444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The RPA (Robotic Process Automation) and hyperautomation market in banking is experiencing rapid growth as financial institutions embrace digital transformation to enhance operational efficiency, customer experience, and competitiveness. This market overview provides insights into the meaning of RPA and hyperautomation, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

RPA refers to the use of software robots or “bots” to automate repetitive and rule-based tasks within business processes. These bots mimic human interactions with computer systems, enabling the automation of manual tasks such as data entry, document processing, and customer onboarding. Hyperautomation, on the other hand, involves the integration of RPA with advanced technologies like artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to automate complex and cognitive tasks.

Executive Summary

The executive summary provides a concise overview of the RPA and hyperautomation market in banking, highlighting its growth potential, key benefits, and market trends. It summarizes the key findings and insights of the market analysis, providing a snapshot of the market landscape and its transformative impact on the banking industry.

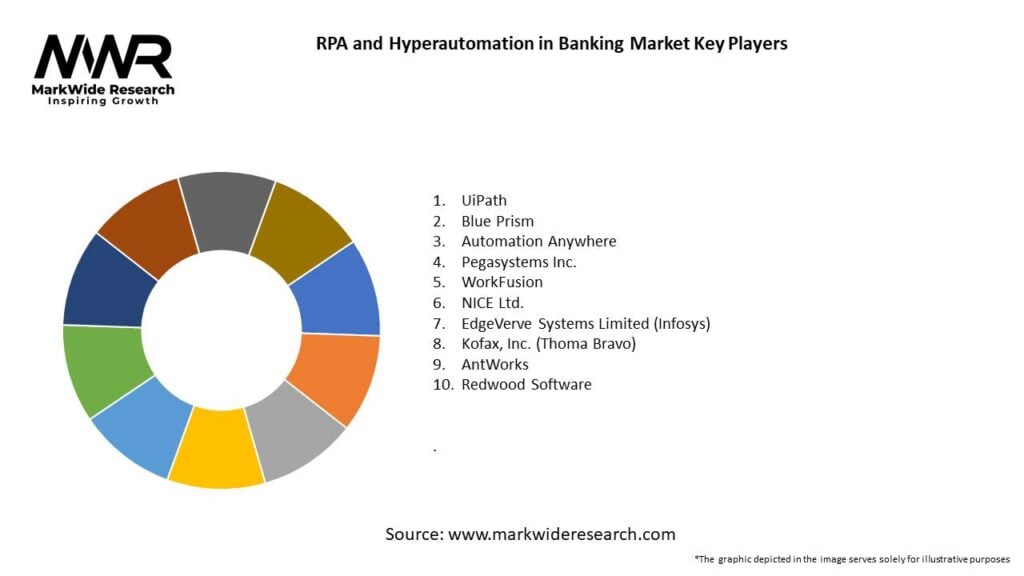

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The RPA and hyperautomation market in banking is driven by several factors that contribute to its growth and adoption. These market drivers include:

Market Restraints

While the RPA and hyperautomation market presents significant growth opportunities, certain factors pose challenges. These market restraints include:

Market Opportunities

The RPA and hyperautomation market in banking presents several opportunities for growth and innovation. These market opportunities include:

Market Dynamics

The RPA and hyperautomation market in banking is influenced by various dynamics that shape its growth and evolution. These market dynamics include changing customer expectations, evolving regulatory landscapes, advancements in technology, and competitive forces. Financial institutions that embrace these dynamics and leverage automation technologies can gain a competitive edge, enhance operational efficiency, and deliver superior customer experiences.

Regional Analysis

The RPA and hyperautomation market in banking exhibits regional variations in adoption and growth. This section provides an analysis of the market across key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. It explores regional trends, market drivers, and regulatory landscapes, enabling stakeholders to identify growth opportunities and tailor their strategies accordingly.

Competitive Landscape

Leading Companies in the RPA and Hyperautomation in Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Segmentation of the RPA and hyperautomation market in banking allows for a deeper understanding of customer needs, market trends, and adoption patterns. This section categorizes the market based on various criteria, such as deployment model (on-premises, cloud-based), organization size (small and medium enterprises, large enterprises), and application areas (back-office operations, customer service, compliance, risk management). The segmentation analysis enables stakeholders to target specific customer segments, customize their offerings, and maximize market potential.

Category-wise Insights

Analyzing the RPA and hyperautomation market in banking by categories provides valuable insights into market trends, technology offerings, and customer preferences. This section explores different categories of solutions, such as attended automation, unattended automation, and hybrid automation. It highlights their features, benefits, and recommended use cases, helping banking institutions identify the most suitable solutions for their specific needs.

