444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China biocontrol agents market represents a rapidly expanding sector within the country’s agricultural landscape, driven by increasing environmental consciousness and stringent regulations on chemical pesticides. Biocontrol agents, comprising beneficial microorganisms, natural predators, and biopesticides, are revolutionizing sustainable farming practices across China’s diverse agricultural regions. The market demonstrates remarkable growth momentum, with adoption rates increasing by 12.5% annually as farmers transition toward eco-friendly pest management solutions.

China’s commitment to sustainable agriculture has positioned the biocontrol agents market as a critical component of the nation’s food security strategy. The integration of biological control methods spans across various crop categories, including cereals, vegetables, fruits, and cash crops, with vegetable cultivation accounting for approximately 35% of total biocontrol agent applications. This shift reflects growing consumer demand for organic produce and government initiatives promoting green agricultural practices.

Market dynamics indicate strong growth potential, supported by technological advancements in microbial formulations and delivery systems. The sector benefits from substantial research and development investments, with biotechnology companies focusing on developing region-specific biocontrol solutions tailored to China’s unique agricultural challenges and climatic conditions.

The China biocontrol agents market refers to the commercial ecosystem encompassing the development, production, distribution, and application of biological pest control solutions within China’s agricultural sector. Biocontrol agents are naturally occurring or genetically modified organisms that suppress pest populations through predation, parasitism, pathogenicity, or competition, offering sustainable alternatives to synthetic chemical pesticides.

These biological solutions include various categories such as microbial pesticides containing bacteria, fungi, or viruses; beneficial insects like predatory mites and parasitic wasps; and biochemical pesticides derived from natural materials. The market encompasses both indigenous biocontrol agents naturally present in China’s ecosystems and introduced species that have undergone rigorous safety evaluations for agricultural use.

Commercial applications extend beyond traditional crop protection to include soil health improvement, plant growth promotion, and integrated pest management systems. The market serves diverse stakeholders including large-scale commercial farms, smallholder farmers, organic producers, and greenhouse operators seeking environmentally responsible pest control solutions.

China’s biocontrol agents market stands at the forefront of agricultural innovation, experiencing unprecedented growth as the nation prioritizes sustainable farming practices and food safety. The market demonstrates robust expansion driven by regulatory support, technological advancement, and increasing farmer awareness of biological pest control benefits. Government policies promoting reduced chemical pesticide usage have created favorable conditions for biocontrol agent adoption across multiple agricultural sectors.

Key market segments include microbial biocontrol agents, beneficial insects, and biopesticides, with microbial solutions commanding the largest market share due to their versatility and effectiveness against diverse pest species. The market serves various crop categories, with fruit and vegetable cultivation representing the highest adoption rates, followed by grain crops and specialty agricultural products.

Regional distribution shows concentrated activity in major agricultural provinces, with Shandong, Henan, and Jiangsu leading in biocontrol agent implementation. The market benefits from strong research infrastructure, with numerous universities and research institutions contributing to product development and field testing programs.

Future prospects remain highly positive, supported by increasing organic food demand, export market requirements, and continued government investment in sustainable agriculture initiatives. The market is expected to maintain strong growth momentum, with adoption rates projected to increase by 15% annually over the next five years.

Strategic market insights reveal several critical factors shaping the China biocontrol agents landscape:

Government policy support serves as the primary driver for China’s biocontrol agents market expansion. The National Action Plan for pesticide reduction targets achieving zero growth in chemical pesticide usage while maintaining agricultural productivity, creating substantial opportunities for biological alternatives. Regulatory incentives include expedited registration processes, research grants, and subsidies for biocontrol agent adoption.

Environmental sustainability concerns drive increasing demand for eco-friendly pest management solutions. Growing awareness of chemical pesticide residues in food products and their environmental impact motivates farmers to explore biological alternatives. Consumer preferences for organic and residue-free produce create market premiums that justify biocontrol agent investments.

Technological advancements in biocontrol agent development enhance product effectiveness and commercial viability. Innovations in microbial formulations, encapsulation techniques, and delivery systems improve biocontrol agent stability, shelf life, and field performance. Precision agriculture technologies enable targeted biocontrol agent applications, optimizing efficacy while reducing costs.

