444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Wi-Fi router market represents a dynamic and rapidly evolving segment of the global networking infrastructure industry. As digital transformation accelerates across residential, commercial, and industrial sectors, the demand for high-performance wireless connectivity solutions continues to surge. The market encompasses a diverse range of products, from basic home routers to enterprise-grade wireless access points, each designed to meet specific connectivity requirements and performance standards.

Market growth is being driven by the proliferation of connected devices, the expansion of smart home ecosystems, and the increasing adoption of bandwidth-intensive applications such as streaming services, online gaming, and remote work solutions. The transition to Wi-Fi 6 and Wi-Fi 6E technologies has created new opportunities for manufacturers to differentiate their offerings while addressing the growing demand for faster, more reliable wireless connections.

Regional dynamics show significant variation, with North America and Asia-Pacific leading in terms of technology adoption and market penetration. The market is experiencing robust growth at a CAGR of approximately 8.2%, driven by continuous technological advancements and the expanding Internet of Things (IoT) ecosystem. Enterprise segment adoption accounts for roughly 35% of total market demand, while residential applications continue to dominate with increasing sophistication in home networking requirements.

The Wi-Fi router market refers to the global industry encompassing the design, manufacturing, distribution, and sale of wireless networking devices that enable internet connectivity and local network communication through radio frequency transmission. These devices serve as central hubs that connect multiple devices to the internet while facilitating communication between connected devices within a local network environment.

Wi-Fi routers function by receiving internet signals from internet service providers through wired connections and converting them into wireless signals that can be accessed by various devices including smartphones, laptops, tablets, smart home devices, and IoT sensors. The market includes various router categories ranging from basic single-band models to advanced tri-band systems with mesh networking capabilities, each designed to serve different user requirements and network environments.

The Wi-Fi router market is experiencing unprecedented growth driven by the convergence of multiple technological and social trends. The widespread adoption of remote work practices, accelerated by global events, has fundamentally transformed home networking requirements, pushing demand for enterprise-grade performance in residential settings. Consumer expectations have evolved significantly, with users now demanding seamless connectivity across multiple devices, low-latency gaming experiences, and reliable streaming capabilities.

Technology evolution remains a key market driver, with Wi-Fi 6 and emerging Wi-Fi 6E standards offering substantial improvements in speed, capacity, and efficiency. These advanced standards support up to 40% better performance in congested environments while enabling more simultaneous device connections. The integration of artificial intelligence and machine learning capabilities into router firmware has enhanced network optimization and security features.

Market segmentation reveals distinct growth patterns across different categories, with mesh networking systems showing particularly strong adoption rates of approximately 22% annually. The enterprise segment continues to invest heavily in infrastructure upgrades, while the residential market shows increasing preference for premium features and advanced security capabilities.

Strategic market analysis reveals several critical insights that are shaping the Wi-Fi router industry landscape. The following key insights provide a comprehensive understanding of market dynamics and growth opportunities:

Multiple interconnected factors are propelling the Wi-Fi router market forward, creating a robust foundation for sustained growth across various market segments. The primary drivers reflect both technological advancement and changing user behavior patterns that have fundamentally altered networking requirements.

Digital transformation initiatives across industries have created unprecedented demand for reliable, high-performance wireless connectivity. Organizations are investing heavily in network infrastructure upgrades to support hybrid work models, cloud-based applications, and digital collaboration tools. This transformation has elevated network performance from a convenience to a business-critical requirement.

Internet of Things expansion continues to drive router demand as smart devices proliferate across residential and commercial environments. Modern households now contain an average of 25-30 connected devices, requiring routers capable of managing multiple simultaneous connections without performance degradation. The growing complexity of IoT ecosystems demands advanced network management capabilities and enhanced security features.

Streaming and gaming growth has created substantial bandwidth demands that traditional networking solutions struggle to meet. The popularity of 4K and 8K video streaming, virtual reality applications, and competitive online gaming requires low-latency, high-bandwidth connections that only advanced router technologies can provide effectively.

Several significant challenges are constraining the Wi-Fi router market’s growth potential, creating obstacles that manufacturers and service providers must navigate carefully. These restraints reflect both technical limitations and market dynamics that impact adoption rates and profitability.

