444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America DPP-4 inhibitors market represents a rapidly expanding segment within the region’s pharmaceutical landscape, driven by increasing diabetes prevalence and growing awareness of advanced treatment options. DPP-4 inhibitors, also known as gliptins, have emerged as a cornerstone therapy for type 2 diabetes management across Latin American countries. The market demonstrates robust growth potential with a projected CAGR of 8.2% over the forecast period, reflecting the region’s commitment to addressing the diabetes epidemic through innovative therapeutic solutions.

Market dynamics in Latin America are characterized by improving healthcare infrastructure, expanding insurance coverage, and increasing physician adoption of newer diabetes medications. Countries such as Brazil, Mexico, Argentina, and Colombia are leading the regional market expansion, with Brazil accounting for approximately 35% of the total market share. The growing middle-class population and enhanced access to healthcare services are contributing to increased diagnosis rates and subsequent treatment initiation with DPP-4 inhibitors.

Regulatory frameworks across Latin American countries have become increasingly supportive of innovative diabetes treatments, with streamlined approval processes and expanded formulary inclusions. The market benefits from strong clinical evidence supporting the efficacy and safety profile of DPP-4 inhibitors, particularly their favorable cardiovascular safety profile and low risk of hypoglycemia compared to traditional diabetes medications.

The Latin America DPP-4 inhibitors market refers to the commercial landscape encompassing the development, manufacturing, distribution, and sales of dipeptidyl peptidase-4 inhibitor medications specifically within Latin American countries. These pharmaceutical products represent a class of oral antidiabetic drugs that work by inhibiting the DPP-4 enzyme, thereby increasing incretin hormone levels and improving glucose homeostasis in patients with type 2 diabetes mellitus.

DPP-4 inhibitors function through a unique mechanism of action that enhances the body’s natural ability to regulate blood glucose levels. By blocking the DPP-4 enzyme, these medications prevent the breakdown of incretin hormones such as GLP-1 and GIP, which stimulate insulin secretion in a glucose-dependent manner and suppress glucagon release when blood glucose levels are elevated.

Market scope encompasses various branded and generic formulations of DPP-4 inhibitors, including sitagliptin, saxagliptin, linagliptin, alogliptin, and vildagliptin. The market also includes combination therapies that pair DPP-4 inhibitors with other antidiabetic agents such as metformin, providing enhanced therapeutic options for healthcare providers and patients across the region.

Strategic market analysis reveals that the Latin America DPP-4 inhibitors market is experiencing unprecedented growth driven by multiple convergent factors. The region’s diabetes prevalence continues to rise, with approximately 62% of diagnosed patients requiring advanced therapeutic interventions beyond first-line treatments. This growing patient population, combined with improved healthcare access and physician education, creates substantial market opportunities for pharmaceutical companies.

Competitive landscape features established multinational pharmaceutical companies alongside emerging regional players, creating a dynamic market environment. Leading market participants are focusing on strategic partnerships with local distributors, expanded market access programs, and educational initiatives to drive adoption of DPP-4 inhibitor therapies among healthcare providers.

Market segmentation analysis indicates strong performance across multiple therapeutic categories, with combination therapies showing particularly robust growth. The integration of DPP-4 inhibitors with established diabetes medications provides enhanced efficacy while maintaining the favorable safety profile that has made this drug class attractive to both physicians and patients.

Regional variations in market development reflect differences in healthcare infrastructure, regulatory environments, and economic conditions across Latin American countries. However, the overall trajectory remains positive, with increasing government initiatives to address diabetes as a public health priority driving market expansion throughout the region.

Primary market drivers include the escalating diabetes epidemic across Latin America, with several countries experiencing diabetes prevalence rates exceeding global averages. The region’s demographic transition, characterized by aging populations and changing lifestyle patterns, contributes to increased type 2 diabetes incidence and creates sustained demand for effective therapeutic interventions.

Market penetration varies significantly across different Latin American countries, with more developed healthcare systems showing higher adoption rates of DPP-4 inhibitors. Brazil and Mexico lead in absolute market size, while countries like Chile and Uruguay demonstrate higher per-capita utilization rates, reflecting their advanced healthcare infrastructure and diabetes management programs.