Export market requirements increasingly demand sustainable production practices and minimal chemical residues. International organic certification standards and importing country regulations drive domestic adoption of biocontrol agents for export-oriented agricultural products. Trade opportunities in premium markets reward sustainable farming practices with higher product valuations.

High initial costs present significant barriers to biocontrol agent adoption, particularly for smallholder farmers with limited financial resources. Product pricing often exceeds conventional pesticide costs, requiring farmers to make long-term investment decisions based on sustainability benefits rather than immediate cost savings. Limited access to agricultural credit specifically designed for sustainable farming transitions compounds this challenge.

Technical complexity in biocontrol agent application requires specialized knowledge and training that many farmers currently lack. Application timing, storage requirements, and integration with existing pest management practices demand expertise that differs significantly from conventional pesticide usage. Inadequate extension services and technical support infrastructure limit effective biocontrol agent implementation.

Product efficacy variability under diverse environmental conditions creates uncertainty for farmers accustomed to consistent chemical pesticide performance. Biological agents may show reduced effectiveness during extreme weather conditions or against severe pest infestations, requiring integrated management approaches that increase complexity.

Limited product availability in remote agricultural areas restricts market penetration, particularly in regions with underdeveloped distribution networks. Cold chain requirements for many biocontrol agents necessitate specialized storage and transportation infrastructure that may not exist in all agricultural regions.

Organic agriculture expansion creates substantial opportunities for biocontrol agent market growth. China’s organic farming sector demonstrates rapid expansion, with certified organic area increasing by 18% annually, driving demand for approved biological pest control solutions. Premium pricing for organic products provides economic incentives for biocontrol agent adoption.

International market integration offers significant growth potential as global demand for sustainably produced agricultural products increases. Export opportunities in developed markets reward sustainable farming practices with premium pricing, creating economic justification for biocontrol agent investments. Bilateral trade agreements increasingly include environmental sustainability provisions that favor biological pest control adoption.

Technology innovation presents opportunities for developing next-generation biocontrol solutions with enhanced efficacy and broader application ranges. Biotechnology advances in genetic engineering, fermentation processes, and formulation chemistry enable creation of more effective and cost-competitive biological pest control products.

Public-private partnerships create opportunities for accelerated market development through shared research costs and risk mitigation. Government support programs provide funding for biocontrol agent research, development, and commercialization, reducing private sector investment barriers and accelerating market entry for innovative products.

Supply chain dynamics in China’s biocontrol agents market reflect the complex interplay between production capabilities, distribution networks, and end-user requirements. Manufacturing capacity continues expanding through both domestic production facility development and international technology transfer agreements. Local production reduces costs and improves product availability while building indigenous technical capabilities.

Demand patterns show seasonal variations aligned with agricultural cycles, requiring flexible production and inventory management strategies. Peak demand periods coincide with planting seasons and pest outbreak cycles, necessitating efficient supply chain coordination to ensure product availability when needed most.

Competitive dynamics feature both established multinational corporations and emerging domestic companies competing across different market segments. Innovation competition drives continuous product development and improvement, with companies investing heavily in research and development to maintain competitive advantages.

Regulatory dynamics continue evolving as government agencies refine biocontrol agent registration requirements and safety standards. Harmonization efforts with international standards facilitate trade while ensuring environmental and human health protection. Regular policy updates require market participants to maintain regulatory compliance and adapt to changing requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into China’s biocontrol agents market. Primary research includes extensive interviews with key stakeholders across the value chain, including biocontrol agent manufacturers, distributors, agricultural cooperatives, and end-user farmers representing diverse crop categories and regional markets.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and regulatory documents to establish market context and validate primary findings. Data triangulation ensures accuracy by cross-referencing information from multiple sources and identifying potential discrepancies or biases in individual data sets.

Field research involves direct observation of biocontrol agent applications across representative agricultural regions, providing practical insights into implementation challenges and success factors. Case study analysis examines specific biocontrol agent adoption examples to understand decision-making processes and outcome measurements.

Quantitative analysis utilizes statistical modeling to identify trends, correlations, and growth patterns within the market data. Qualitative assessment provides contextual understanding of market dynamics, stakeholder motivations, and future development scenarios that quantitative data alone cannot capture.

