444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The GLP-1 agonists market represents one of the most dynamic and rapidly expanding segments within the global pharmaceutical industry. Glucagon-like peptide-1 receptor agonists have emerged as revolutionary therapeutic agents, transforming the treatment landscape for type 2 diabetes and obesity management. These innovative medications work by mimicking the action of naturally occurring incretin hormones, offering patients enhanced glycemic control and significant weight management benefits.

Market dynamics indicate unprecedented growth driven by rising diabetes prevalence, increasing obesity rates, and growing awareness of metabolic health disorders. The market demonstrates remarkable expansion with a projected CAGR of 8.2% through the forecast period, reflecting strong demand across developed and emerging markets. North America currently dominates market share at approximately 45%, followed by Europe and Asia-Pacific regions showing substantial growth potential.

Pharmaceutical innovation continues to drive market evolution, with next-generation formulations offering improved patient compliance through extended-release mechanisms and combination therapies. The therapeutic applications have expanded beyond diabetes management to include cardiovascular risk reduction and weight management, creating new revenue streams and market opportunities for leading manufacturers.

The GLP-1 agonists market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and commercialization of glucagon-like peptide-1 receptor agonist medications. These pharmaceutical compounds represent a class of incretin mimetics that enhance insulin secretion, suppress glucagon release, slow gastric emptying, and promote satiety, making them highly effective for managing type 2 diabetes and obesity.

GLP-1 receptor agonists function by binding to and activating GLP-1 receptors throughout the body, particularly in pancreatic beta cells, gastric tissue, and central nervous system regions controlling appetite and glucose homeostasis. This mechanism of action provides multiple therapeutic benefits including improved glycemic control, weight reduction, and potential cardiovascular protection, distinguishing them from traditional diabetes medications.

Market participants include pharmaceutical manufacturers, biotechnology companies, research institutions, healthcare providers, and regulatory agencies working collaboratively to advance treatment options for metabolic disorders. The market encompasses various delivery mechanisms including daily and weekly injectable formulations, with emerging oral formulations expanding accessibility and patient acceptance.

Strategic market analysis reveals the GLP-1 agonists market as a high-growth pharmaceutical segment driven by increasing metabolic disease prevalence and innovative therapeutic developments. The market benefits from strong clinical evidence supporting efficacy in diabetes management, weight reduction, and cardiovascular risk mitigation, creating multiple therapeutic applications and revenue opportunities.

Key market drivers include rising global diabetes incidence affecting over 11% of adults worldwide, increasing obesity rates, and growing healthcare focus on preventive metabolic health management. Technological advancements in drug delivery systems, including long-acting formulations and combination therapies, enhance patient compliance and therapeutic outcomes, driving market adoption.

Competitive landscape features established pharmaceutical leaders alongside emerging biotechnology companies developing next-generation formulations. Market consolidation through strategic partnerships, licensing agreements, and acquisition activities continues to reshape the competitive environment, with companies investing heavily in research and development to maintain market position.

Regional market dynamics show North American dominance driven by advanced healthcare infrastructure, favorable reimbursement policies, and high diabetes prevalence. European markets demonstrate steady growth supported by comprehensive healthcare systems, while Asia-Pacific regions present significant expansion opportunities due to rapidly increasing diabetes incidence and improving healthcare access.

Market intelligence reveals several critical insights shaping the GLP-1 agonists landscape. Patient adherence rates for weekly formulations exceed 75% compared to daily medications, highlighting the importance of convenient dosing schedules in driving market adoption and therapeutic success.

Market segmentation analysis indicates that weekly injectable formulations command the largest market share, while oral formulations represent the fastest-growing segment. Type 2 diabetes remains the primary indication, though obesity management applications show rapid expansion with approval rates increasing by 35% annually.

Diabetes prevalence surge represents the primary market driver, with global incidence rates continuing to climb due to aging populations, sedentary lifestyles, and dietary changes. The International Diabetes Federation projects diabetes cases will increase by 46% by 2045, creating substantial demand for effective therapeutic interventions like GLP-1 agonists.

Obesity epidemic significantly contributes to market expansion, as GLP-1 agonists demonstrate remarkable efficacy in weight management applications. Clinical studies show average weight loss of 12-15% in obese patients, positioning these medications as valuable tools in comprehensive obesity treatment programs and driving adoption beyond traditional diabetes care.

