444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan beauty fridges market represents a rapidly expanding segment within the country’s beauty and personal care industry, driven by increasing consumer awareness about skincare product preservation and the growing influence of K-beauty and J-beauty trends. Beauty refrigerators, also known as cosmetic fridges or skincare mini-fridges, have gained significant traction among Japanese consumers who prioritize product efficacy and longevity. The market is experiencing robust growth at a CAGR of 12.5%, reflecting the nation’s sophisticated beauty culture and technological adoption patterns.

Japanese consumers are increasingly recognizing the benefits of storing temperature-sensitive beauty products in specialized refrigeration units, which help maintain the stability and effectiveness of serums, eye creams, face masks, and other skincare formulations. The market encompasses various product categories, from compact personal-use units to larger capacity models designed for beauty enthusiasts and professional applications. Market penetration has reached approximately 18% among urban millennials, indicating substantial room for continued expansion across different demographic segments.

The technological advancement in beauty fridge manufacturing has led to the development of energy-efficient models with precise temperature control, UV protection, and aesthetic designs that complement modern Japanese home interiors. Major electronics manufacturers and specialized beauty appliance companies are investing heavily in research and development to create innovative solutions that cater to the discerning Japanese market’s preferences for quality, functionality, and design excellence.

The Japan beauty fridges market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of specialized refrigeration appliances designed specifically for storing cosmetic and skincare products at optimal temperatures. These compact refrigeration units maintain temperatures typically between 4-8°C, creating ideal storage conditions for beauty products that benefit from cool storage to preserve their active ingredients, extend shelf life, and enhance user experience through cooling effects upon application.

Beauty fridges serve multiple purposes beyond simple refrigeration, including protecting light-sensitive formulations from UV damage, preventing bacterial growth in natural and organic products, and providing a luxurious skincare ritual that aligns with Japanese beauty philosophies emphasizing mindfulness and self-care. The market includes various product segments ranging from mini personal units suitable for individual use to larger capacity models designed for beauty professionals, salons, and skincare enthusiasts with extensive product collections.

Market participants include established appliance manufacturers, specialized beauty device companies, and emerging startups focusing on innovative cooling technologies for cosmetic applications. The ecosystem also encompasses retail channels, distribution networks, and supporting services that facilitate product availability and consumer education about proper skincare product storage practices.

Japan’s beauty fridges market is experiencing unprecedented growth momentum, driven by evolving consumer preferences, increased skincare awareness, and the integration of technology into daily beauty routines. The market demonstrates strong fundamentals with consistent year-over-year growth of 15.2% in unit sales, reflecting robust consumer demand across multiple demographic segments. Urban consumers aged 20-40 represent the primary target market, with particularly strong adoption rates among working professionals who invest significantly in premium skincare products.

Key market drivers include the rising popularity of multi-step skincare routines, increased consumer education about product preservation, and the influence of social media beauty trends that emphasize product care and storage. The market benefits from Japan’s advanced retail infrastructure, high disposable income levels, and cultural emphasis on quality and attention to detail in personal care practices. E-commerce channels account for approximately 42% of total sales, with traditional retail and specialty beauty stores maintaining significant market presence.

Competitive dynamics are intensifying as both domestic and international manufacturers recognize the market’s potential. Innovation focuses on energy efficiency, smart connectivity features, and aesthetic designs that appeal to Japanese consumers’ preferences for minimalist and functional home appliances. The market outlook remains highly positive, with expansion opportunities in rural markets and emerging applications in professional beauty services.

Consumer behavior analysis reveals several critical insights that shape the Japan beauty fridges market landscape. MarkWide Research data indicates that Japanese consumers demonstrate exceptional brand loyalty and quality consciousness when selecting beauty appliances, with 78% of purchasers conducting extensive research before making buying decisions. The market exhibits strong seasonal variations, with peak sales occurring during spring and summer months when consumers seek cooling skincare solutions.

