444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China analog IC market represents one of the most dynamic and rapidly evolving segments within the global semiconductor industry. As the world’s largest electronics manufacturing hub, China has witnessed unprecedented growth in analog integrated circuit demand, driven by expanding consumer electronics production, automotive electrification, and industrial automation initiatives. The market encompasses a comprehensive range of analog semiconductors including power management ICs, operational amplifiers, data converters, and interface circuits that serve as critical components in virtually every electronic device manufactured within the region.

Market dynamics indicate robust expansion across multiple application sectors, with the automotive and industrial segments experiencing particularly strong growth momentum. The increasing adoption of electric vehicles has created substantial demand for power management solutions, while the proliferation of Internet of Things (IoT) devices continues to drive requirements for low-power analog components. MarkWide Research analysis suggests that domestic Chinese analog IC manufacturers are gaining significant market share, supported by government initiatives promoting semiconductor self-sufficiency and technological independence.

Regional manufacturing capabilities have expanded dramatically, with major foundries and integrated device manufacturers establishing advanced production facilities across key industrial clusters. The market benefits from strong government support through policies such as the National IC Development Guidelines, which provide substantial funding and incentives for domestic semiconductor development. This supportive environment has attracted significant foreign investment while simultaneously fostering the growth of indigenous analog IC companies.

The China analog IC market refers to the comprehensive ecosystem of analog integrated circuit design, manufacturing, and distribution activities within mainland China, encompassing both domestic and international companies serving the region’s electronics manufacturing requirements. Analog ICs are semiconductor devices that process continuous signals and perform functions such as amplification, filtering, voltage regulation, and signal conversion, distinguishing them from digital ICs that handle discrete binary data.

These components serve as the critical interface between the real world and digital processing systems, converting physical phenomena like temperature, pressure, and sound into electrical signals that can be processed by digital circuits. The Chinese market specifically includes power management integrated circuits (PMICs), analog-to-digital converters (ADCs), digital-to-analog converters (DACs), operational amplifiers, voltage regulators, and specialized interface circuits designed for automotive, industrial, consumer, and telecommunications applications.

Market scope encompasses the entire value chain from semiconductor fabrication and assembly to distribution and end-user integration, representing a crucial component of China’s broader strategy to achieve technological self-reliance in critical semiconductor technologies.

China’s analog IC market has emerged as a cornerstone of the global semiconductor industry, characterized by exceptional growth rates and increasing technological sophistication. The market demonstrates remarkable resilience and adaptability, successfully navigating international trade tensions while building robust domestic capabilities across the entire analog semiconductor value chain.

Key growth drivers include the rapid expansion of electric vehicle production, accelerating 5G infrastructure deployment, and the proliferation of smart manufacturing initiatives throughout Chinese industrial sectors. The automotive segment alone accounts for approximately 28% of total analog IC consumption, reflecting the industry’s transition toward electrification and advanced driver assistance systems. Consumer electronics manufacturing continues to represent the largest application segment, driven by smartphone production and emerging categories such as wearable devices and smart home appliances.

Domestic manufacturers have achieved significant technological breakthroughs, particularly in power management and signal processing applications, reducing dependence on international suppliers while improving cost competitiveness. The market benefits from substantial government investment in semiconductor research and development, with funding initiatives specifically targeting analog IC innovation and manufacturing capacity expansion.

Strategic partnerships between Chinese companies and international technology leaders have accelerated knowledge transfer and capability development, while domestic firms increasingly compete on innovation rather than cost alone. The market’s future trajectory appears exceptionally promising, supported by China’s commitment to technological sovereignty and the growing sophistication of domestic electronics manufacturers.

Market intelligence reveals several critical insights that define the current landscape and future direction of China’s analog IC sector:

These insights demonstrate the market’s rapid evolution from a primarily import-dependent sector to an increasingly self-sufficient ecosystem capable of supporting China’s ambitious technology development goals.

Electric vehicle adoption stands as the most significant driver transforming China’s analog IC landscape. The country’s commitment to carbon neutrality by 2060 has accelerated EV production, creating unprecedented demand for power management solutions, battery management systems, and motor control circuits. Chinese automakers are increasingly integrating advanced analog components to improve energy efficiency and extend driving range, while government subsidies continue supporting EV market expansion.

5G network infrastructure deployment represents another major growth catalyst, requiring sophisticated RF analog circuits, power amplifiers, and mixed-signal processing solutions. China’s aggressive 5G rollout timeline has created substantial opportunities for domestic analog IC suppliers, particularly those specializing in high-frequency applications and low-noise amplification. The integration of 5G capabilities into consumer devices further amplifies demand for advanced analog components.

