444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The West Africa Oil and Gas Upstream Market is a vital component of the region’s energy sector. It encompasses the exploration, production, and extraction of oil and gas resources found beneath the seabed or onshore in West African countries. The discovery of significant oil and gas reserves in this region has attracted global attention, leading to increased investments in exploration and production activities. West Africa’s upstream market plays a crucial role in driving economic growth, foreign investments, and revenue generation for the countries in the region.

Meaning

The term “Upstream” in the context of the oil and gas industry refers to the initial stages of exploration and production. It involves activities related to identifying potential oil and gas reserves, drilling exploratory wells, and extracting these valuable resources from the earth’s surface or beneath the ocean floor. The West Africa Oil and Gas Upstream Market involves numerous multinational and national oil companies, drilling contractors, equipment suppliers, and service providers working together to unlock the region’s hydrocarbon potential.

Executive Summary

The West Africa Oil and Gas Upstream Market has experienced significant growth in recent years, driven by the discovery of substantial reserves and favorable government policies. This executive summary provides a concise overview of the market’s key highlights, including growth opportunities, market drivers, challenges, and the impact of the COVID-19 pandemic. Additionally, it highlights the region’s competitive landscape and key trends shaping the industry’s future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are fueling the growth of the West Africa Oil and Gas Upstream Market:

Rich Hydrocarbon Reserves: West Africa holds some of the world’s largest oil and gas reserves, particularly offshore fields like Nigeria’s Bonga and Angola’s deepwater fields. These reserves are key drivers of exploration and production in the region.

Technological Advancements: The adoption of cutting-edge exploration and extraction technologies, including deepwater drilling and advanced seismic techniques, is enabling companies to tap into previously inaccessible reserves.

Energy Demand: Both regional and global demand for energy is rising, driven by population growth, urbanization, and industrialization. This is driving the need for more oil and gas production, further stimulating upstream activities in West Africa.

Foreign Investment and Partnerships: West Africa continues to attract investment from major international oil companies and sovereign wealth funds, particularly from regions like the Middle East and Europe. These investments are critical for financing exploration and development projects in the region.

Diversification of Energy Sources: In response to energy security concerns, many countries are increasing their investments in oil and gas to diversify their energy mix and reduce dependence on imported energy.

Market Restraints

Despite the promising growth, the West Africa Oil and Gas Upstream Market faces several challenges:

Fluctuating Oil Prices: The volatility of global oil prices significantly impacts the profitability of upstream activities. A sudden decline in oil prices can lead to reduced exploration budgets, delaying projects and affecting production.

Regulatory and Political Instability: Some West African countries face regulatory challenges, such as changes in taxation, licensing, and environmental regulations. Political instability in certain regions, including Nigeria, can also disrupt exploration and production activities.

Environmental Concerns: The oil and gas industry in West Africa has faced criticism for its environmental impact, particularly in areas where spills and gas flaring are prevalent. Increasing pressure for more sustainable practices and stricter regulations on emissions may affect operations.

Limited Infrastructure: In certain countries, inadequate infrastructure for transportation, storage, and distribution of oil and gas limits the effectiveness of upstream activities. This can result in inefficiencies and increased costs.

Security Risks: Some regions in West Africa, particularly parts of Nigeria and Angola, face security threats from piracy, terrorism, and civil unrest, which can disrupt operations and impact the safety of personnel and assets.

Market Opportunities

The West Africa Oil and Gas Upstream Market presents numerous opportunities:

Untapped Reserves: Significant untapped reserves of oil and gas remain in the region, especially in deepwater offshore fields. These areas represent major opportunities for new exploration and extraction projects.

Expansion of Emerging Markets: New discoveries in countries such as Ghana, Côte d’Ivoire, and Mauritania offer significant growth potential. As these countries ramp up production, they will become increasingly important players in the global oil and gas market.

Technological Innovation: The ongoing development of new technologies, such as artificial lift systems and improved offshore drilling methods, provides opportunities to increase efficiency and production levels from existing fields.

Green Energy Transition: As global demand for cleaner energy sources grows, West Africa has an opportunity to transition towards more sustainable oil and gas extraction methods. This includes investing in carbon capture and storage (CCS) technologies and reducing flaring.

