444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific ammonium nitrate market represents one of the most dynamic and rapidly expanding segments within the global fertilizer industry. This region encompasses major agricultural economies including China, India, Japan, Australia, and Southeast Asian nations, where ammonium nitrate serves as a critical nitrogen-based fertilizer supporting food security initiatives. The market demonstrates robust growth patterns driven by increasing agricultural productivity demands, population growth, and modernization of farming practices across diverse climatic zones.

Regional dynamics indicate that the Asia-Pacific ammonium nitrate market is experiencing significant expansion, with growth rates reaching 6.2% CAGR over recent years. This growth trajectory reflects the region’s commitment to enhancing agricultural output while addressing the nutritional needs of over half the world’s population. The market encompasses both agricultural-grade and industrial-grade ammonium nitrate applications, with agricultural use dominating approximately 78% of total consumption across the region.

Manufacturing capabilities within the Asia-Pacific region have strengthened considerably, with countries like China and India establishing themselves as major production hubs. The region benefits from abundant natural gas resources, advanced chemical processing infrastructure, and proximity to key agricultural markets. Supply chain integration has improved significantly, enabling efficient distribution networks that serve both domestic consumption and export markets throughout the region.

The Asia-Pacific ammonium nitrate market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of ammonium nitrate (NH4NO3) across countries within the Asia-Pacific geographical region. This white crystalline compound serves primarily as a high-nitrogen fertilizer containing approximately 34% nitrogen content, making it highly effective for crop nutrition and soil enhancement applications.

Market scope includes various grades and formulations of ammonium nitrate, ranging from agricultural-grade fertilizers to industrial applications in mining, explosives manufacturing, and chemical processing. The Asia-Pacific market specifically addresses the unique agricultural requirements, regulatory frameworks, and economic conditions prevalent across diverse countries from East Asia to Oceania, encompassing both developed and emerging economies with varying agricultural intensities.

Functional applications within this market extend beyond traditional fertilizer use to include specialized industrial applications, soil conditioning products, and integrated nutrient management systems. The market definition encompasses the entire value chain from raw material procurement and manufacturing to end-user application across agricultural, industrial, and commercial sectors throughout the Asia-Pacific region.

Strategic positioning of the Asia-Pacific ammonium nitrate market reveals a landscape characterized by strong growth fundamentals, increasing agricultural modernization, and expanding industrial applications. The region’s market demonstrates resilience through diversified end-use applications, with agricultural consumption representing the dominant segment while industrial applications provide additional growth opportunities and market stability.

Key performance indicators highlight the market’s robust expansion, with production capacity utilization rates reaching 82% across major manufacturing facilities in the region. This high utilization reflects strong demand dynamics and efficient supply chain management. The market benefits from favorable government policies supporting agricultural productivity, food security initiatives, and sustainable farming practices that encourage optimal fertilizer utilization.

Competitive dynamics showcase a mix of large-scale integrated chemical companies, regional fertilizer manufacturers, and specialized distributors serving diverse market segments. The market structure supports both commodity-grade products for large-scale agricultural operations and specialty formulations for precision agriculture applications. Innovation focus centers on enhanced efficiency formulations, controlled-release technologies, and environmentally sustainable production processes.

Future trajectory indicates continued market expansion supported by increasing food demand, agricultural intensification, and industrial development across the region. The market is positioned to benefit from ongoing infrastructure development, technological advancement, and regional trade integration that facilitates efficient product distribution and market access across diverse geographical areas.

Agricultural transformation across the Asia-Pacific region drives fundamental market dynamics, with countries implementing modern farming techniques that require precise nutrient management. The shift toward intensive agriculture and crop yield optimization creates sustained demand for high-quality nitrogen fertilizers, positioning ammonium nitrate as a preferred choice for many crop types and soil conditions.

Population growth across the Asia-Pacific region creates fundamental pressure for increased food production, directly driving demand for effective fertilizers including ammonium nitrate. With regional population growth rates maintaining steady momentum, agricultural systems must enhance productivity to meet growing nutritional requirements while working within existing arable land constraints.

Agricultural modernization initiatives implemented by governments throughout the region promote adoption of scientific farming practices, precision agriculture technologies, and optimized nutrient management systems. These programs often include subsidies, technical support, and educational initiatives that encourage farmers to utilize high-quality fertilizers like ammonium nitrate for improved crop yields and soil health.

