444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The wound care and medical device coatings market is a rapidly growing sector within the healthcare industry. Wound care refers to the management and treatment of wounds, while medical device coatings involve the application of coatings to medical devices to enhance their performance and functionality. These two areas are closely related as they both aim to improve patient outcomes and enhance the efficacy of medical interventions.

Wound care is a critical aspect of healthcare that focuses on the treatment and management of various types of wounds, including acute and chronic wounds, burns, and surgical wounds. It involves a range of techniques and products aimed at promoting wound healing, preventing infection, and minimizing scarring. Medical device coatings, on the other hand, involve the application of specialized coatings to medical devices to enhance their surface properties, biocompatibility, and functionality.

Executive Summary

The global wound care and medical device coatings market is witnessing robust growth, driven by the increasing prevalence of chronic wounds, such as diabetic ulcers and pressure ulcers. The market is also fueled by technological advancements in wound care products and medical device coatings. Rising geriatric population, increasing healthcare expenditure, and growing awareness about wound care are further contributing to market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

High‐Value Advanced Dressings Leading Growth: Hydrofiber, foam, and biologic dressings are growing at over 8% CAGR, outpacing traditional gauze and non‐adherent pads.

Antimicrobial Coatings Surge: The antimicrobial/antifouling coatings segment accounts for nearly 35% of the medical device coatings market, driven by hospital‐acquired infection concerns.

Technology Convergence: Platforms combining wound care dressings with sensing capabilities (e.g., color‐change pH indicators) are emerging, enabling real‐time wound monitoring.

Regional Variations: North America dominates with over 40% market share, followed by Europe; Asia Pacific exhibits the fastest regional CAGR (~9%), led by China and India.

COVID‐19 Aftereffects: The pandemic heightened focus on infection control and remote patient management, boosting sales of advanced dressings suitable for home care and telehealth integration.

Market Drivers

Rising Chronic Wound Incidence: Aging populations and increasing diabetes prevalence fuel chronic wound cases, estimated to grow at 5% annually in major markets.

Infection Prevention Imperative: Hospital‐acquired infections (HAIs) affect 5–10% of patients; antimicrobial coatings reduce device‐related infection rates by up to 50%.

Advancements in Biomaterials: Innovations in hydrogel, collagen, and polymer chemistries enable high‐moisture retention, cell proliferation support, and controlled drug release.

Shift to Outpatient & Home Care: Healthcare cost containment and patient preference accelerate adoption of wearable wound sensors and easy‐to‐apply dressings amenable to self‐care.

Regulatory & Reimbursement Support: Favorable coding and reimbursement pathways (e.g., CMS’ Home Health PPS) incentivize use of advanced wound care products over standard dressings.

Market Restraints

High Product Costs: Advanced dressings and specialty coatings cost 3–5× more than conventional options, limiting uptake in price‐sensitive markets.

Regulatory Complexity & Delays: Biologic dressings and combination products face lengthy approval pathways (e.g., FDA’s combination product regulation), delaying market entry.

Clinical Evidence Gaps: Limited large‐scale, randomized trials comparing advanced dressings to standard care hinder broader formulary inclusion.

Supply Chain Disruptions: Dependence on specialized polymers, biologics, and nanoparticles exposes manufacturers to raw material volatility and logistics challenges.

Adherence & Training Issues: Proper application of advanced dressings and device coatings requires clinician and caregiver training, impacting real‐world efficacy.

Market Opportunities

Smart & Connected Care: Integration of biosensors and IoT connectivity in dressings and coatings to monitor wound pH, temperature, and biomarkers remotely.

Personalized Wound Care: Customized 3D‐printed dressings and patient‐specific implant coatings tailored to wound geometry and microbiome profile.

Regenerative Medicine Convergence: Combining coatings with stem cell and growth factor delivery enables advanced tissue regeneration in chronic wounds and orthopedic implants.

Emerging Market Penetration: Growth in China, India, and Latin America driven by expanding healthcare infrastructure and rising per‐capita healthcare spending.

Sustainable & Biodegradable Materials: Development of eco‐friendly, biodegradable dressing substrates and coating polymers reduces medical waste burden.

Market Dynamics

M&A & Collaborations: Consolidation among wound care giants (e.g., Smith & Nephew, Coloplast) and coatings specialists (e.g., Covalon, BioInteractions) expands portfolios.

Cross‐Industry Partnerships: Alliances between medical device OEMs and nanotechnology firms accelerate development of next‐gen coatings.

Value‐Based Care Models: Hospitals adopting outcome‐based procurement favor dressings and coatings that demonstrably reduce infection rates and healing times.

Digital Therapeutics Integration: Wound care platforms integrating mobile apps guide dressing changes and remotely adjust treatment protocols.

Regulatory Convergence: Harmonization efforts by ICH, IMDRF streamline global approval processes for combination wound care/coating products.

Regional Analysis

North America: Dominant region with ~45% share; strong adoption of advanced dressings and antimicrobial coatings, robust reimbursement, and high healthcare R&D investment.

Europe: Mature market with ~30% share; early adoption of ultra‐high‐moisture and bioengineered dressings, stringent MDR requirements for coated devices.

Asia Pacific: Fastest CAGR (~9%); government initiatives to expand wound care access in China and India drive domestic manufacturing and private‐label growth.

Latin America: Growing demand (~6% CAGR) in Brazil and Mexico, though limited by reimbursement constraints and competing traditional dressings.

Middle East & Africa: Nascent but accelerating market, with Gulf countries investing in advanced wound care centers and procurement of coated implants.

