444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The wire-to-board connector market represents a critical component segment within the global electronics industry, facilitating essential electrical connections between wires and printed circuit boards across diverse applications. Market dynamics indicate robust growth driven by increasing demand for miniaturization, enhanced connectivity solutions, and expanding applications in automotive, consumer electronics, and industrial automation sectors. The market demonstrates significant expansion potential with technological advancements in connector design, materials, and manufacturing processes.

Growth trajectories show the wire-to-board connector market experiencing substantial momentum, with industry projections indicating a compound annual growth rate (CAGR) of 6.8% through the forecast period. This growth reflects increasing adoption of electronic systems across various industries, particularly in automotive electronics where connector density requirements continue to escalate. The market benefits from ongoing trends toward electrification, digitalization, and smart device proliferation.

Regional distribution reveals North America and Asia-Pacific as dominant markets, collectively accounting for approximately 68% of global market share. Asia-Pacific leads in manufacturing volume due to concentrated electronics production facilities, while North America demonstrates strong demand in automotive and aerospace applications. European markets show steady growth driven by industrial automation and renewable energy applications.

The wire-to-board connector market refers to the commercial ecosystem encompassing the design, manufacture, distribution, and application of electrical connectors that establish reliable connections between individual wires or wire harnesses and printed circuit boards (PCBs). These connectors serve as critical interface components enabling electrical signal transmission, power distribution, and data communication within electronic systems.

Fundamental characteristics of wire-to-board connectors include their ability to provide secure, removable connections that maintain electrical integrity while accommodating various wire gauges, voltage requirements, and environmental conditions. These components typically feature housing structures, contact elements, and retention mechanisms designed to ensure reliable performance across diverse operating environments and application requirements.

Market analysis reveals the wire-to-board connector market experiencing dynamic growth driven by technological advancement, expanding application scope, and increasing demand for reliable connectivity solutions. The market demonstrates resilience and adaptability, with manufacturers continuously innovating to meet evolving industry requirements for miniaturization, enhanced performance, and cost-effectiveness.

Key growth drivers include the automotive industry’s transition toward electric vehicles, which requires 35% more connectors per vehicle compared to traditional internal combustion engines. Consumer electronics demand continues expanding, particularly in smartphones, tablets, and wearable devices requiring compact, high-density connector solutions. Industrial automation applications drive demand for robust connectors capable of withstanding harsh operating environments.

Competitive landscape features established manufacturers leveraging technological expertise, manufacturing scale, and global distribution networks to maintain market position. Innovation focuses on developing smaller form factors, higher current-carrying capacity, and enhanced environmental resistance. Market consolidation trends continue as companies seek to expand product portfolios and geographic reach through strategic acquisitions.

Strategic insights highlight several critical factors shaping wire-to-board connector market development:

Primary market drivers propelling wire-to-board connector demand encompass technological advancement, industry transformation, and evolving consumer preferences. The automotive sector represents a particularly significant growth catalyst, with electric vehicle production requiring substantially more connectors than conventional vehicles. Electrification trends across transportation, industrial, and consumer applications continue driving connector innovation and market expansion.

Consumer electronics proliferation maintains strong momentum as global smartphone penetration approaches 78% of the world population, with each device containing numerous wire-to-board connectors for various functions including charging, data transfer, and component interconnection. Wearable device adoption accelerates demand for ultra-miniature connectors capable of reliable performance in compact form factors.

Industrial automation advancement creates substantial opportunities as manufacturers implement smart factory concepts requiring extensive sensor networks, control systems, and communication infrastructure. These applications demand robust connectors capable of withstanding industrial environments while maintaining reliable performance over extended operational periods. IoT integration across industrial applications further amplifies connector requirements.

Infrastructure modernization initiatives worldwide drive demand for connectors supporting renewable energy systems, smart grid implementations, and telecommunications network upgrades. These applications require specialized connectors designed for outdoor installation, high-voltage operation, and long-term reliability under challenging environmental conditions.