Diabetes prevalence surge represents the most significant driver propelling the Latin America DPP-4 inhibitors market forward. The region experiences one of the world’s highest diabetes growth rates, with prevalence increasing by approximately 4.8% annually across major markets. This epidemiological trend creates sustained demand for effective diabetes medications, particularly those offering improved safety profiles and patient convenience.

Healthcare system modernization across Latin American countries has enhanced access to advanced diabetes treatments. Government initiatives to strengthen primary healthcare networks and expand specialist services have improved diagnosis rates and treatment initiation. The integration of diabetes management protocols into national health programs has standardized care delivery and increased physician familiarity with DPP-4 inhibitor therapies.

Economic development and expanding middle-class populations have increased healthcare spending capacity and insurance coverage. Private health insurance penetration has grown substantially, providing patients with access to newer diabetes medications that may not be fully covered under public health systems. This economic progression enables broader adoption of DPP-4 inhibitors among patient populations previously limited to generic alternatives.

Clinical evidence accumulation supporting the cardiovascular safety and renal benefits of certain DPP-4 inhibitors has strengthened physician confidence in prescribing these medications. Large-scale clinical trials demonstrating neutral or beneficial cardiovascular outcomes have addressed previous safety concerns and positioned these drugs as preferred options for patients with cardiovascular comorbidities.

Pharmaceutical industry investment in Latin American markets has increased significantly, with major companies establishing regional manufacturing facilities and distribution networks. This local presence reduces costs, improves supply chain reliability, and enables more competitive pricing strategies that enhance market accessibility.

Cost considerations remain a primary barrier to widespread adoption of DPP-4 inhibitors across Latin American markets. Despite improving economic conditions, these medications typically command premium pricing compared to traditional diabetes treatments, limiting accessibility for patients without comprehensive insurance coverage. The cost-effectiveness debate continues to influence prescribing patterns, particularly in public healthcare systems with limited pharmaceutical budgets.

Healthcare infrastructure limitations in rural and underserved areas restrict market penetration. Many Latin American countries face challenges in providing consistent access to specialized diabetes care, with significant disparities between urban and rural healthcare availability. Limited diagnostic capabilities and physician shortages in remote areas constrain the identification and treatment of diabetes patients who could benefit from DPP-4 inhibitor therapy.

Regulatory complexities across different Latin American countries create challenges for pharmaceutical companies seeking regional market expansion. Varying approval requirements, pricing negotiations, and formulary inclusion processes can delay market entry and increase operational costs. The lack of harmonized regulatory frameworks requires companies to navigate multiple distinct approval pathways.

Generic competition intensification poses challenges for branded DPP-4 inhibitor manufacturers. As patents expire and generic alternatives enter the market, pricing pressure increases significantly. While generic availability can expand overall market access, it may reduce revenue potential for innovator companies and impact their investment in market development activities.

Clinical inertia among some healthcare providers continues to limit optimal diabetes management. Despite clinical evidence supporting DPP-4 inhibitors, some physicians remain hesitant to prescribe newer medications, preferring familiar treatment options. This conservative prescribing behavior can slow market adoption and delay patient access to potentially beneficial therapies.

Combination therapy expansion presents significant growth opportunities within the Latin America DPP-4 inhibitors market. The development of fixed-dose combinations pairing DPP-4 inhibitors with complementary diabetes medications addresses physician preferences for simplified treatment regimens while potentially improving patient adherence. These combination products can capture larger market share by offering enhanced convenience and therapeutic benefits.

Telemedicine integration and digital health initiatives across Latin America create new channels for diabetes management and medication monitoring. The COVID-19 pandemic accelerated telehealth adoption, providing opportunities to reach previously underserved patient populations. Digital platforms can facilitate remote monitoring of patients on DPP-4 inhibitor therapy and support medication adherence programs.

