444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA DPP-4 inhibitors market represents a rapidly expanding segment within the Middle East and Africa pharmaceutical landscape, driven by the increasing prevalence of type 2 diabetes and growing awareness of advanced treatment options. DPP-4 inhibitors, also known as gliptins, have emerged as a cornerstone therapy for diabetes management across the region, offering patients improved glycemic control with reduced risk of hypoglycemia. The market demonstrates significant growth potential, with regional adoption rates increasing by approximately 12.5% annually as healthcare systems modernize and patient access to innovative therapies expands.

Regional dynamics within the MEA territory showcase diverse market characteristics, with Gulf Cooperation Council countries leading in terms of per capita consumption and advanced healthcare infrastructure. The market benefits from increasing government healthcare investments, particularly in Saudi Arabia, UAE, and South Africa, where diabetes prevalence rates have reached concerning levels of 18-22% among adult populations. Healthcare providers across the region are increasingly recognizing the clinical benefits of DPP-4 inhibitors, including their oral administration convenience and favorable safety profile compared to traditional insulin therapies.

Market penetration varies significantly across different MEA countries, with developed healthcare systems in the Gulf region achieving higher adoption rates compared to sub-Saharan African markets. The therapeutic class continues to gain traction among endocrinologists and primary care physicians, supported by robust clinical evidence demonstrating efficacy in HbA1c reduction and cardiovascular safety. Patient preference for oral medications over injectable alternatives has contributed to the sustained growth trajectory, with market share expanding at a compound annual growth rate of 8.9% across the broader MEA region.

The MEA DPP-4 inhibitors market refers to the commercial landscape encompassing the development, manufacturing, distribution, and consumption of dipeptidyl peptidase-4 inhibitor medications specifically within Middle East and Africa territories. These pharmaceutical products represent a class of oral antidiabetic drugs that work by blocking the DPP-4 enzyme, thereby increasing incretin hormone levels and improving glucose-dependent insulin secretion while simultaneously reducing glucagon release from pancreatic alpha cells.

DPP-4 inhibitors function through a sophisticated mechanism that enhances the body’s natural ability to regulate blood glucose levels without causing significant weight gain or hypoglycemic episodes. The market encompasses various branded and generic formulations, including sitagliptin, saxagliptin, linagliptin, and alogliptin, each offering unique pharmacokinetic properties and dosing advantages. Healthcare systems across the MEA region utilize these medications as both monotherapy and combination therapy options, particularly for patients who cannot tolerate metformin or require additional glycemic control beyond first-line treatments.

Market definition extends beyond simple pharmaceutical sales to include associated services such as patient education programs, healthcare provider training initiatives, and digital health solutions that support medication adherence and monitoring. The scope encompasses regulatory frameworks, reimbursement policies, and healthcare infrastructure developments that influence market access and patient outcomes across diverse MEA healthcare environments.

Strategic market analysis reveals that the MEA DPP-4 inhibitors market is experiencing robust expansion driven by demographic shifts, urbanization trends, and evolving lifestyle patterns that contribute to increased diabetes prevalence. The market demonstrates strong fundamentals with growing physician acceptance, expanding patient populations, and supportive regulatory environments across key regional markets. Clinical evidence supporting the cardiovascular safety and efficacy of DPP-4 inhibitors has strengthened their position within diabetes treatment algorithms, leading to increased prescribing confidence among healthcare providers.

Competitive dynamics within the market reflect a mix of multinational pharmaceutical companies and regional players, with patent expirations creating opportunities for generic competition while simultaneously expanding patient access through reduced pricing. The market benefits from increasing healthcare expenditure across Gulf countries, with diabetes care representing approximately 15-20% of total healthcare budgets in several MEA nations. Patient demographics show a concerning trend toward younger onset diabetes, creating long-term market opportunities for chronic disease management solutions.

Market trajectory indicates sustained growth potential supported by improving healthcare infrastructure, expanding insurance coverage, and growing awareness of diabetes complications. Regional governments are implementing comprehensive diabetes care programs that include DPP-4 inhibitors as preferred treatment options, particularly in countries with established healthcare systems. Innovation trends focus on combination therapies and patient-centric formulations that enhance adherence and clinical outcomes while reducing overall treatment costs.