Market challenges include increasing price pressure from customers seeking cost reduction while demanding enhanced performance characteristics. Manufacturers face ongoing pressure to reduce connector costs while simultaneously improving functionality, reliability, and miniaturization capabilities. This dynamic creates margin compression challenges, particularly for standard product categories facing intense competition.

Supply chain complexities present significant challenges as connector manufacturers depend on specialized materials, precision manufacturing equipment, and global distribution networks. Raw material price volatility, particularly for precious metals used in contact plating, creates cost uncertainty and margin pressure. Geopolitical tensions and trade restrictions further complicate supply chain management and market access.

Technical complexity increases as applications demand higher performance specifications including enhanced signal integrity, increased current capacity, and improved environmental resistance. Meeting these requirements while maintaining cost competitiveness requires substantial research and development investment, creating barriers for smaller manufacturers and limiting market entry opportunities.

Standardization challenges emerge as different industries and regions maintain varying connector specifications and approval requirements. This fragmentation increases development costs, extends time-to-market, and complicates global market penetration strategies for connector manufacturers seeking to serve multiple market segments.

Emerging opportunities within the wire-to-board connector market span multiple high-growth application areas and technological advancement vectors. Electric vehicle adoption presents substantial growth potential, with industry analysts projecting EV market penetration reaching 32% by 2030, creating unprecedented demand for specialized automotive connectors designed for high-voltage applications and harsh operating environments.

5G infrastructure deployment creates significant opportunities for connector manufacturers capable of developing solutions supporting higher frequencies, reduced signal loss, and enhanced electromagnetic interference protection. These applications require advanced materials, precision manufacturing, and rigorous testing capabilities, creating competitive advantages for technology leaders.

Medical device innovation offers attractive growth prospects as healthcare technology advances toward more sophisticated diagnostic equipment, implantable devices, and telemedicine solutions. These applications demand connectors meeting stringent biocompatibility requirements, sterilization resistance, and long-term reliability specifications, often commanding premium pricing.

Renewable energy expansion presents substantial opportunities as global solar and wind power installations continue accelerating. These applications require connectors designed for outdoor operation, UV resistance, and long-term reliability under challenging environmental conditions. Energy storage systems further expand connector requirements for battery management and power distribution applications.

Market dynamics reflect the complex interplay between technological advancement, industry transformation, and competitive pressures shaping the wire-to-board connector landscape. Innovation cycles accelerate as manufacturers invest heavily in research and development to address evolving customer requirements for miniaturization, enhanced performance, and cost reduction.

Customer consolidation trends create both challenges and opportunities as major electronics manufacturers seek to reduce supplier bases while demanding enhanced technical support, global manufacturing capability, and competitive pricing. This dynamic favors larger connector manufacturers with comprehensive product portfolios and global presence while creating challenges for specialized suppliers.

Manufacturing evolution toward automated production processes enables higher precision, improved quality consistency, and reduced labor costs. However, these investments require substantial capital commitments and technical expertise, creating competitive advantages for established manufacturers while raising barriers for new market entrants. Quality requirements continue escalating across all application segments.

Regulatory compliance requirements increase complexity as different regions implement varying environmental, safety, and performance standards. Manufacturers must navigate multiple certification processes while maintaining cost competitiveness and time-to-market objectives. Environmental regulations particularly impact material selection and manufacturing processes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights into wire-to-board connector market dynamics. Primary research includes extensive interviews with industry executives, technical specialists, and key customers across major application segments to understand current trends, future requirements, and competitive dynamics.

Secondary research encompasses analysis of industry publications, company financial reports, patent filings, and regulatory documentation to identify market trends, technological developments, and competitive positioning. MarkWide Research analysts leverage proprietary databases and industry relationships to access comprehensive market intelligence and validate research findings.

Quantitative analysis incorporates statistical modeling, trend analysis, and forecasting methodologies to project market growth, segment evolution, and regional development patterns. Data validation processes ensure accuracy and reliability of market projections and strategic insights.