Improvement in Infrastructure: Ongoing investments in infrastructure, such as pipeline networks, storage facilities, and ports, will improve efficiency and open new avenues for exploration and production in previously underdeveloped areas.

Market Dynamics

The West Africa Oil and Gas Upstream Market is influenced by several key dynamics:

Technological Innovation: Continued advancements in drilling and extraction technologies will drive growth in the market by enabling access to more challenging and remote reserves. Technologies like deepwater drilling and hydraulic fracturing will increase production capabilities.

Geopolitical Factors: Political and regulatory changes, as well as regional instability, can have a major impact on exploration and production in West Africa. Countries with stable governance and favorable investment environments are likely to attract more foreign investment.

Global Energy Transition: The global shift toward cleaner energy solutions presents both challenges and opportunities for the oil and gas industry. As the demand for fossil fuels faces long-term pressure, the industry in West Africa may need to adapt to more sustainable practices.

Supply Chain and Logistics: Supply chain disruptions, especially related to the transportation and export of oil and gas, can impact production timelines and costs. Companies that invest in improving infrastructure will have a competitive advantage.

Regional Analysis

West Africa’s oil and gas upstream market shows a varied landscape across its major players:

Nigeria: Nigeria remains the largest oil and gas producer in West Africa and a dominant player in the global market. The country’s offshore fields, particularly in the deepwater regions, hold significant potential for future production growth.

Angola: Angola is another leading oil and gas producer in the region, with extensive offshore reserves. The country’s government is actively working to attract investment to boost exploration and production activities.

Ghana: Ghana has emerged as a significant player in West Africa’s oil and gas sector, with new discoveries and increasing production levels. The country’s offshore fields are expected to continue driving growth.

Equatorial Guinea: Equatorial Guinea has large gas reserves and is a key producer of liquefied natural gas (LNG). The country is also looking to expand its oil production capacity through new exploration and development projects.

Côte d’Ivoire and Mauritania: Both countries have made significant strides in recent years with offshore discoveries and are expected to play a more prominent role in the region’s oil and gas production.

Competitive Landscape

Leading Companies in the West Africa Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

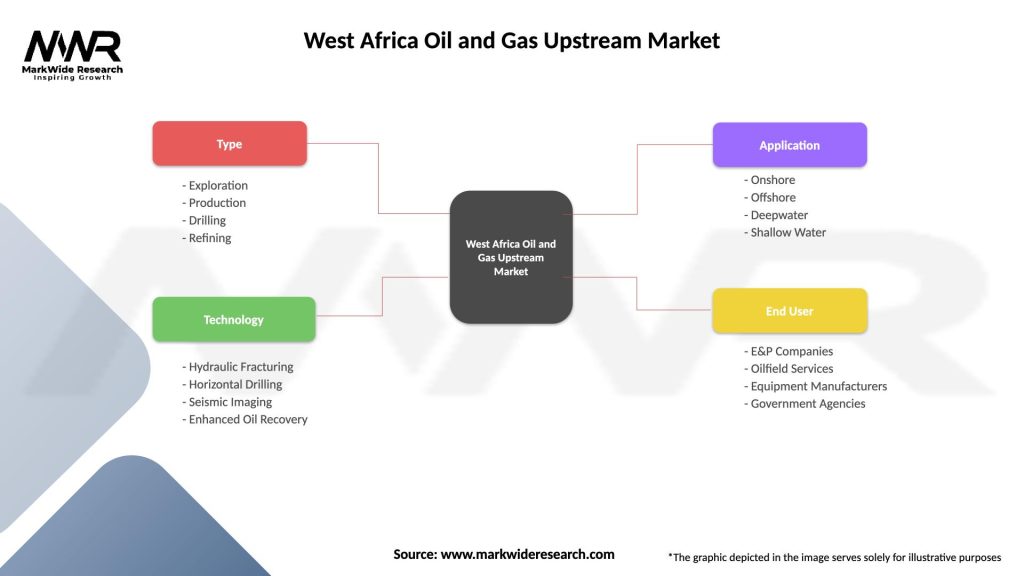

Segmentation

The West Africa Oil and Gas Upstream Market can be segmented based on the following:

By Type: Onshore, Offshore.

