444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK fixed connectivity market represents a cornerstone of the nation’s digital infrastructure, encompassing broadband services, fiber optic networks, and traditional copper-based connections that serve residential, commercial, and enterprise customers across England, Scotland, Wales, and Northern Ireland. Market dynamics indicate robust growth driven by increasing demand for high-speed internet access, remote working requirements, and digital transformation initiatives across various sectors.

Technological advancement continues to reshape the landscape, with fiber-to-the-premises (FTTP) deployments accelerating at an unprecedented pace, achieving coverage rates exceeding 35% of UK premises. The market encompasses multiple service categories including standard broadband, superfast broadband, ultrafast connections, and emerging gigabit-capable services that support bandwidth-intensive applications and future connectivity needs.

Regulatory frameworks established by Ofcom drive competition and infrastructure investment, while government initiatives such as the Gigabit Broadband Programme aim to deliver universal high-speed connectivity. The market demonstrates strong resilience and adaptability, with providers investing heavily in network upgrades and service enhancement to meet evolving consumer and business requirements in an increasingly connected digital economy.

The UK fixed connectivity market refers to the comprehensive ecosystem of wired internet services, telecommunications infrastructure, and broadband technologies that provide stationary internet access to homes, businesses, and organizations throughout the United Kingdom. This market encompasses various connection types including fiber optic networks, copper-based services, cable broadband, and hybrid technologies that deliver data transmission capabilities to fixed locations.

Fixed connectivity distinguishes itself from mobile networks by providing dedicated, high-capacity connections through physical infrastructure such as underground cables, overhead lines, and fiber optic networks. The market includes internet service providers (ISPs), network operators, infrastructure companies, and technology vendors that collectively deliver broadband services ranging from basic internet access to enterprise-grade connectivity solutions.

Service categories within this market span residential broadband packages, business connectivity solutions, wholesale network access, and specialized services for sectors such as healthcare, education, and government. The market’s scope extends beyond simple internet provision to include value-added services, network management, cybersecurity solutions, and integrated communications platforms that support the UK’s digital economy and social connectivity needs.

Strategic positioning within the UK fixed connectivity market reveals a dynamic landscape characterized by intense competition, technological innovation, and substantial infrastructure investment. Major service providers including BT Group, Virgin Media O2, Sky, and emerging alternative network providers compete across multiple service segments while government policies drive nationwide connectivity improvements.

Market transformation accelerates through fiber optic network expansion, with full-fiber availability growing at annual rates approaching 25% as providers race to meet government targets for gigabit-capable coverage. Consumer demand patterns shift toward higher bandwidth services, driven by streaming media consumption, remote working adoption, and smart home technology integration that requires reliable, high-speed connectivity.

Investment trends demonstrate significant capital allocation toward network infrastructure modernization, with both established operators and new entrants deploying advanced technologies including XGS-PON, DOCSIS 4.0, and software-defined networking capabilities. The market benefits from supportive regulatory frameworks that promote competition while ensuring universal service obligations and consumer protection standards are maintained across all regions.

Fundamental market dynamics reveal several critical insights that shape the UK fixed connectivity landscape:

Digital transformation initiatives across public and private sectors create substantial demand for reliable, high-capacity fixed connectivity services. Organizations implementing cloud computing strategies, digital collaboration tools, and data-intensive applications require robust broadband infrastructure that supports business continuity and operational efficiency.

Remote working adoption fundamentally alters residential connectivity requirements, with households demanding business-grade reliability and performance for video conferencing, file sharing, and virtual collaboration. This trend drives upgrades from basic broadband to superfast and ultrafast services, creating revenue opportunities for service providers while expanding the addressable market.

Government policy support through initiatives such as the £5 billion Project Gigabit programme accelerates infrastructure development in underserved areas. Public sector investment complements private sector deployment efforts, creating a comprehensive approach to achieving universal gigabit-capable coverage by 2030 while supporting economic development and social inclusion objectives.