Expert consultation with industry specialists, technology developers, and market participants provides additional perspective on market dynamics, competitive trends, and future development scenarios. This multi-faceted approach ensures comprehensive coverage of market factors influencing wire-to-board connector industry evolution.

Asia-Pacific dominance characterizes the wire-to-board connector market, with the region accounting for approximately 45% of global production volume due to concentrated electronics manufacturing facilities in China, Japan, South Korea, and Taiwan. Manufacturing advantages include established supply chains, skilled workforce availability, and proximity to major electronics customers driving continued regional growth.

North American markets demonstrate strong demand across automotive, aerospace, and industrial applications, representing roughly 25% of global market share. The region benefits from advanced technology development, stringent quality requirements, and substantial research and development investment. Automotive electrification initiatives particularly drive connector demand growth in the United States and Canada.

European markets show steady expansion driven by industrial automation, renewable energy projects, and automotive innovation, accounting for approximately 22% of global market share. Germany leads regional demand due to strong automotive and industrial sectors, while Nordic countries drive growth through renewable energy applications. Environmental regulations influence product development and material selection across European markets.

Emerging markets including Latin America, Middle East, and Africa demonstrate increasing connector demand as infrastructure development, industrialization, and consumer electronics adoption accelerate. These regions offer growth opportunities for manufacturers seeking to expand geographic presence and diversify market exposure.

Market leadership concentrates among established manufacturers with comprehensive product portfolios, global manufacturing capabilities, and strong customer relationships. The competitive landscape features both large multinational corporations and specialized connector manufacturers serving specific market niches.

Competitive strategies emphasize technological innovation, manufacturing efficiency, and customer service excellence. Companies invest heavily in research and development to address evolving market requirements while maintaining cost competitiveness through operational optimization and supply chain management.

Product segmentation encompasses various connector types designed for specific application requirements and performance characteristics:

By Connector Type:

By Pitch Size:

By Current Rating:

Automotive applications represent the fastest-growing segment, with electric vehicle adoption driving demand for specialized connectors capable of handling high-voltage applications and harsh operating environments. Battery management systems require connectors with enhanced safety features, while charging infrastructure demands weather-resistant solutions supporting rapid charging protocols.

Consumer electronics maintain substantial market share through continuous device innovation and replacement cycles. Smartphone manufacturers drive demand for ultra-miniature connectors supporting multiple functions including charging, data transfer, and component interconnection. Wearable devices create additional opportunities for specialized connector solutions.

Industrial automation applications demonstrate steady growth as manufacturers implement smart factory concepts requiring extensive connectivity infrastructure. These applications demand robust connectors capable of withstanding industrial environments while maintaining reliable performance over extended operational periods. Sensor networks and control systems drive connector requirements.

Telecommunications infrastructure benefits from 5G network deployment requiring connectors supporting higher frequencies and enhanced signal integrity. Base station equipment, fiber optic systems, and network infrastructure create substantial connector demand with stringent performance requirements.

Manufacturers benefit from expanding market opportunities across multiple high-growth application segments, enabling revenue diversification and reduced dependence on single market verticals. Technological advancement creates competitive advantages for companies investing in research and development while establishing barriers for competitors lacking innovation capabilities.

Customers gain access to increasingly sophisticated connector solutions offering enhanced performance, improved reliability, and reduced total cost of ownership. Miniaturization trends enable more compact product designs while maintaining or improving functionality, creating competitive advantages in space-constrained applications.

Supply chain participants benefit from market growth through increased demand for raw materials, manufacturing equipment, and distribution services. Material suppliers particularly benefit from demand for advanced materials supporting enhanced performance requirements including high-temperature operation and environmental resistance.

End users experience improved product reliability, enhanced functionality, and reduced maintenance requirements through advanced connector technologies. System integrators benefit from standardized connector solutions simplifying design processes and reducing development time and costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization acceleration continues as electronic devices become increasingly compact while maintaining or expanding functionality. This trend drives demand for connectors with reduced form factors, higher pin density, and enhanced performance characteristics. Pitch reduction below 1.0mm becomes increasingly common in consumer electronics applications.