Public-private partnerships offer pathways to expand market access while addressing public health objectives. Collaborations between pharmaceutical companies and government health agencies can develop sustainable pricing models and distribution strategies that make DPP-4 inhibitors more accessible to broader patient populations. These partnerships can also support physician education and patient awareness programs.

Emerging market segments within Latin America, including countries with developing healthcare systems, represent untapped growth potential. As these markets strengthen their healthcare infrastructure and expand insurance coverage, demand for advanced diabetes treatments will increase. Early market entry strategies can establish competitive advantages in these emerging opportunities.

Personalized medicine approaches utilizing pharmacogenomic testing and biomarker identification could optimize DPP-4 inhibitor therapy selection. As precision medicine capabilities expand across Latin America, opportunities exist to develop targeted treatment strategies that improve therapeutic outcomes and justify premium pricing for personalized diabetes management solutions.

Supply chain evolution within the Latin America DPP-4 inhibitors market reflects broader pharmaceutical industry trends toward regionalization and supply security. Companies are establishing local manufacturing capabilities and distribution networks to reduce dependency on global supply chains while improving cost competitiveness. This localization strategy enhances market responsiveness and enables more flexible pricing approaches.

Competitive intensity continues to increase as both multinational pharmaceutical companies and regional players vie for market share. The competitive landscape features differentiation strategies based on clinical profiles, pricing models, and market access programs. Companies are investing in real-world evidence generation to demonstrate the value proposition of their DPP-4 inhibitor products in Latin American patient populations.

Regulatory harmonization efforts across Latin American countries are gradually improving market access efficiency. Regional regulatory initiatives aim to streamline approval processes and facilitate faster market entry for innovative diabetes treatments. These harmonization efforts reduce regulatory complexity and associated costs for pharmaceutical companies while potentially accelerating patient access to new therapies.

Healthcare digitization is transforming diabetes management practices across the region, creating new opportunities for DPP-4 inhibitor market growth. Electronic health records, digital prescribing systems, and patient monitoring platforms are improving treatment tracking and adherence monitoring. According to MarkWide Research analysis, digital health integration has contributed to improved medication adherence rates of approximately 23% in markets with advanced digital infrastructure.

Economic volatility in certain Latin American countries creates both challenges and opportunities for the pharmaceutical market. Currency fluctuations and economic instability can impact pricing strategies and market access, while also creating demand for cost-effective treatment solutions. Companies are developing adaptive strategies to navigate these economic dynamics while maintaining market presence.

Comprehensive market analysis of the Latin America DPP-4 inhibitors market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with key stakeholders including endocrinologists, primary care physicians, hospital administrators, pharmaceutical executives, and regulatory officials across major Latin American markets.

Data collection strategies encompass both quantitative and qualitative research approaches. Quantitative analysis includes examination of prescription data, sales figures, market share information, and epidemiological statistics from reliable healthcare databases and government sources. Qualitative insights are gathered through structured interviews, focus groups, and expert consultations to understand market dynamics and future trends.

Geographic scope covers major Latin American countries including Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Venezuela, with additional analysis of smaller markets where relevant. Country-specific research accounts for unique healthcare systems, regulatory environments, and economic conditions that influence DPP-4 inhibitor market development.

Temporal analysis examines historical market trends over the past five years while projecting future developments over a ten-year forecast period. This longitudinal approach identifies cyclical patterns, growth trajectories, and emerging trends that inform strategic decision-making for market participants.

Validation processes include triangulation of data sources, expert review panels, and statistical verification to ensure research accuracy. Multiple independent sources are consulted for each data point, and discrepancies are resolved through additional investigation and expert consultation to maintain research integrity and reliability.

Brazil dominates the Latin America DPP-4 inhibitors market, representing the largest single country market with sophisticated healthcare infrastructure and established pharmaceutical distribution networks. The Brazilian market benefits from a large patient population, comprehensive healthcare coverage through the SUS public system, and significant private insurance penetration. Market share distribution shows Brazil accounting for approximately 38% of regional DPP-4 inhibitor consumption.

