444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC meglitinide market represents a critical segment within the Asia-Pacific diabetes therapeutics landscape, demonstrating robust growth momentum driven by escalating diabetes prevalence and increasing healthcare awareness. Meglitinides, a class of short-acting insulin secretagogues, have gained significant traction across the region due to their unique mechanism of action and favorable safety profile for postprandial glucose control.

Regional dynamics indicate that the APAC meglitinide market is experiencing substantial expansion, with growth rates reaching approximately 8.2% CAGR over the forecast period. This growth trajectory reflects the increasing adoption of advanced diabetes management solutions across key markets including China, Japan, India, and South Korea. Healthcare infrastructure improvements and rising disposable incomes have contributed to enhanced accessibility of meglitinide-based therapies throughout the region.

Market penetration varies significantly across APAC countries, with developed markets like Japan and Australia showing higher adoption rates of approximately 35% market share compared to emerging economies. The therapeutic class benefits from strong physician preference due to its rapid onset and short duration of action, making it particularly suitable for managing postprandial hyperglycemia in Asian populations with distinct dietary patterns.

The APAC meglitinide market refers to the commercial landscape encompassing the development, manufacturing, distribution, and consumption of meglitinide-class antidiabetic medications across Asia-Pacific territories. Meglitinides are non-sulfonylurea insulin secretagogues that stimulate insulin release from pancreatic beta cells in a glucose-dependent manner, offering rapid onset and short duration of action for optimal postprandial glucose control.

This therapeutic class includes primary compounds such as repaglinide and nateglinide, which bind to specific receptors on pancreatic beta cells distinct from sulfonylurea binding sites. The market encompasses various formulations, dosage strengths, and combination therapies designed to address the diverse needs of diabetic patients across different APAC demographics and healthcare systems.

Regional significance of the meglitinide market extends beyond pharmaceutical sales to include healthcare outcomes, patient quality of life improvements, and economic impact on diabetes management costs. The market definition also encompasses regulatory frameworks, reimbursement policies, and clinical guidelines that influence prescribing patterns and patient access across different APAC jurisdictions.

Strategic analysis of the APAC meglitinide market reveals a dynamic therapeutic landscape characterized by increasing demand for flexible diabetes management solutions and growing recognition of postprandial glucose control importance. The market demonstrates strong fundamentals supported by demographic trends, healthcare policy initiatives, and evolving treatment paradigms across the Asia-Pacific region.

Key performance indicators highlight sustained market expansion with adoption rates increasing by approximately 12% annually in major APAC markets. This growth momentum reflects successful market penetration strategies, enhanced physician education programs, and improved patient awareness regarding the benefits of meal-time glucose control. Competitive dynamics remain favorable for established players while creating opportunities for generic manufacturers and biosimilar developers.

Market segmentation analysis indicates strong performance across multiple therapeutic applications, with type 2 diabetes management representing the primary indication. Geographic distribution shows concentrated growth in China and India, driven by large patient populations and expanding healthcare access. Future prospects remain optimistic, supported by pipeline developments, combination therapy innovations, and increasing healthcare expenditure across emerging APAC economies.

Critical market insights reveal several transformative trends shaping the APAC meglitinide landscape:

Primary market drivers propelling APAC meglitinide market growth encompass multiple interconnected factors that create sustained demand for these therapeutic agents. Diabetes prevalence continues to escalate across the region, with incidence rates increasing by approximately 6.5% annually in key markets, creating a substantial patient population requiring effective glucose management solutions.

Healthcare accessibility improvements represent another crucial driver, as governments across APAC territories invest heavily in healthcare infrastructure development and insurance coverage expansion. These initiatives have significantly enhanced patient access to specialized diabetes medications, including meglitinides, particularly in previously underserved rural and semi-urban areas.

Physician preference trends favor meglitinides due to their unique pharmacokinetic profile and reduced hypoglycemia risk compared to traditional sulfonylureas. The flexibility of meal-time dosing aligns well with diverse dietary patterns across Asian cultures, making these medications particularly suitable for regional patient populations. Clinical evidence supporting superior postprandial glucose control has strengthened physician confidence in prescribing meglitinides as first-line or combination therapy options.

Economic prosperity in emerging APAC markets has increased healthcare spending capacity among middle-class populations, enabling greater adoption of branded diabetes medications. Rising health consciousness and preventive care awareness have also contributed to earlier diabetes diagnosis and proactive treatment initiation, expanding the addressable patient population for meglitinide therapies.

