Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Advanced Packaging Trends: Flip-chip, WLP, and SiP require highly accurate, high-throughput die attach machines to manage smaller die sizes and multi-die configurations.

-

Material Innovation: The rise of lead-free solders, silver sinter, and conductive adhesives demands machines capable of precise dispensing, temperature control, and programmable pressure profiles.

-

Miniaturization Drivers: As consumer electronics and IoT devices shrink, die attach machines must achieve placement accuracies below 10 µm and handle ultra-thin dies.

-

Thermal Management Focus: High-power applications (e.g., EV inverters) drive demand for sintering-based die attach for superior thermal conductivity and mechanical robustness.

-

Automation and Industry 4.0 Integration: Modern die attach systems integrate AMHS, MES connectivity, and advanced vision systems for real-time process control and yield optimization.

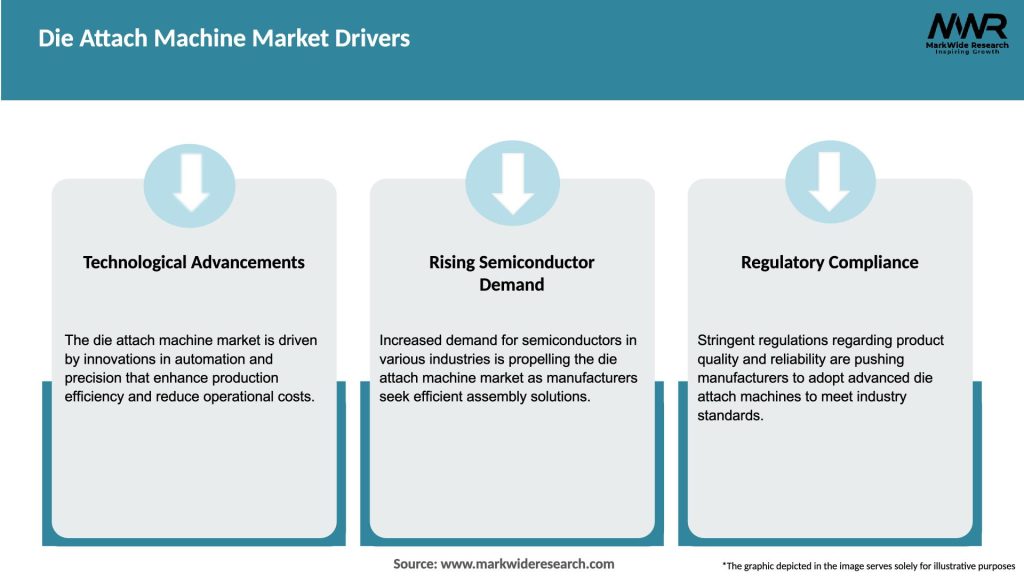

Market Drivers

-

Growing Semiconductor Demand: Rising global semiconductor production—bolstered by 5G rollouts, AI adoption, and EV electrification—increases demand for die attach equipment.

-

Shift to Advanced Packaging: Adoption of flip-chip and wafer-level packaging technologies drives need for high-precision die attach machines.

-

Thermal and Mechanical Performance Requirements: High-power and high-reliability applications (automotive, industrial IoT) necessitate advanced die bonding solutions.

-

Automation and Yield Improvement: Demand for fully automated, high-throughput systems with integrated vision and AI-driven defect detection boosts market growth.

-

Regulatory and Sustainability Pressures: Lead-free solder adoption and green manufacturing initiatives encourage development of eco-friendly die attach processes.

Market Restraints

-

High Capital Expenditure: Advanced die attach machines represent significant capital investments, posing barriers for small and mid-sized foundries.

-

Complexity of Integration: Integrating die attach equipment into existing production lines—especially with varied packaging formats—can be challenging.

-

Material Handling Challenges: New materials such as nanoparticles and sintering pastes require specialized handling and maintenance, increasing operational complexity.

-

Skilled Workforce Shortage: Operating and maintaining state-of-the-art die attach systems demands highly skilled technicians and engineers.

-

Market Volatility: Semiconductor industry cyclicality can lead to fluctuating equipment investment cycles, impacting die attach machine demand.

