444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India dry mix mortar market represents a transformative segment within the country’s construction industry, experiencing unprecedented growth driven by rapid urbanization, infrastructure development, and modernization of construction practices. Dry mix mortar has emerged as a preferred alternative to traditional wet mortar, offering superior quality, consistency, and ease of application across residential, commercial, and industrial construction projects.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 12.5% over the forecast period. This growth trajectory reflects India’s massive infrastructure push, including smart city initiatives, affordable housing programs, and industrial corridor developments. The market encompasses various product categories including tile adhesives, wall putty, grouts, repair mortars, and specialty construction chemicals.

Regional distribution shows concentrated demand in major metropolitan areas and emerging tier-2 cities, with western and southern regions accounting for approximately 65% of total market consumption. The increasing adoption of mechanized construction methods and growing awareness about quality construction materials continue to drive market penetration across diverse geographical segments.

The India dry mix mortar market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of pre-mixed construction materials that require only water addition for application. These factory-manufactured products combine cement, sand, additives, and polymers in precise proportions to deliver consistent performance characteristics superior to site-mixed alternatives.

Dry mix mortar systems represent a technological advancement in construction methodology, offering enhanced workability, improved adhesion properties, reduced material wastage, and standardized quality control. The market includes various specialized formulations designed for specific applications such as exterior insulation finishing systems, waterproofing solutions, flooring compounds, and decorative plasters.

Industry stakeholders include raw material suppliers, manufacturing companies, distributors, contractors, and end-users spanning residential builders, commercial developers, and infrastructure project implementers. The market’s evolution reflects India’s transition toward modern construction practices aligned with international quality standards and sustainable building technologies.

Strategic analysis reveals the India dry mix mortar market positioned for substantial expansion, driven by fundamental shifts in construction industry practices and increasing quality consciousness among builders and consumers. The market demonstrates strong momentum across multiple application segments, with tile adhesives representing the largest category followed by wall putty and repair mortars.

Key growth drivers include government infrastructure initiatives, rising disposable incomes, urbanization trends, and increasing adoption of modern construction technologies. The market benefits from favorable regulatory frameworks promoting quality construction materials and energy-efficient building practices. Digital transformation initiatives within the construction sector further accelerate market adoption through improved supply chain efficiency and customer engagement platforms.

Competitive landscape features both international players and domestic manufacturers competing through product innovation, distribution network expansion, and strategic partnerships. Market leaders focus on developing specialized formulations catering to India’s diverse climatic conditions and construction requirements while maintaining cost competitiveness essential for market penetration.

Future prospects indicate continued growth supported by ongoing urbanization, infrastructure development programs, and increasing preference for quality construction materials. The market’s evolution toward sustainable and high-performance products aligns with global construction industry trends and environmental consciousness among stakeholders.

Market intelligence reveals several critical insights shaping the India dry mix mortar landscape:

Market maturity varies significantly across different regions and application segments, with metropolitan areas demonstrating higher adoption rates compared to rural markets. The increasing focus on quality construction and time-efficient building practices continues to drive market evolution toward sophisticated product offerings.

Primary growth catalysts propelling the India dry mix mortar market include comprehensive infrastructure development initiatives, rapid urbanization trends, and evolving construction industry practices. The government’s ambitious housing programs, including Pradhan Mantri Awas Yojana and smart city missions, create substantial demand for quality construction materials and modern building technologies.

Urbanization acceleration drives residential and commercial construction activities, with emerging tier-2 and tier-3 cities witnessing significant real estate development. The growing middle-class population’s preference for quality housing and commercial spaces fuels demand for superior construction materials offering enhanced durability and aesthetic appeal.

Technology advancement in construction methodologies promotes dry mix mortar adoption through improved application efficiency, reduced labor requirements, and consistent quality outcomes. The increasing mechanization of construction processes and growing awareness about modern building practices among contractors and builders support market expansion.

Quality consciousness among consumers and builders drives preference for factory-manufactured products over site-mixed alternatives. The superior performance characteristics, including enhanced adhesion, reduced shrinkage, and improved workability, make dry mix mortars increasingly attractive for quality-focused construction projects.

Regulatory support through building codes emphasizing quality construction materials and energy-efficient building practices creates favorable market conditions. Environmental regulations promoting sustainable construction practices further encourage adoption of advanced dry mix formulations with reduced environmental impact.

Cost considerations represent the primary challenge limiting widespread dry mix mortar adoption, particularly in price-sensitive market segments. The higher initial cost compared to traditional site-mixed alternatives creates resistance among cost-conscious builders and smaller contractors operating with limited budgets.

