444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The wires and cables market represents a fundamental infrastructure component driving global connectivity and power transmission across diverse industries. This expansive sector encompasses electrical wires, power cables, communication cables, and specialized transmission solutions that form the backbone of modern technological advancement. Market dynamics indicate robust growth driven by increasing urbanization, renewable energy adoption, and expanding telecommunications infrastructure worldwide.

Industrial applications span from residential construction and commercial buildings to automotive manufacturing, aerospace systems, and renewable energy installations. The market demonstrates remarkable resilience with consistent demand patterns reflecting global economic development and technological evolution. Growth trajectories show particularly strong momentum in emerging economies where infrastructure development accelerates at unprecedented rates.

Regional variations highlight distinct market characteristics, with Asia-Pacific leading consumption volumes while North America and Europe focus on high-value specialty applications. The sector experiences continuous innovation in materials science, manufacturing processes, and application-specific solutions. Market penetration reaches virtually every industry vertical, establishing wires and cables as essential components for economic functionality and technological progress.

The wires and cables market refers to the comprehensive industry encompassing the design, manufacturing, distribution, and installation of electrical conductors used for power transmission, signal communication, and data transfer across residential, commercial, and industrial applications.

Product categories include power cables for electrical transmission, communication cables for data and telecommunications, automotive wiring harnesses, building wires for construction applications, and specialized cables for aerospace, marine, and industrial equipment. Manufacturing processes involve conductor preparation, insulation application, shielding installation, and protective jacketing to ensure optimal performance under specific operating conditions.

Market scope extends from basic copper and aluminum conductors to advanced fiber optic cables, high-voltage transmission lines, and smart grid infrastructure components. The industry serves critical functions in enabling electrical power distribution, telecommunications connectivity, internet infrastructure, and automated control systems across global markets.

Market fundamentals demonstrate sustained growth momentum driven by infrastructure modernization, renewable energy expansion, and digital transformation initiatives worldwide. The wires and cables sector benefits from multiple growth vectors including urbanization trends, industrial automation adoption, and telecommunications network upgrades. Demand patterns reflect increasing complexity in application requirements and performance specifications.

Technology advancement focuses on enhanced conductivity, improved insulation materials, environmental sustainability, and smart cable solutions with integrated monitoring capabilities. Manufacturing innovation emphasizes production efficiency, quality consistency, and customization capabilities to meet diverse customer requirements. Supply chain optimization addresses raw material sourcing, inventory management, and distribution network efficiency.

Competitive dynamics feature established manufacturers expanding global presence while emerging players focus on specialized applications and regional market penetration. The sector demonstrates strong correlation with construction activity, infrastructure investment, and industrial production levels. Future prospects indicate continued expansion supported by electrification trends, renewable energy deployment, and digital infrastructure development.

Strategic insights reveal fundamental market characteristics shaping industry development and competitive positioning:

Primary growth drivers propel market expansion through multiple interconnected factors creating sustained demand momentum. Infrastructure development initiatives worldwide generate substantial requirements for power transmission and communication cables. Urbanization trends accelerate construction activity in residential, commercial, and industrial sectors, driving consistent cable consumption patterns.

Renewable energy adoption creates significant opportunities for specialized cables designed for solar installations, wind farms, and energy storage systems. Grid modernization projects require advanced cable solutions supporting smart grid functionality and improved transmission efficiency. Electrification initiatives in transportation, industrial processes, and residential applications expand market scope beyond traditional boundaries.

Telecommunications expansion drives demand for fiber optic cables, data transmission solutions, and network infrastructure components. Industrial automation trends require specialized cables for control systems, robotics applications, and process monitoring equipment. Automotive evolution toward electric vehicles creates substantial opportunities for high-voltage cables, charging infrastructure, and advanced wiring harnesses with enhanced performance specifications.

Market challenges include raw material price volatility affecting copper, aluminum, and specialized polymer costs, creating margin pressure for manufacturers. Regulatory compliance requirements increase development costs and manufacturing complexity, particularly for specialized applications with stringent safety standards. Competition intensity from low-cost producers impacts pricing strategies and profitability margins across market segments.

Technical complexity in advanced applications requires significant research and development investments, creating barriers for smaller manufacturers. Installation challenges in existing infrastructure limit retrofit opportunities and increase project costs. Environmental regulations regarding material composition and disposal create compliance burdens and potential supply chain disruptions.

Economic sensitivity to construction cycles and industrial investment patterns creates demand volatility affecting production planning and inventory management. Trade tensions and supply chain disruptions impact raw material availability and manufacturing costs. Technology obsolescence risks require continuous innovation investments to maintain competitive positioning in rapidly evolving applications.

