444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America activated alumina market represents a dynamic and rapidly expanding sector within the industrial materials landscape. This specialized market encompasses the production, distribution, and application of activated alumina across diverse industries including water treatment, petrochemicals, pharmaceuticals, and air purification systems. Market dynamics indicate robust growth driven by increasing environmental regulations, industrial expansion, and technological advancements in purification processes.

Regional distribution across North America shows the United States commanding approximately 78% market share, followed by Canada and Mexico contributing significantly to overall market expansion. The market demonstrates exceptional resilience with projected growth rates of 6.2% CAGR over the forecast period, reflecting strong demand fundamentals and expanding application areas.

Industrial applications continue to diversify, with water treatment facilities representing the largest consumption segment, followed by catalyst support systems and desiccant applications. The market benefits from North America’s advanced industrial infrastructure, stringent environmental standards, and continuous investment in water treatment and air purification technologies.

The North America activated alumina market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and utilization of activated alumina products across the United States, Canada, and Mexico. This market includes various grades and specifications of activated alumina designed for specific industrial applications including adsorption, catalysis, and filtration processes.

Activated alumina represents a highly porous form of aluminum oxide characterized by exceptional surface area and adsorption properties. The material undergoes specialized thermal treatment processes to create microscopic pores that enable effective removal of contaminants, moisture, and impurities from gases and liquids. Market participants include manufacturers, distributors, end-users, and technology providers supporting the activated alumina value chain.

Commercial applications span multiple industries where purification, drying, and catalytic processes are essential. The market encompasses both commodity-grade and specialty activated alumina products, each tailored to specific performance requirements and regulatory standards prevalent across North American industrial sectors.

Market performance in North America’s activated alumina sector demonstrates consistent growth momentum supported by expanding industrial applications and environmental compliance requirements. The market benefits from technological innovations in manufacturing processes, resulting in improved product quality and cost-effectiveness across various application segments.

Key growth drivers include increasing water treatment infrastructure investments, expanding petrochemical processing capacity, and rising demand for air purification systems. Environmental regulations mandating stricter emission controls contribute approximately 35% of market demand growth, while industrial expansion accounts for additional market momentum.

Competitive landscape features established manufacturers alongside emerging players focusing on specialized applications and innovative product formulations. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding geographic reach and technological capabilities. Regional advantages include proximity to raw materials, advanced manufacturing infrastructure, and established distribution networks supporting efficient market operations.

Future prospects remain positive with anticipated market expansion driven by infrastructure modernization, industrial growth, and increasing environmental awareness. Technology advancements in activated alumina production and application methods continue to create new market opportunities and enhance product performance characteristics.

Strategic analysis reveals several critical insights shaping the North America activated alumina market landscape. These insights provide valuable perspective on market dynamics, competitive positioning, and growth opportunities across the region.

Environmental compliance serves as the primary market driver, with increasingly stringent regulations requiring advanced purification technologies across industrial sectors. Water quality standards mandate effective removal of fluoride, arsenic, and other contaminants, driving substantial demand for activated alumina in treatment facilities.

Industrial expansion across North America creates sustained demand for activated alumina in various applications. Petrochemical processing facilities require high-performance desiccants and catalyst supports, while pharmaceutical manufacturing demands ultra-pure activated alumina for critical processes. Manufacturing growth in these sectors contributes approximately 42% of market expansion.

Infrastructure modernization programs across North American municipalities drive significant investments in water treatment upgrades. Aging infrastructure replacement creates opportunities for advanced activated alumina applications, particularly in fluoride removal and water purification systems. Government initiatives supporting infrastructure development provide sustained market momentum.

Technological advancements in activated alumina production enable development of specialized products with enhanced performance characteristics. Improved surface area, pore structure optimization, and extended service life create competitive advantages and justify premium pricing in demanding applications.

High initial costs associated with activated alumina systems present significant barriers for smaller industrial users and municipal facilities with limited budgets. Capital investment requirements for complete treatment systems, including activated alumina media, can deter adoption among cost-sensitive market segments.

Competition from alternatives poses ongoing challenges as other adsorbent materials and treatment technologies compete for market share. Ion exchange resins, reverse osmosis systems, and alternative purification methods offer competing solutions in certain applications, potentially limiting activated alumina market growth.