High implementation costs associated with advanced router technologies present barriers for price-sensitive consumers and small businesses. Premium Wi-Fi 6 and mesh networking solutions often require substantial upfront investments, limiting adoption among budget-conscious market segments. The cost differential between basic and advanced router solutions can exceed 300-400%, creating significant decision-making challenges for consumers.

Technical complexity in router setup and management continues to deter less technically-savvy users from adopting advanced networking solutions. Despite improvements in user interfaces and automated configuration processes, many consumers find network optimization, security configuration, and troubleshooting procedures overwhelming and intimidating.

Infrastructure limitations in many regions constrain the benefits that advanced routers can provide. Areas with limited broadband availability or aging internet infrastructure cannot fully utilize high-performance router capabilities, reducing the value proposition for consumers and limiting market expansion opportunities.

Emerging opportunities in the Wi-Fi router market present significant potential for growth and innovation across multiple dimensions. These opportunities reflect evolving technology trends, changing consumer preferences, and new application areas that create value for both manufacturers and end users.

5G integration represents a transformative opportunity as telecommunications providers deploy 5G networks globally. Routers with integrated 5G capabilities can serve as primary internet connections in areas with limited fixed broadband infrastructure, while providing backup connectivity for critical applications. This convergence creates new market categories and revenue opportunities.

Artificial intelligence integration offers substantial opportunities for product differentiation and enhanced user experiences. AI-powered routers can automatically optimize network performance, detect security threats, and provide predictive maintenance capabilities. These intelligent features command premium pricing while delivering measurable value to users through improved network reliability and performance.

Edge computing applications are creating demand for routers with enhanced processing capabilities that can support local data processing and reduce cloud dependency. This trend is particularly relevant for IoT applications, smart city initiatives, and industrial automation systems that require low-latency processing and enhanced data privacy.

The Wi-Fi router market operates within a complex ecosystem of technological, economic, and social forces that continuously reshape competitive dynamics and growth patterns. Understanding these interconnected dynamics is essential for stakeholders seeking to navigate market challenges and capitalize on emerging opportunities.

Technology evolution cycles create both opportunities and challenges for market participants. The rapid pace of wireless standard development, from Wi-Fi 5 to Wi-Fi 6 and beyond, requires continuous investment in research and development while potentially obsoleting existing product lines. Companies must balance innovation investments with market timing to maximize returns while avoiding premature technology transitions.

Competitive intensity has increased significantly as traditional networking companies face competition from technology giants, telecommunications providers, and specialized startups. This competition drives innovation and price competition while creating challenges for smaller manufacturers seeking to differentiate their offerings in an increasingly crowded marketplace.

Supply chain dynamics significantly impact market stability and growth potential. Semiconductor shortages, component cost fluctuations, and manufacturing capacity constraints can create supply-demand imbalances that affect pricing and availability. According to MarkWide Research analysis, supply chain optimization has become a critical competitive advantage in the router market.

Comprehensive market research for the Wi-Fi router industry requires a multi-faceted approach that combines quantitative analysis, qualitative insights, and industry expertise to provide accurate and actionable market intelligence. The research methodology encompasses various data collection and analysis techniques to ensure robust and reliable findings.

Primary research activities include extensive interviews with industry executives, technology developers, channel partners, and end users across different market segments. These interviews provide insights into market trends, competitive dynamics, technology roadmaps, and customer preferences that quantitative data alone cannot capture effectively.

Secondary research involves comprehensive analysis of industry reports, financial statements, patent filings, regulatory documents, and technology specifications. This research provides historical context, market sizing data, competitive positioning information, and regulatory environment analysis that supports primary research findings.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. These models incorporate multiple variables including technology adoption rates, economic indicators, demographic trends, and competitive dynamics to provide comprehensive market projections.

Regional market dynamics in the Wi-Fi router industry reflect diverse economic conditions, technology adoption patterns, infrastructure development levels, and regulatory environments that create distinct opportunities and challenges across different geographic markets.

North America maintains market leadership with approximately 32% of global router demand, driven by high technology adoption rates, advanced broadband infrastructure, and strong consumer spending on networking equipment. The region shows particular strength in premium router segments, with mesh networking and Wi-Fi 6 adoption rates significantly above global averages. Enterprise demand remains robust, supported by continued digital transformation investments and hybrid work model adoption.