Emerging opportunities span multiple high-growth segments offering substantial expansion potential. Smart city initiatives create demand for intelligent cable systems with integrated monitoring and communication capabilities. Renewable energy projects require specialized cables for offshore wind installations, solar farms, and energy storage facilities with enhanced durability and performance characteristics.

Electric vehicle infrastructure presents significant opportunities for charging station cables, high-voltage automotive applications, and residential charging solutions. Data center expansion drives demand for high-performance cables supporting increased bandwidth requirements and power efficiency. Industrial automation creates opportunities for specialized cables in robotics, process control, and smart manufacturing applications.

Developing markets offer substantial growth potential through infrastructure development, urbanization projects, and industrial expansion. Submarine cable projects for international connectivity and offshore energy transmission represent high-value market segments. Retrofit applications in aging infrastructure create opportunities for cable replacement and system upgrades with improved performance and safety features.

Dynamic market forces shape competitive positioning and strategic decision-making across the wires and cables industry. Supply and demand balance fluctuates with construction cycles, infrastructure investment patterns, and industrial production levels. Price dynamics reflect raw material costs, manufacturing efficiency, and competitive pressures from global suppliers.

Innovation cycles drive product development focusing on enhanced performance, environmental sustainability, and application-specific solutions. Customer requirements evolve toward higher quality standards, improved reliability, and integrated functionality. Manufacturing trends emphasize automation, quality consistency, and production flexibility to meet diverse market demands.

Regulatory environment influences product specifications, safety standards, and environmental compliance requirements. Global trade patterns affect sourcing strategies, manufacturing locations, and market access opportunities. Technology convergence creates opportunities for cables with multiple functionalities combining power transmission, data communication, and monitoring capabilities in single solutions.

Comprehensive research approach combines primary and secondary data sources to provide accurate market analysis and strategic insights. Primary research includes industry expert interviews, manufacturer surveys, and customer feedback collection across key market segments. Secondary research encompasses industry publications, government statistics, trade association reports, and regulatory documentation analysis.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification. Market sizing methodologies incorporate bottom-up and top-down approaches for comprehensive coverage. Analytical frameworks include competitive analysis, value chain assessment, and regional market comparison studies.

Forecasting models integrate historical trends, current market conditions, and future growth drivers to project market development scenarios. Quality assurance procedures include peer review, expert validation, and methodology transparency. Research scope covers global markets with detailed regional analysis and segment-specific insights for strategic decision support.

Asia-Pacific region dominates global consumption with approximately 45% market share, driven by rapid industrialization, infrastructure development, and manufacturing expansion in China, India, and Southeast Asian countries. Construction activity and renewable energy projects create substantial demand for power cables and communication infrastructure. Manufacturing capabilities in the region support both domestic consumption and global export markets.

North America represents a mature market with 25% regional share, characterized by infrastructure modernization, renewable energy adoption, and advanced telecommunications requirements. Grid upgrade projects and electric vehicle infrastructure development drive specialized cable demand. Technology leadership in high-performance applications creates opportunities for premium product segments.

Europe maintains approximately 22% market presence with strong emphasis on environmental sustainability, renewable energy integration, and smart grid development. Regulatory frameworks promote high-quality standards and environmental compliance. Regional initiatives focus on energy efficiency, grid interconnection projects, and sustainable manufacturing practices.

Latin America and Middle East regions show growing demand driven by infrastructure development, urbanization projects, and industrial expansion. Oil and gas sector requirements create opportunities for specialized cables in harsh environment applications. Market development reflects economic growth patterns and infrastructure investment priorities across emerging economies.

Market leadership features established global manufacturers with comprehensive product portfolios and extensive distribution networks:

Competitive strategies emphasize product innovation, manufacturing efficiency, and market expansion through acquisitions and partnerships. Technology development focuses on enhanced performance, environmental sustainability, and application-specific solutions.

By Product Type:

By Application:

By End-User:

Power cables segment demonstrates steady growth driven by grid modernization and renewable energy integration projects. High-voltage transmission cables show particular strength in emerging markets with expanding electrical infrastructure. Medium-voltage distribution cables benefit from urbanization trends and industrial development across global regions.

Communication cables category experiences rapid expansion with fiber optic solutions leading growth due to increasing bandwidth requirements and network upgrade projects. Data center applications drive demand for high-performance cables with enhanced transmission capabilities. Telecommunications infrastructure development creates opportunities for specialized communication cable solutions.

Automotive segment shows transformation toward electric vehicle applications requiring high-voltage cables and advanced wiring harnesses. Traditional automotive cables maintain steady demand while electric vehicle infrastructure creates new growth opportunities. Charging infrastructure development drives specialized cable requirements for residential and commercial applications.

Building wire category correlates directly with construction activity levels and demonstrates regional variations based on building standards and electrical codes. Smart building applications create opportunities for cables with integrated monitoring and communication capabilities. Residential applications show consistent demand patterns reflecting housing construction and renovation activities.

