444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The spay and neuter market represents a critical segment of the global veterinary services industry, encompassing surgical sterilization procedures for companion animals. This market has experienced substantial growth driven by increasing pet ownership, heightened awareness of animal welfare, and comprehensive public health initiatives aimed at controlling pet overpopulation. The market demonstrates robust expansion across developed and emerging economies, with growth rates consistently exceeding 6.2% annually in key regions.

Market dynamics indicate that urbanization trends, coupled with rising disposable incomes and evolving attitudes toward pet healthcare, continue to fuel demand for professional veterinary sterilization services. The sector benefits from strong governmental support through subsidized programs and public-private partnerships, particularly in addressing stray animal populations. Technological advancements in surgical techniques and anesthesia protocols have significantly improved procedure safety and recovery times, contributing to increased market acceptance and adoption rates of 78% among pet owners in developed markets.

Regional variations in market penetration reflect different cultural attitudes toward pet sterilization, regulatory frameworks, and veterinary infrastructure development. North American markets lead in terms of procedure volume and technological sophistication, while emerging markets in Asia-Pacific and Latin America present significant growth opportunities driven by expanding middle-class populations and increasing pet ownership rates.

The spay and neuter market refers to the comprehensive ecosystem of veterinary services, medical equipment, pharmaceuticals, and support systems dedicated to surgical sterilization procedures for domestic animals. Spaying involves the surgical removal of female reproductive organs, while neutering encompasses the removal of male reproductive organs, both procedures designed to prevent reproduction and provide various health benefits.

Market scope extends beyond basic surgical procedures to include pre-operative diagnostics, anesthesia management, post-operative care, pain management protocols, and follow-up services. The sector encompasses private veterinary clinics, animal hospitals, mobile veterinary units, non-profit organizations, and government-sponsored programs. Supporting industries include surgical instrument manufacturers, pharmaceutical companies producing anesthetics and pain medications, and educational institutions providing veterinary training.

Economic significance of this market extends to broader societal benefits, including reduced costs associated with stray animal management, decreased disease transmission risks, and improved public health outcomes. The market also supports employment generation across veterinary professionals, support staff, and ancillary service providers, contributing to local economic development in communities worldwide.

Market performance in the spay and neuter sector demonstrates consistent upward trajectory, driven by evolving pet ownership patterns and increased awareness of responsible pet care practices. The industry benefits from strong demographic trends, including urbanization, aging populations seeking companionship, and millennials embracing pet ownership at unprecedented rates. Procedure adoption rates have reached 83% in urban areas of developed countries, reflecting successful public education campaigns and improved accessibility to veterinary services.

Technological innovation continues to reshape market dynamics through minimally invasive surgical techniques, advanced anesthesia protocols, and improved pain management solutions. These developments have reduced procedure risks and recovery times, contributing to increased consumer confidence and market expansion. Digital health platforms and telemedicine integration are emerging as significant growth drivers, enabling better pre- and post-operative care coordination.

Competitive landscape features a mix of established veterinary service providers, specialized animal hospitals, and innovative mobile service platforms. Market consolidation trends are evident as larger veterinary chains acquire independent practices, while simultaneously, niche service providers are gaining market share through specialized offerings and community-focused approaches. Regulatory support through government subsidies and public health initiatives continues to drive market accessibility and growth.

Primary market drivers encompass multiple interconnected factors that collectively fuel sustained industry growth and evolution:

Market segmentation reveals distinct patterns across different service categories, geographic regions, and customer demographics. Urban markets demonstrate higher procedure volumes and premium service adoption, while rural areas increasingly benefit from mobile veterinary services and community outreach programs.

Demographic transformation represents the most significant driver of market expansion, as changing lifestyle patterns and urbanization trends create favorable conditions for pet ownership growth. Millennial consumers demonstrate particularly strong commitment to pet healthcare, with 89% prioritizing preventive veterinary care including sterilization procedures. This demographic shift coincides with delayed family formation patterns, leading to increased emotional and financial investment in companion animals.

