444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC oral care market represents one of the most dynamic and rapidly expanding consumer healthcare segments across the Asia-Pacific region. This comprehensive market encompasses a diverse range of oral hygiene products including toothpaste, toothbrushes, mouthwash, dental floss, and specialized dental care solutions. The region’s growing awareness of oral health importance, combined with rising disposable incomes and urbanization trends, has created unprecedented opportunities for market expansion.

Market dynamics in the APAC region are characterized by significant heterogeneity across different countries, with varying consumer preferences, regulatory frameworks, and economic development levels. The market is experiencing robust growth driven by increasing health consciousness, aging populations, and the proliferation of modern retail channels. Digital transformation has also played a crucial role in reshaping consumer purchasing behaviors and brand engagement strategies.

Regional diversity presents both opportunities and challenges for market participants. While developed markets like Japan and South Korea demonstrate sophisticated consumer preferences for premium oral care products, emerging economies such as India and Southeast Asian nations show tremendous potential for basic oral care product penetration. The market is projected to grow at a substantial CAGR over the forecast period, with natural and organic oral care products gaining significant traction among health-conscious consumers.

The APAC oral care market refers to the comprehensive ecosystem of products, services, and solutions designed to maintain and improve oral hygiene across the Asia-Pacific region. This market encompasses traditional oral care products such as toothpaste, toothbrushes, and mouthwash, as well as innovative solutions including electric toothbrushes, whitening products, and specialized therapeutic oral care items.

Market scope extends beyond basic hygiene products to include professional dental care accessories, orthodontic care products, and emerging categories like oral probiotics and natural oral care solutions. The definition also encompasses the entire value chain from raw material suppliers and manufacturers to distributors, retailers, and end consumers across diverse APAC markets.

Geographic coverage includes major economies such as China, India, Japan, South Korea, Australia, and Southeast Asian nations, each contributing unique market characteristics and growth drivers. The market definition recognizes the cultural, economic, and regulatory diversity that shapes consumer preferences and market dynamics across different APAC countries.

Strategic analysis reveals that the APAC oral care market is positioned for sustained growth, driven by demographic shifts, increasing health awareness, and evolving consumer preferences. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating diverse regulatory environments and cultural preferences across the region.

Key growth drivers include urbanization trends, rising middle-class populations, and increased focus on preventive healthcare. The market is witnessing a significant shift toward premium and specialized oral care products, with consumers increasingly willing to invest in advanced oral hygiene solutions. Innovation momentum remains strong, with companies investing heavily in research and development to create products tailored to regional preferences and needs.

Market consolidation trends are evident, with leading global brands strengthening their presence through strategic acquisitions and partnerships with local players. The competitive landscape is characterized by intense rivalry among established multinational corporations and emerging regional brands that leverage local market knowledge and cost advantages.

Digital transformation has accelerated market evolution, with e-commerce platforms becoming increasingly important distribution channels. Social media marketing and influencer partnerships have emerged as critical strategies for brand building and consumer engagement, particularly among younger demographics who represent the future of oral care consumption.

Consumer behavior analysis reveals several critical insights shaping the APAC oral care market landscape:

Demographic transformation serves as a primary catalyst for market growth across the APAC region. The expanding middle-class population, coupled with increasing urbanization rates, has created a substantial consumer base with higher disposable incomes and greater awareness of oral health importance. Population aging in developed APAC markets has also driven demand for specialized oral care products addressing age-related dental concerns.

Health consciousness evolution represents another significant driver, with consumers increasingly recognizing the connection between oral health and overall wellness. This awareness has been amplified by healthcare professionals’ advocacy and educational campaigns highlighting the importance of preventive oral care. Lifestyle changes associated with urbanization, including dietary shifts and increased stress levels, have further emphasized the need for comprehensive oral care solutions.

Economic prosperity across many APAC markets has enabled consumers to upgrade from basic oral care products to premium alternatives offering enhanced benefits. Rising disposable incomes have particularly benefited the premium and specialized oral care segments, with consumers showing willingness to invest in products promising superior results and convenience.

Technological advancement has revolutionized product development and consumer engagement strategies. Innovation in product formulations, packaging technologies, and digital marketing has created new opportunities for market expansion and consumer education. Smart oral care devices and connected health solutions are gaining traction among technology-adopting consumers, particularly in developed APAC markets.

