444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe intraocular lenses industry market represents a dynamic and rapidly evolving segment of the continent’s healthcare technology landscape. This sophisticated market encompasses the development, manufacturing, and distribution of advanced optical devices designed to replace the natural lens of the eye during cataract surgery and refractive lens exchange procedures. European healthcare systems have increasingly embraced innovative intraocular lens technologies, driving substantial growth across multiple market segments.

Market dynamics indicate robust expansion driven by an aging population, increasing prevalence of cataracts, and technological advancements in lens design and materials. The region’s commitment to healthcare innovation has positioned Europe as a leading market for premium intraocular lenses, with countries like Germany, France, and the United Kingdom serving as key growth drivers. Adoption rates for advanced IOL technologies have reached approximately 68% in major European markets, reflecting strong acceptance among both healthcare providers and patients.

Technological innovation continues to reshape the European intraocular lenses landscape, with manufacturers introducing multifocal, toric, and accommodating lens designs that address various vision correction needs. The market benefits from well-established healthcare infrastructure, favorable reimbursement policies, and increasing patient awareness about advanced vision correction options. Regional growth patterns show consistent expansion across Western European markets, with emerging opportunities in Eastern European countries as healthcare systems modernize.

The Europe intraocular lenses industry market refers to the comprehensive ecosystem encompassing the research, development, manufacturing, distribution, and clinical application of artificial lens implants used to replace the natural crystalline lens of the eye. These sophisticated medical devices serve as permanent vision correction solutions, primarily addressing cataracts while also correcting refractive errors such as myopia, hyperopia, and astigmatism.

Intraocular lenses represent a critical component of modern ophthalmology, offering patients restored vision and improved quality of life following cataract surgery or refractive lens exchange procedures. The European market encompasses various lens types, including monofocal, multifocal, toric, and accommodating designs, each engineered to address specific vision correction requirements and patient preferences.

Market scope includes the entire value chain from raw material suppliers and lens manufacturers to distributors, healthcare providers, and end-users. The industry operates within a highly regulated environment, with European Medicines Agency oversight ensuring product safety, efficacy, and quality standards. Clinical applications extend beyond basic vision restoration to include premium vision correction services that reduce dependence on glasses and contact lenses.

Strategic market analysis reveals the Europe intraocular lenses industry as a mature yet dynamic sector experiencing steady growth driven by demographic trends and technological innovation. The market demonstrates resilience and adaptability, with manufacturers continuously developing advanced lens technologies to meet evolving patient needs and clinical requirements.

Key growth drivers include the aging European population, with individuals over 65 representing approximately 20% of the total population, leading to increased cataract incidence and surgical demand. Premium IOL adoption has accelerated, with multifocal and toric lenses capturing significant market share as patients seek comprehensive vision correction solutions. Healthcare infrastructure across major European markets supports advanced surgical procedures and premium lens implantation.

Competitive landscape features established multinational corporations alongside innovative specialty manufacturers, creating a diverse ecosystem of technology providers. Market consolidation trends have emerged as larger companies acquire specialized lens manufacturers to expand their product portfolios and market reach. Regulatory compliance remains a critical success factor, with companies investing heavily in quality assurance and clinical validation processes.

Future prospects indicate continued market expansion supported by technological advancements, increasing patient awareness, and expanding healthcare access across European regions. The integration of digital health technologies and artificial intelligence in surgical planning and lens selection presents additional growth opportunities for market participants.

Market intelligence reveals several critical insights shaping the European intraocular lenses industry landscape:

Clinical trends indicate increasing adoption of femtosecond laser-assisted cataract surgery, which enhances precision in IOL placement and improves patient outcomes. Surgeon preferences continue evolving toward advanced lens platforms that offer predictable results and patient satisfaction.

Demographic factors serve as the primary catalyst for European intraocular lenses market growth, with population aging creating sustained demand for cataract surgery and lens implantation procedures. The increasing prevalence of age-related eye conditions, particularly cataracts affecting over 75% of individuals above age 75, establishes a robust foundation for market expansion.

Technological advancement drives market evolution through the development of sophisticated lens designs that address multiple vision correction needs simultaneously. Multifocal and extended depth of focus lenses enable patients to achieve functional vision at various distances, reducing dependence on corrective eyewear. Material innovations have improved lens biocompatibility and optical performance, enhancing patient outcomes and satisfaction rates.

