation initiatives.

Industry-specific solutions offer growth potential for providers that develop deep vertical expertise in sectors such as healthcare, financial services, manufacturing, and retail. Specialized knowledge of industry regulations, business processes, and technology requirements enables providers to deliver more targeted and valuable services.

Hybrid delivery models create opportunities for innovative service approaches that combine onshore, nearshore, and offshore capabilities to optimize cost, quality, and risk management. Organizations increasingly seek flexible delivery models that can adapt to changing business requirements and market conditions.

Automation services represent a high-growth opportunity as organizations seek to implement robotic process automation, intelligent document processing, and automated testing capabilities. Providers with strong automation expertise can help clients achieve significant operational efficiency improvements.

Cybersecurity specialization offers substantial growth potential given increasing threat landscapes and regulatory requirements. Specialized security services including threat monitoring, incident response, and compliance management show strong demand across all industry sectors.

Competitive intensity continues to increase as traditional IT service providers compete with cloud-native companies, consulting firms, and specialized technology providers. This competition drives innovation in service delivery models, pricing strategies, and technology capabilities, ultimately benefiting client organizations through improved service options.

Technology disruption reshapes market dynamics as artificial intelligence, automation, and cloud technologies change the fundamental nature of IT services. Providers must continuously invest in new capabilities and retrain their workforce to remain competitive in this rapidly evolving landscape.

Client expectations have evolved significantly, with organizations demanding greater transparency, measurable outcomes, and strategic partnership approaches rather than traditional vendor relationships. This shift requires providers to develop more sophisticated engagement models and demonstrate clear business value.

Regulatory environment influences market dynamics through data protection requirements, industry-specific compliance mandates, and international trade policies. Providers must navigate complex regulatory landscapes while maintaining service quality and cost competitiveness.

Economic factors impact outsourcing decisions through budget constraints, investment priorities, and risk management considerations. Economic uncertainty can both drive outsourcing adoption as organizations seek cost flexibility and constrain growth as budgets tighten.

Comprehensive analysis of the United States IT outsourcing market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, technology leaders, and procurement professionals across various industry sectors to understand current trends, challenges, and future requirements.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and technology trend studies to provide quantitative context for market dynamics. This approach ensures that findings reflect both current market conditions and emerging trends that may impact future development.

Market segmentation analysis examines service categories, delivery models, industry verticals, and geographic regions to identify growth patterns and opportunity areas. This detailed segmentation provides insights into market dynamics at granular levels that inform strategic decision-making.

Competitive landscape assessment evaluates provider capabilities, market positioning, and strategic initiatives to understand competitive dynamics and identify market leaders. This analysis includes both established providers and emerging companies that may disrupt traditional market structures.

Trend analysis incorporates technology evolution, regulatory changes, and economic factors to project future market development. This forward-looking perspective helps stakeholders understand potential opportunities and challenges that may emerge in the market.

West Coast dominance continues to characterize the United States IT outsourcing market, with California representing approximately 35% of total market activity. Silicon Valley remains the epicenter of technology innovation and outsourcing demand, driven by the concentration of technology companies, startups, and venture capital investment in the region.

East Coast markets show strong growth, particularly in New York, Boston, and Washington DC metropolitan areas. The financial services sector drives significant demand in New York, while government and defense contractors create substantial opportunities in the Washington DC region. Boston’s concentration of healthcare and biotechnology companies generates specialized outsourcing requirements.

Texas emergence as a major technology hub has created substantial outsourcing opportunities, with Austin, Dallas, and Houston showing rapid growth in IT services demand. The state’s business-friendly environment and growing technology sector contribute to 12% market share in national outsourcing activity.

Midwest expansion reflects the region’s manufacturing base modernization and financial services concentration in Chicago. Traditional industries are increasingly adopting digital technologies, creating new outsourcing opportunities for providers with industrial and manufacturing expertise.

Southeast growth accelerates in cities like Atlanta, Charlotte, and Miami, driven by corporate relocations and expanding technology sectors. The region benefits from favorable business climates and growing talent pools that support both client demand and service provider operations.

Market leadership remains distributed among several categories of providers, each with distinct competitive advantages and market positioning strategies. The competitive landscape includes global technology giants, specialized service providers, and emerging niche players that focus on specific technologies or industry verticals.