Economic disparities across APAC markets present significant challenges for uniform market development. While some regions demonstrate strong purchasing power, others remain price-sensitive, limiting the adoption of premium oral care products. Income inequality within individual markets also creates segmented consumer bases with vastly different spending capabilities and priorities.

Cultural barriers and traditional oral care practices in certain regions may resist modern commercial oral care products. Some consumers prefer traditional remedies and natural alternatives, viewing commercial products with skepticism. Educational gaps regarding oral health importance persist in rural and less developed areas, limiting market penetration for advanced oral care solutions.

Regulatory complexity across different APAC markets creates compliance challenges for manufacturers and distributors. Varying safety standards, labeling requirements, and import regulations increase operational costs and complexity for companies operating across multiple markets. Regulatory changes can also impact product formulations and marketing strategies, requiring continuous adaptation and investment.

Competitive intensity has led to margin pressure across various market segments. The presence of numerous local and international players has intensified price competition, particularly in basic oral care categories. Counterfeit products in some markets also pose challenges to legitimate brands, affecting consumer trust and market dynamics.

Emerging market penetration presents substantial growth opportunities, particularly in countries with large populations and improving economic conditions. Rural market development initiatives and infrastructure improvements are creating new distribution channels and consumer touchpoints. Market education programs can significantly expand the addressable market by increasing awareness of oral health importance and product benefits.

Product innovation opportunities abound in developing specialized solutions for specific consumer needs and preferences. Natural and organic oral care products represent a high-growth segment with significant potential for expansion. Personalized oral care solutions leveraging technology and consumer data analytics offer opportunities for premium positioning and enhanced customer loyalty.

Digital transformation creates opportunities for direct consumer engagement and innovative distribution models. E-commerce platforms, subscription services, and digital marketing strategies can help brands reach previously inaccessible consumer segments. Social commerce and influencer partnerships present new avenues for brand building and product promotion, particularly among younger demographics.

Strategic partnerships with healthcare providers, dental professionals, and local distributors can accelerate market penetration and credibility building. Collaborative approaches with educational institutions and government health initiatives can support market development while contributing to public health objectives. Sustainability initiatives also present opportunities for differentiation and alignment with growing environmental consciousness among consumers.

Supply chain evolution continues to reshape the APAC oral care market landscape. Companies are investing in regional manufacturing capabilities to reduce costs and improve supply chain resilience. Local sourcing initiatives are gaining momentum, driven by both cost considerations and sustainability objectives. The COVID-19 pandemic has accelerated supply chain localization trends and highlighted the importance of supply chain flexibility.

Consumer engagement strategies have evolved significantly with digital transformation. Brands are leveraging social media platforms, mobile applications, and digital content to educate consumers and build brand loyalty. Omnichannel approaches combining online and offline touchpoints are becoming essential for comprehensive market coverage and consumer convenience.

Innovation cycles are accelerating as companies compete to introduce differentiated products and capture market share. Research and development investments are focusing on natural ingredients, advanced formulations, and technology integration. Collaborative innovation with research institutions and technology partners is becoming increasingly common to accelerate product development timelines.

Regulatory landscape continues to evolve across APAC markets, with governments implementing stricter safety standards and labeling requirements. Companies must navigate complex regulatory environments while ensuring compliance across multiple jurisdictions. Regulatory harmonization efforts in some regions are creating opportunities for streamlined operations and reduced compliance costs.

Comprehensive research approach employed for this analysis combines primary and secondary research methodologies to ensure data accuracy and market insight depth. The methodology encompasses quantitative data collection through surveys and market analysis, complemented by qualitative insights from industry expert interviews and focus group discussions with consumers across key APAC markets.

Primary research activities included structured interviews with industry executives, distributors, retailers, and healthcare professionals to gather firsthand insights into market trends and dynamics. Consumer surveys were conducted across major APAC markets to understand purchasing behaviors, brand preferences, and emerging needs. Market observation studies in retail environments provided additional insights into consumer decision-making processes and product positioning strategies.

Secondary research involved comprehensive analysis of industry reports, company financial statements, regulatory filings, and trade publications. Market data was cross-validated through multiple sources to ensure accuracy and reliability. Database analysis of import-export statistics, production data, and consumption patterns provided quantitative foundations for market sizing and trend analysis.

