444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India foundry market represents one of the most dynamic and rapidly evolving manufacturing sectors in the country, serving as a critical backbone for numerous industries including automotive, construction, aerospace, and heavy machinery. India’s foundry industry has established itself as a global manufacturing hub, leveraging advanced casting technologies, skilled workforce, and competitive cost structures to meet both domestic and international demand.

Market dynamics indicate robust growth driven by increasing industrialization, infrastructure development, and the government’s Make in India initiative. The sector demonstrates remarkable resilience with 8.2% annual growth rate in production capacity, positioning India as the second-largest foundry market globally. Manufacturing excellence in ferrous and non-ferrous castings has attracted significant investments from multinational corporations seeking cost-effective production solutions.

Technology adoption across Indian foundries has accelerated dramatically, with 65% of major foundries implementing automated molding systems and advanced metallurgical processes. The integration of digital technologies, including IoT sensors and predictive maintenance systems, has enhanced operational efficiency and product quality standards. Environmental compliance initiatives have also gained momentum, with foundries investing heavily in emission control systems and sustainable manufacturing practices.

The India foundry market refers to the comprehensive ecosystem of metal casting operations, facilities, and related services that transform raw metals into finished or semi-finished components through various casting processes including sand casting, investment casting, die casting, and centrifugal casting.

Foundry operations encompass the entire value chain from pattern making and mold preparation to melting, pouring, cooling, and finishing processes. The market includes both ferrous foundries specializing in iron and steel castings, and non-ferrous foundries focusing on aluminum, copper, zinc, and other metal alloys. Modern foundries integrate advanced technologies such as computer-aided design, automated molding lines, and sophisticated quality control systems to deliver precision castings meeting international standards.

Industry scope extends beyond traditional casting operations to include specialized services such as machining, heat treatment, surface finishing, and assembly operations. The market serves diverse end-user industries with customized casting solutions ranging from small precision components to large industrial machinery parts weighing several tons.

India’s foundry sector stands at the forefront of the country’s manufacturing revolution, demonstrating exceptional growth potential and technological advancement. The industry has successfully transformed from traditional casting methods to sophisticated, technology-driven operations that compete effectively in global markets. Strategic positioning as a low-cost, high-quality manufacturing destination has attracted substantial foreign investments and technology transfers.

Key performance indicators reveal impressive market expansion with production volumes increasing consistently across all major casting categories. The automotive sector remains the largest consumer, accounting for 42% of total foundry output, followed by construction and infrastructure applications. Export performance has been particularly strong, with Indian foundries capturing significant market share in developed economies through competitive pricing and quality improvements.

Government initiatives including the Production Linked Incentive scheme and infrastructure development programs have provided substantial momentum to the foundry industry. MarkWide Research analysis indicates that policy support combined with private sector investments has created favorable conditions for sustained growth and technological modernization across the foundry ecosystem.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of India’s foundry industry:

Automotive industry expansion serves as the primary growth driver for India’s foundry market, with increasing vehicle production and the shift toward electric vehicles creating new opportunities for specialized castings. The automotive sector’s demand for lightweight, high-strength components has spurred innovation in aluminum and magnesium casting technologies. Electric vehicle adoption is generating demand for specialized motor housings, battery enclosures, and thermal management components.

Infrastructure development under various government initiatives has created substantial demand for construction-related castings including manhole covers, pipe fittings, and structural components. The expansion of metro rail networks, highways, and smart city projects has provided consistent order flow for foundries specializing in infrastructure applications. Housing sector growth has similarly boosted demand for architectural castings and plumbing components.

Make in India initiative has encouraged domestic manufacturing across multiple sectors, reducing import dependence and creating opportunities for local foundries to serve previously import-dependent industries. The policy framework has attracted foreign manufacturers to establish production facilities in India, creating demand for locally sourced castings. Defense manufacturing localization has opened new market segments for precision foundries capable of meeting stringent quality and security requirements.