Environmental resistance enhancement reflects growing demand for connectors capable of operating in challenging conditions including extreme temperatures, moisture exposure, and chemical contamination. Automotive applications particularly drive requirements for connectors withstanding under-hood environments and outdoor exposure.

Smart connector integration emerges as manufacturers incorporate diagnostic capabilities, authentication features, and communication protocols directly into connector designs. These intelligent solutions enable predictive maintenance, system optimization, and enhanced security across various applications.

Sustainable manufacturing gains importance as customers and regulations demand environmentally responsible production processes and materials. Recyclable materials and reduced packaging become competitive advantages while meeting corporate sustainability objectives.

Recent developments highlight the dynamic nature of the wire-to-board connector market with continuous innovation and strategic initiatives shaping industry evolution. MarkWide Research analysis indicates accelerating development cycles as manufacturers respond to rapidly evolving customer requirements and competitive pressures.

Product innovations focus on addressing specific application challenges including higher current capacity, enhanced signal integrity, and improved environmental resistance. Manufacturers introduce connector families designed for electric vehicle applications, 5G infrastructure, and industrial automation systems requiring specialized performance characteristics.

Manufacturing investments expand production capacity and enhance automation capabilities to meet growing demand while improving cost competitiveness. Companies establish regional manufacturing facilities to serve local markets and reduce supply chain risks while maintaining quality standards and delivery performance.

Strategic partnerships between connector manufacturers and key customers accelerate product development and market penetration. These collaborations enable customized solutions addressing specific application requirements while reducing development time and costs for both parties.

Strategic recommendations for wire-to-board connector market participants emphasize the importance of technological innovation, market diversification, and operational excellence in maintaining competitive position. Investment priorities should focus on research and development capabilities, manufacturing automation, and customer relationship management systems.

Market expansion strategies should target high-growth application segments including electric vehicles, 5G infrastructure, and industrial automation while maintaining strong positions in established markets. Geographic diversification reduces market concentration risks while accessing emerging opportunities in developing regions.

Technology development should emphasize miniaturization, enhanced performance, and environmental resistance to address evolving customer requirements. Collaboration opportunities with material suppliers, equipment manufacturers, and key customers can accelerate innovation while sharing development costs and risks.

Operational optimization through manufacturing automation, supply chain management, and quality systems enhancement improves cost competitiveness while maintaining product quality and delivery performance. Sustainability initiatives become increasingly important for customer acceptance and regulatory compliance.

Market projections indicate continued robust growth for the wire-to-board connector market driven by technological advancement, expanding applications, and global economic development. Long-term growth rates are expected to maintain momentum at approximately 6.5% CAGR through the next decade, supported by electric vehicle adoption, 5G infrastructure deployment, and industrial automation expansion.

Technology evolution will focus on addressing emerging requirements including higher data rates, increased power density, and enhanced environmental resistance. Material innovations will enable improved performance characteristics while meeting sustainability objectives and cost reduction targets.

Application diversification will continue expanding connector requirements across new market segments including renewable energy, medical devices, and aerospace applications. These specialized markets often demand premium performance characteristics and offer attractive margin opportunities for technology leaders.

Regional development patterns indicate continued Asia-Pacific manufacturing dominance while North American and European markets focus on high-value applications and technology development. Emerging markets will provide incremental growth opportunities as infrastructure development and industrialization accelerate.

The wire-to-board connector market demonstrates strong fundamentals and attractive growth prospects driven by technological advancement, expanding applications, and global economic development. Market dynamics favor companies with strong innovation capabilities, global manufacturing presence, and comprehensive customer support while creating challenges for participants lacking these competitive advantages.

Strategic success requires continuous investment in research and development, manufacturing excellence, and customer relationship management to address evolving market requirements and maintain competitive position. Market opportunities span multiple high-growth application segments offering substantial revenue potential for well-positioned participants.

Future market evolution will be shaped by technological innovation, regulatory requirements, and changing customer preferences toward more sustainable, reliable, and cost-effective connectivity solutions. Companies that successfully navigate these trends while maintaining operational excellence will capture disproportionate value creation opportunities in this dynamic and essential market segment.

