444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom tumble dryers market represents a significant segment within the broader domestic appliances industry, characterized by robust consumer demand and technological innovation. This market encompasses various types of tumble dryers, including vented, condenser, and heat pump models, serving both residential and commercial applications across England, Scotland, Wales, and Northern Ireland. The market has experienced steady growth driven by changing lifestyle patterns, increased urbanization, and rising consumer awareness about energy efficiency.

Market dynamics indicate substantial expansion opportunities, with the sector demonstrating resilience despite economic fluctuations. The UK market benefits from strong consumer purchasing power, established retail infrastructure, and growing preference for premium appliances with advanced features. Energy-efficient models have gained significant traction, representing approximately 68% of total sales as consumers increasingly prioritize sustainability and cost-effectiveness in their purchasing decisions.

Technological advancement continues to reshape the market landscape, with manufacturers introducing smart connectivity features, improved energy ratings, and enhanced drying performance. The market serves diverse consumer segments, from budget-conscious households seeking basic functionality to premium buyers demanding cutting-edge technology and superior build quality. Heat pump technology has emerged as a particularly strong growth driver, capturing 42% market share among energy-efficient models due to its exceptional energy savings and gentle fabric care capabilities.

The United Kingdom tumble dryers market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, retail, and servicing of electric and gas-powered clothes drying appliances within the UK territory. This market includes various stakeholder categories such as international manufacturers, domestic producers, authorized dealers, independent retailers, and service providers who collectively facilitate the availability and maintenance of tumble drying solutions for British consumers.

Market scope extends beyond simple appliance sales to include related services, spare parts distribution, installation services, and extended warranty programs. The definition encompasses all tumble dryer categories, from compact apartment-sized units to large-capacity commercial models, serving residential households, laundromats, hospitality establishments, and healthcare facilities. Consumer preferences within this market reflect broader UK lifestyle trends, including space constraints in urban housing, environmental consciousness, and demand for convenience-oriented appliances.

Strategic market analysis reveals the UK tumble dryers market as a mature yet dynamic sector experiencing transformation through technological innovation and evolving consumer expectations. The market demonstrates strong fundamentals with consistent demand patterns supported by replacement cycles, new household formation, and increasing adoption of energy-efficient technologies. Premium segment growth has outpaced traditional categories, with high-end models accounting for 35% of revenue generation despite representing a smaller volume share.

Key market drivers include rising disposable income, changing weather patterns affecting outdoor drying preferences, and government incentives promoting energy-efficient appliances. The market has shown remarkable adaptability to external challenges, including supply chain disruptions and raw material cost fluctuations. Digital transformation has emerged as a critical success factor, with smart-enabled models experiencing 78% year-over-year growth in consumer interest and adoption rates.

Competitive landscape features a mix of established European manufacturers and emerging Asian brands, creating a dynamic environment that benefits consumers through improved product offerings and competitive pricing. Market consolidation trends have strengthened distribution networks while maintaining healthy competition across all price segments.

Consumer behavior analysis reveals several critical insights shaping market development and strategic planning for industry participants:

Urbanization trends continue to fuel market expansion as increasing numbers of UK residents live in apartments and homes with limited outdoor drying space. This demographic shift creates consistent demand for tumble dryers as essential household appliances rather than luxury items. Climate considerations also play a significant role, with unpredictable weather patterns making outdoor clothes drying less reliable throughout the year.

Energy efficiency regulations have become powerful market drivers, with government initiatives promoting high-efficiency appliances through rebate programs and energy labeling requirements. These policies encourage consumers to upgrade older, less efficient models while incentivizing manufacturers to invest in advanced technologies. Heat pump technology has particularly benefited from these regulatory frameworks, achieving widespread market acceptance.

Lifestyle changes including dual-income households, longer working hours, and increased focus on convenience have elevated tumble dryers from optional to essential appliances. Time-saving benefits resonate strongly with busy consumers who value the ability to dry clothes quickly and efficiently regardless of weather conditions or time constraints.

Technological advancement continues driving market growth through improved performance, reduced energy consumption, and enhanced user experiences. Smart connectivity features, sensor-based drying programs, and mobile app integration appeal to tech-savvy consumers while delivering tangible benefits in terms of convenience and energy savings.

