444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

West Europe renewable energy market stands as a global leader in sustainable energy transformation, representing one of the most mature and technologically advanced regions for clean energy adoption. The region encompasses major economies including Germany, France, United Kingdom, Italy, Spain, Netherlands, and other progressive nations committed to achieving carbon neutrality by 2050. Renewable energy sources including wind, solar, hydroelectric, biomass, and geothermal power have experienced unprecedented growth across Western European countries, driven by ambitious climate policies and substantial government investments.

Market dynamics indicate robust expansion with the region achieving approximately 42% renewable energy in its electricity mix as of recent assessments. The offshore wind sector particularly demonstrates exceptional growth potential, with Western Europe hosting nearly 75% of global offshore wind capacity. Countries like Denmark, Germany, and the United Kingdom lead in wind energy deployment, while Spain and Italy excel in solar photovoltaic installations.

Policy frameworks including the European Green Deal, Renewable Energy Directive, and national energy transition strategies provide strong regulatory support for continued market expansion. The region’s commitment to phasing out fossil fuels and achieving energy independence has accelerated renewable energy investments, creating favorable conditions for sustained growth at an estimated CAGR of 8.5% through the forecast period.

The West Europe renewable energy market refers to the comprehensive ecosystem of clean energy technologies, infrastructure, and services deployed across Western European nations to generate electricity from naturally replenishing sources. This market encompasses the development, manufacturing, installation, operation, and maintenance of renewable energy systems including wind turbines, solar panels, hydroelectric facilities, biomass plants, and geothermal installations.

Renewable energy technologies in Western Europe represent a fundamental shift from traditional fossil fuel-based power generation toward sustainable alternatives that harness natural resources without depleting them. The market includes both utility-scale projects and distributed energy systems, covering everything from massive offshore wind farms in the North Sea to residential rooftop solar installations across Mediterranean countries.

Market participants include energy developers, equipment manufacturers, utility companies, government agencies, financial institutions, and technology providers working collaboratively to advance clean energy adoption. The sector encompasses various value chain activities from research and development to project financing, construction, grid integration, and long-term asset management.

Western Europe’s renewable energy market continues to demonstrate exceptional momentum as the region pursues aggressive decarbonization targets and energy security objectives. The market benefits from mature regulatory frameworks, advanced grid infrastructure, and strong public-private partnerships that facilitate large-scale renewable energy deployment across diverse geographical and climatic conditions.

Wind energy maintains its position as the dominant renewable technology, accounting for approximately 38% of renewable electricity generation across the region. Offshore wind development particularly shows remarkable progress, with countries like the United Kingdom, Germany, and Denmark leading global deployment efforts. Solar photovoltaic technology experiences rapid growth, especially in southern European markets where favorable solar irradiation conditions support high-efficiency installations.

Market consolidation trends indicate increasing involvement of major utility companies and international energy corporations in renewable energy development. Strategic partnerships between technology providers, project developers, and financial institutions create integrated value chains that enhance project execution capabilities and reduce overall development costs.

Grid integration challenges and energy storage requirements drive innovation in smart grid technologies and battery storage solutions. The region’s commitment to achieving 55% greenhouse gas emissions reduction by 2030 compared to 1990 levels creates sustained demand for renewable energy capacity additions across all technology segments.

Technological advancement drives significant improvements in renewable energy efficiency and cost-effectiveness across Western European markets. Key insights reveal several critical trends shaping market development:

Climate policy commitments serve as the primary catalyst for renewable energy market expansion across Western Europe. The European Union’s ambitious climate neutrality target by 2050, combined with intermediate goals for 2030, creates regulatory certainty that encourages long-term investments in clean energy infrastructure.

Energy security concerns have intensified following geopolitical developments, driving accelerated renewable energy deployment to reduce dependence on fossil fuel imports. Countries prioritize domestic renewable energy resources to enhance energy independence and price stability for consumers and businesses.

Technological cost reductions make renewable energy increasingly competitive with conventional power generation. Economies of scale in manufacturing, improved efficiency ratings, and optimized project development processes contribute to declining levelized costs of electricity from renewable sources.

Corporate sustainability initiatives drive substantial demand for renewable energy procurement through power purchase agreements and direct investments. Multinational corporations operating in Western Europe increasingly commit to 100% renewable electricity consumption to meet environmental, social, and governance objectives.

Financial market support includes green bonds, sustainable finance taxonomies, and preferential lending terms for renewable energy projects. European financial institutions actively promote clean energy investments through dedicated funding mechanisms and risk mitigation instruments.