Cardiovascular benefits emerging from clinical research create additional market opportunities, with studies demonstrating reduced cardiovascular events in high-risk patients. This evidence supports expanded therapeutic applications and improved reimbursement coverage, encouraging healthcare providers to prescribe GLP-1 agonists for broader patient populations.

Healthcare cost containment initiatives favor GLP-1 agonists due to their potential for reducing long-term complications and healthcare utilization. Economic analyses demonstrate cost-effectiveness through improved glycemic control, reduced hospitalizations, and delayed disease progression, making these medications attractive to healthcare payers and systems.

Technological advancement in drug delivery systems enhances patient experience and compliance, driving market adoption. Weekly formulations, combination therapies, and emerging oral options address patient preferences and clinical needs, expanding the addressable market and improving therapeutic outcomes.

High medication costs present significant market barriers, particularly in price-sensitive regions and healthcare systems with limited reimbursement coverage. The premium pricing of GLP-1 agonists compared to traditional diabetes medications creates accessibility challenges for many patients, potentially limiting market penetration and adoption rates.

Gastrointestinal side effects including nausea, vomiting, and diarrhea affect patient tolerance and treatment continuation. Clinical studies indicate that 20-30% of patients experience these adverse effects, leading to treatment discontinuation and limiting market growth potential among sensitive patient populations.

Injectable delivery requirements for most formulations create patient acceptance barriers, particularly among needle-phobic individuals and those preferring oral medications. This limitation restricts market accessibility and requires ongoing patient education and support programs to maintain treatment adherence and market expansion.

Regulatory complexity surrounding new indications and formulations creates development delays and increased costs for market participants. Stringent safety requirements and extensive clinical trial demands extend time-to-market and increase investment risks, potentially deterring smaller companies from entering the market.

Healthcare provider education requirements represent ongoing market challenges, as optimal prescribing practices and patient management protocols continue evolving. Limited familiarity with newer formulations and applications may slow adoption rates and require substantial educational investments from manufacturers.

Emerging market expansion presents substantial growth opportunities as healthcare infrastructure improves and diabetes awareness increases in developing regions. Countries in Asia-Pacific and Latin America show rapid market development potential, with diabetes incidence rates rising and healthcare access expanding significantly.

Combination therapy development offers innovative treatment approaches combining GLP-1 agonists with complementary mechanisms of action. These formulations can enhance therapeutic efficacy while potentially reducing side effects, creating new market segments and competitive advantages for innovative manufacturers.

Oral formulation advancement represents a transformative opportunity to expand market accessibility and patient acceptance. Successful development of effective oral GLP-1 agonists could dramatically increase market penetration by addressing injection-related barriers and improving patient compliance rates.

Preventive medicine applications create new market opportunities as healthcare systems increasingly focus on preventing diabetes and metabolic disorders in high-risk populations. Early intervention strategies using GLP-1 agonists could expand the addressable patient population and create new therapeutic paradigms.

Digital health integration offers opportunities to enhance patient outcomes through connected devices, mobile applications, and telemedicine platforms. These technologies can improve medication adherence, monitor treatment responses, and provide personalized care management, adding value to GLP-1 agonist therapies.

Supply chain dynamics within the GLP-1 agonists market reflect complex manufacturing processes requiring specialized facilities and quality control systems. Manufacturing capacity constraints occasionally impact product availability, with demand growth outpacing production capabilities by approximately 15% in certain regions, creating temporary supply challenges.

Competitive dynamics intensify as patent expirations approach for early-generation products, potentially enabling biosimilar entry and price competition. Market leaders invest heavily in next-generation formulations and expanded indications to maintain competitive positions and defend market share against emerging competitors.

Regulatory dynamics continue evolving with expanded approval pathways for obesity indications and cardiovascular benefits. MarkWide Research analysis indicates that regulatory agencies are increasingly recognizing the multi-faceted benefits of GLP-1 agonists, leading to accelerated approval processes and broader therapeutic applications.

Pricing dynamics face pressure from healthcare payers seeking cost-effective solutions while manufacturers aim to recoup substantial research and development investments. Value-based pricing models and outcome-based contracts are emerging as mechanisms to balance access and innovation incentives in the market.

