444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East Africa ice cream market represents a dynamic and rapidly expanding segment within the region’s food and beverage industry. This market encompasses a diverse range of frozen dessert products, from traditional ice cream flavors to innovative premium offerings tailored to local tastes and preferences. The region’s unique climate conditions, growing urbanization, and increasing disposable income have created substantial opportunities for ice cream manufacturers and retailers.

Market dynamics in the Middle East and Africa are characterized by a strong demand for cooling refreshments, driven by the region’s predominantly hot climate. The market has experienced remarkable growth, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory reflects the increasing consumer preference for premium and artisanal ice cream products, alongside the expansion of modern retail infrastructure across key markets.

Regional variations play a significant role in shaping market dynamics, with the Gulf Cooperation Council (GCC) countries leading consumption patterns due to higher per capita income levels and established retail networks. Meanwhile, emerging markets in Africa present substantial growth potential, with urbanization rates reaching 65% in major metropolitan areas, creating new consumer bases for ice cream products.

The Middle East Africa ice cream market refers to the comprehensive ecosystem of frozen dessert manufacturing, distribution, and retail operations across the Middle East and African regions. This market encompasses various product categories including traditional ice cream, gelato, frozen yogurt, sorbet, and innovative fusion flavors that cater to diverse cultural preferences and dietary requirements.

Market scope extends beyond simple frozen treats to include premium artisanal products, health-conscious alternatives, and culturally-inspired flavors that resonate with local consumer preferences. The market includes both international brands establishing regional presence and local manufacturers developing products specifically for regional tastes, creating a competitive landscape that drives innovation and quality improvements.

Industry stakeholders include manufacturers, distributors, retailers, ingredient suppliers, and packaging companies, all contributing to a complex value chain that serves millions of consumers across diverse geographic and economic segments. The market’s definition also encompasses seasonal variations, with peak consumption periods during summer months and religious celebrations driving significant sales spikes.

Strategic positioning within the Middle East Africa ice cream market reveals a landscape characterized by robust growth potential and evolving consumer preferences. The market demonstrates strong resilience and adaptability, with manufacturers increasingly focusing on premium product offerings and innovative flavor profiles that appeal to sophisticated consumer palates.

Key growth drivers include rising disposable incomes, expanding retail infrastructure, and increasing consumer awareness of premium ice cream brands. The market has witnessed a 45% increase in premium product adoption over recent years, indicating a shift toward higher-value offerings. Additionally, the growing expatriate population in Gulf countries has created demand for international flavors and brands.

Market challenges primarily revolve around supply chain complexities, temperature-sensitive logistics, and varying regulatory requirements across different countries. However, these challenges have spurred innovation in cold chain management and local manufacturing capabilities, ultimately strengthening the market’s foundation for sustainable growth.

Future prospects remain highly favorable, with industry experts anticipating continued expansion driven by demographic trends, urbanization, and evolving lifestyle preferences. The market’s trajectory suggests significant opportunities for both established players and new entrants willing to invest in understanding local consumer preferences and building robust distribution networks.

Consumer behavior analysis reveals distinct patterns that shape the Middle East Africa ice cream market landscape. Understanding these insights provides crucial guidance for manufacturers and retailers seeking to optimize their market strategies and product offerings.

Economic prosperity across key Middle Eastern markets has emerged as a fundamental driver of ice cream market expansion. Rising per capita incomes, particularly in Gulf Cooperation Council countries, have enabled consumers to allocate greater spending toward premium food and beverage products, including high-quality ice cream offerings.

Demographic trends significantly influence market dynamics, with a young and growing population driving consumption patterns. The region’s median age remains below global averages, creating a substantial consumer base with strong preferences for indulgent treats and innovative flavors. Additionally, increasing urbanization rates have concentrated populations in areas with better retail infrastructure and cold chain capabilities.

Climate considerations provide a natural advantage for ice cream consumption throughout the year. The region’s consistently warm temperatures create sustained demand for cooling refreshments, unlike temperate markets where consumption is highly seasonal. This climate advantage supports year-round production and sales, providing stable revenue streams for market participants.

Retail infrastructure development has accelerated market growth by improving product accessibility and availability. The expansion of modern retail formats, including hypermarkets, supermarkets, and convenience stores, has created new distribution channels and enhanced consumer exposure to diverse ice cream brands and products. Furthermore, improvements in cold chain logistics have enabled better product quality and extended shelf life.