Grid infrastructure development enables greater renewable energy integration through enhanced transmission capacity, smart grid technologies, and cross-border interconnections that facilitate regional energy trading and system balancing.

Grid integration challenges pose significant technical and economic obstacles to renewable energy expansion, particularly as variable wind and solar generation increases. Existing transmission infrastructure requires substantial upgrades to accommodate bidirectional power flows and maintain system stability with higher renewable energy penetration levels.

Intermittency concerns related to wind and solar energy generation necessitate costly backup systems, energy storage solutions, and demand response programs. Grid operators must invest heavily in balancing services and flexibility resources to manage supply-demand variations effectively.

Permitting complexities and lengthy approval processes delay renewable energy project development across many Western European jurisdictions. Environmental assessments, stakeholder consultations, and regulatory compliance requirements can extend project timelines by several years, increasing development costs and investment risks.

Land availability constraints limit onshore renewable energy development in densely populated regions. Competition for suitable sites between renewable energy projects, urban development, agriculture, and conservation areas creates challenges for project siting and community acceptance.

Supply chain disruptions affect renewable energy equipment availability and pricing, particularly for critical components like wind turbine generators, solar panels, and power electronics. Global supply chain constraints and raw material shortages impact project delivery schedules and cost predictability.

Skills shortage in specialized renewable energy sectors creates workforce development challenges. The rapid pace of technology deployment outpaces training programs for technicians, engineers, and project managers with relevant expertise in emerging clean energy technologies.

Offshore wind expansion presents exceptional growth opportunities as Western European countries develop deeper water sites and floating wind technologies. The vast offshore wind resource potential, combined with improving technology and declining costs, creates opportunities for gigawatt-scale project development.

Green hydrogen production emerges as a transformative opportunity for renewable energy utilization in hard-to-decarbonize sectors including steel, chemicals, and heavy transportation. Electrolysis capacity development creates new revenue streams for renewable energy generators while supporting industrial decarbonization.

Energy storage integration offers significant market potential as battery costs decline and grid-scale storage becomes economically viable. Co-located renewable energy and storage projects enhance grid services capabilities while improving project economics through multiple revenue streams.

Agrivoltaics development combines solar energy generation with agricultural activities, maximizing land use efficiency while providing additional income streams for farmers. This innovative approach addresses land availability constraints while supporting rural economic development.

Digitalization and artificial intelligence applications optimize renewable energy operations through predictive maintenance, advanced forecasting, and automated control systems. Smart technologies improve asset performance while reducing operational costs and extending equipment lifespans.

Sector coupling initiatives integrate renewable electricity with heating, cooling, and transportation systems through heat pumps, electric vehicles, and power-to-X technologies. Cross-sector electrification creates new markets for renewable energy while supporting broader decarbonization objectives.

Competitive dynamics in the Western European renewable energy market reflect increasing consolidation among major players while new entrants continue to emerge in specialized technology segments. Traditional utility companies expand renewable energy portfolios through acquisitions and organic growth, while independent power producers focus on specific technologies or geographic markets.

Technology evolution drives continuous improvements in renewable energy performance and cost-effectiveness. Next-generation wind turbines feature larger rotors and advanced control systems that increase capacity factors by 15-20% compared to previous generations. Similarly, solar panel efficiency improvements and bifacial technologies enhance energy yield per installed capacity.

Market maturation leads to more sophisticated financing structures and risk management approaches. Project developers increasingly utilize hybrid renewable energy projects that combine multiple technologies to optimize resource utilization and revenue generation. MarkWide Research analysis indicates that hybrid projects account for approximately 18% of new renewable energy capacity additions in recent years.

Regulatory evolution continues to shape market development through updated support mechanisms, grid codes, and environmental standards. Governments transition from feed-in tariffs to competitive auction systems while implementing carbon pricing mechanisms that improve renewable energy competitiveness against fossil fuel alternatives.

Supply chain localization efforts aim to reduce dependence on international suppliers while building domestic manufacturing capabilities. European companies invest in local production facilities for wind turbine components, solar panels, and energy storage systems to enhance supply security and reduce transportation costs.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Western European renewable energy market. Primary research includes extensive interviews with industry executives, government officials, technology providers, and financial institutions actively involved in renewable energy development and deployment.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and regulatory filings to establish baseline market data and identify emerging trends. Statistical databases from national energy agencies, European statistical offices, and international organizations provide quantitative foundations for market assessments.