Healthcare infrastructure development across European markets supports increased surgical capacity and advanced procedure adoption. Investment in modern surgical equipment, including femtosecond lasers and advanced biometry systems, enables more precise lens selection and placement. Surgeon training programs and continuing education initiatives promote best practices in premium IOL implantation techniques.

Patient awareness campaigns and educational initiatives have increased understanding of available vision correction options, driving demand for premium lens solutions. Social media and digital health platforms facilitate information sharing about advanced IOL technologies and patient experiences. Quality of life considerations motivate patients to invest in premium lens options that provide comprehensive vision correction and lifestyle benefits.

Reimbursement policy evolution in several European countries has improved coverage for premium IOL procedures, making advanced lens technologies more accessible to broader patient populations. Economic factors including increased disposable income and healthcare spending support market growth in developed European markets.

Economic constraints present significant challenges to European intraocular lenses market expansion, particularly regarding premium lens adoption rates. High out-of-pocket costs for advanced IOL technologies limit accessibility for certain patient segments, especially in countries with restrictive reimbursement policies. Healthcare budget pressures across European systems create tension between cost containment and technology adoption.

Regulatory complexity and lengthy approval processes can delay new product introductions and increase development costs for manufacturers. The European Medical Device Regulation implementation has created additional compliance requirements, potentially slowing innovation cycles. Clinical validation requirements for new lens technologies demand extensive testing and documentation, extending time-to-market timelines.

Surgical complications and patient dissatisfaction with certain premium IOL outcomes can negatively impact market perception and adoption rates. Visual phenomena such as halos, glare, and reduced contrast sensitivity associated with some multifocal lenses may limit patient acceptance. Surgeon hesitancy to adopt new technologies without extensive clinical evidence can slow market penetration.

Competition from alternative treatments including advanced cataract surgery techniques and external vision correction methods may limit IOL market growth. Market saturation in developed European countries could constrain future expansion opportunities as penetration rates reach optimal levels.

Supply chain disruptions and manufacturing challenges can impact product availability and pricing stability. Skilled surgeon availability limitations in certain regions may constrain market growth potential, particularly for complex premium IOL procedures requiring specialized expertise.

Emerging market expansion presents substantial growth opportunities as Eastern European healthcare systems modernize and increase access to advanced ophthalmic procedures. Countries such as Poland, Czech Republic, and Hungary demonstrate growing demand for premium IOL technologies as economic conditions improve and healthcare infrastructure develops. Market penetration rates in these regions remain significantly below Western European levels, indicating substantial expansion potential.

Technological innovation continues creating new market segments through the development of smart IOLs, adjustable lenses, and extended depth of focus technologies. Digital health integration offers opportunities for enhanced surgical planning, patient selection, and post-operative monitoring systems. Artificial intelligence applications in biometry and lens selection could improve surgical outcomes and patient satisfaction.

Combination procedures integrating cataract surgery with other ophthalmic treatments present opportunities for comprehensive vision correction solutions. Refractive lens exchange procedures for presbyopia correction in pre-cataract patients represent an expanding market segment with significant growth potential.

Value-based healthcare initiatives create opportunities for IOL manufacturers to demonstrate the long-term economic benefits of premium lens technologies. Patient-reported outcome measures and quality of life improvements associated with advanced IOLs support reimbursement expansion and market growth.

Strategic partnerships between lens manufacturers and healthcare providers can facilitate market expansion and technology adoption. Educational programs targeting both surgeons and patients present opportunities to increase awareness and adoption of advanced IOL technologies across European markets.

Supply chain dynamics in the European intraocular lenses market reflect a complex ecosystem involving raw material suppliers, specialized manufacturers, distributors, and healthcare providers. Manufacturing concentration among major global players creates both efficiency benefits and potential supply vulnerabilities. The market demonstrates resilience through diversified supplier networks and strategic inventory management practices.

Pricing dynamics vary significantly across European markets, influenced by healthcare system structures, reimbursement policies, and competitive landscapes. Premium lens pricing strategies balance innovation value with market accessibility, while volume-based contracts with healthcare systems drive competitive positioning. Market dynamics show increasing price transparency and value-based purchasing decisions.