Eastern China dominates biocontrol agent adoption, with provinces like Shandong, Jiangsu, and Zhejiang leading in both market size and technological advancement. These regions benefit from well-developed agricultural infrastructure, higher farmer education levels, and proximity to research institutions. Vegetable production areas in these provinces show particularly high biocontrol agent adoption rates, reaching 45% of total cultivated area in some districts.

Central China represents a rapidly growing market segment, with Henan, Hubei, and Hunan provinces showing increasing biocontrol agent implementation across grain crop production systems. Government demonstration projects in these regions showcase biocontrol agent effectiveness for major crops like rice, wheat, and corn, driving broader farmer adoption.

Southern China focuses primarily on tropical and subtropical crop applications, with Guangdong, Guangxi, and Hainan provinces leading in biocontrol agent usage for fruit production and cash crops. The region’s year-round growing seasons create sustained demand for biological pest control solutions, with adoption rates increasing by 20% annually in key agricultural areas.

Western China presents emerging opportunities despite current limited market penetration. Xinjiang, Gansu, and Qinghai provinces show growing interest in biocontrol agents for specialty crops and organic agriculture development. Infrastructure development and government support programs are gradually expanding market access in these regions.

Market leadership in China’s biocontrol agents sector features a diverse mix of international corporations, domestic companies, and research institution spin-offs competing across different product categories and market segments.

Competitive strategies emphasize product innovation, local partnerships, and integrated solution offerings that combine biocontrol agents with complementary agricultural technologies. Market consolidation trends show increasing collaboration between international technology providers and domestic manufacturing partners.

Product-based segmentation reveals distinct market categories with varying growth rates and application characteristics:

By Product Type:

By Application Method:

By Crop Category:

Microbial biocontrol agents dominate the market landscape, offering versatile solutions for diverse pest and disease challenges. Bacterial agents like Bacillus thuringiensis show particular strength in lepidopteran pest control, while fungal agents excel in soil-borne disease management. These products benefit from established production technologies and proven field efficacy across multiple crop systems.

Beneficial insects represent a rapidly growing segment, particularly in greenhouse and protected cultivation systems. Predatory mites for spider mite control and parasitic wasps for aphid management show strong adoption rates in vegetable production. The segment benefits from increasing farmer awareness and improved distribution networks for live biological products.

Biochemical pesticides derived from plant extracts and natural compounds appeal to organic farmers and export-oriented producers. Neem-based products and essential oil formulations show consistent market growth, supported by consumer preferences for natural pest control solutions and minimal environmental impact.

Pheromone-based products serve specialized applications in integrated pest management programs, particularly for high-value crops requiring precise pest monitoring and control. Mating disruption technologies show strong performance in fruit production systems, with adoption rates reaching 25% in premium apple growing regions.

Farmers benefit from biocontrol agents through reduced chemical input costs, improved soil health, and access to premium markets for sustainably produced crops. Long-term economic advantages include enhanced crop quality, reduced pesticide resistance development, and compliance with increasingly stringent food safety regulations. Environmental benefits create positive community relations and support sustainable farming reputation.

Manufacturers gain from growing market demand, supportive regulatory environment, and opportunities for product differentiation in competitive agricultural markets. Innovation opportunities in biocontrol agent development provide pathways for intellectual property creation and technology licensing revenue. Partnership opportunities with research institutions accelerate product development while sharing costs and risks.

Distributors and retailers benefit from expanding product portfolios and higher margin opportunities compared to commodity chemical pesticides. Technical service requirements create additional revenue streams through consulting and application support services. Growing market demand ensures sustainable business growth in the agricultural input sector.

Government stakeholders achieve environmental protection objectives while maintaining agricultural productivity and food security. Policy success in promoting sustainable agriculture enhances international reputation and supports trade relationships with environmentally conscious markets. Reduced environmental remediation costs provide long-term economic benefits for public resources.

Strengths:

Weaknesses:

Opportunities:

Threats:

Integrated pest management adoption represents the dominant trend shaping biocontrol agent market development. Farmers increasingly recognize the value of combining biological, cultural, and selective chemical control methods to achieve optimal pest management outcomes while minimizing environmental impact. This approach maximizes biocontrol agent effectiveness while providing backup options for severe pest pressure situations.