Streaming media consumption continues growing exponentially, with multiple household devices simultaneously accessing high-definition video content, gaming services, and interactive applications. This usage pattern necessitates symmetric, high-bandwidth connections that traditional copper-based services cannot adequately support, driving migration to fiber-based technologies.

Infrastructure deployment costs present significant challenges for network operators, particularly in rural and remote areas where low population density reduces return on investment potential. The expense of trenching, ducting, and fiber installation creates financial barriers that slow network expansion and limit service availability in economically challenging regions.

Planning and regulatory complexities can delay network deployment projects, with local authority approval processes, environmental assessments, and wayleave negotiations extending project timelines. These administrative challenges increase deployment costs and create uncertainty for infrastructure investment planning, particularly affecting smaller alternative network providers with limited resources.

Skills shortages within the telecommunications sector limit the pace of network construction and maintenance activities. The industry faces challenges recruiting qualified engineers, technicians, and project managers with specialized fiber optic installation and network management expertise, constraining expansion capabilities during peak deployment periods.

Consumer price sensitivity influences adoption rates for premium connectivity services, with some households reluctant to upgrade from existing broadband packages despite superior performance benefits. Economic pressures and cost-of-living concerns can slow migration to higher-value services, affecting revenue growth potential for service providers investing heavily in network infrastructure.

Enterprise connectivity services present substantial growth opportunities as businesses increasingly require dedicated, high-performance connections for cloud computing, data backup, and inter-site communications. The demand for managed services, cybersecurity integration, and service level agreements creates premium revenue streams that complement residential broadband offerings.

Smart city initiatives across UK municipalities drive demand for comprehensive connectivity infrastructure supporting IoT deployments, traffic management systems, environmental monitoring, and public safety applications. These projects require extensive fiber networks that create long-term revenue opportunities while supporting broader economic development objectives.

5G network backhaul requirements create new market segments as mobile operators deploy small cells and distributed antenna systems that require high-capacity fiber connections. This convergence between fixed and mobile networks opens additional revenue streams for fiber network operators while supporting the broader telecommunications ecosystem.

Data center connectivity expansion driven by cloud computing growth, edge computing deployment, and digital content distribution creates demand for high-capacity, low-latency connections between facilities. According to MarkWide Research analysis, this segment demonstrates strong growth potential as digital infrastructure requirements continue expanding across multiple industry sectors.

Competitive intensity within the UK fixed connectivity market drives continuous innovation and service improvement as established operators face challenges from alternative network providers and technology disruptors. This competition benefits consumers through improved service quality, competitive pricing, and expanded coverage options while encouraging infrastructure investment and technological advancement.

Technology evolution creates both opportunities and challenges as providers must balance investments in current-generation technologies with preparation for future standards. The transition from copper to fiber, implementation of advanced networking protocols, and integration of artificial intelligence for network management require substantial capital allocation and technical expertise.

Regulatory frameworks continue evolving to address market developments, consumer protection requirements, and infrastructure sharing opportunities. Ofcom’s approach to wholesale pricing, competition policy, and universal service obligations significantly influences market dynamics and investment decisions across the industry.

Consumer expectations increasingly focus on service reliability, customer support quality, and value-added features beyond basic connectivity. Providers must differentiate through superior customer experience, innovative service bundles, and proactive network management to maintain competitive positioning in an increasingly commoditized market environment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UK fixed connectivity market. Primary research activities include structured interviews with industry executives, network operators, regulatory officials, and technology vendors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of regulatory filings, company financial reports, industry publications, and government policy documents to establish factual foundations for market assessments. This approach ensures comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor throughout the research process.

Data validation procedures include cross-referencing multiple sources, conducting follow-up interviews for clarification, and applying statistical analysis techniques to identify trends and patterns. The methodology emphasizes accuracy and reliability while acknowledging the dynamic nature of telecommunications markets and the need for regular updates to maintain relevance.

Market modeling techniques incorporate quantitative analysis of deployment rates, adoption patterns, and competitive dynamics to project future market developments. These models consider regulatory changes, technology evolution, and economic factors that influence market growth and transformation patterns across different regions and customer segments.