Innovation cycles drive market evolution through continuous product development and clinical validation processes. Research and development investments by leading manufacturers focus on addressing unmet clinical needs and improving patient outcomes. Technology transfer and licensing agreements facilitate rapid innovation diffusion across the European market.

Regulatory dynamics continue shaping market access and competitive positioning through evolving compliance requirements and clinical evidence standards. Post-market surveillance systems provide ongoing safety and efficacy data that influence product adoption and market confidence. Harmonized European regulations facilitate market access while maintaining high safety standards.

Competitive dynamics feature both collaboration and competition among market participants, with companies forming strategic alliances while competing for market share. Market consolidation trends create larger, more diversified companies capable of supporting comprehensive product portfolios and global market reach.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the European intraocular lenses industry market. Primary research included extensive interviews with key industry stakeholders, including lens manufacturers, distributors, ophthalmic surgeons, and healthcare administrators across major European markets.

Secondary research encompassed analysis of industry reports, clinical studies, regulatory filings, and company financial statements to establish market baselines and trend identification. Data triangulation methods validated findings across multiple sources to ensure accuracy and reliability of market insights and projections.

Market sizing methodologies utilized bottom-up and top-down approaches, analyzing surgical volumes, lens penetration rates, and pricing dynamics across different market segments and geographic regions. Statistical analysis of historical data patterns enabled identification of growth trends and market drivers.

Expert validation processes involved consultation with leading ophthalmologists, industry executives, and healthcare policy experts to verify market assumptions and validate research findings. Peer review mechanisms ensured research quality and methodological rigor throughout the analysis process.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence. Database integration combines multiple data sources to provide comprehensive market coverage and analytical depth.

Western European markets dominate the regional landscape, with Germany, France, and the United Kingdom representing the largest segments by surgical volume and technology adoption. Germany leads in premium IOL penetration with approximately 42% market share for advanced lens technologies, supported by robust healthcare infrastructure and favorable reimbursement policies. The German market demonstrates strong surgeon expertise and patient acceptance of innovative IOL solutions.

France maintains a significant market position with growing adoption of multifocal and toric IOLs, driven by an aging population and increasing patient awareness. Healthcare system support for advanced ophthalmic procedures facilitates market growth, while regulatory frameworks ensure high safety and quality standards. French market dynamics show increasing preference for premium lens solutions among both surgeons and patients.

United Kingdom presents a mixed public-private healthcare environment that influences IOL market dynamics. NHS procedures primarily utilize standard monofocal lenses, while private healthcare segments drive premium IOL adoption. Brexit implications have created some supply chain adjustments, but market fundamentals remain strong with continued growth in premium lens procedures.

Italy and Spain represent substantial markets with growing premium IOL adoption rates, supported by increasing healthcare investments and modernizing surgical facilities. Regional healthcare systems demonstrate varying levels of premium lens coverage, creating opportunities for market expansion through improved reimbursement policies.

Eastern European markets show rapid growth potential as healthcare systems modernize and economic conditions improve. Poland, Czech Republic, and Hungary lead regional development with increasing surgical volumes and growing awareness of advanced IOL technologies. Market penetration rates remain below Western European levels, indicating substantial expansion opportunities.

Nordic countries including Sweden, Norway, and Denmark maintain high healthcare standards and demonstrate strong adoption of innovative medical technologies. Scandinavian markets show particular interest in premium IOL solutions that align with quality-focused healthcare delivery models.

Market leadership in the European intraocular lenses industry is characterized by a mix of established multinational corporations and innovative specialty manufacturers. The competitive landscape demonstrates ongoing consolidation trends while maintaining space for technological innovation and market differentiation.

Competitive strategies focus on product innovation, clinical evidence generation, and strategic partnerships with healthcare providers. Market differentiation occurs through advanced lens designs, proprietary materials, and comprehensive surgical support programs.

Acquisition activity continues reshaping the competitive landscape as larger companies seek to expand their technology portfolios and market reach through strategic acquisitions of innovative smaller companies.