Rising skincare consciousness among Japanese consumers represents the primary driver propelling beauty fridges market growth. The increasing adoption of elaborate skincare routines, influenced by K-beauty trends and traditional Japanese beauty practices, has created demand for proper product storage solutions. Consumer education about ingredient stability and product efficacy has heightened awareness of temperature-sensitive formulations that benefit from refrigerated storage, particularly vitamin C serums, retinol products, and natural formulations without synthetic preservatives.

Social media influence and beauty content creators have significantly impacted market dynamics by showcasing beauty fridges as essential components of comprehensive skincare routines. Instagram and TikTok beauty influencers regularly feature these appliances in their content, demonstrating proper usage and highlighting the luxury aspect of chilled skincare application. This digital marketing phenomenon has particularly resonated with younger demographics who view beauty fridges as both functional tools and lifestyle accessories.

Technological advancement in appliance manufacturing has made beauty fridges more accessible, energy-efficient, and feature-rich. Modern units incorporate precise temperature control, silent operation, LED lighting, and compact designs that fit seamlessly into Japanese living spaces. The integration of smart technology, including smartphone connectivity and temperature monitoring, appeals to tech-savvy consumers who appreciate connected home appliances. Energy efficiency improvements have addressed environmental concerns while reducing operational costs, making these appliances more attractive to environmentally conscious consumers.

Premium beauty product proliferation has created a natural market for specialized storage solutions. As consumers invest in expensive serums, treatments, and luxury skincare products, the desire to maximize product longevity and effectiveness through proper storage becomes increasingly important. The growth of organic and natural beauty products, which often lack synthetic preservatives, has further emphasized the need for refrigerated storage to prevent spoilage and maintain product integrity.

High initial investment costs present a significant barrier to market expansion, particularly among price-sensitive consumer segments. Quality beauty fridges with advanced features command premium prices that may exceed the budget constraints of younger consumers or those new to elaborate skincare routines. The cost-benefit perception remains challenging for consumers who question whether the investment justifies the benefits, especially when compared to traditional refrigerator storage alternatives.

Limited consumer awareness about the necessity and benefits of beauty fridges continues to restrict market penetration beyond core beauty enthusiast segments. Many consumers remain unaware of how temperature affects skincare product stability or the potential benefits of chilled application. Educational barriers exist regarding proper usage, maintenance, and which products benefit most from refrigerated storage, creating hesitation among potential buyers who lack confidence in making informed purchasing decisions.

Space constraints in Japanese homes, particularly in urban areas where living spaces are compact, limit the appeal of additional appliances. Consumers must balance the desire for beauty fridges against practical considerations of counter space, electrical outlet availability, and overall home organization. The minimalist lifestyle trends popular in Japan sometimes conflict with the addition of specialized appliances, creating internal consumer conflicts between functionality and simplicity.

Maintenance requirements and ongoing operational costs, including electricity consumption and periodic cleaning, may deter some consumers from adoption. Concerns about appliance reliability, warranty coverage, and long-term durability create additional hesitation, particularly among consumers who prefer low-maintenance beauty routines. The seasonal usage patterns in some regions may also raise questions about year-round utility and cost-effectiveness.

Rural market expansion presents substantial growth opportunities as beauty consciousness spreads beyond major metropolitan areas. Improved internet connectivity and e-commerce penetration in rural regions have increased access to beauty information and products, creating demand for complementary storage solutions. Regional expansion strategies focusing on local preferences and price points could unlock significant untapped market potential across Japan’s diverse geographic regions.

Professional market applications offer promising growth avenues through partnerships with beauty salons, spas, dermatology clinics, and aesthetic treatment centers. These professional environments require reliable product storage solutions and represent high-volume purchasing opportunities. B2B market development could include specialized models designed for commercial use, bulk purchasing programs, and professional-grade features that justify premium pricing.