Significant market restraints continue to challenge APAC meglitinide market expansion despite overall positive growth trends. Cost considerations remain a primary barrier, particularly in price-sensitive emerging markets where patients often face out-of-pocket expenses for diabetes medications. The premium pricing of branded meglitinides compared to generic alternatives limits accessibility for lower-income patient segments.

Regulatory complexities across diverse APAC jurisdictions create challenges for manufacturers seeking regional market expansion. Varying approval requirements, clinical trial standards, and post-market surveillance obligations increase development costs and time-to-market for new formulations or indications. Reimbursement limitations in several markets restrict patient access, as insurance coverage for newer diabetes medications remains inconsistent across different healthcare systems.

Clinical limitations associated with meglitinides, including the need for multiple daily doses and potential drug interactions, may limit their appeal compared to newer long-acting alternatives. Some patients experience difficulty adhering to meal-time dosing requirements, particularly those with irregular eating patterns or demanding work schedules common in rapidly developing APAC economies.

Competition from alternative therapies poses ongoing challenges, as newer drug classes like GLP-1 receptor agonists and SGLT-2 inhibitors offer additional benefits beyond glucose control, including cardiovascular protection and weight management. These competitive pressures may limit market share growth for traditional meglitinide products in certain therapeutic segments.

Substantial market opportunities exist within the APAC meglitinide landscape, driven by unmet medical needs and evolving healthcare paradigms. Combination therapy development represents a significant growth avenue, with fixed-dose combinations offering improved patient convenience and potentially enhanced therapeutic outcomes. Market research indicates that combination products could capture approximately 25% market share within the next five years.

Generic market expansion presents lucrative opportunities as patent protections expire for major branded products. Local manufacturers in China, India, and other emerging markets are well-positioned to capitalize on cost-conscious healthcare systems and growing demand for affordable diabetes medications. Biosimilar development initiatives could further expand market access and reduce treatment costs across price-sensitive segments.

Digital health integration offers innovative opportunities to enhance meglitinide therapy management through smart dosing systems, adherence monitoring applications, and personalized treatment optimization platforms. These technological solutions could address current limitations related to dosing complexity and improve overall treatment outcomes for patients using meglitinide-based therapies.

Emerging market penetration in countries like Vietnam, Thailand, and Indonesia presents substantial growth potential as healthcare infrastructure develops and diabetes awareness increases. MarkWide Research analysis suggests these markets could experience adoption rates exceeding 15% annually as healthcare access expands and economic conditions improve.

Complex market dynamics shape the APAC meglitinide landscape through interconnected supply and demand factors, regulatory influences, and competitive pressures. Supply chain considerations have become increasingly important, with manufacturers focusing on regional production capabilities to reduce costs and improve market responsiveness. Local manufacturing initiatives in China and India have enhanced supply security while reducing dependence on international suppliers.

Demand patterns vary significantly across APAC markets, influenced by healthcare system maturity, physician prescribing preferences, and patient demographic characteristics. Developed markets like Japan and South Korea demonstrate stable demand with emphasis on premium formulations, while emerging economies show rapid growth in generic product adoption driven by cost considerations and expanding patient populations.

Pricing dynamics reflect competitive pressures and healthcare policy influences, with generic competition driving down average selling prices by approximately 18% over recent years. However, innovative formulations and combination products maintain premium pricing in markets where clinical differentiation is valued by healthcare providers and patients.

Regulatory evolution continues to influence market dynamics, with harmonized approval processes facilitating faster product launches while stringent safety requirements ensure high-quality standards. These regulatory frameworks create both opportunities for innovation and barriers for market entry, shaping competitive landscapes across different APAC territories.

Comprehensive research methodology employed for APAC meglitinide market analysis incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with key opinion leaders, healthcare providers, pharmaceutical executives, and regulatory officials across major APAC markets to gather firsthand perspectives on market trends and dynamics.

Secondary research encompasses extensive analysis of published clinical studies, regulatory filings, company annual reports, and industry publications to establish baseline market understanding and validate primary research findings. Data triangulation methods ensure consistency across multiple information sources while identifying potential discrepancies or emerging trends that require further investigation.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and competitive positioning based on historical data and identified market drivers. Qualitative assessment incorporates expert opinions, regulatory analysis, and strategic evaluation of market opportunities and challenges to provide comprehensive market understanding.

Market validation processes include cross-referencing findings with industry databases, regulatory submissions, and clinical trial registries to ensure data accuracy and completeness. Geographic scope encompasses all major APAC markets with detailed analysis of country-specific factors influencing meglitinide adoption and market development patterns.