Primary market drivers encompass several interconnected factors that collectively support sustained market expansion across the MEA region:

Market intelligence indicates that combination therapy approaches are gaining significant traction, with DPP-4 inhibitors frequently prescribed alongside metformin and SGLT-2 inhibitors to achieve comprehensive glycemic control. Regional variations in prescribing patterns reflect differences in healthcare system maturity, with Gulf countries demonstrating higher adoption of newer therapeutic classes compared to other MEA territories.

Epidemiological factors represent the most significant driver of market growth, with diabetes prevalence continuing to rise across all MEA countries due to lifestyle changes, dietary transitions, and genetic predisposition factors. The region faces a diabetes epidemic, with some countries reporting prevalence rates approaching 20% of adult populations, creating substantial demand for effective oral antidiabetic medications. Urbanization trends contribute to sedentary lifestyles and dietary changes that increase diabetes risk, particularly among younger demographics who prefer convenient oral treatment options.

Healthcare system evolution across the MEA region supports market expansion through improved diabetes care infrastructure, specialized clinics, and enhanced healthcare provider training programs. Government initiatives focused on non-communicable disease prevention and management have elevated diabetes care as a healthcare priority, with dedicated funding for innovative treatment options. Insurance coverage expansion in several countries has improved patient access to branded DPP-4 inhibitors, reducing out-of-pocket costs and enabling broader market penetration.

Clinical advantages of DPP-4 inhibitors drive physician preference and patient acceptance, including their weight-neutral profile, low hypoglycemia risk, and convenient once-daily dosing regimens. The therapeutic class offers particular benefits for elderly patients and those with renal impairment, populations that are growing across the MEA region. Safety profile advantages compared to sulfonylureas and insulin have led to increased first-line and second-line prescribing, with clinical guidelines increasingly recommending DPP-4 inhibitors for specific patient populations.

Economic development in key MEA markets has increased healthcare spending capacity and created demand for premium pharmaceutical products. Rising disposable incomes, particularly in Gulf countries, enable patients to access branded medications and comprehensive diabetes care programs. Medical tourism within the region also contributes to market growth as patients seek advanced diabetes treatments in countries with superior healthcare infrastructure.

Economic constraints represent significant barriers to market expansion, particularly in lower-income MEA countries where healthcare budgets are limited and patient out-of-pocket expenses remain high. The cost differential between DPP-4 inhibitors and traditional diabetes medications like metformin and sulfonylureas creates accessibility challenges for price-sensitive patient populations. Healthcare infrastructure limitations in certain regions restrict specialist availability and diabetes care quality, limiting appropriate patient identification and treatment optimization opportunities.

Regulatory complexities across diverse MEA markets create challenges for pharmaceutical companies seeking regional market entry, with varying approval timelines, documentation requirements, and pricing negotiations. Some countries maintain restrictive formulary policies that limit DPP-4 inhibitor access to specific patient populations or require extensive prior authorization processes. Reimbursement limitations in several markets force patients to bear significant medication costs, particularly for newer branded formulations without generic alternatives.

Clinical considerations include ongoing debates regarding cardiovascular outcomes and long-term safety profiles, which may influence physician prescribing patterns and regulatory approval decisions. The emergence of newer diabetes medication classes, including SGLT-2 inhibitors and GLP-1 receptor agonists, creates competitive pressure and may limit DPP-4 inhibitor market share growth. Generic competition following patent expirations has reduced profit margins for branded products while creating pricing pressure across the therapeutic class.

Healthcare provider education gaps in some regions limit optimal DPP-4 inhibitor utilization, with insufficient awareness of appropriate patient selection criteria and combination therapy strategies. Patient adherence challenges persist despite oral formulation advantages, particularly in populations with limited health literacy or inadequate diabetes education support systems.

Combination therapy development presents substantial growth opportunities as pharmaceutical companies develop fixed-dose combinations that improve patient convenience and adherence while providing comprehensive glycemic control. The market potential for DPP-4 inhibitor combinations with metformin, SGLT-2 inhibitors, and insulin represents significant revenue opportunities across the MEA region. Generic market expansion following patent expirations creates opportunities for local manufacturers to enter the market with cost-effective alternatives, potentially expanding patient access and market penetration.

Digital health integration offers innovative opportunities to enhance DPP-4 inhibitor therapy through connected devices, mobile applications, and telemedicine platforms that support medication adherence and remote monitoring. The growing adoption of digital health solutions across MEA markets creates potential for value-added services that differentiate products and improve patient outcomes. Precision medicine approaches utilizing genetic testing and biomarker identification may enable more targeted DPP-4 inhibitor prescribing and improved therapeutic outcomes.