Export market opportunities continue to expand as global manufacturers seek cost-effective sourcing solutions. Indian foundries have successfully penetrated markets in North America, Europe, and Asia-Pacific through competitive pricing and improved quality standards. Trade agreements and diplomatic relations have facilitated market access and reduced trade barriers for Indian foundry products.

Environmental regulations pose significant challenges for foundry operations, requiring substantial investments in pollution control equipment and waste management systems. Stricter emission norms and environmental clearance procedures have increased compliance costs and operational complexity. Water scarcity in certain regions has forced foundries to invest in water recycling systems and alternative cooling technologies.

Raw material price volatility continues to impact foundry profitability, particularly for steel scrap, pig iron, and non-ferrous metals. Fluctuating commodity prices make it difficult to maintain consistent pricing for customers and plan long-term investments. Import dependence for certain specialized alloys and additives exposes foundries to currency fluctuation risks and supply chain disruptions.

Skilled labor shortage remains a persistent challenge, particularly for specialized roles such as metallurgists, quality control technicians, and automation specialists. The industry’s traditional image and working conditions have made it difficult to attract young talent despite competitive compensation packages. Training costs and time required to develop skilled workers add to operational expenses.

Technology upgrade costs represent significant capital investments that smaller foundries struggle to finance. The rapid pace of technological advancement requires continuous investment in equipment and training, creating financial strain for traditional foundries. Competition from imports in certain segments puts pressure on margins and market share, particularly from low-cost producers in neighboring countries.

Electric vehicle revolution presents unprecedented opportunities for foundries to develop specialized components including motor housings, battery enclosures, and thermal management systems. The transition to electric mobility requires new casting technologies and materials, creating first-mover advantages for innovative foundries. Charging infrastructure development will generate additional demand for electrical components and housing systems.

Renewable energy sector expansion offers substantial growth potential, particularly for wind turbine components, solar panel mounting systems, and energy storage solutions. The government’s ambitious renewable energy targets have created a robust pipeline of projects requiring specialized castings. Green hydrogen initiatives may generate demand for specialized equipment components and storage systems.

Aerospace and defense manufacturing localization presents high-value opportunities for precision foundries capable of meeting stringent quality and security requirements. The government’s focus on defense self-reliance has opened previously restricted market segments to domestic suppliers. Space program expansion creates demand for specialized aerospace components and satellite equipment.

Export market diversification beyond traditional markets offers growth potential, particularly in emerging economies and specialized niche segments. MWR analysis suggests that Indian foundries can capture additional market share through strategic partnerships and technology collaborations with international customers. Value-added services including machining, assembly, and logistics can enhance competitiveness and customer relationships.

Supply chain integration has become increasingly sophisticated, with foundries developing strategic partnerships with raw material suppliers, equipment manufacturers, and end-users. Vertical integration strategies have helped larger foundries control costs and ensure quality consistency throughout the production process. Digital supply chains enable real-time inventory management and demand forecasting, improving operational efficiency.

Competitive landscape continues to evolve with consolidation among smaller players and expansion of larger foundries into new market segments. Strategic acquisitions and mergers have created more comprehensive service offerings and enhanced technological capabilities. Foreign collaborations have brought advanced technologies and international market access to Indian foundries.

Customer relationships have shifted toward long-term partnerships with shared development programs and collaborative innovation initiatives. Original equipment manufacturers increasingly prefer suppliers who can provide comprehensive solutions including design support, prototyping, and supply chain management. Quality partnerships have become essential for maintaining competitiveness in premium market segments.

Innovation cycles have accelerated with foundries investing in research and development capabilities to stay ahead of market requirements. Collaboration with academic institutions and technology providers has enhanced innovation capacity and access to cutting-edge technologies. Intellectual property development has become increasingly important for maintaining competitive advantages.

