444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Working Capital Management market is a crucial component of financial management that has gained significant traction in recent years. This market revolves around optimizing a company’s short-term operational efficiency by ensuring that its current assets and liabilities are balanced effectively. It’s a complex endeavor that requires astute financial planning and strategic decision-making. With businesses recognizing the importance of maintaining a healthy working capital cycle, the market has evolved to provide specialized solutions and services.

Meaning

Working Capital Management refers to the process of monitoring and controlling a company’s current assets and liabilities to ensure the smooth flow of operations. It involves managing elements like accounts payable, accounts receivable, inventory, and short-term debt. Effective management of working capital allows businesses to meet their short-term obligations, seize growth opportunities, and minimize financial risks.

Executive Summary

In a fast-paced business landscape, where cash flow is king, the role of Working Capital Management cannot be overstated. It directly impacts a company’s liquidity, profitability, and overall financial stability. This report delves into the key insights of the Working Capital Management market, highlighting its driving factors, challenges, and opportunities. Furthermore, it provides a comprehensive analysis of regional trends, competitive landscapes, and emerging market trends.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Working Capital Management Market is influenced by several key factors:

Market Drivers

Several factors are driving the growth of the Working Capital Management Market:

Market Restraints

Despite the positive market growth, the Working Capital Management Market faces several challenges:

Market Opportunities

The Working Capital Management Market offers numerous growth opportunities:

Market Dynamics

The dynamics of the Working Capital Management Market are influenced by various factors:

Supply Side Factors:

Demand Side Factors:

Economic Factors:

Regional Analysis

The Working Capital Management Market is seeing different growth trends across regions:

North America:

Europe:

Asia-Pacific:

Latin America:

Middle East and Africa:

Competitive Landscape

Leading Companies in Working Capital Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

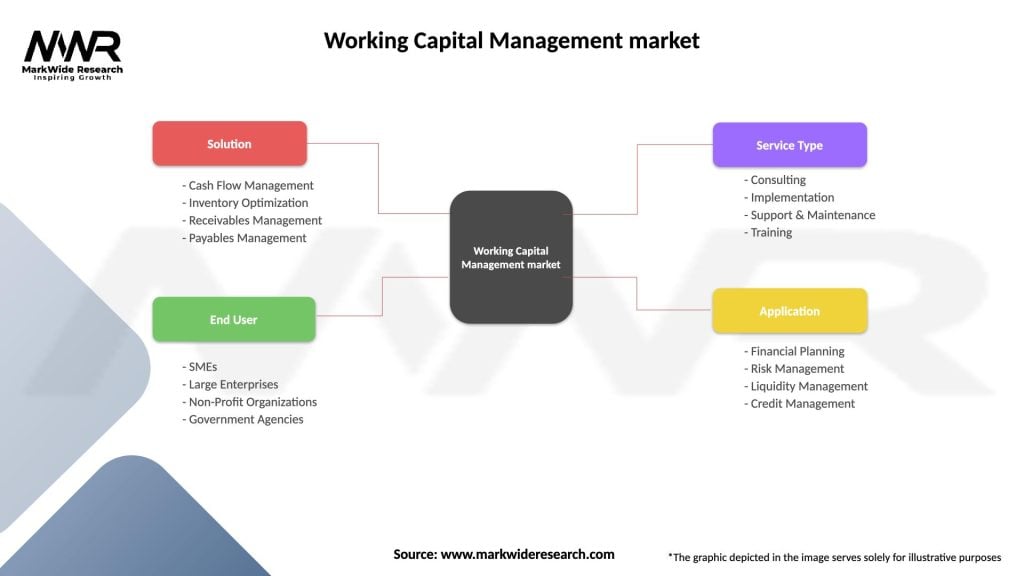

The Working Capital Management Market can be segmented based on the following criteria:

By Solution:

By End-User:

By Industry:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic highlighted the importance of robust Working Capital Management practices. Many businesses faced disruptions in their supply chains and cash flow, underscoring the need for agility and preparedness. Companies that had efficient working capital strategies in place were better equipped to weather the storm.