Public health imperatives continue to drive market growth through comprehensive animal population control initiatives. Government agencies and public health organizations recognize sterilization programs as cost-effective strategies for managing stray animal populations, reducing disease transmission risks, and minimizing public safety concerns. Rabies prevention programs in developing countries particularly emphasize sterilization as a critical component of comprehensive disease control strategies.

Technological advancement in surgical techniques and anesthesia protocols has significantly improved procedure outcomes and reduced associated risks. Laparoscopic techniques and minimally invasive approaches have gained widespread adoption, offering reduced recovery times and improved patient comfort. Advanced monitoring systems and improved pharmaceutical protocols have enhanced procedure safety, contributing to increased consumer confidence and market acceptance.

Economic factors including rising disposable incomes and increased spending on pet healthcare create favorable market conditions. Pet insurance adoption has grown substantially, with many policies covering sterilization procedures, thereby reducing financial barriers for pet owners. Additionally, flexible payment options and subsidized programs have improved accessibility across diverse socioeconomic segments.

Economic barriers remain significant constraints for market expansion, particularly in developing regions where veterinary services may represent substantial household expenses. Procedure costs can be prohibitive for low-income pet owners, despite the long-term economic benefits of sterilization. This challenge is compounded by limited insurance coverage and insufficient government subsidy programs in many markets.

Cultural and religious considerations present ongoing challenges in certain geographic regions where traditional beliefs may conflict with sterilization practices. Educational initiatives must navigate sensitive cultural contexts while promoting animal welfare and public health benefits. These factors can significantly impact market penetration rates and require tailored approaches for different communities.

Veterinary workforce limitations constrain market growth in many regions, particularly rural and underserved areas where qualified professionals may be scarce. Training requirements and certification processes can create barriers to service expansion, while competition for veterinary talent may drive up service costs. Geographic disparities in veterinary infrastructure create uneven market development patterns.

Regulatory complexities vary significantly across jurisdictions, creating challenges for standardized service delivery and market expansion. Licensing requirements, facility standards, and professional certification criteria can differ substantially between regions, complicating efforts to scale operations efficiently. Additionally, pharmaceutical regulations governing anesthesia and pain management medications may impact service delivery models.

Emerging market expansion presents substantial growth opportunities as developing economies experience rising pet ownership rates and improved veterinary infrastructure. Asia-Pacific markets demonstrate particularly strong potential, with urbanization trends and growing middle-class populations driving increased demand for professional veterinary services. Market penetration rates in these regions remain below 45%, indicating significant room for growth.

Mobile veterinary services represent an innovative opportunity to address geographic and economic barriers while expanding market reach. Technology integration enables efficient scheduling, route optimization, and comprehensive service delivery in underserved areas. These services can achieve cost reductions of up to 30% compared to traditional clinic-based models while improving accessibility for rural and low-income communities.

Digital health integration offers opportunities to enhance service delivery through telemedicine consultations, digital health records, and remote monitoring capabilities. Artificial intelligence applications can improve surgical planning, risk assessment, and post-operative care protocols. Blockchain technology may enable secure, portable health records that facilitate continuity of care across different providers.

Public-private partnerships create opportunities for sustainable market expansion through collaborative funding models and shared resource utilization. Corporate social responsibility initiatives from major corporations can support community sterilization programs while building brand loyalty. International development programs increasingly recognize animal population control as integral to public health and economic development objectives.

Supply chain evolution within the spay and neuter market reflects broader trends toward specialization and efficiency optimization. Pharmaceutical suppliers are developing specialized anesthesia protocols and pain management solutions specifically designed for sterilization procedures. Surgical instrument manufacturers continue to innovate with minimally invasive tools and disposable options that reduce infection risks and improve operational efficiency.

Service delivery models are diversifying to address varying customer needs and market conditions. High-volume, low-cost clinics serve price-sensitive segments while maintaining quality standards through standardized protocols and efficient workflows. Premium service providers offer comprehensive care packages including advanced diagnostics, extended monitoring, and luxury recovery accommodations.

Competitive dynamics feature increasing consolidation among larger veterinary service providers while simultaneously supporting growth of specialized niche players. Franchise models are gaining popularity as methods to rapidly expand geographic coverage while maintaining service standardization. Technology platforms are emerging as competitive differentiators, enabling improved customer experience and operational efficiency.