Cultural celebrations and social occasions drive significant consumption spikes, particularly during religious festivals and family gatherings. These events create predictable demand patterns that manufacturers can leverage for production planning and promotional activities, contributing to overall market stability and growth.

Supply chain complexities present significant challenges for ice cream manufacturers and distributors operating across the Middle East and Africa. The requirement for uninterrupted cold chain management from production to point of sale creates substantial logistical costs and operational risks, particularly in regions with less developed infrastructure.

Regulatory variations across different countries create compliance challenges for manufacturers seeking to operate regionally. Varying food safety standards, labeling requirements, and import regulations necessitate substantial investment in regulatory expertise and product adaptation, potentially limiting market entry for smaller players.

Economic volatility in certain markets can impact consumer spending patterns and purchasing power. Currency fluctuations, inflation pressures, and economic uncertainty may lead consumers to reduce discretionary spending on premium ice cream products, affecting overall market growth rates.

Seasonal demand fluctuations, while generally favorable due to climate, can create inventory management challenges and production planning complexities. Manufacturers must balance production capacity to meet peak demand while avoiding excess inventory during slower periods, requiring sophisticated demand forecasting capabilities.

Cultural and dietary restrictions in certain markets may limit product acceptance and require specialized formulations. Halal certification requirements, lactose intolerance considerations, and religious dietary guidelines necessitate careful product development and marketing strategies to ensure broad market acceptance.

Competition from alternative treats and beverages may constrain market share growth, particularly from traditional desserts and cooling beverages that hold cultural significance. Local preferences for traditional sweets and refreshments can limit adoption of Western-style ice cream products in certain demographic segments.

Premium segment expansion represents the most significant growth opportunity within the Middle East Africa ice cream market. Consumer willingness to pay premium prices for artisanal, organic, and innovative products creates substantial revenue potential for manufacturers focusing on quality and differentiation strategies.

Health-conscious product development offers considerable opportunities as consumers become increasingly aware of nutritional considerations. The development of low-sugar, high-protein, and functional ice cream products can capture growing market segments focused on wellness and healthy indulgence options.

E-commerce and digital channels present emerging opportunities for direct-to-consumer sales and brand engagement. The growing adoption of online shopping and food delivery services creates new distribution channels that can reach consumers directly and provide personalized product offerings.

Local flavor innovation provides opportunities for manufacturers to differentiate their products and build stronger connections with regional consumers. Developing ice cream flavors inspired by traditional Middle Eastern and African desserts, spices, and ingredients can create unique market positioning and competitive advantages.

Emerging market penetration in African countries with growing middle-class populations offers substantial expansion potential. Countries experiencing economic growth and urbanization present opportunities for establishing new market presence and building brand recognition among emerging consumer segments.

Foodservice channel development through partnerships with restaurants, cafes, and entertainment venues can expand market reach and create new consumption occasions. Developing specialized products for foodservice applications can generate additional revenue streams and increase brand visibility.

Competitive intensity within the Middle East Africa ice cream market has increased significantly as both international brands and local manufacturers vie for market share. This competition drives continuous innovation in product development, marketing strategies, and distribution approaches, ultimately benefiting consumers through improved quality and variety.

Technology adoption is transforming production processes and supply chain management, enabling manufacturers to improve efficiency and product quality. Advanced freezing technologies, automated production lines, and sophisticated cold chain monitoring systems are becoming standard industry practices, reducing costs and enhancing product consistency.

Consumer education and awareness campaigns are elevating market sophistication, with consumers becoming more knowledgeable about ingredient quality, production methods, and nutritional content. This trend favors manufacturers who invest in transparency and quality communication, creating opportunities for premium positioning.

Sustainability initiatives are gaining importance as environmental consciousness grows among consumers and regulatory bodies. Manufacturers are increasingly focusing on sustainable packaging, responsible sourcing, and energy-efficient production processes to meet evolving market expectations and regulatory requirements.

Partnership strategies between manufacturers, retailers, and foodservice operators are creating new market dynamics and distribution opportunities. Strategic alliances enable market participants to leverage complementary strengths and access new customer segments more effectively than independent operations.

Comprehensive market analysis for the Middle East Africa ice cream market employs multiple research methodologies to ensure accuracy and reliability of findings. The research approach combines quantitative data collection with qualitative insights to provide a complete understanding of market dynamics and trends.

Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, retailers, and consumers across key markets. These interviews provide firsthand insights into market challenges, opportunities, and emerging trends that may not be captured through secondary research sources.

Secondary research compilation involves analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments and geographic regions.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review panels to ensure research accuracy and reliability. Quality control measures are implemented throughout the research process to maintain high standards of data integrity.

Market modeling techniques utilize advanced statistical methods to project future market trends and growth patterns. These models incorporate various economic, demographic, and industry-specific variables to provide robust forecasting capabilities for strategic planning purposes.

Gulf Cooperation Council (GCC) countries represent the most mature and lucrative segment of the Middle East Africa ice cream market. These markets, including the United Arab Emirates, Saudi Arabia, and Qatar, demonstrate strong consumer purchasing power and sophisticated retail infrastructure that supports premium product positioning.

Saudi Arabia leads regional consumption with its large population and growing retail sector. The market has experienced significant expansion in modern retail formats, creating new opportunities for ice cream brands to reach consumers through hypermarkets and specialty stores. Local preferences for traditional flavors combined with international options drive product diversity.

United Arab Emirates serves as a regional hub for international brands and innovative products. The country’s diverse expatriate population creates demand for global flavors while the local population maintains preferences for culturally relevant options. Dubai and Abu Dhabi represent key consumption centers with high per capita spending on premium food products.

Egypt presents substantial growth potential with its large population and expanding middle class. The market demonstrates strong demand for affordable ice cream options while showing increasing interest in premium products among urban consumers. Local manufacturing capabilities support both domestic consumption and regional export opportunities.

South Africa leads the African continent in ice cream consumption and market sophistication. The country’s established retail infrastructure and diverse consumer base create opportunities for both local and international brands. Market growth is driven by urbanization and increasing disposable income among emerging middle-class consumers.

Nigeria represents the largest potential market in Africa with its substantial population and growing economy. While the market remains developing, increasing urbanization and retail modernization create significant long-term opportunities for ice cream manufacturers willing to invest in market development and distribution infrastructure.

Market leadership in the Middle East Africa ice cream market is characterized by a mix of international brands and strong regional players, each leveraging different competitive advantages to capture market share and build consumer loyalty.

Competitive strategies vary significantly across market participants, with international brands typically focusing on premium positioning and brand heritage while local manufacturers emphasize affordability, cultural relevance, and distribution accessibility. Innovation in flavors, packaging, and marketing approaches drives competitive differentiation.

Market consolidation trends are emerging as larger players acquire regional brands and distribution networks to strengthen their market positions. These acquisitions enable global companies to access local market knowledge while providing regional players with resources for expansion and modernization.

Product type segmentation reveals distinct consumer preferences and market opportunities across different ice cream categories. Understanding these segments enables manufacturers to optimize their product portfolios and marketing strategies for maximum market impact.

By Product Type:

By Distribution Channel:

By Packaging Format:

Premium ice cream category demonstrates the strongest growth momentum within the Middle East Africa market, driven by increasing consumer sophistication and willingness to pay for quality experiences. This segment benefits from growing disposable incomes and exposure to international culinary trends through travel and social media.

Traditional ice cream products maintain the largest market share due to their broad appeal and accessible pricing. However, this segment faces increasing pressure from premium alternatives and health-conscious options, requiring manufacturers to innovate within traditional formulations to maintain competitiveness.

Health-focused alternatives including low-sugar, high-protein, and dairy-free options represent the fastest-growing category segment. Consumer awareness of health and wellness considerations drives demand for functional ice cream products that provide indulgence without compromising nutritional goals.

Local and fusion flavors create significant differentiation opportunities for manufacturers willing to invest in understanding regional taste preferences. Products incorporating traditional Middle Eastern and African ingredients and flavor profiles demonstrate strong consumer acceptance and brand loyalty.

Seasonal and limited-edition products generate excitement and drive trial among consumers seeking novelty and exclusivity. These products enable manufacturers to test new concepts and create buzz around their brands while commanding premium pricing during limited availability periods.

Foodservice-specific products designed for restaurants and cafes represent an underexploited opportunity for manufacturers to expand their market reach. Developing products optimized for foodservice applications can create new revenue streams and increase brand visibility among consumers.

Manufacturers operating in the Middle East Africa ice cream market benefit from sustained demand driven by favorable climate conditions and growing consumer affluence. The market’s expansion provides opportunities for capacity utilization, economies of scale, and return on investment in production facilities and distribution networks.

