444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The well completion equipment service market plays a vital role in the oil and gas industry, ensuring the efficient and safe extraction of hydrocarbons from reservoirs. Well completion equipment includes a range of tools and devices used during the completion process, which involves preparing the well for production after drilling. This market encompasses various services, such as installation, maintenance, and repair of well completion equipment. Companies providing these services are essential for maximizing production rates, optimizing well performance, and minimizing downtime.

Well completion equipment service refers to the comprehensive range of activities and services involved in the installation, maintenance, and repair of equipment necessary for the completion of oil and gas wells. This equipment typically includes components such as wellheads, packers, tubing, valves, and control systems. Well completion is a critical phase in the life cycle of a well, as it allows for the safe and efficient extraction of hydrocarbons from the reservoir. The well completion equipment service market ensures that these components are installed and maintained properly to maximize production and ensure operational safety.

Executive Summary

The well completion equipment service market is witnessing significant growth due to the increasing global demand for oil and gas. The exploration and production activities are expanding to new offshore and onshore locations, creating a demand for reliable and efficient well completion services. This market is driven by the need for enhanced oil recovery techniques, rising investments in oil and gas infrastructure, and the growing complexity of well completion operations. Additionally, technological advancements in well completion equipment and the adoption of digital solutions are further fueling the market’s growth.

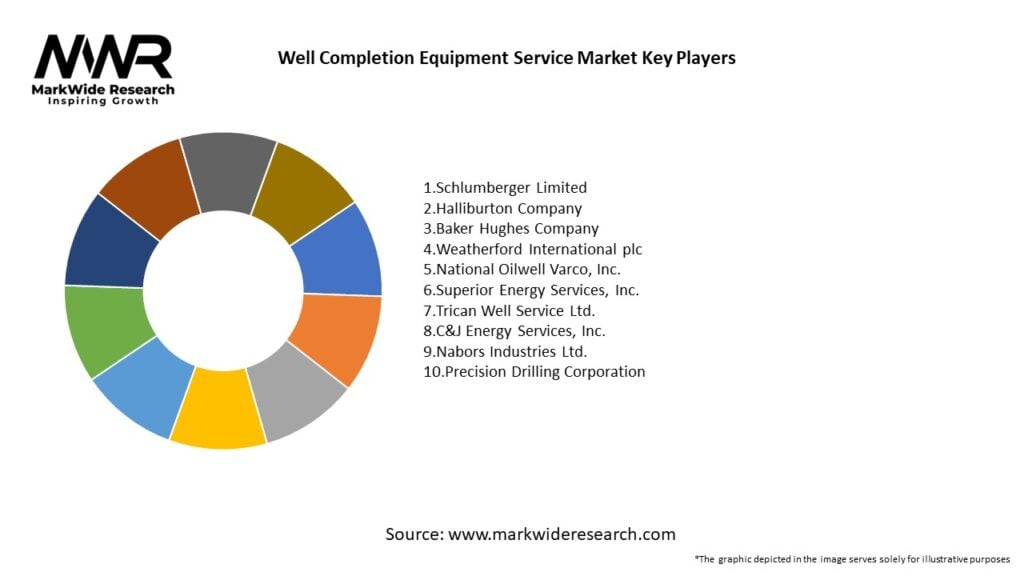

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

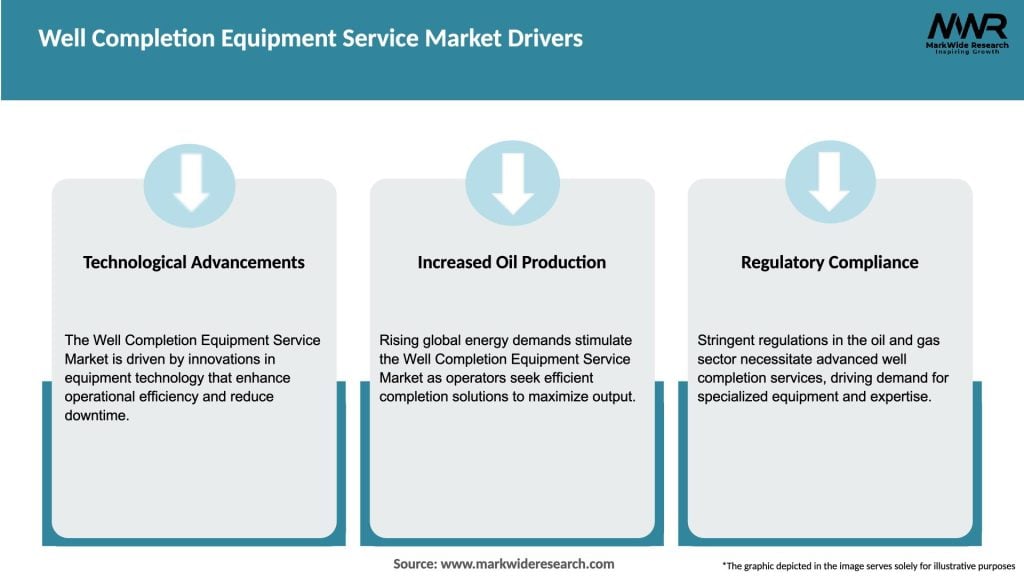

Market Drivers

Energy Demand Growth: Rising global energy consumption spurs drilling and completion activities in mature and frontier basins.

