444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC museums, historical sites, zoos, and parks market represents a dynamic and rapidly evolving sector that encompasses cultural preservation, educational tourism, and recreational entertainment across the Asia-Pacific region. This comprehensive market includes traditional museums, archaeological sites, wildlife conservation facilities, theme parks, and natural reserves that serve millions of visitors annually while contributing significantly to regional economies and cultural heritage preservation.

Market dynamics in the APAC region are driven by increasing disposable income, growing urbanization, and heightened awareness of cultural and environmental conservation. The sector has experienced remarkable transformation with digital integration, interactive exhibits, and sustainable tourism practices becoming standard offerings. Regional growth is particularly strong in countries like China, Japan, South Korea, Australia, and Singapore, where government initiatives support cultural tourism development.

Technological advancement has revolutionized visitor experiences through virtual reality installations, augmented reality guides, and mobile applications that enhance educational value. The market demonstrates robust resilience with visitor engagement rates showing consistent improvement of approximately 12% annually across major APAC destinations. Digital transformation initiatives have enabled institutions to reach broader audiences while maintaining operational efficiency during challenging periods.

Sustainability initiatives have become central to market development, with eco-friendly practices and conservation programs attracting environmentally conscious visitors. The integration of educational programs with entertainment value has created unique positioning for APAC institutions, differentiating them from global competitors while preserving regional cultural identity and natural heritage.

The APAC museums, historical sites, zoos, and parks market refers to the comprehensive ecosystem of cultural, educational, and recreational institutions across Asia-Pacific countries that preserve heritage, promote learning, and provide entertainment through curated experiences, wildlife conservation, and natural environment preservation.

This market encompasses diverse institutional categories including art museums, science centers, historical monuments, archaeological sites, zoological gardens, botanical parks, theme parks, and natural reserves. These institutions serve multiple purposes: cultural preservation, educational advancement, scientific research, conservation efforts, and tourism development while generating economic value through visitor admissions, merchandise, and ancillary services.

Operational frameworks within this market include both public and private institutions, with many operating under hybrid models that combine government funding with commercial revenue streams. The sector integrates traditional preservation methods with modern technology to create immersive experiences that appeal to diverse demographic segments while maintaining educational and conservation objectives.

Market participants range from government-operated national museums and state parks to privately-owned theme parks and commercial zoos. The interconnected nature of these institutions creates synergistic relationships that enhance overall market value through collaborative programs, shared resources, and integrated tourism packages that benefit the entire regional ecosystem.

The APAC museums, historical sites, zoos, and parks market demonstrates exceptional growth potential driven by rising middle-class populations, increased cultural awareness, and government investments in tourism infrastructure. Regional markets show varying maturity levels, with developed economies like Japan and Australia leading in technological integration while emerging markets focus on capacity expansion and infrastructure development.

Key performance indicators reveal strong visitor growth trends with annual attendance increases of 8-15% across major APAC destinations. Digital engagement metrics show particularly impressive results, with online visitor interactions growing by 35% year-over-year as institutions adapt to changing consumer preferences and technological capabilities.

Market segmentation analysis indicates that family entertainment and educational tourism represent the largest visitor categories, accounting for approximately 60% of total attendance. Corporate and group visits contribute significantly to revenue streams, while international tourism provides substantial growth opportunities as travel restrictions ease and regional connectivity improves.

Competitive landscape features both traditional institutions and innovative new entrants that leverage technology and unique positioning strategies. Market leaders demonstrate strong brand recognition, operational efficiency, and ability to adapt to changing visitor expectations while maintaining core educational and conservation missions that define sector success.

Strategic market analysis reveals several critical insights that shape the APAC museums, historical sites, zoos, and parks landscape. MarkWide Research data indicates that visitor experience quality has become the primary differentiator, with institutions investing heavily in interactive technologies and personalized services to enhance engagement and satisfaction levels.

Market maturation varies significantly across APAC countries, with developed markets focusing on experience enhancement while emerging markets prioritize infrastructure development and capacity expansion to meet growing demand from domestic and international visitors.

Economic prosperity across APAC regions serves as the fundamental driver for market expansion, with rising disposable incomes enabling increased spending on cultural and recreational activities. Middle-class growth particularly in China, India, and Southeast Asian countries creates substantial demand for quality leisure experiences that combine education, entertainment, and cultural enrichment.

Government initiatives play crucial roles in market development through infrastructure investments, cultural preservation programs, and tourism promotion strategies. National and regional governments recognize the economic and social benefits of robust cultural and recreational sectors, leading to increased funding and policy support that facilitates market growth and institutional development.