Retailers gain from ice cream’s high-margin characteristics and strong consumer appeal, particularly during peak seasons and promotional periods. Ice cream products drive foot traffic and impulse purchases while providing opportunities for cross-selling complementary products and building customer loyalty.

Distributors and logistics providers benefit from the specialized requirements of ice cream distribution, including cold chain management and temperature-controlled transportation. These specialized services command premium pricing and create barriers to entry that protect established players from new competition.

Ingredient suppliers experience stable demand for dairy products, stabilizers, flavoring agents, and packaging materials. The market’s growth creates opportunities for suppliers to develop specialized ingredients and solutions tailored to regional preferences and manufacturing requirements.

Consumers benefit from increasing product variety, quality improvements, and competitive pricing as market competition intensifies. The expansion of retail channels and product availability enhances consumer access to diverse ice cream options that meet varying preferences and dietary requirements.

Economic development in the region benefits from job creation in manufacturing, distribution, and retail sectors. The ice cream industry’s growth contributes to local economic activity and provides opportunities for skill development and technology transfer, particularly in emerging markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend continues to reshape the Middle East Africa ice cream market as consumers increasingly seek high-quality, artisanal products that offer superior taste experiences and ingredient transparency. This trend drives manufacturers to invest in premium product development and sophisticated marketing strategies that communicate quality and craftsmanship.

Health and wellness integration has become a dominant trend as consumers seek indulgent treats that align with their nutritional goals. Manufacturers are responding with innovative formulations that reduce sugar content, increase protein levels, and incorporate functional ingredients while maintaining taste appeal and consumer satisfaction.

Local flavor innovation represents a significant trend as manufacturers recognize the importance of cultural relevance in product development. Ice cream flavors inspired by traditional Middle Eastern and African desserts, spices, and ingredients create unique market positioning and stronger consumer connections.

Sustainable packaging solutions are gaining importance as environmental consciousness grows among consumers and regulatory bodies. Manufacturers are investing in eco-friendly packaging materials and designs that reduce environmental impact while maintaining product quality and shelf appeal.

Digital marketing and engagement strategies are becoming essential for brand building and consumer communication. Social media platforms, influencer partnerships, and digital advertising enable manufacturers to reach younger demographics and create brand awareness more effectively than traditional marketing approaches.

Convenience and accessibility trends drive innovation in packaging formats, distribution channels, and product positioning. Single-serve options, grab-and-go formats, and extended shelf-life products cater to busy lifestyles and impulse purchase behaviors among urban consumers.

Manufacturing capacity expansion across the region reflects growing market confidence and demand projections. Several major manufacturers have announced significant investments in new production facilities and equipment upgrades to serve expanding consumer bases and improve operational efficiency.

Strategic partnerships and acquisitions are reshaping the competitive landscape as companies seek to strengthen their market positions and access new distribution channels. Recent transactions have focused on combining international brand strength with local market knowledge and distribution capabilities.

Technology adoption initiatives are transforming production processes and supply chain management throughout the industry. Advanced freezing technologies, automated production lines, and sophisticated cold chain monitoring systems are becoming standard practices that improve quality and reduce costs.

Regulatory harmonization efforts across certain regional markets are simplifying compliance requirements and facilitating cross-border trade. These developments reduce barriers to market entry and enable manufacturers to achieve greater economies of scale through standardized products and processes.

Sustainability commitments from major industry players are driving innovation in packaging, sourcing, and production processes. Companies are implementing comprehensive sustainability programs that address environmental concerns while maintaining product quality and consumer appeal.

Research and development investments in flavor innovation, nutritional enhancement, and production efficiency are accelerating as companies compete for market differentiation. MarkWide Research indicates that R&D spending has increased substantially as manufacturers seek to develop products that meet evolving consumer preferences and regulatory requirements.

Market entry strategies for new participants should focus on understanding local consumer preferences and building strong distribution partnerships. Success in the Middle East Africa ice cream market requires significant investment in market research, product adaptation, and relationship building with key retail and foodservice partners.

Product portfolio optimization should balance premium offerings with accessible price points to capture diverse consumer segments. Manufacturers should consider developing tiered product lines that serve different market segments while maintaining brand coherence and quality standards across all offerings.