Raw material availability and pricing volatility impact manufacturing costs and profit margins. Aluminum hydroxide and other precursor materials experience periodic supply constraints and price fluctuations, affecting activated alumina production economics and market pricing strategies.

Technical complexity in system design and operation requires specialized knowledge and training, potentially limiting adoption among less sophisticated users. Proper activated alumina system operation demands understanding of regeneration cycles, performance monitoring, and maintenance requirements that may challenge some market participants.

Emerging applications in specialized industries present significant growth opportunities for activated alumina manufacturers. Advanced semiconductor manufacturing, biotechnology processing, and renewable energy systems require ultra-high purity materials, creating premium market segments with attractive profit margins.

Geographic expansion within North America offers substantial opportunities as industrial development spreads to previously underserved regions. Rural water treatment needs, small-scale industrial applications, and distributed manufacturing create new market segments for activated alumina products.

Product innovation opportunities include development of specialized activated alumina formulations for specific applications. Customized pore structures, enhanced selectivity, and extended service life products command premium pricing and strengthen customer relationships through differentiated offerings.

Sustainability initiatives create opportunities for recyclable and environmentally friendly activated alumina products. Green manufacturing processes and circular economy approaches appeal to environmentally conscious customers and align with corporate sustainability goals, potentially capturing 28% additional market share among sustainability-focused buyers.

Supply-demand equilibrium in the North America activated alumina market reflects balanced growth between production capacity and consumption requirements. Manufacturing capacity utilization rates maintain healthy levels around 82% average utilization, indicating efficient market operations without significant oversupply concerns.

Pricing dynamics demonstrate stability with gradual increases reflecting raw material costs and value-added product development. Premium-grade activated alumina commands higher prices due to superior performance characteristics and specialized applications, while commodity grades remain price-competitive in standard applications.

Innovation cycles drive market evolution through continuous product development and application expansion. Research and development investments focus on enhanced performance, cost reduction, and new application development, creating competitive differentiation and market growth opportunities.

Regulatory influences significantly impact market dynamics through environmental standards, quality requirements, and safety regulations. MarkWide Research analysis indicates that regulatory compliance drives approximately 45% of product specification requirements, influencing manufacturing processes and product development priorities.

Comprehensive analysis of the North America activated alumina market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, end-users, and technology providers across the activated alumina value chain.

Secondary research encompasses analysis of industry publications, regulatory filings, company reports, and technical literature relevant to activated alumina applications and market dynamics. Government databases, trade association reports, and academic research provide additional data sources supporting market analysis.

Market modeling utilizes statistical analysis and forecasting techniques to project market trends, growth rates, and segment performance. Quantitative analysis includes correlation studies, regression analysis, and scenario modeling to validate market projections and identify key growth drivers.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review, and consistency checks across different market segments and geographic regions. Quality assurance measures include peer review and validation against historical market performance data.

United States market dominates North America activated alumina consumption, representing the largest share due to extensive industrial infrastructure, stringent environmental regulations, and advanced water treatment requirements. Major consumption centers include Texas, California, and Louisiana, where petrochemical and water treatment applications drive substantial demand.

Canadian market demonstrates steady growth supported by mining industry applications, municipal water treatment needs, and industrial expansion. Oil sands processing and natural gas purification create specialized demand for high-performance activated alumina products. Market share distribution shows Canada accounting for approximately 15% of regional consumption.

Mexican market exhibits rapid growth driven by industrial development, infrastructure modernization, and increasing environmental awareness. Manufacturing expansion and water treatment infrastructure investments create expanding opportunities for activated alumina applications across diverse industrial sectors.

Regional integration benefits from NAFTA trade agreements facilitating cross-border commerce and supply chain optimization. Manufacturing facilities strategically located to serve multiple markets enhance cost competitiveness and supply chain efficiency across the North American region.

Market leadership in North America’s activated alumina sector features several established players with strong manufacturing capabilities and extensive distribution networks. Competition focuses on product quality, technical support, and customer service excellence rather than price competition alone.