Regulatory evolution continues to shape market dynamics through updated safety standards, professional certification requirements, and quality assurance protocols. Accreditation programs are becoming increasingly important for market credibility and consumer confidence. International harmonization efforts may facilitate cross-border service expansion and technology transfer.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into spay and neuter market dynamics. Primary research involves extensive surveys of veterinary professionals, pet owners, and industry stakeholders across diverse geographic markets. In-depth interviews with key opinion leaders, including veterinary specialists, animal welfare advocates, and public health officials, provide qualitative insights into market trends and future developments.

Secondary research encompasses analysis of industry reports, government statistics, academic publications, and regulatory documents from multiple countries and regions. Data triangulation techniques ensure consistency and reliability across different information sources. Statistical modeling approaches incorporate demographic trends, economic indicators, and regulatory changes to project future market developments.

Market segmentation analysis utilizes advanced analytical techniques to identify distinct customer segments, service categories, and geographic patterns. Behavioral analysis examines pet owner decision-making processes, service selection criteria, and satisfaction factors. Competitive intelligence gathering involves systematic monitoring of industry participants, service offerings, pricing strategies, and market positioning approaches.

Validation processes include expert panel reviews, stakeholder feedback sessions, and cross-referencing with established industry benchmarks. Continuous monitoring systems track market developments, regulatory changes, and emerging trends to ensure ongoing accuracy and relevance of research findings.

North American markets maintain leadership positions in terms of market maturity, technological adoption, and service sophistication. United States demonstrates the highest procedure volumes globally, with market penetration rates exceeding 85% in urban areas. Canada shows similar patterns with strong government support for animal welfare initiatives and comprehensive veterinary infrastructure development.

European markets exhibit diverse characteristics reflecting varying cultural attitudes and regulatory frameworks across different countries. Scandinavian countries lead in terms of comprehensive animal welfare policies and high sterilization rates. Western European markets demonstrate strong growth in premium service segments, while Eastern European regions present emerging opportunities driven by EU integration and rising living standards.

Asia-Pacific region represents the fastest-growing market segment, with annual growth rates exceeding 8.5% in key countries. Japan and South Korea show mature market characteristics with high urban penetration rates. China and India present substantial growth opportunities as pet ownership rates increase and veterinary infrastructure expands. Australia maintains strong market positions with comprehensive animal welfare programs.

Latin American markets demonstrate significant potential despite current infrastructure limitations. Brazil and Mexico lead regional development with growing urban pet populations and improving veterinary service availability. Government initiatives in several countries focus on stray animal population control through subsidized sterilization programs.

Middle East and Africa represent emerging markets with substantial long-term potential. Urban centers in countries like UAE and South Africa show increasing adoption of professional veterinary services. International development programs support market development through capacity building and infrastructure investment initiatives.

Market structure encompasses diverse participants ranging from large veterinary chains to independent practitioners and specialized service providers. Consolidation trends are evident as major players acquire smaller practices to expand geographic coverage and service capabilities.

Competitive strategies focus on service differentiation, geographic expansion, and technology integration. Premium providers emphasize advanced surgical techniques and comprehensive care packages, while value-oriented services compete on accessibility and affordability. Mobile service providers are gaining market share through innovative delivery models and community-focused approaches.

By Service Type:

By Animal Type:

By Customer Segment:

Surgical Technology Categories demonstrate distinct growth patterns and market dynamics reflecting technological advancement and customer preferences. Traditional open surgery maintains dominant market share due to widespread provider familiarity and established protocols, though growth rates are moderating as minimally invasive alternatives gain adoption.

Minimally invasive procedures represent the fastest-growing category, with adoption rates increasing by 23% annually among qualified providers. These techniques offer significant advantages including reduced tissue trauma, faster recovery times, and improved cosmetic outcomes. Investment requirements for specialized equipment and training initially limit adoption but demonstrate strong return on investment through premium pricing and increased customer satisfaction.