Mexico represents the second-largest market opportunity, driven by proximity to the United States, established pharmaceutical manufacturing capabilities, and growing healthcare investment. The Mexican healthcare system’s integration of public and private sectors creates multiple market access pathways for DPP-4 inhibitors. Recent healthcare reforms have expanded insurance coverage and improved access to specialty medications.

Argentina maintains a significant market presence despite economic challenges, with a well-developed healthcare system and strong pharmaceutical industry. The country’s universal healthcare coverage and established diabetes management programs support consistent demand for advanced diabetes treatments. However, currency volatility and economic instability create pricing and access challenges.

Colombia emerges as a high-growth market with improving healthcare infrastructure and expanding insurance coverage. The country’s healthcare system reforms have enhanced access to specialty medications, while growing economic stability supports increased healthcare spending. Market penetration rates for DPP-4 inhibitors have increased by approximately 15% annually over recent years.

Chile and Peru represent smaller but important markets with distinct characteristics. Chile’s advanced healthcare system and higher per-capita income support premium medication adoption, while Peru’s large population and improving healthcare access create substantial growth potential. Both countries demonstrate increasing physician adoption of DPP-4 inhibitor therapies.

Market leadership in the Latin America DPP-4 inhibitors segment is characterized by intense competition among established multinational pharmaceutical companies. The competitive environment features both patent-protected branded products and emerging generic alternatives, creating a complex market dynamic that requires sophisticated strategic approaches.

Strategic initiatives among market participants include expanded manufacturing capabilities, enhanced distribution networks, and comprehensive market access programs. Companies are investing in real-world evidence generation to demonstrate the value of their products in Latin American patient populations, while also developing partnerships with local healthcare organizations.

Innovation focus extends beyond product development to include digital health solutions, patient support programs, and healthcare provider education initiatives. Leading companies are leveraging technology platforms to enhance medication adherence, monitor patient outcomes, and provide comprehensive diabetes management support.

By Product Type: The Latin America DPP-4 inhibitors market segments into multiple product categories based on active pharmaceutical ingredients and formulation characteristics. Single-agent products maintain significant market share, while combination therapies demonstrate rapid growth as physicians and patients seek simplified treatment regimens.

By Formulation: Market segmentation based on pharmaceutical formulation reveals distinct prescribing preferences and patient needs across different Latin American markets.

By Distribution Channel: Market access pathways vary significantly across Latin American countries, reflecting different healthcare system structures and pharmaceutical distribution models.

Therapeutic Categories within the DPP-4 inhibitors market demonstrate distinct utilization patterns and growth trajectories across Latin American countries. Monotherapy applications remain important for patients with mild to moderate diabetes who require treatment intensification beyond metformin, while combination therapies address more complex patient needs.

First-line Therapy: While not typically used as initial diabetes treatment, DPP-4 inhibitors serve as preferred second-line options when metformin alone provides insufficient glycemic control. This category represents substantial market opportunity as diabetes progression necessitates treatment intensification. Adoption rates for second-line DPP-4 inhibitor therapy have reached approximately 42% in major Latin American markets.

Combination Therapy: Fixed-dose combinations represent the fastest-growing category, offering enhanced patient convenience and potentially improved adherence compared to separate medications. These products address physician preferences for simplified prescribing while maintaining therapeutic flexibility. The combination category demonstrates particular strength in markets with advanced healthcare infrastructure.

Special Populations: Certain patient populations, including elderly individuals and those with renal impairment, represent specialized market segments where DPP-4 inhibitors offer particular advantages. The favorable safety profile and minimal dose adjustment requirements make these medications attractive options for complex patient management.

Geographic Variations: Category preferences vary across Latin American countries based on healthcare system characteristics, physician training, and patient demographics. Urban markets typically show higher adoption of combination therapies, while rural areas may favor single-agent products due to prescribing simplicity and cost considerations.

Pharmaceutical Companies benefit from the Latin America DPP-4 inhibitors market through multiple value creation opportunities. The growing diabetes prevalence provides sustained demand for effective treatments, while improving healthcare infrastructure expands market accessibility. Companies can leverage their clinical expertise and regulatory capabilities to establish strong market positions in this expanding therapeutic area.

