444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada senior living market represents a rapidly evolving sector driven by demographic shifts, changing consumer preferences, and innovative care delivery models. Canada’s aging population continues to reshape the landscape of senior care services, with the market experiencing unprecedented growth as baby boomers transition into retirement and require specialized living arrangements. The sector encompasses various service categories including independent living communities, assisted living facilities, memory care units, and continuing care retirement communities.

Market dynamics indicate robust expansion driven by increasing life expectancy rates and growing awareness of quality senior care options. The Canadian senior living industry has witnessed significant transformation with technology integration, enhanced healthcare services, and lifestyle-focused amenities becoming standard offerings. Provincial regulations and healthcare policies continue to influence market development, creating opportunities for both established operators and new market entrants.

Geographic distribution shows concentrated development in major metropolitan areas including Toronto, Vancouver, Calgary, and Montreal, where 65% of senior living facilities are currently located. The market demonstrates strong potential for expansion into secondary markets as demand outpaces supply in many regions. Investment activity remains robust with both domestic and international investors recognizing the long-term growth potential of Canada’s senior living sector.

The Canada senior living market refers to the comprehensive ecosystem of residential communities, care facilities, and support services designed specifically for adults aged 55 and older who seek independent or assisted living arrangements outside traditional home environments. This market encompasses various accommodation types ranging from active adult communities to specialized memory care facilities, each tailored to meet different levels of care needs and lifestyle preferences.

Senior living communities provide residents with maintenance-free living, social engagement opportunities, healthcare coordination, and various amenities designed to enhance quality of life during retirement years. The market includes both private-pay and government-subsidized options, reflecting Canada’s mixed healthcare system approach. Service integration typically combines housing, dining, recreational activities, and varying levels of personal care assistance under comprehensive monthly fee structures.

Market participants include real estate developers, healthcare operators, hospitality management companies, and specialized senior living providers who develop, own, and operate these communities across Canadian provinces. The sector serves as a bridge between independent home ownership and institutional care settings, offering graduated care options that can adapt to changing health and mobility needs over time.

Canada’s senior living market stands at a pivotal growth phase characterized by demographic tailwinds, evolving consumer expectations, and significant investment opportunities. The sector benefits from Canada’s rapidly aging population, with seniors representing the fastest-growing demographic segment nationwide. Market expansion is driven by increasing demand for high-quality, lifestyle-oriented senior housing options that prioritize wellness, community engagement, and comprehensive care coordination.

Key market drivers include rising life expectancy, changing family structures, increased wealth accumulation among baby boomers, and growing preference for community-based living over aging in place. The market demonstrates resilience through economic cycles due to essential nature of senior housing needs and relatively inelastic demand patterns. Technology adoption has accelerated significantly, with 78% of operators implementing digital health monitoring and communication systems.

Competitive landscape features a mix of large-scale operators, regional developers, and specialized care providers, creating diverse market opportunities. Investment activity remains strong with both public and private capital flowing into development projects, acquisitions, and operational improvements. Regulatory environment continues evolving to support quality standards while enabling market growth and innovation in service delivery models.

Demographic transformation drives fundamental market growth with Canada’s 65+ population projected to continue expanding significantly over the next two decades. Consumer preferences have shifted toward communities offering comprehensive wellness programs, technology integration, and resort-style amenities rather than traditional institutional care models.

Market segmentation reveals distinct preferences across different senior cohorts, with younger seniors prioritizing active lifestyle amenities while older residents focus on healthcare access and personal care services. Regional variations reflect local demographics, regulatory environments, and economic conditions affecting development patterns and pricing strategies.

Demographic shifts represent the primary catalyst for Canada’s senior living market expansion, with the aging baby boomer generation creating unprecedented demand for specialized housing options. Population projections indicate continued growth in the 65+ demographic, with this segment expected to comprise an increasingly larger portion of Canada’s total population over the coming decades.

Economic factors support market growth through accumulated wealth among retiring Canadians who possess greater financial resources than previous generations. Real estate appreciation has enabled many seniors to leverage home equity for senior living expenses, while improved retirement savings and pension benefits provide ongoing income streams. Healthcare cost management drives interest in communities offering coordinated care services that can potentially reduce overall medical expenses.

Lifestyle preferences have evolved significantly, with modern seniors seeking active, socially engaging environments rather than traditional retirement approaches. Family structure changes including smaller family sizes, geographic dispersion of adult children, and increased female workforce participation have reduced availability of informal family caregiving. Technology acceptance among seniors has improved dramatically, enabling innovative service delivery models and enhanced communication capabilities within senior living communities.