Comprehensive market analysis was conducted through a multi-faceted approach combining primary research, secondary data analysis, and industry expert consultations. The methodology encompassed detailed surveys of foundry operators, equipment suppliers, raw material vendors, and end-user industries to gather comprehensive market intelligence. Data validation was performed through cross-referencing multiple sources and statistical analysis to ensure accuracy and reliability.

Primary research included structured interviews with senior executives from leading foundries, industry associations, and government officials involved in policy formulation. Field visits to manufacturing facilities provided firsthand insights into operational practices, technology adoption, and market challenges. Customer surveys captured demand patterns, quality requirements, and future procurement strategies across various end-user industries.

Secondary research involved extensive analysis of industry reports, government statistics, trade publications, and company financial statements. Historical data analysis identified market trends, growth patterns, and cyclical variations affecting the foundry industry. Regulatory analysis examined policy impacts, environmental regulations, and trade policies affecting market dynamics.

Market modeling utilized statistical techniques including regression analysis, time series forecasting, and scenario planning to project future market trends. Economic indicators, demographic factors, and industrial growth patterns were incorporated into forecasting models. Sensitivity analysis evaluated the impact of various factors on market projections and identified key variables affecting future growth.

Western India dominates the foundry landscape, accounting for 38% of total production capacity, with Maharashtra and Gujarat leading in automotive and industrial castings. The region benefits from excellent infrastructure, proximity to major ports, and established industrial ecosystems. Pune and Aurangabad have emerged as major foundry clusters serving the automotive industry, while Gujarat specializes in chemical and petrochemical equipment castings.

Northern India represents 28% of market share, with significant concentrations in Punjab, Haryana, and Uttar Pradesh. The region serves diverse industries including agriculture, construction, and consumer goods. Ludhiana cluster has developed expertise in small to medium castings for bicycles, sewing machines, and hand tools, while Delhi NCR focuses on automotive and infrastructure applications.

Southern India contributes 25% of production, with Tamil Nadu and Karnataka leading in precision castings and export-oriented manufacturing. The region has developed strong capabilities in aerospace, defense, and high-tech applications. Coimbatore and Hosur have emerged as major foundry centers with advanced technology adoption and international quality certifications.

Eastern India accounts for 9% of market share, primarily focused on heavy industrial castings and mining equipment. West Bengal and Jharkhand have traditional strengths in ferrous castings for railways, mining, and heavy machinery. Infrastructure development in the region is creating new opportunities for construction-related castings and industrial components.

Market leadership is distributed among several large integrated foundries and numerous specialized players serving specific market segments. The competitive environment has intensified with technological advancement and quality requirements driving consolidation and strategic partnerships.

Competitive strategies focus on technology upgradation, capacity expansion, and market diversification. Leading players are investing heavily in automation, quality systems, and environmental compliance to maintain competitive advantages. Strategic alliances with international technology providers and customers have become essential for accessing advanced technologies and global markets.

By Material Type:

By Process Technology:

By End-User Industry:

Automotive castings represent the most dynamic segment with continuous innovation driven by lightweighting requirements and electric vehicle adoption. Aluminum castings are gaining market share due to superior strength-to-weight ratios and recyclability. Engine components remain the largest application, though electric vehicle growth is creating demand for motor housings and battery enclosures.

Infrastructure castings benefit from government spending on roads, railways, and urban development projects. Ductile iron pipes for water distribution and sewage systems represent a major growth area. Smart city initiatives are creating demand for specialized components including LED lighting fixtures and telecommunications equipment housings.

Industrial machinery castings serve diverse applications from textile machinery to mining equipment. The segment requires high-strength materials and precision manufacturing capabilities. Automation trends in manufacturing are creating demand for specialized components including robot frames and precision mechanical parts.

Aerospace and defense castings represent the highest value segment with stringent quality requirements and security considerations. The government’s focus on defense manufacturing localization has opened new opportunities for qualified foundries. Space program expansion creates additional demand for specialized lightweight components and satellite equipment.