Mobile service categories show exceptional growth potential, particularly in underserved geographic areas and price-sensitive market segments. Operational efficiency improvements through route optimization and standardized protocols enable competitive pricing while maintaining service quality. Community partnerships with animal welfare organizations enhance market penetration and social impact.

Pharmaceutical categories supporting sterilization procedures demonstrate steady growth driven by improved anesthesia protocols and enhanced pain management solutions. Specialized formulations designed specifically for sterilization procedures offer improved safety profiles and reduced side effects. Generic alternatives are expanding market accessibility while maintaining clinical efficacy standards.

Veterinary service providers benefit from stable demand patterns and recurring revenue opportunities within the spay and neuter market. Procedure standardization enables efficient workflow optimization and staff training programs. Technology adoption creates competitive advantages through improved outcomes and enhanced customer satisfaction, supporting premium pricing strategies and market differentiation.

Pet owners realize substantial long-term benefits including reduced healthcare costs, improved pet behavior, and elimination of unwanted breeding. Health benefits for sterilized animals include reduced cancer risks, decreased aggressive behaviors, and improved longevity. Economic advantages extend beyond direct healthcare savings to include reduced property damage and elimination of breeding-related expenses.

Public health authorities achieve significant cost savings through effective animal population control and disease prevention programs. Rabies prevention initiatives particularly benefit from comprehensive sterilization programs that reduce stray animal populations and associated transmission risks. Community safety improvements result from reduced aggressive animal behaviors and decreased stray animal incidents.

Animal welfare organizations advance their missions through increased adoption rates and reduced euthanasia numbers in shelter systems. Resource optimization enables more effective allocation of limited funding toward rescue and rehabilitation efforts. Community partnerships with veterinary providers enhance service delivery capabilities and expand program reach.

Pharmaceutical and equipment manufacturers benefit from steady demand for specialized products and ongoing innovation opportunities. Market expansion in developing regions creates new revenue streams and growth opportunities. Technology development initiatives support product differentiation and premium positioning strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally invasive surgical techniques are transforming service delivery standards across the spay and neuter market. Laparoscopic procedures offer significant advantages including reduced tissue trauma, faster recovery times, and improved cosmetic outcomes. Adoption rates for these advanced techniques are increasing rapidly among qualified providers, with implementation growing by 28% annually in developed markets.

Mobile veterinary services represent a major trend addressing geographic and economic barriers to service access. Technology integration enables efficient scheduling, route optimization, and comprehensive service delivery in underserved areas. These services demonstrate cost advantages while improving accessibility for rural and low-income communities, contributing to overall market expansion.

Digital health platforms are emerging as significant trend drivers through telemedicine integration, digital health records, and remote monitoring capabilities. Artificial intelligence applications support improved surgical planning, risk assessment, and post-operative care protocols. Customer engagement through digital platforms enhances service experience and supports long-term client relationships.

Sustainability initiatives are gaining prominence as environmental consciousness influences business practices and consumer preferences. Eco-friendly surgical supplies, waste reduction programs, and energy-efficient facilities appeal to environmentally conscious consumers. Green certification programs are emerging as competitive differentiators in premium market segments.

Personalized medicine approaches are developing through genetic testing, breed-specific protocols, and individualized anesthesia management. Precision veterinary care enables optimized outcomes while reducing risks and complications. These approaches support premium service positioning and enhanced customer satisfaction.

Technological innovations continue to reshape the spay and neuter market through advanced surgical equipment and improved pharmaceutical solutions. Robotic-assisted surgery is beginning to emerge in premium veterinary facilities, offering enhanced precision and reduced invasiveness. Advanced monitoring systems provide real-time patient data during procedures, improving safety and outcomes.

Regulatory developments include updated safety standards, enhanced professional certification requirements, and improved quality assurance protocols. Accreditation programs are becoming increasingly important for market credibility and consumer confidence. International harmonization efforts facilitate cross-border service expansion and technology transfer.

Market consolidation continues as larger veterinary service providers acquire independent practices to expand geographic coverage and service capabilities. Franchise models are gaining popularity as methods to rapidly expand market presence while maintaining service standardization. Strategic partnerships between veterinary providers and animal welfare organizations enhance service delivery and community impact.