Data validation processes include cross-referencing multiple sources, conducting expert interviews for verification, and applying statistical analysis techniques to ensure data accuracy and consistency. Market forecasts utilize econometric modeling approaches that incorporate policy scenarios, technology cost curves, and macroeconomic factors.

Geographic coverage encompasses all major Western European markets with detailed analysis of country-specific conditions, regulatory frameworks, and market dynamics. Regional aggregation provides comprehensive insights while maintaining granular understanding of local market variations and opportunities.

Technology segmentation analyzes each renewable energy technology separately while identifying cross-technology trends and interactions. Market sizing methodologies account for capacity additions, generation output, investment flows, and employment impacts across different renewable energy sectors.

Germany maintains its position as the largest renewable energy market in Western Europe, with wind and solar technologies leading capacity additions. The country’s Energiewende program drives continued expansion despite grid integration challenges and policy adjustments. Offshore wind development in the North and Baltic Seas represents a key growth area, while distributed solar installations continue across residential and commercial sectors.

United Kingdom demonstrates exceptional offshore wind leadership, hosting some of the world’s largest offshore wind farms. The country targets 40 gigawatts of offshore wind capacity by 2030, supported by competitive allocation rounds and streamlined planning processes. Onshore wind and solar development face greater constraints due to planning restrictions and grid capacity limitations.

France pursues renewable energy expansion while maintaining its nuclear power base, creating unique market dynamics. Solar photovoltaic installations accelerate across southern regions, while offshore wind development begins along Atlantic and Mediterranean coastlines. The country’s renewable energy targets require significant acceleration in deployment rates across all technologies.

Spain leverages exceptional solar resources to become a leading photovoltaic market, with utility-scale installations dominating capacity additions. Wind energy development continues across suitable regions, while innovative projects combine solar and wind technologies. The country’s renewable energy auction system attracts significant international investment and drives cost reductions.

Italy focuses on distributed renewable energy systems, particularly rooftop solar installations and small-scale wind projects. The country’s complex regulatory environment creates challenges for large-scale development, while regional variations in resource availability and grid infrastructure influence project economics.

Netherlands emphasizes offshore wind development in the North Sea while expanding onshore solar capacity despite land availability constraints. The country’s innovative approach to floating solar installations and agrivoltaics demonstrates creative solutions to space limitations.

Market leadership in Western Europe’s renewable energy sector includes a diverse mix of international corporations, regional specialists, and emerging technology companies. The competitive landscape reflects ongoing consolidation trends while maintaining space for innovation and specialized expertise.

Technology providers include leading manufacturers such as Vestas, Siemens Gamesa, and GE Renewable Energy for wind turbines, while solar panel manufacturers like First Solar and various Asian companies supply photovoltaic equipment. Energy storage companies including Tesla and Fluence provide grid-scale battery solutions for renewable energy integration.

Emerging players focus on specialized technologies such as floating wind platforms, advanced energy storage systems, and digital optimization solutions. These companies often partner with established developers and utilities to commercialize innovative technologies and access larger markets.

By Technology: The Western European renewable energy market segments into distinct technology categories, each with unique characteristics and growth trajectories.

By Application: Market applications span multiple end-use sectors with varying requirements and growth patterns.

By End-User: Different customer segments drive renewable energy adoption through various motivations and requirements.

Wind Energy Category demonstrates the most mature market development with established supply chains, proven technologies, and extensive operational experience. Offshore wind particularly shows exceptional growth potential, with floating wind technologies opening previously inaccessible deep-water sites. Capacity factors for modern wind turbines exceed 50% for offshore installations, making wind energy highly competitive with conventional power sources.

Solar Photovoltaic Category benefits from continuous cost reductions and efficiency improvements, with module prices declining by more than 85% over the past decade. Distributed solar installations grow rapidly across residential and commercial segments, while utility-scale projects increasingly incorporate energy storage for enhanced grid services. Agrivoltaics and floating solar represent emerging subcategories with significant growth potential.

Hydroelectric Category focuses on modernization and efficiency improvements of existing facilities while developing pumped storage projects for grid balancing. Small-scale hydroelectric development continues in suitable locations, though environmental considerations limit large-scale expansion opportunities. Pumped storage hydroelectric facilities provide critical grid stability services as renewable energy penetration increases.

Biomass Category emphasizes advanced conversion technologies and sustainable feedstock sourcing to address environmental concerns. Biogas production from organic waste streams supports circular economy principles while providing renewable energy. Co-firing biomass with fossil fuels in existing power plants offers transitional decarbonization solutions for conventional generators.

