444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The engineering insurance market refers to the insurance coverage provided for engineering projects, infrastructure, and related risks. Engineering insurance offers protection against financial losses arising from damage to property, machinery breakdown, construction defects, and other engineering-related risks. This market overview provides insights into the meaning of engineering insurance, key market trends, drivers, restraints, opportunities, and a regional analysis of the market.

Meaning:

Engineering insurance is a specialized form of insurance designed to protect individuals, businesses, and contractors involved in engineering projects from financial losses resulting from various risks. It covers a wide range of engineering-related risks, including construction and erection risks, machinery breakdown, loss of profits, third-party liability, and professional indemnity. Engineering insurance provides financial security and risk management for stakeholders in the engineering sector.

Executive Summary:

The engineering insurance market is driven by the increasing demand for comprehensive coverage in engineering projects and the need for risk mitigation. The market is characterized by the presence of specialized insurance providers offering tailored insurance solutions for engineering risks. Key factors influencing the market include infrastructure development, technological advancements, and regulatory requirements.

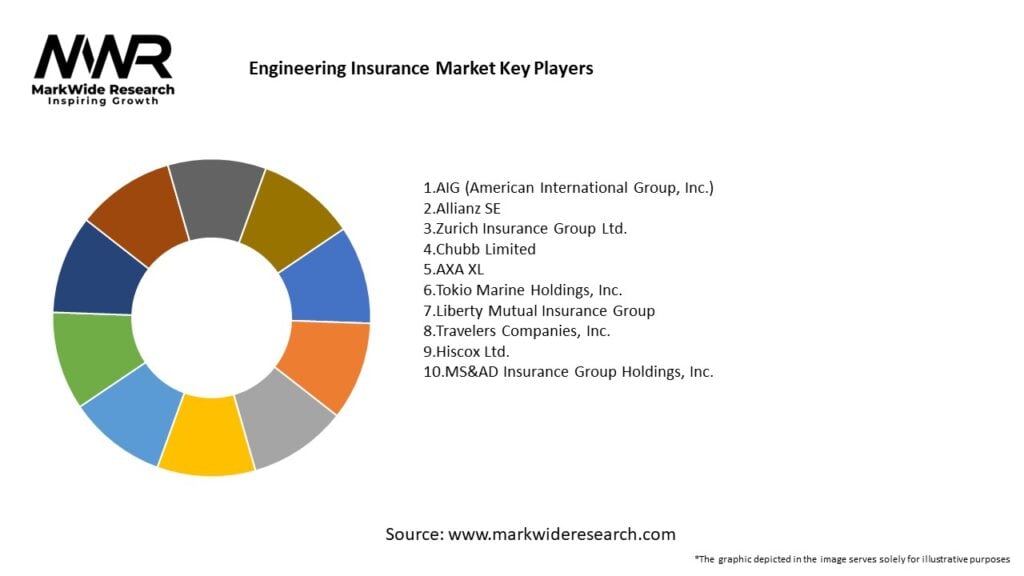

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The engineering insurance market is influenced by factors such as infrastructure development, regulatory requirements, risk management practices, and technological advancements. The market is driven by the growing emphasis on risk mitigation, financial protection, and compliance with contractual obligations and industry regulations.

Regional Analysis:

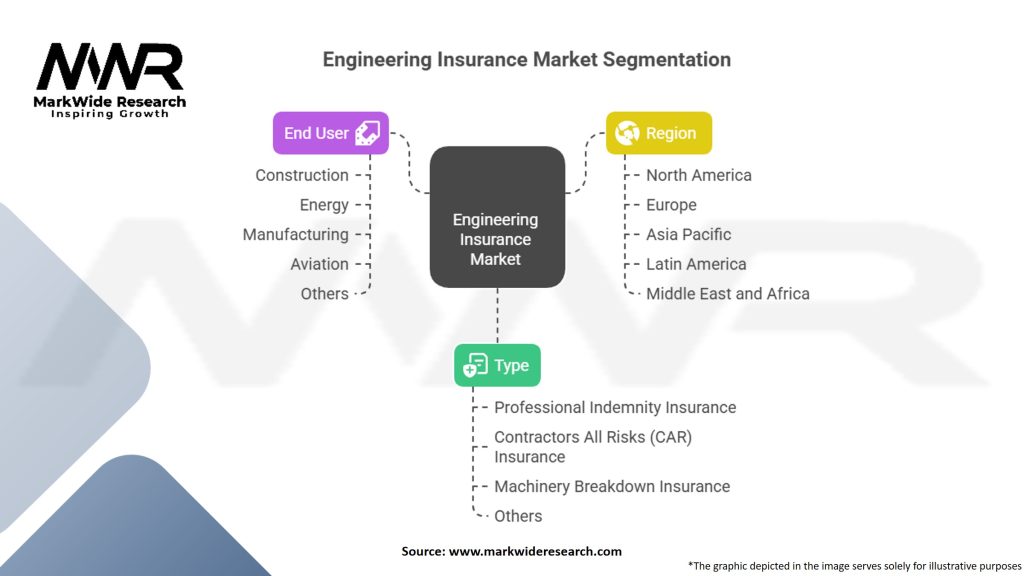

The engineering insurance market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific is a significant market for engineering insurance due to rapid infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe also have significant market shares due to the presence of established engineering sectors and construction activities.

Competitive Landscape:

Leading Companies in the Engineering Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The engineering insurance market can be segmented based on product type, application, and region. Each segment plays a crucial role in shaping market trends and identifying growth opportunities.

By Product Type:

By End-Use Industry:

By Region:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a notable impact on the engineering insurance market. The slowdown in construction activities, delays in project timelines, and disruptions in supply chains affected the demand for engineering insurance. However, the pandemic highlighted the importance of risk management and insurance coverage in mitigating unforeseen events and uncertainties.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the engineering insurance market is positive, driven by the increasing need for risk management and financial protection in engineering projects. The market is expected to witness steady growth, fueled by infrastructure development, technological advancements, and regulatory compliance requirements. The integration of technology, customization of insurance products, and expansion into emerging markets will shape the future of the engineering insurance market.

Conclusion:

The engineering insurance market plays a crucial role in providing financial protection and risk management solutions for engineering projects and related risks. The market benefits from the increasing demand for comprehensive coverage, risk mitigation, and compliance with regulatory requirements. Customized insurance products, technological integration, and sustainability considerations are key trends shaping the market.

Despite challenges such as complex underwriting processes and insurance premium costs, the market offers significant opportunities for specialized insurance providers. The future outlook for the engineering insurance market is promising, with growth driven by infrastructure development, technological advancements, and the need for effective risk management in the engineering sector.

What is Engineering Insurance?

Engineering Insurance refers to specialized coverage designed to protect against risks associated with engineering projects, including construction, machinery breakdown, and liability for third-party damages. It is essential for managing the financial uncertainties inherent in engineering activities.

What are the key players in the Engineering Insurance Market?

Key players in the Engineering Insurance Market include companies like Allianz, AIG, and Zurich Insurance Group, which offer a range of policies tailored to engineering projects. These companies provide coverage for construction risks, equipment breakdown, and professional liability, among others.

What are the main drivers of growth in the Engineering Insurance Market?

The growth of the Engineering Insurance Market is driven by increasing infrastructure development, rising construction activities, and the need for risk management in complex engineering projects. Additionally, advancements in technology and project management practices are contributing to the demand for specialized insurance solutions.

What challenges does the Engineering Insurance Market face?

The Engineering Insurance Market faces challenges such as fluctuating construction costs, regulatory changes, and the complexity of assessing risks in large-scale projects. Additionally, the increasing frequency of natural disasters can lead to higher claims, impacting the profitability of insurance providers.

What opportunities exist in the Engineering Insurance Market?

Opportunities in the Engineering Insurance Market include the expansion of renewable energy projects, smart infrastructure development, and the integration of digital technologies in engineering processes. These trends create a demand for innovative insurance products that address new risks and challenges.

What trends are shaping the Engineering Insurance Market?

Trends shaping the Engineering Insurance Market include the rise of digital transformation, the adoption of data analytics for risk assessment, and a growing focus on sustainability in engineering projects. Insurers are increasingly leveraging technology to enhance underwriting processes and improve customer service.

Engineering Insurance Market

| Segmentation | Details |

|---|---|

| Type | Professional Indemnity Insurance, Contractors All Risks (CAR) Insurance, Machinery Breakdown Insurance, Others |

| End User | Construction, Energy, Manufacturing, Aviation, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Engineering Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at