Asia-Pacific represents the fastest-growing regional market, with expansion rates exceeding 12% annually in several key countries. China, India, and Southeast Asian markets show strong demand growth driven by expanding internet penetration, smart city initiatives, and growing middle-class populations. The region’s manufacturing capabilities also position it as a critical supply chain hub for global router production.

Europe demonstrates steady market growth with emphasis on energy efficiency, security features, and regulatory compliance. The region’s focus on data privacy and cybersecurity creates opportunities for routers with advanced security capabilities, while sustainability initiatives drive demand for energy-efficient networking solutions.

The competitive landscape in the Wi-Fi router market is characterized by intense rivalry among established networking companies, technology giants, and emerging specialists, each pursuing different strategies to capture market share and drive growth.

Market segmentation in the Wi-Fi router industry reveals distinct categories based on technology standards, application areas, price points, and target customer segments. This segmentation provides insights into growth patterns, competitive dynamics, and investment opportunities across different market areas.

By Technology Standard:

By Application:

Detailed category analysis reveals specific trends, growth patterns, and competitive dynamics within distinct Wi-Fi router market segments, providing actionable insights for strategic decision-making and investment planning.

Gaming Router Category shows exceptional growth momentum, with specialized features including quality of service optimization, low-latency modes, and gaming-specific user interfaces. This segment commands premium pricing while serving the expanding esports and competitive gaming markets. Performance improvements of up to 50% in gaming applications justify higher price points for dedicated gaming enthusiasts.

Mesh Networking Systems represent the fastest-growing router category, addressing coverage challenges in large homes and complex building layouts. These systems offer seamless roaming, centralized management, and scalable coverage expansion capabilities. Market adoption rates exceed 25% annually in premium residential segments, driven by improved user experiences and simplified installation processes.

Enterprise Router Segment emphasizes security, management capabilities, and integration with existing IT infrastructure. Features including advanced firewall capabilities, VPN support, and centralized device management create value for business customers willing to invest in comprehensive networking solutions.

Budget Router Category maintains significant market share by serving price-sensitive consumers and basic connectivity requirements. While feature-limited compared to premium alternatives, these products provide essential internet access and local networking capabilities for cost-conscious market segments.

Industry participants across the Wi-Fi router ecosystem can realize substantial benefits through strategic positioning, technology investments, and market development initiatives that align with evolving customer needs and technology trends.

Manufacturers benefit from expanding market opportunities driven by technology transitions, growing device connectivity requirements, and increasing consumer sophistication. The transition to Wi-Fi 6 and mesh networking creates opportunities for product differentiation, premium pricing, and market share expansion. Advanced features including AI optimization and security enhancements enable manufacturers to command higher margins while delivering measurable customer value.

Channel Partners including retailers, distributors, and system integrators can capitalize on growing demand for networking solutions across residential and commercial markets. The increasing complexity of networking requirements creates opportunities for value-added services including installation, configuration, and ongoing support that generate recurring revenue streams.

Technology Providers supplying components, software, and intellectual property to router manufacturers benefit from industry growth and technology advancement cycles. Opportunities exist in semiconductor design, antenna technology, security software, and network management platforms that enable router innovation and differentiation.

Service Providers can leverage advanced router capabilities to enhance service offerings, reduce support costs, and improve customer satisfaction. Routers with remote management capabilities and self-healing features reduce operational expenses while enabling new service models and revenue opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the Wi-Fi router market landscape, creating new opportunities while challenging traditional business models and competitive strategies. These trends reflect broader technology evolution and changing user expectations that drive innovation and market development.

Mesh Networking Mainstream Adoption has transformed home networking from single-router solutions to distributed systems that provide comprehensive coverage and seamless connectivity. This trend addresses coverage challenges in modern homes while simplifying network management through centralized control applications. Mesh system adoption rates continue accelerating, particularly in premium market segments.

AI-Powered Network Optimization is becoming a standard feature rather than a premium option, with routers automatically adjusting performance parameters based on usage patterns, device requirements, and network conditions. These intelligent systems can improve network efficiency by up to 35% while reducing user intervention requirements and technical support needs.

Security-First Design reflects growing cybersecurity awareness among consumers and businesses, with manufacturers integrating advanced threat detection, automatic security updates, and VPN capabilities as standard features. This trend is driven by increasing cyber threats and regulatory requirements for connected device security.