Market Opportunities

-

Emerging Economies: Expansion of semiconductor fabs in China, India, and Southeast Asia creates new markets for die attach machinery.

-

Collaborative Development: Partnerships between equipment manufacturers and material suppliers can accelerate development of optimized bonding solutions.

-

Secondary Packaging Equipment: Demand for die attach machines in back-end assembly (e.g., OSATs) provides additional growth avenues.

-

Customized Solutions: Tailoring die attach machines for niche applications (MEMS, optical sensors, biophotonics) opens specialized market segments.

-

Retrofit and Upgrade Services: Providing automation upgrades and retrofit kits for existing die attach equipment extends machine lifecycles and service revenue.

Market Dynamics

-

Supply Side Factors: Technological innovation in robotics, machine vision, and thermal management drives the capabilities of die attach machines. Consolidation among equipment suppliers fosters larger R&D budgets but may limit choice for end-users.

-

Demand Side Factors: Semiconductor manufacturers demand machines with minimal downtime, high throughput, and flexible process recipes to handle diverse product mixes. Consumer electronics cycles and automotive qualification lead times influence procurement schedules.

-

Economic Factors: Capital equipment budgets align with semiconductor capital expenditure (CapEx) cycles. Global economic health impacts device demand, which in turn affects investment in packaging equipment.

Regional Analysis

-

Asia-Pacific: Leader in die attach demand, driven by fabs in Taiwan (TSMC), South Korea (Samsung, SK Hynix), China (SMIC, Huawei), and Japan. Proximity to major semiconductor manufacturers and local OEMs fuels robust equipment sales.

-

North America: Home to major IDMs (Intel, GlobalFoundries) and OSAT providers (Amkor), North America drives demand for high-end, customized die attach solutions and R&D collaborations.

-

Europe: Strong automotive and industrial electronics base (Infineon, STMicroelectronics) requires advanced packaging for power devices, stimulating demand for sintering-capable die attach machines.

-

Rest of World: Emerging fab projects in India, Vietnam, and the Middle East offer growth potential, though at present volumes are small. European and North American suppliers target these regions via local partnerships.

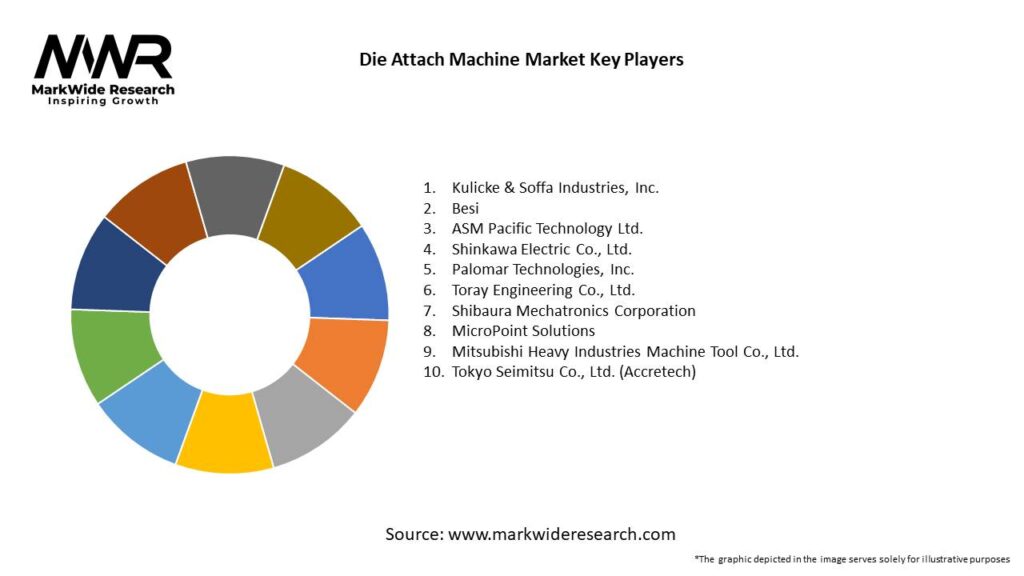

Competitive Landscape

Leading companies in the Die Attach Machine Market:

- Kulicke & Soffa Industries, Inc.

- Besi

- ASM Pacific Technology Ltd.

- Shinkawa Electric Co., Ltd.