Product innovation opportunities exist in developing specialized features that address specific consumer needs and preferences. Smart technology integration could include inventory management systems, expiration date tracking, and personalized temperature recommendations based on product types. Aesthetic customization options, energy efficiency improvements, and multi-functional designs that serve additional purposes could differentiate products in an increasingly competitive market.

Partnership opportunities with beauty brands, skincare companies, and retail chains could drive market growth through co-marketing initiatives, bundled offerings, and educational campaigns. Cross-promotional strategies that combine beauty fridge purchases with premium skincare products could increase consumer value perception and drive adoption rates. Collaboration with beauty subscription services and online retailers could create new distribution channels and customer acquisition strategies.

Supply chain dynamics in the Japan beauty fridges market reflect the complex interplay between domestic manufacturing capabilities, international component sourcing, and evolving consumer demands. Manufacturing efficiency has improved significantly as producers achieve economies of scale and optimize production processes. The market benefits from Japan’s advanced electronics manufacturing infrastructure and expertise in precision appliance development, enabling rapid innovation cycles and quality improvements.

Competitive intensity continues to escalate as new entrants recognize market potential and established players expand their product portfolios. Price competition has emerged in entry-level segments while premium categories maintain healthy margins through differentiation strategies. The market demonstrates resilience to economic fluctuations due to the discretionary nature of beauty spending among target demographics and the relatively small investment required compared to major appliance purchases.

Consumer behavior evolution shows increasing sophistication in product evaluation criteria, with buyers considering energy efficiency, noise levels, design aesthetics, and smart features alongside basic refrigeration functionality. Brand loyalty patterns indicate that positive initial experiences lead to strong repeat purchase intentions and word-of-mouth recommendations, creating sustainable competitive advantages for quality-focused manufacturers.

Regulatory environment remains supportive with minimal barriers to entry and standard appliance safety requirements. Environmental regulations promoting energy efficiency align with market trends toward sustainable products, creating opportunities for manufacturers who prioritize eco-friendly designs. The market benefits from stable economic conditions and supportive consumer spending patterns in the beauty and personal care sector.

Primary research methodology employed comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions with target demographic segments to gather firsthand market insights. Survey participants included current beauty fridge users, potential customers, retail partners, and industry experts across major Japanese metropolitan areas. The research design incorporated both quantitative and qualitative elements to capture statistical trends and nuanced consumer perspectives.

Secondary research involved extensive analysis of industry reports, company financial statements, patent filings, and regulatory documentation to understand market structure and competitive dynamics. Data sources included government statistics, trade association publications, academic research, and proprietary databases containing historical market performance data. Cross-referencing multiple sources ensured data accuracy and reliability throughout the analysis process.

Market sizing methodology utilized bottom-up and top-down approaches to validate findings and ensure comprehensive coverage of all market segments. Statistical analysis employed advanced modeling techniques to project future growth trends and identify key performance indicators. The research incorporated seasonal adjustment factors and regional variations to provide accurate market representations across different time periods and geographic areas.

Quality assurance protocols included peer review processes, data validation procedures, and expert consultation to verify findings and conclusions. Research limitations were clearly identified and addressed through supplementary analysis and conservative estimation approaches. The methodology ensured reproducible results and provided confidence intervals for key market projections and growth forecasts.

Tokyo metropolitan area dominates the Japan beauty fridges market, accounting for approximately 35% of total market share due to high population density, elevated income levels, and strong beauty culture penetration. The region demonstrates the highest adoption rates among young professionals and beauty enthusiasts who drive premium product demand. Retail infrastructure in Tokyo provides extensive distribution channels including flagship stores, department stores, and specialty beauty retailers that facilitate market access and consumer education.

Osaka and surrounding Kansai region represents the second-largest market segment with 22% market share, characterized by strong consumer spending on beauty products and growing awareness of skincare preservation techniques. The region benefits from established beauty retail networks and increasing influence of social media beauty trends. Consumer preferences in Osaka show particular interest in compact, space-efficient models that accommodate urban living constraints while providing premium functionality.

