444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada disposable insulin syringes market represents a critical component of the nation’s diabetes care infrastructure, serving millions of Canadians who depend on insulin therapy for managing their condition. Market dynamics indicate robust growth driven by increasing diabetes prevalence, aging population demographics, and enhanced healthcare accessibility across provincial systems. The market encompasses various syringe types, needle gauges, and capacity configurations designed to meet diverse patient needs and clinical requirements.

Healthcare professionals and patients increasingly favor disposable insulin syringes due to their convenience, safety features, and reduced infection risk compared to reusable alternatives. The market demonstrates steady expansion with growth rates reflecting the rising incidence of both Type 1 and Type 2 diabetes across Canadian provinces. Provincial healthcare systems play a significant role in market dynamics through coverage policies, procurement strategies, and patient access programs that influence product adoption and utilization patterns.

Technological advancements in needle design, safety mechanisms, and ergonomic features continue to drive market evolution. The integration of ultra-fine needles, safety shields, and user-friendly designs addresses patient comfort concerns while maintaining clinical efficacy. Market penetration varies across regions, with urban centers typically showing higher adoption rates of premium products compared to rural areas where cost considerations may influence product selection.

The Canada disposable insulin syringes market refers to the comprehensive ecosystem of single-use medical devices specifically designed for subcutaneous insulin administration to diabetic patients across Canadian healthcare settings. This market encompasses the manufacturing, distribution, and consumption of sterile, pre-packaged syringes that combine precise dosing capabilities with safety features to ensure optimal patient outcomes and clinical efficiency.

Disposable insulin syringes represent medical devices engineered for one-time use, featuring graduated barrels for accurate dose measurement, ultra-fine needles for patient comfort, and safety mechanisms to prevent needlestick injuries. These devices serve as essential tools in diabetes management protocols, enabling patients to self-administer insulin therapy while maintaining sterility standards and reducing cross-contamination risks inherent in reusable systems.

Market scope includes various product categories such as standard insulin syringes, safety syringes with retractable needles, and specialized designs for pediatric or geriatric populations. The definition extends beyond physical products to encompass associated services, training programs, and support systems that facilitate proper syringe utilization within Canada’s healthcare framework.

Canada’s disposable insulin syringes market demonstrates consistent growth momentum driven by fundamental demographic and epidemiological trends affecting the nation’s healthcare landscape. The market benefits from universal healthcare coverage that ensures broad patient access to essential diabetes management tools, while provincial variations in coverage policies create diverse market dynamics across different regions.

Key market drivers include the rising prevalence of diabetes, estimated to affect approximately 11.7% of the Canadian population, along with increasing awareness of diabetes complications and the importance of proper insulin administration techniques. The market responds to evolving patient preferences for convenient, safe, and comfortable injection devices that support adherence to prescribed therapy regimens.

Competitive landscape features established medical device manufacturers competing on product innovation, safety features, and cost-effectiveness. Market participants focus on developing advanced needle technologies, ergonomic designs, and integrated safety systems that address both clinical requirements and patient experience considerations. Distribution channels span hospital pharmacies, retail pharmacies, diabetes clinics, and direct-to-patient programs that ensure comprehensive market coverage across urban and rural communities.

Future growth prospects remain positive, supported by demographic trends, technological innovations, and expanding diabetes screening programs that identify previously undiagnosed cases requiring insulin therapy. The market evolution reflects broader healthcare digitization trends and personalized medicine approaches that customize treatment protocols to individual patient needs and preferences.

Market analysis reveals several critical insights that shape the Canada disposable insulin syringes landscape and influence strategic decision-making across the healthcare value chain:

Diabetes prevalence serves as the primary market driver, with Type 2 diabetes cases increasing at approximately 5.1% annually across Canadian populations. This epidemiological trend directly correlates with insulin syringe demand as more patients require insulin therapy to manage their condition effectively. Lifestyle factors including sedentary behavior, dietary changes, and obesity contribute to diabetes incidence rates that sustain long-term market growth.

Healthcare accessibility improvements through provincial insurance programs and diabetes-specific coverage initiatives expand patient access to quality insulin delivery devices. Government initiatives promoting diabetes prevention and management create supportive policy environments that encourage proper treatment adherence and appropriate medical device utilization.

