444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East offshore MRO market represents a critical component of the region’s energy infrastructure, encompassing maintenance, repair, and overhaul services for offshore oil and gas platforms, marine vessels, and related equipment. This specialized sector has experienced remarkable growth driven by the region’s strategic position as a global energy hub and increasing investments in offshore exploration activities. The market demonstrates robust expansion with projected growth rates of 6.2% CAGR over the forecast period, reflecting the essential nature of MRO services in maintaining operational efficiency and safety standards.

Regional dynamics indicate that the Middle East’s offshore MRO sector benefits from substantial hydrocarbon reserves, advanced technological adoption, and strategic government initiatives promoting energy sector development. Countries including Saudi Arabia, UAE, Qatar, and Kuwait lead market development through significant investments in offshore infrastructure and maintenance capabilities. The market encompasses various service categories including preventive maintenance, corrective repairs, equipment overhaul, and emergency response services.

Market characteristics reveal increasing demand for specialized MRO services driven by aging offshore infrastructure, stringent safety regulations, and the need for enhanced operational efficiency. The sector demonstrates strong resilience with approximately 78% of operators prioritizing predictive maintenance technologies to optimize asset performance and reduce downtime costs.

The Middle East offshore MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for offshore oil and gas installations, marine vessels, and associated equipment operating in the region’s territorial waters. This specialized market encompasses planned maintenance activities, emergency repairs, equipment upgrades, and complete system overhauls essential for maintaining operational continuity and safety compliance in challenging offshore environments.

MRO services in this context include mechanical repairs, electrical system maintenance, structural inspections, equipment replacement, and technological upgrades performed on offshore platforms, drilling rigs, production facilities, and support vessels. The market integrates advanced diagnostic technologies, specialized equipment, and highly skilled technicians to deliver comprehensive maintenance solutions that ensure optimal asset performance and regulatory compliance.

Service scope extends beyond traditional maintenance to include condition monitoring, asset integrity management, supply chain optimization, and digital transformation initiatives that enhance operational efficiency and reduce total cost of ownership for offshore operators throughout the Middle East region.

Market dynamics in the Middle East offshore MRO sector demonstrate exceptional growth potential driven by expanding offshore exploration activities, increasing focus on asset optimization, and rising demand for specialized maintenance services. The market benefits from the region’s strategic importance in global energy markets and substantial investments in offshore infrastructure development.

Key growth drivers include aging offshore assets requiring intensive maintenance, implementation of predictive maintenance technologies, and stringent safety regulations mandating regular equipment inspections and repairs. Approximately 65% of offshore operators are investing in digital MRO solutions to enhance maintenance efficiency and reduce operational costs.

Regional leadership positions the Middle East as a hub for offshore MRO excellence, with major service providers establishing comprehensive facilities and capabilities to serve both domestic and international markets. The sector demonstrates strong resilience with consistent demand for specialized services regardless of oil price fluctuations.

Technological advancement plays a crucial role in market evolution, with increasing adoption of IoT sensors, artificial intelligence, and drone-based inspection technologies transforming traditional maintenance approaches and enabling more efficient service delivery.

Infrastructure aging represents the primary driver for Middle East offshore MRO market growth, as numerous platforms and facilities installed decades ago require intensive maintenance and modernization to maintain operational efficiency. Many offshore installations are approaching or exceeding their original design life, necessitating comprehensive MRO programs to extend asset longevity and ensure continued production capability.

Regulatory requirements increasingly mandate regular inspections, maintenance activities, and safety compliance measures for offshore operations. Government agencies and international bodies enforce stringent standards requiring operators to maintain detailed maintenance records, conduct periodic equipment overhauls, and implement preventive maintenance programs to ensure worker safety and environmental protection.

Operational efficiency demands drive investment in advanced MRO services as operators seek to maximize asset utilization, minimize unplanned downtime, and optimize production output. Companies recognize that effective maintenance programs directly impact profitability through improved equipment reliability, reduced emergency repairs, and extended asset life cycles.

Technological evolution creates opportunities for enhanced MRO service delivery through digital transformation initiatives, predictive maintenance capabilities, and automated monitoring systems. These technologies enable more precise maintenance scheduling, early fault detection, and optimized resource allocation, resulting in 35% reduction in maintenance costs for early adopters.