Healthcare system pressures create additional market drivers as hospitals and healthcare providers seek alternative care settings for seniors who require support but not intensive medical intervention. Government policies increasingly recognize senior living communities as cost-effective alternatives to institutional care, supporting market development through various regulatory and funding mechanisms.

Affordability challenges represent significant market constraints, particularly for middle-income seniors who may not qualify for government assistance but lack sufficient resources for premium private-pay communities. Cost escalation in construction, labor, and operational expenses continues pressuring pricing structures, potentially limiting market accessibility for broader senior populations.

Regulatory complexity across different provincial jurisdictions creates operational challenges for multi-provincial operators and may slow market entry for new participants. Licensing requirements, building codes, and care standards vary significantly between provinces, increasing compliance costs and operational complexity. Staffing shortages in healthcare and hospitality sectors affect service quality and operational efficiency, with 23% of operators reporting significant recruitment challenges.

Consumer resistance persists among some senior cohorts who prefer aging in place or view senior living communities negatively based on outdated perceptions. Family decision-making processes can be complex and emotionally challenging, often delaying transitions until crisis situations arise. Economic uncertainty may cause some seniors to defer senior living decisions, particularly during periods of market volatility affecting retirement savings and real estate values.

Development constraints include limited availability of suitable land in desirable locations, lengthy approval processes, and increasing construction costs. Competition for sites with other real estate uses can drive up land costs and limit development opportunities in prime markets.

Geographic expansion presents substantial opportunities as demand growth outpaces supply development in many Canadian markets. Secondary markets including mid-sized cities and suburban areas offer attractive development prospects with lower land costs and underserved senior populations. Rural market development remains largely untapped, presenting opportunities for innovative service delivery models adapted to smaller population centers.

Technology integration creates opportunities for operational efficiency improvements, enhanced resident experiences, and new service offerings. Digital health monitoring, smart home technologies, and virtual reality programming represent emerging areas for competitive differentiation. Telehealth services can expand healthcare access while reducing costs, particularly valuable for communities in smaller markets.

Specialized care segments offer growth opportunities including memory care, short-term rehabilitation, and respite care services. Wellness programming expansion can attract health-conscious seniors while potentially reducing healthcare costs through preventive care approaches. Intergenerational housing concepts and mixed-use developments present innovative approaches to community design and social engagement.

Partnership opportunities with healthcare providers, technology companies, and hospitality operators can enhance service offerings while sharing development and operational risks. Government collaboration on affordable housing initiatives and healthcare integration presents opportunities for public-private partnerships supporting market expansion.

Supply and demand imbalances characterize many Canadian markets, with demand growth consistently outpacing new supply development. Occupancy rates remain strong across most markets, with established communities maintaining 92% average occupancy levels despite new competition. Pricing power has strengthened in markets with limited supply, enabling operators to implement regular rate increases while maintaining high occupancy.

Competitive dynamics continue evolving as the market matures, with differentiation increasingly focused on service quality, amenity offerings, and specialized care capabilities rather than basic accommodation. Brand recognition has become more important as consumers become more sophisticated in evaluating senior living options. Operational efficiency improvements through technology adoption and process optimization help operators manage cost pressures while maintaining service quality.

Investment flows remain robust with both domestic and international capital recognizing the sector’s long-term growth potential and relatively stable cash flows. Consolidation activity has increased as larger operators seek to achieve economies of scale and expand geographic presence. Development cycles have lengthened due to regulatory approval processes and construction capacity constraints, affecting supply responsiveness to demand growth.

Consumer behavior patterns show increasing advance planning for senior living transitions, with many seniors researching options years before actual moves. MarkWide Research analysis indicates growing preference for communities offering trial stays and flexible contract terms that reduce commitment barriers for prospective residents.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Canada’s senior living sector. Primary research includes extensive interviews with industry executives, operators, developers, and residents to gather firsthand perspectives on market conditions, trends, and challenges. Secondary research incorporates government statistics, industry reports, financial filings, and academic studies to provide quantitative foundation for market analysis.

Data collection methods encompass surveys of senior living operators, analysis of occupancy and pricing trends, and evaluation of development pipeline projects across major Canadian markets. Demographic analysis utilizes Statistics Canada data and population projections to assess long-term market drivers and regional variations in senior population growth patterns.