Educational initiatives focus on expanding veterinary training programs and continuing education opportunities for practicing professionals. Specialized certification programs in sterilization procedures are developing to ensure consistent service quality and safety standards. Public education campaigns continue to promote responsible pet ownership and sterilization benefits.

International expansion efforts by major service providers are targeting emerging markets with growing pet populations and improving veterinary infrastructure. Technology transfer programs support capacity building in developing regions through training and equipment provision. Development partnerships with international organizations facilitate sustainable market growth.

MarkWide Research analysis indicates that market participants should prioritize technology adoption and service differentiation strategies to maintain competitive advantages in evolving market conditions. Investment priorities should focus on minimally invasive surgical capabilities, digital health platform integration, and mobile service delivery models to address diverse customer needs and market segments.

Geographic expansion strategies should target emerging markets with growing pet populations and improving economic conditions. Partnership approaches with local veterinary providers, animal welfare organizations, and government agencies can facilitate market entry while building community trust and support. Cultural sensitivity in service delivery and marketing approaches is essential for successful market penetration.

Service portfolio diversification should encompass comprehensive care packages including pre-operative diagnostics, advanced pain management, and extended post-operative support. Premium service segments offer opportunities for margin improvement and customer loyalty development. Value-oriented services remain important for market accessibility and volume growth.

Technology investment should focus on solutions that improve operational efficiency, enhance customer experience, and support quality assurance objectives. Digital platforms for appointment scheduling, customer communication, and health record management provide competitive advantages and operational benefits. Training programs for staff development ensure successful technology implementation and service quality maintenance.

Sustainability initiatives should be integrated into business strategies to address environmental concerns and appeal to conscious consumers. Waste reduction programs, energy-efficient operations, and eco-friendly supply chain practices support both environmental objectives and cost optimization goals.

Market projections indicate sustained growth momentum driven by demographic trends, technological advancement, and expanding global pet ownership patterns. Annual growth rates are expected to maintain 6.8% globally over the next five years, with emerging markets demonstrating particularly strong expansion potential. Technology adoption will continue to drive service evolution and competitive differentiation.

Emerging market development represents the most significant growth opportunity, with Asia-Pacific regions projected to achieve growth rates exceeding 9.2% annually. Infrastructure investment and capacity building initiatives will support sustainable market expansion in these regions. Government support through policy development and funding programs will facilitate market accessibility and growth.

Technology integration will accelerate through artificial intelligence applications, robotic-assisted procedures, and comprehensive digital health platforms. Telemedicine capabilities will expand service reach and improve customer experience. Personalized medicine approaches will enhance service quality and support premium positioning strategies.

Service delivery innovation will continue through mobile platforms, specialized facilities, and comprehensive care models. Customer experience enhancement through digital engagement, personalized service, and convenient access options will drive competitive advantage. Sustainability integration will become increasingly important for brand differentiation and consumer appeal.

Regulatory evolution will support market standardization and quality assurance while facilitating international expansion and technology transfer. Professional development programs will ensure adequate workforce capacity to support market growth. Public-private partnerships will continue to play crucial roles in market accessibility and community impact.

The spay and neuter market demonstrates robust growth potential driven by fundamental demographic trends, technological advancement, and increasing awareness of responsible pet ownership practices. Market dynamics reflect strong underlying demand supported by public health initiatives, animal welfare advocacy, and evolving consumer attitudes toward companion animal care.

Technology innovation continues to reshape service delivery through minimally invasive techniques, digital health integration, and mobile service platforms. These developments enhance service quality while improving accessibility and affordability across diverse market segments. Competitive advantages increasingly depend on technology adoption, service differentiation, and comprehensive customer experience strategies.

Regional opportunities vary significantly, with emerging markets presenting substantial growth potential while developed markets focus on service sophistication and premium positioning. Cultural considerations and regulatory frameworks require tailored approaches for successful market penetration and sustainable growth.