Analytical framework incorporated statistical modeling techniques to project market trends and identify growth opportunities. Scenario analysis was employed to assess potential market developments under different economic and regulatory conditions. Expert validation processes ensured research findings aligned with industry realities and provided actionable insights for market participants.

China dominates the APAC oral care market landscape, representing approximately 40% of regional market share due to its massive population and rapidly growing middle class. The Chinese market demonstrates strong growth in premium oral care segments, with consumers increasingly adopting international brands and advanced oral care technologies. E-commerce penetration in China has reached exceptional levels, with online platforms becoming primary distribution channels for oral care products.

India represents the second-largest market opportunity with significant growth potential driven by population size and improving economic conditions. The Indian market shows strong preference for value-oriented products, though premium segments are experiencing rapid growth in urban areas. Rural market development initiatives are expanding market reach and creating new growth opportunities for basic oral care products.

Japan and South Korea demonstrate mature market characteristics with sophisticated consumer preferences for premium and innovative oral care solutions. These markets lead in technology adoption and show strong demand for specialized products addressing specific oral health concerns. Aging populations in these markets are driving demand for therapeutic and age-specific oral care products.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and the Philippines show robust growth potential with improving economic conditions and increasing health awareness. These markets demonstrate diverse consumer preferences influenced by cultural factors and varying economic development levels. Market penetration rates for modern oral care products remain relatively low, presenting significant expansion opportunities.

Australia and New Zealand represent developed markets with high penetration rates for premium oral care products. These markets show strong environmental consciousness, driving demand for sustainable and natural oral care solutions. Professional recommendations significantly influence consumer choices in these markets, emphasizing the importance of dental professional engagement strategies.

Market leadership is characterized by intense competition among established multinational corporations and emerging regional players. The competitive landscape demonstrates clear segmentation between global brands leveraging international expertise and local brands capitalizing on regional market knowledge and cost advantages.

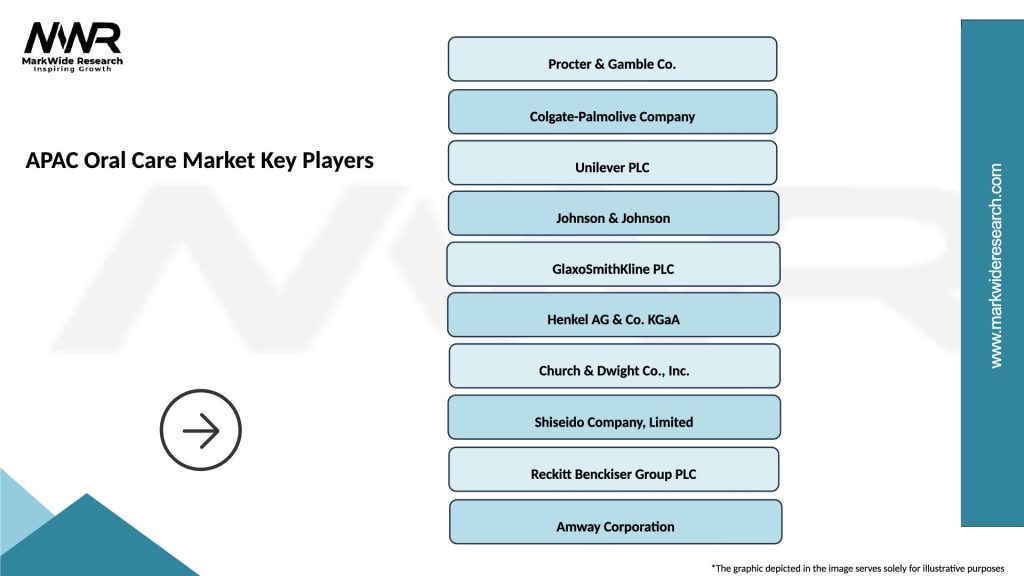

Leading market participants include:

Competitive strategies focus on product innovation, brand building, distribution expansion, and strategic partnerships. Companies are investing heavily in research and development to create differentiated products addressing specific regional preferences and needs. Digital transformation initiatives are becoming critical competitive differentiators, particularly in consumer engagement and e-commerce capabilities.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Toothpaste category maintains market dominance with continuous innovation in formulations and packaging. Natural and organic toothpaste variants are experiencing exceptional growth rates as consumers seek chemical-free alternatives. Whitening toothpaste represents a premium sub-segment with strong growth potential, particularly among younger demographics influenced by social media and aesthetic consciousness.