Market segmentation analysis examines different care levels, price points, and geographic markets to identify growth opportunities and competitive dynamics. Financial performance evaluation includes analysis of publicly traded operators, private market transactions, and development project economics to assess market health and investment attractiveness.

Regulatory review covers provincial licensing requirements, building codes, and healthcare policies affecting senior living operations across different jurisdictions. Technology assessment evaluates adoption trends and innovation opportunities within the sector, providing insights into operational efficiency and resident experience improvements.

Ontario market dominates Canada’s senior living sector, representing approximately 45% of total market activity due to large population base and concentrated urban development. Greater Toronto Area leads in both supply and demand, with strong development pipeline and premium pricing supporting robust investment returns. Ottawa region demonstrates steady growth with government employee retirees providing stable demand base.

British Columbia represents the second-largest provincial market, with Vancouver metropolitan area commanding premium pricing due to desirable climate and limited development sites. Victoria region attracts retirees from across Canada, supporting strong occupancy rates and development activity. Fraser Valley markets offer more affordable options while maintaining access to urban amenities and healthcare services.

Alberta market shows resilience despite economic volatility, with Calgary and Edmonton supporting diverse senior living options across different price points. Energy sector retirees provide strong demand foundation, while lower cost structure enables competitive pricing compared to eastern markets. Rural Alberta presents emerging opportunities for innovative service delivery models.

Quebec market operates under distinct regulatory framework emphasizing public sector involvement in senior care. Montreal region demonstrates growing private-pay market development, while Quebec City maintains strong demand from government retirees. Language considerations create both opportunities and challenges for operators serving francophone populations.

Atlantic provinces show emerging market development with aging populations creating demand growth opportunities. Halifax region leads regional development activity, while smaller markets present opportunities for right-sized community concepts adapted to local demographics and economic conditions.

Market leadership includes both large-scale operators with national presence and regional specialists focused on specific geographic markets or care segments. Competitive differentiation increasingly centers on service quality, technology integration, and specialized programming rather than basic accommodation features.

Competitive strategies vary significantly across operators, with some focusing on geographic expansion while others emphasize service innovation or operational efficiency improvements. Technology adoption has become key differentiator, with leading operators implementing comprehensive digital platforms for resident engagement, health monitoring, and family communication.

New market entrants include hospitality companies, healthcare providers, and real estate developers recognizing growth opportunities in senior living sector. International operators have shown increasing interest in Canadian market entry through acquisitions and development partnerships.

By Care Level: Market segmentation reflects diverse resident needs and preferences across the senior living spectrum. Independent living communities serve active seniors seeking maintenance-free lifestyle with social engagement opportunities. Assisted living provides personal care services while maintaining resident independence and dignity. Memory care offers specialized programming and secure environments for residents with cognitive impairments.

By Price Point: Market serves diverse economic segments from affordable housing options to luxury communities with resort-style amenities. Premium segment emphasizes hospitality services, fine dining, and extensive amenity packages. Mid-market communities balance affordability with quality services and amenities. Affordable segment focuses on essential services while maintaining quality standards.

By Geographic Market: Urban markets offer diverse options with access to healthcare and cultural amenities, while suburban communities provide more spacious environments often at lower cost points. Rural markets present opportunities for innovative service delivery adapted to smaller populations and different lifestyle preferences.

By Ownership Structure: Private-pay communities offer flexibility in service delivery and amenity offerings, while non-profit operators often focus on affordability and community mission. For-profit operators emphasize efficiency and return on investment, while non-profit organizations prioritize resident welfare and community service objectives.

Independent Living Communities represent the largest market segment, serving active seniors who desire maintenance-free living with social engagement opportunities. Demand drivers include desire for community lifestyle, access to amenities, and security of planned care progression. Service offerings typically include dining programs, fitness facilities, transportation services, and social programming designed to promote active aging.

Assisted Living Facilities provide personal care services while maintaining resident independence and choice. Care coordination includes medication management, assistance with daily activities, and healthcare monitoring. Staffing models emphasize trained care professionals available around-the-clock while respecting resident privacy and autonomy. Family involvement remains important component of care planning and service delivery.

Memory Care Units offer specialized environments and programming for residents with Alzheimer’s disease and other forms of dementia. Design features include secure outdoor spaces, way-finding systems, and calming environments that reduce confusion and anxiety. Specialized staffing includes dementia care training and behavioral management expertise. Family support services provide education and emotional support throughout the care journey.

