444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The yeast and yeast ingredients market represents a dynamic and rapidly expanding sector within the global food and beverage industry. This market encompasses various types of yeast products including baker’s yeast, brewer’s yeast, nutritional yeast, and specialized yeast extracts used across multiple applications. Market growth is being driven by increasing consumer demand for natural fermentation processes, rising health consciousness, and expanding applications in food processing, pharmaceuticals, and animal feed industries.

Industry dynamics indicate robust expansion with the market experiencing a compound annual growth rate (CAGR) of 8.2% during the forecast period. This growth trajectory reflects the versatility of yeast products and their essential role in various manufacturing processes. The market benefits from technological advancements in yeast cultivation, improved production methods, and growing awareness of yeast’s nutritional benefits among health-conscious consumers.

Regional distribution shows significant market presence across North America, Europe, Asia-Pacific, and emerging markets in Latin America and Africa. Europe maintains a dominant market share of approximately 35%, driven by established bakery traditions and advanced fermentation technologies. Meanwhile, the Asia-Pacific region demonstrates the fastest growth rate at 9.7% CAGR, fueled by expanding food processing industries and changing dietary preferences in developing economies.

The yeast and yeast ingredients market refers to the comprehensive industry encompassing the production, processing, and distribution of various yeast-based products used in food, beverage, pharmaceutical, and industrial applications. This market includes live yeast cultures, dried yeast products, yeast extracts, autolyzed yeast, and specialized yeast derivatives designed for specific industrial purposes.

Yeast products serve multiple functions including fermentation agents in baking and brewing, flavor enhancers in food processing, nutritional supplements for human consumption, and growth promoters in animal feed formulations. The market encompasses both traditional yeast applications and innovative uses in biotechnology, pharmaceuticals, and specialty chemical production.

Market fundamentals demonstrate strong growth potential driven by increasing global food production, expanding bakery industries, and rising demand for natural ingredients. The yeast and yeast ingredients market benefits from diverse application areas including bread and bakery products, alcoholic beverages, animal feed, and pharmaceutical formulations. Consumer preferences are shifting toward natural, clean-label ingredients, positioning yeast products favorably in the marketplace.

Key market drivers include the growing popularity of artisanal baking, increased consumption of fermented foods, and expanding applications in biotechnology and pharmaceuticals. The market shows resilience due to the essential nature of yeast in food production processes and its irreplaceable role in fermentation applications. Innovation trends focus on developing specialized yeast strains, improving production efficiency, and creating value-added yeast derivatives.

Competitive dynamics feature established global players alongside regional manufacturers, with companies investing heavily in research and development to create differentiated products. Market consolidation continues as larger companies acquire specialized yeast producers to expand their product portfolios and geographic reach.

Market intelligence reveals several critical insights shaping the yeast and yeast ingredients industry. The following key insights provide strategic understanding of market dynamics:

Primary growth drivers propelling the yeast and yeast ingredients market include expanding global food production, increasing consumer preference for natural ingredients, and growing awareness of yeast’s nutritional benefits. The bakery industry expansion represents a fundamental driver, with rising bread consumption in developing countries and premiumization trends in developed markets supporting sustained demand growth.

Health consciousness trends significantly impact market dynamics as consumers increasingly seek natural, nutritious food ingredients. Nutritional yeast, rich in B-vitamins and protein, experiences growing popularity among health-conscious consumers and vegetarian populations. This trend drives market segment diversification beyond traditional applications into dietary supplements and functional food ingredients.

Industrial fermentation growth across pharmaceutical, biotechnology, and chemical industries creates substantial demand for specialized yeast products. The expanding biofuel industry also contributes to market growth as yeast plays a crucial role in ethanol production processes. Innovation in yeast strains enables new applications and improved performance characteristics, further expanding market opportunities.

Urbanization and lifestyle changes in emerging markets drive increased consumption of processed foods, bakery products, and alcoholic beverages, all requiring yeast ingredients. The growing middle class in Asia-Pacific and Latin America represents significant market expansion potential with changing dietary preferences favoring yeast-containing products.

Market challenges include price volatility of raw materials, particularly molasses and other sugar sources used in yeast production. Supply chain disruptions can significantly impact yeast availability and pricing, affecting downstream industries dependent on consistent yeast supply. The perishable nature of fresh yeast products creates logistical challenges and limits market reach in certain geographic regions.

Regulatory constraints in various countries regarding food additives and processing aids can limit market expansion opportunities. Different approval processes and safety requirements across regions create complexity for global yeast manufacturers seeking to expand their market presence. Quality control challenges associated with maintaining consistent yeast viability and performance characteristics require significant investment in production infrastructure.