Healthcare Providers gain access to effective diabetes management tools that improve patient outcomes while offering favorable safety profiles. DPP-4 inhibitors provide physicians with treatment options that address common clinical challenges including hypoglycemia risk, weight management, and dosing complexity.

Patients receive access to advanced diabetes treatments that improve quality of life while minimizing treatment-related complications. The convenience and tolerability of DPP-4 inhibitors support better medication adherence and long-term diabetes management success.

Healthcare Systems benefit from improved diabetes management outcomes that may reduce long-term complications and associated healthcare costs. The safety profile of DPP-4 inhibitors can decrease hospitalization rates and emergency department visits related to diabetes complications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Combination Therapy Adoption represents the most significant trend shaping the Latin America DPP-4 inhibitors market. Healthcare providers increasingly prefer fixed-dose combinations that simplify treatment regimens while maintaining therapeutic efficacy. This trend reflects broader diabetes management evolution toward comprehensive, convenient treatment approaches that improve patient adherence and clinical outcomes.

Digital Health Integration is transforming diabetes care delivery across Latin America, creating new opportunities for DPP-4 inhibitor market growth. Telemedicine platforms, mobile health applications, and remote monitoring systems are enhancing medication management and patient engagement. MWR data indicates that digital health integration has improved medication adherence rates by approximately 28% in markets with advanced digital infrastructure.

Personalized Treatment Approaches are gaining traction as healthcare systems adopt precision medicine principles for diabetes management. Biomarker testing, genetic profiling, and individual patient characteristics increasingly influence DPP-4 inhibitor prescribing decisions, enabling more targeted and effective treatment strategies.

Value-Based Care Models are emerging across Latin American healthcare systems, emphasizing treatment outcomes and cost-effectiveness rather than volume-based metrics. This trend creates opportunities for DPP-4 inhibitors to demonstrate their value through improved patient outcomes and reduced long-term complications.

Generic Market Expansion continues to reshape the competitive landscape as patents expire and local manufacturers enter the market. While this trend increases price competition, it also expands overall market access by making DPP-4 inhibitor therapy more affordable for broader patient populations.

Regulatory Harmonization efforts across Latin American countries are streamlining market access processes and reducing regulatory complexity. These initiatives facilitate faster product launches and more efficient market expansion strategies for pharmaceutical companies.

Manufacturing Localization initiatives have accelerated across the Latin America DPP-4 inhibitors market, with major pharmaceutical companies establishing regional production facilities. These investments improve supply chain security, reduce costs, and enable more competitive pricing strategies while supporting local economic development.

Strategic Partnerships between multinational pharmaceutical companies and regional distributors have expanded market reach and enhanced local market expertise. These collaborations combine global clinical development capabilities with regional market knowledge, creating more effective market access strategies.

Real-World Evidence Generation has become a priority for market participants seeking to demonstrate the value of their DPP-4 inhibitor products in Latin American patient populations. Companies are investing in observational studies and registry programs to generate locally relevant clinical evidence supporting their market positioning.

Digital Platform Development includes the launch of comprehensive diabetes management applications and patient support programs. These digital initiatives enhance medication adherence, provide educational resources, and create direct communication channels between patients and healthcare providers.

Regulatory Milestone Achievements include expanded indications, new combination product approvals, and inclusion in national formularies across multiple Latin American countries. These regulatory successes expand market opportunities and improve patient access to DPP-4 inhibitor therapies.

Market Access Program Expansion encompasses patient assistance programs, insurance coverage negotiations, and public health partnerships designed to improve treatment accessibility. These initiatives address cost barriers while supporting broader market development objectives.

Market Entry Strategies for companies seeking to establish or expand their presence in the Latin America DPP-4 inhibitors market should prioritize local partnerships and regulatory expertise. Understanding country-specific healthcare systems, reimbursement mechanisms, and prescribing patterns is essential for successful market penetration. Companies should consider staged market entry approaches, focusing initially on larger markets before expanding to smaller countries.