Foundry operators benefit from India’s competitive manufacturing environment, skilled workforce, and growing domestic market. Access to low-cost raw materials and energy provides cost advantages over international competitors. Government incentives including tax benefits and infrastructure support enhance profitability and growth potential.

Equipment suppliers find substantial opportunities in the modernization and capacity expansion of Indian foundries. The technology upgrade cycle creates demand for advanced melting systems, automated molding equipment, and quality control instruments. Service partnerships provide recurring revenue opportunities through maintenance and technical support contracts.

Raw material suppliers benefit from consistent demand growth and long-term supply partnerships with foundries. The industry’s focus on supply chain security creates opportunities for reliable suppliers to establish preferred vendor relationships. Recycling operations benefit from the foundry industry’s substantial scrap metal consumption.

End-user industries gain access to cost-effective, high-quality casting solutions that support their manufacturing competitiveness. Local sourcing reduces supply chain risks and transportation costs while enabling closer collaboration on product development. Customization capabilities of Indian foundries provide flexibility in meeting specific application requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing foundry operations with IoT sensors, data analytics, and predictive maintenance systems improving efficiency and reducing downtime. Smart foundries are implementing real-time monitoring systems that optimize energy consumption and predict equipment failures. Industry 4.0 technologies enable better quality control and traceability throughout the production process.

Sustainability initiatives are gaining momentum with foundries investing in energy-efficient technologies, waste reduction programs, and circular economy practices. Electric melting systems and renewable energy adoption are reducing carbon footprints. Recycling programs for metal waste and sand reclamation systems are becoming standard practices in modern foundries.

Lightweighting trends across industries are driving demand for aluminum and magnesium castings with superior strength-to-weight ratios. Advanced alloy development and casting technologies enable production of thinner, lighter components without compromising strength. Material innovation includes development of hybrid materials and composite reinforced castings.

Customization capabilities are becoming increasingly important as customers demand specialized solutions for specific applications. Flexible manufacturing systems and rapid prototyping technologies enable foundries to serve niche markets effectively. Design collaboration with customers during product development phases creates stronger partnerships and competitive advantages.

Technology partnerships between Indian foundries and international equipment suppliers have accelerated modernization and capability enhancement. Recent collaborations have brought advanced melting technologies, automated molding systems, and quality control equipment to Indian facilities. Knowledge transfer programs have enhanced technical capabilities and operational efficiency.

Capacity expansion projects by major foundries reflect confidence in long-term market growth and demand sustainability. New facilities incorporate latest technologies and environmental compliance systems from the design stage. Greenfield investments in strategic locations provide access to raw materials and transportation infrastructure.

Quality certifications have become essential for market access with increasing numbers of foundries achieving international standards including ISO 9001, TS 16949, and AS 9100. MarkWide Research data indicates that certified foundries command premium pricing and preferential customer relationships. Continuous improvement programs ensure ongoing compliance and performance enhancement.

Export market penetration has accelerated with Indian foundries establishing direct relationships with international customers and setting up overseas offices. Strategic partnerships with global distributors have enhanced market reach and customer service capabilities. Trade mission participation has increased visibility and credibility in international markets.

Technology investment should be prioritized by foundries seeking to maintain competitiveness in evolving markets. Automation and digitalization initiatives provide immediate returns through improved efficiency and quality consistency. Phased implementation strategies can help manage capital requirements while ensuring continuous operational improvement.

Market diversification beyond traditional automotive applications can reduce cyclical risks and capture growth in emerging sectors. Aerospace, defense, and renewable energy markets offer higher value opportunities for qualified foundries. Capability development in precision casting and specialized alloys opens access to premium market segments.

Strategic partnerships with technology providers, raw material suppliers, and customers can enhance competitive positioning and market access. Joint ventures and licensing agreements provide access to advanced technologies and international markets. Supply chain integration creates mutual dependencies that strengthen business relationships.

