444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The collateralized loan obligation (CLO) market is a vital segment of the global financial industry. It serves as a key source of financing for corporations and provides investors with attractive investment opportunities. CLOs are structured financial instruments that pool together a portfolio of loans and issue different tranches of securities backed by those loans. The market for CLOs has witnessed significant growth over the years, driven by various factors such as increasing demand for alternative investments and the search for higher yields.

Meaning

A collateralized loan obligation (CLO) is a type of structured financial product that enables investors to gain exposure to a diversified pool of loans. These loans can include corporate loans, bank loans, or other types of debt instruments. CLOs are typically managed by specialized investment firms known as collateralized loan obligation managers. The loans in a CLO portfolio are divided into different tranches, each with a varying level of risk and return. Investors can choose to invest in a specific tranche based on their risk appetite and return expectations.

Executive Summary

The collateralized loan obligation market has experienced remarkable growth in recent years, driven by factors such as the search for yield and the demand for alternative investments. The market offers investors the opportunity to diversify their portfolios and potentially achieve attractive returns. However, it is important to note that investing in CLOs involves risks, including credit risk and market volatility. Therefore, investors need to conduct thorough due diligence and consider the advice of financial professionals before investing in this market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The collateralized loan obligation market is influenced by various dynamics, including market conditions, investor sentiment, and regulatory factors. Market conditions, such as interest rates and credit spreads, can impact the pricing and performance of collateralized loan obligations. Investor sentiment plays a crucial role in driving demand for these securities, as investors seek attractive returns and diversification benefits. Regulatory factors, including changes in regulations and reporting requirements, can shape the market landscape and impact market participants.

Regional Analysis

The collateralized loan obligation market is global in nature, with activity observed in various regions around the world. North America has traditionally been a significant market for CLOs, driven by the developed corporate debt market and the presence of established investment firms. Europe has also seen substantial growth in the market, with increasing investor demand and regulatory developments. Emerging markets in Asia Pacific and Latin America are showing potential for market expansion, driven by favorable economic conditions and increasing investor awareness.

Competitive Landscape

Leading Companies in the Collateralized Loan Obligation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