Innovation dynamics drive continuous product development with companies pursuing novel delivery mechanisms, extended-duration formulations, and combination therapies. Research pipeline activities focus on improving efficacy, reducing side effects, and enhancing patient convenience to maintain competitive advantages.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GLP-1 agonists market landscape. Primary research includes extensive interviews with healthcare professionals, pharmaceutical executives, regulatory experts, and patient advocacy groups to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of clinical trial databases, regulatory filings, patent landscapes, and published literature to understand technological developments and competitive positioning. Financial reports, investor presentations, and industry publications provide insights into market performance and strategic directions of key market participants.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth trajectories and segment performance. Data validation through multiple sources ensures accuracy and reliability of market estimates and trend projections used in strategic decision-making processes.

Expert consultation with leading endocrinologists, diabetes specialists, and pharmaceutical industry veterans provides clinical and commercial insights into market dynamics. These consultations help validate research findings and provide context for interpreting market data and trends.

Market surveillance includes continuous monitoring of regulatory developments, clinical trial results, and competitive activities to maintain current understanding of rapidly evolving market conditions and emerging opportunities in the GLP-1 agonists space.

North American markets maintain leadership position with approximately 45% market share, driven by advanced healthcare infrastructure, favorable reimbursement policies, and high diabetes prevalence rates. The United States represents the largest single market, supported by robust clinical adoption and comprehensive insurance coverage for diabetes medications.

European markets demonstrate steady growth with 30% market share, characterized by strong regulatory frameworks and comprehensive healthcare systems supporting patient access to innovative therapies. Germany, France, and the United Kingdom lead regional adoption, while emerging European markets show increasing penetration rates.

Asia-Pacific regions represent the fastest-growing market segment with 18% current share but projected growth rates exceeding 12% annually. China, Japan, and India drive regional expansion through improving healthcare infrastructure, rising diabetes incidence, and increasing healthcare spending on chronic disease management.

Latin American markets show emerging potential with growing diabetes awareness and improving healthcare access. Brazil and Mexico lead regional adoption, while regulatory harmonization efforts facilitate market entry and expansion for international pharmaceutical companies.

Middle East and Africa present developing opportunities as healthcare systems modernize and diabetes prevalence increases. Gulf Cooperation Council countries demonstrate strong market potential due to high diabetes rates and advanced healthcare infrastructure investments.

Market leadership is characterized by established pharmaceutical companies with strong research capabilities and extensive commercial infrastructure. The competitive environment features both large multinational corporations and specialized biotechnology companies developing innovative formulations and delivery systems.

Strategic partnerships and licensing agreements shape competitive dynamics, with companies collaborating on research, development, and commercialization activities. These alliances enable resource sharing, risk mitigation, and accelerated market entry for innovative formulations and therapeutic applications.

Innovation competition intensifies around next-generation formulations, with companies investing heavily in oral delivery systems, extended-duration formulations, and combination therapies. Patent landscapes and intellectual property strategies play crucial roles in maintaining competitive advantages and market positioning.

By Drug Type: The market segments into various GLP-1 agonist formulations, with exenatide, liraglutide, dulaglutide, and semaglutide representing major therapeutic options. Weekly formulations command the largest market share due to improved patient compliance and convenience factors.

By Application: Primary therapeutic applications include type 2 diabetes management, obesity treatment, and cardiovascular risk reduction. Diabetes management represents the largest segment, while obesity applications show the fastest growth rates with expanding clinical evidence and regulatory approvals.

By Delivery Method: Market segmentation includes injectable formulations and emerging oral formulations. Injectable products dominate current market share, while oral formulations represent high-growth potential segments addressing patient preference for non-injectable options.

By End User: Healthcare delivery segments include hospitals, specialty clinics, primary care practices, and retail pharmacies. Specialty diabetes and endocrinology clinics represent key prescribing centers, while primary care adoption continues expanding market reach.

By Distribution Channel: Market channels include hospital pharmacies, retail pharmacies, specialty pharmacies, and online platforms. Specialty pharmacies play increasingly important roles in patient education and adherence support for complex injectable medications.

Weekly Injectable Formulations dominate market share due to superior patient compliance rates and clinical outcomes. These formulations achieve adherence rates of 78% compared to daily alternatives, driving physician preference and patient satisfaction. Market leaders continue investing in extended-duration formulations to further improve convenience and outcomes.

Daily Injectable Options maintain significant market presence, particularly among patients requiring flexible dosing or those transitioning from other diabetes medications. These formulations offer dose titration advantages and may be preferred in specific clinical situations requiring precise glycemic control.

