444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC apheresis market represents a rapidly expanding healthcare segment driven by increasing prevalence of chronic diseases, growing awareness of blood component therapy, and advancing medical technologies across the Asia-Pacific region. Apheresis procedures have gained significant traction in countries like Japan, China, India, and Australia, where healthcare infrastructure development and rising healthcare expenditure support market growth. The region demonstrates substantial market potential with therapeutic apheresis applications expanding beyond traditional blood banking into specialized treatment areas including autoimmune disorders, neurological conditions, and oncology support.

Market dynamics in the APAC region reflect diverse healthcare landscapes, with developed markets like Japan and Australia leading in advanced apheresis technologies, while emerging economies including India and Southeast Asian countries show accelerating adoption rates of approximately 12-15% annually. The integration of automated apheresis systems in hospitals and blood centers has enhanced procedural efficiency and patient outcomes, contributing to the region’s robust market expansion.

Regional healthcare policies supporting blood safety initiatives and therapeutic plasma programs have created favorable conditions for market development. Countries across APAC are investing in modern healthcare infrastructure, with particular emphasis on specialized treatment centers and blood component separation facilities that utilize advanced apheresis technologies.

The APAC apheresis market refers to the comprehensive ecosystem of medical devices, consumables, and services related to apheresis procedures across Asia-Pacific countries. Apheresis technology enables the selective separation and collection of specific blood components while returning the remaining elements to the donor or patient, facilitating both therapeutic treatments and blood component collection for transfusion purposes.

Therapeutic apheresis applications encompass a wide range of medical interventions including plasmapheresis for autoimmune conditions, cytapheresis for blood disorders, and photopheresis for certain cancers and immune-mediated diseases. The market includes automated apheresis systems, disposable kits, replacement fluids, and associated medical services provided by healthcare facilities across the region.

Market scope extends from traditional blood banking operations to specialized clinical applications, with increasing integration of digital technologies and automation enhancing procedural precision and patient safety standards throughout the APAC healthcare landscape.

Strategic market analysis reveals that the APAC apheresis market is experiencing unprecedented growth driven by demographic shifts, disease pattern changes, and healthcare modernization initiatives across the region. Key growth drivers include the rising incidence of autoimmune disorders, increasing awareness of plasma-derived therapies, and expanding healthcare infrastructure in emerging economies.

Market segmentation demonstrates strong performance across multiple categories, with therapeutic apheresis showing particularly robust growth rates of 8-10% annually in major markets. The donor apheresis segment continues to dominate volume-wise, while therapeutic applications command premium pricing and higher profit margins for market participants.

Competitive landscape features both global medical device manufacturers and regional players, with innovation focusing on automation, user-friendly interfaces, and enhanced safety features. The market benefits from favorable regulatory environments in key countries and increasing government support for blood safety and therapeutic plasma programs.

Future projections indicate sustained growth momentum, with emerging applications in regenerative medicine and personalized therapy approaches expected to create new market opportunities throughout the forecast period.

Critical market insights reveal several transformative trends shaping the APAC apheresis landscape:

Primary market drivers propelling APAC apheresis market growth encompass demographic, technological, and healthcare policy factors that create sustained demand for apheresis procedures and equipment.

Demographic transitions across APAC countries, including aging populations and changing disease patterns, significantly impact market dynamics. The increasing prevalence of autoimmune disorders, with growth rates of 6-8% annually in major markets, creates expanding demand for therapeutic apheresis interventions. Countries like Japan and South Korea, with rapidly aging populations, demonstrate particularly strong demand for plasma exchange therapies and specialized blood component treatments.

Healthcare infrastructure development in emerging economies provides substantial growth opportunities. Countries including India, Vietnam, and Indonesia are investing heavily in modern healthcare facilities, with specialized blood centers and therapeutic apheresis units becoming integral components of comprehensive healthcare systems.

Technological advancement in apheresis equipment enhances procedural efficiency and safety, driving adoption among healthcare providers. Modern automated systems offer improved separation precision, reduced procedure times, and enhanced patient comfort, making apheresis more accessible and acceptable to both medical professionals and patients.

Government initiatives supporting blood safety and plasma collection programs create favorable market conditions. National health policies emphasizing self-sufficiency in blood products and therapeutic plasma derivatives drive investment in apheresis infrastructure and capabilities.