Precision agriculture integration enables targeted biocontrol agent applications based on real-time pest monitoring and environmental conditions. Digital technologies including drones, sensors, and mobile applications support precise timing and placement of biological control measures, improving efficacy while reducing costs. Data-driven decision making enhances farmer confidence in biocontrol agent performance.

Product formulation innovations focus on improving biocontrol agent stability, shelf life, and field performance under diverse conditions. Encapsulation technologies protect beneficial microorganisms during storage and application, while slow-release formulations extend biological activity periods. These advances address key farmer concerns about product reliability and consistency.

Supply chain digitization improves biocontrol agent distribution efficiency and product quality maintenance. Cold chain monitoring systems ensure optimal storage conditions throughout the distribution process, while inventory management platforms optimize product availability and reduce waste. Digital platforms connect farmers directly with biocontrol agent suppliers, improving access and reducing costs.

Regulatory streamlining initiatives have significantly reduced biocontrol agent registration timelines and costs, encouraging increased industry investment in product development. Fast-track approval processes for low-risk biological products accelerate market entry while maintaining safety standards. Harmonization with international registration requirements facilitates global product development strategies.

Research collaboration expansion between universities, government institutes, and private companies accelerates biocontrol agent innovation and commercialization. Joint research programs share costs and risks while combining complementary expertise in microbiology, entomology, and agricultural engineering. Technology transfer agreements facilitate rapid scaling of laboratory discoveries to commercial production.

Manufacturing capacity investments by both domestic and international companies expand biocontrol agent production capabilities within China. New production facilities incorporate advanced fermentation technologies and quality control systems, improving product consistency and reducing costs. Local production reduces import dependence and improves product availability.

Distribution network development addresses key market access challenges through specialized biological product handling capabilities. Cold storage facilities and temperature-controlled transportation systems ensure product viability throughout the supply chain. Partnership agreements between manufacturers and agricultural cooperatives improve rural market penetration.

MarkWide Research analysis indicates that successful biocontrol agent market participation requires comprehensive strategies addressing both technical and commercial challenges. Product development should prioritize locally relevant pest and disease targets while ensuring consistent performance under Chinese agricultural conditions. Companies should invest in field testing programs that demonstrate clear economic benefits to farmers.

Market entry strategies should emphasize partnership development with established agricultural input distributors and farmer cooperatives to leverage existing relationships and distribution networks. Technical support services including farmer training and application guidance are essential for building market confidence and ensuring product success.

Investment priorities should focus on production capacity development, cold chain infrastructure, and research and development capabilities that support continuous product innovation. Regulatory compliance systems must be robust and adaptable to evolving government requirements and international standards.

Long-term success requires building strong relationships with key stakeholders including government agencies, research institutions, and farmer organizations. Sustainability messaging should emphasize both environmental benefits and economic advantages to appeal to diverse farmer motivations and decision-making criteria.

Market growth prospects remain exceptionally positive, driven by continued government support for sustainable agriculture and increasing farmer awareness of biocontrol agent benefits. Adoption rates are projected to accelerate as product costs decline and efficacy improves through technological advancement. The market is expected to maintain robust expansion with compound annual growth rates exceeding 14% over the next decade.

Technology evolution will continue enhancing biocontrol agent effectiveness and commercial viability through advances in genetic engineering, fermentation processes, and formulation chemistry. Next-generation products will offer improved stability, broader spectrum activity, and enhanced compatibility with existing agricultural practices. Precision agriculture integration will optimize application timing and placement for maximum efficacy.

Market maturation will bring increased competition and product differentiation as more companies enter the sector. Consolidation trends may emerge as successful companies acquire smaller competitors or form strategic partnerships to expand market coverage and technical capabilities. International companies will likely increase local presence through joint ventures and direct investment.

Regulatory evolution will continue supporting market development while ensuring environmental and human health protection. MWR projections indicate that streamlined approval processes and harmonized international standards will facilitate global product development and trade. Policy support for sustainable agriculture will remain strong, providing long-term market stability and growth opportunities.

The China biocontrol agents market represents a transformative force in the nation’s agricultural sector, offering sustainable solutions to pest management challenges while supporting environmental protection objectives. Strong government support, technological advancement, and increasing farmer awareness create favorable conditions for continued market expansion and innovation.

