444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East Africa wine market represents a fascinating intersection of ancient winemaking traditions and modern consumer preferences, creating unique opportunities across diverse regional landscapes. Market dynamics in this region reflect a complex tapestry of cultural, religious, and economic factors that shape wine consumption patterns and production capabilities. The region encompasses established wine-producing nations alongside emerging markets with growing appreciation for premium wine experiences.

Regional diversity characterizes the Middle East Africa wine market, with South Africa leading production volumes while countries like Lebanon, Israel, and Turkey contribute distinctive varietals and winemaking expertise. The market demonstrates steady growth momentum driven by increasing tourism, expatriate populations, and evolving consumer sophistication. Premium wine segments show particularly strong performance, with consumers increasingly seeking quality over quantity in their wine selections.

Market expansion occurs through multiple channels including luxury hotels, fine dining establishments, specialty wine retailers, and emerging e-commerce platforms. The region benefits from favorable climatic conditions in certain areas, supporting both traditional and innovative winemaking approaches. Investment flows into vineyard development and modern production facilities indicate strong confidence in long-term market potential across key producing regions.

The Middle East Africa wine market refers to the comprehensive ecosystem encompassing wine production, distribution, and consumption across the Middle Eastern and African regions. This market includes traditional wine-producing countries with centuries-old viticulture heritage alongside emerging markets developing new wine appreciation cultures. Market scope extends from premium estate wines to accessible everyday varieties, serving diverse consumer segments with varying preferences and purchasing power.

Geographic boundaries of this market encompass North African wine regions including Morocco and Algeria, Middle Eastern producers like Lebanon and Israel, and the dominant South African wine industry. The market definition includes imported wine segments serving expatriate communities and tourism sectors, creating additional revenue streams beyond domestic production. Cultural considerations play significant roles in market development, with certain regions showing stronger growth potential due to more liberal alcohol consumption policies.

Market participants range from family-owned boutique wineries to large-scale commercial producers, each contributing to the region’s diverse wine portfolio. The market encompasses various wine styles including traditional varietals, innovative blends, and organic wine segments responding to global sustainability trends.

Strategic positioning of the Middle East Africa wine market reveals significant growth opportunities driven by demographic shifts, urbanization trends, and increasing disposable income levels. The market benefits from tourism expansion across key destinations, creating sustained demand for quality wine experiences in hospitality sectors. Consumer sophistication continues advancing, with wine education programs and tasting events fostering deeper appreciation for premium wine categories.

Production capabilities across the region demonstrate remarkable diversity, from South Africa’s internationally recognized wine estates to Lebanon’s high-altitude vineyards producing distinctive Mediterranean varietals. Market growth shows resilience despite regional challenges, with established producers expanding export capabilities while new entrants focus on domestic market development. Investment trends indicate strong confidence in sector potential, with modern winemaking technology adoption improving quality standards.

Competitive dynamics feature both regional producers and international wine brands competing for market share across different price segments. The market demonstrates premiumization trends with consumers increasingly willing to pay higher prices for quality wines with authentic regional characteristics. Distribution channels continue evolving, with digital platforms complementing traditional retail and hospitality sales channels.

Consumer behavior analysis reveals distinct preferences across different regional markets, with urban consumers showing greater openness to wine experimentation compared to traditional rural populations. Age demographics indicate younger consumers driving market growth, particularly in metropolitan areas where wine culture integration occurs more rapidly. Gender preferences show balanced consumption patterns with women increasingly participating in wine appreciation activities.

Economic prosperity across key regional markets creates favorable conditions for wine market expansion, with rising disposable income levels enabling consumers to explore premium wine categories. Urbanization trends concentrate populations in metropolitan areas where wine culture adoption occurs more readily through restaurants, bars, and social venues. Tourism growth brings international visitors familiar with wine consumption, creating demand for quality wine experiences in hospitality sectors.

Cultural evolution in certain regional markets shows increasing acceptance of moderate alcohol consumption, particularly among educated urban populations. Expatriate communities maintain wine consumption habits from their home countries, creating steady demand for both imported and locally produced wines. Restaurant industry expansion drives wine sales through food pairing programs and sommelier-guided experiences that introduce consumers to new wine varieties.

