444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

Japan Whey Protein Market

Whey protein has gained immense popularity in recent years as a nutritional supplement, and the Japanese market is no exception to this trend. Japan, renowned for its health-conscious consumers and advanced sports nutrition industry, has witnessed substantial growth in the whey protein market. This article delves into the various aspects of the Japan whey protein market, including its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding remark.

Meaning:

Whey protein is a high-quality protein derived from milk during the cheese-making process. It contains all essential amino acids required by the human body, making it a popular choice among fitness enthusiasts, athletes, and health-conscious individuals. With its superior nutritional profile, whey protein is known for its role in muscle recovery, muscle building, weight management, and overall health improvement.

Executive Summary:

The Japan whey protein market has experienced significant growth over the past few years, primarily driven by the increasing awareness of health and fitness, rising disposable incomes, and the growing popularity of sports nutrition products. The demand for high-quality protein supplements, such as whey protein, has surged among individuals seeking to maintain an active lifestyle and achieve their fitness goals. Key players in the market have been introducing innovative products to cater to the specific needs of consumers, further propelling market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Slow but Steady Growth: The Japan whey protein market is more mature and faces a lower growth ceiling relative to emerging markets—but still shows consistent incremental expansion.

Consumer Health Trends Drive Demand: Older adults, fitness enthusiasts, and health-conscious consumers are key segments. Dietary protein from supplements is seen as a complement to skeletal health, weight management, and muscle maintenance.

Premiumization & Differentiation: Brands compete on purity (isolates, hydrolysates), added functional ingredients (vitamins, digestive enzymes), flavor and mixability, and branding appeal.

Imported vs. Domestic Balance: Japan relies on imports for many premium or specialized formulations, though domestic producers supply standard or mass-market whey products.

Regulation & Labeling Sensitivity: Whey protein products must navigate food-supplement regulations, labeling laws, additive limits, health claims, and import standards.

Market Drivers

Health & Aging Population Needs: Japan’s demographics mean a rising number of elderly consumers who require adequate protein to prevent sarcopenia and maintain bone/muscle health.

Rise in Fitness and Sports Culture: Urban fitness clubs, cross-training, and wellness trends push demand for protein supplements among younger adults.

Supplement Integration in Daily Diets: Consumers view whey protein as a convenient protein source for busy lifestyles or meal supplementation.

Product Innovation & Convenience: Ready-to-drink (RTD) protein shakes, single-serve sachets, blends with probiotics or vitamins, and flavored versions increase accessibility and attractiveness.

Medical / Clinical Nutrition Use: Post-surgery recovery, clinical nutrition, and hospital supplementation support demand for high-purity whey used in medical formulations.

Market Restraints

High Price Sensitivity: Premium whey protein often carries a price premium that restricts penetration among average consumers.

Competition from Plant Proteins: Growing plant-based protein alternatives (soy, pea, rice) attract consumers seeking vegan or allergen-free options.

Regulatory Hurdles & Import Barriers: Novel protein formulations or novel enzyme additions may face delays under Japanese regulatory review.

Consumer Skepticism & Safety Concerns: Issues with supplement safety or adulteration in the broader supplement industry can cause consumer distrust.

Mature Market Saturation: The market may be approaching saturation in core urban and fitness-savvy segments, making aggressive growth harder.

Market Opportunities

Elder Nutrition Products: Whey blends tailored for older adults (easier digestibility, added micronutrients) represent a growth niche.

RTD and On-the-Go Formats: Convenient formulations (ready-made drinks, small packs) appeal to working professionals and students.

Functional Blends: Whey combined with collagen, BCAAs, vitamins, probiotics, or adaptogens appeals to broader health goals.

B2B Ingredient Sales: Whey as an ingredient in fortified foods, dairy alternatives, bars, and baking mixes.

Localization & Joint Ventures: Partnerships with domestic dairy or supplement firms reduce costs, improve trust, and navigate regulation.

Market Dynamics

Supply-Side Factors:

Dairy processing and cheese production supply whey feedstock.

International whey protein producers supply specialty isolates or hydrolysates.

Toll manufacturing, co-packing, and private label arrangements anchor cost structures.

Demand-Side Factors:

Urban consumers gravitate toward fitness and convenience nutrition.

Clinical and eldercare institutions adopt whey-based nutrition solutions.

Retail channels (online, specialty nutrition stores) expand reach and competition.

Economic & Regulatory Factors:

Trade policies and import duties affect cost competitiveness of foreign whey products.

Health claims, labeling standards, and safety testing policies influence product design.

Exchange rate fluctuations affect import costs and price stability.

Regional Analysis

Greater Tokyo / Kanto Region: Highest concentration of fitness consumers, sports clinics, and dietary supplement demand.

Osaka / Kansai Region: Strong supplement retail presence and manufacturing clusters support regional demand.

Nagoya / Chubu Region: Industrial and health-conscious populations with stable protein supplement consumption.