Significant market restraints present challenges to APAC apheresis market expansion, requiring strategic approaches from industry participants to address barriers and limitations.

High capital investment requirements for apheresis equipment and facility setup create entry barriers, particularly for smaller healthcare providers and emerging market facilities. The substantial initial costs associated with automated apheresis systems, along with ongoing maintenance and consumable expenses, can limit market penetration in cost-sensitive healthcare environments.

Skilled personnel shortage represents a critical constraint across many APAC countries. Apheresis procedures require specialized training and expertise, and the limited availability of qualified technicians and medical professionals can restrict market growth and procedural capacity expansion.

Regulatory complexity varies significantly across APAC countries, creating challenges for manufacturers seeking regional market access. Different approval processes, quality standards, and compliance requirements can delay product launches and increase market entry costs.

Patient awareness limitations in certain regions affect demand generation. Limited understanding of apheresis benefits and applications among healthcare providers and patients can restrict market development, particularly in emerging economies where traditional treatment approaches may be preferred.

Infrastructure constraints in rural and remote areas limit market reach. Inadequate healthcare facilities, power supply issues, and logistical challenges can prevent apheresis service expansion to underserved populations across the region.

Emerging market opportunities in the APAC apheresis sector present substantial growth potential for industry participants willing to invest in innovation and market development strategies.

Therapeutic application expansion offers significant opportunities as medical research continues to identify new clinical applications for apheresis procedures. Growing evidence supporting apheresis effectiveness in treating neurological disorders, certain cancers, and immune-mediated conditions creates new market segments with premium pricing potential.

Digital health integration presents transformative opportunities for market participants. The incorporation of artificial intelligence, remote monitoring, and data analytics into apheresis systems can enhance procedural outcomes, improve patient management, and create new service delivery models that differentiate market offerings.

Emerging market penetration in countries like Bangladesh, Myanmar, and Pacific Island nations offers untapped growth potential. These markets demonstrate increasing healthcare investment and growing awareness of advanced medical technologies, creating opportunities for market expansion with appropriate localization strategies.

Public-private partnerships with government health agencies can accelerate market development. Collaborative initiatives focusing on blood safety, plasma collection, and therapeutic program development can provide stable revenue streams while supporting public health objectives.

Mobile apheresis services represent an innovative opportunity to extend market reach. Portable and mobile apheresis units can serve remote areas and provide flexible service delivery options that address geographic and infrastructure constraints.

Complex market dynamics shape the APAC apheresis landscape, with multiple interconnected factors influencing growth patterns, competitive positioning, and strategic decision-making across the region.

Supply chain considerations play a crucial role in market dynamics, with manufacturers balancing global production efficiencies against regional customization requirements. The need for reliable consumable supply chains and local technical support capabilities influences market entry strategies and competitive positioning.

Healthcare reimbursement policies significantly impact market dynamics across different APAC countries. Variations in insurance coverage for apheresis procedures affect patient access and demand patterns, with countries offering comprehensive coverage demonstrating higher procedure volumes and market growth rates of 10-12% annually.

Competitive intensity varies across market segments and geographic regions. While donor apheresis markets show intense price competition, therapeutic apheresis segments offer opportunities for differentiation through advanced technology features and clinical support services.

Innovation cycles drive market evolution, with manufacturers continuously developing enhanced automation features, improved separation efficiency, and better user interfaces. The rapid pace of technological advancement creates opportunities for market leaders while challenging existing players to maintain competitive positions.

Regulatory evolution across APAC countries influences market dynamics through changing approval requirements, safety standards, and quality specifications. Harmonization efforts in some regions facilitate market access, while divergent regulatory approaches in others create complexity for multinational manufacturers.

Comprehensive research methodology employed in analyzing the APAC apheresis market combines multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with key industry stakeholders, including apheresis equipment manufacturers, healthcare providers, blood center administrators, and regulatory officials across major APAC markets. These interactions provide real-time market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, regulatory filings, clinical studies, and healthcare statistics from government agencies and international organizations. This comprehensive data collection ensures broad market coverage and historical trend analysis.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing procedure volumes, equipment installations, and consumable usage patterns across different market segments and geographic regions. Cross-validation techniques ensure data accuracy and consistency.