Investment in infrastructure improves wine production capabilities and distribution networks, enabling producers to reach broader consumer bases with consistent quality products. Educational initiatives including wine courses and tasting events build consumer knowledge and appreciation, supporting market growth across all price segments. Climate advantages in certain regions provide optimal growing conditions for producing distinctive wines that compete effectively in international markets.

Religious considerations significantly impact wine market development across certain regional areas where alcohol consumption faces cultural or legal restrictions. Regulatory frameworks vary considerably between countries, creating complex compliance requirements for producers and distributors operating across multiple markets. Import duties and taxes on alcoholic beverages increase wine prices, potentially limiting market accessibility for price-sensitive consumer segments.

Infrastructure limitations in some regional areas affect wine distribution efficiency and product quality maintenance throughout supply chains. Climate challenges including drought conditions and extreme weather events impact grape production consistency and quality in certain wine-growing regions. Limited consumer awareness about wine appreciation and proper storage practices may restrict market growth potential in emerging consumer segments.

Competition from alternative beverages including spirits and beer may limit wine market share growth, particularly among younger consumer demographics. Economic volatility in certain regional markets affects consumer spending on discretionary items like premium wines. Cultural barriers to alcohol consumption persist in conservative communities, limiting market penetration opportunities for wine producers and retailers.

Wine tourism development presents substantial growth opportunities for regional producers to create immersive experiences that combine wine tasting with cultural education and scenic vineyard visits. E-commerce expansion enables wine producers to reach consumers directly, bypassing traditional distribution channels while building stronger brand relationships. Premium positioning strategies allow regional wines to compete effectively against international brands by emphasizing unique terroir characteristics and authentic production methods.

Export market development offers significant revenue potential for quality regional wines, particularly as international consumers seek diverse wine experiences beyond traditional producing countries. Organic wine production responds to growing consumer demand for sustainable and environmentally conscious products, creating differentiation opportunities for forward-thinking producers. Corporate hospitality markets provide steady demand for premium wines through business entertainment and special events.

Partnership opportunities with international wine companies can provide regional producers with technical expertise, marketing support, and distribution networks for market expansion. Wine education programs in hospitality schools and consumer venues build market awareness while developing knowledgeable staff who can effectively promote wine sales. Seasonal celebrations and festivals create promotional opportunities for wine producers to showcase their products to broader consumer audiences.

Supply chain evolution demonstrates increasing sophistication as regional wine producers invest in modern logistics systems to maintain product quality from vineyard to consumer. Pricing strategies reflect market segmentation approaches, with producers offering diverse price points to capture different consumer demographics while maintaining profitability. Brand positioning increasingly emphasizes regional authenticity and unique production methods to differentiate from international wine competitors.

Consumer education initiatives by producers and retailers build market awareness while developing more sophisticated wine appreciation among regional consumers. Seasonal demand patterns show strong performance during holiday periods and special occasions, with producers adapting production and marketing strategies accordingly. Technology integration in winemaking processes improves quality consistency while reducing production costs for regional producers.

Distribution channel diversification includes traditional retail, hospitality, and emerging online platforms, providing multiple touchpoints for consumer engagement. Regulatory compliance requires ongoing attention as governments adjust alcohol policies affecting wine production, distribution, and marketing activities. Market consolidation trends show larger producers acquiring smaller wineries to expand production capacity and market reach across regional territories.

Comprehensive market analysis employs multiple research approaches including primary data collection through industry interviews, consumer surveys, and producer questionnaires across key regional markets. Secondary research incorporates government statistics, industry reports, and trade association data to validate market trends and growth projections. Field research activities include vineyard visits, retail outlet assessments, and hospitality venue evaluations to understand market dynamics firsthand.

Data triangulation methods ensure research accuracy by comparing information from multiple sources including producers, distributors, retailers, and consumers. Market segmentation analysis examines consumer behavior patterns across different demographic groups, geographic regions, and price categories. Competitive intelligence gathering includes monitoring producer activities, pricing strategies, and marketing initiatives across regional markets.

Quantitative analysis incorporates statistical modeling to project market growth trends and identify key performance indicators for different market segments. Qualitative research through expert interviews provides insights into market challenges, opportunities, and future development prospects. Regional market studies examine specific country markets to understand local dynamics affecting wine consumption and production patterns.