Urbanization trends contribute significantly to market expansion as concentrated populations seek accessible cultural and recreational outlets. Urban development creates opportunities for new institutions while existing facilities benefit from increased visitor accessibility and demographic concentration that supports sustainable operations and growth.

Educational awareness drives demand for institutions that provide learning opportunities beyond traditional classroom settings. Parents and educators increasingly value experiential learning environments that museums, zoos, and parks provide, creating steady demand from school groups, families, and individual learners seeking engaging educational experiences.

Tourism development initiatives across APAC countries position cultural and natural attractions as key differentiators in competitive tourism markets. International visitor growth creates revenue opportunities while domestic tourism provides stable foundation demand that supports institutional sustainability and expansion plans.

Technological advancement enables institutions to create innovative experiences that attract tech-savvy visitors while improving operational efficiency. Digital tools enhance visitor engagement, streamline operations, and create new revenue opportunities through virtual experiences and digital merchandise that extend institutional reach beyond physical boundaries.

High operational costs represent significant challenges for many institutions, particularly those focused on conservation and educational missions that require specialized facilities, expert staff, and ongoing maintenance of collections or living specimens. Financial sustainability becomes increasingly difficult when balancing mission objectives with commercial viability requirements.

Regulatory compliance creates operational complexities and cost burdens, especially for institutions housing live animals or managing historical artifacts. Safety standards, conservation requirements, and accessibility regulations require continuous investment and operational adjustments that can strain institutional resources and limit growth opportunities.

Skilled workforce shortages affect institutional operations across multiple functional areas including curatorial expertise, conservation specialists, educational program developers, and technology integration specialists. Talent acquisition and retention challenges increase operational costs while potentially limiting institutional capabilities and growth potential.

Seasonal demand fluctuations create revenue volatility that complicates financial planning and resource allocation. Weather dependencies and school calendar impacts affect visitor patterns, requiring institutions to develop strategies for managing cash flow variations and maintaining year-round operational efficiency.

Competition from digital entertainment alternatives challenges traditional institutions to demonstrate unique value propositions that justify physical visits over virtual experiences. Changing consumer preferences toward digital and home-based entertainment options require institutional adaptation and innovation to maintain relevance and visitor engagement.

Infrastructure limitations in some APAC regions restrict institutional development and visitor accessibility. Transportation connectivity, parking availability, and supporting amenities affect visitor experience quality and institutional growth potential, particularly in emerging markets with developing tourism infrastructure.

Digital transformation presents unprecedented opportunities for market expansion through virtual reality experiences, online educational programs, and digital merchandise that extend institutional reach beyond geographical boundaries. Hybrid experiences that combine physical and digital elements create new revenue streams while enhancing visitor engagement and educational value.

Sustainable tourism trends align perfectly with institutional missions focused on conservation and education, creating opportunities to attract environmentally conscious visitors while developing programs that support conservation objectives. Eco-tourism integration enables institutions to differentiate themselves while contributing to environmental preservation goals.

Corporate partnerships offer significant growth opportunities through sponsorship programs, educational collaborations, and employee engagement initiatives. Business-to-business services including corporate events, team building programs, and professional development workshops create additional revenue streams while expanding institutional impact.

International collaboration enables knowledge sharing, traveling exhibitions, and joint conservation programs that enhance institutional capabilities while creating unique visitor experiences. Cultural exchange programs attract international visitors while strengthening diplomatic and educational relationships between APAC countries.

Technology integration opportunities include artificial intelligence for personalized visitor experiences, blockchain for artifact authentication, and Internet of Things for operational efficiency improvements. Innovation adoption creates competitive advantages while improving operational effectiveness and visitor satisfaction levels.

Demographic shifts toward aging populations create opportunities for specialized programs targeting senior visitors, while growing youth populations drive demand for interactive and technology-enhanced experiences. Multi-generational programming enables institutions to serve diverse age groups simultaneously while maximizing facility utilization and revenue potential.

Supply and demand equilibrium in the APAC museums, historical sites, zoos, and parks market demonstrates regional variations with developed markets showing mature demand patterns while emerging economies experience rapid growth in visitor interest and institutional development. Market forces include government policy changes, economic conditions, and cultural trends that influence both institutional operations and visitor behavior patterns.