Market expansion into underserved MEA regions presents growth opportunities as healthcare infrastructure develops and patient access improves. Countries with emerging healthcare systems represent untapped markets with significant diabetes burden and growing treatment demand. Public-private partnerships focused on diabetes care delivery create opportunities for pharmaceutical companies to participate in comprehensive care programs and expand market reach through innovative access models.

Educational initiatives targeting healthcare providers and patients offer opportunities to increase appropriate DPP-4 inhibitor utilization and improve treatment outcomes. Research collaborations with regional academic institutions and healthcare organizations can generate real-world evidence supporting expanded indications and optimal treatment strategies specific to MEA patient populations.

Supply chain dynamics within the MEA DPP-4 inhibitors market reflect complex distribution networks spanning diverse regulatory environments, with multinational pharmaceutical companies establishing regional manufacturing and distribution capabilities to serve growing demand. The market demonstrates increasing localization trends as companies invest in regional production facilities to reduce costs and improve supply chain resilience. Pricing dynamics vary significantly across MEA countries, with Gulf markets supporting premium pricing while other regions require value-based pricing strategies to achieve market penetration.

Competitive dynamics continue evolving as patent expirations create opportunities for generic competition while established brands focus on differentiation through combination products and patient support programs. The market experiences ongoing consolidation as smaller regional players partner with multinational companies to access advanced formulations and manufacturing capabilities. Innovation cycles drive market evolution through next-generation DPP-4 inhibitors with improved pharmacokinetic profiles and reduced dosing frequency requirements.

Regulatory dynamics across MEA markets show increasing harmonization efforts, with regional regulatory bodies collaborating to streamline approval processes and improve patient access to innovative diabetes treatments. Healthcare policy changes in several countries have elevated diabetes care as a national health priority, leading to increased funding and improved reimbursement policies for DPP-4 inhibitors. The market benefits from growing recognition of diabetes as a major public health challenge requiring comprehensive treatment approaches.

Technology integration is reshaping market dynamics through digital health platforms that support medication adherence, remote monitoring, and personalized treatment optimization. Patient engagement strategies utilizing mobile applications and connected devices are becoming increasingly important for market success, with companies investing in comprehensive diabetes management ecosystems that extend beyond traditional pharmaceutical products.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the MEA DPP-4 inhibitors market landscape. Primary research activities include structured interviews with key stakeholders across the healthcare ecosystem, including endocrinologists, primary care physicians, hospital administrators, and pharmaceutical industry executives. Healthcare provider surveys capture prescribing patterns, treatment preferences, and clinical experience with various DPP-4 inhibitor formulations across different MEA markets.

Secondary research encompasses extensive analysis of published clinical studies, regulatory filings, healthcare databases, and industry reports to establish comprehensive market understanding. Data sources include national diabetes registries, healthcare utilization databases, pharmaceutical sales data, and epidemiological studies specific to MEA populations. Market intelligence gathering involves systematic monitoring of competitive activities, product launches, pricing changes, and regulatory developments across all major MEA markets.

Quantitative analysis utilizes statistical modeling techniques to project market trends, estimate growth rates, and identify key performance indicators across different market segments and geographic regions. Qualitative insights are gathered through focus groups with patients, healthcare providers, and industry experts to understand market dynamics, treatment preferences, and emerging trends that may impact future market development.

Data validation processes ensure accuracy and reliability through triangulation of multiple data sources, expert review panels, and cross-verification with established healthcare databases. Regional analysis methodology accounts for diverse healthcare systems, regulatory environments, and economic conditions across MEA countries to provide nuanced market insights and accurate growth projections.

Gulf Cooperation Council countries represent the most developed segment of the MEA DPP-4 inhibitors market, with Saudi Arabia and UAE leading in terms of market penetration and per capita consumption. These markets benefit from advanced healthcare infrastructure, comprehensive insurance coverage, and high diabetes prevalence rates reaching 18-20% of adult populations. Healthcare spending in Gulf countries supports premium pricing for branded DPP-4 inhibitors, with patients having access to the latest therapeutic innovations and combination products.

North African markets, including Egypt, Morocco, and Algeria, demonstrate growing adoption of DPP-4 inhibitors supported by expanding healthcare systems and increasing diabetes awareness. These markets show preference for cost-effective generic formulations while maintaining demand for branded products among affluent patient populations. Market penetration in North Africa benefits from improving healthcare infrastructure and government initiatives focused on non-communicable disease management.