Competitive analysis examines market share distribution, product portfolios, pricing strategies, and strategic initiatives of key market participants. This analysis provides insights into competitive dynamics and market positioning strategies.

Trend analysis identifies emerging patterns in technology adoption, clinical applications, and market development across the APAC region. Forward-looking analysis incorporates expert opinions and scenario modeling to project future market evolution.

Regional market analysis reveals significant variations in apheresis market development across APAC countries, with distinct growth patterns, adoption rates, and market characteristics reflecting diverse healthcare landscapes and economic conditions.

Japan represents the most mature apheresis market in the region, with advanced healthcare infrastructure and high procedure volumes. The country demonstrates strong adoption of automated systems and therapeutic applications, with market share of approximately 25-30% of the total APAC apheresis market. Japanese healthcare facilities emphasize quality and safety, driving demand for premium apheresis technologies.

China shows the fastest growth rates in the region, with expanding healthcare infrastructure and increasing healthcare expenditure supporting rapid market development. The country’s large population base and growing awareness of advanced medical treatments create substantial market opportunities, with growth rates exceeding 15% annually in major urban centers.

India presents significant growth potential with improving healthcare access and increasing prevalence of chronic diseases requiring apheresis interventions. The market benefits from government initiatives supporting healthcare modernization and growing private healthcare sector investment.

Australia and New Zealand maintain steady market growth with well-established healthcare systems and comprehensive insurance coverage for apheresis procedures. These markets emphasize clinical excellence and patient outcomes, supporting adoption of advanced apheresis technologies.

Southeast Asian countries including Thailand, Malaysia, and Singapore demonstrate increasing market activity, with medical tourism and healthcare infrastructure development driving apheresis service expansion and equipment adoption.

Competitive landscape analysis reveals a dynamic market environment with established global manufacturers competing alongside regional players, each pursuing distinct strategies to capture market share and drive growth in the APAC apheresis market.

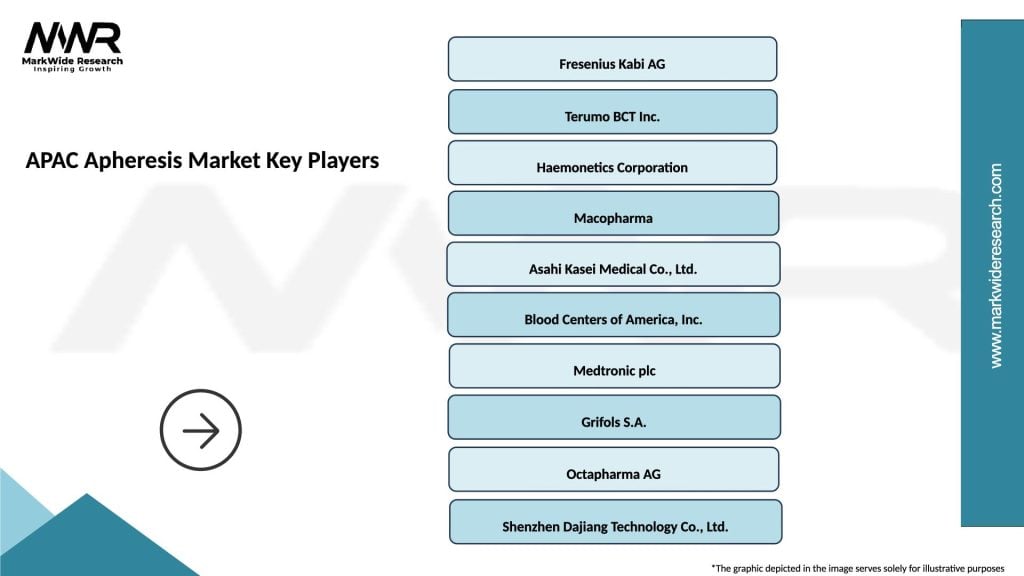

Leading market participants include:

Strategic initiatives among competitors include technology partnerships, regional manufacturing investments, and clinical research collaborations. Companies are focusing on automation enhancement, user experience improvement, and cost optimization to maintain competitive advantages.