Competitive Landscape

Leading Companies in the Wound Care and Medical Device Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

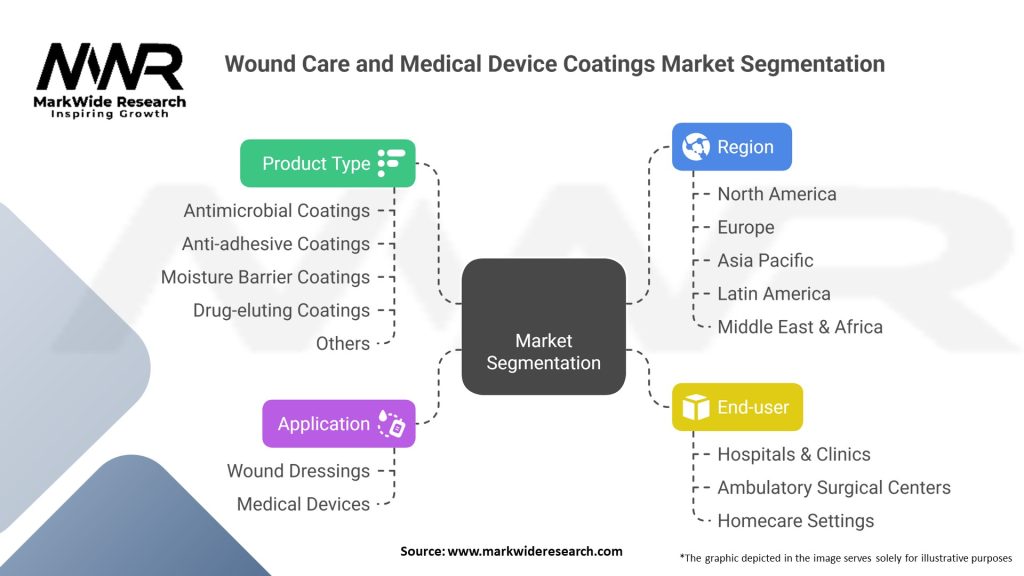

The wound care and medical device coatings market is segmented based on product type, application, end-user, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the wound care and medical device coatings market. The increased focus on infection prevention and control measures has led to a higher demand for antimicrobial coatings and advanced wound dressings. However, disruptions in the supply chain and decreased elective surgeries have affected market growth. The market is expected to recover as healthcare systems stabilize and the focus shifts back to non-COVID-19-related healthcare needs.

Key Industry Developments

Acquisitions & Partnerships: Smith & Nephew’s acquisition of Osiris Therapeutics (decellularized tissue) and 3M’s partnership with Duke University on smart dressings highlight consolidation and innovation.

Regulatory Approvals: FDA clearance of the world’s first in‐dressable pH sensor and EMA approval of antibiotic‐eluting orthopedic coatings exemplify product breakthroughs.

Manufacturing Expansions: Investments in clean‐room facilities and continuous‐flow manufacturing for hydrogels and nanocoatings increase capacity and reduce costs.

Digital Health Integration: Launch of companion mobile apps for wound measurement, dressing change reminders, and digital imaging for remote clinician review.

Analyst Suggestions

Future Outlook

The wound care and medical device coatings market is expected to witness steady growth in the coming years. The increasing prevalence of chronic wounds and chronic diseases, coupled with technological advancements, will drive market growth. Expansion in emerging markets, development of innovative products, and collaborations between industry players and healthcare organizations will present significant opportunities. However, challenges related to high costs and regulatory requirements need to be addressed to ensure sustainable market growth.

Conclusion

The wound care and medical device coatings market is witnessing significant growth driven by the increasing demand for advanced wound care products and the rise in chronic diseases. Technological advancements in wound care products and medical device coatings have improved the efficacy and functionality of these products. The market presents opportunities for expansion in emerging markets and the development of innovative products. Collaboration and partnerships between healthcare organizations and wound care product manufacturers can further drive market growth. However, challenges related to high costs and regulatory requirements need to be addressed to ensure sustained growth in the market.

What are wound care and medical device coatings?

Wound care and medical device coatings refer to specialized materials applied to medical devices and wound dressings to enhance their performance, biocompatibility, and antimicrobial properties. These coatings are crucial in preventing infections and promoting faster healing in various medical applications.

Who are the key players in the wound care and medical device coatings market?

Key players in the wound care and medical device coatings market include companies like Smith & Nephew, Medtronic, and ConvaTec, which are known for their innovative products and solutions in wound management and device coatings, among others.

What are the main drivers of growth in the wound care and medical device coatings market?

The growth of the wound care and medical device coatings market is driven by factors such as the increasing prevalence of chronic wounds, advancements in coating technologies, and a rising demand for effective infection control solutions in healthcare settings.

What challenges does the wound care and medical device coatings market face?

Challenges in the wound care and medical device coatings market include stringent regulatory requirements, high costs associated with research and development, and the need for continuous innovation to meet evolving healthcare needs.

What opportunities exist in the wound care and medical device coatings market?

Opportunities in the wound care and medical device coatings market include the development of smart coatings with enhanced functionalities, the expansion of telehealth services for wound management, and increasing investments in research for advanced biomaterials.

What trends are shaping the wound care and medical device coatings market?

Current trends in the wound care and medical device coatings market include the growing use of nanotechnology in coatings, the rise of personalized medicine approaches, and an increasing focus on sustainability in material selection and manufacturing processes.

Wound Care and Medical Device Coatings Market:

| Segmentation Details | Description |

|---|---|

| Product Type | Antimicrobial Coatings, Anti-adhesive Coatings, Moisture Barrier Coatings, Drug-eluting Coatings, Others |

| Application | Wound Dressings, Medical Devices |

| End-user | Hospitals & Clinics, Ambulatory Surgical Centers, Homecare Settings |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Wound Care and Medical Device Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at