Sub-Saharan Africa presents significant growth potential despite current market constraints related to healthcare access and affordability. South Africa leads the regional market with established healthcare infrastructure and insurance systems that support DPP-4 inhibitor access. Market development in other sub-Saharan countries depends on healthcare system improvements and innovative access programs that address affordability challenges.

Levant region markets, including Jordan, Lebanon, and Iraq, show varying degrees of DPP-4 inhibitor adoption influenced by economic conditions and healthcare system stability. Regional market share distribution reflects Gulf countries accounting for approximately 45-50% of total MEA consumption, followed by North Africa at 25-30% and sub-Saharan Africa representing the remaining market share with significant growth potential.

Market leadership within the MEA DPP-4 inhibitors market is characterized by strong competition among multinational pharmaceutical companies with established regional presence and comprehensive product portfolios. The competitive environment reflects both branded and generic competition, with patent expirations creating opportunities for biosimilar and generic manufacturers to capture market share through cost-effective alternatives.

Competitive strategies focus on product differentiation through combination formulations, patient support programs, and healthcare provider education initiatives. Market access strategies emphasize government relations, tender participation, and innovative pricing models that address diverse economic conditions across MEA markets. Companies invest significantly in regional clinical studies and real-world evidence generation to support market access and physician confidence.

Innovation competition centers on next-generation formulations with improved convenience, safety profiles, and combination therapy options that address comprehensive diabetes management needs. Digital health integration is becoming increasingly important for competitive differentiation, with companies developing connected health platforms and patient engagement tools.

Product segmentation within the MEA DPP-4 inhibitors market encompasses multiple therapeutic options with distinct pharmacological profiles and clinical applications:

By Active Ingredient:

By Formulation Type:

By Distribution Channel:

Geographic segmentation reflects diverse market characteristics across MEA regions, with Gulf countries representing premium markets, North Africa showing balanced growth, and sub-Saharan Africa offering long-term expansion opportunities.

Monotherapy segment represents the traditional foundation of the DPP-4 inhibitors market, serving patients who require add-on therapy to metformin or those with metformin intolerance. This category maintains steady demand driven by clinical guidelines recommending DPP-4 inhibitors as second-line therapy options. Prescribing patterns show continued preference for monotherapy in elderly patients and those with multiple comorbidities where drug interactions and side effects are primary concerns.

Combination therapy segment demonstrates the highest growth potential, with fixed-dose combinations offering improved patient convenience and adherence compared to multiple separate medications. Market adoption of combination products has increased significantly, with metformin-DPP-4 inhibitor combinations achieving market penetration rates of 35-40% in developed MEA markets. The segment benefits from simplified dosing regimens and comprehensive glycemic control through complementary mechanisms of action.

Generic segment continues expanding following patent expirations, creating opportunities for local manufacturers and improving patient access through reduced pricing. Generic adoption varies across MEA markets, with price-sensitive regions showing rapid uptake while premium markets maintain preference for branded formulations with comprehensive patient support programs. The segment contributes to overall market expansion by enabling broader patient access and healthcare system cost management.

Specialty formulations targeting specific patient populations, including renal-impaired and elderly patients, represent niche but important market segments with specialized clinical requirements. Market intelligence from MarkWide Research indicates growing demand for patient-specific formulations that address unique MEA population characteristics and comorbidity patterns.

Pharmaceutical manufacturers benefit from sustained market growth driven by increasing diabetes prevalence and expanding healthcare access across MEA markets. The therapeutic class offers opportunities for product lifecycle management through combination formulations, generic competition, and innovative delivery systems. Revenue diversification across multiple MEA countries provides market stability and growth potential despite individual country economic fluctuations.

Healthcare providers gain access to effective oral diabetes medications that offer clinical benefits including weight neutrality, low hypoglycemia risk, and convenient dosing regimens. DPP-4 inhibitors enable comprehensive diabetes management strategies that improve patient outcomes while reducing healthcare system burden. Clinical advantages include suitability for elderly patients, renal safety profiles, and combination therapy flexibility that supports personalized treatment approaches.

Patients benefit from improved quality of life through effective glycemic control with minimal side effects and convenient oral administration. The therapeutic class offers alternatives for patients who cannot tolerate traditional diabetes medications or require additional glycemic control beyond first-line therapies. Treatment outcomes include sustained HbA1c reduction, cardiovascular safety, and improved medication adherence compared to injectable alternatives.