Economic development in emerging markets within the region increases purchasing power and enables farmers to invest in premium agricultural inputs. Rising income levels support transition from subsistence farming to commercial agriculture, creating demand for efficient fertilizers that maximize return on investment through enhanced crop productivity and quality.

Industrial expansion across various sectors including mining, construction, and chemical processing generates additional demand for ammonium nitrate beyond agricultural applications. The region’s robust industrial growth creates opportunities for market diversification and reduces dependence on seasonal agricultural demand patterns.

Government support programs focusing on food security, agricultural self-sufficiency, and rural development provide policy frameworks that encourage fertilizer adoption. These initiatives often include infrastructure development, research funding, and market access improvements that benefit the entire ammonium nitrate value chain.

Regulatory restrictions surrounding ammonium nitrate handling, storage, and transportation create operational challenges for market participants. Safety regulations implemented to prevent misuse in explosive applications require specialized facilities, trained personnel, and compliance systems that increase operational costs and complexity throughout the supply chain.

Price volatility of raw materials, particularly natural gas and ammonia, directly impacts ammonium nitrate production costs and market pricing. Fluctuating energy prices and feedstock availability create uncertainty for both manufacturers and end-users, potentially affecting demand patterns and investment decisions across the market.

Environmental concerns related to nitrogen fertilizer application, including potential groundwater contamination and greenhouse gas emissions, influence regulatory policies and public perception. These concerns may lead to usage restrictions, application guidelines, or preference shifts toward alternative fertilizer options in environmentally sensitive areas.

Competition from alternatives including urea, ammonium sulfate, and other nitrogen-based fertilizers creates market pressure and limits pricing flexibility. The availability of substitute products provides farmers with options that may offer cost advantages or specific agronomic benefits for particular crops or soil conditions.

Infrastructure limitations in certain regional markets affect distribution efficiency and market penetration. Inadequate storage facilities, transportation networks, or handling equipment can restrict market access and increase logistics costs, particularly in remote agricultural areas or developing economies within the region.

Precision agriculture adoption creates opportunities for specialized ammonium nitrate formulations designed for targeted application systems, variable rate technologies, and integrated nutrient management programs. As farmers embrace data-driven agriculture, demand increases for fertilizer products that support precise nutrient delivery and optimize application efficiency.

Organic farming integration presents opportunities for developing ammonium nitrate products that comply with organic certification requirements while providing effective nitrogen nutrition. This growing segment requires innovative formulations and application methods that align with sustainable agriculture principles and organic farming standards.

Industrial applications expansion offers significant growth potential beyond traditional agricultural markets. Opportunities exist in mining operations, chemical manufacturing, water treatment applications, and specialized industrial processes that require high-quality ammonium nitrate with specific purity levels and performance characteristics.

Technology partnerships with agricultural equipment manufacturers, precision farming companies, and digital agriculture platforms create opportunities for integrated solutions that combine ammonium nitrate products with advanced application technologies, monitoring systems, and data analytics capabilities.

Export market development enables regional manufacturers to access international markets and diversify revenue sources. Strategic partnerships, quality certifications, and competitive pricing can position Asia-Pacific producers to serve global demand while reducing dependence on domestic market fluctuations.

Supply-demand equilibrium within the Asia-Pacific ammonium nitrate market reflects complex interactions between production capacity, agricultural demand cycles, industrial consumption, and international trade flows. The market demonstrates seasonal patterns aligned with regional planting schedules, while industrial demand provides baseline consumption that stabilizes overall market dynamics throughout the year.

Manufacturing efficiency improvements have enhanced production capabilities across the region, with modern facilities achieving 95% operational efficiency through advanced process technologies and automation systems. These improvements reduce production costs, improve product quality, and enable competitive pricing that supports market expansion and customer satisfaction.

Regional trade patterns influence market dynamics through import-export flows, cross-border partnerships, and regional supply chain integration. Countries with surplus production capacity serve regional markets, while import-dependent nations rely on efficient distribution networks and strategic partnerships to ensure reliable product availability.

Innovation cycles drive market evolution through development of enhanced formulations, improved production processes, and novel application technologies. Research and development investments focus on increasing nitrogen use efficiency, reducing environmental impact, and developing products that meet evolving agricultural and industrial requirements.