Sustainability initiatives should be integrated into long-term strategic planning as environmental regulations become more stringent. Investment in clean technologies and circular economy practices provides competitive advantages and regulatory compliance. Carbon footprint reduction programs align with global sustainability trends and customer requirements.

Market expansion is expected to continue driven by industrialization, infrastructure development, and export growth opportunities. The foundry industry is projected to maintain robust growth rates with 7.5% annual expansion in production capacity over the next five years. Technology adoption will accelerate as foundries invest in automation and digitalization to remain competitive.

Electric vehicle transition will create substantial new market opportunities while traditional automotive applications may face gradual decline. Foundries that successfully adapt to electric vehicle requirements will capture disproportionate growth benefits. Battery technology advancement may create additional opportunities for specialized enclosures and thermal management components.

Export market growth is expected to outpace domestic demand as Indian foundries gain international recognition for quality and competitiveness. Market share gains in developed economies will drive revenue growth and technology transfer opportunities. Trade agreements and diplomatic relations will facilitate market access and reduce trade barriers.

Industry consolidation is likely to continue as larger foundries acquire smaller players to achieve economies of scale and expand market coverage. Strategic mergers will create more comprehensive service offerings and enhanced technological capabilities. Foreign investments in Indian foundries will bring advanced technologies and international market access.

India’s foundry market stands at a pivotal juncture with tremendous growth potential driven by industrialization, technological advancement, and expanding global market opportunities. The industry has successfully transformed from traditional casting operations to sophisticated manufacturing facilities capable of competing in international markets through quality, cost-effectiveness, and innovation.

Strategic positioning as a global manufacturing hub continues to attract investments and technology transfers that enhance capabilities and market access. The combination of skilled workforce, competitive costs, and government support creates favorable conditions for sustained growth and market expansion. Technology adoption and sustainability initiatives will determine long-term competitiveness and market leadership.

Future success will depend on the industry’s ability to adapt to changing market requirements, embrace new technologies, and maintain quality standards while managing environmental responsibilities. Foundries that invest in modernization, diversify market exposure, and develop strategic partnerships will capture disproportionate benefits from market growth. The India foundry market is well-positioned to maintain its growth trajectory and strengthen its position as a global manufacturing destination.

What is Foundry?

Foundry refers to a manufacturing process where metal is melted and poured into molds to create various components and products. This process is essential in industries such as automotive, aerospace, and construction, where precision and material properties are critical.

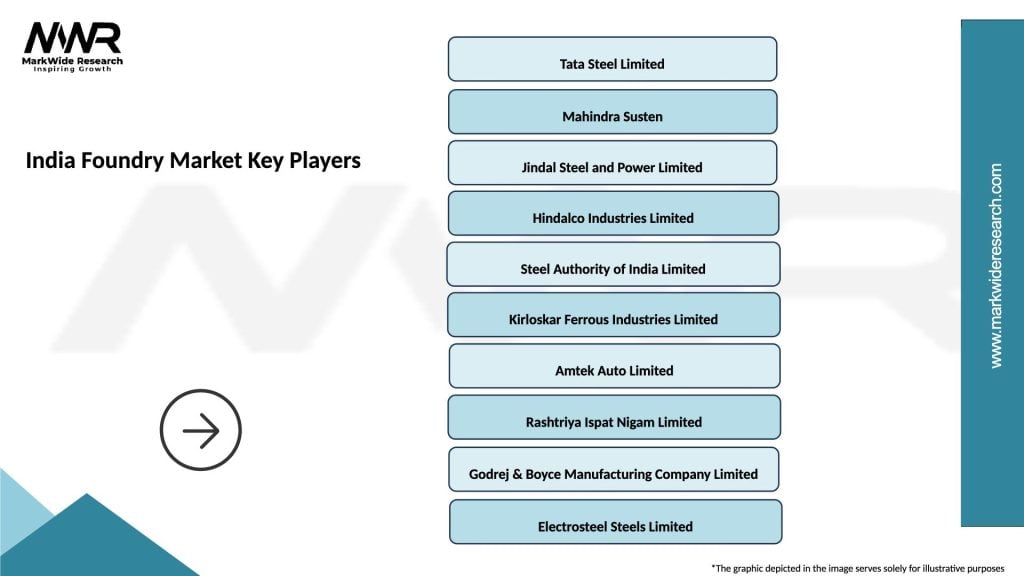

What are the key players in the India Foundry Market?

