444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The West Africa alcoholic beverages market refers to the industry that encompasses the production, distribution, and consumption of alcoholic beverages in the countries located in the western region of Africa. This market plays a significant role in the region’s economy and cultural fabric, with a wide variety of alcoholic beverages being consumed and enjoyed by the local population.

Meaning

The West African alcoholic beverages market refers to the industry that encompasses the production, distribution, and consumption of various alcoholic beverages in the countries located in the western region of Africa. These countries include Nigeria, Ghana, Cote d’Ivoire, Senegal, and many others. The market consists of a wide range of alcoholic beverages, including beer, wine, spirits, and other alcoholic drinks. The West Africa alcoholic beverages market has witnessed significant growth in recent years, driven by factors such as changing consumer preferences, increasing disposable incomes, and a growing young population.

Executive Summary

The West Africa alcoholic beverages market has experienced substantial growth in recent years, fueled by various factors such as urbanization, changing lifestyles, and increasing disposable incomes. The market offers a diverse range of alcoholic beverages, including beer, wine, spirits, and traditional drinks. The region’s large and youthful population, along with rising consumer awareness and preference for premium and international brands, has contributed to the market’s expansion. However, the market also faces challenges such as regulatory constraints, high taxation, and cultural norms regarding alcohol consumption. Despite these challenges, the West Africa alcoholic beverages market presents several opportunities for industry players to tap into the region’s growing demand for alcoholic beverages.

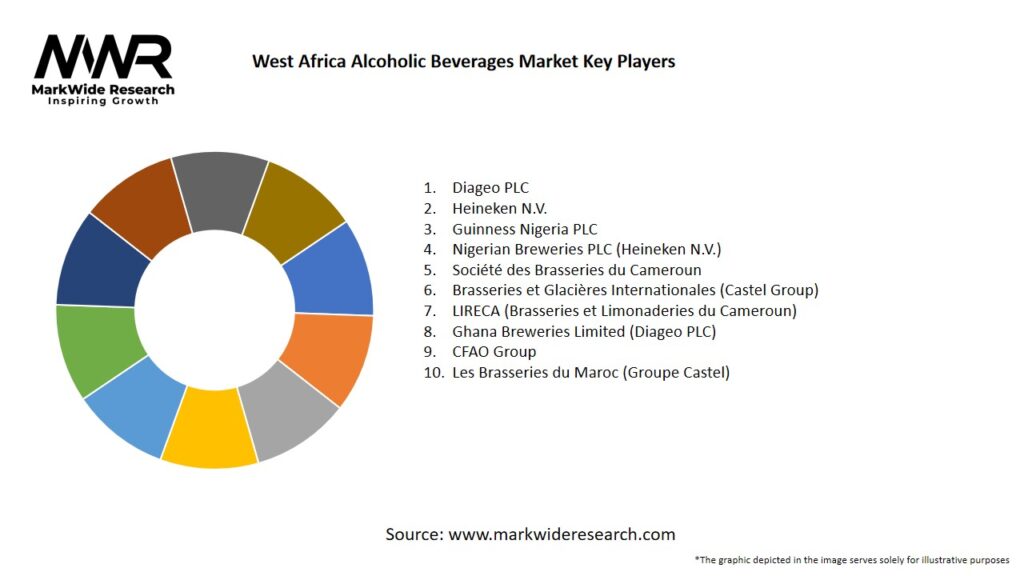

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The West Africa alcoholic beverages market is characterized by dynamic consumer preferences, changing regulations, and evolving market dynamics. Factors such as urbanization, rising disposable incomes, and the influence of Western culture drive market growth. However, regulatory constraints, high taxation, cultural norms, and illicit trade pose challenges to market players. To succeed in this market, industry participants need to stay abreast of consumer trends, invest in product innovation, navigate regulatory landscapes effectively, and build strong distribution networks.

Regional Analysis

The West Africa alcoholic beverages market comprises several countries, each with its own unique characteristics and consumer preferences. Nigeria, the largest economy in the region, holds a significant share of the market. It is followed by Ghana, Cote d’Ivoire, Senegal, and other countries. Nigeria, with its large population and urban centers, offers immense potential for alcoholic beverage companies. Ghana, known for its thriving hospitality industry, presents opportunities for market players in the tourism sector. Understanding the specific dynamics and consumer behavior within each country is crucial for industry participants to effectively penetrate and succeed in the West Africa alcoholic beverages market.