Technological advancement in needle design and safety features drives market evolution as manufacturers develop increasingly sophisticated products that address patient comfort and clinical safety concerns. Ultra-fine needle technology reduces injection pain and improves patient compliance, while safety mechanisms protect healthcare workers from occupational hazards.

Patient empowerment trends encourage self-management of diabetes through education programs and support systems that increase demand for user-friendly injection devices. Healthcare professional recommendations significantly influence product selection, with clinical endorsements driving adoption of specific syringe brands and technologies that demonstrate superior performance characteristics.

Cost pressures within provincial healthcare systems create budget constraints that limit adoption of premium syringe products, particularly in cost-sensitive market segments where basic functionality takes precedence over advanced features. Healthcare funding limitations may restrict coverage for newer technologies, forcing patients to choose between clinical benefits and out-of-pocket expenses.

Needle phobia affects a significant portion of diabetic patients, creating psychological barriers to proper insulin administration that may limit market growth potential. Patient anxiety regarding injections can lead to treatment non-adherence and reduced syringe utilization, despite clinical necessity for insulin therapy.

Regulatory complexity surrounding medical device approval and market entry creates barriers for new manufacturers seeking to enter the Canadian market. Compliance requirements with Health Canada standards demand substantial investment in quality systems and documentation that may discourage smaller companies from market participation.

Environmental concerns regarding medical waste disposal and single-use device sustainability create growing pressure for eco-friendly alternatives. Waste management challenges in healthcare facilities and home settings may influence future product development toward more environmentally responsible solutions that maintain clinical safety standards.

Digital health integration presents significant opportunities for smart syringe technologies that connect with diabetes management applications and electronic health records. Connected devices can provide dose tracking, injection reminders, and clinical data collection that enhance patient outcomes while creating new revenue streams for manufacturers.

Pediatric market expansion offers growth potential as childhood diabetes rates increase and specialized products address unique requirements of young patients. Child-friendly designs incorporating colorful aesthetics, smaller needle gauges, and simplified operation mechanisms can capture this underserved market segment effectively.

Home healthcare growth driven by healthcare system efficiency initiatives creates demand for patient-centric syringe designs that support safe self-administration outside clinical settings. Telemedicine expansion requires reliable injection devices that patients can use confidently with remote clinical supervision and support.

Indigenous community outreach programs present opportunities to address diabetes disparities in First Nations populations through culturally appropriate product development and distribution strategies. Community partnerships can facilitate market penetration while supporting public health objectives in underserved regions.

Supply chain dynamics in the Canada disposable insulin syringes market reflect complex interactions between manufacturers, distributors, healthcare institutions, and end users. Manufacturing concentration among established medical device companies creates stable supply conditions while potentially limiting price competition and innovation diversity.

Demand patterns exhibit seasonal variations influenced by healthcare utilization cycles, with higher consumption during winter months when diabetes complications may increase. Inventory management strategies across healthcare facilities must balance cost efficiency with ensuring adequate stock levels to meet patient needs consistently.

Pricing dynamics respond to provincial procurement policies, volume purchasing agreements, and competitive pressures that influence market accessibility. Value-based purchasing initiatives increasingly evaluate total cost of ownership including clinical outcomes, safety benefits, and operational efficiency rather than unit price alone.

Innovation cycles drive market evolution as manufacturers invest in research and development to differentiate products through enhanced safety features, improved patient experience, and clinical efficacy improvements. Market feedback from healthcare professionals and patients guides product development priorities and feature enhancement strategies.

Market research methodology for analyzing the Canada disposable insulin syringes market employs comprehensive data collection and analysis techniques to ensure accurate market characterization and trend identification. Primary research involves direct engagement with healthcare professionals, diabetes educators, patients, and industry stakeholders through structured interviews, surveys, and focus groups that capture qualitative insights and quantitative data.

Secondary research incorporates analysis of government health statistics, provincial healthcare databases, clinical literature, and industry reports to establish market context and validate primary findings. Data triangulation methods compare multiple information sources to ensure reliability and accuracy of market assessments and projections.

Statistical analysis techniques include trend analysis, correlation studies, and predictive modeling to identify market patterns and forecast future developments. Segmentation analysis examines market dynamics across different product categories, geographic regions, and customer segments to provide granular market understanding.

Quality assurance protocols ensure data integrity through verification procedures, expert review processes, and methodological validation that maintains research standards and credibility. Continuous monitoring of market developments enables real-time updates and refinements to research findings as new information becomes available.