Manufacturers benefit from diverse market opportunities across multiple application segments, providing revenue stability and growth potential. Product innovation capabilities enable differentiation and premium pricing strategies. Global market reach allows risk diversification and access to emerging market opportunities with higher growth rates.

Distributors gain from comprehensive product portfolios serving diverse customer bases and application requirements. Value-added services including technical support and logistics management create competitive advantages. Market relationships with manufacturers and customers provide strategic positioning and business development opportunities.

End-users receive improved product performance, reliability, and safety features through continuous innovation and quality improvements. Standardization efforts reduce complexity and improve interoperability across systems. Technical support and application expertise from suppliers enhance project success and operational efficiency.

Investors benefit from market stability and growth potential driven by infrastructure development and technological advancement. Dividend yields and capital appreciation opportunities reflect industry maturity and consistent cash flow generation. ESG considerations align with sustainability trends and environmental responsibility initiatives across the sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives drive development of environmentally friendly cable materials and manufacturing processes. Recycling programs and circular economy principles influence product design and end-of-life management. Carbon footprint reduction efforts focus on energy-efficient manufacturing and sustainable material sourcing strategies.

Smart cable technology integrates monitoring capabilities, data transmission functionality, and predictive maintenance features. Internet of Things connectivity enables remote monitoring and performance optimization. Digital transformation in manufacturing incorporates automation, quality control systems, and supply chain optimization technologies.

Customization trends reflect increasing customer requirements for application-specific solutions and performance characteristics. Modular design approaches enable flexible configurations and reduced inventory requirements. Service integration expands beyond product supply to include installation, maintenance, and technical support services.

Regional localization strategies balance global efficiency with local market responsiveness and supply chain resilience. Near-shoring initiatives reduce transportation costs and improve delivery times. Partnership development creates collaborative relationships across the value chain for enhanced customer service and market penetration.

Technology advancement includes development of high-temperature superconducting cables for power transmission applications with reduced energy losses. Advanced insulation materials improve performance and environmental resistance. Manufacturing innovation incorporates automation and quality control systems for improved consistency and efficiency.

Market consolidation continues through strategic acquisitions and partnerships aimed at expanding geographic reach and product capabilities. Vertical integration strategies enhance supply chain control and cost management. Capacity expansion projects focus on high-growth regions and specialized application segments.

Regulatory developments include updated safety standards, environmental compliance requirements, and performance specifications across global markets. Standardization efforts improve interoperability and reduce complexity. Certification programs ensure quality consistency and customer confidence in product performance.

Research initiatives focus on next-generation materials, improved manufacturing processes, and application-specific solutions. University partnerships and collaborative research programs accelerate innovation development. Patent activities protect intellectual property and maintain competitive advantages in specialized applications.

Strategic recommendations for market participants emphasize diversification across application segments and geographic regions to reduce risk exposure. Investment in research and development capabilities enables product differentiation and premium pricing opportunities. MarkWide Research analysis indicates that companies focusing on specialized applications and value-added services achieve superior financial performance.

Operational excellence initiatives should prioritize manufacturing efficiency, quality consistency, and supply chain optimization. Digital transformation investments improve operational visibility and customer service capabilities. Sustainability programs align with customer requirements and regulatory trends while potentially reducing operational costs.

Market expansion strategies should consider emerging economies with infrastructure development opportunities and established markets with replacement and upgrade requirements. Partnership development enhances market access and technical capabilities. Customer relationship management systems improve service delivery and identify growth opportunities through deeper market understanding.

Financial management approaches should address raw material price volatility through hedging strategies and supplier diversification. Working capital optimization improves cash flow management and financial flexibility. Risk management programs should address supply chain disruptions, regulatory changes, and competitive pressures through comprehensive planning and contingency strategies.

Long-term prospects indicate sustained growth driven by infrastructure modernization, renewable energy adoption, and digital transformation initiatives worldwide. The market demonstrates resilience through diverse application segments and essential infrastructure role. Growth projections suggest continued expansion at approximately 6.2% CAGR over the next decade, supported by emerging market development and technology advancement.

Technology evolution will focus on smart cable solutions, enhanced materials, and sustainable manufacturing processes. Electric vehicle adoption and renewable energy integration create substantial opportunities for specialized cable applications. Market maturation in developed regions will emphasize replacement cycles and performance upgrades rather than capacity expansion.

Competitive dynamics will likely feature continued consolidation, technology differentiation, and service integration strategies. Regional market development offers growth opportunities for established manufacturers and emerging players. MWR projections indicate that companies with strong innovation capabilities and global presence will achieve superior market positioning.

