444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Whole Juvenile Life Insurance Market caters to the unique needs of parents and guardians seeking financial protection and security for their children. This specialized segment of the life insurance industry offers policies designed specifically for minors, providing coverage from infancy through adolescence and into adulthood. Whole juvenile life insurance policies combine elements of traditional whole life insurance with features tailored to the needs of young policyholders, offering benefits such as guaranteed coverage, cash value accumulation, and future insurability. With an emphasis on long-term financial planning and protection, the Whole Juvenile Life Insurance Market serves as a critical component of families’ overall financial strategies, providing peace of mind and security for the future of their children.

Meaning

Whole juvenile life insurance, also known as child life insurance or juvenile life insurance, is a type of permanent life insurance policy designed to provide coverage for minors. Unlike term life insurance, which provides coverage for a specified period, whole juvenile life insurance offers lifetime coverage, ensuring that the policy remains in force as long as premiums are paid. These policies typically accumulate cash value over time, which policyholders can access through loans or withdrawals for various financial needs, such as education expenses or homeownership. Additionally, whole juvenile life insurance policies often include options for guaranteed future insurability, allowing policyholders to purchase additional coverage as their insurance needs evolve. Overall, whole juvenile life insurance serves as a proactive financial planning tool, offering families a way to protect their children’s future financial security and well-being.

Executive Summary

The Whole Juvenile Life Insurance Market is a specialized segment of the life insurance industry that caters to the unique needs of parents and guardians seeking to secure their children’s financial future. With features such as lifetime coverage, cash value accumulation, and guaranteed future insurability, whole juvenile life insurance policies offer a comprehensive solution for long-term financial planning. Key market drivers such as parental concerns for their children’s welfare, the desire for financial security, and the need for future insurability options contribute to the market’s growth and development. However, challenges such as affordability, product complexity, and regulatory considerations require industry stakeholders to innovate and adapt to meet evolving customer needs and market dynamics. This executive summary provides a comprehensive overview of the Whole Juvenile Life Insurance Market, highlighting key trends, drivers, challenges, and opportunities shaping its future growth and evolution.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Whole Juvenile Life Insurance Market operates within a dynamic environment influenced by factors such as demographic trends, economic conditions, regulatory changes, and consumer preferences. These dynamics shape market demand, product innovation, competitive landscapes, and industry trends, driving continuous evolution and adaptation within the market.

Regional Analysis

Regional variations in demographic profiles, economic conditions, cultural norms, and regulatory environments impact the demand for whole juvenile life insurance across different geographies. Key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa exhibit unique market characteristics and growth opportunities, necessitating region-specific strategies for market penetration and expansion.

Competitive Landscape

Leading Companies in the Whole Juvenile Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