Subscription Service Models are emerging as manufacturers seek recurring revenue opportunities through premium features, advanced security services, and enhanced support offerings. These models provide ongoing value to customers while creating predictable revenue streams for manufacturers and service providers.

Recent industry developments highlight the dynamic nature of the Wi-Fi router market, with significant technological advances, strategic partnerships, and market expansion initiatives shaping competitive dynamics and growth trajectories.

Wi-Fi 6E Standard Deployment has accelerated significantly, with major manufacturers launching products that utilize the 6GHz spectrum band for reduced congestion and enhanced performance. This development addresses growing bandwidth demands while providing competitive differentiation opportunities for early adopters in the premium market segment.

Strategic Acquisitions continue reshaping the competitive landscape as technology companies seek to expand their networking capabilities and market presence. These acquisitions often focus on specialized technologies, intellectual property, or market access that complement existing product portfolios and strategic objectives.

Cloud Integration Initiatives are expanding as manufacturers develop comprehensive ecosystem solutions that combine hardware, software, and cloud services. These integrated approaches provide enhanced user experiences while creating opportunities for recurring revenue and customer lock-in through proprietary platforms and services.

Sustainability Programs are gaining prominence as manufacturers respond to environmental concerns and regulatory requirements. Energy-efficient designs, recyclable materials, and sustainable manufacturing processes are becoming important differentiators in environmentally conscious market segments.

Strategic recommendations for Wi-Fi router market participants focus on positioning for long-term success while navigating current market challenges and capitalizing on emerging opportunities. These suggestions reflect comprehensive analysis of market dynamics, competitive trends, and technology evolution patterns.

Technology Investment Priorities should focus on Wi-Fi 6E and future wireless standards while developing AI-powered optimization capabilities that deliver measurable performance improvements. Companies should balance innovation investments with market timing to avoid premature technology transitions while maintaining competitive positioning in rapidly evolving market segments.

Market Segmentation Strategy requires careful positioning across different customer segments, with particular attention to gaming, mesh networking, and enterprise security applications that command premium pricing. MWR analysis suggests that specialized market segments offer better profitability and growth potential than commodity router categories.

Partnership Development should emphasize ecosystem integration with smart home platforms, cloud service providers, and telecommunications companies that can expand market reach and create differentiated value propositions. Strategic partnerships can accelerate market penetration while reducing development costs and time-to-market requirements.

Customer Experience Focus must address setup complexity, ongoing management requirements, and technical support needs that often frustrate users and limit market expansion. Simplified installation processes, intuitive management interfaces, and proactive support capabilities can significantly improve customer satisfaction and brand loyalty.

The future trajectory of the Wi-Fi router market appears highly promising, with multiple growth drivers converging to create sustained expansion opportunities across various market segments and geographic regions. Technology evolution, changing user requirements, and emerging applications will continue driving innovation and market development.

Technology roadmaps indicate continued advancement in wireless standards, with Wi-Fi 7 development already underway and promising even greater performance improvements. These advances will enable new applications including augmented reality, virtual reality, and ultra-high-definition video streaming that require exceptional bandwidth and low latency performance. Market adoption of next-generation technologies is projected to accelerate, with Wi-Fi 6 penetration reaching 65% of new router sales within the next three years.

Market expansion will be driven by continued IoT growth, smart city initiatives, and industrial automation applications that require robust, reliable wireless connectivity. The convergence of Wi-Fi and 5G technologies will create new product categories and market opportunities, particularly in areas with limited fixed broadband infrastructure or applications requiring mobility support.

Competitive dynamics will likely intensify as technology giants continue expanding their networking portfolios while traditional manufacturers invest in advanced capabilities and ecosystem integration. Success will increasingly depend on the ability to deliver comprehensive solutions rather than standalone products, with software and services becoming critical differentiators.

The Wi-Fi router market stands at a pivotal juncture, with technological advancement, changing user requirements, and expanding application areas creating unprecedented opportunities for growth and innovation. The transition to advanced wireless standards, particularly Wi-Fi 6 and Wi-Fi 6E, combined with the proliferation of connected devices and bandwidth-intensive applications, has fundamentally transformed market dynamics and competitive requirements.