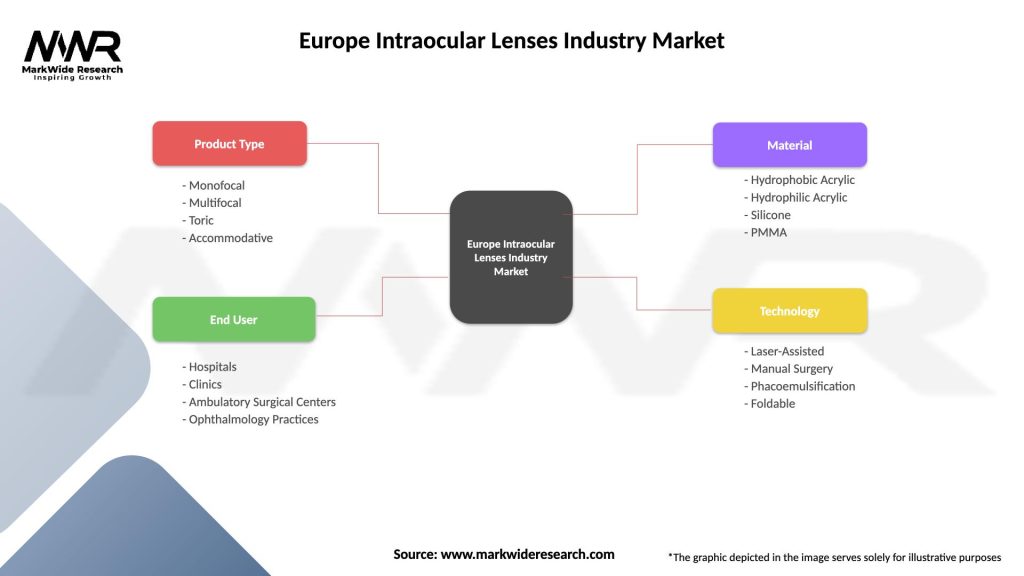

Product segmentation divides the European intraocular lenses market into distinct categories based on lens design, functionality, and clinical applications:

By Lens Type:

By Material:

By End User:

Premium IOL segment demonstrates the strongest growth trajectory within the European market, driven by increasing patient awareness and improved clinical outcomes. Multifocal lenses capture significant market share among patients seeking spectacle independence, with adoption rates reaching 28% in major European markets. Advanced lens designs continue addressing previous limitations such as visual phenomena and contrast sensitivity issues.

Toric IOL category shows consistent expansion as surgeons increasingly recognize the importance of addressing astigmatism during cataract surgery. Clinical evidence supporting improved patient outcomes with toric lenses drives adoption among both surgeons and patients. Market penetration varies across European countries based on reimbursement policies and surgeon training levels.

Extended depth of focus lenses represent the fastest-growing category, offering advantages over traditional multifocal designs with reduced visual side effects. Patient satisfaction rates with EDOF lenses exceed 85% in clinical studies, supporting continued market adoption and expansion. Technology refinements continue improving optical performance and clinical predictability.

Monofocal IOL segment maintains market stability as the standard of care for cataract surgery, particularly in public healthcare systems with cost constraints. Volume growth continues driven by increasing surgical rates, while value-based purchasing initiatives focus on cost-effectiveness and clinical outcomes.

Accommodating IOL category shows emerging potential despite limited current market penetration. Technology development focuses on improving accommodative amplitude and clinical predictability to enhance patient outcomes and market acceptance.

Healthcare providers benefit from advanced IOL technologies through improved patient outcomes, enhanced surgical efficiency, and differentiated service offerings. Premium lens procedures generate higher revenue per case while providing comprehensive vision correction solutions that increase patient satisfaction and loyalty. Advanced biometry and surgical planning tools associated with premium IOLs improve surgical precision and predictability.

Patients experience significant quality of life improvements through reduced dependence on corrective eyewear and enhanced visual function across multiple distances. Long-term value of premium IOLs includes reduced ongoing costs for glasses and contact lenses, improved safety through better vision, and increased independence in daily activities. Patient satisfaction rates with advanced IOL technologies consistently exceed 90% in clinical studies.

Manufacturers benefit from higher profit margins on premium IOL products compared to standard monofocal lenses, supporting continued investment in research and development. Market differentiation through innovative lens designs and proprietary technologies creates competitive advantages and brand loyalty among surgeons and patients.

Healthcare systems realize long-term economic benefits through reduced need for secondary vision correction procedures and improved patient productivity. Value-based care models increasingly recognize the total cost of ownership advantages associated with premium IOL technologies.

