444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Gold Derivatives and Futures market is a segment of the global financial market that focuses on trading gold derivatives contracts and futures contracts. These financial instruments provide investors with opportunities to speculate on the price movements of gold without physically owning the underlying asset. The market operates on regulated exchanges and offers participants a way to hedge against price risks or take leveraged positions on the price of gold. It is a crucial component of the overall gold market, offering liquidity, price discovery, and risk management tools to investors.

Meaning

Gold derivatives and futures refer to financial contracts that derive their value from the price of gold. These contracts enable investors to buy or sell gold at a predetermined price on a future date. The derivatives market allows participants to trade gold-related instruments without the need for physical ownership. Futures contracts, in particular, provide investors with a standardized and regulated platform for trading gold, offering opportunities for profit through price speculation or risk mitigation.

Executive Summary

The Gold Derivatives and Futures market play a significant role in the global financial landscape, providing investors with avenues to participate in gold trading without the need for physical possession. The market offers various financial instruments, including gold futures contracts, options, and swaps, which allow investors to manage price risks, speculate on gold price movements, and diversify investment portfolios. Key factors driving the market include the demand for hedging instruments, investor interest in gold as a safe-haven asset, and the liquidity and transparency provided by exchanges. The market faces challenges such as regulatory compliance, market volatility, and the impact of macroeconomic factors on gold prices. However, opportunities exist for market expansion through technological advancements, new product development, and the integration of gold derivatives with other financial instruments.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

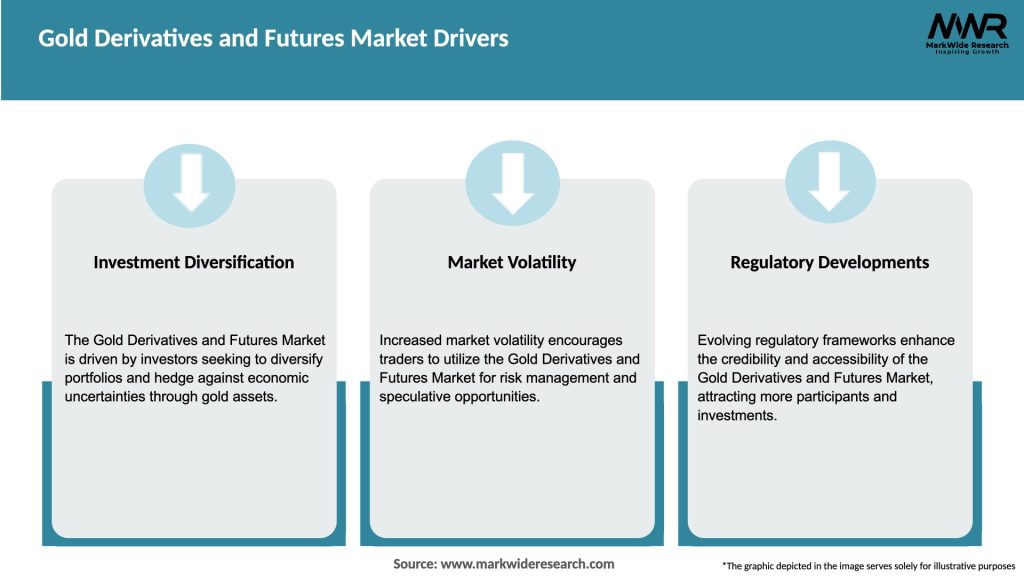

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Gold Derivatives and Futures market operates within a dynamic environment influenced by various factors:

Regional Analysis

The Gold Derivatives and Futures market is a global market with participants from various regions. However, certain regions have significant market participation and influence:

Competitive Landscape

Leading Companies in the Gold Derivatives and Futures Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Gold Derivatives and Futures market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had significant impacts on the global financial markets, including the gold derivatives and futures market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Gold Derivatives and Futures market remains positive. The market is expected to witness continued growth as investors seek opportunities for hedging, speculation, and portfolio diversification. Factors such as geopolitical uncertainties, macroeconomic developments, and technological advancements will influence the market’s trajectory. The market’s resilience and adaptability, combined with investor demand for gold-related instruments, position it for future expansion.

Conclusion

The Gold Derivatives and Futures market offers investors a regulated platform to trade gold-related contracts, providing opportunities for hedging, speculation, and portfolio diversification. The market benefits from gold’s safe-haven status, liquidity, and price discovery mechanisms. While the market faces challenges such as regulatory compliance and price volatility, technological advancements and new product development present opportunities for growth.

The market’s future outlook is positive, driven by factors such as macroeconomic trends, investor demand, and advancements in trading technology. Market participants should focus on risk management, technological integration, and investor education to navigate the evolving landscape and harness the market’s potential.

What is Gold Derivatives and Futures?

Gold derivatives and futures are financial contracts that derive their value from the price of gold. These instruments allow investors to hedge against price fluctuations or speculate on future price movements in the gold market.

What are the key companies in the Gold Derivatives and Futures Market?

Key companies in the Gold Derivatives and Futures Market include CME Group, Intercontinental Exchange, and London Metal Exchange, among others.

What are the growth factors driving the Gold Derivatives and Futures Market?

The growth of the Gold Derivatives and Futures Market is driven by increasing demand for gold as a safe-haven asset, rising geopolitical tensions, and the growing popularity of gold investment among retail investors.

What challenges does the Gold Derivatives and Futures Market face?

The Gold Derivatives and Futures Market faces challenges such as regulatory changes, market volatility, and the impact of economic downturns on gold prices, which can affect trading volumes and investor confidence.

What opportunities exist in the Gold Derivatives and Futures Market?

Opportunities in the Gold Derivatives and Futures Market include the development of new financial products, increased participation from institutional investors, and the potential for technological advancements in trading platforms.

What trends are shaping the Gold Derivatives and Futures Market?

Trends in the Gold Derivatives and Futures Market include the rise of algorithmic trading, the integration of blockchain technology for transaction transparency, and a growing focus on sustainable investing practices.

Gold Derivatives and Futures Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gold Futures, Gold Options, Gold ETFs, Gold Swaps |

| Investor Type | Institutional Investors, Retail Investors, Hedge Funds, Sovereign Wealth Funds |

| Trading Platform | Exchange-Traded, Over-the-Counter, Direct Market Access, Algorithmic Trading |

| Contract Size | Mini Contracts, Standard Contracts, Micro Contracts, Custom Contracts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Gold Derivatives and Futures Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at