Electric toothbrush segment demonstrates remarkable growth trajectory with technology adoption rates increasing significantly across developed APAC markets. Smart toothbrushes with mobile app connectivity are gaining traction among tech-savvy consumers. The segment benefits from dental professional recommendations and growing awareness of superior cleaning efficacy compared to manual alternatives.

Mouthwash category shows strong diversification with therapeutic, cosmetic, and natural variants addressing specific consumer needs. Alcohol-free formulations are gaining popularity due to health consciousness and preference for gentler products. Professional-grade mouthwash products are expanding from dental offices to consumer markets, driven by efficacy claims and professional endorsements.

Natural and organic oral care represents the fastest-growing category segment with double-digit growth rates across multiple APAC markets. Consumer preference for natural ingredients, environmental sustainability, and chemical-free formulations drives this segment’s expansion. Traditional medicine integration, particularly Ayurvedic and herbal formulations, resonates strongly with regional consumer preferences.

Children’s oral care segment demonstrates steady growth with specialized formulations, appealing flavors, and educational marketing approaches. Parents’ increasing awareness of early oral health importance drives premium product adoption in this segment. Character licensing and gamification strategies prove effective in encouraging children’s oral care habits and brand loyalty development.

Manufacturers benefit from expanding market opportunities across diverse APAC economies with varying development stages and consumer preferences. The region’s demographic diversity allows for portfolio optimization and risk distribution across multiple market segments. Innovation opportunities abound in developing products tailored to specific regional needs and cultural preferences, creating competitive advantages and premium positioning possibilities.

Distributors and retailers gain from growing consumer demand and expanding product categories. E-commerce growth creates new distribution opportunities and direct consumer engagement possibilities. Omnichannel strategies enable comprehensive market coverage and improved customer service capabilities, leading to enhanced profitability and market share expansion.

Healthcare professionals benefit from increased consumer awareness of oral health importance and willingness to invest in preventive care solutions. Professional recommendations carry significant influence in consumer decision-making, creating opportunities for partnership and education initiatives. Therapeutic product growth expands professional involvement in oral care product selection and patient education.

Consumers gain access to innovative products offering superior efficacy, convenience, and personalization options. Competitive market dynamics drive continuous product improvement and pricing optimization. Digital platforms provide enhanced access to product information, reviews, and purchasing convenience, improving overall consumer experience and satisfaction.

Investors find attractive opportunities in a growing market with diverse investment options across different segments and geographic regions. The market’s resilience and essential nature provide stability, while innovation and premium segments offer growth potential. Sustainability trends create opportunities for ESG-focused investments aligned with environmental and social responsibility objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic trend continues to reshape the APAC oral care market with consumers increasingly seeking chemical-free alternatives. This trend is particularly strong among health-conscious consumers and parents selecting products for children. Herbal formulations incorporating traditional medicine principles are gaining significant traction, especially in markets with strong traditional medicine heritage.

Personalization trend is emerging as brands leverage technology and consumer data to create customized oral care solutions. Personalized toothpaste formulations, customized electric toothbrush settings, and tailored oral care regimens are gaining consumer interest. AI-powered recommendations and smart oral care devices are facilitating this personalization trend.

Sustainability movement is influencing packaging innovations and ingredient sourcing strategies. Consumers are increasingly considering environmental impact in purchasing decisions, driving demand for recyclable packaging and sustainably sourced ingredients. Zero-waste oral care products and refillable packaging systems are emerging as innovative solutions addressing environmental concerns.

Professional-grade products are transitioning from dental offices to consumer markets as consumers seek clinical-level efficacy in home care products. This trend is supported by dental professional endorsements and consumer education about advanced oral care benefits. Therapeutic formulations previously available only through dental professionals are becoming accessible through retail channels.

Digital health integration is creating connected oral care ecosystems where devices, apps, and professional care coordinate to optimize oral health outcomes. Smart toothbrushes, mobile health apps, and teledentistry integration are examples of this trend. Data-driven oral care is enabling personalized recommendations and progress tracking for consumers.

Strategic acquisitions have accelerated as major players seek to expand their regional presence and product portfolios. Recent acquisitions focus on natural and organic brands, technology companies, and regional market leaders with strong local presence. Consolidation trends are reshaping competitive dynamics and creating opportunities for market share expansion.