Regional market analysis reveals distinct characteristics and growth patterns across major APAC territories, with China representing the largest market opportunity due to its substantial diabetic population and expanding healthcare infrastructure. Chinese market dynamics show strong preference for cost-effective generic alternatives, with local manufacturers capturing approximately 42% market share through competitive pricing and improved distribution networks.

Japanese market characteristics emphasize quality and innovation, with patients and healthcare providers willing to pay premium prices for advanced formulations and proven clinical benefits. The aging population and high diabetes prevalence create sustained demand, while stringent regulatory requirements ensure high product standards. Market penetration in Japan remains stable with focus on combination therapies and personalized treatment approaches.

Indian market expansion demonstrates rapid growth potential driven by increasing diabetes awareness, improving healthcare access, and rising disposable incomes among urban populations. Generic manufacturers dominate the landscape, offering affordable alternatives that make meglitinide therapy accessible to broader patient populations. Rural market penetration remains limited but presents significant future opportunities as healthcare infrastructure develops.

South Korean and Australian markets show mature characteristics with emphasis on clinical outcomes and healthcare system efficiency. These markets favor evidence-based treatment selection and demonstrate strong adoption of innovative delivery systems and combination products. Regulatory harmonization initiatives across these developed markets facilitate product launches and market expansion strategies.

Competitive landscape analysis reveals a diverse ecosystem of pharmaceutical companies competing across different market segments and geographic territories within the APAC meglitinide market. Market leadership positions are held by established multinational pharmaceutical companies with strong research and development capabilities and extensive regional distribution networks.

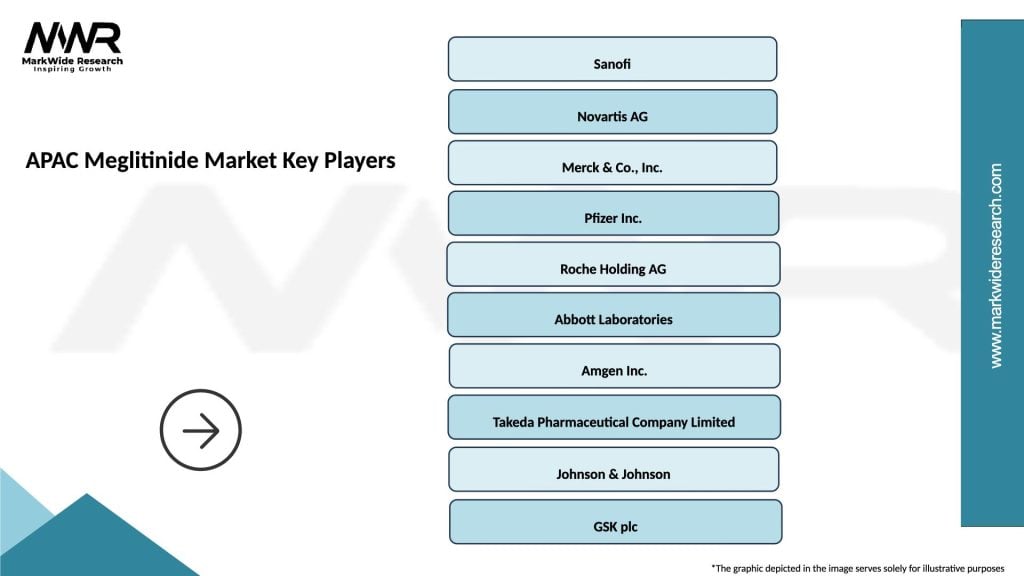

Key market participants include:

Competitive strategies vary across market segments, with branded manufacturers focusing on clinical differentiation and combination product development, while generic companies emphasize cost competitiveness and market access expansion. Strategic partnerships and licensing agreements have become increasingly common as companies seek to leverage regional expertise and distribution capabilities.

Market segmentation analysis provides detailed insights into various categories and applications within the APAC meglitinide market, enabling targeted strategies and opportunity identification across different patient populations and therapeutic scenarios.

By Product Type:

By Application:

By Distribution Channel:

Detailed category analysis reveals specific performance characteristics and growth patterns across different meglitinide market segments, providing actionable insights for strategic decision-making and market positioning.

Repaglinide Category: This segment maintains market leadership with approximately 68% category share due to extensive clinical experience and proven efficacy profile. Generic competition has intensified pricing pressures while expanding patient access across price-sensitive markets. Innovation opportunities exist in novel delivery systems and combination formulations that enhance patient convenience and therapeutic outcomes.

Nateglinide Category: Although smaller in market share, this segment demonstrates steady growth in specific patient populations where rapid onset and short duration are particularly valued. Clinical differentiation focuses on reduced hypoglycemia risk and flexibility in dosing schedules, appealing to patients with irregular meal patterns common in modern Asian lifestyles.