High initial costs associated with premium energy-efficient models can deter price-sensitive consumers, particularly in economic downturns or periods of reduced disposable income. While long-term energy savings justify higher upfront investments, the immediate financial burden remains a significant barrier for many households, especially first-time buyers or those replacing functional older units.

Space limitations in UK housing stock present ongoing challenges, particularly in urban areas where compact living spaces cannot accommodate standard-sized tumble dryers. This constraint limits market penetration in certain demographic segments and geographic regions, requiring manufacturers to develop specialized compact models that may command premium pricing.

Environmental concerns about energy consumption and carbon footprint create conflicting consumer sentiments, with some environmentally conscious buyers preferring air-drying methods despite convenience benefits. These concerns are amplified by rising energy costs and climate change awareness, potentially limiting market expansion among certain consumer segments.

Maintenance requirements and potential repair costs associated with complex modern tumble dryers can discourage adoption, particularly among older consumers who may prefer simpler, more reliable appliances. Technical complexity in advanced models may also create user experience challenges that impact customer satisfaction and brand loyalty.

Smart home integration presents substantial growth opportunities as UK consumers increasingly adopt connected home ecosystems. Tumble dryers with advanced IoT capabilities, voice control compatibility, and integration with home energy management systems can command premium pricing while delivering enhanced user experiences. Artificial intelligence applications in fabric care and energy optimization represent emerging opportunities for differentiation.

Sustainability focus creates opportunities for manufacturers to develop and market ultra-efficient models that exceed current energy standards. Circular economy principles including appliance recycling programs, component remanufacturing, and extended product lifecycles can generate new revenue streams while appealing to environmentally conscious consumers.

Commercial market expansion offers significant growth potential in hospitality, healthcare, and service sectors where professional-grade tumble dryers serve specialized applications. These markets typically feature higher-capacity requirements, more frequent usage patterns, and willingness to invest in premium equipment for operational efficiency.

Rental market growth in UK housing creates opportunities for appliance leasing programs and rent-to-own models that make premium tumble dryers accessible to broader consumer segments. Subscription-based services including maintenance, upgrades, and replacement programs could generate recurring revenue while reducing consumer ownership barriers.

Supply chain evolution continues reshaping market dynamics as manufacturers adapt to global component sourcing challenges, logistics constraints, and raw material cost fluctuations. Regional manufacturing initiatives aimed at reducing dependence on distant suppliers are gaining momentum, potentially affecting pricing structures and product availability patterns across different market segments.

Retail channel transformation reflects changing consumer shopping preferences, with online sales gaining significant market share while traditional appliance stores adapt their service offerings. Omnichannel strategies combining digital marketing, online configuration tools, and physical showroom experiences are becoming essential for competitive success in the evolving retail landscape.

Regulatory environment continues influencing market dynamics through energy efficiency standards, safety requirements, and environmental regulations. Policy changes related to energy labeling, disposal requirements, and efficiency incentives create both challenges and opportunities for market participants, requiring ongoing adaptation and strategic planning.

Consumer education initiatives by manufacturers and retailers are improving market dynamics by helping buyers understand energy efficiency benefits, proper usage techniques, and maintenance requirements. MarkWide Research analysis indicates that informed consumers demonstrate 23% higher satisfaction rates with their tumble dryer purchases, leading to stronger brand loyalty and positive word-of-mouth recommendations.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings across all market segments and geographic regions within the United Kingdom. Primary research components include structured consumer surveys, in-depth interviews with industry executives, retailer feedback sessions, and focus groups representing diverse demographic segments and usage patterns.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and regulatory filings to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends, identify growth patterns, and assess competitive positioning across different product categories and price segments.

Data collection spans multiple touchpoints including manufacturer sales data, retailer inventory reports, consumer purchase surveys, and service provider feedback to create comprehensive market intelligence. Geographic segmentation ensures representation across England, Scotland, Wales, and Northern Ireland, accounting for regional variations in consumer preferences, housing characteristics, and economic conditions.