Market positioning strategies vary from premium technology leadership to cost-effective solutions targeting price-sensitive segments. Successful companies demonstrate strong local presence, comprehensive service support, and continuous innovation capabilities.

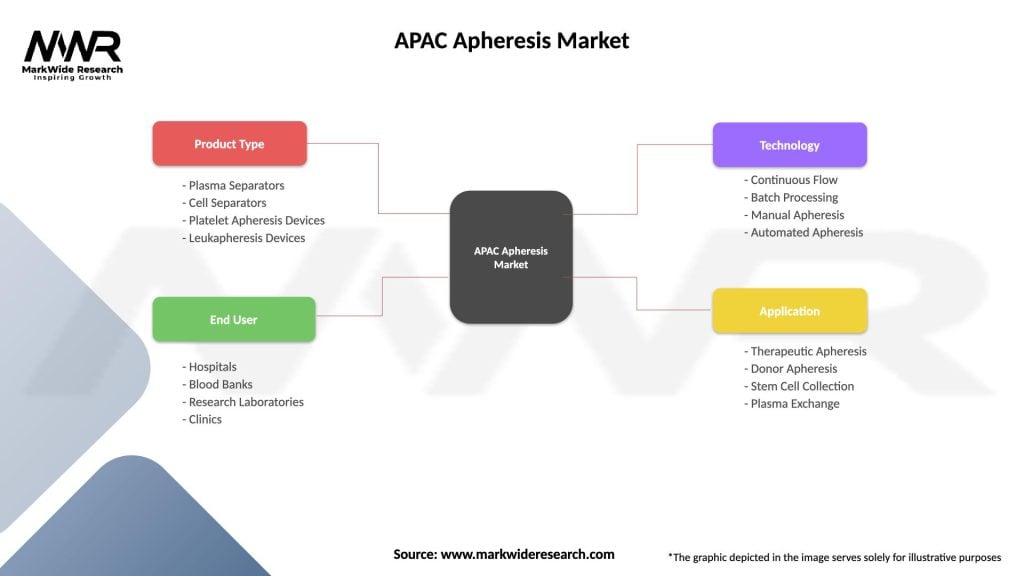

Market segmentation analysis provides detailed insights into different categories within the APAC apheresis market, revealing growth patterns, opportunities, and competitive dynamics across various dimensions.

By Technology:

By Application:

By End User:

By Country:

Detailed category analysis reveals specific trends, growth drivers, and market characteristics within each segment of the APAC apheresis market, providing strategic insights for industry participants.

Donor Apheresis Category maintains market leadership with consistent volume growth driven by increasing blood donation awareness and expanding blood banking infrastructure. This segment benefits from government initiatives promoting voluntary blood donation and self-sufficiency in blood products. Platelet apheresis shows particularly strong growth with adoption rates of 18-20% in major markets, driven by increasing demand for platelet concentrates in cancer treatment and surgical procedures.

Therapeutic Apheresis Category demonstrates the highest growth potential with expanding clinical applications and increasing physician awareness. Plasmapheresis procedures for autoimmune disorders show robust growth, while emerging applications in neurology and rheumatology create new market opportunities. This category commands premium pricing and offers higher profit margins for equipment manufacturers and service providers.

Equipment Category evolution focuses on automation, connectivity, and user experience enhancement. Modern apheresis systems incorporate advanced monitoring capabilities, predictive maintenance features, and integration with hospital information systems. Automated systems account for approximately 75-80% of new installations in developed markets, while manual systems remain relevant in cost-sensitive segments.

Consumables Category provides recurring revenue streams with steady growth patterns. Disposable kits, replacement fluids, and accessories represent significant market value, with manufacturers focusing on cost optimization and supply chain efficiency to maintain competitive positioning.

Strategic benefits for industry participants in the APAC apheresis market encompass multiple value creation opportunities across different stakeholder categories, supporting sustainable growth and competitive advantage development.

For Equipment Manufacturers:

For Healthcare Providers:

For Patients:

Comprehensive SWOT analysis provides strategic insights into the APAC apheresis market’s internal capabilities and external environment, supporting informed decision-making for industry participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends are reshaping the APAC apheresis landscape, creating new opportunities and challenges for industry participants while driving innovation and market evolution.

