444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Australia Intelligent Virtual Assistant (IVA) Based Banking Market represents a significant evolution in the banking sector, leveraging advanced artificial intelligence (AI) and natural language processing (NLP) technologies to enhance customer service, streamline banking operations, and improve overall efficiency. IVAs, also known as virtual assistants or chatbots, offer personalized and real-time assistance to banking customers through digital channels such as websites, mobile apps, and messaging platforms. As Australian banks prioritize digital transformation and customer experience excellence, the adoption of IVAs continues to grow, reshaping the future of banking in the country.

Meaning

Intelligent Virtual Assistants (IVAs) in the banking sector refer to AI-powered digital assistants designed to interact with customers, provide information, answer queries, and perform transactions in a conversational manner. IVAs leverage NLP algorithms, machine learning, and data analytics to understand customer intent, context, and preferences, delivering personalized banking experiences across digital touchpoints. By integrating IVAs into their banking platforms, Australian financial institutions aim to enhance customer engagement, automate routine tasks, and deliver seamless omnichannel banking services.

Executive Summary

The Australia Intelligent Virtual Assistant (IVA) Based Banking Market is witnessing rapid growth and adoption driven by the demand for digital banking solutions, the rise of AI technology, and the focus on customer-centricity in the financial services industry. Key market trends include the integration of IVAs into banking apps, the expansion of chatbot functionalities, and the emergence of voice-enabled banking services. Understanding market dynamics, customer expectations, and regulatory requirements is crucial for banks to leverage IVAs effectively and deliver superior banking experiences to Australian consumers.

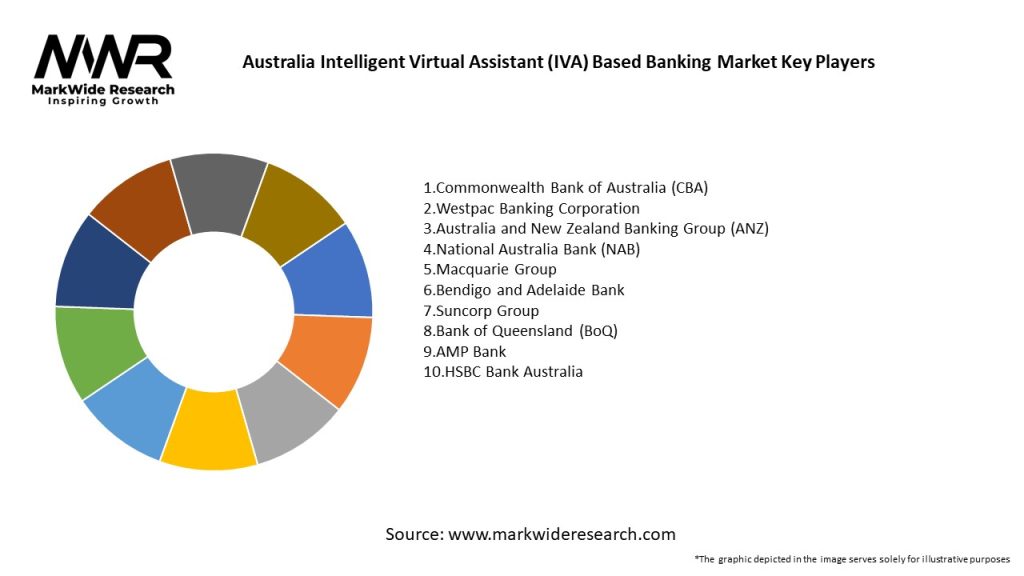

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia Intelligent Virtual Assistant (IVA) Based Banking Market operates within a dynamic ecosystem shaped by technological innovation, regulatory changes, competitive pressures, and evolving customer expectations. Market dynamics influence product development, market positioning, and strategic decision-making among banks and fintech companies seeking to capitalize on the opportunities presented by IVAs in banking.

Regional Analysis

Regional analysis of the Australia Intelligent Virtual Assistant (IVA) Based Banking Market highlights variations in market demand, customer preferences, and regulatory landscapes across different states and territories. Major metropolitan areas such as Sydney, Melbourne, Brisbane, and Perth serve as hubs for banking innovation and digital transformation, driving adoption of IVAs and digital banking solutions among urban consumers.