Competition from alternatives including chemical leavening agents and synthetic flavor enhancers poses ongoing challenges to traditional yeast applications. While consumer preference trends favor natural ingredients, cost considerations in industrial applications may limit yeast adoption in price-sensitive market segments.

Environmental concerns related to yeast production processes, including water usage and waste generation, require ongoing investment in sustainable production technologies. Climate change impacts on agricultural raw materials used in yeast production may affect long-term supply stability and pricing dynamics.

Emerging opportunities in the yeast and yeast ingredients market include expanding applications in plant-based food products, where yeast extracts provide umami flavors and nutritional enhancement. The alternative protein market presents significant growth potential as yeast-based proteins gain acceptance among consumers seeking sustainable protein sources.

Biotechnology applications offer substantial growth opportunities as yeast serves as a platform for producing pharmaceuticals, enzymes, and specialty chemicals through fermentation processes. The development of genetically modified yeast strains for specific industrial applications represents a high-value market segment with significant growth potential.

Functional food development creates opportunities for specialized yeast ingredients that provide health benefits beyond basic nutrition. Probiotic yeast strains and yeast-derived bioactive compounds represent emerging market segments with strong growth prospects driven by consumer health awareness.

Geographic expansion in emerging markets offers substantial opportunities as improving economic conditions and urbanization drive increased consumption of processed foods and beverages. The craft brewing industry growth worldwide creates demand for specialty yeast strains and premium yeast products, representing a high-margin market opportunity.

Market dynamics in the yeast and yeast ingredients sector reflect complex interactions between supply-side factors, demand drivers, and technological developments. The industry experiences cyclical patterns influenced by agricultural commodity prices, seasonal demand variations, and economic conditions affecting end-user industries.

Supply chain dynamics play a crucial role in market stability, with yeast manufacturers requiring consistent access to quality raw materials including molasses, sugar, and nutrients. Production capacity utilization rates typically range between 75-85% across major manufacturers, indicating healthy demand-supply balance while maintaining flexibility for market fluctuations.

Innovation cycles drive market evolution as companies invest in developing improved yeast strains, enhanced production processes, and new application areas. The industry demonstrates strong research and development intensity with leading companies allocating 3-5% of revenue to innovation activities focused on product differentiation and performance improvement.

Competitive dynamics feature both consolidation trends among major players and the emergence of specialized niche producers serving specific market segments. Market concentration varies by region and application, with the top five global players controlling approximately 60% of market share while numerous smaller companies serve regional and specialty markets.

Research approach for analyzing the yeast and yeast ingredients market employs comprehensive primary and secondary research methodologies to ensure accurate market assessment and reliable forecasting. The methodology combines quantitative analysis with qualitative insights from industry experts, manufacturers, and end-users across various application segments.

Primary research involves extensive interviews with key industry stakeholders including yeast manufacturers, distributors, food processors, and technology providers. Survey methodologies capture market trends, pricing dynamics, and future demand projections from industry participants representing different geographic regions and market segments.

Secondary research encompasses analysis of industry publications, regulatory filings, company annual reports, and trade association data to validate primary research findings and provide comprehensive market context. Data triangulation ensures accuracy by cross-referencing information from multiple sources and methodologies.

Market modeling utilizes advanced statistical techniques to project future market trends based on historical data, identified drivers, and expert insights. The research methodology accounts for regional variations, application-specific dynamics, and technological developments affecting market evolution.

European markets maintain leadership in the global yeast and yeast ingredients industry, driven by established baking traditions, advanced fermentation technologies, and strong regulatory frameworks supporting food safety. Germany, France, and the United Kingdom represent major consumption centers with Europe accounting for 35% of global market share. The region benefits from sophisticated supply chains, high-quality standards, and innovation in specialty yeast products.

North American markets demonstrate steady growth supported by large-scale food processing industries, expanding craft brewing sectors, and increasing consumer interest in natural ingredients. The United States dominates regional consumption with significant demand from bakery, beverage, and animal feed applications. Market growth rates in North America average 6.8% annually, reflecting mature market conditions with opportunities in premium and specialty segments.

Asia-Pacific region exhibits the strongest growth dynamics with rapidly expanding food industries, urbanization trends, and changing dietary preferences driving yeast demand. China and India represent major growth markets with combined market share increasing by 12% annually. The region benefits from cost-competitive manufacturing, growing middle-class populations, and increasing adoption of Western food products.

Latin American markets show promising growth potential driven by economic development, expanding food processing industries, and increasing bread consumption. Brazil and Mexico lead regional demand with growing bakery sectors and rising disposable incomes supporting market expansion.