Competitive differentiation increasingly focuses on specialized capabilities, industry expertise, and innovative delivery models rather than traditional cost competition. Providers invest heavily in emerging technologies, talent development, and strategic partnerships to maintain competitive positioning.

Market consolidation continues through strategic acquisitions as larger providers seek to expand capabilities and geographic reach. This consolidation trend creates opportunities for specialized providers that can offer unique value propositions in specific technology areas or industry verticals.

Service-based segmentation reveals distinct growth patterns across different categories of IT outsourcing services. Application development and maintenance continues to represent the largest segment, while cloud services and cybersecurity show the highest growth rates.

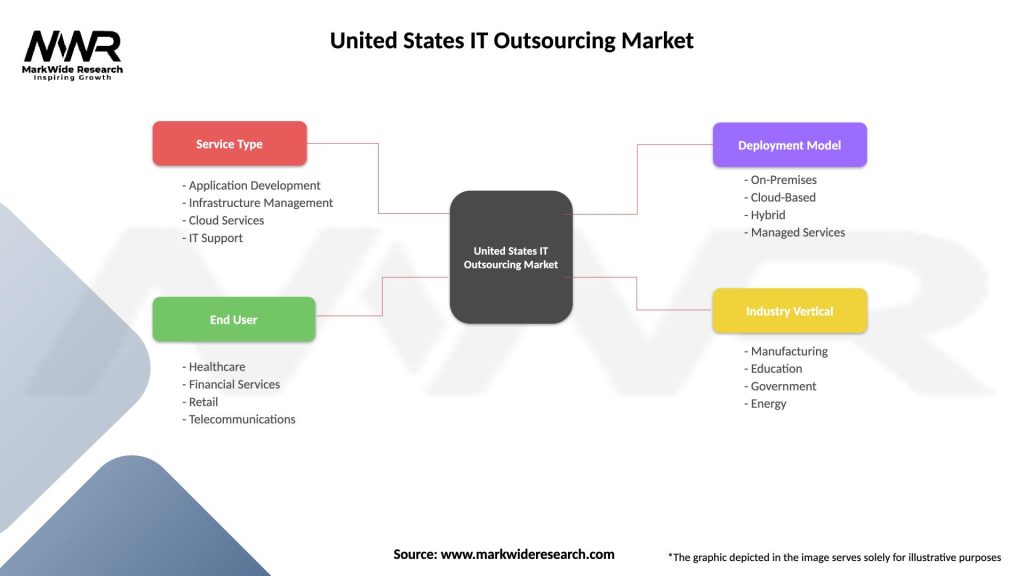

By Service Type:

By Delivery Model:

By Industry Vertical:

Application Development remains the cornerstone of IT outsourcing services, with organizations increasingly seeking partners capable of delivering modern, cloud-native applications. The shift toward microservices architecture, containerization, and DevOps practices requires providers to continuously update their technical capabilities and development methodologies.

Cloud Services represent the fastest-growing category, driven by widespread cloud adoption and digital transformation initiatives. Organizations require specialized expertise for cloud migration, multi-cloud management, and cloud-native application development. The complexity of hybrid cloud environments creates opportunities for providers with comprehensive cloud capabilities.

Cybersecurity Services show exceptional growth as organizations face increasing threat landscapes and regulatory requirements. Specialized security services including managed security operations centers, threat intelligence, and incident response capabilities are in high demand across all industry sectors.

Data Analytics services gain prominence as organizations seek to leverage data for competitive advantage. Advanced analytics, machine learning implementation, and real-time data processing capabilities require specialized expertise that many organizations prefer to outsource rather than develop internally.

Infrastructure Management evolves toward software-defined infrastructure and automation-driven operations. Traditional hardware-focused services transition to cloud infrastructure management and automated operations that require different skill sets and service delivery approaches.

Cost optimization remains a fundamental benefit of IT outsourcing, though the focus has evolved from simple labor cost reduction to comprehensive total cost of ownership improvements. Organizations achieve cost benefits through economies of scale, shared infrastructure, and optimized resource utilization that external providers can deliver.

Access to expertise provides organizations with specialized capabilities that may not be economically feasible to develop internally. This access is particularly valuable for emerging technologies where skilled professionals are scarce and expensive to recruit and retain.