Market consolidation trends affect competitive dynamics as companies pursue strategic acquisitions, joint ventures, and partnerships to strengthen market position, expand geographical coverage, and enhance technological capabilities. These activities reshape market structure and influence pricing, product availability, and customer service levels.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Asia-Pacific ammonium nitrate market. Primary research includes direct interviews with industry executives, manufacturers, distributors, and end-users across key markets within the region to gather firsthand perspectives on market conditions, trends, and future expectations.

Secondary research integration incorporates analysis of industry reports, government statistics, trade publications, and regulatory documents to provide comprehensive market context and validate primary research findings. This approach ensures thorough coverage of market segments, geographical regions, and application areas within the scope of analysis.

Data validation processes include cross-referencing multiple sources, statistical analysis of market trends, and expert review to ensure accuracy and reliability of market insights. Quantitative analysis focuses on production volumes, consumption patterns, trade flows, and growth rates while qualitative analysis addresses market dynamics, competitive positioning, and strategic implications.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. These models incorporate economic indicators, agricultural trends, industrial development patterns, and regulatory changes that influence market development across different time horizons.

China dominates the Asia-Pacific ammonium nitrate market with approximately 42% regional market share, driven by extensive agricultural operations, large-scale manufacturing capabilities, and significant industrial consumption. The country’s integrated chemical industry, abundant natural gas resources, and government support for agricultural modernization create favorable conditions for market expansion and technological advancement.

India represents the second-largest market within the region, accounting for roughly 28% of regional consumption. The country’s vast agricultural sector, growing population, and government initiatives promoting food security drive substantial demand for nitrogen fertilizers. India’s market is characterized by both domestic production and strategic imports to meet growing agricultural requirements.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Malaysia collectively contribute 18% of regional demand. These markets benefit from tropical agriculture systems, export-oriented crop production, and economic development that supports agricultural intensification. The region shows strong growth potential driven by expanding palm oil, rice, and cash crop production.

Japan and South Korea represent mature markets with approximately 8% combined regional share, characterized by high-value agriculture, precision farming adoption, and quality-focused applications. These markets emphasize premium products, environmental compliance, and technological innovation in fertilizer application and crop management systems.

Australia and New Zealand account for the remaining 4% of regional consumption, with markets focused on extensive agriculture, livestock support crops, and export-oriented production systems. These markets emphasize efficiency, sustainability, and integration with modern farming practices that optimize input utilization and environmental stewardship.

Market leadership within the Asia-Pacific ammonium nitrate sector is characterized by a mix of large integrated chemical companies, regional fertilizer manufacturers, and specialized distributors serving diverse market segments. The competitive environment emphasizes production efficiency, product quality, distribution capabilities, and customer service excellence.

Competitive strategies focus on operational efficiency, product innovation, market expansion, and strategic partnerships that enhance market position and customer value. Companies invest in advanced manufacturing technologies, quality improvement programs, and sustainability initiatives that differentiate their offerings in competitive markets.

By Application: The Asia-Pacific ammonium nitrate market segments into agricultural and industrial applications, with agriculture representing the dominant segment due to extensive farming operations across the region. Agricultural applications include field crops, horticulture, plantation crops, and specialty agriculture that require precise nitrogen nutrition for optimal productivity.

By Grade: Market segmentation includes various product grades designed for specific applications and quality requirements, ranging from agricultural-grade fertilizers to high-purity industrial grades with specialized performance characteristics.

Agricultural category dominates the Asia-Pacific ammonium nitrate market with robust demand driven by intensive farming systems, crop diversification, and yield optimization requirements. This segment benefits from government support programs, agricultural modernization initiatives, and increasing adoption of scientific farming practices that emphasize balanced nutrition and soil health management.

Rice cultivation represents a significant application category within the agricultural segment, particularly in countries like China, India, Thailand, and Vietnam where rice serves as a staple crop. Ammonium nitrate provides readily available nitrogen that supports tillering, grain filling, and overall plant development in flooded rice systems.

Industrial category shows steady growth driven by mining operations, chemical manufacturing, and specialized industrial processes across the region. This segment values product consistency, purity levels, and reliable supply chains that support continuous operations and quality requirements in industrial applications.

Horticultural applications represent a growing category characterized by premium pricing, quality focus, and specialized formulations designed for high-value crops. This segment includes greenhouse production, fruit cultivation, and vegetable farming that require precise nutrient management and consistent product performance.