Quality assurance protocols include data triangulation, expert validation, and statistical significance testing to ensure research findings meet professional standards for accuracy and reliability. Continuous monitoring systems track market developments and update analysis to reflect emerging trends and changing market conditions.

England dominates the UK tumble dryers market with approximately 84% of total demand, driven by its large population base, higher urbanization rates, and concentrated economic activity in major metropolitan areas. London and Southeast England represent particularly strong markets due to high disposable incomes, space-constrained housing, and consumer preference for premium appliances with advanced features.

Scotland accounts for roughly 8% of market share, with distinct preferences for energy-efficient models driven by environmental consciousness and higher energy costs. Scottish consumers demonstrate strong loyalty to established brands while showing increasing interest in smart connectivity features and extended warranty programs.

Wales represents approximately 5% of market volume, characterized by price-sensitive purchasing patterns and preference for reliable, straightforward appliances without complex features. Rural areas within Wales show lower penetration rates due to housing characteristics that favor outdoor drying methods and lower population density.

Northern Ireland comprises about 3% of total market demand, with unique characteristics including strong preference for gas-powered models where natural gas infrastructure permits, and emphasis on durability and service support due to geographic isolation from major service centers. Cross-border shopping patterns with the Republic of Ireland create additional complexity in market analysis and competitive positioning.

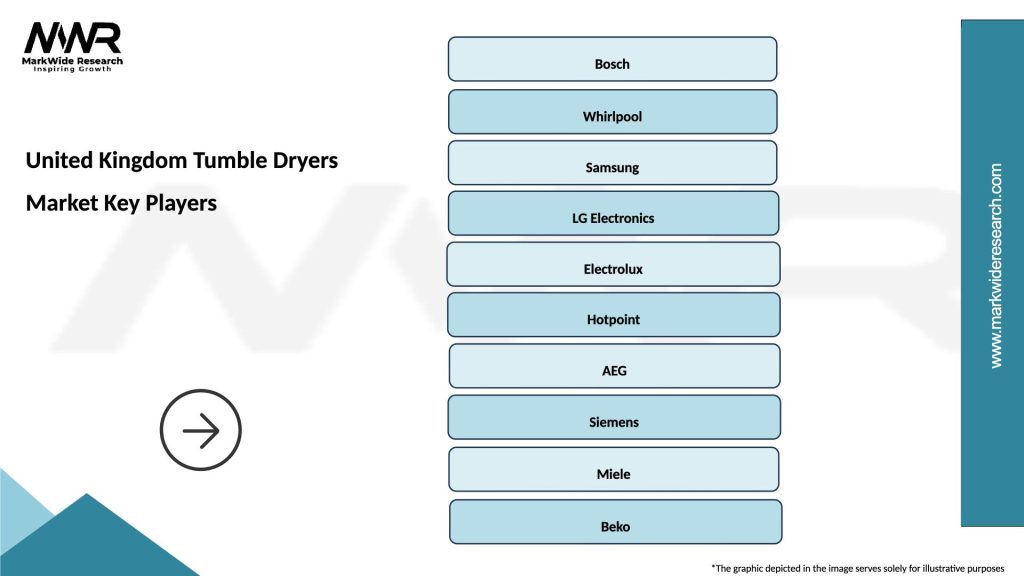

Market leadership is distributed among several established manufacturers, each with distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly across market segments, with premium brands emphasizing technological innovation and build quality while value-oriented manufacturers focus on cost optimization and basic functionality. Brand differentiation increasingly relies on energy efficiency ratings, smart features, and comprehensive service support rather than traditional factors like capacity or basic performance.

By Technology:

By Capacity:

By Application:

By Distribution Channel:

Heat pump technology has emerged as the fastest-growing category, driven by exceptional energy efficiency ratings and government incentives promoting sustainable appliances. Consumer adoption continues accelerating despite higher initial costs, with buyers recognizing long-term operational savings and environmental benefits. Advanced models feature precise temperature control, moisture sensing, and fabric-specific programs that deliver superior results while minimizing energy consumption.