Competitive Landscape

Leading Companies in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

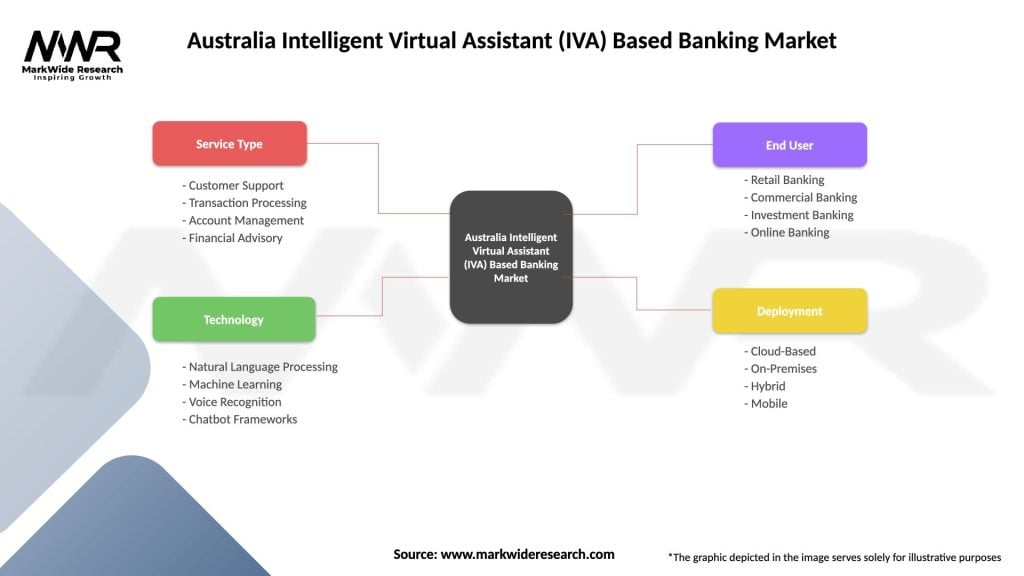

Segmentation

Segmentation of the Australia Intelligent Virtual Assistant (IVA) Based Banking Market allows for targeted marketing, product development, and customer segmentation strategies tailored to specific banking segments, demographics, and user personas. Key segmentation criteria include customer preferences, banking needs, digital literacy levels, and channel preferences, enabling banks to offer customized IVAs and banking experiences to different customer segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of IVAs in the Australia banking sector, reshaping customer interactions, service delivery, and operational strategies in response to changing market dynamics and consumer behavior:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Australia Intelligent Virtual Assistant (IVA) Based Banking Market is characterized by opportunities for innovation, growth, and transformation in the banking industry:

Conclusion

In conclusion, the Australia Intelligent Virtual Assistant (IVA) Based Banking Market represents a transformative shift in the banking industry, driven by advances in AI, NLP, and digital technologies that enable personalized, conversational, and omnichannel banking experiences. IVAs play a pivotal role in enhancing customer engagement, streamlining banking operations, and driving innovation in financial services, positioning banks to meet the evolving needs and expectations of Australian consumers in the digital age. By embracing AI-driven personalization, voice-first banking, and ethical AI practices, banks can unlock new opportunities for growth, differentiation, and value creation in the Australia banking sector, shaping the future of banking with intelligent virtual assistant technology.

What is Intelligent Virtual Assistant (IVA) Based Banking?

Intelligent Virtual Assistant (IVA) Based Banking refers to the use of AI-driven virtual assistants in the banking sector to enhance customer service, streamline operations, and provide personalized financial advice. These systems can handle inquiries, process transactions, and offer insights based on user data.

What are the key players in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market?

Key players in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market include Commonwealth Bank of Australia, Westpac Banking Corporation, and ANZ Banking Group, among others. These companies are leveraging IVA technology to improve customer engagement and operational efficiency.

What are the growth factors driving the Australia Intelligent Virtual Assistant (IVA) Based Banking Market?

The growth of the Australia Intelligent Virtual Assistant (IVA) Based Banking Market is driven by increasing demand for enhanced customer service, the need for operational efficiency, and the rising adoption of AI technologies in financial services. Additionally, the shift towards digital banking is propelling the use of IVAs.

What challenges does the Australia Intelligent Virtual Assistant (IVA) Based Banking Market face?

Challenges in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market include concerns over data privacy and security, the need for continuous updates to AI algorithms, and potential resistance from customers who prefer human interaction. These factors can hinder the widespread adoption of IVAs.

What opportunities exist in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market?

Opportunities in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market include the potential for personalized banking experiences, the integration of IVAs with other digital services, and the ability to analyze customer data for better service offerings. This can lead to improved customer satisfaction and loyalty.

What trends are shaping the Australia Intelligent Virtual Assistant (IVA) Based Banking Market?

Trends shaping the Australia Intelligent Virtual Assistant (IVA) Based Banking Market include the increasing use of natural language processing for better customer interactions, the rise of omnichannel banking experiences, and the growing focus on AI ethics and responsible use of technology. These trends are influencing how banks implement IVA solutions.

Australia Intelligent Virtual Assistant (IVA) Based Banking Market

| Segmentation Details | Description |

|---|---|

| Service Type | Customer Support, Transaction Processing, Account Management, Financial Advisory |

| Technology | Natural Language Processing, Machine Learning, Voice Recognition, Chatbot Frameworks |

| End User | Retail Banking, Commercial Banking, Investment Banking, Online Banking |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Intelligent Virtual Assistant (IVA) Based Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at