Healthcare systems benefit from cost-effective diabetes management solutions that reduce long-term complications and associated healthcare costs. DPP-4 inhibitors support comprehensive diabetes care programs while offering economic advantages through generic competition and improved patient outcomes. System efficiency improves through reduced hospitalization rates, fewer diabetes complications, and enhanced chronic disease management capabilities.

Regulatory authorities benefit from established safety profiles and extensive clinical evidence supporting DPP-4 inhibitor approval and market access decisions. The therapeutic class provides proven treatment options that support national diabetes care strategies and public health objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Combination therapy adoption represents the most significant trend reshaping the MEA DPP-4 inhibitors market, with fixed-dose combinations achieving increasing market penetration as healthcare providers seek comprehensive diabetes management solutions. The trend toward multi-mechanism therapy reflects growing understanding of diabetes pathophysiology and the need for individualized treatment approaches. Clinical guidelines increasingly recommend combination therapy for patients requiring intensive glycemic control, driving demand for convenient fixed-dose formulations.

Digital health integration is transforming diabetes care delivery through connected devices, mobile applications, and telemedicine platforms that support medication adherence and remote monitoring. Technology adoption in MEA markets varies significantly, with Gulf countries leading in digital health implementation while other regions show growing interest in technology-enabled care solutions. The trend creates opportunities for pharmaceutical companies to develop comprehensive diabetes management ecosystems beyond traditional medication provision.

Personalized medicine approaches are gaining traction as healthcare providers recognize the importance of individualized treatment selection based on patient characteristics, comorbidities, and genetic factors. Biomarker research and pharmacogenomic studies specific to MEA populations may enable more targeted DPP-4 inhibitor prescribing and improved therapeutic outcomes. The trend supports premium pricing for branded formulations that offer personalized treatment advantages.

Value-based healthcare models are emerging across MEA markets, with healthcare systems increasingly focused on treatment outcomes and cost-effectiveness rather than simple medication access. Outcome-based contracts and risk-sharing agreements between pharmaceutical companies and healthcare payers are becoming more common, particularly in developed MEA markets with sophisticated healthcare systems.

Generic market maturation continues accelerating as patent expirations create opportunities for local manufacturers and biosimilar developers to enter the market with cost-effective alternatives. The trend supports market expansion through improved patient access while creating pricing pressure on branded formulations.

Regulatory approvals for new DPP-4 inhibitor combinations and formulations continue expanding treatment options across MEA markets, with several countries streamlining approval processes for established therapeutic classes. Recent approvals include triple-combination products incorporating DPP-4 inhibitors with metformin and SGLT-2 inhibitors, offering comprehensive diabetes management in single formulations. Regulatory harmonization efforts across MEA regions are improving market access timelines and reducing development costs for pharmaceutical companies.

Manufacturing investments by multinational pharmaceutical companies in MEA regions are improving supply chain resilience and reducing product costs through local production capabilities. Several companies have established regional manufacturing facilities to serve growing MEA demand while meeting local content requirements and reducing import dependencies. Technology transfer initiatives with local partners are expanding manufacturing capacity and creating employment opportunities across the region.

Clinical research initiatives focused on MEA patient populations are generating real-world evidence supporting DPP-4 inhibitor use in diverse ethnic and genetic backgrounds. MarkWide Research analysis indicates increasing investment in regional clinical studies that address specific MEA population characteristics and treatment response patterns. These studies support regulatory approvals and clinical guideline development tailored to regional patient needs.

Digital health partnerships between pharmaceutical companies and technology providers are creating comprehensive diabetes management platforms that integrate medication adherence, glucose monitoring, and lifestyle management tools. Innovation collaborations are developing region-specific solutions that address MEA market characteristics including language preferences, cultural considerations, and healthcare system integration requirements.

Market access agreements with government healthcare systems and insurance providers are expanding patient access to DPP-4 inhibitors through innovative pricing models and outcome-based contracts. Public-private partnerships focused on diabetes care delivery are creating sustainable market access while supporting national health objectives across MEA countries.

Strategic positioning in the MEA DPP-4 inhibitors market requires comprehensive understanding of regional healthcare dynamics and regulatory frameworks. MarkWide Research analysis indicates that pharmaceutical companies should prioritize market entry strategies that align with each country’s specific healthcare infrastructure and reimbursement policies. Market penetration strategies should focus on establishing strong relationships with key opinion leaders and healthcare providers across major markets including Saudi Arabia, UAE, Egypt, and South Africa.