Smart connectivity features are transforming traditional appliance categories into connected home devices with remote monitoring, diagnostic capabilities, and integration with home automation systems. Mobile applications enable users to monitor drying progress, receive completion notifications, and access troubleshooting support, enhancing overall user experience and satisfaction levels.

Compact models address specific market needs in urban environments where space constraints limit appliance options. Engineering innovations in compact designs have improved capacity efficiency while maintaining performance standards, making these models increasingly attractive to city dwellers and small households.

Commercial applications represent a specialized but lucrative market segment with distinct requirements for durability, capacity, and service support. Professional-grade models feature enhanced construction, extended warranties, and specialized programs designed for high-frequency usage patterns in business environments.

Manufacturers benefit from strong market demand, technological differentiation opportunities, and premium pricing potential for innovative products. Research and development investments in energy efficiency and smart features generate competitive advantages while meeting evolving consumer expectations and regulatory requirements.

Retailers gain from healthy profit margins, recurring service revenue opportunities, and strong consumer demand for replacement and upgrade purchases. Value-added services including installation, extended warranties, and maintenance programs create additional revenue streams while strengthening customer relationships.

Consumers enjoy improved product quality, enhanced energy efficiency, and advanced features that deliver superior convenience and performance. Long-term cost savings from energy-efficient models offset higher initial investments while providing environmental benefits and improved fabric care.

Service providers benefit from growing demand for professional installation, maintenance, and repair services as appliances become more sophisticated. Specialized expertise in advanced technologies creates competitive advantages and premium pricing opportunities in the service sector.

Energy utilities gain from reduced peak demand as efficient tumble dryers consume less electricity while smart models can participate in demand response programs. Grid stability improves through load management capabilities in connected appliances.

Strengths:

Weaknesses:

Opportunities:

Threats:

Energy efficiency optimization continues driving product development as manufacturers strive to exceed current standards and meet future regulatory requirements. Heat pump technology refinements are delivering even greater efficiency gains while reducing operational noise levels and improving reliability. Advanced sensor systems enable precise moisture detection and temperature control for optimal energy utilization.

Smart connectivity expansion is transforming tumble dryers into integral components of connected home ecosystems. Artificial intelligence applications include predictive maintenance, usage pattern analysis, and automated program selection based on fabric types and load characteristics. Voice control integration with popular smart home platforms enhances user convenience and accessibility.

Sustainability initiatives extend beyond energy efficiency to encompass entire product lifecycles, including recyclable materials, reduced packaging, and take-back programs for end-of-life appliances. Circular economy principles are influencing design decisions and business models across the industry.

Customization capabilities allow consumers to tailor appliance features and programs to specific household needs and preferences. Modular designs enable feature upgrades and capacity adjustments without complete appliance replacement, extending product lifecycles and improving value propositions.

Technological breakthroughs in heat pump efficiency have achieved new performance benchmarks while reducing manufacturing costs, making advanced technology accessible to broader market segments. Inverter motor technology improvements deliver quieter operation, improved reliability, and enhanced energy efficiency across all product categories.

Manufacturing consolidation has strengthened supply chain efficiency while enabling greater investment in research and development initiatives. Strategic partnerships between appliance manufacturers and technology companies are accelerating smart feature development and market introduction timelines.

Retail channel evolution includes expanded online presence, virtual showroom experiences, and enhanced delivery and installation services. Augmented reality applications help consumers visualize appliances in their homes and understand feature benefits before purchase decisions.

Service innovation encompasses predictive maintenance programs, remote diagnostics capabilities, and comprehensive warranty extensions that improve customer satisfaction while generating recurring revenue streams. MarkWide Research data indicates that enhanced service offerings contribute to 31% higher customer retention rates among premium appliance buyers.

Market participants should prioritize investment in energy efficiency technologies and smart connectivity features to meet evolving consumer expectations and regulatory requirements. Heat pump technology represents the most promising growth opportunity, requiring continued refinement to improve performance while reducing costs and complexity.

Distribution strategy optimization should balance online and offline channels while enhancing customer experience through improved consultation, delivery, and installation services. Omnichannel approaches that integrate digital marketing with physical showroom experiences can maximize market reach and conversion rates.