High service costs present significant challenges for offshore MRO market growth, as specialized equipment, skilled technicians, and logistical complexities contribute to elevated maintenance expenses. The remote nature of offshore installations requires expensive transportation, accommodation, and safety equipment, increasing overall service delivery costs and impacting operator budgets.

Skilled workforce shortage constrains market expansion as the industry faces difficulties recruiting and retaining qualified technicians with specialized offshore experience. The demanding nature of offshore work, safety requirements, and technical complexity limit the available talent pool, creating capacity constraints for MRO service providers.

Weather dependencies significantly impact MRO service scheduling and delivery in offshore environments, where adverse weather conditions can delay maintenance activities, extend project timelines, and increase operational risks. Seasonal weather patterns and extreme conditions common in some Middle East offshore areas create planning challenges and potential service disruptions.

Regulatory complexity poses challenges as operators must navigate varying national regulations, international standards, and industry-specific requirements across different jurisdictions. Compliance costs and administrative burdens associated with regulatory adherence can impact service delivery efficiency and increase operational complexity.

Digital transformation presents substantial opportunities for MRO service providers to develop innovative solutions incorporating artificial intelligence, machine learning, and IoT technologies. These digital capabilities enable predictive maintenance programs, remote monitoring systems, and automated diagnostic tools that significantly enhance service efficiency and reduce operational costs.

Regional expansion opportunities exist as Middle East countries continue investing in offshore exploration and production activities. New field developments, infrastructure projects, and capacity expansion initiatives create demand for comprehensive MRO services and long-term maintenance partnerships with experienced service providers.

Service diversification enables MRO companies to expand their offerings beyond traditional maintenance to include asset integrity management, condition monitoring, and performance optimization services. This comprehensive approach allows providers to capture greater value from client relationships and establish competitive differentiation in the marketplace.

Sustainability initiatives create opportunities for MRO providers to develop environmentally friendly maintenance practices, energy-efficient equipment solutions, and waste reduction programs. Companies implementing green MRO practices can attract environmentally conscious clients and comply with evolving environmental regulations, with 42% of operators prioritizing sustainable maintenance solutions.

Supply and demand dynamics in the Middle East offshore MRO market reflect the balance between growing maintenance requirements and available service capacity. Increasing offshore activity levels, aging infrastructure, and enhanced safety standards drive demand growth, while service provider capacity expansion and technological improvements influence supply capabilities.

Competitive intensity continues to increase as both international and regional MRO providers compete for market share through service differentiation, technological innovation, and strategic partnerships. Companies focus on developing specialized capabilities, expanding geographic coverage, and establishing long-term client relationships to maintain competitive advantages.

Price pressures influence market dynamics as operators seek cost-effective maintenance solutions while maintaining quality and safety standards. Service providers must balance competitive pricing with investment requirements for advanced technologies, skilled workforce development, and equipment modernization to remain viable in the marketplace.

Technology integration transforms market dynamics by enabling more efficient service delivery, improved maintenance outcomes, and enhanced client value propositions. Digital technologies facilitate remote monitoring, predictive analytics, and automated maintenance scheduling, resulting in 28% improvement in maintenance efficiency for technology-enabled service providers.

Primary research methodology encompasses comprehensive interviews with industry executives, MRO service providers, offshore operators, and regulatory officials across the Middle East region. This direct engagement provides valuable insights into market trends, operational challenges, technology adoption patterns, and future growth expectations from key stakeholders.

Secondary research involves extensive analysis of industry reports, company financial statements, government publications, and trade association data to validate primary findings and establish comprehensive market understanding. This research approach ensures data accuracy and provides historical context for market trend analysis.

Market modeling utilizes advanced analytical techniques to project market growth, segment performance, and competitive dynamics based on historical data, current market conditions, and identified growth drivers. Statistical analysis and forecasting models provide quantitative foundations for market projections and strategic recommendations.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. This rigorous approach maintains research integrity and provides reliable market intelligence for strategic decision-making by industry participants and stakeholders.

Saudi Arabia dominates the Middle East offshore MRO market with approximately 38% market share, driven by extensive offshore oil and gas operations in the Arabian Gulf and Red Sea regions. The kingdom’s substantial offshore infrastructure, including numerous production platforms and support facilities, creates significant demand for comprehensive MRO services and specialized maintenance capabilities.

United Arab Emirates represents the second-largest market segment, accounting for 24% of regional MRO activity, with major offshore operations in Abu Dhabi and Dubai waters. The UAE’s strategic position as a regional business hub attracts international MRO service providers and facilitates technology transfer and best practice implementation across the region.