Distribution network development requires careful attention to cold chain capabilities and retail partner selection. Companies should prioritize building relationships with retailers who demonstrate strong cold chain management and commitment to product quality maintenance throughout the distribution process.

Innovation investment priorities should focus on health-conscious formulations, local flavor development, and sustainable packaging solutions. These areas represent the greatest opportunities for differentiation and long-term market success in an increasingly competitive environment.

Marketing strategy development should emphasize digital channels and social media engagement to reach younger demographics effectively. Traditional marketing approaches should be complemented with innovative digital strategies that create brand awareness and consumer engagement through interactive and shareable content.

Supply chain optimization investments should focus on cold chain reliability, inventory management systems, and demand forecasting capabilities. These operational improvements can significantly impact product quality, cost efficiency, and customer satisfaction levels throughout the distribution network.

Long-term growth prospects for the Middle East Africa ice cream market remain highly favorable, driven by demographic trends, economic development, and evolving consumer preferences. MWR analysis suggests that the market will continue expanding as urbanization accelerates and middle-class populations grow across key regional markets.

Technology integration will play an increasingly important role in market development, with advanced production techniques, supply chain optimization, and digital marketing strategies becoming essential competitive advantages. Manufacturers who invest in technology adoption will be better positioned to serve evolving consumer needs and operational requirements.

Market consolidation is expected to continue as larger players acquire regional brands and distribution networks to strengthen their market positions. This consolidation will create opportunities for operational synergies while potentially reducing competitive intensity in certain market segments.

Sustainability initiatives will become increasingly important as environmental regulations evolve and consumer awareness grows. Companies that proactively address sustainability concerns through packaging innovation, responsible sourcing, and energy-efficient operations will gain competitive advantages and regulatory compliance benefits.

Innovation acceleration in product development, particularly in health-conscious formulations and local flavor profiles, will drive market differentiation and growth. The most successful companies will be those that balance innovation with consumer acceptance and operational feasibility across diverse regional markets.

Regional market development will create new opportunities as infrastructure improvements and economic growth expand ice cream accessibility in emerging markets. Companies that establish early presence in developing markets while building strong local partnerships will be best positioned to capitalize on long-term growth potential.

The Middle East Africa ice cream market presents exceptional opportunities for growth and development, driven by favorable demographic trends, climate advantages, and evolving consumer preferences. Market participants who understand regional dynamics, invest in quality and innovation, and build strong distribution networks will be well-positioned to capitalize on the market’s substantial potential.

Strategic success in this market requires balancing international best practices with local market knowledge and cultural sensitivity. Companies that can effectively combine global brand strength with regional relevance will achieve the strongest competitive positions and sustainable growth trajectories.

Future market leaders will be those who embrace innovation, sustainability, and consumer-centric approaches while maintaining operational excellence and cost efficiency. The market’s continued evolution toward premium products and health-conscious options creates opportunities for differentiation and value creation that will benefit both industry participants and consumers throughout the region.

What is Ice Cream?

Ice cream is a frozen dessert made from dairy products, such as milk and cream, combined with sweeteners and flavorings. It is popular in various forms and flavors across different cultures, including traditional and artisanal varieties.