Market leadership in the yeast and yeast ingredients industry features several global players with strong market positions across different geographic regions and application segments. The competitive landscape demonstrates both scale advantages and specialization strategies among market participants.

Competitive strategies include product innovation, geographic expansion, vertical integration, and strategic acquisitions to strengthen market positions and expand application coverage.

Product segmentation in the yeast and yeast ingredients market encompasses various categories based on type, form, and application requirements. The market divides into distinct segments serving different end-user needs and performance specifications.

By Product Type:

By Form:

By Application:

Baker’s yeast category represents the largest market segment, accounting for approximately 45% of total market volume. This category benefits from consistent global bread consumption and expanding bakery industries in emerging markets. Innovation focus includes developing yeast strains with improved performance characteristics, extended shelf life, and enhanced nutritional profiles.

Yeast extracts segment demonstrates strong growth driven by increasing demand for natural flavor enhancers and clean-label ingredients. This category serves multiple applications including soups, sauces, snack foods, and meat products. Market expansion occurs through development of specialized extracts with specific flavor profiles and functional properties.

Nutritional yeast category experiences rapid growth fueled by health consciousness trends and expanding vegetarian populations. This segment benefits from high protein content, B-vitamin richness, and umami flavor characteristics. Consumer adoption increases particularly among health-conscious demographics seeking natural nutritional supplements.

Industrial yeast applications show promising growth in biotechnology and pharmaceutical sectors where yeast serves as a production platform for various compounds. This category represents high-value applications with specialized requirements and premium pricing structures.

Manufacturers benefit from diverse application opportunities, stable demand patterns, and opportunities for product differentiation through innovation. The yeast industry offers multiple revenue streams across food, feed, and industrial applications, providing business diversification and risk mitigation advantages.

Food processors gain access to natural fermentation agents, flavor enhancers, and nutritional ingredients that meet consumer preferences for clean-label products. Yeast ingredients provide functional benefits including improved texture, extended shelf life, and enhanced nutritional profiles in processed foods.

Consumers benefit from improved product quality, enhanced nutritional value, and natural ingredient profiles in food and beverage products. Yeast-based ingredients contribute to better taste, texture, and health benefits while supporting sustainable food production practices.

Distributors and retailers benefit from stable product demand, diverse product portfolios, and opportunities to serve multiple market segments. The essential nature of yeast in food production provides business stability and growth opportunities across various geographic markets.

Research institutions find opportunities in developing new yeast strains, improving production processes, and exploring novel applications in biotechnology and pharmaceuticals. Collaboration opportunities exist between academia and industry for advancing yeast science and technology.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label trends significantly influence yeast market development as consumers increasingly demand natural, recognizable ingredients in food products. This trend drives growth in organic yeast products and specialty yeast ingredients that replace synthetic additives in food formulations. Manufacturers respond by developing yeast-based solutions that provide functional benefits while meeting clean label requirements.

Health and wellness focus creates growing demand for nutritional yeast products rich in B-vitamins, protein, and bioactive compounds. This trend particularly benefits the nutritional supplement segment where yeast-based products serve health-conscious consumers seeking natural vitamin sources. Product innovation focuses on enhancing nutritional profiles and developing targeted health benefits.

Sustainability initiatives drive industry efforts to reduce environmental impact through improved production efficiency, waste reduction, and sustainable sourcing practices. Companies invest in technologies that minimize water usage, reduce energy consumption, and utilize renewable raw materials in yeast production processes.

Premiumization trends in food and beverage markets create opportunities for specialty yeast products that enhance flavor, texture, and nutritional value. Artisanal baking, craft brewing, and gourmet food applications drive demand for premium yeast strains and specialized fermentation ingredients.

Biotechnology advancement enables development of genetically modified yeast strains optimized for specific applications, improved performance characteristics, and novel product capabilities. This trend opens new market opportunities in pharmaceuticals, chemicals, and advanced materials production.

Recent industry developments demonstrate ongoing innovation and market expansion activities among major yeast manufacturers. MarkWide Research analysis indicates significant investment in production capacity expansion, particularly in Asia-Pacific markets where demand growth exceeds current supply capabilities.

Technological innovations include development of new yeast strains with enhanced performance characteristics, improved shelf stability, and specialized functional properties. Companies invest in biotechnology platforms for producing high-value compounds using yeast fermentation processes, expanding beyond traditional food applications.

Strategic acquisitions continue as major players seek to expand geographic presence, acquire specialized technologies, and strengthen product portfolios. Recent transactions focus on companies with expertise in specialty yeast products, organic ingredients, and emerging market presence.