Export-oriented agriculture creates demand for high-quality ammonium nitrate products that support production of cash crops, plantation crops, and agricultural commodities destined for international markets. This category emphasizes product quality, application efficiency, and compliance with international quality standards.

Manufacturers benefit from expanding market opportunities, diversified application segments, and growing regional demand that supports capacity utilization and revenue growth. The Asia-Pacific market offers scale advantages, cost-effective production opportunities, and access to both domestic and export markets through strategic positioning and operational excellence.

Distributors and retailers gain from comprehensive product portfolios, established supply chains, and growing customer base across agricultural and industrial segments. Market expansion creates opportunities for geographic diversification, customer relationship development, and value-added services that enhance competitive positioning and profitability.

Agricultural producers benefit from reliable nitrogen nutrition that supports crop productivity, quality improvement, and economic returns. Ammonium nitrate provides quick-release nitrogen that matches plant uptake patterns, enabling efficient nutrient utilization and reduced application costs compared to alternative fertilizer options.

Industrial users gain access to consistent, high-quality products that meet specific process requirements and performance standards. Reliable supply chains, technical support, and product consistency enable efficient operations and quality outcomes in industrial applications ranging from mining to chemical processing.

Government stakeholders benefit from enhanced food security, agricultural productivity, and economic development supported by efficient fertilizer markets. The industry contributes to rural development, employment generation, and export earnings while supporting national objectives for agricultural self-sufficiency and food security.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture adoption drives demand for specialized ammonium nitrate formulations designed for variable rate application, targeted nutrient delivery, and integration with digital farming technologies. This trend supports market premiumization and creates opportunities for value-added products that enhance application efficiency and crop performance.

Sustainability focus influences product development toward enhanced efficiency formulations, reduced environmental impact, and sustainable production processes. MarkWide Research indicates that 67% of manufacturers are investing in sustainability initiatives that address environmental concerns while maintaining product effectiveness and economic viability.

Supply chain digitization transforms distribution networks through digital platforms, inventory management systems, and customer service technologies that improve efficiency and market responsiveness. These developments enhance customer experience, reduce operational costs, and enable better demand forecasting and supply planning.

Quality standardization trends emphasize consistent product specifications, enhanced purity levels, and compliance with international quality standards that support export opportunities and premium market positioning. This focus on quality creates competitive advantages and supports market expansion into quality-sensitive applications.

Regional integration facilitates cross-border trade, supply chain optimization, and market access improvements that benefit manufacturers, distributors, and end-users throughout the Asia-Pacific region. Trade agreements and infrastructure development support market expansion and competitive positioning.

Capacity expansion projects across major manufacturing facilities reflect industry confidence in long-term market growth and demand sustainability. Recent investments focus on advanced production technologies, environmental compliance, and operational efficiency improvements that enhance competitive positioning and market service capabilities.

Strategic partnerships between manufacturers, distributors, and technology companies create integrated solutions that combine ammonium nitrate products with application technologies, monitoring systems, and customer support services. These collaborations enhance market reach, customer value, and competitive differentiation in evolving markets.

Regulatory developments including safety standards, environmental regulations, and quality requirements influence industry practices and market dynamics. Companies invest in compliance systems, safety technologies, and environmental management programs that ensure regulatory adherence while maintaining operational efficiency.

Technology innovations in production processes, product formulations, and application methods drive industry advancement and market evolution. Research and development investments focus on efficiency improvements, environmental sustainability, and performance enhancement that benefit both manufacturers and end-users.

Market consolidation activities including acquisitions, joint ventures, and strategic alliances reshape competitive dynamics and market structure. These developments create opportunities for operational synergies, market expansion, and enhanced customer service capabilities across the region.

Market participants should focus on operational excellence, customer relationship development, and strategic positioning that leverages regional growth opportunities while addressing competitive challenges. Success requires balancing cost efficiency with quality improvement and customer service enhancement that creates sustainable competitive advantages.

Investment priorities should emphasize production efficiency, environmental compliance, and technology integration that support long-term market position and operational sustainability. Companies should consider capacity optimization, quality improvement, and supply chain enhancement as key areas for strategic investment and development.

Geographic expansion strategies should target high-growth markets within the region while building distribution capabilities and customer relationships that support market penetration and revenue growth. Success requires understanding local market conditions, regulatory requirements, and customer preferences that influence product acceptance and market success.