By Product: Crude Oil, Natural Gas.

By Application: Exploration, Production.

By Country: Nigeria, Angola, Ghana, Equatorial Guinea, Côte d’Ivoire, Mauritania, Others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The West Africa Oil and Gas Upstream Market offers significant benefits:

Access to Rich Reserves: Companies can tap into some of the largest and most promising oil and gas reserves globally.

Growing Demand for Energy: The increasing regional and global demand for energy provides a stable market for West African oil and gas exports.

Technological Advancements: Continued innovation in exploration and extraction technologies presents opportunities for stakeholders to increase production efficiency and profitability.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the global oil and gas industry, and the West Africa Oil and Gas Upstream Market was no exception. The pandemic led to a sharp decline in oil prices, disrupted operations, and delayed investment decisions. However, as the world emerges from the pandemic, the region’s upstream market is gradually rebounding, driven by economic recovery and renewed investor confidence.

Key Industry Developments

The West Africa Oil and Gas Upstream Market has witnessed several key industry developments that have shaped its current state. These developments may include major exploration discoveries, policy changes, significant investment announcements, and infrastructure projects. Tracking and analyzing these developments help in understanding the market’s direction and identifying new opportunities.

Analyst Suggestions

Based on thorough research and analysis, analysts may suggest various strategies for industry participants and stakeholders. These suggestions may include focusing on innovative exploration techniques, diversifying investments, promoting sustainable practices, and fostering partnerships for resource development. Implementing such suggestions can help companies navigate challenges and optimize their market presence.

Future Outlook

The future outlook for the West Africa Oil and Gas Upstream Market is promising yet complex. Continued exploration efforts, advancements in technology, and the region’s growing energy demand are expected to drive market growth. However, companies must address challenges related to infrastructure development, environmental concerns, and geopolitical risks to capitalize on the market’s potential fully.

Conclusion

In conclusion, the West Africa Oil and Gas Upstream Market presents significant opportunities for exploration and production activities in the region. With vast untapped oil and gas reserves and supportive government policies, the market has attracted both international and local players. However, there are challenges, including geopolitical uncertainties, environmental concerns, and volatile oil prices, which require careful navigation.

The region’s competitive landscape is marked by the presence of global oil majors and indigenous companies, all vying for exploration licenses and production contracts. As the market evolves, companies must adapt to changing trends, such as digitalization, renewable energy adoption, and the emergence of gas as a significant energy source..

What is Oil and Gas Upstream?

Oil and Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on the extraction of crude oil and natural gas from the earth. This includes activities such as drilling, well completion, and production operations.

What are the key players in the West Africa Oil and Gas Upstream Market?

Key players in the West Africa Oil and Gas Upstream Market include companies like TotalEnergies, Eni, and ExxonMobil, which are involved in exploration and production activities in the region, among others.

What are the growth factors driving the West Africa Oil and Gas Upstream Market?

The growth of the West Africa Oil and Gas Upstream Market is driven by increasing energy demand, significant oil and gas reserves, and advancements in extraction technologies. Additionally, foreign investments and government initiatives to boost production contribute to market expansion.

What challenges does the West Africa Oil and Gas Upstream Market face?

The West Africa Oil and Gas Upstream Market faces challenges such as political instability, regulatory hurdles, and environmental concerns. These factors can hinder investment and operational efficiency in the region.

What opportunities exist in the West Africa Oil and Gas Upstream Market?

Opportunities in the West Africa Oil and Gas Upstream Market include the potential for new discoveries, the development of offshore resources, and the increasing focus on sustainable practices. These factors can attract investment and enhance production capabilities.

What trends are shaping the West Africa Oil and Gas Upstream Market?

Trends in the West Africa Oil and Gas Upstream Market include the adoption of digital technologies, a shift towards renewable energy integration, and enhanced focus on environmental, social, and governance (ESG) criteria. These trends are influencing operational strategies and investment decisions.

West Africa Oil and Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Drilling, Refining |

| Technology | Hydraulic Fracturing, Horizontal Drilling, Seismic Imaging, Enhanced Oil Recovery |

| Application | Onshore, Offshore, Deepwater, Shallow Water |

| End User | E&P Companies, Oilfield Services, Equipment Manufacturers, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the West Africa Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at