Nagoya and central Japan markets demonstrate steady growth with 15% market share, driven by rising disposable income and expanding beauty consciousness among working professionals. The region shows preference for mid-range products that balance functionality with affordability. Distribution strategies focus on online channels and regional retail partnerships to reach consumers across diverse urban and suburban areas.

Northern regions including Sendai and Sapporo represent emerging opportunities with 12% combined market share, showing accelerating adoption rates as beauty trends spread from major metropolitan centers. These markets demonstrate price sensitivity while maintaining interest in quality products. Seasonal factors influence purchasing patterns, with higher demand during warmer months when cooling benefits are most appreciated.

Market leadership is distributed among several key players who have established strong positions through different strategic approaches. Domestic manufacturers leverage their understanding of Japanese consumer preferences, design aesthetics, and quality standards to maintain competitive advantages. The competitive environment encourages continuous innovation and feature enhancement as companies seek to differentiate their offerings in an increasingly crowded marketplace.

Competitive strategies vary significantly across market participants, with some focusing on premium positioning through advanced features and superior build quality, while others compete on price and accessibility. Innovation leadership has become increasingly important as consumers demand more sophisticated functionality, energy efficiency, and aesthetic appeal. Strategic partnerships with beauty brands and retail chains provide competitive advantages through enhanced distribution and co-marketing opportunities.

By Capacity: The market segments into distinct capacity categories serving different consumer needs and usage patterns. Mini fridges (2-6 liters) dominate with the largest market share due to their suitability for personal use and space-constrained environments. Medium capacity units (6-12 liters) appeal to serious skincare enthusiasts and small professional applications. Large capacity models (12+ liters) serve professional establishments and consumers with extensive product collections.

By Technology: Traditional thermoelectric cooling systems represent the majority of current market offerings, providing reliable temperature control with minimal noise generation. Compressor-based systems offer superior cooling performance and energy efficiency for larger units. Smart-enabled models with connectivity features represent the fastest-growing segment, appealing to tech-savvy consumers who value remote monitoring and control capabilities.

By Price Range: Budget segment (under ¥15,000) targets price-conscious consumers and first-time buyers seeking basic functionality. Mid-range products (¥15,000-¥30,000) balance features and affordability, representing the largest volume segment. Premium offerings (above ¥30,000) focus on advanced features, superior design, and brand prestige, showing strong growth among affluent consumers.

By Distribution Channel: Online retail channels capture the largest market share through convenience and competitive pricing. Department stores maintain significant presence in premium segments through experiential retail and expert consultation. Specialty beauty stores provide targeted marketing and product education. Electronics retailers leverage their appliance expertise and established customer relationships.

Personal Use Category represents the core market segment, driven by individual consumers seeking to enhance their skincare routines through proper product storage. This category demonstrates strong growth momentum with annual expansion of 14.8%, reflecting increasing consumer awareness and disposable income allocation toward beauty investments. Purchase motivations include product preservation, luxury experience enhancement, and social media influence from beauty content creators.

Professional Use Category encompasses beauty salons, spas, dermatology clinics, and aesthetic treatment centers requiring reliable product storage solutions. This segment shows consistent growth of 11.2% annually as professional establishments recognize the importance of proper product storage for client satisfaction and treatment efficacy. Professional requirements emphasize durability, larger capacity, and precise temperature control for diverse product types.

Gift Market Category has emerged as a significant segment, particularly during holiday seasons and special occasions when beauty fridges serve as premium gifts for beauty enthusiasts. This category experiences seasonal peaks with 25% higher sales during gift-giving periods. Gift preferences favor aesthetically appealing models with premium packaging and comprehensive feature sets that justify the investment for recipients.

Replacement Market Category is developing as early adopters upgrade to newer models with enhanced features, improved energy efficiency, and better design aesthetics. This segment shows emerging growth potential of 8.5% as the installed base matures and technology advancement creates upgrade incentives. Replacement drivers include feature enhancement desires, capacity expansion needs, and aesthetic preference evolution.