- Palomar Technologies, Inc.

- Toray Engineering Co., Ltd.

- Shibaura Mechatronics Corporation

- MicroPoint Solutions

- Mitsubishi Heavy Industries Machine Tool Co., Ltd.

- Tokyo Seimitsu Co., Ltd. (Accretech)

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

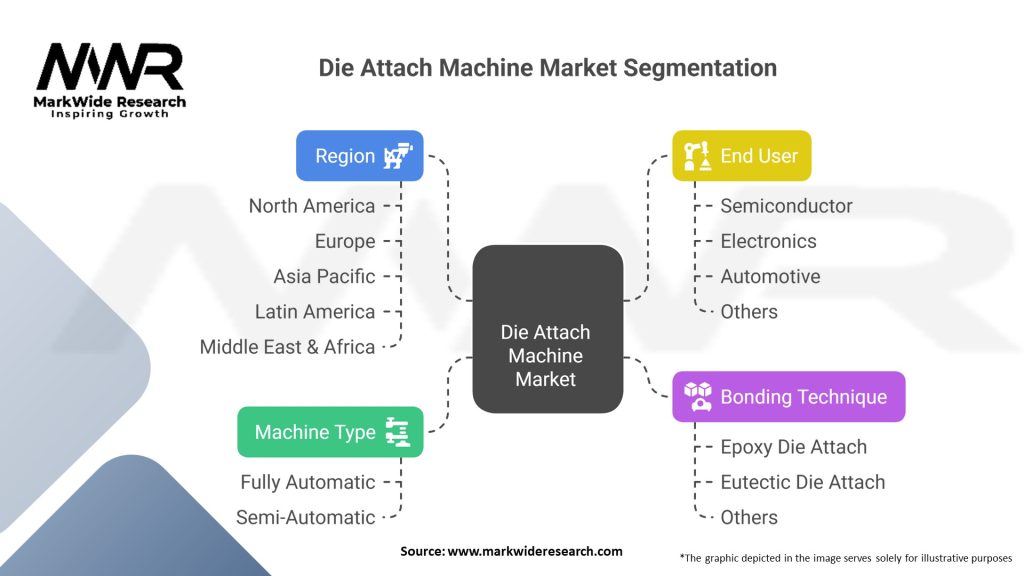

Segmentation

-

By Bonding Technology:

-

Solder Die Attach (lead-free, eutectic)

-

Silver Sintering

-

Epoxy/Conductive Adhesive Dispensing

-

Ultrasonic Wire Bonding (adjacent process)

-

-

By Automation Level:

-

Manual/Benchtop

-

Semi-Automated

-

Fully Automated Inline Systems

-

-

By Placement Accuracy:

-

<10 µm

-

10–25 µm

-

>25 µm

-

-

By End-User Industry:

-

Consumer Electronics

-

Automotive Electronics

-

Industrial & Power Devices

-

Medical Devices

-

Aerospace & Defense

-

-

By Region:

-

Asia-Pacific

-

North America

-

Europe

-

Rest of World

-

Category-wise Insights

-

Consumer Electronics: High-speed, low-cost die attach machines dominate, optimized for small dies (e.g., SoCs, sensors).

-

Automotive Electronics: Reliability and thermal performance drive adoption of sintering-capable systems and high-precision flip-chip bonders.

-

Industrial & Power Devices: Larger dies and multi-die modules require machines with programmable force profiles and enhanced thermal control.

-

Medical Devices & Aerospace: Ultra-high precision, cleanroom compliance, and qualification to stringent standards are mandatory, justifying premium equipment.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Device Reliability: Precise, uniform die bonds improve thermal performance and reduce failure rates.

-

Increased Throughput: Automated, high-speed machines boost production capacity and lower per-unit costs.

-

Flexibility & Scalability: Modular systems allow quick changeover between products and accommodate future packaging trends.

-

Process Control & Traceability: Integrated data logging and vision systems enable in-line quality assurance and yield optimization.

-

Sustainability: Reduced material waste and energy-efficient bonding processes support green manufacturing initiatives.

SWOT Analysis

-

Strengths:

• Technological sophistication in alignment, force control, and thermal management.

• Strong R&D pipelines from major suppliers.