What is Wire-to-Board Connector?

Wire-to-Board Connectors are electrical connectors that facilitate the connection between wires and printed circuit boards (PCBs). They are commonly used in various electronic devices to ensure reliable electrical connections and signal transmission.

What are the key players in the Wire-to-Board Connector Market?

Key players in the Wire-to-Board Connector Market include Molex, TE Connectivity, Amphenol, and JST, among others. These companies are known for their innovative connector solutions and extensive product portfolios.

What are the growth factors driving the Wire-to-Board Connector Market?

The growth of the Wire-to-Board Connector Market is driven by the increasing demand for compact and efficient electronic devices, advancements in automotive electronics, and the rise of IoT applications. Additionally, the expansion of consumer electronics is contributing to market growth.

What challenges does the Wire-to-Board Connector Market face?

The Wire-to-Board Connector Market faces challenges such as the need for miniaturization of components, competition from alternative connection technologies, and stringent regulatory standards. These factors can impact product development and market entry.

What opportunities exist in the Wire-to-Board Connector Market?

Opportunities in the Wire-to-Board Connector Market include the growing adoption of electric vehicles, the expansion of smart home technologies, and the increasing demand for renewable energy solutions. These trends are expected to create new avenues for growth.

What trends are shaping the Wire-to-Board Connector Market?

Trends shaping the Wire-to-Board Connector Market include the development of high-speed connectors, the integration of smart technologies, and the focus on sustainability in manufacturing processes. These innovations are enhancing the performance and reliability of connectors.

Wire-to-Board Connector Market

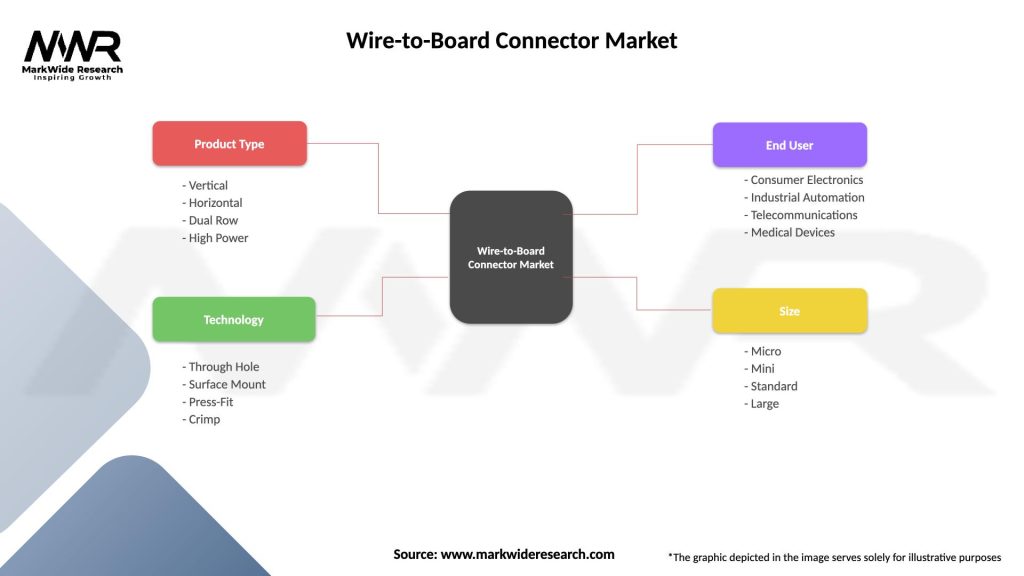

| Segmentation Details | Description |

|---|---|

| Product Type | Vertical, Horizontal, Dual Row, High Power |

| Technology | Through Hole, Surface Mount, Press-Fit, Crimp |

| End User | Consumer Electronics, Industrial Automation, Telecommunications, Medical Devices |

| Size | Micro, Mini, Standard, Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Wire-to-Board Connector Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at