Awareness limitations in rural and semi-urban markets restrict market penetration, with many builders and contractors remaining unfamiliar with dry mix mortar benefits and application techniques. The lack of technical knowledge and training infrastructure in remote areas hampers market expansion beyond metropolitan regions.

Supply chain complexities including transportation costs, storage requirements, and distribution network limitations affect product availability and pricing in distant markets. The need for specialized storage conditions and shorter shelf life compared to basic construction materials create logistical challenges for widespread distribution.

Skilled labor shortage for proper application techniques limits market growth, as dry mix mortars require specific mixing ratios and application methods for optimal performance. The lack of trained applicators in many regions affects product adoption and customer satisfaction levels.

Raw material price volatility impacts product pricing and profit margins, with fluctuations in cement, polymer, and additive costs affecting market competitiveness. The dependence on imported specialty chemicals and additives creates additional cost pressures and supply chain vulnerabilities.

Emerging market segments present substantial growth opportunities, particularly in tier-2 and tier-3 cities experiencing rapid infrastructure development and rising construction quality standards. The expanding retail construction market and growing DIY segment create new avenues for market penetration through specialized product offerings and consumer-friendly packaging.

Technology integration opportunities include development of smart mortars with self-healing properties, enhanced thermal insulation, and improved sustainability characteristics. The integration of nanotechnology and advanced polymer systems offers potential for premium product categories commanding higher margins and superior performance.

Export potential to neighboring countries and emerging markets provides growth opportunities for established Indian manufacturers. The competitive cost structure and growing technical expertise position Indian companies favorably for international market expansion, particularly in South Asian and African regions.

Sustainability initiatives create opportunities for eco-friendly product development using recycled materials, reduced carbon footprint formulations, and energy-efficient manufacturing processes. The growing environmental consciousness among consumers and regulatory emphasis on green building practices support sustainable product innovation.

Digital transformation opportunities include e-commerce platforms, mobile applications for technical support, and digital marketing initiatives targeting modern contractors and builders. The integration of IoT technologies for quality monitoring and application guidance represents emerging opportunities for market differentiation.

Competitive dynamics within the India dry mix mortar market reflect intense competition between established international players and emerging domestic manufacturers. Market leaders leverage brand recognition, extensive distribution networks, and technical expertise to maintain market position, while newer entrants compete through competitive pricing and regional focus strategies.

Innovation cycles drive continuous product development with manufacturers investing in research and development to create specialized formulations addressing specific market needs. The focus on climate-specific products, application-specific solutions, and performance-enhanced formulations creates competitive differentiation opportunities.

Supply chain evolution demonstrates increasing sophistication with manufacturers developing integrated distribution networks, strategic partnerships with retailers, and direct-to-consumer channels. The optimization of logistics and inventory management systems improves market responsiveness and cost efficiency.

Customer behavior patterns show increasing preference for branded products, technical support services, and comprehensive solution offerings. The growing importance of after-sales service, application training, and technical consultation influences competitive strategies and market positioning approaches.

Regulatory landscape continues evolving with stricter quality standards, environmental regulations, and building code requirements shaping product development and market strategies. The alignment with international standards and certification requirements creates both challenges and opportunities for market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India dry mix mortar market. The research framework combines primary data collection through industry interviews, surveys, and expert consultations with secondary research from industry reports, government publications, and trade association data.

Primary research activities include structured interviews with key industry stakeholders including manufacturers, distributors, contractors, and end-users across different geographical regions. The survey methodology encompasses both quantitative data collection and qualitative insights gathering to understand market trends, challenges, and opportunities comprehensively.

Secondary research sources encompass industry publications, government statistical data, trade association reports, and company annual reports to validate primary findings and provide historical context. The analysis includes examination of regulatory frameworks, policy documents, and industry standards affecting market development.

Data validation processes ensure accuracy through triangulation of information sources, expert review panels, and statistical analysis techniques. The research methodology incorporates both bottom-up and top-down approaches to market sizing and forecasting, providing robust analytical foundations for strategic insights.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive understanding of market dynamics and competitive positioning. The research incorporates scenario analysis and sensitivity testing to account for market uncertainties and alternative development pathways.

Western India dominates the dry mix mortar market, with Maharashtra and Gujarat leading consumption due to robust industrial development, extensive construction activities, and higher adoption of modern building technologies. The region benefits from established manufacturing infrastructure, proximity to raw material sources, and strong distribution networks supporting market growth.

Southern India represents the second-largest market segment, with Karnataka, Tamil Nadu, and Andhra Pradesh driving demand through rapid urbanization, IT sector expansion, and increasing construction quality standards. The region demonstrates 18% higher adoption rates for premium dry mix products compared to national averages, reflecting greater quality consciousness among builders and consumers.