Product Differentiation becomes increasingly important as generic competition intensifies. Companies should focus on developing unique value propositions through combination products, enhanced formulations, or comprehensive patient support programs. Clinical differentiation through real-world evidence generation and head-to-head comparative studies can support premium positioning strategies.

Digital Strategy Development should be a priority for all market participants, given the accelerating adoption of digital health solutions across Latin America. Companies should invest in digital platforms that enhance medication adherence, provide patient education, and support healthcare provider decision-making. Integration with existing healthcare IT systems will be crucial for successful implementation.

Pricing Strategy Optimization requires careful consideration of economic conditions, competitive dynamics, and healthcare system characteristics across different Latin American markets. Value-based pricing models that demonstrate cost-effectiveness and improved patient outcomes may be more sustainable than traditional cost-plus approaches.

Stakeholder Engagement programs should encompass healthcare providers, patients, regulators, and payers to build comprehensive market support. Educational initiatives, clinical training programs, and policy advocacy can create favorable market conditions for DPP-4 inhibitor adoption and utilization.

Supply Chain Resilience planning should address potential disruptions and ensure consistent product availability across the region. Local manufacturing capabilities, diversified supplier networks, and robust distribution systems will be essential for maintaining market position and customer confidence.

Market trajectory for the Latin America DPP-4 inhibitors market remains positive despite increasing competitive pressures and economic challenges. The fundamental drivers of diabetes prevalence growth, healthcare system development, and improved treatment access continue to support sustained market expansion. Long-term growth projections indicate the market will maintain a robust CAGR of approximately 7.5% through the next decade.

Therapeutic landscape evolution will likely see continued emphasis on combination therapies and personalized treatment approaches. The integration of DPP-4 inhibitors with newer diabetes drug classes and digital health platforms will create enhanced value propositions for patients and healthcare providers. Innovation in drug delivery systems and formulation technologies may provide additional differentiation opportunities.

Competitive dynamics will be shaped by the balance between generic competition and innovation-driven differentiation. While patent expiration will continue to create pricing pressures, companies that successfully develop unique value propositions through clinical differentiation, digital integration, or comprehensive patient support programs will maintain competitive advantages.

Regulatory environment trends suggest continued support for diabetes treatment innovation, with streamlined approval processes and expanded formulary inclusions. Harmonization efforts across Latin American countries will likely reduce regulatory complexity and facilitate more efficient market access strategies for pharmaceutical companies.

Healthcare system development across the region will create new opportunities for market expansion, particularly in countries with emerging healthcare infrastructure. According to MarkWide Research projections, improved healthcare access could expand the addressable patient population by approximately 35% over the next five years, creating substantial growth opportunities for market participants.

Technology integration will transform diabetes care delivery, with digital health platforms becoming standard components of comprehensive diabetes management. Companies that successfully integrate their DPP-4 inhibitor products with digital health ecosystems will be well-positioned for future market leadership.

The Latin America DPP-4 inhibitors market represents a dynamic and growing segment within the region’s pharmaceutical landscape, driven by increasing diabetes prevalence, improving healthcare infrastructure, and expanding access to advanced treatments. Despite challenges including economic volatility, generic competition, and healthcare disparities, the market demonstrates robust growth potential supported by strong clinical evidence and favorable safety profiles.

Strategic opportunities exist for pharmaceutical companies willing to invest in local market development, digital health integration, and comprehensive patient support programs. The evolution toward combination therapies, personalized medicine approaches, and value-based care models creates multiple pathways for market differentiation and sustainable competitive advantage.

Future success in the Latin America DPP-4 inhibitors market will depend on companies’ ability to navigate complex regulatory environments, develop cost-effective market access strategies, and create meaningful value propositions for patients and healthcare providers. The integration of digital health technologies and real-world evidence generation will become increasingly important for maintaining market position and supporting premium pricing strategies.

Market participants should focus on building comprehensive regional strategies that address the diverse needs of Latin American healthcare systems while leveraging the therapeutic advantages of DPP-4 inhibitors. The continued growth of the diabetes epidemic, combined with improving healthcare access and economic development, ensures that this market will remain an important opportunity for pharmaceutical companies committed to addressing the region’s healthcare needs.