Manufacturers benefit from expanding market opportunities with strong growth trajectories and premium pricing potential in specialized appliance segments. The market offers differentiation opportunities through innovative features, design excellence, and technology integration that command higher margins compared to commodity appliances. Brand building potential exists through association with beauty and lifestyle trends that resonate with affluent consumer demographics.

Retailers gain access to high-margin products that attract desirable customer segments and create cross-selling opportunities with beauty and skincare products. E-commerce platforms particularly benefit from the product’s suitability for online sales, detailed product descriptions, and visual marketing approaches. Specialty beauty retailers can enhance their service offerings and position themselves as comprehensive beauty solution providers.

Consumers receive tangible benefits including extended product shelf life, enhanced skincare experiences, and improved product efficacy through proper storage conditions. Cost savings result from reduced product waste and longer usability periods for expensive skincare formulations. Lifestyle enhancement occurs through the luxury experience of chilled product application and the satisfaction of comprehensive skincare routine optimization.

Beauty Brands can leverage beauty fridges as complementary products that enhance their core offerings and provide additional revenue streams through partnerships and co-marketing initiatives. Product differentiation opportunities exist for brands that emphasize the importance of proper storage for their formulations. Customer engagement increases through educational content and storage recommendations that demonstrate brand expertise and care for product efficacy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Technology Integration represents the most significant trend shaping the beauty fridges market, with manufacturers incorporating IoT connectivity, smartphone apps, and intelligent temperature monitoring systems. Connected features enable remote temperature control, usage tracking, and maintenance alerts that appeal to tech-savvy consumers. This trend shows adoption acceleration of 28% among younger demographics who value integrated smart home ecosystems.

Aesthetic Design Evolution emphasizes premium materials, minimalist styling, and customizable appearance options that complement modern interior design preferences. Color variety expansion and texture options allow consumers to match their beauty fridges with personal style preferences and home décor themes. Compact luxury positioning combines functionality with visual appeal to justify premium pricing and enhance user satisfaction.

Energy Efficiency Focus drives innovation in cooling technology, insulation materials, and power management systems that reduce environmental impact and operational costs. Eco-conscious consumers increasingly prioritize energy-efficient appliances that align with sustainability values. Green technology adoption shows consistent growth of 16% as environmental awareness influences purchasing decisions across all demographic segments.

Multi-Functional Designs incorporate additional features such as LED lighting, UV sterilization, and storage organization systems that enhance utility beyond basic refrigeration. Value-added features help justify higher price points and differentiate products in competitive markets. Functionality expansion appeals to consumers seeking comprehensive solutions that maximize space utilization and investment returns.

Product Innovation Acceleration has intensified as manufacturers invest heavily in research and development to create differentiated offerings that address evolving consumer needs. Recent launches feature advanced temperature control systems, noise reduction technology, and enhanced energy efficiency that set new industry standards. Patent activity has increased significantly, indicating robust innovation pipelines and competitive positioning strategies among major players.

Strategic Partnerships between appliance manufacturers and beauty brands have created new market opportunities through co-branded products, bundled offerings, and cross-promotional campaigns. Collaboration initiatives leverage complementary expertise and customer bases to accelerate market penetration and brand awareness. MWR analysis indicates that partnership-driven products show 23% higher adoption rates compared to standalone offerings.

Distribution Channel Evolution reflects changing consumer shopping preferences with significant expansion in e-commerce platforms, social commerce integration, and direct-to-consumer sales models. Online marketplace growth has enabled smaller manufacturers to reach national audiences and compete effectively with established brands. Omnichannel strategies combine online convenience with in-store experience to optimize customer engagement and conversion rates.

International Market Entry by global appliance manufacturers has increased competitive intensity while bringing advanced technologies and manufacturing efficiencies to the Japanese market. Foreign investment in local production facilities and distribution networks demonstrates long-term commitment to market development. Technology transfer and knowledge sharing have accelerated innovation cycles and improved product quality across the industry.