Northern India shows significant growth potential with Delhi NCR, Punjab, and Haryana leading market development through infrastructure projects, residential construction, and industrial expansion. The region’s market growth accelerates through government initiatives, improving distribution networks, and increasing awareness about modern construction materials.

Eastern India presents emerging opportunities with West Bengal and Odisha witnessing gradual market development supported by infrastructure investments and industrial growth. The region demonstrates 25% annual growth rates in dry mix mortar adoption, though from a relatively smaller base compared to western and southern markets.

Central India shows steady market expansion with Madhya Pradesh and Chhattisgarh contributing to regional growth through mining industry development, infrastructure projects, and increasing construction activities. The region benefits from strategic location advantages and improving connectivity supporting market penetration.

Market leadership is characterized by a mix of international companies and domestic players competing across different market segments and geographical regions. The competitive environment demonstrates increasing consolidation with larger players acquiring regional manufacturers to expand market presence and distribution capabilities.

Competitive strategies include product innovation, distribution network expansion, strategic partnerships, and market-specific product development. Companies invest heavily in research and development, technical support services, and brand building activities to maintain competitive positioning and market share growth.

Market consolidation trends indicate increasing merger and acquisition activities as companies seek to expand geographical presence, enhance product portfolios, and achieve economies of scale. The competitive landscape continues evolving with new entrants challenging established players through innovative products and competitive pricing strategies.

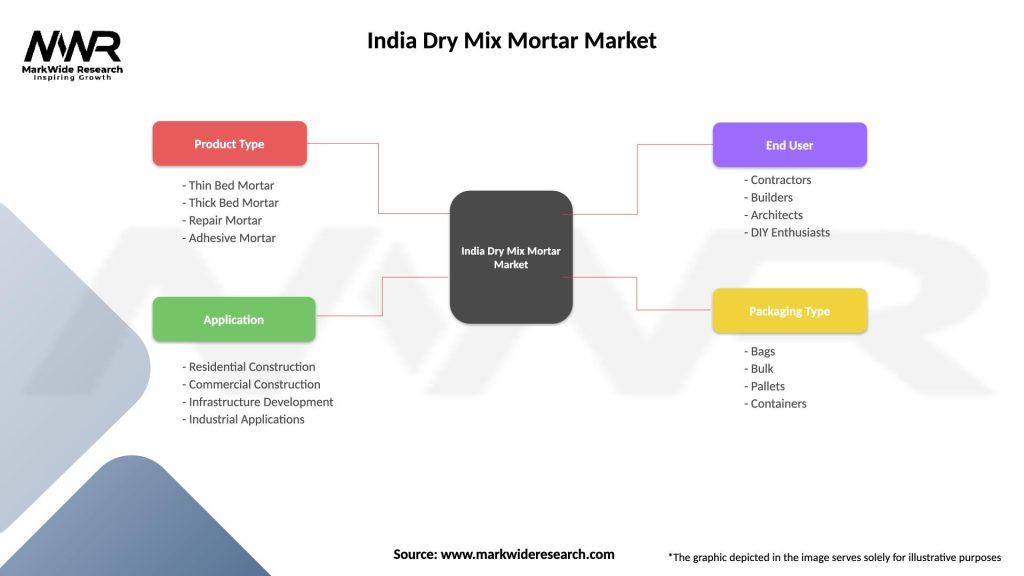

Product-based segmentation reveals diverse market categories serving different construction applications and performance requirements:

Application-based segmentation demonstrates varied market dynamics across different construction sectors:

End-user segmentation reflects diverse customer categories with varying requirements and purchasing patterns, from large contractors and builders to individual consumers and DIY enthusiasts seeking quality construction materials.

Tile Adhesives Category dominates market revenue with superior performance characteristics compared to traditional cement-based alternatives. The segment benefits from increasing ceramic tile usage, growing preference for large format tiles, and expanding application in exterior cladding systems. Innovation focus includes rapid-setting formulations, flexible adhesives for challenging substrates, and eco-friendly options meeting green building requirements.

Wall Putty Segment demonstrates steady growth driven by increasing focus on interior finishing quality and aesthetic appeal. The category evolution includes specialized formulations for different climatic conditions, improved workability characteristics, and enhanced durability properties. Market dynamics show increasing preference for ready-to-use products over powder formulations in urban markets.

Repair Mortars Category shows significant growth potential as infrastructure maintenance and building restoration activities increase. The segment includes specialized products for concrete repair, structural strengthening, and heritage building restoration. Technical advancement focuses on rapid-strength gain, corrosion protection, and compatibility with existing structures.