What is DPP-4 Inhibitors?

DPP-4 inhibitors are a class of medications used to treat type two diabetes by increasing insulin production and decreasing glucose production in the liver. They work by inhibiting the enzyme Dipeptidyl Peptidase-4, which is involved in glucose metabolism.

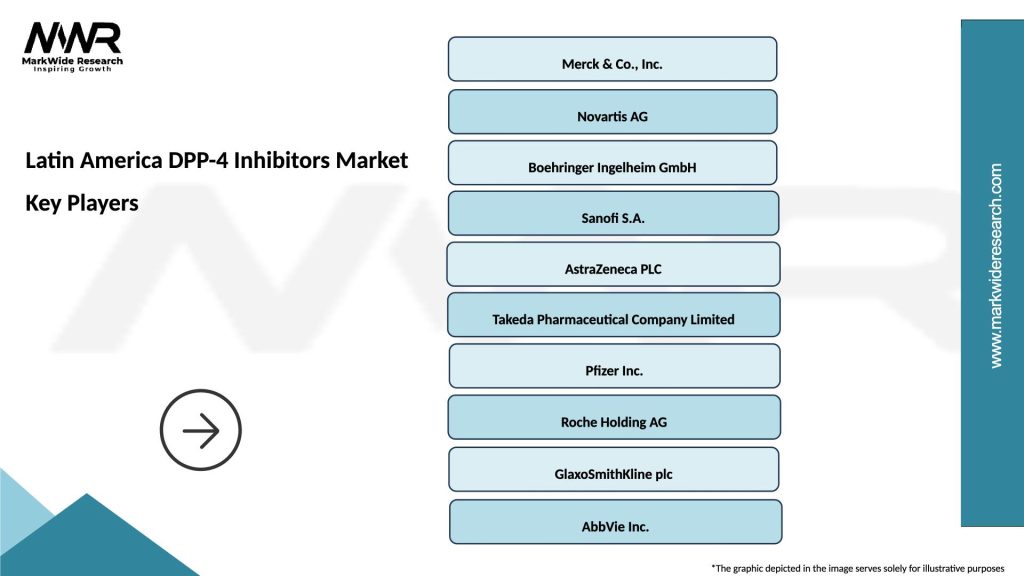

What are the key players in the Latin America DPP-4 Inhibitors Market?

Key players in the Latin America DPP-4 Inhibitors Market include Merck & Co., Novartis, Sanofi, and AstraZeneca, among others. These companies are involved in the development and distribution of various DPP-4 inhibitor medications.

What are the growth factors driving the Latin America DPP-4 Inhibitors Market?

The growth of the Latin America DPP-4 Inhibitors Market is driven by the rising prevalence of type two diabetes, increasing healthcare expenditure, and the growing awareness of diabetes management. Additionally, advancements in drug formulations and delivery methods contribute to market expansion.

What challenges does the Latin America DPP-4 Inhibitors Market face?

The Latin America DPP-4 Inhibitors Market faces challenges such as regulatory hurdles, high competition among pharmaceutical companies, and the availability of alternative diabetes treatments. These factors can impact market growth and accessibility of medications.

What opportunities exist in the Latin America DPP-4 Inhibitors Market?

Opportunities in the Latin America DPP-4 Inhibitors Market include the potential for new product launches, increasing investment in diabetes research, and expanding healthcare infrastructure. These factors can enhance patient access to innovative treatments.

What trends are shaping the Latin America DPP-4 Inhibitors Market?

Trends shaping the Latin America DPP-4 Inhibitors Market include the integration of digital health technologies in diabetes management, personalized medicine approaches, and a focus on combination therapies. These trends aim to improve patient outcomes and treatment adherence.

Latin America DPP-4 Inhibitors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sitagliptin, Saxagliptin, Linagliptin, Alogliptin |

| Therapy Area | Type 2 Diabetes, Cardiovascular Disease, Obesity, Metabolic Syndrome |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Distribution Channel | Retail Pharmacies, Online Pharmacies, Hospitals, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America DPP-4 Inhibitors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at