London and Southeast England demonstrate the highest concentration of advanced connectivity infrastructure, with fiber availability reaching coverage levels exceeding 60% in many metropolitan areas. This region benefits from dense population concentrations, high disposable income levels, and substantial business demand that justify extensive infrastructure investment by multiple competing providers.

Northern England regions including Manchester, Leeds, and Liverpool experience rapid fiber deployment growth as alternative network providers target these areas for competitive expansion. Government investment programs support connectivity improvements in post-industrial areas, creating opportunities for economic regeneration and digital inclusion initiatives.

Scotland and Wales present unique challenges and opportunities, with urban centers achieving good connectivity while rural and remote areas require targeted government intervention. The Scottish and Welsh governments implement complementary policies to support nationwide connectivity goals while addressing specific geographic and demographic challenges.

Rural and remote areas across all UK regions continue experiencing connectivity gaps that government programs and commercial initiatives work to address. These areas often require innovative deployment approaches, alternative technologies, and public-private partnerships to achieve economically viable service provision while meeting universal service obligations.

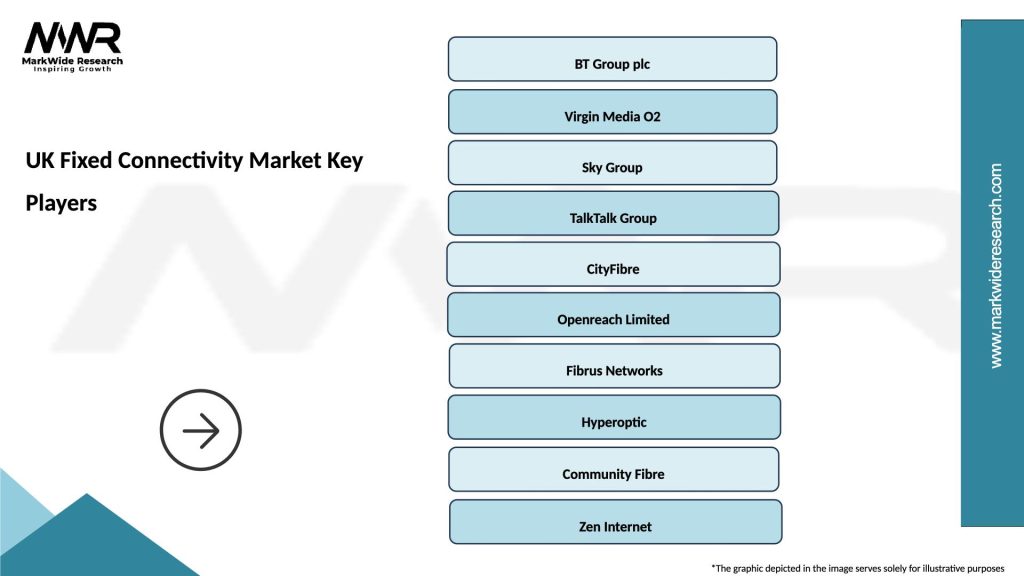

Market leadership remains concentrated among several major providers who compete across multiple service segments and geographic regions:

Competitive strategies vary significantly across providers, with some focusing on infrastructure ownership, others emphasizing retail excellence, and emerging players targeting specific geographic or demographic niches. This diversity creates a dynamic market environment that benefits consumers through choice and innovation.

By Technology:

By Customer Segment:

By Service Type:

Residential broadband services continue evolving toward higher speed tiers as household internet usage patterns change. Streaming video consumption, online gaming, smart home devices, and remote working create demand for symmetric, high-bandwidth connections that support multiple simultaneous applications without performance degradation.

Business connectivity solutions emphasize reliability, security, and managed services that support digital transformation initiatives. Organizations require guaranteed service levels, rapid fault resolution, and integrated cybersecurity capabilities that justify premium pricing for dedicated connectivity solutions.

Wholesale network services enable competition by providing infrastructure access to retail service providers who lack their own network facilities. This market segment supports regulatory objectives for competition while creating revenue opportunities for infrastructure owners through efficient asset utilization.