Sustainability initiatives gain prominence with companies implementing circular economy principles, reducing waste generation, and developing renewable raw material sourcing strategies. Industry leaders establish sustainability targets and invest in technologies that minimize environmental impact while maintaining product quality.

Regulatory developments include updated food safety standards, organic certification requirements, and biotechnology regulations affecting yeast production and marketing. Companies adapt operations to comply with evolving regulatory frameworks while maintaining market access across different regions.

Strategic recommendations for yeast industry participants include focusing on product differentiation through innovation, expanding geographic presence in high-growth markets, and developing sustainable production practices. Companies should prioritize research and development investments to create specialized yeast products serving emerging applications and premium market segments.

Market positioning strategies should emphasize natural ingredient benefits, nutritional advantages, and functional performance characteristics that differentiate yeast products from synthetic alternatives. Building strong relationships with food manufacturers and developing customized solutions for specific applications can create competitive advantages and customer loyalty.

Investment priorities should include production capacity expansion in emerging markets, technology upgrades for improved efficiency, and development of specialty product lines serving high-value applications. Companies should also invest in supply chain optimization and quality assurance systems to ensure consistent product performance.

Partnership opportunities exist with food manufacturers, biotechnology companies, and research institutions for developing innovative applications and expanding market reach. Strategic alliances can provide access to new technologies, market channels, and application expertise while sharing development costs and risks.

Long-term prospects for the yeast and yeast ingredients market remain highly positive, driven by fundamental growth drivers including global population increase, urbanization trends, and expanding food processing industries. MWR projections indicate sustained market expansion with growth rates expected to maintain 7-9% annually over the next decade across different regional markets.

Technology evolution will continue driving market development through improved yeast strains, enhanced production processes, and new application areas. Biotechnology advances enable development of yeast platforms for producing pharmaceuticals, specialty chemicals, and advanced materials, creating high-value market opportunities beyond traditional food applications.

Market diversification trends indicate expanding applications in plant-based foods, functional ingredients, and sustainable packaging materials where yeast-derived compounds provide unique properties and environmental benefits. The growing alternative protein market represents significant long-term opportunity for yeast-based protein products.

Regional growth patterns suggest continued expansion in Asia-Pacific and Latin American markets driven by economic development, changing dietary preferences, and expanding food processing industries. Developed markets will focus on premium products, specialty applications, and sustainable production methods to maintain growth momentum.

Innovation focus will emphasize developing yeast solutions that address consumer health concerns, environmental sustainability, and functional performance requirements. Companies investing in research and development capabilities will be best positioned to capture emerging opportunities and maintain competitive advantages in evolving market conditions.

The yeast and yeast ingredients market demonstrates robust growth potential supported by diverse application areas, increasing consumer preference for natural ingredients, and expanding global food production. Market dynamics favor continued expansion driven by health consciousness trends, clean label requirements, and innovation in biotechnology applications.

Industry fundamentals remain strong with essential product characteristics, diverse end-user markets, and ongoing technological advancement supporting long-term growth prospects. The market benefits from both traditional applications in food and beverages and emerging opportunities in pharmaceuticals, biotechnology, and specialty chemicals.

Strategic success in this market requires focus on innovation, quality assurance, and sustainable production practices while building strong relationships with end-users across multiple application segments. Companies that invest in research and development, expand geographic presence, and develop differentiated products will be best positioned for future growth and market leadership in the evolving yeast and yeast ingredients industry.

What is Yeast and Yeast Ingredients?

Yeast and Yeast Ingredients refer to the microorganisms and products derived from them that are used in various applications, including baking, brewing, and fermentation processes. These ingredients play a crucial role in food production and beverage manufacturing.