Combination Product Category: Represents the fastest-growing segment with expansion rates exceeding 22% annually as healthcare providers seek simplified treatment regimens. Fixed-dose combinations with metformin and other antidiabetic agents offer improved patient adherence and potentially superior clinical outcomes compared to separate medication administration.

Pediatric Applications: Emerging category with limited but growing clinical evidence supporting meglitinide use in adolescent type 2 diabetes patients. Regulatory approvals for pediatric indications could significantly expand addressable market populations across APAC territories with increasing childhood obesity and diabetes prevalence.

Pharmaceutical manufacturers benefit from substantial market opportunities driven by growing diabetes prevalence and expanding healthcare access across APAC markets. Revenue diversification through geographic expansion and product portfolio development provides stability and growth potential in dynamic healthcare environments. Generic manufacturers particularly benefit from patent expiries and cost-conscious healthcare systems seeking affordable treatment alternatives.

Healthcare providers gain access to flexible treatment options that align with diverse patient needs and dietary patterns common across Asian populations. Clinical benefits include improved postprandial glucose control, reduced hypoglycemia risk, and enhanced patient satisfaction through meal-time dosing flexibility. Combination products simplify prescribing decisions and potentially improve treatment adherence rates.

Patients and caregivers experience improved quality of life through effective glucose management and flexible dosing schedules that accommodate varying lifestyle demands. Economic benefits include reduced long-term diabetes complications and associated healthcare costs, while generic alternatives provide affordable treatment access for broader patient populations.

Healthcare systems benefit from cost-effective diabetes management solutions that demonstrate favorable economic outcomes compared to alternative therapeutic approaches. Population health improvements result from better diabetes control and reduced complication rates, ultimately reducing healthcare system burden and improving resource allocation efficiency across APAC territories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends are reshaping the APAC meglitinide landscape through technological innovation, changing patient preferences, and evolving healthcare delivery models. Digital therapeutics integration represents a significant trend, with smart insulin pens and continuous glucose monitoring systems enhancing medication management and clinical outcomes for meglitinide users.

Personalized medicine adoption is gaining momentum across developed APAC markets, with pharmacogenomic testing helping optimize meglitinide selection and dosing for individual patients. This trend aligns with broader healthcare personalization initiatives and could improve treatment efficacy while reducing adverse events. Precision dosing based on genetic markers and metabolic profiles represents a key differentiation opportunity for innovative manufacturers.

Combination therapy preferences continue to strengthen as healthcare providers seek simplified treatment regimens that improve patient adherence and clinical outcomes. Triple combination products incorporating meglitinides with complementary mechanisms of action are under development, potentially offering superior glucose control compared to individual agent therapy.

Sustainability initiatives are influencing pharmaceutical manufacturing and packaging decisions, with companies adopting environmentally friendly production processes and recyclable packaging materials. MarkWide Research indicates that sustainability considerations are becoming increasingly important in procurement decisions across APAC healthcare systems, particularly in environmentally conscious markets like Japan and Australia.

Recent industry developments highlight dynamic innovation and strategic positioning within the APAC meglitinide market, reflecting ongoing efforts to address unmet medical needs and capture emerging opportunities across diverse regional markets.

Regulatory approvals for new combination products have expanded treatment options, with several fixed-dose combinations receiving marketing authorization across major APAC territories. These approvals represent significant milestones for manufacturers seeking to differentiate their portfolios and capture market share in competitive therapeutic segments.

Manufacturing capacity expansion initiatives by leading generic manufacturers in India and China have enhanced regional supply capabilities while reducing production costs. These investments support growing demand across emerging markets and provide strategic advantages in price-competitive segments where cost leadership determines market success.

Strategic partnerships between multinational pharmaceutical companies and regional distributors have strengthened market access capabilities, particularly in emerging economies where local expertise and relationships are critical for commercial success. Licensing agreements have enabled technology transfer and accelerated generic product development across multiple APAC markets.

Clinical research initiatives focusing on Asian patient populations have generated valuable real-world evidence supporting meglitinide efficacy and safety in regional demographics. These studies address previous gaps in clinical data and support expanded indication approvals and treatment guideline recommendations across APAC healthcare systems.

Strategic recommendations for APAC meglitinide market participants emphasize the importance of differentiation through innovation, cost optimization, and regional market adaptation. Product development priorities should focus on combination therapies and novel delivery systems that address current limitations while providing clear clinical advantages over existing alternatives.