Future success in the spay and neuter market will depend on strategic technology investment, geographic expansion capabilities, and comprehensive service portfolio development. Sustainability initiatives and community partnership approaches will become increasingly important for long-term market leadership and social impact achievement. The market outlook remains positive with sustained growth expected across all major regions and service categories.

What is Spay And Neuter?

Spay and neuter refers to the surgical procedures that sterilize animals, preventing them from reproducing. These procedures are commonly performed on pets to help control the population of stray and unwanted animals.

What are the key players in the Spay And Neuter Market?

Key players in the Spay And Neuter Market include veterinary clinics, animal shelters, and organizations like the ASPCA and Humane Society. These entities play a crucial role in promoting spay and neuter programs to reduce pet overpopulation, among others.

What are the main drivers of the Spay And Neuter Market?

The main drivers of the Spay And Neuter Market include increasing awareness of pet overpopulation, rising adoption rates of pets, and the growing emphasis on responsible pet ownership. These factors contribute to a higher demand for spay and neuter services.

What challenges does the Spay And Neuter Market face?

Challenges in the Spay And Neuter Market include public misconceptions about the procedures, limited access to veterinary services in certain areas, and financial constraints for pet owners. These issues can hinder the effectiveness of spay and neuter initiatives.

What opportunities exist in the Spay And Neuter Market?

Opportunities in the Spay And Neuter Market include expanding outreach programs to educate pet owners, increasing partnerships with local governments for funding, and developing low-cost spay and neuter clinics. These initiatives can enhance community engagement and participation.

What trends are emerging in the Spay And Neuter Market?

Emerging trends in the Spay And Neuter Market include the use of mobile clinics to reach underserved areas, the integration of technology for appointment scheduling, and the promotion of spay and neuter as part of comprehensive pet wellness programs. These trends aim to improve accessibility and awareness.

Spay And Neuter Market

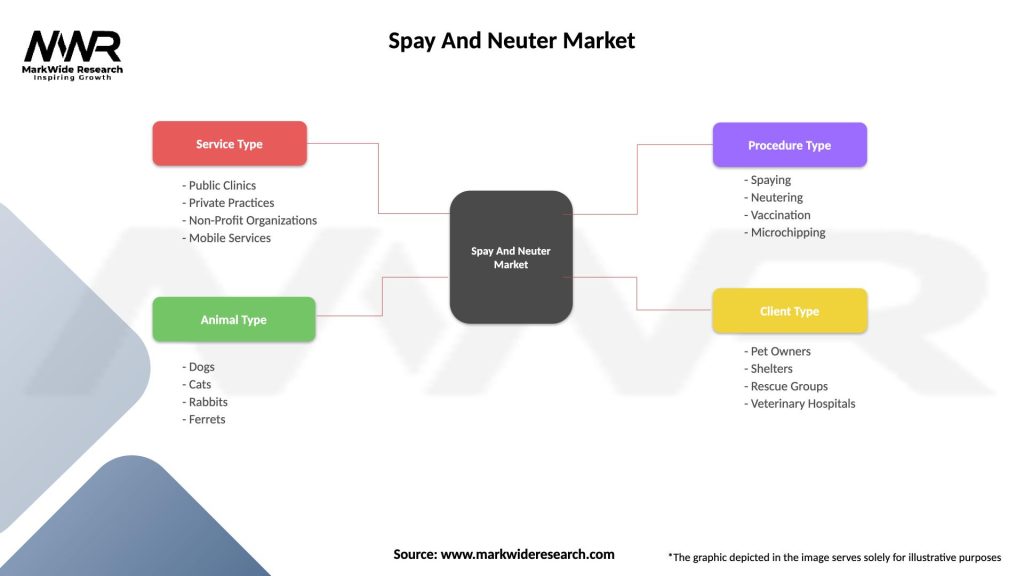

| Segmentation Details | Description |

|---|---|

| Service Type | Public Clinics, Private Practices, Non-Profit Organizations, Mobile Services |

| Animal Type | Dogs, Cats, Rabbits, Ferrets |

| Procedure Type | Spaying, Neutering, Vaccination, Microchipping |

| Client Type | Pet Owners, Shelters, Rescue Groups, Veterinary Hospitals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spay And Neuter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at