Market Entry Strategies should focus on understanding Japanese consumer preferences for quality, reliability, and aesthetic appeal rather than competing solely on price. New entrants should invest in local market research, cultural adaptation, and partnership development to establish credibility and distribution access. Brand positioning must emphasize unique value propositions that differentiate products from existing offerings while addressing specific consumer pain points.

Product Development Priorities should emphasize smart technology integration, energy efficiency, and compact design optimization that align with Japanese lifestyle preferences. Innovation focus should address noise reduction, temperature precision, and aesthetic customization options that enhance user experience. Feature development must balance functionality with simplicity to avoid overwhelming consumers with unnecessary complexity.

Marketing Strategies should leverage social media platforms, beauty influencer partnerships, and educational content that demonstrates product benefits and proper usage techniques. Consumer education remains critical for market expansion beyond core beauty enthusiast segments. Seasonal marketing should capitalize on gift-giving occasions and summer cooling benefits to maximize sales opportunities.

Distribution Optimization requires multi-channel approaches that combine online convenience with in-store experience and expert consultation. Retail partnerships with beauty specialty stores and department stores provide credibility and customer education opportunities. E-commerce excellence through detailed product information, customer reviews, and competitive pricing remains essential for market success.

Market trajectory indicates continued robust growth with expanding consumer adoption across diverse demographic segments and geographic regions. Long-term projections suggest sustained expansion driven by increasing beauty consciousness, rising disposable income, and technological advancement in appliance manufacturing. The market is expected to maintain double-digit growth rates of 13.2% over the next five years as awareness spreads and product accessibility improves.

Technology evolution will drive next-generation products featuring artificial intelligence, predictive maintenance, and enhanced connectivity that create more sophisticated user experiences. Smart home integration will become standard as consumers expect seamless connectivity across their appliance ecosystems. Sustainability features will gain importance as environmental consciousness influences purchasing decisions and regulatory requirements evolve.

Market maturation will create opportunities for specialized segments including professional applications, luxury positioning, and customized solutions that address specific consumer needs. Replacement cycles will develop as early adopters upgrade to newer technologies and enhanced features. Export potential may emerge as Japanese manufacturers leverage their expertise to serve international markets with similar consumer preferences.

Competitive landscape evolution will favor companies that successfully balance innovation, quality, and cost-effectiveness while building strong brand relationships with consumers. Market consolidation may occur as successful players acquire smaller competitors or form strategic alliances to enhance market position. MarkWide Research anticipates that market leaders will emerge through superior product development, effective marketing, and comprehensive distribution strategies that address the full spectrum of consumer needs and preferences.

Japan’s beauty fridges market represents a dynamic and rapidly expanding segment within the country’s sophisticated beauty and personal care industry. The market demonstrates strong fundamentals driven by increasing consumer awareness, technological innovation, and evolving lifestyle preferences that prioritize skincare product preservation and luxury experiences. Growth momentum remains robust with significant opportunities for continued expansion across demographic segments, geographic regions, and application categories.

Key success factors for market participants include understanding Japanese consumer preferences for quality and reliability, investing in innovative product development, and implementing comprehensive marketing strategies that educate consumers about product benefits. The competitive landscape rewards companies that can effectively balance premium positioning with accessibility while maintaining the high standards expected by discerning Japanese consumers. Strategic partnerships and omnichannel distribution approaches provide competitive advantages in reaching target audiences and building brand loyalty.

Future prospects indicate sustained market growth driven by technological advancement, expanding consumer awareness, and the continued evolution of beauty and skincare practices in Japan. The market’s resilience to economic fluctuations and strong consumer engagement suggest long-term viability and investment attractiveness. Innovation opportunities in smart technology, sustainability, and aesthetic design will continue to drive product differentiation and market expansion, creating value for manufacturers, retailers, and consumers throughout the beauty fridges ecosystem.

What is a Beauty Fridge?