Automation Enhancement represents a dominant trend with manufacturers developing increasingly sophisticated automated systems. These advanced platforms incorporate artificial intelligence, predictive analytics, and remote monitoring capabilities, reducing operator dependency and improving procedural consistency. Automation adoption rates exceed 70% in developed APAC markets, with emerging economies showing rapid catch-up trends.

Personalized Medicine Integration is gaining momentum as apheresis procedures become more tailored to individual patient characteristics and treatment requirements. This trend supports precision medicine initiatives and enables optimized therapeutic outcomes through customized treatment protocols.

Digital Health Connectivity transforms apheresis systems into connected medical devices capable of real-time data sharing, remote monitoring, and integrated healthcare system communication. This connectivity enables better patient management, predictive maintenance, and quality assurance capabilities.

Minimally Invasive Approaches drive technology development toward gentler procedures with reduced patient discomfort and shorter recovery times. Advanced separation technologies and improved vascular access methods contribute to enhanced patient experience and broader treatment acceptance.

Point-of-Care Solutions emerge as important trends, with portable and compact apheresis systems enabling treatment delivery in diverse healthcare settings. These solutions address geographic accessibility challenges and support decentralized healthcare delivery models.

Significant industry developments across the APAC apheresis market demonstrate ongoing innovation, strategic positioning, and market evolution among key participants and stakeholders.

Technology Advancement Initiatives include major manufacturers launching next-generation apheresis platforms with enhanced automation, improved user interfaces, and advanced safety features. These developments focus on reducing procedural complexity while improving separation efficiency and patient outcomes.

Strategic Partnerships between global manufacturers and regional healthcare providers are expanding market reach and service capabilities. MarkWide Research analysis indicates that such partnerships have increased by 35% over recent years, facilitating technology transfer and local market development.

Regulatory Approvals for new apheresis systems and therapeutic applications continue to expand market opportunities. Recent approvals for specialized therapeutic procedures and pediatric applications demonstrate regulatory support for market development and clinical innovation.

Manufacturing Investments in APAC countries support local production capabilities and supply chain optimization. Several manufacturers have established regional production facilities to serve growing local demand while reducing costs and improving service responsiveness.

Clinical Research Expansion includes numerous studies investigating new therapeutic applications and procedural optimization. These research initiatives support evidence-based medicine approaches and create pathways for market expansion into new clinical areas.

Training Program Development addresses skilled personnel shortages through comprehensive education initiatives. Manufacturers and healthcare organizations are investing in training centers and certification programs to build local expertise and support market growth.

Strategic recommendations for APAC apheresis market participants focus on sustainable growth strategies, competitive positioning, and market development approaches that address regional opportunities and challenges.

Market Entry Strategies should emphasize local partnerships and gradual market development rather than aggressive expansion approaches. Successful market entry requires understanding of local healthcare systems, regulatory requirements, and cultural factors that influence adoption patterns.

Technology Investment Priorities should focus on automation, connectivity, and user experience enhancement. Companies investing in digital health integration and artificial intelligence capabilities are likely to achieve competitive advantages and premium market positioning.

Geographic Expansion recommendations prioritize emerging markets with growing healthcare infrastructure and increasing healthcare expenditure. Countries like Vietnam, Indonesia, and Philippines offer substantial growth potential for companies with appropriate localization strategies.

Product Portfolio Development should balance advanced technology offerings with cost-effective solutions suitable for price-sensitive market segments. Tiered product strategies can address diverse market requirements while maximizing market coverage and revenue potential.

Service Enhancement initiatives should focus on comprehensive customer support, training programs, and technical assistance capabilities. Strong service networks are essential for market success in the complex and diverse APAC healthcare landscape.

Regulatory Strategy development should anticipate evolving compliance requirements and invest in regulatory expertise for key markets. Proactive regulatory engagement can facilitate faster market access and reduce compliance risks.

Future market projections for the APAC apheresis market indicate sustained growth momentum driven by demographic trends, healthcare modernization, and expanding clinical applications across the region.

Growth trajectory analysis suggests continued market expansion with emerging economies leading growth rates while developed markets focus on technology advancement and clinical sophistication. MWR projections indicate overall market growth rates of 8-12% annually across major APAC countries, with therapeutic applications showing particularly strong momentum.