Grouts and Sealants represent specialized segments with high-performance requirements for waterproofing and joint sealing applications. The category benefits from increasing awareness about moisture protection and growing adoption of modern bathroom and kitchen designs requiring superior sealing solutions.

Specialty Products including self-leveling compounds, thermal insulation mortars, and decorative plasters represent emerging high-value segments with significant growth potential driven by evolving construction requirements and performance standards.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and brand differentiation possibilities through product innovation and quality positioning. The market offers opportunities for capacity expansion, geographical diversification, and development of specialized product portfolios catering to specific market segments and applications.

Distributors and retailers gain from higher margin products, reduced inventory complexity, and growing customer demand for quality construction materials. The dry mix mortar market provides opportunities for business expansion, customer relationship development, and value-added services including technical support and application training.

Contractors and builders benefit from improved construction efficiency, consistent quality outcomes, reduced material wastage, and enhanced project timelines. The adoption of dry mix mortars enables better project management, reduced labor requirements, and improved customer satisfaction through superior construction quality.

End-users and consumers gain from enhanced building durability, improved aesthetic appeal, reduced maintenance requirements, and better long-term value. The use of quality dry mix products contributes to energy efficiency, moisture protection, and overall building performance improvements.

Industry ecosystem benefits from technology advancement, skill development opportunities, quality standardization, and alignment with international construction practices. The market development supports employment generation, technical expertise building, and overall construction industry modernization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with manufacturers developing eco-friendly formulations using recycled materials, reduced carbon footprint processes, and biodegradable additives. The trend aligns with global environmental consciousness and regulatory requirements promoting green building practices and sustainable construction materials.

Digital Transformation accelerates across the industry with companies implementing e-commerce platforms, mobile applications for technical support, and digital marketing strategies targeting modern contractors and consumers. Technology integration includes QR codes for product information, online calculators for material estimation, and virtual training programs for applicators.

Customization Demand increases as customers seek specialized products tailored to specific applications, climatic conditions, and performance requirements. The trend drives product portfolio diversification and development of niche formulations addressing unique market needs and challenging application conditions.

Premium Positioning becomes increasingly important as market maturity drives differentiation through superior performance, brand reputation, and comprehensive service offerings. Companies focus on value-added services including technical consultation, application training, and after-sales support to justify premium pricing.

Regional Expansion accelerates with established players targeting tier-2 and tier-3 cities through adapted distribution strategies, localized product offerings, and competitive pricing models. The trend includes development of regional manufacturing facilities and strategic partnerships with local distributors.

Innovation Focus intensifies with research and development investments in advanced polymer systems, nanotechnology applications, and smart material properties. The trend includes development of self-healing mortars, temperature-responsive formulations, and enhanced durability characteristics.

Manufacturing Capacity Expansion represents a significant industry development with major players investing in new production facilities and upgrading existing plants to meet growing demand. Recent investments focus on automated production lines, quality control systems, and environmental compliance measures ensuring sustainable growth.

Strategic Partnerships between manufacturers and distributors strengthen market presence and improve customer reach across different geographical regions. These collaborations include joint marketing initiatives, shared technical expertise, and coordinated supply chain management for enhanced market penetration.

Product Innovation Launches continue accelerating with companies introducing specialized formulations for specific applications, improved performance characteristics, and sustainable alternatives. Recent developments include rapid-setting adhesives, flexible waterproofing compounds, and eco-friendly repair mortars meeting evolving market requirements.

Technology Integration advances through digital platform development, mobile application launches, and IoT-enabled quality monitoring systems. These technological developments enhance customer engagement, improve application guidance, and provide real-time technical support for optimal product performance.

Market Consolidation activities include mergers, acquisitions, and strategic alliances as companies seek to expand geographical presence, enhance product portfolios, and achieve operational synergies. These developments reshape competitive dynamics and market structure across different segments.

Regulatory Compliance initiatives focus on meeting evolving quality standards, environmental regulations, and building code requirements. Industry developments include certification programs, quality assurance systems, and compliance frameworks ensuring product reliability and market acceptance.

Market Entry Strategies should focus on understanding regional preferences, developing appropriate distribution networks, and building brand awareness through targeted marketing initiatives. MarkWide Research analysis suggests that successful market entry requires comprehensive market research, local partnerships, and adapted product offerings meeting specific regional requirements.

Product Development Priorities should emphasize sustainability, performance enhancement, and cost optimization to address diverse market needs effectively. Companies should invest in research and development capabilities, technical expertise, and innovation infrastructure supporting continuous product improvement and market differentiation.