Continuing Care Retirement Communities provide graduated care levels within single campus settings, enabling residents to age in place as care needs change. Service integration includes independent living, assisted living, and skilled nursing care options. Entrance fee models often include refundable deposits and monthly service fees, providing financial predictability for residents and operators.

Residents and Families benefit from comprehensive care coordination, social engagement opportunities, and peace of mind regarding future care needs. Maintenance-free living eliminates home ownership responsibilities while providing access to services and amenities that enhance quality of life. Healthcare coordination ensures appropriate medical care while maintaining independence and dignity.

Operators and Investors benefit from stable cash flows, demographic-driven demand growth, and relatively recession-resistant business models. Operational efficiency improvements through technology adoption and scale economies enhance profitability while improving service quality. Asset appreciation potential provides long-term investment returns beyond operational cash flows.

Healthcare Systems benefit from reduced pressure on acute care facilities and more appropriate care settings for seniors with varying needs. Cost effectiveness of senior living communities compared to institutional care provides system-wide savings opportunities. Preventive care focus in many communities can reduce overall healthcare costs through early intervention and wellness programming.

Communities and Governments benefit from economic development, job creation, and efficient use of healthcare resources. Tax revenue generation from development and operations supports local government services. Intergenerational programming and community partnerships enhance social cohesion and mutual support systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wellness-Focused Programming has emerged as primary differentiator, with communities implementing comprehensive fitness centers, nutrition counseling, and preventive health services. Holistic wellness approaches address physical, mental, and social well-being through integrated programming that promotes active aging and quality of life enhancement.

Technology Integration continues accelerating across all aspects of senior living operations, from smart home automation to digital health monitoring systems. Resident engagement platforms facilitate communication with family members and care coordination, while operational technologies improve efficiency and service delivery. Telehealth services expand healthcare access while reducing costs and transportation requirements.

Hospitality-Style Services reflect changing consumer expectations, with communities adopting hotel-like amenities and service standards. Concierge services, fine dining programs, and luxury amenities attract discerning seniors seeking premium lifestyle experiences. Personalized service delivery emphasizes individual preferences and choice in daily activities and care services.

Intergenerational Programming creates connections between senior residents and younger community members through educational partnerships, volunteer programs, and shared activities. Community integration reduces isolation while providing mutual benefits for participants across age groups. MWR data indicates 67% of residents value intergenerational interaction opportunities.

Sustainable Design and environmental consciousness influence development decisions, with communities incorporating energy-efficient systems, sustainable materials, and outdoor spaces that promote connection with nature. Green building certifications become increasingly important for attracting environmentally conscious residents and reducing operational costs.

Consolidation Activity has accelerated as larger operators seek to achieve economies of scale and expand geographic presence through strategic acquisitions. Portfolio transactions enable rapid market expansion while providing exit opportunities for smaller operators and developers. Management contract arrangements allow asset owners to partner with experienced operators without full ownership transfer.

Technology Partnerships between senior living operators and healthcare technology companies are creating innovative service delivery models. Digital health platforms enable remote monitoring and early intervention capabilities, while artificial intelligence applications support care planning and operational optimization. Smart building technologies enhance safety, security, and energy efficiency.

Healthcare Integration initiatives create closer partnerships between senior living communities and healthcare providers, enabling coordinated care delivery and improved health outcomes. On-site healthcare services reduce transportation requirements while providing convenient access to medical care. Rehabilitation partnerships support post-acute care transitions and recovery services.

Workforce Development programs address staffing challenges through enhanced training, career advancement opportunities, and competitive compensation packages. Immigration programs help address labor shortages by attracting international healthcare workers to Canadian senior living sector. Technology training ensures staff can effectively utilize digital tools and platforms.

Regulatory Evolution includes updated building codes, care standards, and licensing requirements that reflect modern senior living practices and consumer expectations. Quality assurance programs emphasize resident satisfaction and outcome measurement, while innovation-friendly policies support new service delivery models and technology adoption.

Market Entry Strategies should focus on underserved geographic markets where demand exceeds supply and competition remains limited. Secondary markets offer attractive development opportunities with lower land costs and strong demographic fundamentals. Partnership approaches with local healthcare providers or real estate developers can reduce market entry risks while providing operational expertise.

Service Differentiation becomes increasingly important as market competition intensifies, with successful operators focusing on specialized care capabilities, technology integration, and unique programming offerings. Wellness programming and hospitality-style services provide competitive advantages that justify premium pricing and support occupancy rates.