Northern & Rural Regions: Slower uptake but growing awareness via digital retail channels.

Hokkaido & Dairy Regions: Local dairy production provides whey resource proximity, possibly lowering supply logistics.

Competitive Landscape:

Leading Companies in Japan Whey Protein Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

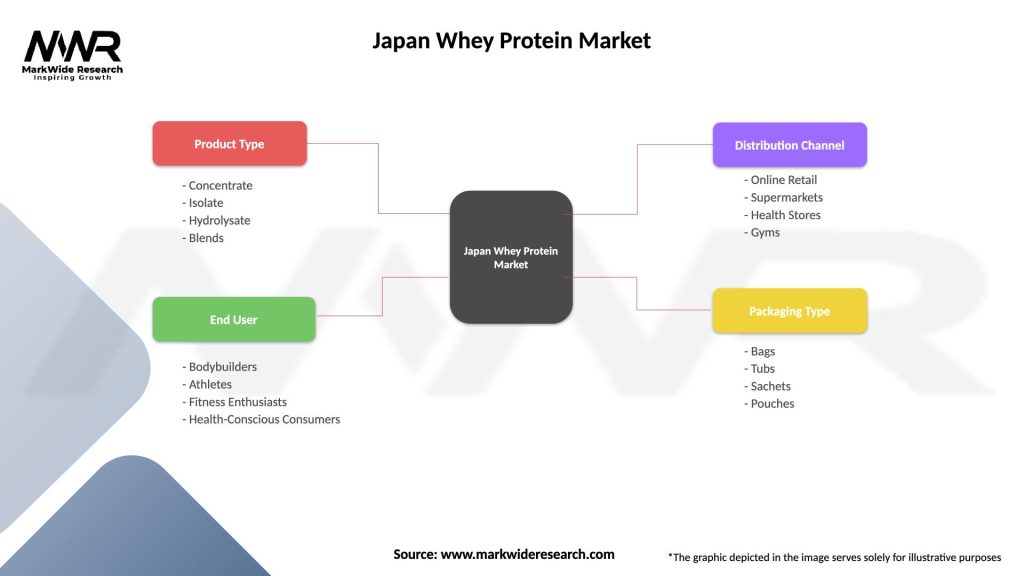

Segmentation

By Protein Type:

Whey Protein Concentrate (WPC)

Whey Protein Isolate (WPI)

Whey Protein Hydrolysate (WPH)

Microparticulated / specialty whey forms

By Application / End-User:

Sports & Performance Nutrition

Daily Nutritional Supplement

Clinical / Medical Nutrition

Functional Foods & Ingredient Use

By Product Format:

Powder (bulk, flavored, single-serve sachets)

Ready-to-Drink (RTD) formulations

Sachets / stick packs

Ingredient formulations (for food processing use)

By Sales Channel:

E-commerce and direct-to-consumer

Specialty nutrition / supplement stores

Pharmacies and drugstores

Food ingredient / B2B supply channels

By Region:

Kanto (Tokyo and surrounding)

Kansai

Chubu

Northern Japan & rural areas

Category-wise Insights

Concentrate (WPC): Most cost-efficient and common base product, often used in blended formulations or general nutrition.

Isolate (WPI): Preferred in high-purity, low-lactose, performance-oriented products; commands higher margins.

Hydrolysate (WPH): Premium segment, often used for faster absorption or reduced allergenic potential—niche in Japan.

RTD Whey Beverages: Growing, especially among on-the-go consumers, though logistical costs (cold chain) are a barrier.

Whey as Ingredient: Increasingly used in fortified foods, high-protein snacks, dairy enhancements, and bakery applications.

Key Benefits for Industry Participants and Stakeholders

High-Quality Protein Source: Whey is biologically complete, fast absorbing, and efficient in supporting muscle protein synthesis.

Premium Branding Opportunity: Associations with fitness, health, and performance enhance product positioning.

Diversification of Product Line: Brands can leverage whey across powders, drinks, food products, and clinical nutrition.

Export Potential: Japan’s reputation in quality enables export or premium niche whey products in Asia.

Margin Leverage: Specialty formulations (isolate, hydrolysate, blends) can command higher margins.

SWOT Analysis

Strengths:

Strong consumer health awareness and trust in nutritional supplements.

High standards for product quality and safety bolsters consumer confidence.

Access to dairy feedstock via domestic dairy industry, although limited.

Weaknesses:

Relatively high cost structures in Japan impact competitiveness.

Import dependence for advanced whey types or specialty processing.

Saturated competition in core urban and fitness segments.

Opportunities:

Growth in elder & clinical nutrition formulations.

Innovation in RTD and convenience formats.

Partnerships with food manufacturers to incorporate whey in everyday foods.

Integration with digital health/wellness ecosystems, personalized nutrition.

Threats:

Regulatory changes tightening supplement claims or ingredient approvals.