• Critical role in enabling advanced semiconductor packaging. -

Weaknesses:

• High capital and maintenance costs.

• Dependence on cyclical semiconductor industry capital expenditures.

• Complexity in handling emerging materials (e.g., nanosilver). -

Opportunities:

• Expansion into microsystem and photonics packaging.

• Retrofit programs for legacy equipment.

• Growth in adjacent sectors (power electronics, micro-LED). -

Threats:

• Competitive pressure from integrated packaging solution providers.

• Technological obsolescence with rapid packaging innovation.

• Geopolitical tensions affecting supply chains and local content requirements.

Market Key Trends

-

Shift to Silver Sintering: Superior thermal/mechanical properties are driving replacement of traditional eutectic solders in power and automotive applications.

-

Micro-LED & Photonics Packaging: Ultra-precise die attach for next-gen displays and optical devices demands sub-5 µm placement accuracy.

-

AI-Enabled Vision Systems: Machine learning algorithms improve defect detection, alignment speed, and adaptive process control.

-

Hybrid Automation Lines: Integrated pick-and-place, die attach, and inspection stations reduce footprint and cycle time.

-

Eco-Friendly Processes: Water-based adhesives and low-energy sintering processes align with sustainability goals.

Covid-19 Impact

-

Supply Chain Disruptions: Delays in critical components (robotics, sensors) caused temporary slowdowns in equipment deliveries.

-

Accelerated Digitalization: Remote monitoring and predictive maintenance solutions gained prominence to support unmanned production.

-

Shift in End-Market Demand: Automotive chip shortages spurred investments in power packaging and die bonding capacity.

-

Health & Safety Protocols: Equipment vendors enhanced cleanroom compatibility and contactless service capabilities.

Key Industry Developments

-

High-Throughput Sintering Systems: Launch of rapid sintering platforms that reduce cycle times by up to 50%.

-

Modular Die Bonder Platforms: Introduction of configurable machines that accommodate both small die attach and large power modules.

-

Collaborative R&D Consortia: Joint development projects between equipment suppliers, foundries, and material developers targeting next-gen packaging.

-

AI-Driven Yield Optimization: Early commercial deployments of AI tools that analyze process data and dynamically adjust bonding parameters.

-

Green Initiatives: Rollout of bonding processes that minimize volatile organic compound (VOC) emissions and energy consumption.

Analyst Suggestions

-

Deepen Material Partnerships: Collaborate with adhesive and sinter paste suppliers to co-develop process recipes optimized for new materials.

-

Expand Retrofit Business: Offer upgrade kits and service contracts for legacy die attach machines to capture additional revenue streams.

-

Invest in AI & IoT: Embed advanced analytics and remote-monitoring capabilities to differentiate offerings and support higher uptime.

-

Target Niche Packaging: Develop specialized solutions for high-growth segments—micro-LED, SiP modules, and biomedical devices.

-

Localize Support Infrastructure: Establish regional service hubs and spare part warehouses to reduce downtime and strengthen customer relationships.

Future Outlook

The Die Attach Machine Market is set for continued growth, underpinned by:

-

Advanced Packaging Adoption: As semiconductor packaging complexity increases, precision die attach will remain a bottleneck technology with sustained investment.

-

Technology Convergence: Integration of robotics, AI-driven vision, and IoT into die bonding systems will enhance flexibility and reduce cost of ownership.

-

New Material Synergies: Development of novel die attach materials (e.g., low-temperature sintering pastes, conductive polymers) will expand machine capabilities.

-

Global Fab Expansion: Upcoming wafer fab investments in Asia, Europe, and North America will drive demand for new die attach equipment.

-

Sustainability Imperative: Efficient, low-waste die attach processes will align with corporate ESG goals and regulatory pressures.

Conclusion

The Die Attach Machine Market occupies a vital niche in the semiconductor value chain, enabling the high-precision, high-reliability packaging required by today’s advanced electronics. With strong demand from consumer electronics, automotive, industrial, and healthcare sectors—and fueled by innovations in automation, materials, and digitalization—die attach machines will continue to be a strategic investment for semiconductor manufacturers. By focusing on process optimization, AI integration, and sustainable practices, equipment suppliers can capture significant growth opportunities and support the next wave of semiconductor evolution.