Market participants who successfully navigate this evolving landscape will be those who balance technological innovation with user experience improvements, while developing comprehensive ecosystem solutions that address the full spectrum of customer needs. The integration of artificial intelligence, enhanced security capabilities, and simplified management interfaces will become essential differentiators in an increasingly competitive marketplace.

Future success will depend on the ability to anticipate and respond to changing market requirements while maintaining focus on core networking performance and reliability. As the market continues evolving toward more sophisticated, intelligent networking solutions, companies that invest in the right technologies and partnerships while maintaining customer-centric approaches will be best positioned to capitalize on the substantial growth opportunities ahead.

What is Wi-Fi Router?

A Wi-Fi router is a device that connects to a broadband modem and allows multiple devices to access the internet wirelessly. It facilitates communication between devices on a local network and manages data traffic efficiently.

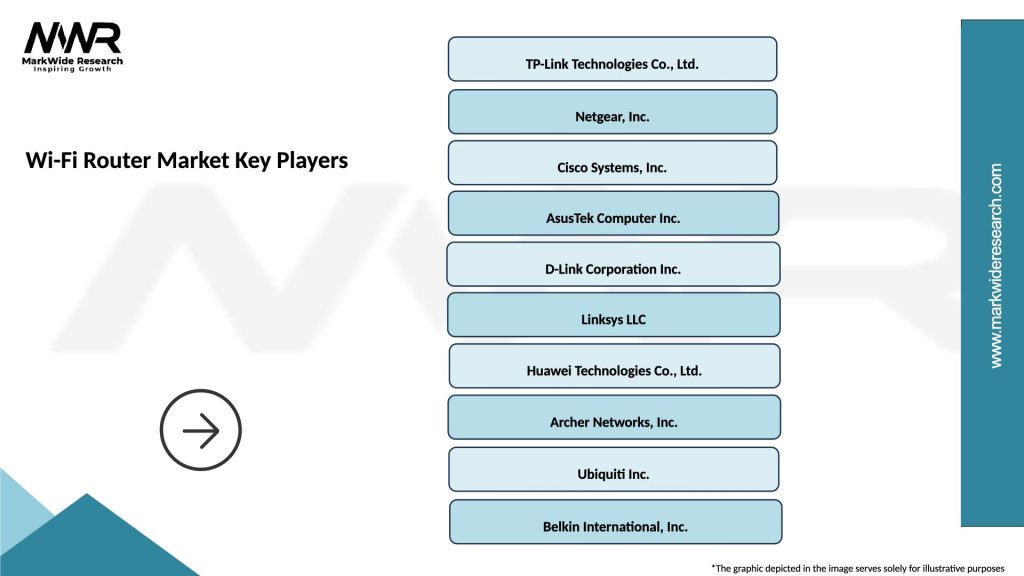

What are the key players in the Wi-Fi Router Market?

Key players in the Wi-Fi Router Market include TP-Link, Netgear, and Asus, which are known for their innovative products and extensive market reach. These companies offer a range of routers catering to different consumer needs, among others.

What are the growth factors driving the Wi-Fi Router Market?

The growth of the Wi-Fi Router Market is driven by the increasing demand for high-speed internet, the rise in smart home devices, and the expansion of online gaming and streaming services. Additionally, the shift towards remote work has heightened the need for reliable home networking solutions.

What challenges does the Wi-Fi Router Market face?

The Wi-Fi Router Market faces challenges such as network security concerns, the complexity of installation for some users, and competition from alternative technologies like mobile data networks. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Wi-Fi Router Market?

Opportunities in the Wi-Fi Router Market include the development of advanced technologies like Wi-Fi six and mesh networking systems, which enhance connectivity and coverage. Additionally, the growing trend of IoT devices presents a significant opportunity for innovative router solutions.

What trends are shaping the Wi-Fi Router Market?

Trends in the Wi-Fi Router Market include the increasing adoption of smart home technology, the demand for higher bandwidth for streaming and gaming, and the integration of security features to protect user data. These trends are influencing product development and consumer preferences.

Wi-Fi Router Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mesh Routers, Dual-Band Routers, Tri-Band Routers, Range Extenders |

| Technology | 802.11ac, 802.11ax, Wi-Fi 6, Wi-Fi 5 |

| End User | Residential, Small Office, Large Enterprise, Educational Institutions |

| Distribution Channel | Online Retail, Offline Retail, Direct Sales, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Wi-Fi Router Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at