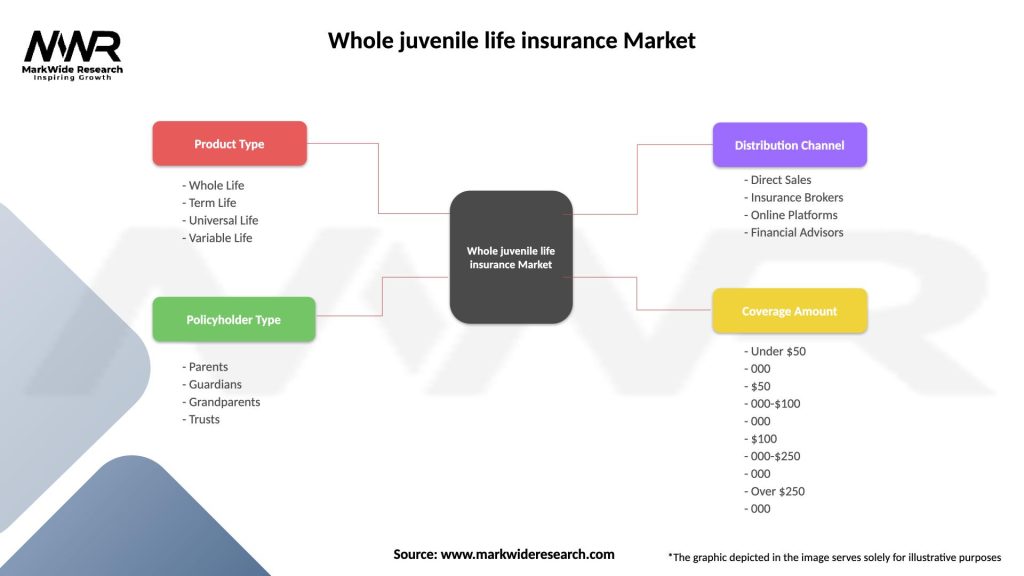

Segmentation

Segmentation of the Whole Juvenile Life Insurance Market based on factors such as age, coverage amount, premium affordability, and policy features provides insights into market dynamics, customer preferences, and growth opportunities. Tailoring products and services to specific customer segments enables insurers to address diverse market needs, enhance customer satisfaction, and improve business performance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has affected the Whole Juvenile Life Insurance Market in various ways, including changes in consumer behavior, regulatory responses, and economic implications. Heightened awareness of health and financial risks increases demand for whole juvenile life insurance as a proactive way to protect children’s future financial security and well-being. However, economic uncertainties, job losses, and financial constraints may impact affordability and purchasing decisions, requiring insurers to innovate and adapt to meet changing customer needs and market dynamics.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Whole Juvenile Life Insurance Market is poised for continued growth and innovation driven by factors such as parental concerns for children’s welfare, increasing emphasis on financial planning, digital transformation, and regulatory developments. However, challenges such as affordability, product complexity, and competitive pressures require insurers to innovate and adapt to meet changing customer needs and market dynamics. The future outlook for the market remains optimistic, with opportunities for insurers to expand market reach, develop customized solutions, and enhance customer engagement and satisfaction.

Conclusion

In conclusion, the Whole Juvenile Life Insurance Market plays a critical role in providing financial protection and security for minors, offering lifetime coverage, cash value accumulation, and guaranteed future insurability. Parental concerns for children’s welfare, increasing emphasis on financial planning, and digital transformation drive market demand and innovation. However, challenges such as affordability, product complexity, and regulatory constraints require insurers to innovate and adapt to meet evolving customer needs and market dynamics. By offering customized solutions, enhancing education and awareness, and embracing digital transformation, insurers can capitalize on growth opportunities and foster long-term relationships with customers seeking to secure their children’s future financial well-being and security.

What is Whole juvenile life insurance?

Whole juvenile life insurance is a type of permanent life insurance designed specifically for children. It provides lifelong coverage and builds cash value over time, which can be accessed by the policyholder or the child when they reach adulthood.

What are the key players in the Whole juvenile life insurance Market?

Key players in the Whole juvenile life insurance Market include companies like MetLife, Prudential, and New York Life. These companies offer various policies tailored to meet the needs of families seeking financial security for their children, among others.

What are the growth factors driving the Whole juvenile life insurance Market?

The Whole juvenile life insurance Market is driven by factors such as increasing awareness of financial planning for children, the desire for long-term savings, and the benefits of locking in lower premiums at a young age. Additionally, parents are increasingly seeking financial products that provide both protection and investment opportunities.

What challenges does the Whole juvenile life insurance Market face?

Challenges in the Whole juvenile life insurance Market include competition from other savings and investment products, such as education savings accounts and mutual funds. Additionally, there may be a lack of understanding among parents about the benefits of juvenile life insurance, which can hinder market growth.

What opportunities exist in the Whole juvenile life insurance Market?

Opportunities in the Whole juvenile life insurance Market include the potential for product innovation, such as customizable policies that cater to specific family needs. There is also an opportunity to educate parents about the long-term benefits of juvenile life insurance, which can enhance market penetration.

What trends are shaping the Whole juvenile life insurance Market?

Trends in the Whole juvenile life insurance Market include a growing emphasis on financial literacy among parents and the integration of technology in policy management. Additionally, there is an increasing trend towards offering flexible premium payment options to accommodate varying family budgets.

Whole Juvenile Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Life, Term Life, Universal Life, Variable Life |

| Policyholder Type | Parents, Guardians, Grandparents, Trusts |

| Distribution Channel | Direct Sales, Insurance Brokers, Online Platforms, Financial Advisors |

| Coverage Amount | Under $50,000, $50,000-$100,000, $100,000-$250,000, Over $250,000 |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Whole Juvenile Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at