Industrial automation initiatives under the “Made in China 2025” strategy drive significant analog IC consumption across manufacturing sectors. Smart factory implementations require extensive sensor interfaces, motor control circuits, and power management solutions, creating sustained demand for industrial-grade analog components. The emphasis on precision manufacturing and quality improvement necessitates increasingly sophisticated analog signal processing capabilities.

Government policy support through semiconductor development funds and tax incentives encourages domestic analog IC innovation and manufacturing capacity expansion. The National IC Development Guidelines provide substantial financial backing for companies developing critical analog technologies, while import substitution policies create preferential market conditions for domestic suppliers.

Technology gaps in certain high-performance analog applications continue to challenge domestic manufacturers, particularly in precision instrumentation and aerospace applications where international suppliers maintain significant advantages. The development of advanced analog processes requires substantial time and investment, creating barriers for companies seeking to compete in premium market segments.

International trade restrictions have complicated access to certain manufacturing equipment and materials essential for advanced analog IC production. Export controls on semiconductor manufacturing technology have forced Chinese companies to develop alternative supply chains and manufacturing approaches, potentially increasing costs and development timelines.

Talent shortage in analog circuit design represents a persistent challenge, as the specialized skills required for analog IC development differ significantly from digital design expertise. The industry faces intense competition for experienced analog engineers, with salary inflation and talent poaching affecting smaller companies disproportionately.

Capital intensity of analog IC manufacturing requires substantial upfront investment in fabrication facilities and testing equipment. The long development cycles and high validation costs associated with analog products create financial pressures, particularly for startups and smaller companies attempting to enter established market segments.

Quality and reliability concerns regarding some domestic analog IC products have slowed adoption in critical applications where failure rates must be minimized. Building trust and establishing track records in reliability-sensitive markets requires time and consistent performance demonstration.

Automotive electrification presents extraordinary opportunities for analog IC suppliers, with Chinese EV manufacturers seeking cost-effective, high-performance power management solutions. The transition from internal combustion engines to electric powertrains requires entirely new analog architectures, creating opportunities for innovative companies to establish market leadership in emerging application areas.

IoT device proliferation across smart cities, industrial monitoring, and consumer applications generates demand for ultra-low-power analog components optimized for battery-operated devices. Chinese manufacturers are well-positioned to serve this growing market segment through cost-effective solutions tailored to specific application requirements.

Renewable energy infrastructure expansion creates substantial opportunities for power conversion and grid interface analog circuits. China’s leadership in solar panel manufacturing and wind energy installation drives demand for specialized analog components optimized for renewable energy applications.

Healthcare electronics represent an emerging opportunity as China’s aging population drives demand for medical devices and health monitoring equipment. The COVID-19 pandemic has accelerated adoption of digital health solutions, creating new markets for analog ICs in diagnostic equipment and patient monitoring systems.

Export market expansion offers significant growth potential as Chinese analog IC manufacturers achieve quality and performance parity with international competitors. The Belt and Road Initiative provides access to emerging markets where Chinese companies can leverage cost advantages and government support to establish market presence.

Supply chain dynamics within China’s analog IC market have undergone fundamental transformation, driven by geopolitical tensions and domestic policy initiatives promoting semiconductor self-sufficiency. The market has witnessed accelerated localization efforts, with Chinese electronics manufacturers increasingly prioritizing domestic suppliers to reduce supply chain risks and align with government objectives.

Competitive dynamics reflect a rapidly evolving landscape where domestic companies are challenging established international players through aggressive pricing strategies and customized solutions tailored to local market requirements. The emergence of Chinese analog IC companies with significant technical capabilities has intensified competition while providing customers with alternative sourcing options.

Innovation dynamics demonstrate increasing sophistication in domestic R&D capabilities, with Chinese companies developing proprietary analog architectures and manufacturing processes. Collaboration between universities, research institutes, and commercial entities has accelerated technology transfer and capability development across the analog IC ecosystem.

Investment dynamics show substantial capital flowing into analog IC development, supported by both government funding and private investment. Venture capital and private equity firms are actively investing in promising analog IC startups, while established companies are expanding manufacturing capacity and R&D capabilities.

Regulatory dynamics continue evolving as the Chinese government balances support for domestic industry development with international trade obligations and technology transfer agreements. Policy frameworks increasingly favor domestic suppliers while maintaining market access for international companies that contribute to local economic development.

Primary research for this comprehensive market analysis involved extensive interviews with key industry stakeholders including analog IC manufacturers, electronics OEMs, distributors, and technology integrators across major Chinese industrial centers. The research team conducted structured interviews with over 150 industry professionals to gather insights on market trends, competitive dynamics, and future growth prospects.