Ontario market represents the largest regional segment, accounting for approximately 38.7% of national demand due to population concentration and advanced healthcare infrastructure. Toronto metropolitan area demonstrates particularly strong adoption of premium syringe products, while rural Ontario regions show preference for cost-effective alternatives covered by provincial insurance programs.

Quebec market exhibits unique characteristics influenced by provincial healthcare policies and language preferences that affect product labeling and marketing strategies. Montreal and Quebec City serve as primary distribution hubs, with approximately 23.2% market share reflecting the province’s demographic and economic significance.

British Columbia shows strong growth potential driven by aging population demographics and increasing diabetes prevalence, particularly in urban centers like Vancouver and Victoria. Provincial coverage policies support access to advanced syringe technologies, contributing to 13.8% regional market share.

Alberta market benefits from robust healthcare funding and oil industry economic strength that supports premium product adoption. Calgary and Edmonton represent key market centers with growing diabetes populations requiring comprehensive insulin delivery solutions.

Atlantic provinces collectively demonstrate steady demand despite smaller population bases, with Nova Scotia leading regional adoption of safety-engineered syringes in healthcare facilities. Rural access challenges influence distribution strategies and product availability across maritime communities.

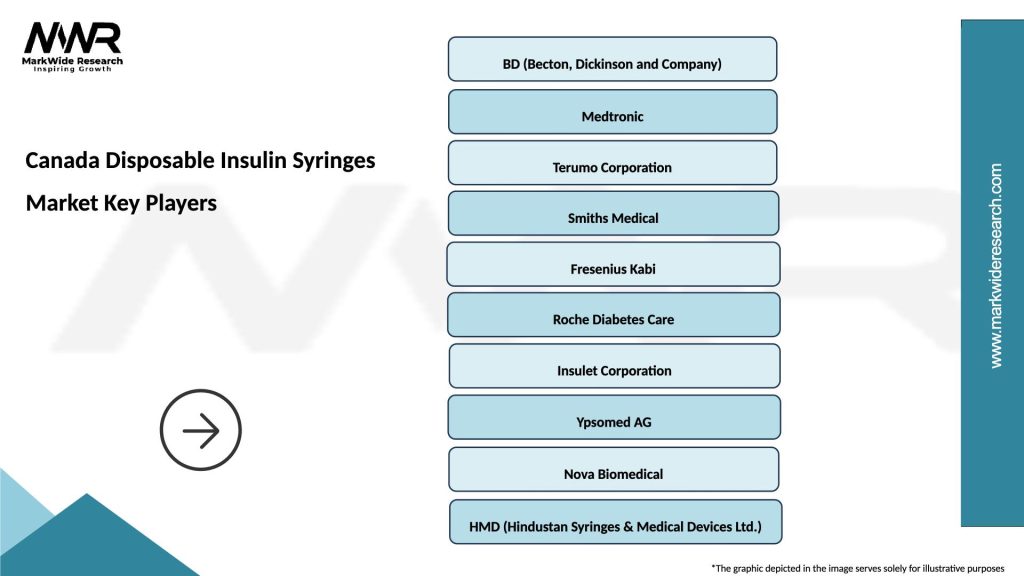

Market leadership in Canada’s disposable insulin syringes sector features several established medical device manufacturers competing on product innovation, safety features, and cost-effectiveness:

Competitive strategies emphasize product differentiation through safety features, needle technology advancement, and ergonomic improvements that address specific patient and healthcare provider needs. Market positioning varies from premium quality leaders to cost-effective alternatives that serve price-sensitive segments.

Distribution partnerships with major pharmacy chains, hospital group purchasing organizations, and diabetes specialty clinics provide competitive advantages in market access and customer relationship management. Innovation investment continues to drive competitive differentiation as manufacturers develop next-generation products with enhanced functionality and user experience.

Product segmentation within the Canada disposable insulin syringes market reflects diverse patient needs and clinical requirements across different diabetes management scenarios:

By Needle Gauge:

By Syringe Capacity:

By Safety Features:

Standard insulin syringes maintain significant market presence due to cost-effectiveness and widespread familiarity among healthcare providers and patients. This category serves price-sensitive segments while delivering reliable clinical performance for routine insulin administration. Provincial coverage policies often favor standard syringes as first-line options, supporting sustained demand across public healthcare systems.