Combination Therapies represent emerging high-growth segments, combining GLP-1 agonists with complementary mechanisms such as insulin or SGLT-2 inhibitors. These formulations address complex patient needs and may improve therapeutic outcomes while simplifying treatment regimens.

Oral Formulations constitute the fastest-growing category despite limited current availability. MWR analysis indicates that successful oral GLP-1 agonist development could capture 25-30% of new patient starts, particularly among injection-averse populations and those preferring oral medications.

Biosimilar Products begin emerging as patents expire on early-generation formulations, potentially creating price competition and improved access. However, complex manufacturing requirements and regulatory pathways may limit biosimilar development compared to other therapeutic classes.

Pharmaceutical Manufacturers benefit from substantial revenue opportunities in a high-growth market with strong clinical differentiation and premium pricing potential. The expanding therapeutic applications and geographic markets provide multiple growth vectors and risk diversification opportunities for industry participants.

Healthcare Providers gain access to highly effective therapeutic tools for managing complex metabolic disorders, improving patient outcomes and satisfaction. GLP-1 agonists offer multiple benefits including glycemic control, weight management, and cardiovascular protection, simplifying treatment approaches and enhancing clinical results.

Patients receive innovative treatment options with demonstrated efficacy in multiple therapeutic areas, improving quality of life and long-term health outcomes. Convenient dosing schedules and comprehensive benefits address key patient needs and preferences in chronic disease management.

Healthcare Payers potentially realize long-term cost savings through improved disease management and reduced complications. Despite higher upfront medication costs, GLP-1 agonists may reduce overall healthcare utilization and improve cost-effectiveness in diabetes and obesity management.

Research Institutions benefit from collaborative opportunities and funding for advancing understanding of incretin biology and therapeutic applications. Academic partnerships with pharmaceutical companies accelerate research progress and clinical development of next-generation formulations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized Medicine Integration emerges as a significant trend, with genetic testing and biomarker analysis helping optimize GLP-1 agonist selection and dosing for individual patients. This approach improves therapeutic outcomes while reducing adverse effects, enhancing overall treatment success rates and patient satisfaction.

Digital Health Convergence transforms patient care through connected devices, mobile applications, and telemedicine platforms supporting GLP-1 agonist therapy. These technologies improve medication adherence, monitor treatment responses, and provide personalized care management, adding substantial value to therapeutic interventions.

Combination Therapy Expansion accelerates as manufacturers develop fixed-dose combinations and co-formulations addressing multiple pathophysiological pathways. These approaches simplify treatment regimens while potentially enhancing efficacy and reducing side effects, creating competitive advantages and improved patient outcomes.

Oral Delivery Development represents a transformative trend with multiple companies pursuing effective oral GLP-1 agonist formulations. Successful development could revolutionize market accessibility and patient acceptance, potentially capturing significant market share from injectable alternatives.

Value-Based Care Models increasingly influence prescribing decisions and reimbursement policies, with outcomes-based contracts and risk-sharing arrangements becoming more common. These models align stakeholder incentives around patient outcomes rather than volume, potentially favoring effective therapies like GLP-1 agonists.

Regulatory Milestone Achievements include expanded approvals for obesity management and cardiovascular risk reduction, broadening therapeutic applications and market opportunities. Recent approvals demonstrate regulatory confidence in GLP-1 agonist safety and efficacy profiles across multiple indications.

Clinical Trial Breakthroughs continue demonstrating additional benefits beyond glycemic control, including neuroprotective effects and potential applications in neurodegenerative diseases. These findings could open entirely new therapeutic markets and revenue opportunities for GLP-1 agonist developers.

Manufacturing Capacity Expansions address growing demand with pharmaceutical companies investing heavily in production facilities and supply chain infrastructure. These investments aim to prevent supply shortages and support continued market growth across global regions.

Strategic Partnership Formations accelerate development and commercialization activities, with companies collaborating on research, manufacturing, and market access initiatives. These partnerships enable resource sharing and risk mitigation while accelerating time-to-market for innovative formulations.

Technology Integration Advances include development of smart injection devices, adherence monitoring systems, and integrated digital health platforms. These innovations enhance patient experience and clinical outcomes while creating additional value propositions for healthcare providers and payers.