Competitive strategies emphasize technical innovation, customer service excellence, and geographic expansion. Strategic partnerships and acquisitions enable market participants to enhance capabilities and expand market reach across North American regions.

By Application:

By Grade:

By End-User Industry:

Water Treatment Category represents the largest market segment, driven by municipal infrastructure needs and industrial water treatment requirements. Fluoride removal applications dominate this category, with activated alumina providing cost-effective and reliable treatment solutions. Growth rates in this category reach 7.1% annually, reflecting expanding water treatment infrastructure and stricter quality standards.

Catalyst Support Applications demonstrate strong performance in petrochemical and refining sectors. Activated alumina serves as an essential carrier material for various catalysts, enabling efficient chemical processes and product quality enhancement. Technical requirements in this category demand high mechanical strength and thermal stability.

Desiccant Applications show steady growth across industrial gas processing and compressed air systems. Activated alumina’s excellent moisture adsorption properties make it ideal for maintaining dry conditions in sensitive industrial processes. Market penetration in this category approaches 65% of potential applications.

Specialty Applications including pharmaceuticals and electronics represent high-value market segments with premium pricing opportunities. These applications require ultra-pure activated alumina with stringent quality specifications and comprehensive documentation supporting regulatory compliance requirements.

Manufacturers benefit from stable demand patterns and opportunities for product differentiation through technical innovation. The activated alumina market offers attractive margins for specialized products while providing steady revenue streams from commodity applications. Production efficiency improvements enable cost competitiveness and market expansion opportunities.

End-users gain access to reliable purification solutions with proven performance characteristics and established supply chains. Activated alumina provides cost-effective treatment options with predictable operating costs and maintenance requirements. Performance benefits include consistent contaminant removal and extended service life.

Distributors enjoy stable product demand and opportunities for value-added services including technical support and system design assistance. The activated alumina market provides recurring revenue through replacement cycles and expanding customer bases across diverse industrial sectors.

Technology providers benefit from opportunities to develop integrated solutions combining activated alumina with complementary technologies. System optimization and performance enhancement services create additional revenue streams and strengthen customer relationships through comprehensive support offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with manufacturers developing environmentally friendly production processes and recyclable activated alumina products. Green manufacturing initiatives reduce environmental impact while appealing to sustainability-conscious customers across industrial sectors.

Product Customization trends toward specialized activated alumina formulations designed for specific applications and performance requirements. Custom pore structures, enhanced selectivity, and optimized physical properties create competitive advantages and premium pricing opportunities.

Digital Integration includes smart monitoring systems and IoT-enabled performance tracking for activated alumina applications. Technology adoption rates show 38% of facilities implementing digital monitoring solutions to optimize activated alumina system performance and maintenance scheduling.

Supply Chain Optimization focuses on regional sourcing, inventory management, and logistics efficiency. MWR analysis indicates supply chain improvements contribute approximately 12% cost reduction while enhancing delivery reliability and customer satisfaction.

Quality Enhancement trends emphasize superior product consistency, extended service life, and enhanced performance characteristics. Advanced quality control systems and process optimization enable production of high-performance activated alumina meeting demanding application requirements.

Manufacturing Expansion initiatives across North America include new production facilities and capacity upgrades to meet growing demand. Recent investments focus on advanced manufacturing technologies enabling improved product quality and cost competitiveness in global markets.

Technology Partnerships between activated alumina manufacturers and end-users drive product development and application optimization. Collaborative research programs focus on enhanced performance characteristics and new application development across emerging industrial sectors.

Regulatory Approvals for new activated alumina grades and applications expand market opportunities in regulated industries. Recent certifications enable market entry into pharmaceutical, food processing, and other high-value applications requiring stringent quality standards.

Acquisition Activity includes strategic consolidation among market participants seeking expanded capabilities and geographic reach. Recent transactions focus on technology acquisition, manufacturing capacity expansion, and market access enhancement across North American regions.

Sustainability Initiatives encompass environmental impact reduction, energy efficiency improvements, and circular economy implementation. Industry-wide efforts focus on sustainable manufacturing practices and product lifecycle optimization supporting environmental stewardship goals.