Secondary research encompassed analysis of government publications, industry reports, company financial statements, and patent filings to establish market size estimates and identify technological development trends. The research methodology incorporated data from multiple sources to ensure accuracy and comprehensiveness of market intelligence.

Market modeling utilized sophisticated analytical frameworks to project future market growth based on identified drivers, restraints, and opportunity factors. The modeling approach considered macroeconomic indicators, industry-specific trends, and policy developments to generate realistic growth scenarios and market forecasts.

Data validation processes included cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and assumptions. The research team employed statistical analysis techniques to identify patterns and correlations within the collected data.

Expert consultation with leading analog IC engineers, market analysts, and industry executives provided additional validation of research findings and insights into emerging market trends and technological developments.

Eastern China dominates analog IC consumption and manufacturing, with the Yangtze River Delta region accounting for approximately 45% of national market activity. Shanghai serves as a major hub for international analog IC companies, while Jiangsu and Zhejiang provinces host numerous domestic manufacturers and electronics assembly operations. The region benefits from excellent infrastructure, skilled workforce availability, and proximity to major consumer electronics manufacturers.

Southern China represents the second-largest regional market, centered around the Pearl River Delta manufacturing cluster in Guangdong Province. Shenzhen’s position as China’s electronics capital drives substantial analog IC demand, while the region’s focus on consumer electronics and telecommunications equipment creates opportunities for specialized analog solutions. The area accounts for approximately 32% of national analog IC consumption.

Northern China shows growing importance in automotive and industrial applications, with Beijing serving as a technology development center and surrounding regions hosting major automotive manufacturers. The region’s emphasis on heavy industry and infrastructure development creates demand for industrial-grade analog components, representing about 18% of national market share.

Western China demonstrates emerging potential driven by government initiatives to develop inland manufacturing capabilities and reduce regional economic disparities. Cities like Chengdu and Xi’an are attracting semiconductor investment and developing local analog IC capabilities, though the region currently represents approximately 5% of national market activity.

Regional specialization patterns are emerging, with different areas developing expertise in specific analog IC applications based on local industry concentrations and government development priorities.

The competitive landscape in China’s analog IC market features a dynamic mix of international leaders, established domestic players, and emerging local companies, creating an increasingly complex and competitive environment.

International Leaders:

Domestic Champions:

Competitive strategies increasingly emphasize innovation, customer service, and supply chain reliability as key differentiators, with companies investing heavily in R&D capabilities and manufacturing capacity expansion.

By Product Type:

By Application:

By End-User Industry:

Power Management ICs dominate the Chinese analog IC market, driven by the proliferation of battery-powered devices and the need for energy-efficient solutions across all application segments. The automotive transition to electrification has created particularly strong demand for high-voltage power management solutions capable of handling the demanding requirements of electric vehicle powertrains. Chinese manufacturers have achieved significant success in this category, developing cost-effective solutions that compete favorably with international alternatives.

Signal Processing ICs represent a rapidly growing category, fueled by the increasing sophistication of consumer electronics and industrial equipment. The integration of artificial intelligence capabilities into edge devices requires advanced analog front-ends capable of conditioning sensor signals for digital processing. Chinese companies are investing heavily in developing specialized signal processing solutions optimized for emerging applications such as machine vision and voice recognition.

Interface and Connectivity ICs benefit from the expansion of IoT applications and the need for seamless device interconnection. The category includes USB controllers, wireless interface circuits, and industrial communication protocols that enable device connectivity across various networks. The growth of smart manufacturing and Industry 4.0 initiatives drives demand for robust industrial interface solutions.

Automotive-specific Analog ICs constitute a specialized but rapidly expanding category, encompassing solutions designed to meet the stringent reliability and safety requirements of automotive applications. Chinese suppliers are developing automotive-qualified products to serve the domestic EV market while building capabilities to compete in international automotive markets.

Electronics Manufacturers benefit from increased supplier diversity and competitive pricing as domestic analog IC companies expand their capabilities and product portfolios. The availability of local suppliers reduces supply chain risks and enables faster time-to-market for new products, while government incentives for domestic sourcing provide additional cost advantages.

Analog IC Companies gain access to the world’s largest electronics manufacturing market, with opportunities to establish partnerships with leading OEMs and build scale economies. The supportive government policy environment and availability of skilled engineering talent create favorable conditions for technology development and business expansion.

Automotive Industry participants benefit from specialized analog solutions optimized for electric vehicle applications, enabling improved performance and cost competitiveness. The growing ecosystem of domestic suppliers provides automotive manufacturers with greater flexibility in supply chain management and product customization.