Geothermal Category expands beyond traditional high-temperature resources through enhanced geothermal systems and ground-source heat pump applications. District heating networks increasingly incorporate geothermal energy for urban heating solutions. Deep geothermal projects demonstrate potential for baseload renewable electricity generation in suitable geological conditions.

Economic benefits for renewable energy industry participants include stable long-term revenue streams through power purchase agreements, government support mechanisms, and competitive electricity market participation. Project developers benefit from improving project economics as technology costs decline and financing becomes more accessible through green finance initiatives.

Environmental advantages position renewable energy companies as leaders in climate action and sustainability. Corporate customers achieve greenhouse gas emission reduction targets through renewable energy procurement, while communities benefit from improved air quality and reduced environmental impacts compared to fossil fuel alternatives.

Energy security benefits include reduced dependence on fossil fuel imports and enhanced price stability for electricity consumers. Domestic renewable energy resources provide long-term energy independence while creating local employment opportunities in manufacturing, installation, and maintenance activities.

Innovation opportunities emerge through technology development, digitalization, and system integration projects. Companies investing in renewable energy gain access to cutting-edge technologies and position themselves for future market developments in areas such as green hydrogen, energy storage, and sector coupling.

Financial returns for investors include attractive risk-adjusted returns from operational renewable energy assets, while development activities offer higher returns for companies with appropriate risk management capabilities. MWR analysis indicates that renewable energy investments consistently outperform traditional energy sector returns over long-term investment horizons.

Regulatory compliance benefits help companies meet increasingly stringent environmental regulations and carbon pricing mechanisms. Early adoption of renewable energy technologies provides competitive advantages as regulatory requirements become more demanding and carbon costs increase.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid renewable energy projects combine multiple technologies such as wind, solar, and energy storage to optimize resource utilization and improve project economics. These integrated systems provide more predictable generation profiles while maximizing revenue opportunities through multiple market participation strategies.

Power purchase agreement evolution includes longer contract terms, more sophisticated pricing mechanisms, and corporate renewable energy procurement growth. Virtual power purchase agreements enable companies without suitable sites to access renewable energy benefits while supporting new project development.

Floating renewable technologies expand deployment opportunities through floating solar installations on water bodies and floating wind turbines in deep offshore locations. These innovations address land availability constraints while accessing superior resource conditions in previously inaccessible areas.

Digitalization acceleration transforms renewable energy operations through predictive maintenance, advanced forecasting, and automated control systems. Artificial intelligence applications optimize performance while reducing operational costs and extending asset lifespans across renewable energy portfolios.

Green hydrogen integration creates new value streams for renewable energy projects through electrolysis applications. Power-to-X technologies enable renewable energy storage and utilization in industrial processes, transportation, and heating applications that cannot be directly electrified.

Community energy initiatives engage local stakeholders in renewable energy development through cooperative ownership models and benefit-sharing arrangements. These approaches improve public acceptance while creating local economic benefits and energy democracy opportunities.

Offshore wind scaling reaches unprecedented levels with multiple gigawatt-scale projects under development across North Sea and Atlantic Ocean sites. Advanced installation vessels and larger turbine technologies enable cost-effective development of remote offshore locations with exceptional wind resources.

Solar manufacturing expansion includes new production facilities across Western Europe to reduce supply chain dependencies and support local content requirements. European companies invest in next-generation solar technologies including perovskite tandem cells and bifacial modules for enhanced efficiency.

Grid modernization investments exceed historical levels as transmission system operators upgrade infrastructure to accommodate bidirectional power flows and variable renewable generation. Smart grid technologies and advanced control systems improve system flexibility and reliability.

Energy storage deployment accelerates through utility-scale battery installations and innovative storage technologies including compressed air energy storage and power-to-gas systems. Co-located renewable energy and storage projects become increasingly common for grid services provision.

Corporate renewable procurement reaches record levels as multinational companies commit to 100% renewable electricity consumption targets. Long-term power purchase agreements provide revenue certainty for developers while enabling corporate sustainability goal achievement.

Green finance innovation includes sustainability-linked bonds, green taxonomies, and blended finance mechanisms that reduce renewable energy project costs. European Investment Bank and national development banks increase renewable energy lending to support climate objectives.

Strategic focus on offshore wind development offers the greatest growth potential for renewable energy companies operating in Western European markets. Companies should prioritize floating wind technologies and deep-water site development to access superior wind resources and avoid onshore development constraints.