Competitive dynamics involve traditional institutions adapting to modern visitor expectations while new entrants leverage technology and innovative approaches to capture market share. Differentiation strategies focus on unique collections, specialized programs, and exceptional visitor experiences that create sustainable competitive advantages in increasingly crowded markets.

Value chain integration opportunities emerge through partnerships between institutions, tourism operators, and hospitality providers that create comprehensive visitor experiences. Ecosystem development enables institutions to participate in broader tourism networks while maintaining individual identity and mission focus that attracts dedicated visitor segments.

Innovation cycles drive continuous improvement in visitor experiences, operational efficiency, and educational effectiveness. Technology adoption rates vary across institutions and regions, with leaders demonstrating efficiency improvements of 25-30% through strategic technology integration and process optimization initiatives.

Market consolidation trends include strategic partnerships and resource sharing agreements that enable smaller institutions to compete effectively while maintaining independence. Collaborative models create opportunities for shared expertise, joint marketing initiatives, and coordinated programming that benefits entire regional markets.

External factors including climate change, geopolitical developments, and global health considerations influence market dynamics and require institutional adaptability. Resilience planning becomes essential for sustainable operations while maintaining visitor safety and satisfaction during challenging periods.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the APAC museums, historical sites, zoos, and parks market. Primary research includes structured interviews with institutional leaders, visitor surveys, and stakeholder consultations that provide direct insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, academic studies, and institutional publications that provide historical context and trend analysis. Data triangulation methods ensure research accuracy by comparing multiple sources and validating findings through cross-reference analysis and expert review processes.

Quantitative analysis includes visitor statistics, revenue data, operational metrics, and performance indicators collected from institutional sources and government databases. Statistical modeling techniques identify trends, correlations, and predictive patterns that inform market projections and strategic recommendations for stakeholders.

Qualitative assessment involves expert interviews, focus group discussions, and observational studies that provide deeper understanding of visitor motivations, institutional challenges, and market dynamics. Thematic analysis identifies key patterns and insights that complement quantitative findings and provide comprehensive market understanding.

Regional analysis methodology includes country-specific studies, comparative analysis, and cross-border trend identification that account for cultural, economic, and regulatory differences across APAC markets. Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct visitor groups and institutional categories.

Validation processes include peer review, stakeholder feedback, and data verification procedures that ensure research quality and reliability. Continuous monitoring systems track market changes and update analysis to maintain current and relevant insights for decision-making purposes.

China dominates the APAC museums, historical sites, zoos, and parks market with extensive government investment in cultural infrastructure and massive domestic tourism demand. Market leadership is evident through world-class institutions like the Palace Museum and Shanghai Disney Resort, while regional museums and parks experience rapid development supported by urbanization and rising living standards.

Japan maintains technological leadership in visitor experience innovation with advanced digital integration and exceptional operational standards. Cultural preservation excellence combined with modern presentation methods creates unique market positioning, while domestic and international visitor loyalty demonstrates sustainable market strength with repeat visitation rates exceeding 40%.

Australia and New Zealand excel in natural heritage preservation and eco-tourism integration, attracting international visitors through unique wildlife experiences and environmental conservation programs. Market maturity enables focus on experience enhancement and sustainability initiatives that serve as regional benchmarks for best practices.

South Korea demonstrates rapid market development through technology integration and cultural content creation that appeals to both domestic and international audiences. Hallyu influence drives cultural tourism while traditional institutions modernize to capture younger demographic segments and international visitors interested in Korean culture.

Southeast Asian markets including Singapore, Thailand, Malaysia, and Indonesia show strong growth potential with government tourism initiatives and infrastructure development. Regional diversity creates opportunities for specialized cultural and natural attractions while growing middle-class populations drive domestic demand expansion.

India represents significant untapped potential with rich cultural heritage and growing economic prosperity creating opportunities for institutional development. Market development focuses on infrastructure improvement and capacity expansion to serve large domestic populations while attracting international cultural tourists seeking authentic experiences.

Market leadership in the APAC museums, historical sites, zoos, and parks sector includes both traditional institutions with historical significance and modern facilities that leverage technology and innovative approaches. Competitive positioning varies by institutional type, geographic location, and target audience segments.

Competitive strategies focus on unique positioning, exceptional visitor experiences, and operational excellence that create sustainable advantages. Innovation leadership through technology adoption, conservation programs, and educational initiatives differentiates market leaders from competitors while building visitor loyalty and brand recognition.

Market entry strategies for new competitors include niche specialization, technology integration, and partnership development that enable effective competition with established institutions. Collaboration opportunities exist between institutions for shared expertise, joint programming, and resource optimization that benefit entire market ecosystems.