Strategic Focus recommendations emphasize product differentiation through technical innovation and specialized application development. Companies should invest in research and development capabilities enabling creation of high-performance activated alumina products commanding premium pricing in demanding applications.

Market Expansion strategies should target underserved geographic regions and emerging application areas. Growth opportunities exist in rural water treatment, small-scale industrial applications, and specialized purification requirements across diverse industrial sectors.

Partnership Development with technology providers and end-users creates opportunities for integrated solutions and enhanced customer value. Collaborative approaches enable better understanding of customer requirements and development of optimized activated alumina solutions.

Operational Excellence initiatives should focus on manufacturing efficiency, quality consistency, and supply chain optimization. Cost competitiveness and reliable delivery performance remain essential for success in competitive market segments.

Sustainability Integration becomes increasingly important for long-term market success. Companies should develop environmental strategies addressing manufacturing impact, product recyclability, and circular economy principles appealing to environmentally conscious customers.

Market trajectory for North America’s activated alumina sector remains positive with sustained growth expected across multiple application segments. Infrastructure modernization, environmental compliance requirements, and industrial expansion provide fundamental support for continued market development.

Technology evolution will drive product innovation and application expansion, creating new market opportunities and enhanced performance capabilities. Advanced manufacturing processes and product customization enable differentiation and premium positioning in competitive markets.

Regional growth patterns indicate expanding opportunities across North America as industrial development spreads and environmental awareness increases. MarkWide Research projects regional market expansion will maintain 6.8% compound annual growth over the forecast period, reflecting strong fundamental demand drivers.

Industry consolidation trends may continue as companies seek scale advantages and expanded capabilities. Strategic partnerships and acquisitions will likely shape competitive dynamics while creating opportunities for enhanced market coverage and technical capabilities.

Sustainability focus will increasingly influence market development as environmental considerations become more prominent in industrial decision-making. Companies emphasizing sustainable practices and environmentally friendly products will likely gain competitive advantages in evolving markets.

The North America activated alumina market demonstrates robust growth potential supported by diverse industrial applications, environmental compliance requirements, and technological advancement opportunities. Market fundamentals remain strong with expanding demand across water treatment, petrochemical, and specialty application segments.

Strategic opportunities exist for market participants willing to invest in product innovation, geographic expansion, and customer relationship development. The market rewards technical excellence, quality consistency, and comprehensive customer support while providing attractive returns for specialized applications.

Future success in this market will depend on adaptability to changing customer requirements, regulatory evolution, and competitive dynamics. Companies emphasizing sustainability, innovation, and operational excellence will be best positioned to capitalize on emerging opportunities and maintain competitive advantages in the evolving North America activated alumina market landscape.

What is Activated Alumina?

Activated Alumina is a highly porous form of aluminum oxide that is used for various applications, including water treatment, air drying, and as a catalyst support. Its high surface area and adsorption properties make it effective in removing impurities and moisture from gases and liquids.