Qatar demonstrates strong market growth potential with 18% regional market share, supported by significant offshore gas field developments and LNG production facilities. The country’s focus on technological advancement and operational excellence drives demand for sophisticated MRO services and innovative maintenance solutions.

Kuwait and other regional markets collectively represent 20% of market activity, with growing offshore exploration programs and infrastructure development projects creating opportunities for MRO service expansion. These markets benefit from regional expertise sharing and technology transfer from more established offshore operations.

Market leadership in the Middle East offshore MRO sector is characterized by a combination of international service giants and specialized regional providers offering comprehensive maintenance solutions. The competitive environment emphasizes technological capabilities, safety performance, and operational excellence as key differentiation factors.

By Service Type: The market segments into preventive maintenance services, corrective maintenance and repairs, equipment overhaul and modernization, and emergency response services. Preventive maintenance represents the largest segment due to operator focus on avoiding unplanned downtime and extending asset life cycles.

By Application: Market applications include offshore drilling platforms, production facilities, marine vessels, subsea equipment, and support infrastructure. Production facilities account for the highest MRO service demand due to continuous operation requirements and complex equipment systems.

By Technology: Technology segmentation encompasses traditional maintenance approaches, condition-based maintenance, predictive maintenance using IoT and AI, and remote monitoring systems. Predictive maintenance technologies show the fastest growth as operators seek to optimize maintenance scheduling and reduce costs.

By End User: End user segments include national oil companies, international oil companies, independent operators, and drilling contractors. National oil companies represent the largest customer segment due to their extensive offshore operations and infrastructure ownership in the Middle East region.

Preventive Maintenance Services dominate market activity with 45% of total MRO spending, as operators prioritize scheduled maintenance programs to prevent equipment failures and maintain operational continuity. This category includes routine inspections, component replacements, system testing, and performance monitoring activities essential for offshore asset reliability.

Emergency Repair Services represent a critical market category requiring rapid response capabilities and specialized expertise to address unexpected equipment failures. These services command premium pricing due to urgency requirements and the potential impact of equipment downtime on production operations.

Equipment Overhaul Programs encompass comprehensive refurbishment and modernization activities designed to extend asset life cycles and improve performance capabilities. This category shows strong growth as operators seek to maximize returns from existing infrastructure investments rather than pursuing costly replacements.

Digital MRO Solutions emerge as a high-growth category incorporating IoT sensors, predictive analytics, and remote monitoring technologies. These solutions enable more efficient maintenance scheduling, early fault detection, and optimized resource allocation, resulting in significant cost savings and improved operational performance.

Operational Excellence benefits include improved equipment reliability, reduced unplanned downtime, and enhanced safety performance through comprehensive MRO programs. Operators experience increased production efficiency, lower maintenance costs, and extended asset life cycles when implementing effective maintenance strategies.

Cost Optimization advantages encompass reduced total cost of ownership, optimized spare parts inventory, and improved maintenance scheduling efficiency. Strategic MRO partnerships enable operators to access specialized expertise and advanced technologies while maintaining cost control and budget predictability.

Risk Mitigation benefits include enhanced safety compliance, reduced environmental risks, and improved regulatory adherence through professional MRO services. Comprehensive maintenance programs help operators avoid costly accidents, regulatory penalties, and reputation damage associated with equipment failures.

Technology Access advantages provide operators with cutting-edge maintenance technologies, digital solutions, and industry best practices through partnerships with specialized MRO providers. This access enables smaller operators to benefit from advanced capabilities without significant capital investments.

Workforce Development benefits include access to skilled technicians, specialized training programs, and knowledge transfer opportunities that enhance internal maintenance capabilities. MRO partnerships facilitate skill development and technology adoption while maintaining operational focus on core business activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Predictive Maintenance Adoption represents the most significant trend transforming the Middle East offshore MRO market, with 52% of operators implementing or planning predictive maintenance programs. These systems utilize IoT sensors, machine learning algorithms, and data analytics to predict equipment failures before they occur, enabling optimized maintenance scheduling and reduced downtime costs.

Digital Twin Technology emerges as a revolutionary trend enabling virtual modeling of offshore assets for maintenance planning and optimization. This technology allows MRO providers to simulate maintenance scenarios, predict equipment behavior, and optimize service delivery strategies without disrupting actual operations.