By Institution Type:

By Visitor Type:

By Revenue Model:

By Technology Integration:

Museums category demonstrates strong performance in educational tourism with visitor engagement rates improving 18% annually through interactive exhibits and digital integration. Art museums lead in international visitor attraction while science museums excel in family and educational group segments. Technology adoption varies significantly, with leading institutions achieving substantial operational efficiency improvements through digital systems.

Historical sites benefit from cultural tourism growth and government preservation initiatives that enhance visitor accessibility and experience quality. Archaeological sites show particular strength in international tourism while heritage buildings attract domestic visitors interested in cultural education. Conservation challenges require ongoing investment but create unique positioning opportunities.

Zoos and aquariums excel in conservation education and family entertainment, with successful institutions demonstrating conservation program participation rates exceeding 70% among visitors. Wildlife conservation missions resonate strongly with environmentally conscious audiences while breeding programs and research initiatives provide educational content that differentiates these institutions from pure entertainment venues.

Parks and gardens category shows diverse performance patterns with theme parks leading in revenue generation while botanical gardens excel in educational programming. Natural reserves benefit from eco-tourism trends while recreational parks serve local communities with consistent visitation patterns. Seasonal variations affect outdoor facilities more significantly than indoor institutions.

Hybrid institutions that combine multiple categories demonstrate superior performance through diversified offerings and broader audience appeal. Integrated experiences that blend education, conservation, and entertainment create competitive advantages while maximizing facility utilization and visitor satisfaction levels across different demographic segments.

Institutional operators benefit from growing market demand, government support, and technology opportunities that enable operational improvements and revenue diversification. Operational efficiency gains through digital systems and process optimization create cost savings while enhanced visitor experiences drive increased attendance and customer loyalty.

Government stakeholders realize economic benefits through tourism revenue, job creation, and cultural preservation that support broader economic development objectives. Social impact includes educational advancement, cultural awareness, and community engagement that contribute to social cohesion and national identity preservation.

Tourism industry participants benefit from attraction diversity that enhances destination appeal and visitor length of stay. Collaborative opportunities with hotels, restaurants, and transportation providers create integrated tourism experiences that benefit entire regional economies while supporting sustainable tourism development.

Educational institutions gain access to experiential learning environments that complement traditional classroom instruction. Partnership opportunities enable curriculum integration, teacher training, and student engagement programs that enhance educational outcomes while supporting institutional missions.

Conservation organizations benefit from public engagement platforms that raise awareness and support for environmental and cultural preservation initiatives. Research collaboration opportunities advance scientific knowledge while public education programs build support for conservation efforts.

Technology providers find growing market opportunities for specialized solutions including interactive displays, mobile applications, and operational management systems. Innovation partnerships with institutions create opportunities for product development and market expansion while contributing to sector advancement.

Local communities benefit from employment opportunities, economic activity, and cultural amenities that enhance quality of life. Community engagement programs create educational and recreational opportunities while preserving local heritage and supporting community identity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the APAC museums, historical sites, zoos, and parks market. Virtual reality integration enables immersive experiences that transport visitors to different times and places, while augmented reality applications provide contextual information and interactive elements that enhance educational value and visitor engagement.

Sustainability focus drives operational changes and program development across all institutional categories. Green building practices, renewable energy adoption, and waste reduction initiatives demonstrate environmental responsibility while reducing operational costs. Conservation programs and environmental education create authentic connections with environmentally conscious visitors.

Personalization technology enables customized visitor experiences through mobile applications, RFID tracking, and artificial intelligence systems that adapt content and recommendations based on individual preferences and behavior patterns. Data analytics provide insights into visitor preferences and operational optimization opportunities.

Experiential learning approaches replace traditional passive viewing with hands-on activities, interactive demonstrations, and immersive programs that engage multiple senses. Educational innovation includes maker spaces, citizen science programs, and collaborative learning environments that appeal to diverse learning styles and age groups.

Cultural authenticity emphasis drives institutions to preserve and present genuine cultural experiences while incorporating modern presentation methods. Storytelling approaches use narrative techniques and emotional connections to create memorable experiences that resonate with visitors and encourage return visits.

Wellness integration includes programs that promote physical and mental health through nature connection, mindfulness activities, and therapeutic programs. Biophilic design principles create healing environments while supporting conservation and educational missions.