South Africa dominates regional wine production with 75% market share across the Middle East Africa wine market, leveraging established vineyard infrastructure and international export capabilities. Cape Town region serves as the primary production hub, benefiting from optimal climate conditions and centuries of winemaking expertise. Export performance shows strong growth with South African wines gaining recognition in international markets for quality and value positioning.

Lebanon contributes approximately 8% of regional production, with high-altitude vineyards in the Bekaa Valley producing distinctive wines that command premium prices in regional and international markets. Israeli wine industry accounts for 6% market share, focusing on innovative winemaking techniques and desert viticulture that creates unique wine characteristics. Turkey represents 5% of regional production with ancient winemaking traditions experiencing modern revival through investment in contemporary production facilities.

North African markets including Morocco and Algeria collectively represent 4% market share, with growing domestic consumption and emerging export potential. Gulf Cooperation Council countries serve primarily as consumption markets for imported wines, driven by expatriate populations and tourism sectors. East African markets show emerging potential with 2% current market share but growing interest in wine production development projects.

Market leadership features established producers with strong brand recognition and distribution networks across multiple regional markets. Competitive positioning strategies emphasize quality differentiation, regional authenticity, and sustainable production practices to attract discerning consumers.

By Wine Type: The market segments into red wines commanding 45% market share, white wines representing 35% of consumption, and rosé wines accounting for 15% market share. Sparkling wines constitute the remaining 5% of market volume but show strong growth potential in celebration and hospitality segments.

By Price Category: Premium wines priced above average market levels represent 30% of market value despite lower volume shares, indicating strong consumer willingness to pay for quality. Mid-range wines capture 50% of market volume serving mainstream consumers seeking quality-price balance. Economy wines account for 20% of market volume primarily in price-sensitive consumer segments.

By Distribution Channel: Hospitality venues including restaurants and hotels account for 40% of wine sales, while retail outlets represent 45% of market volume. Online sales channels constitute 10% of current market but demonstrate rapid growth potential. Direct-to-consumer sales through vineyard visits and wine clubs represent 5% of market volume with higher profit margins for producers.

Red Wine Segment: Demonstrates strongest consumer preference across regional markets, with Cabernet Sauvignon and Merlot varieties leading consumption patterns. Local varietals including South African Pinotage and Lebanese indigenous grapes create differentiation opportunities for regional producers. Aging potential of red wines supports premium pricing strategies while building brand prestige through vintage collections.

White Wine Category: Shows growing popularity particularly among younger consumers and in warmer climate regions where lighter wines complement local cuisine preferences. Sauvignon Blanc and Chardonnay lead international varietal preferences, while regional specialties create unique market positioning opportunities. Food pairing programs in restaurants drive white wine consumption through sommelier recommendations and menu integration.

Rosé Wine Segment: Experiences rapid growth driven by social media influence and lifestyle marketing approaches that position rosé as fashionable and accessible. Seasonal consumption patterns peak during warmer months and holiday periods, requiring producers to adapt production and marketing strategies accordingly. Premium rosé categories command higher prices through sophisticated production methods and elegant packaging approaches.

Sparkling Wine Category: Benefits from celebration culture and special occasion consumption, with New Year celebrations and wedding ceremonies driving seasonal demand spikes. Traditional method sparkling wines compete with more affordable alternatives while maintaining quality differentiation through production technique emphasis.

Wine Producers benefit from expanding consumer bases and growing appreciation for quality wines across regional markets. Revenue diversification through multiple sales channels reduces dependency on single market segments while building resilient business models. Brand building opportunities through wine tourism and direct consumer engagement create lasting relationships that support premium pricing strategies.

Distributors and Retailers capitalize on growing wine market demand through expanded product portfolios and specialized wine retail concepts. Margin improvements result from consumer willingness to pay premium prices for quality wines and expert recommendations. Market education roles position retailers as trusted advisors, building customer loyalty and repeat business patterns.

Hospitality Industry enhances dining experiences through wine pairing programs and sommelier services that increase average transaction values. Tourism integration creates additional revenue streams through wine-focused travel experiences and vineyard partnerships. Staff training programs in wine knowledge improve service quality while supporting higher wine sales volumes.