Technology evolution will continue toward greater automation, enhanced connectivity, and improved patient experience. Future apheresis systems are expected to incorporate advanced artificial intelligence, predictive analytics, and seamless integration with electronic health records and hospital information systems.

Clinical application expansion will drive market diversification as research continues to identify new therapeutic indications for apheresis procedures. Emerging applications in regenerative medicine, immunotherapy support, and personalized treatment approaches will create new market segments and revenue opportunities.

Market consolidation trends may emerge as smaller regional players seek partnerships with global manufacturers to access advanced technologies and broader market reach. This consolidation could improve market efficiency while maintaining competitive dynamics.

Regulatory harmonization across APAC countries is expected to facilitate market access and reduce compliance complexity. Regional cooperation initiatives and international standard adoption will support market development and technology transfer.

Healthcare infrastructure development in emerging markets will continue to create new opportunities for apheresis service expansion. Government healthcare investments and private sector participation will support market growth and accessibility improvement.

The APAC apheresis market represents a dynamic and rapidly evolving healthcare segment with substantial growth potential driven by demographic transitions, healthcare modernization, and expanding clinical applications across the Asia-Pacific region. Market analysis reveals a complex landscape characterized by diverse growth patterns, varying market maturity levels, and significant opportunities for industry participants willing to invest in innovation and market development.

Key success factors for market participants include technology leadership, strong local presence, comprehensive service capabilities, and strategic partnerships with healthcare providers and government agencies. The market rewards companies that can balance advanced technology offerings with cost-effective solutions suitable for diverse economic conditions across APAC countries.

Strategic positioning requires understanding of regional variations in healthcare systems, regulatory requirements, and market dynamics. Successful companies demonstrate flexibility in their market approaches while maintaining consistent quality and safety standards across all operations.

Future market development will be shaped by continued healthcare infrastructure investment, expanding therapeutic applications, and advancing automation technologies. The integration of digital health capabilities and artificial intelligence will create new value propositions and competitive advantages for forward-thinking market participants. As the APAC apheresis market continues its growth trajectory, companies that invest in innovation, local partnerships, and comprehensive market strategies will be best positioned to capture emerging opportunities and achieve sustainable success in this dynamic healthcare segment.

What is Apheresis?

Apheresis is a medical procedure that involves the separation of blood components, allowing for the collection of specific elements such as plasma or platelets. This technique is commonly used in blood donation and therapeutic treatments.

What are the key players in the APAC Apheresis Market?

Key players in the APAC Apheresis Market include Fresenius Kabi, Terumo BCT, Haemonetics Corporation, and Grifols, among others. These companies are involved in the development and distribution of apheresis equipment and consumables.

What are the growth factors driving the APAC Apheresis Market?

The APAC Apheresis Market is driven by increasing demand for blood components in transfusions, rising prevalence of chronic diseases, and advancements in apheresis technology. Additionally, the growing awareness of blood donation benefits contributes to market growth.

What challenges does the APAC Apheresis Market face?

Challenges in the APAC Apheresis Market include regulatory hurdles, high costs associated with apheresis procedures, and a shortage of trained professionals. These factors can hinder the adoption of apheresis technologies in some regions.

What opportunities exist in the APAC Apheresis Market?

The APAC Apheresis Market presents opportunities for growth through the development of innovative apheresis technologies and increasing partnerships between healthcare providers and apheresis companies. Expanding applications in therapeutic apheresis also offer potential.

What trends are shaping the APAC Apheresis Market?

Trends in the APAC Apheresis Market include the integration of automation in apheresis procedures, the rise of personalized medicine, and the increasing use of apheresis in treating autoimmune diseases. These trends are expected to enhance efficiency and patient outcomes.

APAC Apheresis Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plasma Separators, Cell Separators, Platelet Apheresis Devices, Leukapheresis Devices |

| End User | Hospitals, Blood Banks, Research Laboratories, Clinics |

| Technology | Continuous Flow, Batch Processing, Manual Apheresis, Automated Apheresis |

| Application | Therapeutic Apheresis, Donor Apheresis, Stem Cell Collection, Plasma Exchange |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Apheresis Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at