Market dynamics favor biocontrol agent adoption through regulatory incentives, research investment, and growing consumer demand for sustainably produced food products. The sector benefits from China’s large agricultural base, advanced research infrastructure, and commitment to environmental sustainability, positioning it for long-term success in the global biocontrol market.

Future success will depend on continued collaboration between government, industry, and research institutions to address remaining challenges including cost competitiveness, product consistency, and farmer education. The China biocontrol agents market stands poised to become a global leader in sustainable agriculture technology, contributing to food security while protecting environmental resources for future generations.

What is Biocontrol Agents?

Biocontrol agents are natural organisms or substances derived from them that are used to control pests and diseases in agriculture. They include beneficial insects, microorganisms, and plant extracts that help manage crop health sustainably.

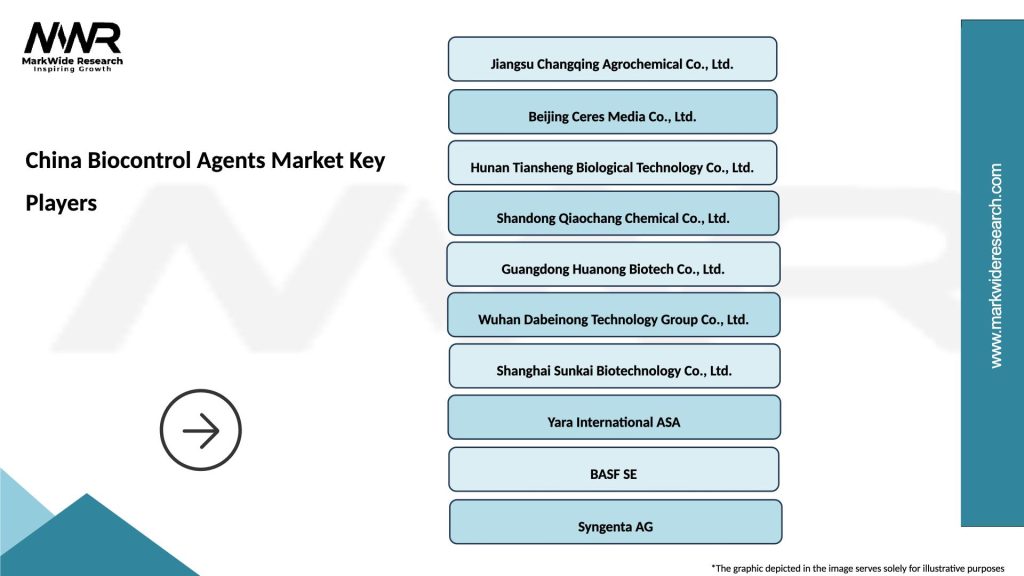

What are the key players in the China Biocontrol Agents Market?

Key players in the China Biocontrol Agents Market include companies like Syngenta, BASF, and Bayer, which are known for their innovative biocontrol solutions. Other notable companies include Novozymes and Marrone Bio Innovations, among others.

What are the growth factors driving the China Biocontrol Agents Market?

The growth of the China Biocontrol Agents Market is driven by increasing demand for sustainable agriculture practices, rising awareness of environmental issues, and the need for effective pest management solutions. Additionally, government support for organic farming is also contributing to market expansion.

What challenges does the China Biocontrol Agents Market face?

The China Biocontrol Agents Market faces challenges such as regulatory hurdles, limited awareness among farmers, and competition from chemical pesticides. These factors can hinder the adoption of biocontrol methods in traditional farming practices.

What opportunities exist in the China Biocontrol Agents Market?

Opportunities in the China Biocontrol Agents Market include the development of new biocontrol products, increasing investment in research and development, and the growing trend towards organic farming. These factors are likely to enhance market growth in the coming years.

What trends are shaping the China Biocontrol Agents Market?

Trends shaping the China Biocontrol Agents Market include the integration of biocontrol agents with precision agriculture technologies, the rise of biopesticides, and increased collaboration between research institutions and agricultural companies. These trends are fostering innovation and improving pest management strategies.

China Biocontrol Agents Market

| Segmentation Details | Description |

|---|---|

| Product Type | Microbial Agents, Biochemical Agents, Plant Extracts, Others |

| Application | Agriculture, Horticulture, Forestry, Turf Management |

| End User | Farmers, Agricultural Cooperatives, Research Institutions, Government Agencies |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Biocontrol Agents Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at