Investment requirements will focus on manufacturing modernization, research and development capabilities, and market expansion initiatives. Sustainability investments align with regulatory trends and customer preferences. Market evolution toward integrated solutions and value-added services will reshape competitive positioning and customer relationships across the industry.

The wires and cables market represents a fundamental infrastructure sector with sustained growth potential driven by global development trends and technological advancement. Market dynamics reflect the essential role of cables in electrical power transmission, telecommunications connectivity, and industrial applications across diverse economic sectors. Strategic positioning requires understanding of regional variations, application-specific requirements, and evolving customer needs.

Industry transformation toward smart solutions, sustainable materials, and integrated services creates opportunities for market differentiation and value creation. Companies that successfully navigate raw material volatility, competitive pressures, and regulatory requirements while investing in innovation and operational excellence will achieve superior performance. Future success depends on balancing global efficiency with local market responsiveness and maintaining technological leadership in rapidly evolving applications.

Market participants should focus on diversification strategies, operational excellence, and customer relationship development to capitalize on growth opportunities while managing industry challenges. The sector’s correlation with infrastructure development and economic growth provides stability while emerging applications in renewable energy and electric vehicles offer substantial expansion potential for forward-thinking organizations.

What are Wires and Cables?

Wires and cables are electrical conductors used to transmit power and data. They are essential components in various applications, including telecommunications, power distribution, and electronics.

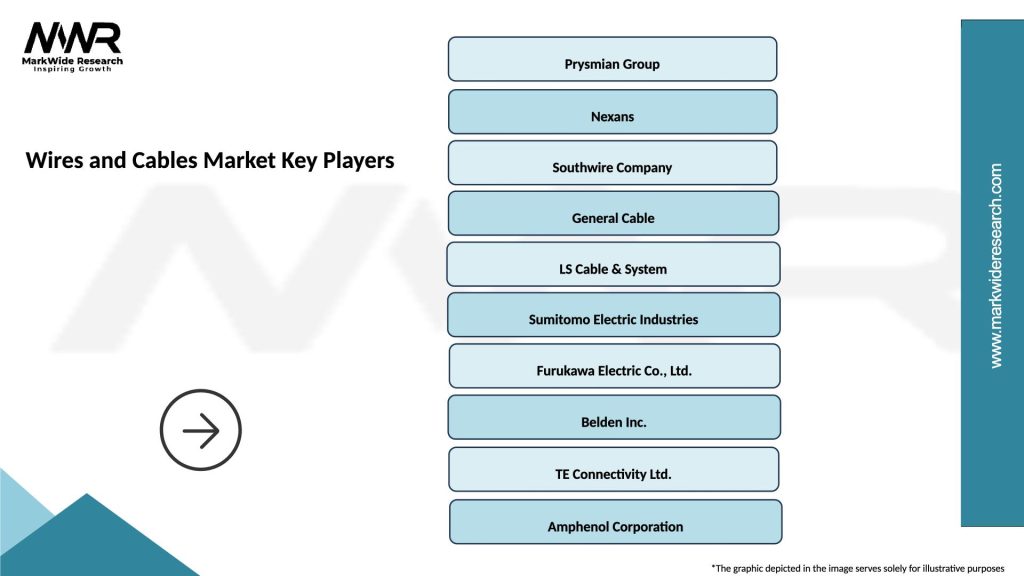

What are the key players in the Wires and Cables Market?

Key players in the Wires and Cables Market include Prysmian Group, Nexans, Southwire Company, and General Cable, among others. These companies are known for their extensive product offerings and global reach.

What are the main drivers of the Wires and Cables Market?

The main drivers of the Wires and Cables Market include the increasing demand for electricity, the growth of renewable energy projects, and advancements in telecommunications infrastructure. These factors contribute to a rising need for efficient wiring solutions.

What challenges does the Wires and Cables Market face?

The Wires and Cables Market faces challenges such as fluctuating raw material prices, stringent regulatory standards, and competition from alternative technologies. These factors can impact production costs and market dynamics.

What opportunities exist in the Wires and Cables Market?

Opportunities in the Wires and Cables Market include the expansion of smart grid technologies, the increasing adoption of electric vehicles, and the growth of the Internet of Things (IoT). These trends are expected to drive innovation and demand for advanced wiring solutions.

What trends are shaping the Wires and Cables Market?

Trends shaping the Wires and Cables Market include the development of environmentally friendly materials, the integration of smart technologies, and the rise of automation in manufacturing processes. These trends are influencing product design and consumer preferences.

Wires and Cables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Coaxial Cables, Fiber Optic Cables, Twisted Pair Cables, Power Cables |

| Material | Copper, Aluminum, Fiber, PVC |

| End User | Telecommunications, Construction, Automotive, Aerospace |

| Installation | Indoor, Outdoor, Underground, Overhead |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Wires and Cables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at