Key players in the India Foundry Market include Tata Metaliks, Jindal Steel and Power, and Bharat Forge, among others. These companies are involved in producing a wide range of castings for various applications, including automotive and industrial machinery.

What are the growth factors driving the India Foundry Market?

The India Foundry Market is driven by the increasing demand for lightweight and high-strength materials in automotive and aerospace applications. Additionally, the growth of infrastructure projects and the rise in manufacturing activities contribute to the market’s expansion.

What challenges does the India Foundry Market face?

The India Foundry Market faces challenges such as fluctuating raw material prices and environmental regulations that impact production processes. Additionally, the need for skilled labor and technological advancements can pose difficulties for foundry operations.

What opportunities exist in the India Foundry Market?

Opportunities in the India Foundry Market include the adoption of advanced manufacturing technologies like automation and 3D printing. Furthermore, the growing focus on sustainable practices and recycling in foundry operations presents avenues for innovation and growth.

What trends are shaping the India Foundry Market?

Trends in the India Foundry Market include the increasing use of digital technologies for process optimization and quality control. Additionally, there is a shift towards producing eco-friendly castings and enhancing supply chain efficiencies to meet market demands.

India Foundry Market

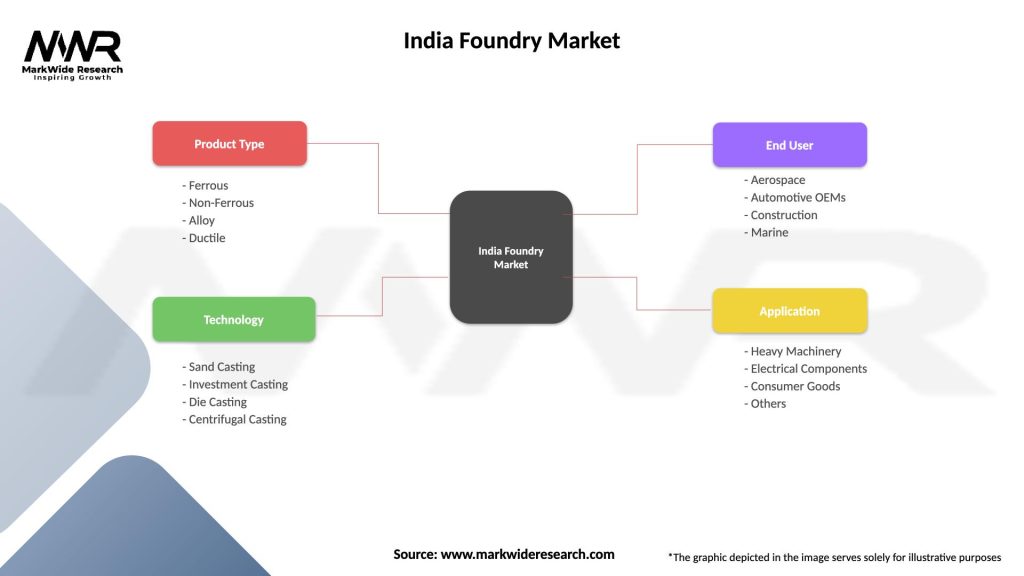

| Segmentation Details | Description |

|---|---|

| Product Type | Ferrous, Non-Ferrous, Alloy, Ductile |

| Technology | Sand Casting, Investment Casting, Die Casting, Centrifugal Casting |

| End User | Aerospace, Automotive OEMs, Construction, Marine |

| Application | Heavy Machinery, Electrical Components, Consumer Goods, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Foundry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at