Safety-engineered syringes demonstrate rapid growth driven by healthcare worker protection initiatives and institutional safety policies. Hospital adoption rates exceed 67% in major medical centers as administrators prioritize occupational safety and regulatory compliance. Cost justification increasingly considers total value including injury prevention and liability reduction benefits.

Ultra-fine needle syringes capture premium market segments where patient comfort and injection experience take priority over cost considerations. Patient preference studies indicate 78% satisfaction improvement with ultra-fine needles compared to standard gauges. Adherence benefits from reduced injection anxiety support clinical outcomes and long-term therapy success.

Pediatric-specific syringes address unique requirements of children with diabetes through specialized design features including smaller capacities, colorful aesthetics, and simplified operation mechanisms. Market growth reflects increasing childhood diabetes incidence and recognition of age-appropriate medical device importance in pediatric care protocols.

Healthcare providers benefit from disposable insulin syringes through enhanced patient safety, reduced infection risk, and streamlined clinical workflows that improve operational efficiency. Standardized products simplify inventory management and staff training while ensuring consistent clinical outcomes across different patient populations and care settings.

Patients experience improved diabetes management through convenient, safe, and comfortable injection devices that support treatment adherence and quality of life. Safety features reduce anxiety and complications associated with insulin administration, while ergonomic designs accommodate diverse physical capabilities and dexterity levels.

Healthcare institutions realize cost benefits through reduced needlestick injuries, decreased infection rates, and improved staff productivity. Safety-engineered syringes provide liability protection and regulatory compliance while supporting institutional quality and safety objectives.

Manufacturers gain market opportunities through product innovation, brand differentiation, and customer loyalty development. Technology advancement creates competitive advantages and premium pricing opportunities while expanding market reach through diverse product portfolios.

Government healthcare systems achieve public health objectives through improved diabetes care outcomes, reduced complications, and enhanced treatment accessibility. Cost-effective solutions support healthcare sustainability while maintaining clinical quality standards across provincial programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Safety technology integration represents the dominant market trend as healthcare institutions prioritize worker protection and regulatory compliance. Retractable needle systems and automatic safety shields gain adoption rates of approximately 12.3% annually across hospital and clinic settings. Innovation focus continues advancing safety mechanisms while maintaining clinical functionality and cost-effectiveness.

Ultra-fine needle adoption accelerates as patient comfort becomes increasingly important in diabetes management protocols. 31-gauge and 32-gauge needles demonstrate growing market penetration, particularly among patients requiring frequent injections. Comfort improvements directly correlate with treatment adherence and clinical outcomes, driving healthcare provider recommendations.

Digital health connectivity emerges as manufacturers explore smart syringe technologies that integrate with diabetes management applications and electronic health records. Connected devices offer dose tracking, injection reminders, and clinical data collection capabilities that enhance patient engagement and clinical monitoring effectiveness.

Sustainability initiatives influence product development as environmental concerns drive demand for eco-friendly packaging and disposal solutions. Biodegradable materials and recycling programs gain attention while maintaining sterility and safety requirements essential for medical device applications.

Regulatory updates from Health Canada continue shaping market dynamics through enhanced safety requirements and quality standards that influence product development and market entry strategies. Recent guidelines emphasize needlestick prevention and medical waste reduction, driving innovation in safety-engineered products.

Manufacturing investments in Canadian production facilities support supply chain resilience and local market responsiveness. Domestic manufacturing capabilities reduce import dependencies while creating employment opportunities and supporting economic development objectives across different provinces.

Partnership developments between syringe manufacturers and diabetes technology companies create integrated solutions that combine injection devices with monitoring systems and mobile health applications. Collaborative innovation accelerates product development while expanding market opportunities through cross-industry synergies.

Clinical research initiatives continue demonstrating the relationship between injection device characteristics and patient outcomes, providing evidence-based support for premium product adoption. Research findings influence clinical guidelines and coverage decisions that shape market dynamics and product utilization patterns.

MarkWide Research analysis suggests that market participants should prioritize safety technology development and patient comfort innovations to capture growing demand for advanced injection devices. Investment strategies should focus on ultra-fine needle technology and integrated safety systems that address both clinical requirements and user experience considerations.