Key Industry Developments

Recent developments in the Working Capital Management market include the launch of mobile apps that allow businesses to monitor their financial health on the go. Moreover, partnerships between technology providers and financial institutions are becoming more common, offering integrated solutions for comprehensive capital management.

Analyst Suggestions

Analysts recommend that businesses prioritize the integration of technology-driven solutions for efficient Working Capital Management. This includes adopting software that provides real-time insights into cash flow, automates routine financial tasks, and utilizes predictive analytics to anticipate future trends. Nevertheless, the WCM landscape is not without complexities. Factors such as global supply chain disruptions, regulatory changes, and shifting consumer behavior demand a holistic approach to managing working capital. Collaborative efforts between finance, procurement, and production departments are essential for streamlining processes and optimizing resource allocation.

Future Outlook

The Working Capital Management market is poised for substantial growth in the coming years. As businesses become more aware of the benefits of optimizing their capital cycles, demand for innovative solutions will surge. Additionally, the integration of AI and data analytics will further revolutionize how companies manage their working capital.

In essence, the Working Capital Management market underscores the criticality of judiciously managing current assets and liabilities. Organizations must embrace innovative solutions, adapt to changing market dynamics, and foster cross-functional cooperation to thrive in an ever-evolving business environment. By doing so, they can unlock the potential for improved operational efficiency, increased profitability, and enduring business resilience.

Conclusion

In a rapidly evolving business landscape, the Working Capital Management market stands as a critical enabler of financial health and operational efficiency. By adopting advanced solutions and strategies, businesses can navigate economic uncertainties, seize growth opportunities, and enhance their overall competitiveness. As technology continues to advance, the potential for innovation in this market is limitless, making it an exciting space to watch.

In conclusion, the dynamic landscape of Working Capital Management (WCM) presents both challenges and opportunities for businesses across industries. As this market continues to evolve, organizations must recognize the pivotal role that efficient WCM plays in maintaining financial health and fostering sustainable growth.

What is Working Capital Management?

Working Capital Management refers to the process of managing a company’s short-term assets and liabilities to ensure operational efficiency and financial stability. It involves monitoring cash flow, inventory levels, and accounts receivable and payable to maintain sufficient liquidity.

Who are the key players in the Working Capital Management market?

Key players in the Working Capital Management market include companies like SAP, Oracle, and Coupa Software, which provide solutions for optimizing working capital. These companies offer tools for cash management, inventory control, and financial forecasting, among others.

What are the main drivers of the Working Capital Management market?

The main drivers of the Working Capital Management market include the increasing need for businesses to optimize cash flow, the rise of e-commerce requiring efficient inventory management, and the growing adoption of technology solutions for financial management.

What challenges does the Working Capital Management market face?

Challenges in the Working Capital Management market include fluctuating economic conditions that affect cash flow, the complexity of managing diverse supply chains, and the need for real-time data to make informed financial decisions.

What opportunities exist in the Working Capital Management market?

Opportunities in the Working Capital Management market include the integration of artificial intelligence for predictive analytics, the expansion of cloud-based solutions for remote access, and the increasing focus on sustainability practices in financial management.

What trends are shaping the Working Capital Management market?

Trends shaping the Working Capital Management market include the growing emphasis on digital transformation, the use of automation to streamline processes, and the increasing importance of data analytics for improving decision-making and efficiency.

Working Capital Management market

| Segmentation Details | Description |

|---|---|

| Solution | Cash Flow Management, Inventory Optimization, Receivables Management, Payables Management |

| End User | SMEs, Large Enterprises, Non-Profit Organizations, Government Agencies |

| Service Type | Consulting, Implementation, Support & Maintenance, Training |

| Application | Financial Planning, Risk Management, Liquidity Management, Credit Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Working Capital Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at