Technology Investment should prioritize solutions that enhance both operational efficiency and resident experiences, with particular focus on digital health monitoring, communication platforms, and smart building systems. Implementation planning must consider staff training requirements and resident adaptation needs to ensure successful technology adoption.

Financial Planning should account for extended development timelines, rising construction costs, and evolving regulatory requirements that may affect project economics. Flexible design approaches enable communities to adapt to changing market conditions and resident preferences over time. MarkWide Research recommends maintaining 18-month operating reserves to manage market volatility and unexpected challenges.

Workforce Development requires proactive approaches to recruitment, training, and retention given ongoing labor market challenges. Competitive compensation packages, career advancement opportunities, and positive workplace culture become essential for attracting and retaining quality staff members.

Long-term growth prospects remain exceptionally strong for Canada’s senior living market, driven by sustained demographic trends and evolving consumer preferences. Population projections indicate continued expansion of the 65+ demographic over the next two decades, creating sustained demand for specialized housing and care services. Market maturation will likely result in increased service sophistication and operational efficiency improvements.

Technology integration will accelerate significantly, with digital health monitoring, artificial intelligence, and smart home technologies becoming standard features rather than premium amenities. Operational automation will help address labor shortages while improving service consistency and cost management. Telehealth services will expand healthcare access while reducing costs and transportation requirements for residents.

Geographic expansion will continue into secondary and tertiary markets as demand growth outpaces supply development in major metropolitan areas. Rural market development presents opportunities for innovative service delivery models adapted to smaller populations and different lifestyle preferences. Cross-border investment may increase as international operators recognize Canada’s attractive market fundamentals.

Service evolution will emphasize wellness, active aging, and lifestyle enhancement rather than traditional care-focused models. Intergenerational programming and community integration will become more prevalent, reducing isolation while creating mutual benefits across age groups. Specialized care segments including memory care and short-term rehabilitation will experience above-average growth rates.

Regulatory environment will continue evolving to support innovation while maintaining quality standards, with potential for increased government involvement in affordable housing development and healthcare integration initiatives. Sustainability requirements will influence design and operational decisions as environmental consciousness grows among consumers and regulators.

Canada’s senior living market represents one of the most compelling long-term growth opportunities in the country’s real estate and healthcare sectors, driven by powerful demographic trends and evolving consumer preferences. The market demonstrates remarkable resilience through economic cycles while offering stable cash flows and appreciation potential for investors and operators.

Market fundamentals remain exceptionally strong, with sustained demand growth from Canada’s aging population creating opportunities across all care levels and price points. Innovation opportunities in technology integration, service delivery, and community design provide competitive advantages for forward-thinking operators while enhancing resident experiences and operational efficiency.

Success factors include strategic market selection, service differentiation through quality and innovation, effective technology adoption, and strong operational management capabilities. Geographic diversification and specialized care expertise will become increasingly important as market competition intensifies and consumer expectations continue evolving.

The Canada senior living market stands poised for continued expansion and evolution, offering significant opportunities for stakeholders who understand demographic trends, consumer preferences, and operational excellence requirements. Long-term outlook remains highly positive, supported by fundamental demand drivers that will persist for decades to come, making this sector an attractive focus for investment, development, and operational excellence initiatives.

What is Senior Living?

Senior living refers to a range of housing options and services designed for older adults, including independent living, assisted living, and memory care facilities. These communities aim to provide a supportive environment that promotes health, well-being, and social engagement for seniors.

