444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

India Less than Truckload (LTL) Road Freight Transport Market refers to the transportation of small shipments or freight that does not require a full truckload. LTL transportation allows multiple shippers to share space in a single truck, reducing costs and maximizing efficiency. It is an essential component of India’s logistics and supply chain industry, catering to the transportation needs of various sectors such as retail, manufacturing, pharmaceuticals, and e-commerce.

Meaning

Less than Truckload (LTL) Road Freight Transport refers to the transportation of relatively smaller shipments or freight that do not require a full truckload. In India, the LTL road freight transport market plays a crucial role in meeting the transportation needs of various industries. It allows businesses to transport their goods efficiently and cost-effectively, especially when the shipment size does not require a dedicated full truck.

Executive Summary

The India Less than Truckload (LTL) Road Freight Transport market is a vital segment of the country’s logistics and transportation industry. It provides a cost-effective solution for transporting smaller shipments, catering to the diverse needs of industries across different sectors. With the rapid growth of e-commerce and the expansion of organized retail, the demand for LTL road freight transport has witnessed significant growth in recent years.

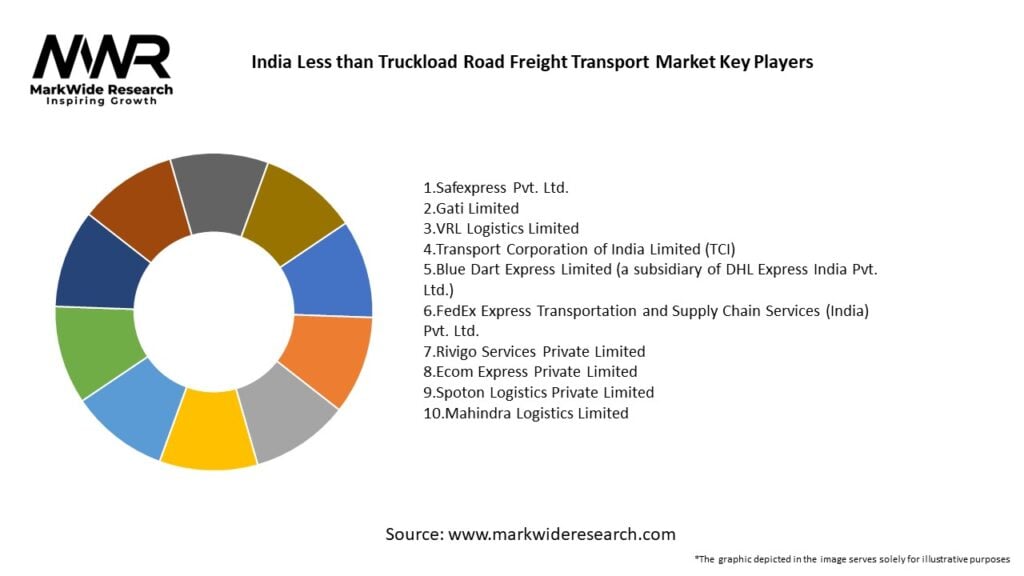

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India Less than Truckload (LTL) Road Freight Transport market operates in a dynamic environment influenced by various factors, including industry trends, economic conditions, government regulations, and technological advancements. The market dynamics shape the strategies and competitiveness of the players involved, as well as the overall growth trajectory of the market.

Regional Analysis

The LTL road freight transport market in India exhibits regional variations in terms of demand, infrastructure, and market dynamics. The major logistics hubs in the country, such as Mumbai, Delhi-NCR, Chennai, Bangalore, and Kolkata, experience higher demand due to their proximity to industrial clusters and commercial centers. However, with the government’s focus on improving connectivity and developing logistics infrastructure across regions, the market potential is expanding beyond these major cities.

Competitive Landscape

Leading Companies in the India Less than Truckload Road Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The LTL road freight transport market in India can be segmented based on various factors, including industry verticals, service types, and geographical regions. The industry verticals may include FMCG, pharmaceuticals, automotive, retail, e-commerce, and others. Service types can include express delivery, door-to-door delivery, part-load transportation, and specialized handling.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the LTL road freight transport market in India. While the initial phases of the pandemic led to disruptions and restrictions on transportation, the market witnessed a surge in demand for essential goods and medical supplies. With the gradual recovery of economic activities, the market has adapted to the new normal, prioritizing safety protocols, contactless deliveries, and digitization to minimize the impact of future disruptions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The India Less than Truckload (LTL) Road Freight Transport market is expected to witness substantial growth in the coming years. Factors such as the continued expansion of e-commerce, organized retail, and the need for efficient distribution networks will drive the demand for LTL road freight transport services. The integration of advanced technologies, increasing focus on sustainability, and the government’s push for logistics reforms are expected to create significant opportunities for market players. However, addressing infrastructure challenges, managing intense competition, and adapting to evolving customer expectations will remain key challenges for the industry.

Conclusion

The India Less than Truckload (LTL) Road Freight Transport market is a vital component of the country’s logistics and transportation industry. It offers cost-effective and efficient solutions for the transportation of smaller shipments, catering to the diverse needs of industries across various sectors. With the growing demand driven by e-commerce, organized retail, and urbanization, the market presents opportunities for companies to expand their operations, adopt advanced technologies, and offer innovative last-mile delivery solutions. However, the market also faces challenges such as infrastructure limitations, intense competition, and regulatory complexities. By embracing technology, focusing on sustainability, and adopting a customer-centric approach, industry participants can navigate these challenges and capitalize on the promising future outlook of the LTL road freight transport market in India.

What is Less than Truckload Road Freight Transport?

Less than Truckload Road Freight Transport refers to the shipping of goods that do not require a full truckload, allowing multiple shipments from different customers to share the same vehicle. This method is cost-effective for businesses that need to transport smaller quantities of goods overland.

What are the key players in the India Less than Truckload Road Freight Transport Market?

Key players in the India Less than Truckload Road Freight Transport Market include companies like Gati Ltd, Blue Dart Express, and TCI Freight, which provide logistics and transportation services tailored to various industries, among others.

What are the growth factors driving the India Less than Truckload Road Freight Transport Market?

The growth of the India Less than Truckload Road Freight Transport Market is driven by the increasing demand for efficient logistics solutions, the rise of e-commerce, and the expansion of manufacturing sectors that require reliable freight services.

What challenges does the India Less than Truckload Road Freight Transport Market face?

Challenges in the India Less than Truckload Road Freight Transport Market include regulatory hurdles, fluctuating fuel prices, and infrastructure limitations that can affect delivery times and costs.

What opportunities exist in the India Less than Truckload Road Freight Transport Market?

Opportunities in the India Less than Truckload Road Freight Transport Market include the adoption of technology for better route optimization, the growth of cold chain logistics, and the increasing focus on sustainability in transportation practices.

What trends are shaping the India Less than Truckload Road Freight Transport Market?

Trends shaping the India Less than Truckload Road Freight Transport Market include the integration of digital platforms for tracking shipments, the use of electric vehicles for reducing carbon footprints, and the emphasis on customer-centric logistics solutions.

India Less than Truckload Road Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Standard Freight, Expedited Freight, Temperature-Controlled Freight, Hazardous Material Freight |

| End User | Manufacturers, Retailers, E-commerce Companies, Wholesalers |

| Vehicle Type | Box Trucks, Flatbed Trucks, Refrigerated Trucks, Cargo Vans |

| Delivery Model | Direct Delivery, Scheduled Delivery, Same-Day Delivery, Cross-Docking |

Leading Companies in the India Less than Truckload Road Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at