Market Entry Strategies should focus on differentiated formulations or delivery systems that address current market limitations such as injection requirements or dosing frequency. Companies entering the market need clear competitive advantages and robust intellectual property protection to succeed against established competitors.

Investment Priorities should emphasize oral formulation development, combination therapies, and emerging market expansion opportunities. MarkWide Research analysis suggests that companies investing in these areas are positioned for superior long-term growth and market share gains.

Partnership Opportunities exist in digital health integration, patient support services, and emerging market development. Strategic alliances can accelerate market penetration while sharing development risks and costs, particularly important for smaller companies with limited resources.

Regulatory Strategy should anticipate evolving safety requirements and expanding indication opportunities. Companies maintaining strong regulatory relationships and comprehensive safety databases will be better positioned for successful approvals and market expansion.

Commercial Excellence requires sophisticated market access strategies, comprehensive patient support programs, and healthcare provider education initiatives. Success in the GLP-1 agonist market demands excellence across the entire commercial value chain from development through patient care.

Market trajectory indicates continued robust growth driven by expanding therapeutic applications, geographic market development, and innovative formulation advances. The market is projected to maintain strong momentum with CAGR exceeding 8% through the next decade, supported by favorable demographic trends and clinical evidence.

Technological evolution will likely center on oral delivery systems, extended-duration formulations, and combination therapies addressing multiple pathophysiological pathways. These innovations could transform treatment paradigms and significantly expand the addressable patient population beyond current injectable limitations.

Geographic expansion into emerging markets presents substantial growth opportunities as healthcare infrastructure improves and diabetes awareness increases. Asia-Pacific and Latin American regions show particular promise with rapidly growing middle-class populations and expanding healthcare access.

Therapeutic applications will likely expand beyond current indications to include neurodegenerative diseases, non-alcoholic fatty liver disease, and other metabolic disorders. These new applications could multiply market opportunities and create additional revenue streams for innovative companies.

Competitive dynamics will intensify with biosimilar entry, oral formulation development, and novel mechanism competitors. Companies maintaining innovation leadership and strong market positions will be best positioned to capitalize on continued market growth and expansion opportunities.

The GLP-1 agonists market represents a compelling growth opportunity within the pharmaceutical industry, driven by strong clinical efficacy, expanding therapeutic applications, and favorable market dynamics. Rising diabetes and obesity prevalence, combined with growing healthcare focus on preventive medicine, creates substantial demand for these innovative therapeutic agents.

Market evolution continues toward more convenient formulations, expanded indications, and improved patient outcomes through technological innovation and clinical research advances. The successful development of oral formulations and combination therapies could dramatically expand market accessibility and therapeutic effectiveness, creating new competitive advantages and growth opportunities.

Strategic success in this market requires sustained innovation, comprehensive market access strategies, and strong clinical evidence generation. Companies that effectively address current limitations while expanding therapeutic applications and geographic reach will be positioned for superior long-term performance in this dynamic and rapidly growing market segment.

What is GLP-1 Agonists?

GLP-1 Agonists are a class of medications that mimic the action of the glucagon-like peptide-1 hormone, which plays a crucial role in glucose metabolism and appetite regulation. They are primarily used in the treatment of type two diabetes and obesity.