Innovation partnerships between oral care companies and technology firms are driving smart product development. Collaborations with mobile app developers, IoT companies, and AI specialists are creating next-generation oral care solutions. Research collaborations with universities and research institutions are advancing ingredient science and formulation technologies.

Sustainability initiatives have gained momentum with companies implementing comprehensive environmental programs. Packaging innovations, carbon footprint reduction, and sustainable sourcing programs are becoming standard industry practices. Circular economy principles are being integrated into product design and manufacturing processes.

Digital transformation investments are reshaping marketing, distribution, and consumer engagement strategies. Companies are building comprehensive digital ecosystems including e-commerce platforms, mobile apps, and social media presence. Data analytics capabilities are being developed to understand consumer behavior and optimize marketing effectiveness.

Regulatory compliance initiatives are addressing evolving safety standards and labeling requirements across APAC markets. Companies are investing in regulatory expertise and compliance systems to navigate complex multi-market requirements. Quality assurance programs are being enhanced to meet increasing consumer expectations and regulatory standards.

Market entry strategies should prioritize understanding local consumer preferences and cultural factors that influence oral care habits. Companies entering new APAC markets should invest in comprehensive market research and consider partnerships with local distributors or brands. Localization efforts in product formulation, packaging, and marketing messaging are critical for success in diverse regional markets.

Innovation focus should align with emerging consumer trends including natural ingredients, sustainability, and technology integration. According to MarkWide Research analysis, companies investing in natural and organic product development are achieving superior growth rates compared to traditional product categories. Technology integration opportunities should be pursued selectively based on market readiness and consumer adoption patterns.

Distribution strategy optimization should embrace omnichannel approaches combining traditional retail with e-commerce platforms. Digital commerce capabilities are becoming essential for market competitiveness, particularly among younger consumer demographics. Rural market development requires specialized distribution strategies and product formulations addressing price sensitivity and accessibility challenges.

Brand building investments should emphasize professional endorsements and educational marketing approaches. Dental professional partnerships provide credibility and influence consumer decision-making significantly. Digital marketing strategies should leverage social media platforms and influencer partnerships to reach target demographics effectively.

Sustainability integration should be considered a strategic imperative rather than optional initiative. Environmental consciousness is growing rapidly among APAC consumers and will increasingly influence purchasing decisions. Circular economy principles should be integrated into product development and packaging strategies to meet evolving consumer expectations.

Market trajectory indicates sustained growth across the APAC oral care market with particularly strong performance expected in emerging economies. The market is projected to experience robust expansion driven by demographic trends, economic development, and increasing health consciousness. Premium segment growth is expected to outpace basic product categories as consumer purchasing power and sophistication increase.

Technology adoption will accelerate with smart oral care devices and connected health solutions gaining mainstream acceptance. The integration of artificial intelligence, IoT connectivity, and mobile health platforms will create new product categories and consumer engagement opportunities. Digital health ecosystems will become increasingly important for comprehensive oral care management.

Natural and organic segments are projected to maintain exceptional growth momentum with expanding consumer base and product variety. Traditional medicine integration and herbal formulations will continue gaining market share, particularly in markets with strong traditional medicine heritage. Sustainability focus will drive innovation in packaging and ingredient sourcing strategies.

Market consolidation is expected to continue with strategic acquisitions and partnerships reshaping competitive dynamics. Regional players with strong local market knowledge will become attractive acquisition targets for global companies seeking market expansion. Innovation partnerships between traditional oral care companies and technology firms will accelerate product development cycles.

Regulatory evolution will continue with governments implementing stricter safety standards and environmental regulations. Companies must prepare for evolving compliance requirements and invest in regulatory expertise. Quality standards will continue rising as consumer expectations and regulatory oversight increase across APAC markets.

The APAC oral care market represents a dynamic and rapidly evolving landscape characterized by significant growth opportunities and diverse consumer preferences across the region. Market analysis reveals strong fundamentals supporting continued expansion, driven by demographic trends, economic development, and increasing health consciousness among consumers. The market’s resilience and essential nature provide stability while innovation and premium segments offer substantial growth potential.

Strategic success in this market requires deep understanding of regional diversity and cultural factors that influence consumer behavior. Companies must balance global expertise with local market knowledge to create products and strategies that resonate with diverse consumer bases. Innovation capabilities and adaptability will be critical competitive differentiators as market dynamics continue evolving rapidly.