Remote Monitoring Systems gain widespread adoption as operators seek to reduce offshore personnel requirements while maintaining comprehensive asset oversight. These systems enable real-time equipment monitoring, automated alert generation, and remote diagnostic capabilities that enhance maintenance efficiency and safety performance.

Sustainability Integration becomes increasingly important as operators and MRO providers focus on environmentally friendly maintenance practices, waste reduction programs, and energy-efficient equipment solutions. This trend aligns with global environmental initiatives and regulatory requirements for reduced environmental impact.

Service Consolidation trends toward comprehensive MRO partnerships where single providers offer integrated maintenance solutions across multiple asset categories. This approach simplifies vendor management, improves service coordination, and enables better cost control for offshore operators.

Technology Partnerships between MRO service providers and technology companies accelerate digital transformation initiatives and advanced capability development. These collaborations focus on developing innovative maintenance solutions, predictive analytics platforms, and automated diagnostic systems that enhance service delivery effectiveness.

Regional Facility Expansion continues as international MRO providers establish comprehensive service centers, equipment staging areas, and logistics hubs throughout the Middle East. These investments improve response times, reduce service costs, and enhance local capability development for offshore maintenance operations.

Workforce Development Programs expand across the region as companies invest in training initiatives, certification programs, and skill development activities to address the shortage of qualified offshore maintenance technicians. These programs focus on safety training, technical skills, and technology adoption to meet evolving industry requirements.

Regulatory Harmonization efforts progress as Middle East countries work toward standardizing offshore safety regulations, maintenance requirements, and compliance procedures. This development simplifies operations for MRO providers and operators working across multiple jurisdictions while maintaining high safety standards.

According to MarkWide Research analysis, strategic acquisitions and partnerships among MRO service providers continue reshaping the competitive landscape as companies seek to expand capabilities, geographic coverage, and technology offerings to better serve offshore operators throughout the Middle East region.

Technology Investment recommendations emphasize the critical importance of MRO providers investing in digital technologies, predictive maintenance capabilities, and automated systems to remain competitive in the evolving market. Companies should prioritize IoT implementation, data analytics platforms, and remote monitoring systems to enhance service delivery and operational efficiency.

Strategic Partnerships present opportunities for MRO providers to collaborate with technology companies, equipment manufacturers, and regional operators to develop comprehensive service offerings and expand market reach. These partnerships enable access to advanced technologies, specialized expertise, and new market opportunities while sharing development costs and risks.

Workforce Development initiatives should focus on recruiting, training, and retaining skilled technicians with offshore experience and digital technology capabilities. Companies must invest in comprehensive training programs, competitive compensation packages, and career development opportunities to address the skilled labor shortage affecting the industry.

Market Diversification strategies should consider expanding service offerings beyond traditional maintenance to include asset integrity management, performance optimization, and sustainability consulting. This diversification enables MRO providers to capture greater value from client relationships and establish competitive differentiation in the marketplace.

Regional Presence expansion recommendations suggest establishing local facilities, partnerships, and capabilities throughout key Middle East markets to improve service delivery, reduce costs, and enhance client relationships. Local presence demonstrates commitment to the region and enables better understanding of specific market requirements and operating conditions.

Market expansion prospects for the Middle East offshore MRO sector remain highly positive, with continued growth expected driven by increasing offshore activities, aging infrastructure requirements, and technology adoption initiatives. The market demonstrates resilience and long-term growth potential despite short-term economic fluctuations and industry challenges.

Technology evolution will continue transforming MRO service delivery through artificial intelligence, machine learning, and automation technologies that enhance maintenance effectiveness and reduce operational costs. MWR projections indicate that technology-enabled MRO services will capture 68% market share within the next five years as operators prioritize digital transformation initiatives.

Service integration trends toward comprehensive maintenance partnerships where providers offer end-to-end solutions encompassing preventive maintenance, emergency repairs, asset optimization, and performance monitoring. This integrated approach creates value for both operators and service providers through improved efficiency and cost optimization.

Sustainability focus will increasingly influence MRO service development as environmental regulations strengthen and operators prioritize sustainable operations. Green maintenance practices, energy-efficient equipment, and waste reduction programs will become standard requirements for MRO service providers.

Regional leadership positioning continues as the Middle East establishes itself as a global center of excellence for offshore MRO services, attracting international investment, technology transfer, and expertise development. This leadership position creates opportunities for regional providers to expand into international markets and establish global service capabilities.