Government Stakeholders benefit from wine industry tax revenues and employment creation in rural agricultural regions. Export earnings from quality wine production contribute to national trade balances while building positive country image associations. Tourism promotion through wine regions attracts international visitors and supports broader economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization Movement drives consumer preferences toward higher-quality wines with authentic regional characteristics and sophisticated production methods. Sustainable Viticulture gains momentum as consumers increasingly value environmentally responsible wine production practices including organic and biodynamic farming approaches. Wine Tourism Integration creates immersive experiences combining wine tasting with cultural education and scenic vineyard visits.

Digital Marketing Adoption enables wine producers to build direct relationships with consumers through social media engagement and e-commerce platforms. Food Pairing Culture develops through restaurant programs and consumer education initiatives that enhance wine appreciation and consumption occasions. Boutique Winery Growth reflects consumer interest in unique, small-batch wines with distinctive characteristics and personal producer stories.

Technology Integration in winemaking processes improves quality consistency while reducing production costs through precision agriculture and automated monitoring systems. Export Market Focus intensifies as regional producers seek revenue diversification and international brand recognition. Consumer Education Emphasis builds market sophistication through wine courses, tasting events, and sommelier-guided experiences that develop deeper wine appreciation.

Investment Expansion in modern winemaking facilities demonstrates industry confidence in long-term market growth potential across key regional markets. International Partnerships between regional producers and global wine companies provide technical expertise and distribution network access for market expansion. Quality Certification Programs establish regional wine standards that build consumer confidence and support premium positioning strategies.

Vineyard Development Projects expand production capacity in optimal growing regions while incorporating sustainable farming practices and modern irrigation systems. Wine Education Initiatives in hospitality schools and consumer venues build market awareness while developing knowledgeable staff who effectively promote wine sales. E-commerce Platform Launches enable direct-to-consumer sales channels that bypass traditional distribution while building stronger brand relationships.

Tourism Infrastructure Investment creates wine destination experiences that combine tasting rooms, accommodation facilities, and cultural attractions. Research and Development Programs focus on indigenous grape varieties and innovative winemaking techniques that create unique regional wine characteristics. Export Promotion Activities through trade missions and international wine competitions build global awareness of regional wine quality and diversity.

Market Entry Strategies should emphasize regional authenticity and unique terroir characteristics to differentiate from international wine competitors. MarkWide Research analysis indicates that successful wine producers focus on building strong local market presence before pursuing export opportunities. Distribution Channel Diversification reduces market risk while capturing different consumer segments through appropriate channel strategies.

Quality Investment Priorities should focus on modern winemaking equipment and vineyard management systems that ensure consistent product quality across production volumes. Brand Building Activities through wine tourism and direct consumer engagement create lasting relationships that support premium pricing and customer loyalty. Sustainability Integration meets growing consumer expectations while potentially reducing production costs through efficient resource management.

Partnership Development with established distributors and hospitality venues provides market access while leveraging existing customer relationships. Consumer Education Programs build market sophistication and wine appreciation that supports higher-value product sales. Export Market Research identifies optimal international markets for regional wine characteristics and price positioning strategies.

Market Growth Trajectory indicates sustained expansion driven by urbanization trends, rising disposable income levels, and growing wine culture acceptance across regional markets. MWR projections suggest continued premiumization trends with consumers increasingly seeking quality wine experiences over volume consumption. Technology Adoption will enhance production efficiency while maintaining artisanal wine characteristics that differentiate regional producers.

Export Market Development presents significant revenue opportunities as international consumers seek diverse wine experiences beyond traditional producing regions. Sustainable Production Practices will become increasingly important for market competitiveness and consumer acceptance. Wine Tourism Growth creates additional revenue streams while building brand awareness and customer loyalty through immersive experiences.

Consumer Sophistication continues advancing through education programs and exposure to diverse wine styles, supporting market growth across all price segments. Distribution Innovation through digital platforms and direct-to-consumer channels will complement traditional retail and hospitality sales. Regional Collaboration among producers may develop to promote collective wine region branding and international market penetration strategies.