Consumer shift toward plant‑based proteins and alternative nutrition trends.

Price volatility in global whey supply and ingredient sourcing.

Market Key Trends

Protein Premiumization: Consumers prefer high-purity isolates or blends with functional ingredients (e.g. digestive enzymes).

On-the-Go Solutions: RTD shakes, stick packs, and portable formats gain traction, especially in urban markets.

Digital & Direct Channels: E-commerce, subscription models, and digital brand engagement grow in importance.

Mixing with Functional Add-ins: Whey blended with collagen, probiotics, MCT oils, or adaptogens to address multiple consumer needs.

Clean Label & Transparency: Demand for minimal additives, non-GMO labeling, traceability, and clarity on origin.

Key Industry Developments

Entry of global sports nutrition brands launching Japan‑specific flavored and packaging variants.

Domestic supplement firms adding isolate/hydrolysate formulations to their product lines.

Launch of whey-based RTD products in convenience retail channels.

Ingredient suppliers expanding supply agreements with food and beverage firms to use whey in fortified products.

Analyst Suggestions

Focus on Differentiated Products: Don’t compete only on price—offer isolates, functional blends, tailored nutrition, or premium flavors.

Improve Convenience & Format Innovation: Develop RTD, sachets, or on-the-go delivery formats to capture busy consumer segments.

Strengthen Local Partnerships: Partner with dairy processors, supplement firms, or co-manufacturers to reduce cost, support regulation, and foster supply security.

Educate Consumers: Emphasize clinical benefits for aging, strength, recovery, and health to expand the market beyond fitness buffs into general wellness.

Leverage Digital Marketing & Direct Channels: Build brand loyalty through e-commerce, subscription models, and content-driven engagement.

Future Outlook

Over the next decade, the Japan Whey Protein Market will evolve gradually rather than explosively. Demand growth will be driven by aging demographics needing supplemental protein, routine wellness trends, and expansion in clinical nutrition segments. RTD and convenience formats will expand, and blends with functional ingredients will become more common. Some shift toward plant proteins will pressure pure whey brands to diversify or emphasize differentiation.

Domestic production of higher-purity whey (isolate, hydrolysate) could expand to reduce import dependence if dairy processors embrace higher-value processing. Brands that combine innovation, convenience, trust, and deeper consumer engagement are likely to succeed in the competitive Japanese market.

Conclusion

The Japan Whey Protein Market is characterized by maturity, slow yet steady growth, and shifting consumer expectations. Rather than mass-growth trajectories seen in emerging markets, success in Japan depends on innovation, premium positioning, convenience formats, and alignment with aging‑population nutrition needs. Stakeholders who understand Japanese regulatory nuance, deliver high-quality and differentiated formulations, and build direct consumer relationships will continue to capture value in this dynamic market.

In conclusion, the Japan whey protein market is experiencing robust growth, driven by health-conscious consumers, fitness trends, and product innovations. The market’s future looks promising, and industry players have significant opportunities to capitalize on this growth by offering high-quality, innovative whey protein products that cater to the diverse needs of consumers. While challenges such as price sensitivity and counterfeit products exist, strategic planning, market research, and adherence to quality standards will enable companies to thrive in this competitive landscape. The Japan whey protein market is poised to contribute significantly to the global sports nutrition industry while promoting a healthier and active lifestyle among its consumers.

What is Whey Protein?

Whey protein is a high-quality protein derived from milk during the cheese-making process. It is commonly used as a dietary supplement to support muscle growth, recovery, and overall health.

What are the key companies in the Japan Whey Protein Market?

Key companies in the Japan Whey Protein Market include Meiji Holdings Co., Ltd., Morinaga Milk Industry Co., Ltd., and Asahi Group Holdings, among others.

What are the growth factors driving the Japan Whey Protein Market?

The growth of the Japan Whey Protein Market is driven by increasing health consciousness among consumers, the rising popularity of fitness and bodybuilding, and the demand for high-protein diets.

What challenges does the Japan Whey Protein Market face?

Challenges in the Japan Whey Protein Market include competition from plant-based protein alternatives, potential regulatory hurdles, and fluctuating raw material prices.

What opportunities exist in the Japan Whey Protein Market?

Opportunities in the Japan Whey Protein Market include the expansion of product offerings such as flavored whey protein and ready-to-drink protein beverages, as well as increasing collaborations with fitness centers and health food stores.

What trends are shaping the Japan Whey Protein Market?

Trends in the Japan Whey Protein Market include a growing interest in clean label products, innovations in protein formulations, and the rise of online sales channels for health supplements.

Japan Whey Protein Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concentrate, Isolate, Hydrolysate, Blends |

| End User | Bodybuilders, Athletes, Fitness Enthusiasts, Health-Conscious Consumers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Gyms |

| Packaging Type | Bags, Tubs, Sachets, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Whey Protein Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at