Market access strategies require careful consideration of regional healthcare system characteristics, reimbursement policies, and competitive dynamics. Companies should prioritize markets with favorable regulatory environments and growing healthcare expenditure while developing cost-effective solutions for price-sensitive segments. Local partnerships and manufacturing capabilities can provide significant competitive advantages in emerging markets.

Digital health integration represents a critical opportunity for market differentiation and patient value creation. Companies should invest in smart dosing systems, adherence monitoring platforms, and data analytics capabilities that enhance treatment outcomes and support healthcare provider decision-making. MWR analysis suggests that digital health adoption could improve patient adherence rates by approximately 28% within the next three years.

Regulatory strategy optimization should focus on streamlined approval processes and harmonized clinical development programs that reduce time-to-market and development costs across multiple APAC jurisdictions. Companies should engage early with regulatory authorities and leverage existing clinical data to support expanded indications and new formulation approvals.

Future market prospects for the APAC meglitinide market remain positive despite competitive challenges and evolving therapeutic landscapes. Long-term growth drivers include continued diabetes prevalence increases, healthcare infrastructure development, and expanding access to specialized diabetes medications across emerging economies. Market maturation in developed territories will likely focus on innovation and clinical differentiation rather than volume expansion.

Technology integration will play an increasingly important role in market development, with digital health solutions enhancing medication management and clinical outcomes for meglitinide users. Artificial intelligence and machine learning applications could optimize dosing algorithms and predict treatment responses, providing significant value for both patients and healthcare providers.

Competitive evolution will likely favor companies that successfully combine cost competitiveness with clinical innovation and digital health capabilities. Generic manufacturers with strong regional presence and manufacturing efficiency will continue to gain market share, while branded companies must demonstrate clear clinical advantages to maintain premium pricing positions.

Regulatory harmonization initiatives across APAC territories should facilitate market access and reduce development costs for innovative products. Market consolidation may accelerate as companies seek scale advantages and portfolio optimization in increasingly competitive therapeutic segments. Overall market growth is projected to maintain momentum with expansion rates of approximately 7.5% CAGR over the next five years, driven by demographic trends and healthcare system evolution across the Asia-Pacific region.

The APAC meglitinide market represents a dynamic and evolving therapeutic landscape with substantial opportunities for growth and innovation despite competitive challenges and market complexities. Market fundamentals remain strong, supported by increasing diabetes prevalence, expanding healthcare access, and growing recognition of postprandial glucose control importance across diverse Asian populations.

Strategic success in this market requires careful balance of innovation, cost optimization, and regional adaptation to address varying healthcare system characteristics and patient needs across APAC territories. Companies that effectively leverage digital health integration, develop meaningful combination products, and maintain competitive cost structures will be best positioned to capture emerging opportunities and sustain long-term growth.

Future market development will likely be shaped by continued technological advancement, regulatory evolution, and changing patient expectations for personalized diabetes care solutions. The ability to demonstrate clear clinical value while maintaining cost-effectiveness will determine competitive positioning in an increasingly sophisticated and demanding healthcare environment across the Asia-Pacific region.

What is Meglitinide?

Meglitinide is a class of oral hypoglycemic agents used to manage blood sugar levels in individuals with type two diabetes. These medications stimulate insulin secretion from the pancreas, helping to control postprandial glucose levels.

What are the key players in the APAC Meglitinide Market?

Key players in the APAC Meglitinide Market include Sanofi, Novo Nordisk, and Eli Lilly, among others. These companies are involved in the development and distribution of Meglitinide medications across the region.

What are the growth factors driving the APAC Meglitinide Market?

The APAC Meglitinide Market is driven by the increasing prevalence of type two diabetes, rising healthcare expenditure, and growing awareness of diabetes management. Additionally, advancements in drug formulations and delivery methods contribute to market growth.

What challenges does the APAC Meglitinide Market face?

The APAC Meglitinide Market faces challenges such as stringent regulatory requirements, competition from alternative diabetes treatments, and potential side effects associated with Meglitinide use. These factors can hinder market expansion and adoption.

What opportunities exist in the APAC Meglitinide Market?

Opportunities in the APAC Meglitinide Market include the development of new formulations, increasing investment in diabetes care, and expanding access to healthcare services. These factors can enhance treatment options for patients and drive market growth.

What trends are shaping the APAC Meglitinide Market?

Trends in the APAC Meglitinide Market include the rise of personalized medicine, the integration of digital health technologies, and a focus on patient-centric care. These trends are influencing how Meglitinide therapies are developed and delivered.

APAC Meglitinide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Repaglinide, Nateglinide, Others |

| Delivery Mode | Oral, Injectable, Others |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Distribution Channel | Online, Retail, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Meglitinide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at