Distribution Network Optimization requires strategic partnerships with retailers, development of direct-to-consumer channels, and implementation of efficient logistics systems. The focus should include inventory management, supply chain visibility, and customer service capabilities ensuring reliable product availability and market responsiveness.

Brand Building Initiatives should emphasize quality positioning, technical expertise, and customer education to build market credibility and preference. Marketing strategies should include demonstration programs, technical seminars, and digital engagement platforms showcasing product benefits and application techniques.

Competitive Positioning requires clear value proposition development, differentiated product offerings, and superior customer service capabilities. Companies should focus on unique selling propositions, competitive pricing strategies, and comprehensive solution offerings addressing specific customer needs and market segments.

Investment Priorities should include manufacturing capacity expansion, technology upgrades, and market development initiatives supporting long-term growth objectives. Strategic investments in automation, quality systems, and sustainability initiatives position companies favorably for future market evolution and regulatory requirements.

Growth Trajectory indicates continued market expansion driven by sustained construction activity, increasing quality consciousness, and ongoing infrastructure development initiatives. The market demonstrates resilience and growth potential across multiple segments with projected CAGR of 12-15% over the next five years, supported by favorable demographic trends and economic development.

Technology Evolution will drive product innovation with advanced formulations, smart material properties, and sustainable alternatives becoming mainstream market offerings. The integration of nanotechnology, polymer science, and digital technologies creates opportunities for premium product categories and enhanced performance characteristics.

Market Maturation across different regions will create opportunities for specialized products, value-added services, and premium positioning strategies. The evolution from price-based competition toward value-based differentiation supports margin improvement and sustainable business models for market participants.

Regulatory Development will continue shaping market dynamics through quality standards, environmental requirements, and building code specifications. The alignment with international standards and sustainability frameworks creates both challenges and opportunities for product development and market positioning.

Digital Integration will transform customer engagement, supply chain management, and technical support services through advanced digital platforms and IoT technologies. MWR projections indicate that digital transformation initiatives will contribute to 20-25% efficiency improvements in market operations and customer service capabilities.

Sustainability Focus will intensify with eco-friendly products, circular economy principles, and carbon footprint reduction becoming critical success factors. The market evolution toward sustainable construction materials aligns with global environmental trends and regulatory requirements promoting responsible building practices.

The India dry mix mortar market represents a dynamic and rapidly evolving sector within the country’s construction industry, characterized by robust growth potential, increasing quality consciousness, and technological advancement. The market benefits from favorable demographic trends, government infrastructure initiatives, and ongoing modernization of construction practices across diverse geographical regions.

Strategic opportunities abound for market participants willing to invest in product innovation, distribution network development, and brand building initiatives. The market’s evolution toward premium products, specialized applications, and sustainable alternatives creates differentiation opportunities and supports margin improvement for companies with appropriate strategic positioning.

Future success in the India dry mix mortar market will depend on understanding regional preferences, developing appropriate product portfolios, and building comprehensive customer support capabilities. Companies that effectively balance quality, cost competitiveness, and market accessibility while maintaining focus on innovation and sustainability will be best positioned for long-term growth and market leadership in this expanding sector.

What is Dry Mix Mortar?

Dry Mix Mortar refers to a pre-mixed combination of cement, sand, and other additives that is used in construction for various applications such as plastering, masonry, and tile fixing.

What are the key players in the India Dry Mix Mortar Market?

Key players in the India Dry Mix Mortar Market include companies like ACC Limited, Ultratech Cement, and Birla White, among others.

What are the growth factors driving the India Dry Mix Mortar Market?

The growth of the India Dry Mix Mortar Market is driven by increasing urbanization, rising construction activities, and the demand for high-quality building materials.

What challenges does the India Dry Mix Mortar Market face?

Challenges in the India Dry Mix Mortar Market include fluctuating raw material prices, competition from traditional mortar, and the need for skilled labor for application.

What opportunities exist in the India Dry Mix Mortar Market?

Opportunities in the India Dry Mix Mortar Market include the growing trend of prefabricated construction, increasing investments in infrastructure, and the rising demand for eco-friendly building materials.

What trends are shaping the India Dry Mix Mortar Market?

Trends in the India Dry Mix Mortar Market include the adoption of advanced manufacturing technologies, the introduction of specialized products for specific applications, and a focus on sustainability in construction practices.

India Dry Mix Mortar Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thin Bed Mortar, Thick Bed Mortar, Repair Mortar, Adhesive Mortar |

| Application | Residential Construction, Commercial Construction, Infrastructure Development, Industrial Applications |

| End User | Contractors, Builders, Architects, DIY Enthusiasts |

| Packaging Type | Bags, Bulk, Pallets, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Dry Mix Mortar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at