Distribution optimization represents a critical success factor, particularly for reaching rural and remote communities where diabetes prevalence may be higher but product access remains challenging. Partnership strategies with regional pharmacy chains and community health centers can improve market penetration while supporting public health objectives.

Digital integration opportunities should be explored through collaboration with diabetes management platform providers and healthcare technology companies. Connected health solutions offer differentiation potential while creating new revenue streams and customer engagement opportunities that extend beyond traditional product sales.

Cost-effectiveness remains important for market success, requiring manufacturers to balance innovation with affordability considerations that align with provincial healthcare budgets and patient accessibility requirements. Value-based positioning should emphasize total cost of ownership including clinical outcomes and safety benefits rather than unit price comparisons alone.

Market growth prospects remain positive over the next decade, supported by demographic trends, increasing diabetes prevalence, and technological innovations that enhance product performance and patient experience. Growth projections indicate sustained expansion at approximately 6.8% CAGR driven by aging population dynamics and improved diabetes screening programs that identify previously undiagnosed cases.

Technology evolution will continue driving market development through smart syringe innovations, enhanced safety features, and improved needle technologies that address patient comfort and clinical efficacy requirements. Digital health integration represents a significant opportunity for market expansion and product differentiation in increasingly connected healthcare environments.

Regulatory environment evolution may influence market dynamics through updated safety requirements, environmental standards, and quality specifications that shape product development priorities. MWR projections suggest that regulatory changes will generally support market growth by establishing higher standards that favor established manufacturers with robust quality systems.

Competitive landscape will likely consolidate around companies that successfully balance innovation, safety, cost-effectiveness, and market access capabilities. Market leadership will depend on ability to serve diverse customer segments while maintaining product quality and regulatory compliance across changing healthcare policy environments.

The Canada disposable insulin syringes market demonstrates robust fundamentals supported by increasing diabetes prevalence, aging demographics, and universal healthcare coverage that ensures broad patient access to essential medical devices. Market dynamics reflect complex interactions between clinical requirements, patient preferences, cost considerations, and regulatory standards that shape product development and adoption patterns across diverse healthcare settings.

Innovation opportunities in safety technology, ultra-fine needles, and digital health integration provide pathways for market growth and competitive differentiation. Successful market participants will balance technological advancement with cost-effectiveness while addressing diverse needs across urban and rural populations, different age groups, and varying clinical scenarios.

Future success in this market requires comprehensive understanding of provincial healthcare policies, patient demographics, clinical trends, and technological possibilities that influence product demand and utilization patterns. Strategic positioning should emphasize value creation through improved patient outcomes, enhanced safety, and operational efficiency that supports both clinical objectives and healthcare system sustainability goals across Canada’s evolving diabetes care landscape.

What is Disposable Insulin Syringes?

Disposable insulin syringes are single-use medical devices designed for the administration of insulin to manage diabetes. They are typically made of plastic and come in various sizes to accommodate different dosages.

What are the key players in the Canada Disposable Insulin Syringes Market?

Key players in the Canada Disposable Insulin Syringes Market include Becton, Dickinson and Company, Terumo Corporation, and Medtronic, among others.

What are the growth factors driving the Canada Disposable Insulin Syringes Market?

The growth of the Canada Disposable Insulin Syringes Market is driven by the increasing prevalence of diabetes, advancements in insulin delivery technologies, and a growing preference for convenient and safe injection methods.

What challenges does the Canada Disposable Insulin Syringes Market face?

Challenges in the Canada Disposable Insulin Syringes Market include regulatory hurdles, the high cost of advanced syringes, and competition from alternative insulin delivery systems such as insulin pens and pumps.

What opportunities exist in the Canada Disposable Insulin Syringes Market?

Opportunities in the Canada Disposable Insulin Syringes Market include the development of smart syringes with integrated technology for better dosage accuracy and the expansion of healthcare access in remote areas.

What trends are shaping the Canada Disposable Insulin Syringes Market?

Trends in the Canada Disposable Insulin Syringes Market include the increasing adoption of eco-friendly materials for syringe production, the rise of telehealth services for diabetes management, and innovations in syringe design for enhanced user experience.

Canada Disposable Insulin Syringes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Syringes, Safety Syringes, Insulin Pens, Prefilled Syringes |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Distribution Channel | Online Retail, Offline Retail, Wholesalers, Direct Sales |

| Material | Plastic, Glass, Rubber, Metal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Disposable Insulin Syringes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at