Technology Investors find attractive opportunities in a rapidly growing market supported by government policy and strong end-market demand. The sector’s strategic importance and growth potential make it an attractive target for both venture capital and strategic investment.

Research Institutions benefit from increased industry collaboration and funding opportunities as companies seek to develop next-generation analog technologies. The emphasis on innovation and technology development creates opportunities for academic-industry partnerships and knowledge transfer.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automotive electrification continues accelerating as Chinese automakers commit to aggressive EV production targets and government policies phase out internal combustion engines. This trend drives demand for sophisticated power management solutions, battery management systems, and motor control circuits specifically designed for automotive applications. The integration of advanced driver assistance systems further increases analog IC content per vehicle.

5G infrastructure deployment creates substantial opportunities for RF analog circuits, power amplifiers, and mixed-signal processing solutions. Chinese telecommunications equipment manufacturers are developing next-generation base station architectures that require increasingly sophisticated analog components optimized for high-frequency operation and energy efficiency.

Industrial digitalization under Industry 4.0 initiatives drives demand for sensor interface circuits, industrial communication ICs, and precision measurement solutions. Smart manufacturing implementations require extensive analog signal conditioning capabilities to interface with diverse sensor types and industrial protocols.

Supply chain localization accelerates as Chinese electronics manufacturers prioritize domestic suppliers to reduce geopolitical risks and align with government policies. This trend creates opportunities for domestic analog IC companies while challenging international suppliers to demonstrate local value creation.

Technology convergence between analog and digital domains leads to increased integration and system-level optimization. Mixed-signal solutions that combine analog and digital functionality on single chips become increasingly important for space-constrained applications and cost optimization.

Major capacity expansions by leading foundries and IDMs demonstrate confidence in long-term market growth prospects. Several companies have announced substantial investments in analog-optimized manufacturing facilities, including specialized process technologies for automotive and industrial applications.

Strategic partnerships between Chinese and international companies facilitate technology transfer and market access. These collaborations often involve joint development programs, licensing agreements, and shared manufacturing arrangements that benefit both parties while advancing domestic capabilities.

Government funding initiatives continue supporting analog IC development through the National IC Development Fund and regional investment programs. Recent funding rounds have targeted companies developing critical analog technologies for automotive, industrial, and communications applications.

Acquisition activity has intensified as companies seek to acquire complementary technologies and market access. Both domestic and international companies are pursuing strategic acquisitions to strengthen their positions in key market segments and expand their product portfolios.

Technology breakthroughs in areas such as gallium nitride (GaN) power devices and silicon carbide (SiC) technologies position Chinese companies to compete in next-generation power management applications. These developments represent significant advances in domestic technological capabilities.

MWR analysis recommends that international analog IC companies establish stronger local partnerships and manufacturing presence to maintain competitiveness in the Chinese market. The trend toward supply chain localization and government preferences for domestic suppliers necessitates local value creation strategies that go beyond traditional sales and distribution approaches.

Domestic companies should prioritize quality and reliability improvements to overcome market perception challenges and expand into premium application segments. Investment in advanced testing capabilities and quality management systems will be essential for competing with established international players in reliability-critical applications.

Automotive industry participants should develop long-term partnerships with analog IC suppliers to ensure access to specialized automotive-qualified components. The rapid growth of the EV market requires close collaboration between vehicle manufacturers and semiconductor suppliers to optimize system-level performance and cost.

Investment strategies should focus on companies with strong technology differentiation and clear paths to market leadership in specific application segments. The market’s rapid growth creates opportunities for well-positioned companies to achieve substantial scale and market share gains.

Supply chain diversification remains critical for electronics manufacturers seeking to balance cost optimization with supply security. Companies should develop multi-sourcing strategies that include both domestic and international suppliers while building capabilities to qualify alternative sources quickly.

Long-term growth prospects for China’s analog IC market remain exceptionally strong, supported by continued electronics manufacturing expansion, automotive electrification, and industrial automation initiatives. The market is expected to maintain robust growth rates as domestic companies achieve greater technological sophistication and international competitiveness.

Technology evolution will drive demand for increasingly sophisticated analog solutions optimized for emerging applications such as artificial intelligence, autonomous vehicles, and renewable energy systems. The convergence of analog and digital technologies will create new product categories and market opportunities for innovative companies.

Market consolidation is likely to accelerate as companies seek scale advantages and complementary capabilities through mergers and acquisitions. This consolidation will create stronger domestic champions capable of competing effectively with international leaders while serving the growing Chinese market.