The Middle East offshore MRO market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing offshore activities, aging infrastructure requirements, and technological advancement initiatives. The market demonstrates strong fundamentals with consistent demand for specialized maintenance services, comprehensive safety requirements, and operational excellence standards that create sustainable business opportunities for qualified service providers.

Strategic positioning in this market requires significant investment in technology capabilities, skilled workforce development, and regional presence establishment to effectively serve the sophisticated requirements of Middle East offshore operators. Companies that successfully integrate digital technologies, develop comprehensive service offerings, and establish strong client relationships will capture the greatest market opportunities and achieve sustainable competitive advantages.

Future success in the Middle East offshore MRO market will depend on the ability to adapt to evolving technology requirements, maintain high safety and quality standards, and provide cost-effective solutions that deliver measurable value to offshore operators. The market outlook remains highly positive for companies that can navigate the complexities of offshore operations while delivering innovative maintenance solutions that enhance operational efficiency and asset performance throughout the region.

What is Offshore MRO?

Offshore MRO refers to maintenance, repair, and overhaul services specifically tailored for offshore assets, including oil rigs, ships, and other marine structures in the Middle East region.

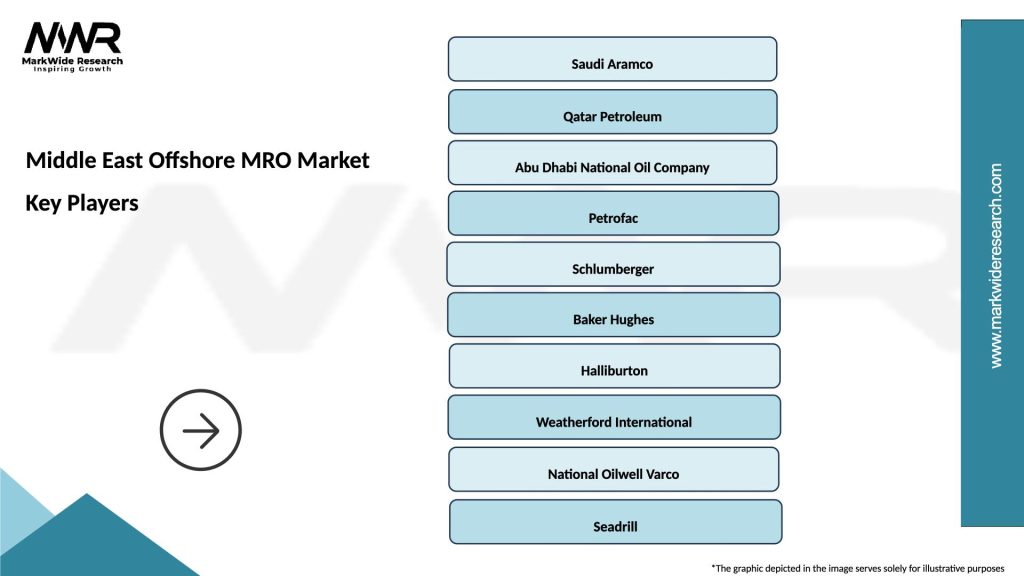

What are the key players in the Middle East Offshore MRO Market?

Key players in the Middle East Offshore MRO Market include companies like Gulf Marine Services, National Oilwell Varco, and Halliburton, among others.

What are the main drivers of growth in the Middle East Offshore MRO Market?

The growth of the Middle East Offshore MRO Market is driven by increasing offshore oil and gas exploration activities, the need for regular maintenance of aging infrastructure, and advancements in MRO technologies.

What challenges does the Middle East Offshore MRO Market face?

Challenges in the Middle East Offshore MRO Market include regulatory compliance issues, fluctuating oil prices affecting budgets, and the shortage of skilled labor in the region.

What opportunities exist in the Middle East Offshore MRO Market?

Opportunities in the Middle East Offshore MRO Market include the expansion of renewable energy projects, increased investment in digital technologies for MRO processes, and the potential for partnerships with international firms.

What trends are shaping the Middle East Offshore MRO Market?

Trends in the Middle East Offshore MRO Market include the adoption of predictive maintenance technologies, a focus on sustainability practices, and the integration of automation in maintenance processes.

Middle East Offshore MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Oil & Gas, Marine, Aviation, Defense |

| Technology | Robotics, Drones, IoT, Automation |

| Product Type | Components, Tools, Equipment, Spare Parts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Offshore MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at