Surgeons gain access to advanced tools and technologies that enhance surgical outcomes and patient satisfaction. Professional development opportunities through premium IOL training programs and continuing education initiatives support career advancement and clinical expertise expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine approaches are revolutionizing IOL selection and surgical planning through advanced biometry, corneal topography, and lifestyle assessment tools. Artificial intelligence integration enables more precise lens calculations and improved surgical outcomes through data-driven decision support systems. According to MarkWide Research analysis, personalized IOL selection improves patient satisfaction rates by approximately 15% compared to standard approaches.

Minimally invasive surgical techniques continue advancing through femtosecond laser technology and micro-incision approaches that enhance precision and reduce recovery times. Surgical automation trends include robotic-assisted procedures and computer-guided lens placement systems that improve consistency and outcomes.

Premium lens technology convergence combines multiple correction modalities within single IOL platforms, addressing presbyopia, astigmatism, and spherical errors simultaneously. Extended depth of focus designs represent the latest evolution in multifocal technology, offering improved visual quality with reduced side effects.

Digital health integration encompasses telemedicine consultations, mobile health applications for patient education, and remote monitoring systems for post-operative care. Patient engagement platforms facilitate informed decision-making and improve satisfaction through enhanced communication and education resources.

Sustainability initiatives drive development of environmentally friendly packaging, manufacturing processes, and product lifecycle management approaches. Circular economy principles influence IOL industry practices through waste reduction and resource optimization strategies.

Value-based care models increasingly influence IOL market dynamics through outcome-based reimbursement and quality metrics that emphasize patient satisfaction and long-term results.

Regulatory milestone achievements include the successful implementation of European Medical Device Regulation compliance across major IOL manufacturers, ensuring enhanced safety and quality standards. Clinical trial completions for next-generation IOL technologies demonstrate improved visual outcomes and reduced complications rates.

Strategic acquisitions continue reshaping the competitive landscape, with major companies acquiring innovative technology platforms and expanding their product portfolios. Partnership agreements between IOL manufacturers and healthcare providers facilitate technology adoption and market expansion initiatives.

Manufacturing capacity expansions across European facilities support growing market demand and ensure supply chain resilience. Technology transfer agreements enable rapid diffusion of innovative IOL designs and manufacturing processes across global operations.

Clinical evidence generation through large-scale post-market studies provides real-world data supporting IOL safety and efficacy claims. Surgeon training programs and certification initiatives ensure proper implementation of advanced IOL technologies and surgical techniques.

Digital transformation initiatives include implementation of artificial intelligence in surgical planning, development of mobile applications for patient education, and integration of electronic health records with IOL selection systems.

Sustainability commitments by leading manufacturers include carbon neutrality goals, sustainable packaging initiatives, and circular economy implementation across product lifecycles.

Market expansion strategies should prioritize Eastern European markets where healthcare modernization creates significant growth opportunities for advanced IOL technologies. Investment focus on local partnerships and distribution networks will facilitate market penetration and sustainable growth in emerging European markets.

Technology development priorities should emphasize extended depth of focus lens designs and smart IOL platforms that address current limitations while providing enhanced patient outcomes. Research and development investments in artificial intelligence and digital health integration will create competitive advantages and improve clinical results.

Reimbursement strategy development requires proactive engagement with healthcare payers to demonstrate the long-term value proposition of premium IOL technologies. Health economics research supporting cost-effectiveness arguments will facilitate improved coverage policies and market access.

Surgeon education initiatives should expand to include comprehensive training programs for premium IOL procedures and advanced surgical techniques. Continuing medical education partnerships with professional organizations will support technology adoption and clinical excellence.

Patient engagement enhancement through digital platforms and educational resources will improve informed decision-making and satisfaction with IOL procedures. Marketing strategies should emphasize quality of life benefits and long-term value propositions of advanced IOL technologies.

Supply chain optimization requires diversification strategies and resilience planning to ensure consistent product availability across European markets. Manufacturing flexibility and capacity planning will support growth while maintaining quality standards.

Long-term market projections indicate sustained growth for the European intraocular lenses industry, driven by demographic trends and technological advancement. Population aging across European countries ensures continued demand expansion, with cataract surgery volumes expected to grow at approximately 3.8% annually over the next decade. MWR forecasts suggest premium IOL penetration will reach 45% of total procedures by 2030 in major European markets.