Future market development will be shaped by technology integration, sustainability consciousness, and the ongoing shift toward premium and specialized oral care solutions. Companies positioning themselves at the intersection of these trends while maintaining strong execution capabilities are likely to achieve superior market performance. The APAC oral care market offers compelling opportunities for stakeholders willing to invest in understanding and serving diverse regional consumer needs effectively.

What is Oral Care?

Oral care refers to the practices and products used to maintain oral hygiene and health, including brushing, flossing, and the use of mouthwash. It encompasses a variety of products such as toothpaste, toothbrushes, and dental treatments.

What are the key players in the APAC Oral Care Market?

Key players in the APAC Oral Care Market include Colgate-Palmolive, Procter & Gamble, Unilever, and GlaxoSmithKline, among others. These companies offer a range of products from toothpaste to mouth rinses, catering to diverse consumer needs.

What are the growth factors driving the APAC Oral Care Market?

The APAC Oral Care Market is driven by increasing awareness of oral hygiene, rising disposable incomes, and the growing prevalence of dental diseases. Additionally, the expansion of retail channels and innovative product offerings contribute to market growth.

What challenges does the APAC Oral Care Market face?

Challenges in the APAC Oral Care Market include intense competition among brands, varying consumer preferences, and regulatory hurdles in different countries. Additionally, the market faces challenges related to counterfeit products and price sensitivity among consumers.

What opportunities exist in the APAC Oral Care Market?

Opportunities in the APAC Oral Care Market include the rising demand for natural and organic oral care products, the growth of e-commerce platforms, and increasing investments in dental health awareness campaigns. These factors can lead to innovative product development and market expansion.

What trends are shaping the APAC Oral Care Market?

Trends in the APAC Oral Care Market include the growing popularity of electric toothbrushes, the introduction of personalized oral care solutions, and an increased focus on sustainability in packaging. These trends reflect changing consumer preferences and technological advancements.

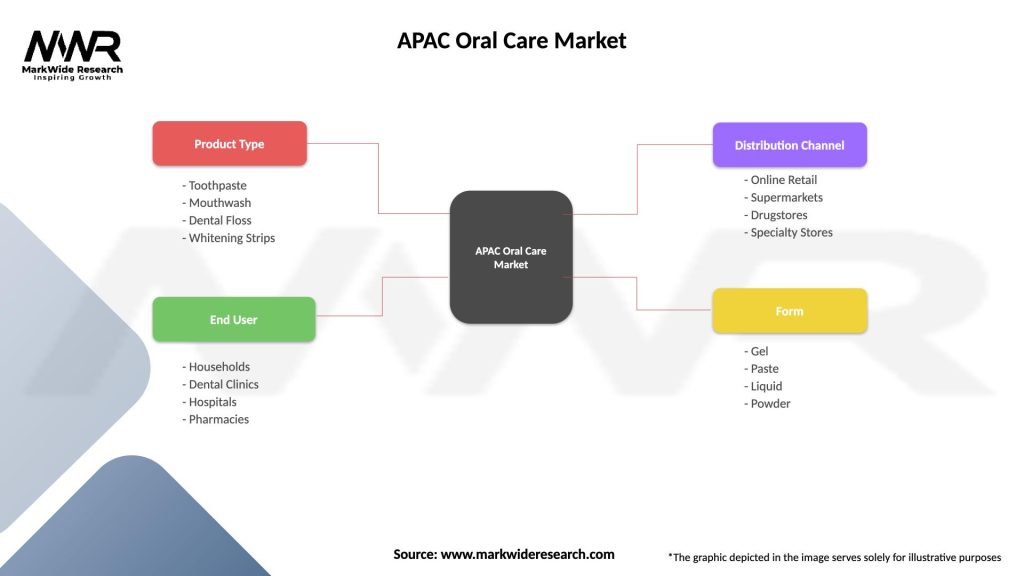

APAC Oral Care Market

| Segmentation Details | Description |

|---|---|

| Product Type | Toothpaste, Mouthwash, Dental Floss, Whitening Strips |

| End User | Households, Dental Clinics, Hospitals, Pharmacies |

| Distribution Channel | Online Retail, Supermarkets, Drugstores, Specialty Stores |

| Form | Gel, Paste, Liquid, Powder |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Oral Care Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at