Technology diversification through hybrid renewable energy projects and energy storage integration provides competitive advantages and improved project economics. Developers should consider combining complementary technologies to optimize resource utilization and revenue generation opportunities.

Supply chain localization reduces dependency risks while supporting local content requirements and transportation cost optimization. Companies should evaluate European manufacturing opportunities for critical components and establish strategic partnerships with regional suppliers.

Digital transformation investments in advanced analytics, predictive maintenance, and automated control systems deliver significant operational improvements and cost reductions. Early adoption of artificial intelligence applications provides competitive advantages in asset optimization and performance management.

Green hydrogen positioning enables participation in emerging hydrogen economy opportunities while creating additional revenue streams for renewable energy assets. Companies should develop electrolysis capabilities and establish partnerships with industrial hydrogen consumers.

Stakeholder engagement improvements through community benefit programs and transparent communication strategies enhance project acceptance and reduce development risks. Proactive engagement with local communities and environmental groups facilitates smoother project approval processes.

Market expansion continues at an accelerated pace as Western European countries implement increasingly ambitious renewable energy targets and phase out fossil fuel generation. MarkWide Research projects sustained growth across all renewable energy technologies, with offshore wind and solar photovoltaics leading capacity additions through the forecast period.

Technology advancement drives continued cost reductions and performance improvements, making renewable energy increasingly competitive with conventional power sources. Next-generation technologies including floating wind platforms, perovskite solar cells, and advanced energy storage systems approach commercial viability.

Grid integration solutions evolve through smart grid investments, demand response programs, and sector coupling initiatives that enhance system flexibility. Regional grid interconnections and cross-border electricity trading facilitate renewable energy optimization across Western European markets.

Policy evolution toward market-based mechanisms and carbon pricing creates increasingly favorable conditions for renewable energy competitiveness. Governments transition from direct subsidies to enabling frameworks that support private sector investment and innovation.

Investment flows into renewable energy projects are expected to reach record levels, supported by institutional investor commitments and green finance market development. ESG investment criteria increasingly favor renewable energy assets over fossil fuel alternatives.

Industrial transformation through renewable energy adoption accelerates as companies pursue net-zero commitments and supply chain decarbonization requirements. Green hydrogen production and utilization expand significantly, creating new markets for renewable electricity consumption.

West Europe renewable energy market represents a dynamic and rapidly evolving sector that continues to lead global clean energy transformation. The region’s combination of ambitious climate policies, advanced technologies, and strong financial markets creates favorable conditions for sustained renewable energy growth across all technology segments.

Market fundamentals remain exceptionally strong, with offshore wind development, solar photovoltaic expansion, and energy storage integration driving the next phase of renewable energy deployment. Technological innovations and cost reductions enhance competitiveness while grid modernization investments enable higher renewable energy penetration levels.

Strategic opportunities abound for companies positioned to capitalize on emerging trends including green hydrogen development, hybrid renewable projects, and digitalization initiatives. The transition toward market-based support mechanisms and corporate renewable energy procurement creates new business models and revenue streams for industry participants.

Long-term prospects for the Western European renewable energy market remain highly positive, supported by regulatory certainty, technological advancement, and increasing economic competitiveness. The region’s commitment to achieving carbon neutrality by 2050 ensures continued demand for renewable energy capacity additions and related services throughout the forecast period.

What is Renewable Energy?

Renewable energy refers to energy derived from natural processes that are replenished constantly, such as solar, wind, hydro, and geothermal energy. This type of energy is crucial for reducing carbon emissions and promoting sustainability.