Product development initiatives should focus on enhanced formulations, specialty applications, and value-added services that differentiate offerings and capture premium market segments. Innovation should address customer needs for efficiency, sustainability, and performance while maintaining cost competitiveness and market accessibility.

Partnership strategies should leverage complementary capabilities, market access, and technology resources that enhance competitive position and market coverage. Strategic alliances with distributors, technology companies, and agricultural service providers can create integrated solutions and market differentiation opportunities.

Long-term growth prospects for the Asia-Pacific ammonium nitrate market remain positive, supported by sustained agricultural development, industrial expansion, and population growth that drive fundamental demand for nitrogen fertilizers. The market is positioned to benefit from ongoing economic development, agricultural modernization, and food security initiatives across the region.

Technology advancement will continue shaping market evolution through improved production processes, enhanced product formulations, and integrated application systems that optimize performance and environmental sustainability. MWR analysis projects that technological innovation adoption rates will reach 85% among major market participants within the next five years.

Market expansion opportunities include geographic diversification, application segment growth, and export market development that leverage regional production capabilities and competitive advantages. Success will depend on strategic positioning, operational excellence, and customer relationship development that create sustainable market presence and revenue growth.

Sustainability integration will become increasingly important as environmental regulations, customer preferences, and industry standards emphasize responsible production and application practices. Companies that successfully balance economic performance with environmental stewardship will achieve competitive advantages and market leadership positions.

Regional integration trends will facilitate market expansion, supply chain optimization, and competitive positioning that benefit industry participants throughout the Asia-Pacific region. Trade facilitation, infrastructure development, and regulatory harmonization will support market growth and operational efficiency improvements across diverse geographical markets.

The Asia-Pacific ammonium nitrate market demonstrates strong fundamentals and positive growth trajectory supported by robust agricultural demand, expanding industrial applications, and favorable regional economic conditions. Market dynamics reflect the complex interplay of agricultural modernization, industrial development, and government policies that create sustained demand for high-quality nitrogen fertilizers across diverse end-use segments.

Strategic positioning within this market requires understanding regional variations, customer requirements, and competitive dynamics that influence market success and sustainable growth. Companies that focus on operational excellence, product quality, customer service, and strategic partnerships are well-positioned to capitalize on market opportunities while addressing competitive challenges and regulatory requirements.

Future success in the Asia-Pacific ammonium nitrate market will depend on balancing traditional agricultural applications with emerging opportunities in industrial segments, specialty applications, and export markets. The market offers significant potential for companies that can effectively combine production efficiency, product innovation, and customer relationship development to create sustainable competitive advantages and long-term market leadership positions.

What is Ammonium Nitrate?

Ammonium Nitrate is a chemical compound commonly used as a fertilizer in agriculture, as well as in explosives for mining and construction. It is known for its high nitrogen content, which promotes plant growth and enhances crop yields.

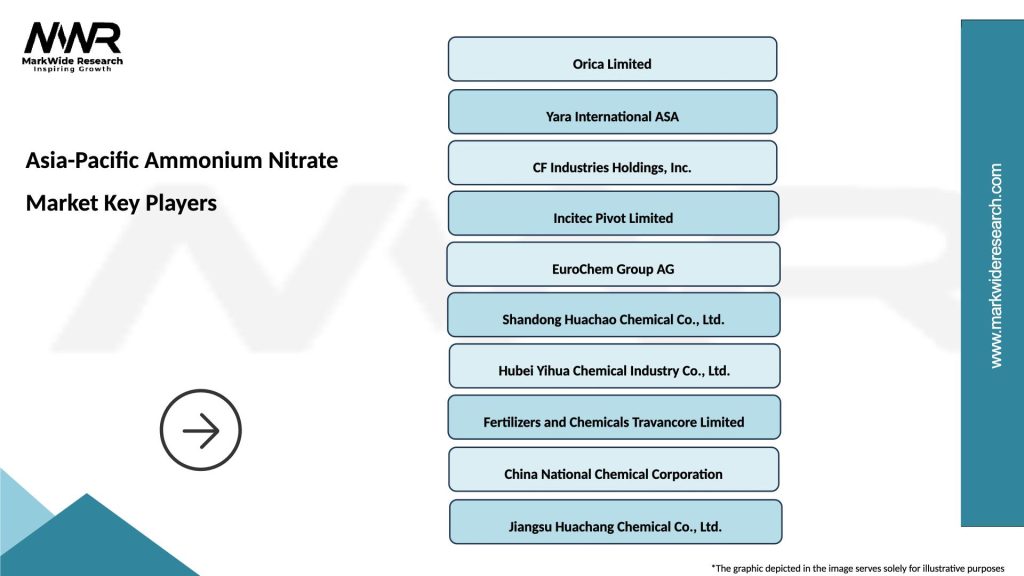

What are the key players in the Asia-Pacific Ammonium Nitrate Market?