Value-added services including managed Wi-Fi, cybersecurity, cloud connectivity, and unified communications create differentiation opportunities for service providers. These offerings generate higher margins while providing comprehensive solutions that address evolving customer requirements beyond basic internet access.

Service providers benefit from expanding market opportunities driven by increasing connectivity demand across all customer segments. Infrastructure investment creates long-term competitive advantages while government support programs reduce deployment risks in challenging geographic areas.

Consumers gain access to improved service quality, competitive pricing, and expanded choice as market competition intensifies. Enhanced connectivity enables participation in digital economy opportunities including remote working, online education, and digital entertainment services.

Businesses achieve operational efficiency improvements through reliable, high-speed connectivity that supports cloud computing, digital collaboration, and data-intensive applications. Improved connectivity infrastructure enables business growth, innovation, and competitive positioning in increasingly digital markets.

Government and public sector organizations benefit from enhanced digital infrastructure that supports policy objectives including economic development, social inclusion, and public service delivery improvements. Comprehensive connectivity enables smart city initiatives, telemedicine, and digital government services that improve citizen experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Fiber-first deployment strategies dominate network expansion plans as providers prioritize future-ready infrastructure over incremental copper network improvements. This approach ensures long-term competitive positioning while meeting growing bandwidth demands from residential and business customers.

Service bundling evolution sees providers combining connectivity with value-added services including cybersecurity, cloud storage, streaming content, and smart home management. These integrated offerings improve customer retention while generating higher average revenue per user through comprehensive service packages.

Sustainability initiatives gain prominence as providers implement energy-efficient network equipment, renewable energy sourcing, and carbon reduction programs. MWR data indicates environmental considerations increasingly influence procurement decisions and network design strategies across the industry.

Artificial intelligence integration transforms network management through predictive maintenance, automated fault resolution, and dynamic capacity allocation. These technologies improve service reliability while reducing operational costs and enabling proactive customer service capabilities.

Edge computing deployment creates demand for distributed fiber connectivity that supports low-latency applications including autonomous vehicles, industrial automation, and augmented reality services. This trend drives investment in metropolitan area networks and specialized connectivity solutions.

Government policy initiatives including the Gigabit Broadband Programme and planning reform measures accelerate infrastructure deployment while reducing regulatory barriers. These developments create favorable conditions for private sector investment and competition in previously underserved markets.

Alternative network provider expansion intensifies competition as new entrants target specific geographic areas and customer segments with differentiated service offerings. This trend promotes innovation and competitive pricing while expanding consumer choice across multiple markets.

Technology standardization progress in areas such as XGS-PON, DOCSIS 4.0, and software-defined networking enables interoperability and reduces equipment costs. These developments support efficient network deployment and operation while facilitating vendor competition and innovation.

Infrastructure sharing agreements between network operators reduce deployment costs and accelerate coverage expansion through collaborative approaches to duct sharing, pole access, and joint construction projects. These partnerships optimize resource utilization while maintaining competitive service delivery.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek scale advantages, geographic expansion, and technology capabilities through strategic combinations. These transactions influence market structure and competitive dynamics across multiple service segments.

Investment prioritization should focus on fiber optic infrastructure deployment in high-demand areas while leveraging government support programs for economically challenging regions. Providers should balance commercial returns with strategic positioning for long-term market leadership and regulatory compliance.

Service differentiation strategies must emphasize customer experience, reliability, and value-added services rather than competing solely on price. Successful providers will develop comprehensive service portfolios that address evolving customer needs while generating sustainable revenue growth and market share expansion.

Partnership development with technology vendors, infrastructure companies, and complementary service providers can accelerate capability development while reducing investment risks. Strategic alliances enable access to specialized expertise and resources that support competitive positioning and operational efficiency.

Regulatory engagement remains critical for influencing policy development, accessing government support programs, and ensuring favorable operating conditions. Active participation in industry consultations and policy discussions helps shape regulatory frameworks that support sustainable market development and competition.