Technology partnerships between institutions and tech companies accelerate innovation adoption and create cutting-edge visitor experiences. Collaborative development projects result in specialized solutions that address unique institutional needs while advancing industry standards and capabilities.

Conservation initiatives expand beyond traditional institutional boundaries through community engagement programs, citizen science projects, and international collaboration efforts. Research partnerships with universities and scientific organizations advance knowledge while providing educational content and visitor engagement opportunities.

Infrastructure investments by governments across APAC countries improve accessibility and support institutional development. Transportation connectivity enhancements and tourism infrastructure development create opportunities for increased visitation and regional economic development.

International exhibitions and traveling programs create opportunities for cultural exchange and visitor attraction while sharing costs and expertise among institutions. Collaborative programming enables smaller institutions to access world-class content while providing unique experiences for visitors.

Sustainability certifications and green building standards become increasingly important for institutional credibility and operational efficiency. Environmental management systems provide frameworks for continuous improvement while demonstrating commitment to conservation missions.

Digital archiving and collection management systems preserve cultural and scientific assets while enabling virtual access and research capabilities. Open access initiatives democratize knowledge while creating new opportunities for educational programming and public engagement.

Strategic positioning recommendations emphasize the importance of unique value propositions that differentiate institutions in competitive markets. MWR analysis suggests that successful institutions focus on authentic experiences, exceptional visitor service, and mission-driven programming that creates emotional connections with audiences.

Technology investment should prioritize visitor experience enhancement over operational automation, with careful consideration of return on investment and mission alignment. Digital integration strategies should complement rather than replace human interaction and authentic experiences that define institutional value.

Partnership development opportunities include educational institutions, tourism operators, and technology providers that can enhance institutional capabilities while sharing costs and risks. Collaborative models enable resource optimization while maintaining institutional independence and mission focus.

Revenue diversification strategies should explore multiple income streams while maintaining mission integrity and visitor experience quality. Commercial activities should enhance rather than detract from educational and conservation objectives that define institutional purpose and public support.

Sustainability planning requires long-term perspective and stakeholder engagement that balances environmental responsibility with operational viability. Climate adaptation strategies should address both immediate operational needs and long-term institutional sustainability.

Workforce development initiatives should address skill gaps through training programs, professional development, and retention strategies that build institutional capabilities. Knowledge management systems should preserve expertise while facilitating knowledge transfer and organizational learning.

Market growth prospects for the APAC museums, historical sites, zoos, and parks sector remain strong with projected annual growth rates of 6-9% driven by continued economic development, urbanization, and cultural awareness across the region. Demographic trends including aging populations and growing youth segments create opportunities for specialized programming and multi-generational experiences.

Technology evolution will continue reshaping visitor experiences with artificial intelligence, virtual reality, and Internet of Things integration becoming standard offerings. Digital transformation will enable hybrid physical-virtual experiences that extend institutional reach while maintaining authentic in-person engagement that defines sector value.

Sustainability imperatives will drive operational changes and program development with carbon neutrality goals becoming standard institutional objectives. Conservation integration will strengthen institutional missions while attracting environmentally conscious visitors and supporting global sustainability initiatives.

International collaboration will increase through cultural exchange programs, traveling exhibitions, and joint conservation initiatives that enhance institutional capabilities while building cross-cultural understanding. Regional integration will create tourism circuits and shared programming that benefit entire APAC markets.

Government support will continue through infrastructure investment, policy development, and tourism promotion that recognizes the economic and social value of cultural and recreational institutions. Public-private partnerships will enable innovative funding models and operational approaches that balance mission objectives with financial sustainability.

Visitor expectations will continue evolving toward personalized, interactive, and meaningful experiences that provide educational value and emotional connection. Experience quality will become the primary competitive differentiator as institutions compete for visitor attention and loyalty in increasingly crowded markets.

The APAC museums, historical sites, zoos, and parks market represents a dynamic and essential sector that combines cultural preservation, education, conservation, and entertainment to serve diverse stakeholder needs across the Asia-Pacific region. Market fundamentals remain strong with growing demand, government support, and technological opportunities creating favorable conditions for continued development and expansion.

Strategic success in this market requires balancing mission-driven objectives with operational sustainability while adapting to changing visitor expectations and technological capabilities. Institutional excellence emerges through authentic experiences, educational value, and conservation impact that create lasting visitor connections and community support.