Product differentiation remains crucial for success in this competitive landscape. Companies should emphasize unique clinical benefits, safety profiles, and dosing convenience to healthcare professionals and patients. Educational initiatives targeting endocrinologists, general practitioners, and diabetes educators can significantly enhance market acceptance and prescription rates. Digital engagement platforms and telemedicine integration should be leveraged to reach healthcare providers in remote areas across the MEA region.

Regulatory compliance strategies must be tailored to each market’s specific requirements. Early engagement with regulatory authorities can streamline approval processes and reduce time-to-market. Companies should invest in local regulatory expertise and establish partnerships with regional distributors who understand complex approval pathways. Pharmacovigilance systems should be robust and compliant with local reporting requirements to maintain market authorization.

Pricing strategies should reflect economic realities across diverse MEA markets. Tiered pricing approaches can maximize accessibility while maintaining profitability. Companies should explore innovative payment models, including installment plans and patient assistance programs, to improve affordability. Health economic data demonstrating cost-effectiveness compared to existing therapies can support reimbursement negotiations with government payers.

Supply chain optimization is critical for maintaining consistent product availability. Regional distribution centers and cold-chain logistics partnerships ensure product integrity across varied climate conditions. Companies should establish contingency plans for supply disruptions and maintain strategic inventory levels. Local manufacturing partnerships can reduce costs and improve supply security while potentially qualifying for preferential pricing considerations.

The MEA DPP-4 inhibitors market is positioned for substantial expansion driven by escalating diabetes prevalence, healthcare infrastructure improvements, and increasing access to advanced diabetes management therapies across the region through 2030 and beyond. Market projections indicate accelerated adoption supported by government healthcare initiatives, insurance coverage expansion, and growing awareness of modern diabetes treatment options across key markets including Saudi Arabia, UAE, Egypt, South Africa, and emerging Middle Eastern economies. Healthcare investments and Vision 2030 initiatives will continue driving market accessibility and treatment adoption throughout the region.

Treatment paradigm evolution will focus on combination therapies, personalized medicine approaches, and integrated diabetes care management programs. Digital health integration including telemedicine consultations, continuous glucose monitoring, and mobile health applications will enhance patient engagement and treatment adherence across diverse geographic areas. Healthcare professional education initiatives and clinical evidence generation will accelerate physician confidence and prescription rates for DPP-4 inhibitor therapies.

Regulatory harmonization across MEA countries will facilitate faster market approvals, streamlined registration processes, and improved product availability for patients requiring advanced diabetes treatments. Local manufacturing partnerships and regional distribution networks will enhance supply chain reliability while potentially reducing treatment costs. Emerging opportunities in pediatric diabetes management, cardiovascular risk reduction, and specialty diabetes care will create new market segments requiring tailored therapeutic approaches.

Market accessibility improvements through patient assistance programs, government subsidies, and innovative payment models will expand treatment reach to previously underserved populations. Clinical research investments in real-world evidence generation and region-specific safety data will support continued market growth and regulatory confidence across the MEA DPP-4 inhibitors landscape.

The MEA DPP-4 inhibitors market represents a critical therapeutic segment addressing the growing diabetes epidemic across Middle Eastern and African countries, driven by lifestyle changes, urbanization, and aging demographics throughout the region. Market dynamics demonstrate significant growth potential supported by healthcare system modernization, increased disease awareness, and expanding access to specialized diabetes care services. Government initiatives and healthcare infrastructure investments continue creating favorable conditions for advanced diabetes treatment adoption across diverse MEA markets.

Strategic success requires understanding complex regulatory environments, economic disparities, and cultural factors influencing treatment decisions across the diverse MEA region. Companies that prioritize local partnerships, healthcare provider education, and patient-centric access programs will be best positioned to capture opportunities in this expanding therapeutic market. Digital health integration and telemedicine platforms have become increasingly important for reaching patients in remote areas and supporting treatment continuity.

Clinical excellence and real-world evidence generation position DPP-4 inhibitors as essential components of comprehensive diabetes management strategies across the region. Treatment accessibility improvements through innovative pricing models and distribution partnerships continue expanding patient reach and therapeutic impact. Healthcare provider engagement and continuous medical education initiatives drive improved treatment outcomes and enhanced quality of diabetes care delivery.