Unconventional Resource Development: Horizontal drilling and multi-stage fracturing drive demand for advanced completion equipment.

Enhanced Oil Recovery (EOR): Flooding, chemical injection, and smart well completions extend field life and improve recovery factors.

Cost-Reduction Pressures: Operators seek optimized service packages to lower per-barrel development costs.

Regulatory Compliance: Stricter well-integrity and environmental standards mandate reliable completion solutions.

Market Restraints

Oil Price Volatility: Fluctuating crude prices affect operator spending on new well completions and recompletions.

High Service Costs: Complex equipment and specialized crews contribute to significant day rates.

Logistical Challenges: Mobilizing heavy completion gear to remote or deepwater locations adds time and expense.

Regulatory Approvals: Obtaining permits for fracturing and chemical injection can delay project timelines.

Skilled Labor Shortages: Demand for experienced completion engineers and rig crews often outstrips supply.

Market Opportunities

Digital Twin Implementations: Virtual models of wells to simulate completion scenarios and predict performance.

Green Fracturing Fluids: Biodegradable, low-toxicity fracturing chemistries to meet environmental regulations.

Plug-and-Perf Innovations: Autonomous downhole tools that eliminate coiled tubing runs and reduce rig time.

Integrated Data Services: Offering real-time completion analytics platforms as part of service contracts.

Emerging Market Expansion: Growing exploration and production in Latin America, Africa, and Southeast Asia.

Market Dynamics

The well completion equipment service market is driven by a combination of factors, including the global energy demand, investments in infrastructure, technological advancements, and environmental concerns. These dynamics create opportunities for market players to offer innovative solutions and expand their customer base. However, the market is also influenced by volatile oil and gas prices and geopolitical uncertainties, which can impact investment decisions and overall market growth. Additionally, regulatory and environmental challenges pose constraints on the market, requiring service providers to comply with stringent regulations and adopt sustainable practices.

Despite these challenges, the market presents several opportunities for growth. The exploration and production of shale gas have gained significant momentum, especially in regions like North America. The extraction of shale gas requires well completion equipment services, driving the demand in these regions. Furthermore, offshore drilling activities continue to expand, with new discoveries in deepwater and ultra-deepwater fields. The installation and maintenance of well completion equipment are crucial for offshore operations, presenting a promising market opportunity.

Another important factor driving market growth is the aging well infrastructure in many regions. As existing wells reach maturity, retrofitting and upgrades are necessary to enhance production rates and extend the life of the wells. Well completion equipment services play a critical role in these activities, offering solutions to optimize well performance and productivity.

The industry is also witnessing a shift towards digitalization and automation. Service providers are increasingly adopting advanced technologies such as real-time monitoring systems, remote operation control, and predictive maintenance. These digital solutions improve operational efficiency, reduce downtime, and enhance safety standards. The integration of artificial intelligence and machine learning algorithms further enables proactive decision-making and optimization of well completion processes.

The growing focus on renewable energy sources and diversification presents new avenues for the well completion equipment service market. As the energy transition gains momentum, there is a rising demand for well completion services in sectors such as geothermal energy and carbon capture storage. Service providers that can adapt and offer specialized solutions for these emerging sectors can gain a competitive edge.

Regional Analysis

The well completion equipment service market exhibits regional variations based on the concentration of oil and gas reserves, exploration activities, and infrastructure development. The key regions influencing the market include:

Competitive Landscape

Leading companies in the Well Completion Equipment Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