Technology evolution will focus on smart IOL platforms incorporating adjustable optics, real-time vision optimization, and integration with digital health ecosystems. Artificial intelligence applications will enhance surgical planning, lens selection, and post-operative monitoring, improving outcomes and efficiency across the treatment continuum.

Market consolidation trends will continue as larger companies acquire innovative technologies and expand their global reach, while maintaining space for specialized manufacturers focused on niche applications. Strategic partnerships between technology companies and healthcare providers will drive innovation and market expansion.

Regulatory landscape evolution will emphasize real-world evidence generation and post-market surveillance, requiring manufacturers to invest in comprehensive data collection and analysis capabilities. International harmonization of regulatory standards will facilitate global market access and technology transfer.

Healthcare delivery transformation through value-based care models will increasingly influence IOL market dynamics, emphasizing patient outcomes and long-term value creation. Personalized medicine approaches will become standard practice, supported by advanced diagnostic tools and artificial intelligence platforms.

Sustainability considerations will drive innovation in manufacturing processes, packaging design, and product lifecycle management, aligning with European environmental goals and corporate responsibility initiatives.

The Europe intraocular lenses industry market represents a dynamic and evolving healthcare technology sector positioned for sustained growth and innovation. Market fundamentals remain strong, supported by demographic trends, technological advancement, and established healthcare infrastructure across European countries. The combination of an aging population, increasing patient awareness, and continuous innovation in lens design creates a favorable environment for market expansion.

Competitive dynamics continue evolving through strategic acquisitions, technology partnerships, and innovation investments that enhance product portfolios and market reach. Premium IOL adoption demonstrates accelerating growth as patients increasingly seek comprehensive vision correction solutions that improve quality of life and reduce dependence on corrective eyewear.

Future success in the European intraocular lenses market will depend on companies’ ability to navigate regulatory requirements, demonstrate clinical value, and address diverse market needs across different European countries. Technology innovation remains critical for maintaining competitive advantage and meeting evolving patient expectations for improved visual outcomes and enhanced surgical experiences.

The market outlook indicates continued expansion opportunities, particularly in Eastern European countries where healthcare modernization creates demand for advanced IOL technologies. Strategic focus on value-based healthcare delivery, personalized medicine approaches, and digital health integration will drive the next phase of market evolution and growth in the European intraocular lenses industry.

What is Intraocular Lenses?

Intraocular lenses are artificial lenses implanted in the eye to replace the eye’s natural lens when it is removed during cataract surgery or to correct vision problems. They are designed to improve visual acuity and can be customized for various refractive errors.

What are the key players in the Europe Intraocular Lenses Industry Market?

Key players in the Europe Intraocular Lenses Industry Market include Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss AG, among others. These companies are known for their innovative lens technologies and extensive product portfolios.

What are the growth factors driving the Europe Intraocular Lenses Industry Market?

The growth of the Europe Intraocular Lenses Industry Market is driven by an increasing aging population, rising prevalence of cataracts, and advancements in lens technology. Additionally, the growing awareness of vision correction options contributes to market expansion.

What challenges does the Europe Intraocular Lenses Industry Market face?

The Europe Intraocular Lenses Industry Market faces challenges such as high costs associated with advanced lens technologies and potential complications from surgeries. Regulatory hurdles and varying reimbursement policies across countries also pose significant challenges.

What opportunities exist in the Europe Intraocular Lenses Industry Market?

Opportunities in the Europe Intraocular Lenses Industry Market include the development of premium lenses with enhanced features, such as multifocal and toric lenses. Additionally, expanding distribution channels and increasing partnerships with healthcare providers present growth avenues.

What trends are shaping the Europe Intraocular Lenses Industry Market?

Trends shaping the Europe Intraocular Lenses Industry Market include the rise of personalized medicine, where lenses are tailored to individual patient needs, and the integration of digital technologies in surgical procedures. Furthermore, there is a growing focus on sustainability in lens manufacturing processes.

Europe Intraocular Lenses Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Monofocal, Multifocal, Toric, Accommodative |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers, Ophthalmology Practices |

| Material | Hydrophobic Acrylic, Hydrophilic Acrylic, Silicone, PMMA |

| Technology | Laser-Assisted, Manual Surgery, Phacoemulsification, Foldable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Intraocular Lenses Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at