The competitive landscape will continue evolving as both established pharmaceutical companies and emerging market participants compete for leadership in this growing therapeutic area. Sustained growth will require ongoing investment in clinical research, regulatory compliance, and market access strategies to meet diverse healthcare system requirements and patient needs across MEA countries. Patient-focused approaches emphasizing safety, efficacy, and treatment convenience will become increasingly important differentiators in this vital and rapidly expanding MEA DPP-4 inhibitors market.

What is DPP-4 Inhibitors?

DPP-4 inhibitors are a class of medications used to treat type two diabetes by increasing insulin production and decreasing glucose production in the liver. They work by inhibiting the enzyme Dipeptidyl Peptidase-4, which is involved in glucose metabolism.

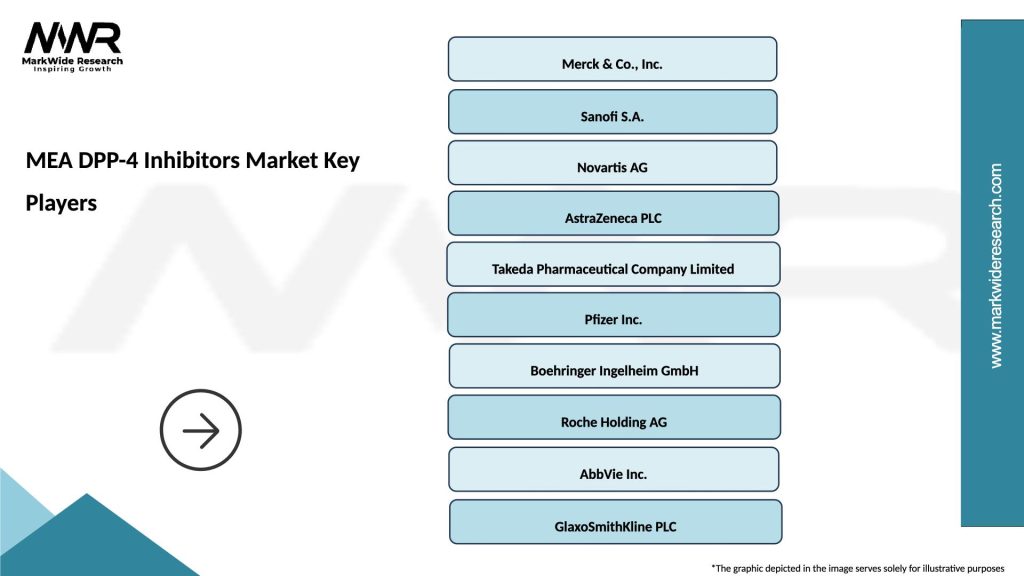

What are the key players in the MEA DPP-4 Inhibitors Market?

Key players in the MEA DPP-4 Inhibitors Market include Merck & Co., Sanofi, and AstraZeneca, among others. These companies are involved in the development and marketing of various DPP-4 inhibitor products.

What are the growth factors driving the MEA DPP-4 Inhibitors Market?

The growth of the MEA DPP-4 Inhibitors Market is driven by the rising prevalence of type two diabetes, increasing awareness about diabetes management, and the growing demand for effective oral hypoglycemic agents.

What challenges does the MEA DPP-4 Inhibitors Market face?

The MEA DPP-4 Inhibitors Market faces challenges such as the emergence of generic alternatives, potential side effects associated with DPP-4 inhibitors, and competition from other diabetes treatment classes.

What opportunities exist in the MEA DPP-4 Inhibitors Market?

Opportunities in the MEA DPP-4 Inhibitors Market include the development of new formulations, combination therapies with other diabetes medications, and expanding into emerging markets with increasing diabetes rates.

What trends are shaping the MEA DPP-4 Inhibitors Market?

Trends shaping the MEA DPP-4 Inhibitors Market include a focus on personalized medicine, advancements in drug delivery systems, and increasing research on the long-term effects of DPP-4 inhibitors on cardiovascular health.

MEA DPP-4 Inhibitors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sitagliptin, Saxagliptin, Linagliptin, Alogliptin |

| Therapy Area | Type 2 Diabetes, Cardiovascular Disease, Obesity, Metabolic Syndrome |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Delivery Mode | Oral Tablets, Injectable Solutions, Combination Therapies, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA DPP-4 Inhibitors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at