Key players in the Asia-Pacific Ammonium Nitrate Market include Orica Limited, Yara International, and CF Industries Holdings, among others. These companies are involved in the production and distribution of ammonium nitrate for various applications.

What are the growth factors driving the Asia-Pacific Ammonium Nitrate Market?

The growth of the Asia-Pacific Ammonium Nitrate Market is driven by increasing agricultural activities, rising demand for food production, and the expansion of mining operations. Additionally, the need for efficient fertilizers to enhance crop yields contributes to market growth.

What challenges does the Asia-Pacific Ammonium Nitrate Market face?

The Asia-Pacific Ammonium Nitrate Market faces challenges such as regulatory restrictions on the use of ammonium nitrate in explosives and environmental concerns regarding its application in agriculture. These factors can impact production and usage patterns.

What opportunities exist in the Asia-Pacific Ammonium Nitrate Market?

Opportunities in the Asia-Pacific Ammonium Nitrate Market include the development of advanced fertilizers that improve nutrient efficiency and the potential for increased exports to regions with growing agricultural needs. Innovations in production processes also present growth avenues.

What trends are shaping the Asia-Pacific Ammonium Nitrate Market?

Trends in the Asia-Pacific Ammonium Nitrate Market include a shift towards sustainable agricultural practices, the adoption of precision farming techniques, and the increasing use of controlled-release fertilizers. These trends aim to enhance efficiency and reduce environmental impact.

Asia-Pacific Ammonium Nitrate Market

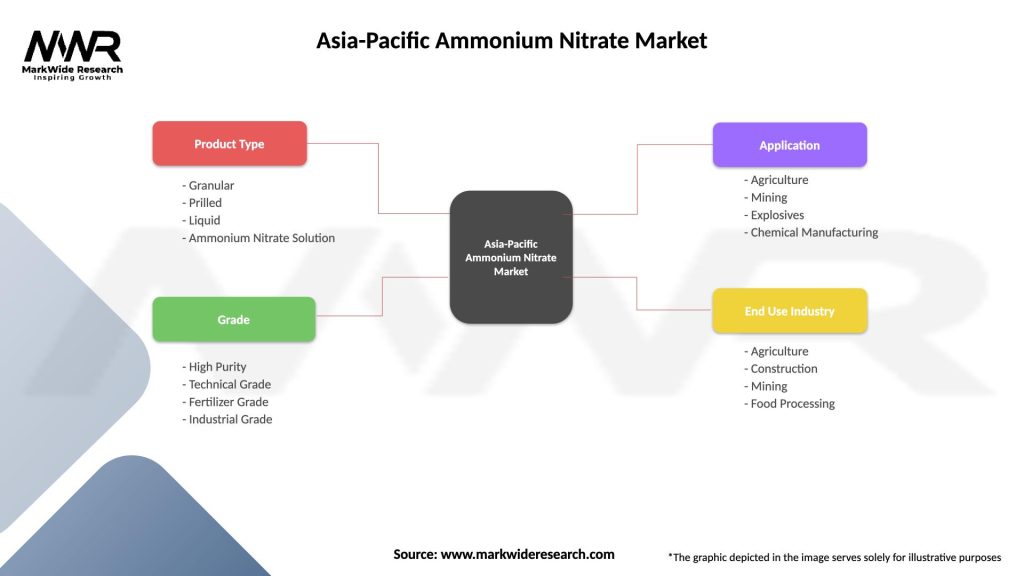

| Segmentation Details | Description |

|---|---|

| Product Type | Granular, Prilled, Liquid, Ammonium Nitrate Solution |

| Grade | High Purity, Technical Grade, Fertilizer Grade, Industrial Grade |

| Application | Agriculture, Mining, Explosives, Chemical Manufacturing |

| End Use Industry | Agriculture, Construction, Mining, Food Processing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Ammonium Nitrate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at