Product portfolio diversification should address specific market segments including compact urban models, premium smart appliances, and commercial-grade solutions. Customization capabilities can differentiate offerings while commanding premium pricing in competitive markets.

Service excellence initiatives including comprehensive warranties, professional installation, and ongoing maintenance support can strengthen customer relationships while generating additional revenue streams. Digital service platforms should complement traditional support channels to meet diverse customer preferences and expectations.

Market evolution will continue driven by technological advancement, changing consumer lifestyles, and environmental considerations. Energy efficiency standards are expected to become more stringent, accelerating adoption of heat pump technology and other advanced solutions. Smart connectivity will transition from premium features to standard expectations across all market segments.

Growth projections indicate sustained market expansion with particular strength in premium segments and commercial applications. MWR analysis suggests that energy-efficient models will capture 85% market share within the next five years as older technologies become obsolete and consumer preferences shift toward sustainable solutions.

Innovation focus will emphasize artificial intelligence integration, predictive maintenance capabilities, and seamless smart home ecosystem compatibility. Sustainability initiatives will expand beyond energy efficiency to encompass entire product lifecycles and circular economy principles.

Market consolidation may continue as manufacturers seek scale advantages and technology capabilities, while new entrants focus on specialized segments or disruptive technologies. Consumer education will remain critical for driving adoption of advanced features and justifying premium pricing in competitive markets.

The United Kingdom tumble dryers market demonstrates strong fundamentals and promising growth prospects driven by technological innovation, changing consumer lifestyles, and supportive regulatory frameworks. Energy efficiency has emerged as the primary differentiating factor, with heat pump technology leading market transformation and commanding premium pricing despite higher initial costs.

Market dynamics favor manufacturers and retailers who can successfully balance innovation with affordability while providing comprehensive customer support throughout the product lifecycle. Smart connectivity features are transitioning from luxury options to essential capabilities, requiring industry participants to invest in digital technologies and platform integration.

Future success will depend on continued advancement in energy efficiency, seamless smart home integration, and comprehensive service offerings that enhance customer satisfaction and loyalty. The market’s evolution toward sustainability and connectivity creates both challenges and opportunities for established players and new entrants alike, requiring strategic adaptation and ongoing investment in technology and customer experience initiatives.

What is Tumble Dryers?

Tumble dryers are household appliances designed to dry clothes by tumbling them in a rotating drum while applying heat. They are commonly used in residential settings to efficiently remove moisture from laundry after washing.

What are the key players in the United Kingdom Tumble Dryers Market?

Key players in the United Kingdom Tumble Dryers Market include Beko, Bosch, and Hotpoint, among others. These companies offer a range of models catering to different consumer needs and preferences.

What are the growth factors driving the United Kingdom Tumble Dryers Market?

The growth of the United Kingdom Tumble Dryers Market is driven by factors such as increasing urbanization, the rise in dual-income households, and advancements in energy-efficient technologies. Additionally, the demand for convenience in laundry care is propelling market expansion.

What challenges does the United Kingdom Tumble Dryers Market face?

The United Kingdom Tumble Dryers Market faces challenges such as high energy consumption and environmental concerns related to appliance efficiency. Additionally, competition from alternative drying methods, like air drying, poses a challenge to market growth.

What opportunities exist in the United Kingdom Tumble Dryers Market?

Opportunities in the United Kingdom Tumble Dryers Market include the development of smart dryers with IoT capabilities and the increasing demand for compact models suitable for smaller living spaces. Furthermore, sustainability trends are encouraging manufacturers to innovate eco-friendly products.

What trends are shaping the United Kingdom Tumble Dryers Market?

Trends shaping the United Kingdom Tumble Dryers Market include the growing popularity of heat pump dryers, which are more energy-efficient, and the integration of smart technology for enhanced user control. Additionally, there is a rising consumer preference for multifunctional appliances.

United Kingdom Tumble Dryers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vented, Condenser, Heat Pump, Compact |

| End User | Residential, Commercial, Industrial, Hospitality |

| Technology | Smart, Energy Efficient, Standard, Hybrid |

| Distribution Channel | Online, Retail, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Tumble Dryers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at