Key Benefits for Industry Participants and Stakeholders

The RPA and hyperautomation market in banking offers several key benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Identifying key trends in the RPA and hyperautomation market in banking helps industry participants stay ahead of the competition and cater to evolving customer needs. Key trends may include the adoption of AI and ML technologies, the integration of chatbots and virtual assistants, the rise of process discovery and analytics, and the increasing focus on security and compliance in automation solutions.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the RPA and hyperautomation market in banking. This section explores the effects of the pandemic, such as the acceleration of digital transformation initiatives, increased demand for remote process automation, and the need for operational resilience. It also highlights how automation technologies have helped banks adapt to remote work environments, ensure business continuity, and deliver uninterrupted services to customers.

Key Industry Developments

Tracking key industry developments, such as partnerships, acquisitions, product launches, and regulatory changes, provides valuable insights into the progress and growth of the RPA and hyperautomation market in banking. This section highlights notable industry developments and their implications for stakeholders and market participants.

Analyst Suggestions

Based on extensive research and analysis, industry analysts provide valuable suggestions and recommendations for stakeholders in the RPA and hyperautomation market in banking. These suggestions may include strategies for effective implementation, integration with legacy systems, change management, talent acquisition, and continuous monitoring of automation processes. Implementing these suggestions enables banks to maximize the benefits of RPA and hyperautomation and drive successful digital transformation.

Future Outlook

The future outlook for the RPA and hyperautomation market in banking is promising, driven by the increasing adoption of automation technologies and the ongoing digital transformation efforts in the industry. The market is expected to witness continued growth, fueled by advancements in AI, ML, and NLP, as well as the need for greater operational efficiency, regulatory compliance, and customer-centric services. Banking institutions that embrace RPA and hyperautomation as strategic enablers will be well-positioned to thrive in the evolving banking landscape.

Conclusion

In conclusion, the RPA and hyperautomation market in banking is experiencing significant growth and transformation. The adoption of automation technologies offers numerous benefits, including improved operational efficiency, cost reduction, compliance management, and enhanced customer experience. However, challenges related to data security, integration complexity, and workforce adaptation must be addressed effectively. With the right strategies, partnerships, and technology investments, banking institutions can harness the power of RPA and hyperautomation to drive innovation, gain a competitive edge, and deliver superior financial services.

What is RPA and Hyperautomation in Banking?

RPA and Hyperautomation in Banking refer to the use of robotic process automation and advanced automation technologies to streamline banking operations, enhance customer service, and improve compliance. These technologies enable banks to automate repetitive tasks, integrate systems, and leverage data analytics for better decision-making.

What are the key players in the RPA and Hyperautomation in Banking Market?

Key players in the RPA and Hyperautomation in Banking Market include UiPath, Automation Anywhere, Blue Prism, and Pega Systems. These companies provide various automation solutions tailored for banking operations, enhancing efficiency and reducing operational costs, among others.

What are the main drivers of growth in the RPA and Hyperautomation in Banking Market?

The main drivers of growth in the RPA and Hyperautomation in Banking Market include the increasing demand for operational efficiency, the need for enhanced customer experiences, and the growing regulatory compliance requirements. Additionally, the rise of digital banking and the need for real-time data processing are significant factors.

What challenges does the RPA and Hyperautomation in Banking Market face?

Challenges in the RPA and Hyperautomation in Banking Market include data security concerns, the complexity of integrating new technologies with legacy systems, and the potential resistance from employees fearing job displacement. These factors can hinder the adoption and implementation of automation solutions.

What opportunities exist in the RPA and Hyperautomation in Banking Market?

Opportunities in the RPA and Hyperautomation in Banking Market include the potential for developing more sophisticated AI-driven automation tools, expanding into emerging markets, and enhancing customer engagement through personalized services. The ongoing digital transformation in banking presents numerous avenues for innovation.

What trends are shaping the RPA and Hyperautomation in Banking Market?

Trends shaping the RPA and Hyperautomation in Banking Market include the increasing adoption of AI and machine learning for predictive analytics, the shift towards cloud-based automation solutions, and the focus on customer-centric automation strategies. These trends are driving the evolution of banking services and operational models.

RPA and Hyperautomation in Banking Market

| Segmentation Details | Description |

|---|---|

| End User | Banks, Credit Unions, Investment Firms, Insurance Companies |

| Solution Type | Process Automation, Workflow Automation, Document Processing, Intelligent Automation |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | Machine Learning, Natural Language Processing, Computer Vision, Robotic Process Automation |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at