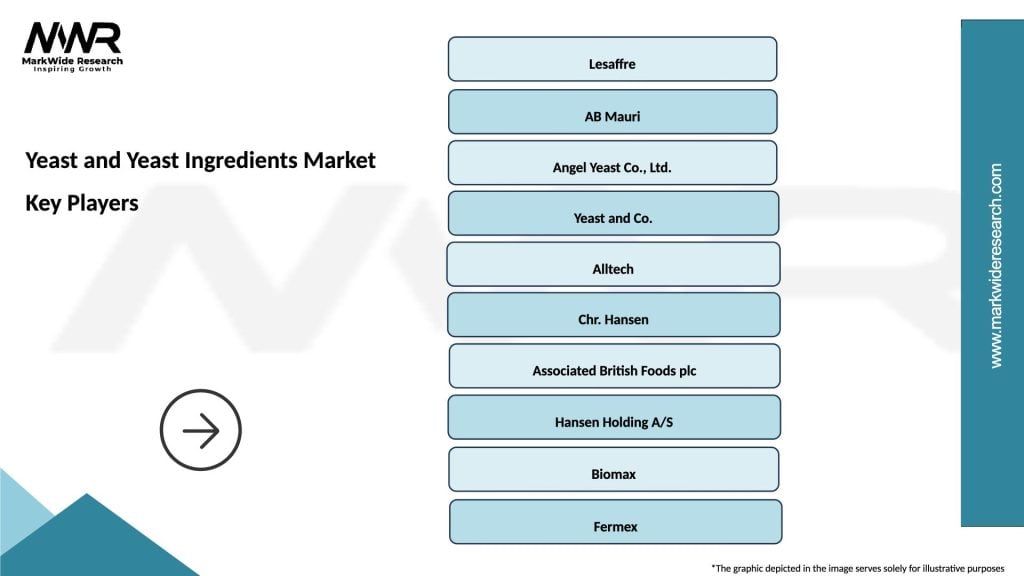

What are the key players in the Yeast and Yeast Ingredients Market?

Key players in the Yeast and Yeast Ingredients Market include companies like Lesaffre, AB Mauri, and Archer Daniels Midland Company. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the Yeast and Yeast Ingredients Market?

The growth of the Yeast and Yeast Ingredients Market is driven by the increasing demand for baked goods, the rise in craft brewing, and the growing interest in natural fermentation processes. Additionally, the trend towards clean label products is boosting the market.

What challenges does the Yeast and Yeast Ingredients Market face?

The Yeast and Yeast Ingredients Market faces challenges such as fluctuating raw material prices and the need for stringent quality control. Additionally, competition from synthetic alternatives can impact market growth.

What opportunities exist in the Yeast and Yeast Ingredients Market?

Opportunities in the Yeast and Yeast Ingredients Market include the expansion of the plant-based food sector and the increasing popularity of probiotic products. Innovations in yeast strains for specific applications also present significant growth potential.

What trends are shaping the Yeast and Yeast Ingredients Market?

Trends in the Yeast and Yeast Ingredients Market include the development of specialty yeasts for unique flavors and health benefits, as well as advancements in fermentation technology. The focus on sustainability and organic ingredients is also influencing market dynamics.

Yeast and Yeast Ingredients Market

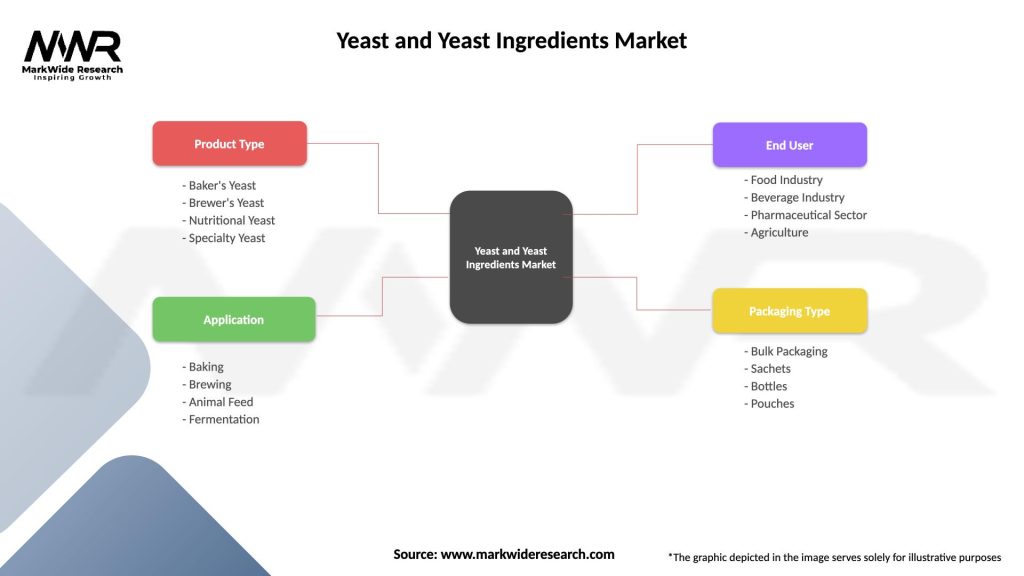

| Segmentation Details | Description |

|---|---|

| Product Type | Baker’s Yeast, Brewer’s Yeast, Nutritional Yeast, Specialty Yeast |

| Application | Baking, Brewing, Animal Feed, Fermentation |

| End User | Food Industry, Beverage Industry, Pharmaceutical Sector, Agriculture |

| Packaging Type | Bulk Packaging, Sachets, Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Yeast and Yeast Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at