Scalability and flexibility enable organizations to adjust their technology capabilities based on business requirements without the fixed costs and complexity of internal team management. This flexibility is especially valuable for organizations with variable workloads or seasonal business patterns.

Risk mitigation occurs through shared responsibility models where external providers assume certain technology and operational risks. Professional service providers typically have more robust disaster recovery, security, and compliance capabilities than individual organizations can maintain independently.

Innovation acceleration results from exposure to best practices, cutting-edge technologies, and proven methodologies that providers bring from their broader client experience. Organizations benefit from innovations developed across the provider’s entire client base.

Focus on core business allows organizations to concentrate internal resources on strategic business activities while external partners handle routine technology operations and support functions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms IT outsourcing services as providers incorporate AI capabilities into their service delivery models. Intelligent automation, predictive analytics, and machine learning-driven operations improve service quality while reducing costs. Organizations increasingly seek providers with proven AI expertise to accelerate their own artificial intelligence initiatives.

Cloud-Native Development becomes the standard approach for application development and modernization projects. Providers must demonstrate expertise in containerization, microservices architecture, and cloud-native technologies to remain competitive. This trend drives significant investment in new development methodologies and cloud platform certifications.

DevSecOps Adoption integrates security practices throughout the development lifecycle, requiring providers to embed security expertise in their development teams. This approach addresses growing security concerns while maintaining development velocity and agility requirements.

Industry-Specific Solutions gain prominence as organizations seek providers with deep vertical expertise rather than generic technology services. Specialized knowledge of industry regulations, business processes, and technology requirements enables providers to deliver more targeted and valuable services.

Outcome-Based Pricing models replace traditional time-and-materials contracts as organizations seek providers willing to share risk and accountability for business results. These models require providers to develop sophisticated measurement capabilities and assume greater responsibility for project success.

Sustainability Focus influences vendor selection as organizations prioritize environmental responsibility in their technology operations. Providers with strong sustainability practices and carbon-neutral operations gain competitive advantages in procurement processes.

Strategic acquisitions reshape the competitive landscape as major providers acquire specialized companies to expand their capabilities in emerging technology areas. Recent acquisitions focus on artificial intelligence, cybersecurity, and industry-specific expertise that enhance provider value propositions.

Partnership ecosystems develop as providers collaborate with technology vendors, consulting firms, and specialized service companies to deliver comprehensive solutions. These partnerships enable providers to offer broader capabilities without internal development investment.

Automation investments accelerate as providers implement robotic process automation, intelligent testing, and automated infrastructure management to improve service delivery efficiency. According to MarkWide Research analysis, automation adoption has increased service delivery efficiency by 40% on average across major providers.

Talent development programs expand as providers invest in reskilling and upskilling initiatives to address emerging technology requirements. These programs focus on cloud technologies, artificial intelligence, cybersecurity, and data analytics capabilities.

Geographic expansion continues as providers establish new delivery centers in emerging markets and expand their presence in key client regions. This expansion supports both cost optimization and client proximity requirements.

Regulatory compliance enhancements address increasing requirements in areas such as data protection, financial services regulation, and healthcare compliance. Providers invest in specialized compliance capabilities and certifications to serve regulated industries.

Strategic partnership approach should replace traditional vendor relationships as organizations seek long-term technology partners capable of supporting comprehensive digital transformation initiatives. This approach requires careful provider selection based on strategic alignment, cultural fit, and long-term capability roadmaps rather than short-term cost considerations.

Multi-vendor strategies can reduce risk and improve service quality by avoiding over-dependence on single providers. Organizations should develop governance capabilities to manage multiple provider relationships effectively while maintaining service integration and accountability.

Emerging technology investment should focus on providers with proven expertise in artificial intelligence, machine learning, and automation technologies. Early adoption of these capabilities can provide competitive advantages and operational efficiency improvements.

Security-first mindset must guide all outsourcing decisions given increasing threat landscapes and regulatory requirements. Organizations should prioritize providers with robust security practices, compliance certifications, and proven incident response capabilities.

Outcome measurement systems should be established to track and validate the business value delivered through outsourcing relationships. Clear metrics and regular performance reviews ensure that partnerships deliver expected benefits and identify areas for improvement.