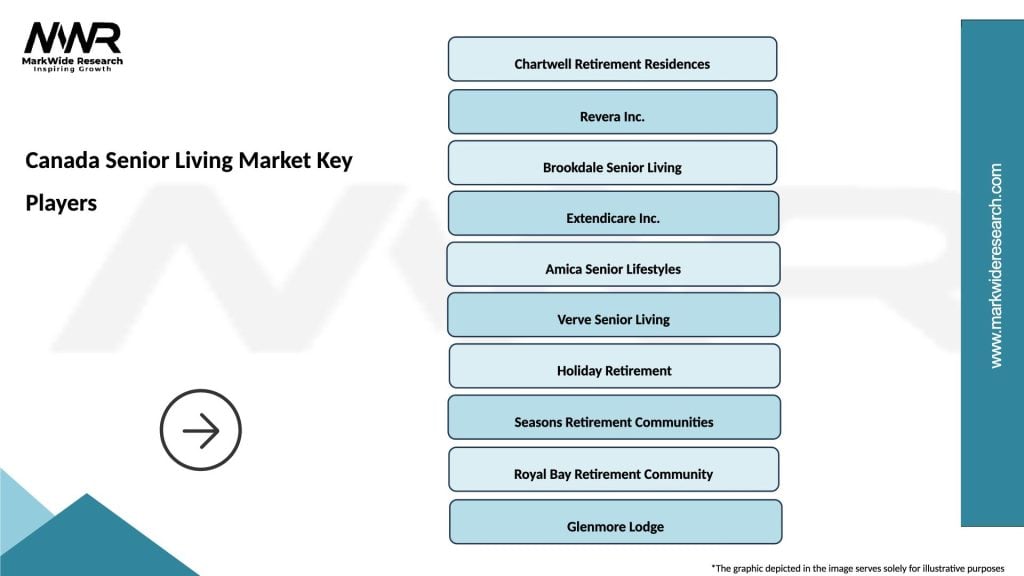

What are the key players in the Canada Senior Living Market?

Key players in the Canada Senior Living Market include companies like Revera Inc., Sienna Senior Living, and Chartwell Retirement Residences. These organizations offer various services and accommodations tailored to the needs of seniors, among others.

What are the main drivers of growth in the Canada Senior Living Market?

The growth of the Canada Senior Living Market is driven by factors such as the aging population, increasing demand for specialized care services, and a growing preference for community living among seniors. Additionally, advancements in healthcare technology are enhancing service delivery.

What challenges does the Canada Senior Living Market face?

The Canada Senior Living Market faces challenges such as staffing shortages, regulatory compliance issues, and the need for continuous investment in facility upgrades. These factors can impact the quality of care and operational efficiency.

What opportunities exist in the Canada Senior Living Market?

Opportunities in the Canada Senior Living Market include the development of innovative housing solutions, integration of technology for better care management, and expansion into underserved regions. These trends can enhance service offerings and attract more residents.

What trends are shaping the Canada Senior Living Market?

Trends in the Canada Senior Living Market include a shift towards more personalized care models, increased focus on wellness and lifestyle programs, and the incorporation of smart home technologies. These trends aim to improve the quality of life for seniors and enhance operational efficiency.

Canada Senior Living Market

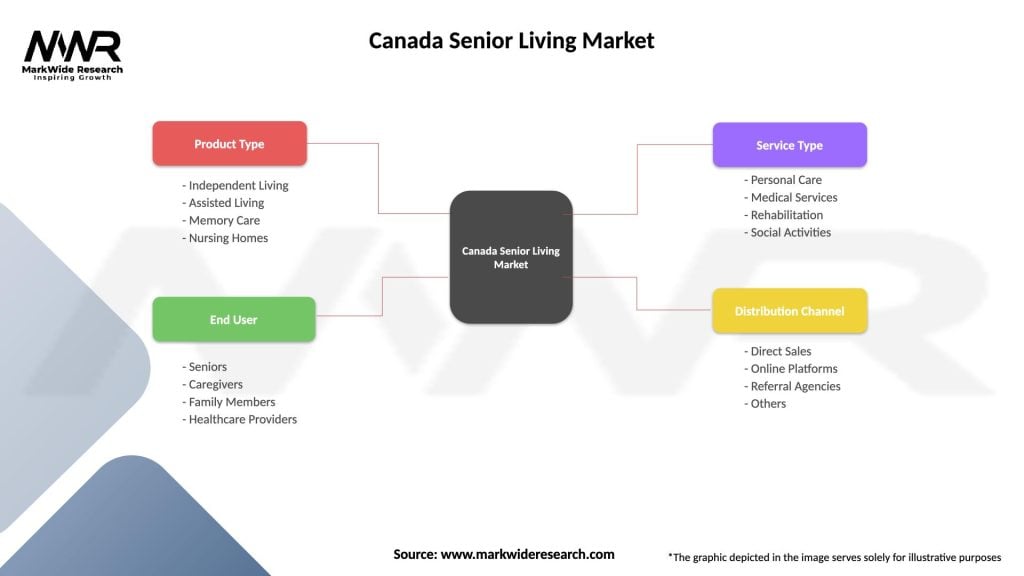

| Segmentation Details | Description |

|---|---|

| Product Type | Independent Living, Assisted Living, Memory Care, Nursing Homes |

| End User | Seniors, Caregivers, Family Members, Healthcare Providers |

| Service Type | Personal Care, Medical Services, Rehabilitation, Social Activities |

| Distribution Channel | Direct Sales, Online Platforms, Referral Agencies, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Senior Living Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at