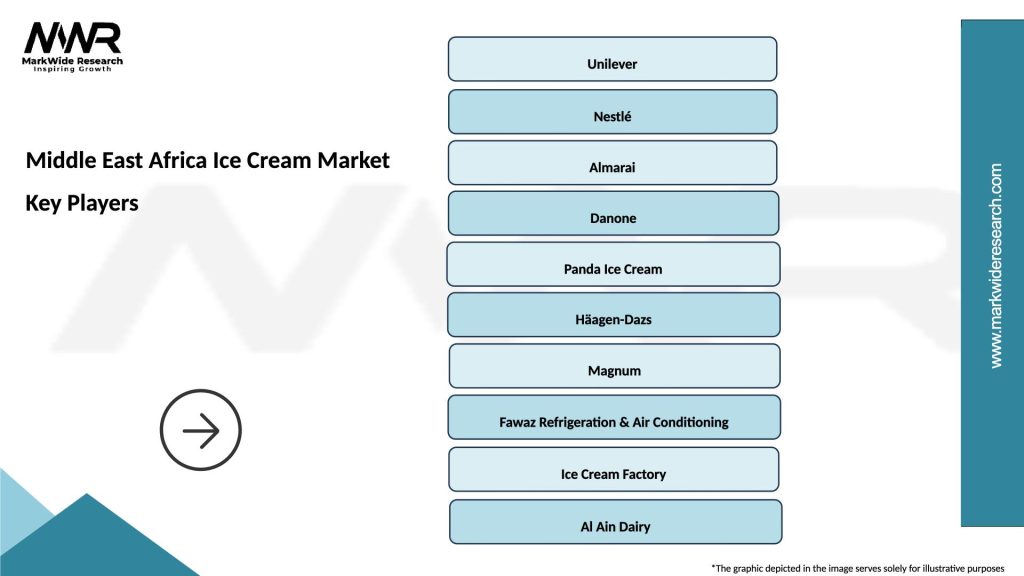

What are the key players in the Middle East Africa Ice Cream Market?

Key players in the Middle East Africa Ice Cream Market include companies like Unilever, Nestlé, and Almarai. These companies are known for their diverse product offerings and strong distribution networks, catering to a wide range of consumer preferences.

What are the growth factors driving the Middle East Africa Ice Cream Market?

The Middle East Africa Ice Cream Market is driven by factors such as increasing disposable incomes, a growing youth population, and rising demand for premium and innovative flavors. Additionally, the expansion of retail channels enhances accessibility for consumers.

What challenges does the Middle East Africa Ice Cream Market face?

Challenges in the Middle East Africa Ice Cream Market include fluctuating raw material prices, stringent regulations on food safety, and competition from alternative frozen desserts. These factors can impact production costs and market dynamics.

What opportunities exist in the Middle East Africa Ice Cream Market?

Opportunities in the Middle East Africa Ice Cream Market include the potential for product diversification, such as dairy-free and health-oriented options, and the expansion of e-commerce platforms for ice cream sales. Additionally, increasing tourism can boost demand in urban areas.

What trends are shaping the Middle East Africa Ice Cream Market?

Trends in the Middle East Africa Ice Cream Market include a growing preference for artisanal and locally sourced ingredients, as well as innovative flavors that cater to regional tastes. Sustainability practices are also becoming more important among consumers and manufacturers.

Middle East Africa Ice Cream Market

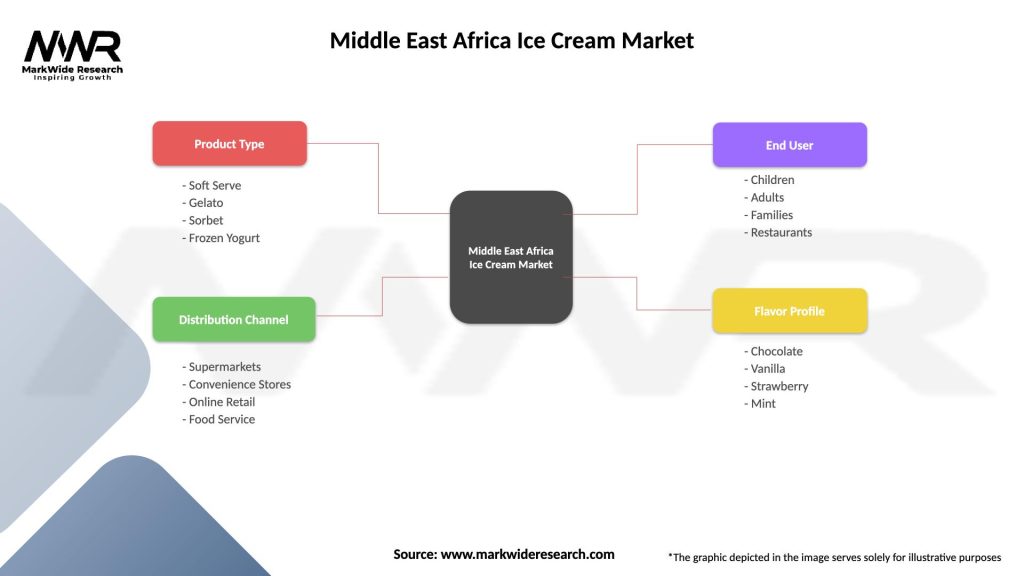

| Segmentation Details | Description |

|---|---|

| Product Type | Soft Serve, Gelato, Sorbet, Frozen Yogurt |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Food Service |

| End User | Children, Adults, Families, Restaurants |

| Flavor Profile | Chocolate, Vanilla, Strawberry, Mint |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Africa Ice Cream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at