Future opportunities include digital expansion, sustainability leadership, and international collaboration that can enhance institutional capabilities while serving broader social and environmental objectives. Market leaders will be those institutions that successfully integrate innovation with tradition, creating unique value propositions that resonate with diverse audiences while maintaining core missions and values that define sector purpose and social contribution.

What is Museums, Historical Sites, Zoos, And Parks?

Museums, Historical Sites, Zoos, and Parks encompass a variety of institutions and locations dedicated to preserving and showcasing cultural heritage, wildlife, and natural beauty. These venues serve educational, recreational, and conservation purposes, attracting visitors from diverse backgrounds.

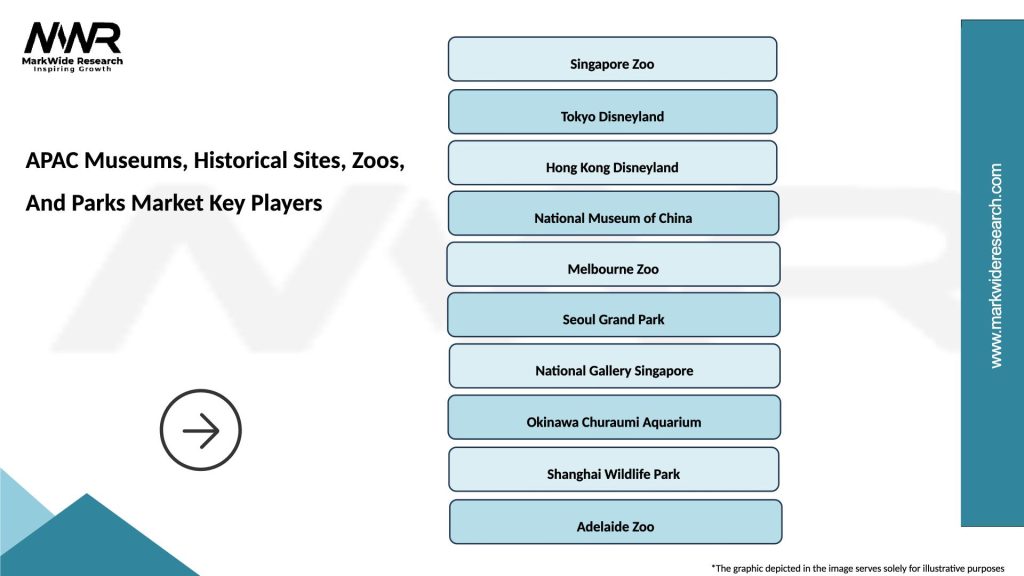

What are the key players in the APAC Museums, Historical Sites, Zoos, And Parks Market?

Key players in the APAC Museums, Historical Sites, Zoos, and Parks Market include the National Museum of China, Singapore Zoo, and the Tokyo National Museum, among others. These organizations play significant roles in cultural preservation, education, and tourism.

What are the growth factors driving the APAC Museums, Historical Sites, Zoos, And Parks Market?

The growth of the APAC Museums, Historical Sites, Zoos, and Parks Market is driven by increasing tourism, rising disposable incomes, and a growing interest in cultural and environmental education. Additionally, government initiatives to promote heritage conservation contribute to market expansion.

What challenges does the APAC Museums, Historical Sites, Zoos, And Parks Market face?

The APAC Museums, Historical Sites, Zoos, and Parks Market faces challenges such as funding limitations, the impact of climate change on natural sites, and competition from digital entertainment options. These factors can hinder visitor engagement and operational sustainability.

What opportunities exist in the APAC Museums, Historical Sites, Zoos, And Parks Market?

Opportunities in the APAC Museums, Historical Sites, Zoos, and Parks Market include the development of interactive exhibits, eco-tourism initiatives, and partnerships with educational institutions. These strategies can enhance visitor experiences and promote conservation efforts.

What trends are shaping the APAC Museums, Historical Sites, Zoos, And Parks Market?

Trends in the APAC Museums, Historical Sites, Zoos, and Parks Market include the integration of technology in exhibits, a focus on sustainability practices, and the rise of virtual tours. These trends aim to enhance visitor engagement and promote environmental awareness.

APAC Museums, Historical Sites, Zoos, And Parks Market

| Segmentation Details | Description |

|---|---|

| Type | Museums, Zoos, Historical Sites, Parks |

| Visitor Demographics | Families, Tourists, Students, Seniors |

| Revenue Model | Admissions, Memberships, Donations, Sponsorships |

| Attraction Features | Exhibits, Guided Tours, Educational Programs, Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Museums, Historical Sites, Zoos, And Parks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at