International expansion by Chinese analog IC companies will increase as domestic capabilities mature and companies seek growth opportunities in global markets. The Belt and Road Initiative and other government programs will facilitate market access and business development in emerging economies.

Sustainability considerations will become increasingly important as environmental regulations tighten and customers demand more energy-efficient solutions. Analog IC companies that develop low-power, environmentally friendly products will be well-positioned for future growth opportunities.

China’s analog IC market represents one of the most dynamic and strategically important segments within the global semiconductor industry, characterized by exceptional growth rates, increasing technological sophistication, and strong government support for domestic industry development. The market has successfully navigated international trade tensions while building robust domestic capabilities across the entire analog semiconductor value chain.

The convergence of multiple growth drivers including automotive electrification, 5G infrastructure deployment, and industrial automation creates unprecedented opportunities for both domestic and international analog IC suppliers. Chinese companies have demonstrated remarkable progress in developing competitive products and gaining market share, while international players continue to benefit from the market’s substantial scale and growth potential.

Future success in this market will require continued investment in technology development, quality improvement, and customer relationships. Companies that can effectively balance innovation with cost competitiveness while meeting the increasingly sophisticated requirements of Chinese electronics manufacturers will be best positioned to capitalize on the market’s exceptional growth prospects and strategic importance within the global technology ecosystem.

What is Analog IC?

Analog ICs, or analog integrated circuits, are electronic components that process continuous signals. They are widely used in applications such as audio processing, signal amplification, and sensor interfacing.

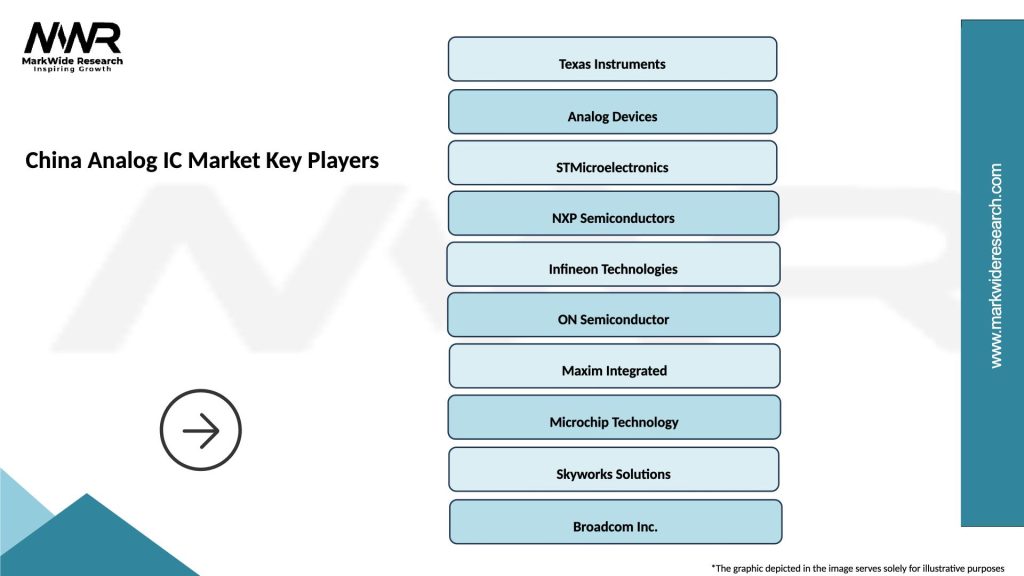

What are the key players in the China Analog IC Market?

Key players in the China Analog IC Market include companies like Semiconductor Manufacturing International Corporation (SMIC), Huada Semiconductor, and Nexperia, among others.

What are the growth factors driving the China Analog IC Market?

The growth of the China Analog IC Market is driven by the increasing demand for consumer electronics, the rise of electric vehicles, and advancements in telecommunications technology.

What challenges does the China Analog IC Market face?

Challenges in the China Analog IC Market include supply chain disruptions, intense competition from international players, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the China Analog IC Market?

Opportunities in the China Analog IC Market include the expansion of the Internet of Things (IoT), the growth of smart home devices, and the increasing adoption of automation in various industries.

What trends are shaping the China Analog IC Market?

Trends in the China Analog IC Market include the miniaturization of components, the integration of AI capabilities in analog devices, and a growing focus on energy-efficient solutions.

China Analog IC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Operational Amplifiers, Voltage Regulators, Comparators, Signal Conditioning |

| Technology | CMOS, Bipolar, BiCMOS, GaN |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Equipment |

| Application | Audio Processing, Power Management, Signal Processing, Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Analog IC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at