Technology roadmap planning should anticipate future connectivity requirements while maintaining flexibility to adapt to changing market conditions and customer demands. Providers must balance current deployment priorities with preparation for emerging technologies and service categories that will define future market opportunities.

Market evolution toward ubiquitous gigabit-capable connectivity will transform the UK digital landscape over the next decade, with coverage rates projected to exceed 85% by 2030. This transformation will enable new service categories, business models, and economic opportunities while supporting the UK’s position as a leading digital economy.

Technology convergence between fixed and mobile networks will create integrated service offerings that provide seamless connectivity across multiple access methods. This convergence will drive efficiency improvements and enable innovative services that leverage the strengths of both network types.

Competitive dynamics will continue evolving as alternative network providers gain market share and established operators adapt their strategies to maintain leadership positions. According to MarkWide Research projections, this competition will benefit consumers through improved services and competitive pricing while driving continued innovation across the industry.

Sustainability requirements will increasingly influence network design, equipment selection, and operational practices as environmental considerations become central to business strategy and regulatory compliance. Providers will need to balance performance requirements with carbon reduction objectives and circular economy principles.

Service innovation will focus on applications enabled by high-speed, low-latency connectivity including virtual reality, artificial intelligence, and IoT platforms that require robust fixed network infrastructure. These emerging applications will create new revenue opportunities while justifying continued infrastructure investment and technological advancement.

The UK fixed connectivity market stands at a pivotal moment characterized by unprecedented infrastructure investment, technological innovation, and competitive intensity that collectively drive toward universal high-speed connectivity. Market participants benefit from supportive government policies, growing consumer and business demand, and technological advances that enable efficient network deployment and service delivery.

Strategic success in this dynamic environment requires balanced approaches to infrastructure investment, service differentiation, and customer experience that address both current market needs and future connectivity requirements. Providers must navigate competitive pressures while maintaining focus on long-term sustainability and market leadership through innovation and operational excellence.

Future market development will be shaped by continued fiber deployment, technology convergence, and evolving customer expectations that demand reliable, high-performance connectivity services. The market’s trajectory toward universal gigabit-capable coverage represents both significant opportunity and substantial challenge for industry participants committed to supporting the UK’s digital transformation and economic competitiveness in an increasingly connected global economy.

What is Fixed Connectivity?

Fixed Connectivity refers to the stable and reliable internet and communication services provided through wired connections, such as fiber optics and DSL. This technology is essential for various applications, including residential broadband, business networking, and data centers.

What are the key players in the UK Fixed Connectivity Market?

Key players in the UK Fixed Connectivity Market include BT Group, Virgin Media, and TalkTalk, which provide a range of services from broadband to enterprise solutions. These companies compete on service quality, pricing, and coverage, among others.

What are the growth factors driving the UK Fixed Connectivity Market?

The UK Fixed Connectivity Market is driven by increasing demand for high-speed internet, the expansion of smart home technologies, and the rise of remote working. Additionally, government initiatives to improve digital infrastructure contribute to market growth.

What challenges does the UK Fixed Connectivity Market face?

Challenges in the UK Fixed Connectivity Market include the high costs of infrastructure development, competition from mobile connectivity solutions, and regulatory hurdles. These factors can hinder the expansion and upgrade of fixed networks.

What opportunities exist in the UK Fixed Connectivity Market?

Opportunities in the UK Fixed Connectivity Market include the rollout of next-generation fiber networks, the integration of 5G technology, and the increasing demand for cloud services. These trends present avenues for innovation and investment.

What trends are shaping the UK Fixed Connectivity Market?

Trends in the UK Fixed Connectivity Market include the shift towards fiber-to-the-home installations, the growing importance of cybersecurity in connectivity solutions, and the adoption of smart city initiatives. These trends are influencing how services are delivered and consumed.

UK Fixed Connectivity Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fiber Optic, DSL, Cable, Satellite |

| End User | Residential, Small Business, Large Enterprise, Government |

| Technology | 5G, LTE, Wi-Fi 6, Ethernet |

| Service Type | Broadband, VoIP, IPTV, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Fixed Connectivity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at