Competitive Landscape

Leading Companies in the West Africa Alcoholic Beverages Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

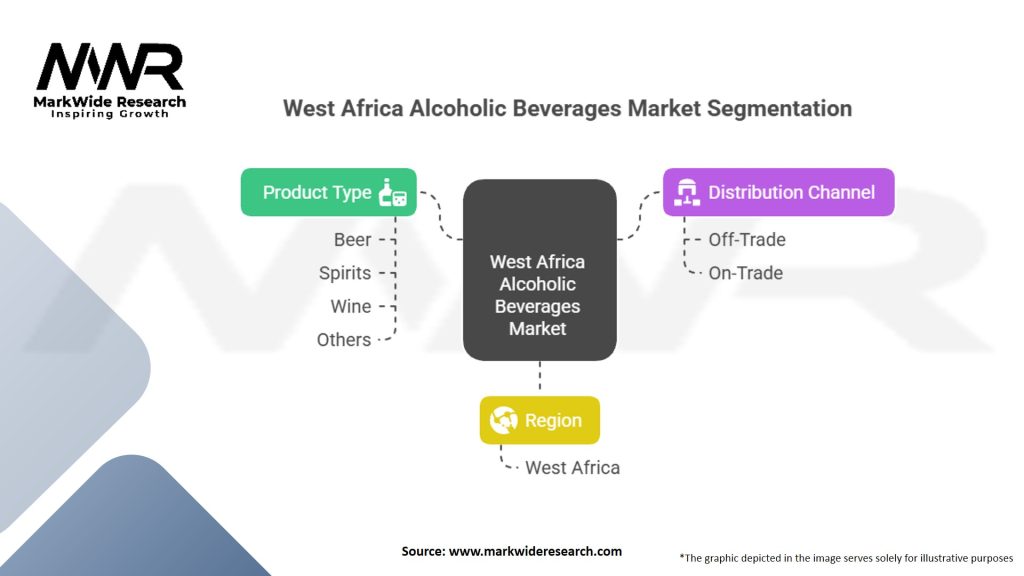

Segmentation

The West Africa alcoholic beverages market can be segmented based on product type, distribution channel, and consumer demographics.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the West Africa alcoholic beverages market. Government-imposed lockdowns, restrictions on social gatherings, and the closure of hospitality establishments had a direct negative effect on sales. The on-trade sector, including bars, restaurants, and clubs, experienced a sharp decline in revenue. However, the off-trade sector, particularly supermarkets and e-commerce platforms, witnessed a surge in demand as consumers shifted to home consumption. The pandemic also highlighted the importance of e-commerce channels, prompting industry players to invest in online sales and delivery capabilities. As vaccination rates increase and restrictions ease, the market is expected to gradually recover, although consumer behavior and spending patterns may continue to evolve.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the West Africa alcoholic beverages market remains positive, driven by factors such as population growth, urbanization, and increasing disposable incomes. The market is expected to witness continued demand for premium and international brands, as well as the emergence of craft and artisanal beverages. However, companies will need to navigate regulatory challenges, cultural norms, and the impact of counterfeit products to capitalize on market opportunities. E-commerce and digital platforms are likely to play an increasingly important role in reaching consumers, while sustainability and health-conscious choices will continue to shape consumer preferences.

Conclusion

The West Africa alcoholic beverages market offers significant growth potential for industry participants, driven by factors such as urbanization, rising disposable incomes, and changing consumer preferences. Despite challenges such as regulatory constraints and cultural norms, the market presents opportunities for companies to expand their product offerings, innovate, and tap into the region’s demand for premium and international brands. Understanding the regional dynamics, investing in distribution networks, and staying updated with market trends will be key to success in this competitive and evolving market.

What are West Africa alcoholic beverages?

West Africa alcoholic beverages refer to a variety of drinks produced and consumed in the West African region, including traditional drinks like palm wine, as well as commercially produced beers, spirits, and wines. These beverages are integral to local cultures and social practices.

Who are the key players in the West Africa Alcoholic Beverages Market?

Key players in the West Africa Alcoholic Beverages Market include multinational companies such as Diageo, Heineken, and Nigerian Breweries, which dominate the beer segment, along with local producers like Guinness Nigeria and Star Lager, among others.

What are the main drivers of growth in the West Africa Alcoholic Beverages Market?

The growth of the West Africa Alcoholic Beverages Market is driven by increasing urbanization, a growing middle class, and changing consumer preferences towards premium and international brands. Additionally, the rise in social gatherings and celebrations boosts demand for alcoholic beverages.

What challenges does the West Africa Alcoholic Beverages Market face?

The West Africa Alcoholic Beverages Market faces challenges such as regulatory hurdles, taxation issues, and competition from illegal or unregulated alcohol production. Additionally, cultural attitudes towards alcohol consumption can vary significantly across the region.

What opportunities exist in the West Africa Alcoholic Beverages Market?

Opportunities in the West Africa Alcoholic Beverages Market include the potential for product innovation, such as the introduction of low-alcohol and non-alcoholic options, as well as the expansion of distribution channels to reach underserved areas. The growing interest in craft beverages also presents a niche market.

What trends are shaping the West Africa Alcoholic Beverages Market?

Trends in the West Africa Alcoholic Beverages Market include a shift towards healthier drinking options, increased demand for locally sourced ingredients, and the rise of e-commerce for beverage sales. Additionally, sustainability practices are becoming more important among consumers and producers.

West Africa Alcoholic Beverages Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beer, Spirits, Wine, Others |

| Distribution Channel | Off-Trade, On-Trade |

| Region | West Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the West Africa Alcoholic Beverages Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at