The Middle East Africa wine market demonstrates remarkable resilience and growth potential despite regional challenges, driven by evolving consumer preferences and expanding appreciation for quality wine experiences. Market dynamics reflect successful adaptation to local cultural contexts while maintaining international quality standards that enable export market development. Investment trends in modern production facilities and sustainable farming practices position regional producers for long-term competitive success.

Strategic opportunities abound for wine producers who emphasize regional authenticity, quality consistency, and consumer education to build lasting market presence. The market benefits from diverse terroir advantages that support unique wine characteristics capable of competing effectively in premium segments. Future growth prospects remain positive as urbanization, tourism expansion, and cultural evolution continue supporting wine market development across the Middle East Africa region.

What is Middle East Africa Wine?

Middle East Africa Wine refers to the production and consumption of wine in the Middle East and African regions, encompassing various styles and varieties influenced by local climates, cultures, and grape types.

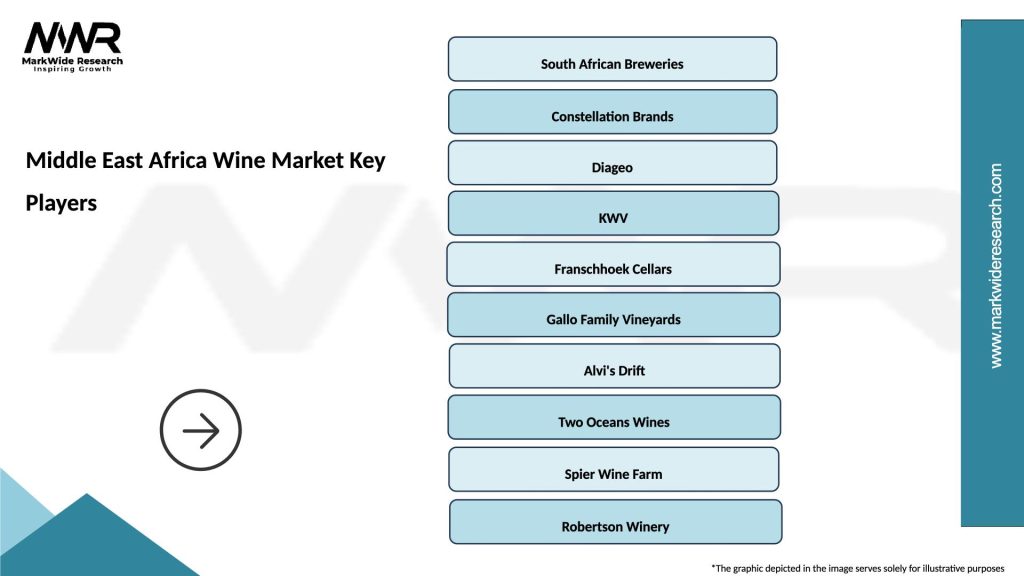

What are the key players in the Middle East Africa Wine Market?

Key players in the Middle East Africa Wine Market include companies like Castel Group, KWV, and Bodega Norton, which are known for their diverse wine offerings and regional influence, among others.

What are the growth factors driving the Middle East Africa Wine Market?

The growth of the Middle East Africa Wine Market is driven by increasing consumer interest in wine, the rise of wine tourism, and the expansion of vineyards in regions like South Africa and Morocco.

What challenges does the Middle East Africa Wine Market face?

Challenges in the Middle East Africa Wine Market include regulatory restrictions on alcohol sales, cultural attitudes towards drinking, and competition from other alcoholic beverages.

What opportunities exist in the Middle East Africa Wine Market?

Opportunities in the Middle East Africa Wine Market include the potential for growth in premium wine segments, increased exports, and the development of wine education programs to enhance consumer knowledge.

What trends are shaping the Middle East Africa Wine Market?

Trends in the Middle East Africa Wine Market include a growing preference for organic and sustainable wines, the emergence of local wine brands, and innovative wine tourism experiences that attract both local and international visitors.

Middle East Africa Wine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Red Wine, White Wine, Sparkling Wine, Rosé Wine |

| Distribution Channel | Retail Stores, Online Sales, Supermarkets, Wine Shops |

| Customer Type | Individual Consumers, Restaurants, Hotels, Distributors |

| Price Tier | Premium, Mid-Range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Africa Wine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at