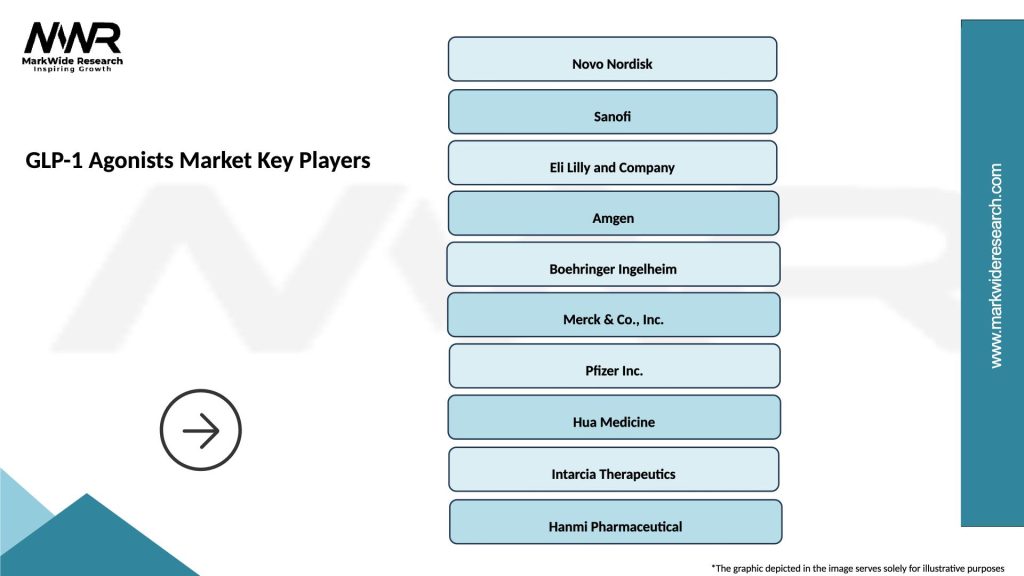

What are the key players in the GLP-1 Agonists Market?

Key players in the GLP-1 Agonists Market include Novo Nordisk, Eli Lilly, Sanofi, and AstraZeneca, among others. These companies are involved in the development and marketing of various GLP-1 receptor agonist products.

What are the growth factors driving the GLP-1 Agonists Market?

The growth of the GLP-1 Agonists Market is driven by the rising prevalence of obesity and type two diabetes, increasing awareness of diabetes management, and the effectiveness of GLP-1 Agonists in weight loss and glycemic control.

What challenges does the GLP-1 Agonists Market face?

The GLP-1 Agonists Market faces challenges such as high treatment costs, potential side effects, and competition from other diabetes medications. Additionally, patient adherence to treatment regimens can be a concern.

What opportunities exist in the GLP-1 Agonists Market?

Opportunities in the GLP-1 Agonists Market include the development of new formulations and combination therapies, expanding indications for use, and increasing market penetration in emerging economies.

What trends are shaping the GLP-1 Agonists Market?

Trends in the GLP-1 Agonists Market include a growing focus on personalized medicine, advancements in drug delivery systems, and increasing research into the long-term benefits of GLP-1 Agonists for cardiovascular health.

GLP-1 Agonists Market

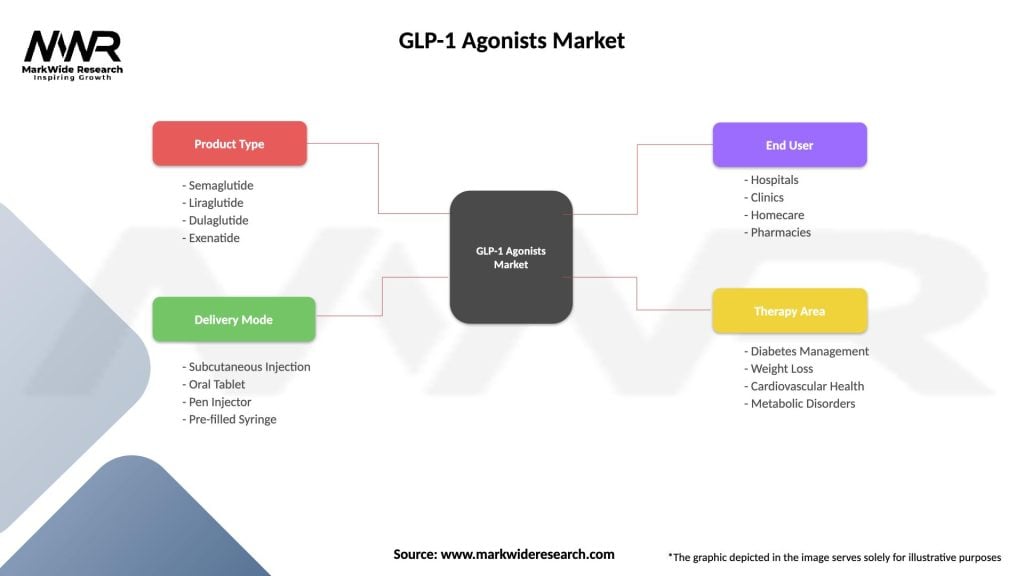

| Segmentation Details | Description |

|---|---|

| Product Type | Semaglutide, Liraglutide, Dulaglutide, Exenatide |

| Delivery Mode | Subcutaneous Injection, Oral Tablet, Pen Injector, Pre-filled Syringe |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Diabetes Management, Weight Loss, Cardiovascular Health, Metabolic Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GLP-1 Agonists Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at