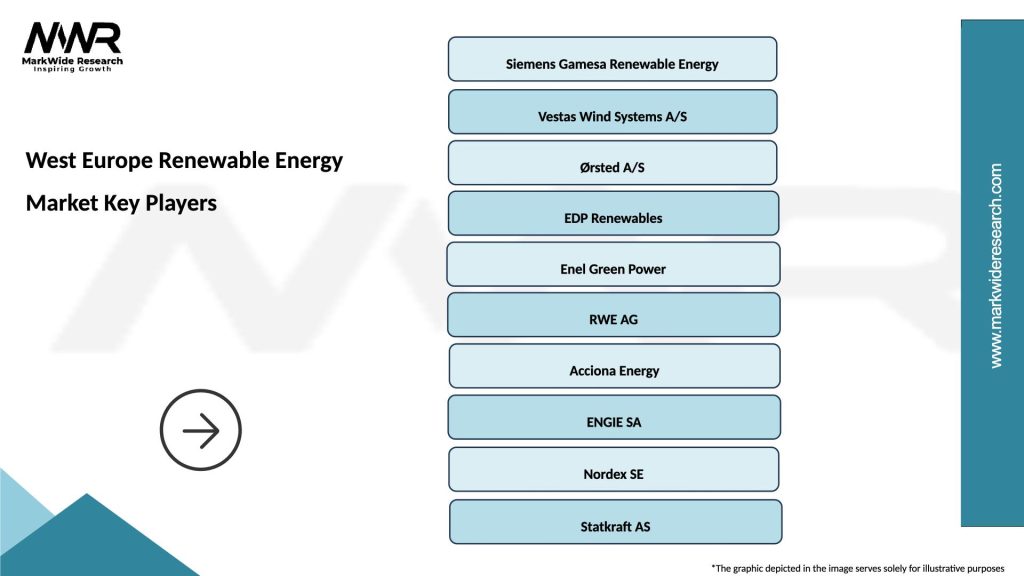

What are the key players in the West Europe Renewable Energy Market?

Key players in the West Europe Renewable Energy Market include companies like Siemens Gamesa, Vestas, and Ørsted, which are involved in wind energy, as well as Enel and EDF, which focus on solar and hydroelectric power, among others.

What are the main drivers of the West Europe Renewable Energy Market?

The main drivers of the West Europe Renewable Energy Market include government policies promoting clean energy, technological advancements in energy efficiency, and increasing consumer demand for sustainable energy solutions.

What challenges does the West Europe Renewable Energy Market face?

Challenges in the West Europe Renewable Energy Market include regulatory hurdles, the intermittency of renewable energy sources, and the need for significant investment in infrastructure to support energy transition.

What opportunities exist in the West Europe Renewable Energy Market?

Opportunities in the West Europe Renewable Energy Market include the expansion of offshore wind farms, advancements in energy storage technologies, and the potential for increased investment in green hydrogen production.

What trends are shaping the West Europe Renewable Energy Market?

Trends shaping the West Europe Renewable Energy Market include the rise of decentralized energy systems, increased integration of smart grid technologies, and a growing focus on energy efficiency and sustainability initiatives.

West Europe Renewable Energy Market

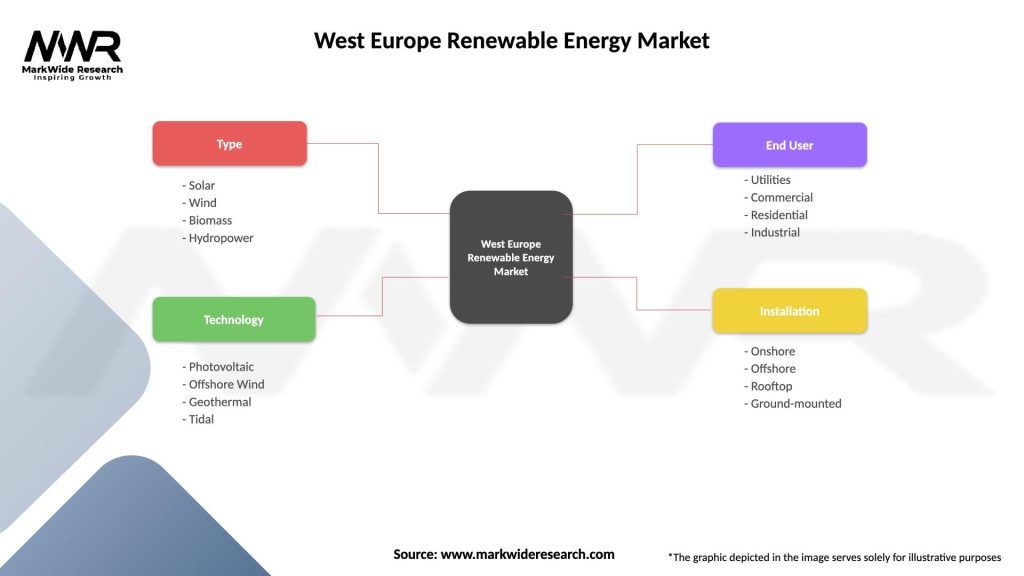

| Segmentation Details | Description |

|---|---|

| Type | Solar, Wind, Biomass, Hydropower |

| Technology | Photovoltaic, Offshore Wind, Geothermal, Tidal |

| End User | Utilities, Commercial, Residential, Industrial |

| Installation | Onshore, Offshore, Rooftop, Ground-mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the West Europe Renewable Energy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at