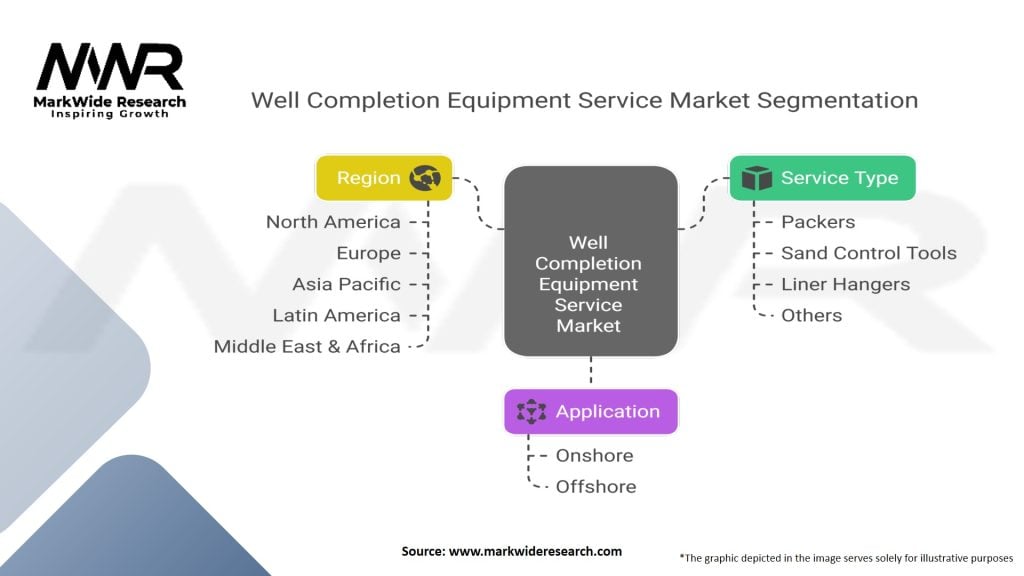

Segmentation

The well completion equipment service market can be segmented based on various factors, including the type of service, well type, application, and geography.

By service type:

By well type:

By application:

By geography:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the well completion equipment service market. The crisis led to a significant decline in global oil demand, resulting in a reduction in exploration and production activities. The industry faced challenges such as supply chain disruptions, project delays, and decreased investments.

Lockdowns and travel restrictions limited the mobility of personnel, affecting the availability of skilled labor for well completion operations. Additionally, the uncertainty surrounding the duration and severity of the pandemic led to cautious spending by oil and gas companies, impacting the demand for well completion equipment services.

However, as the global economy gradually recovers, the demand for oil and gas is expected to rebound. Governments and industry players are implementing measures to stimulate economic growth and revive the oil and gas sector. As vaccination efforts progress and travel restrictions ease, the mobility of personnel for well completion activities is expected to improve.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the well completion equipment service market looks promising, driven by the increasing global energy demand, technological advancements, and the focus on sustainability. As the world transitions towards cleaner energy sources, service providers will need to adapt and offer solutions that cater to evolving market needs.

Digitalization and automation will continue to play a significant role in the market, enabling improved operational efficiency, real-time monitoring, and data-driven decision-making. Companies that invest in digital transformation and embrace innovative technologies will be better positioned to meet the evolving demands of the industry and gain a competitive advantage.

However, the market will continue to face challenges such as volatile oil and gas prices, geopolitical uncertainties, and regulatory complexities. Companies in the well completion equipment service market must remain agile, adaptable, and responsive to market conditions. Diversification, strategic partnerships, and a customer-centric approach will be crucial for long-term success.

Conclusion

The well completion equipment service market is poised for growth due to increasing energy demand, technological advancements, and the focus on sustainability. Service providers that embrace digital transformation, offer eco-friendly solutions, and foster collaboration will be well-positioned to thrive in this dynamic industry. By staying informed about market trends, prioritizing safety, and adapting to changing customer needs, companies can secure their position and seize opportunities in the evolving well completion equipment service market.

The market is expected to witness continued growth in shale gas exploration and production activities, especially in regions like North America. The development of offshore fields, particularly in deepwater and ultra-deepwater areas, will also contribute to the expansion of the well completion equipment service market.

What is Well Completion Equipment Service?

Well Completion Equipment Service refers to the range of services and equipment used to prepare a well for production after drilling. This includes activities such as casing, cementing, and installing production tubing, which are essential for ensuring the well’s integrity and efficiency.

Who are the key players in the Well Completion Equipment Service Market?

Key players in the Well Completion Equipment Service Market include Halliburton, Schlumberger, Baker Hughes, and Weatherford, among others. These companies provide a variety of services and technologies to enhance well completion processes.

What are the main drivers of growth in the Well Completion Equipment Service Market?

The main drivers of growth in the Well Completion Equipment Service Market include the increasing demand for oil and gas, advancements in completion technologies, and the need for efficient resource extraction. Additionally, the rise in unconventional oil and gas production is also contributing to market expansion.

What challenges does the Well Completion Equipment Service Market face?

The Well Completion Equipment Service Market faces challenges such as fluctuating oil prices, regulatory hurdles, and the need for skilled labor. These factors can impact the operational efficiency and profitability of service providers.

What opportunities exist in the Well Completion Equipment Service Market?

Opportunities in the Well Completion Equipment Service Market include the growing focus on sustainable practices, the adoption of digital technologies, and the expansion into emerging markets. These trends can lead to innovative solutions and improved service offerings.

What trends are shaping the Well Completion Equipment Service Market?

Trends shaping the Well Completion Equipment Service Market include the integration of automation and data analytics in completion processes, the shift towards environmentally friendly practices, and the increasing use of advanced materials in equipment design. These trends are enhancing efficiency and reducing environmental impact.

Well Completion Equipment Service Market

| Segmentation | Details |

|---|---|

| Service Type | Packers, Sand Control Tools, Liner Hangers, Others |

| Application | Onshore, Offshore |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Well Completion Equipment Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at