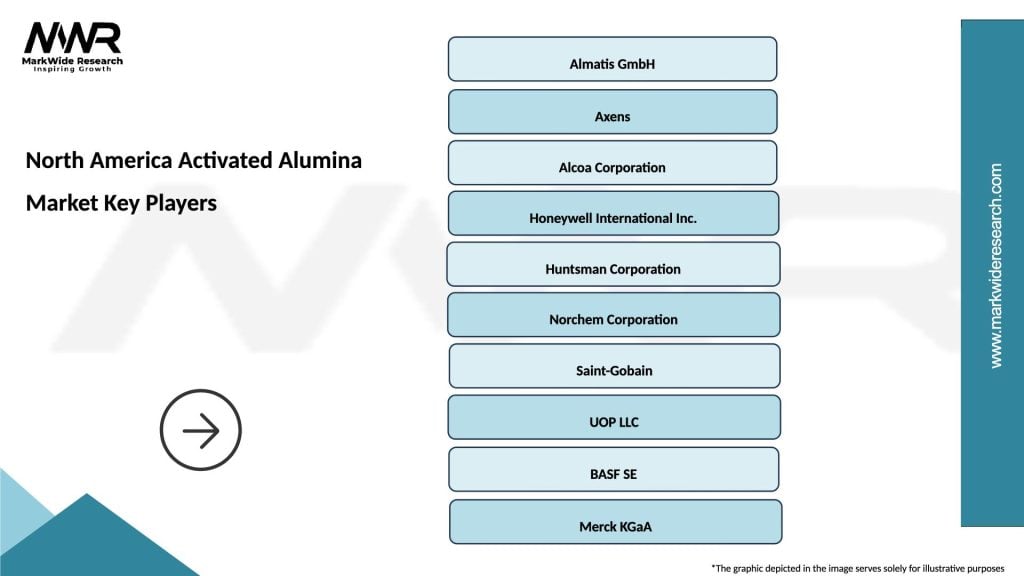

What are the key players in the North America Activated Alumina Market?

Key players in the North America Activated Alumina Market include BASF SE, Sorbead USA, and Axens, among others. These companies are involved in the production and supply of activated alumina for various industrial applications.

What are the growth factors driving the North America Activated Alumina Market?

The growth of the North America Activated Alumina Market is driven by increasing demand for water purification and air drying applications. Additionally, the rising need for efficient catalysts in chemical processes contributes to market expansion.

What challenges does the North America Activated Alumina Market face?

The North America Activated Alumina Market faces challenges such as the availability of alternative materials and fluctuations in raw material prices. These factors can impact production costs and market competitiveness.

What opportunities exist in the North America Activated Alumina Market?

Opportunities in the North America Activated Alumina Market include the growing focus on environmental sustainability and the development of advanced materials for specific applications. Innovations in activated alumina formulations can also open new market segments.

What trends are shaping the North America Activated Alumina Market?

Trends in the North America Activated Alumina Market include the increasing adoption of activated alumina in the pharmaceutical and food industries for moisture control. Additionally, advancements in production technologies are enhancing the efficiency and effectiveness of activated alumina products.

North America Activated Alumina Market

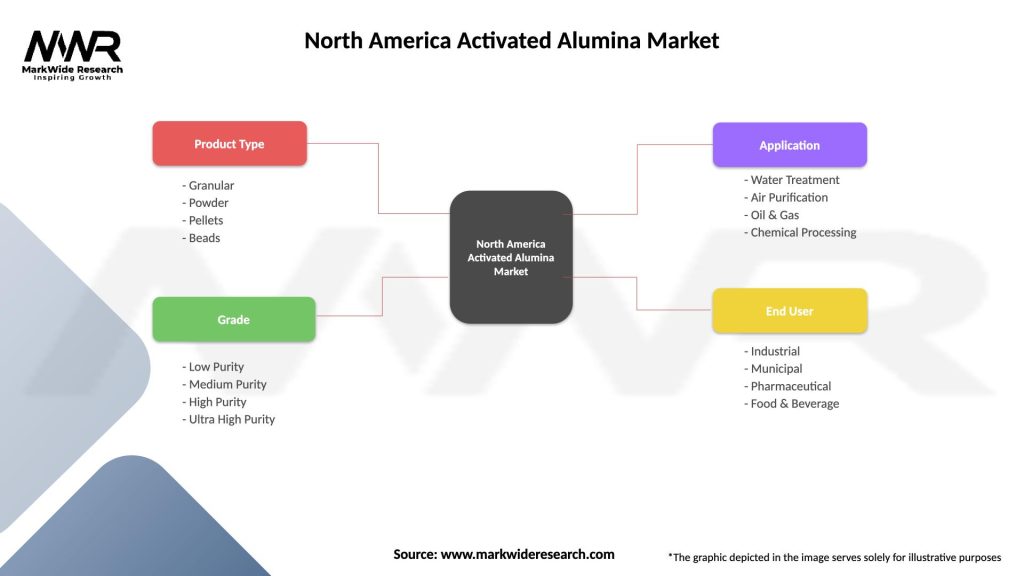

| Segmentation Details | Description |

|---|---|

| Product Type | Granular, Powder, Pellets, Beads |

| Grade | Low Purity, Medium Purity, High Purity, Ultra High Purity |

| Application | Water Treatment, Air Purification, Oil & Gas, Chemical Processing |

| End User | Industrial, Municipal, Pharmaceutical, Food & Beverage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Activated Alumina Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at