Change management capabilities should be developed to support successful outsourcing transitions and ongoing relationship management. Effective change management reduces disruption and accelerates value realization from outsourcing partnerships.

Technology evolution will continue to reshape the IT outsourcing landscape as artificial intelligence, quantum computing, and advanced automation technologies mature. Providers must continuously invest in emerging capabilities to remain competitive, while organizations should seek partners with strong innovation track records and technology roadmaps.

Market growth is projected to maintain strong momentum with an expected CAGR of 9.1% over the next five years, driven by continued digital transformation initiatives and increasing adoption of cloud technologies. MWR projections indicate that cloud services and cybersecurity will represent the fastest-growing segments within the overall market.

Service delivery evolution toward outcome-based models will accelerate as organizations seek providers willing to share accountability for business results. This trend requires providers to develop sophisticated measurement capabilities and assume greater risk in client engagements.

Industry specialization will become increasingly important as organizations seek providers with deep vertical expertise rather than generic technology services. Providers with strong industry knowledge and specialized solutions will command premium pricing and stronger client relationships.

Regulatory environment changes may impact service delivery models, particularly regarding data protection, international trade, and industry-specific compliance requirements. Providers must maintain flexibility to adapt to evolving regulatory landscapes while maintaining service quality and cost competitiveness.

Talent dynamics will continue to influence market development as competition for skilled technology professionals intensifies. Providers with strong talent development programs and attractive work environments will maintain competitive advantages in service delivery capabilities.

The United States IT outsourcing market stands at a pivotal juncture where traditional service models evolve toward strategic technology partnerships that enable comprehensive digital transformation. Organizations increasingly view outsourcing relationships as essential components of their competitive strategy rather than simple cost reduction mechanisms.

Market dynamics reflect the growing sophistication of both client requirements and provider capabilities, with emerging technologies such as artificial intelligence, advanced automation, and cloud-native development driving significant changes in service delivery approaches. The competitive landscape continues to evolve through strategic acquisitions, partnership development, and specialized capability investments.

Future success in this market will depend on providers’ ability to demonstrate clear business value through measurable outcomes, innovative service delivery models, and deep expertise in emerging technologies. Organizations that approach outsourcing as strategic partnerships rather than vendor relationships will achieve the greatest benefits from these evolving market dynamics. The continued growth and evolution of the United States IT outsourcing market positions it as a critical enabler of digital transformation and competitive advantage across all industry sectors.

What is IT Outsourcing?

IT Outsourcing refers to the practice of hiring external service providers to handle IT functions and services, such as software development, infrastructure management, and technical support. This approach allows companies to focus on their core business while leveraging specialized expertise.

What are the key players in the United States IT Outsourcing Market?

Key players in the United States IT Outsourcing Market include companies like Accenture, IBM, and Infosys, which provide a range of IT services from cloud computing to application development. These firms compete on innovation, service quality, and cost-effectiveness, among others.

What are the main drivers of growth in the United States IT Outsourcing Market?

The main drivers of growth in the United States IT Outsourcing Market include the increasing demand for cost reduction, the need for access to advanced technologies, and the growing focus on core business activities. Additionally, the rise of digital transformation initiatives is fueling outsourcing trends.

What challenges does the United States IT Outsourcing Market face?

Challenges in the United States IT Outsourcing Market include concerns over data security, potential communication barriers, and the risk of losing control over critical business functions. Companies must navigate these issues to ensure successful outsourcing relationships.

What opportunities exist in the United States IT Outsourcing Market?

Opportunities in the United States IT Outsourcing Market include the expansion of cloud services, the integration of artificial intelligence, and the growing demand for cybersecurity solutions. These trends present avenues for service providers to innovate and capture new business.

What trends are shaping the United States IT Outsourcing Market?

Trends shaping the United States IT Outsourcing Market include the shift towards remote work, increased automation of IT processes, and the adoption of agile methodologies. These trends are influencing how companies approach outsourcing and manage their IT resources.

United States IT Outsourcing Market

| Segmentation Details | Description |

|---|---|

| Service Type | Application Development, Infrastructure Management, Cloud Services, IT Support |

| End User | Healthcare, Financial Services, Retail, Telecommunications |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Industry Vertical | Manufacturing, Education, Government, Energy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States IT Outsourcing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at