A Beauty Fridge is a small refrigerator designed specifically for storing beauty products at optimal temperatures. These fridges help preserve the efficacy of skincare items, such as serums and masks, by keeping them cool and extending their shelf life.

What are the key players in the Japan Beauty Fridges Market?

Key players in the Japan Beauty Fridges Market include brands like Cooluli, AstroAI, and Chefman, which offer a variety of beauty fridges tailored for skincare enthusiasts. These companies focus on innovative designs and energy-efficient models, among others.

What are the growth factors driving the Japan Beauty Fridges Market?

The Japan Beauty Fridges Market is driven by increasing consumer awareness of skincare, the rising popularity of beauty routines, and the demand for product longevity. Additionally, the trend of personalized beauty regimens contributes to the market’s expansion.

What challenges does the Japan Beauty Fridges Market face?

Challenges in the Japan Beauty Fridges Market include competition from traditional refrigeration solutions and the need for consumer education on the benefits of beauty fridges. Additionally, price sensitivity among consumers can impact market growth.

What future opportunities exist in the Japan Beauty Fridges Market?

Future opportunities in the Japan Beauty Fridges Market include the development of smart fridges with integrated technology for skincare tracking and personalized recommendations. There is also potential for expansion into eco-friendly models that appeal to environmentally conscious consumers.

What trends are shaping the Japan Beauty Fridges Market?

Trends shaping the Japan Beauty Fridges Market include the rise of influencer marketing, which promotes beauty fridges as essential skincare tools, and the growing interest in self-care routines. Additionally, customization options and aesthetic designs are becoming increasingly popular among consumers.

Japan Beauty Fridges Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mini Fridges, Cosmetic Coolers, Skincare Refrigerators, Portable Units |

| End User | Households, Salons, Spas, Retail Stores |

| Technology | Thermoelectric, Compressor-Based, Absorption, Solar-Powered |

| Distribution Channel | Online Retail, Specialty Stores, Department Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

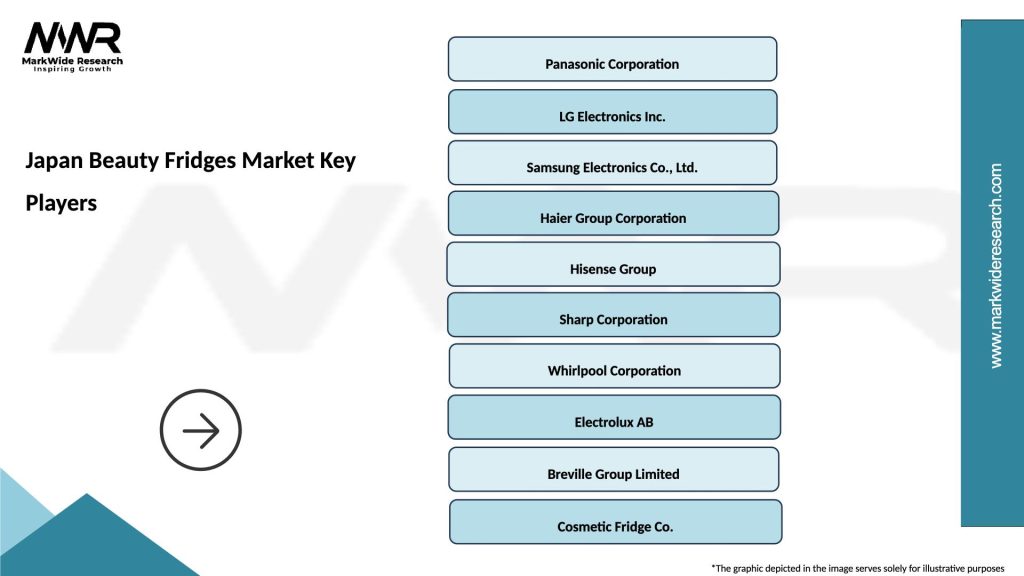

Leading companies in the Japan Beauty Fridges Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at