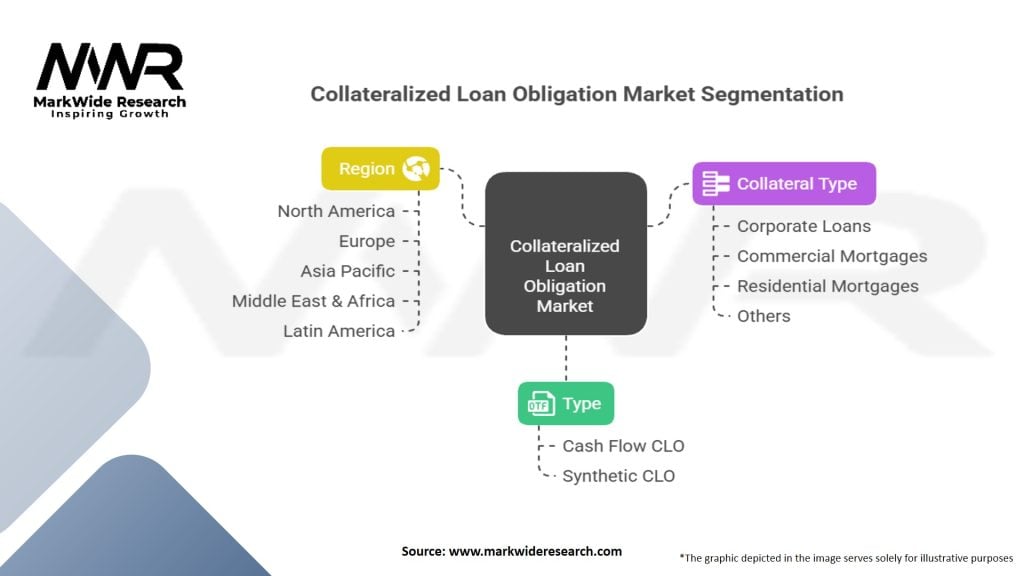

Segmentation

The collateralized loan obligation market can be segmented based on various factors, including the type of underlying loans, tranches of securities, and investor profiles. Based on the type of underlying loans, the market can include corporate loan CLOs, bank loan CLOs, and asset-backed securities CLOs. Tranches of securities can be divided into senior, mezzanine, and equity tranches, each with different risk and return characteristics. Investor profiles can vary from institutional investors to high-net-worth individuals, each with different investment objectives and risk appetites.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the collateralized loan obligation market. The economic downturn and increased market volatility led to credit rating downgrades and heightened credit risk concerns. Investors became more cautious and focused on risk management. Government stimulus measures and central bank interventions played a crucial role in stabilizing financial markets, including the collateralized loan obligation market. As the global economy recovers, the market is gradually regaining its momentum, driven by improving credit conditions and investor confidence.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the collateralized loan obligation market appears positive, with several factors expected to drive its growth. The search for yield in a low-interest-rate environment, coupled with the increasing demand for alternative investments, is likely to fuel investor interest in collateralized loan obligations. Technological advancements will continue to enhance market efficiency, while the integration of ESG factors will attract socially responsible investors. Regulatory developments will shape the market landscape and ensure investor protection. However, it is essential to monitor potential risks, including credit risk and market volatility, and adapt risk management strategies accordingly.

Conclusion

The collateralized loan obligation market plays a crucial role in the global financial industry, providing investors with opportunities for diversification and potentially attractive returns. It enables corporations to access financing by securitizing their loans.

While the market offers benefits, including diversification and yield potential, it also involves risks such as credit risk and market volatility. Investors should conduct thorough due diligence and seek professional advice before investing in collateralized loan obligations.

What is a Collateralized Loan Obligation?

A Collateralized Loan Obligation (CLO) is a type of structured credit product that pools together various loans, typically corporate loans, and issues different tranches of securities backed by these loans. Investors receive payments based on the cash flows generated by the underlying loans, with varying levels of risk and return depending on the tranche.

What companies are involved in the Collateralized Loan Obligation market?

Key players in the Collateralized Loan Obligation market include investment firms such as Blackstone Group, Carlyle Group, and KKR. These companies are involved in the structuring, management, and investment in CLOs, among others.

What are the growth factors driving the Collateralized Loan Obligation market?

The growth of the Collateralized Loan Obligation market is driven by factors such as the increasing demand for yield in a low-interest-rate environment, the expansion of corporate borrowing, and the diversification benefits CLOs offer to investors. Additionally, the rise of institutional investors seeking alternative investment opportunities contributes to market growth.

What challenges does the Collateralized Loan Obligation market face?

The Collateralized Loan Obligation market faces challenges such as regulatory scrutiny, potential credit quality deterioration of underlying loans, and market volatility. These factors can impact investor confidence and the overall stability of CLOs.

What opportunities exist in the Collateralized Loan Obligation market?

Opportunities in the Collateralized Loan Obligation market include the potential for innovation in structuring CLOs, the emergence of new asset classes for collateral, and the growing interest from retail investors. As the market evolves, there may be increased demand for customized CLO products.

What trends are shaping the Collateralized Loan Obligation market?

Trends in the Collateralized Loan Obligation market include the rise of ESG-focused CLOs, advancements in technology for better risk assessment, and the increasing use of data analytics in managing portfolios. These trends are influencing how CLOs are structured and marketed to investors.

Collateralized Loan Obligation Market

| Segmentation | Details |

|---|---|

| Type | Cash Flow CLO, Synthetic CLO |

| Collateral Type | Corporate Loans, Commercial Mortgages, Residential Mortgages, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Collateralized Loan Obligation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at