444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The water solutions in transportation market represents a rapidly evolving sector focused on addressing critical water management challenges across various transportation modes. This comprehensive market encompasses innovative technologies, systems, and services designed to optimize water usage, treatment, and conservation within the transportation industry. Transportation operators worldwide are increasingly recognizing the importance of sustainable water management practices as environmental regulations tighten and operational efficiency becomes paramount.

Market dynamics indicate substantial growth potential driven by stringent environmental regulations, increasing awareness of water scarcity, and the need for cost-effective water management solutions. The sector spans multiple transportation segments including maritime, aviation, rail, and road transport, each presenting unique water management challenges and opportunities. Growth rates in this market are accelerating at approximately 8.5% CAGR as transportation companies prioritize sustainability initiatives and regulatory compliance.

Technological advancements in water treatment, recycling, and purification systems are revolutionizing how transportation companies approach water management. From advanced filtration systems in cruise ships to innovative water recycling technologies in airports, the market is witnessing unprecedented innovation. Regional adoption varies significantly, with North America and Europe leading in implementation while Asia-Pacific shows the highest growth potential with approximately 42% market share in emerging water solution technologies.

The water solutions in transportation market refers to the comprehensive ecosystem of technologies, products, and services designed to address water-related challenges within the transportation industry. This market encompasses water treatment systems, purification technologies, recycling solutions, and conservation methods specifically tailored for various transportation modes including ships, aircraft, trains, and ground transportation facilities.

Core components of this market include advanced filtration systems, water recycling technologies, ballast water treatment systems, greywater management solutions, and smart water monitoring systems. These solutions address critical needs such as regulatory compliance, operational efficiency, environmental sustainability, and cost reduction. Transportation stakeholders utilize these solutions to meet increasingly stringent environmental standards while maintaining operational excellence and reducing overall water consumption footprints.

Market expansion in water solutions for transportation is driven by a convergence of regulatory pressures, environmental consciousness, and technological innovation. The sector demonstrates robust growth potential with increasing adoption across maritime, aviation, rail, and road transportation segments. Key market drivers include stringent ballast water regulations affecting 75% of commercial vessels, growing water scarcity concerns, and rising operational costs associated with traditional water management practices.

Technology integration is reshaping the market landscape, with smart water management systems, IoT-enabled monitoring solutions, and advanced treatment technologies gaining significant traction. The market benefits from increasing investments in sustainable transportation infrastructure and growing awareness of water conservation importance. Competitive dynamics are intensifying as established players and innovative startups compete to deliver comprehensive water management solutions.

Regional markets show varying growth patterns, with developed regions focusing on regulatory compliance and efficiency improvements, while emerging markets prioritize basic water treatment and infrastructure development. The market outlook remains positive with continued technological advancement and increasing regulatory support driving sustained growth across all transportation segments.

Strategic insights reveal several critical trends shaping the water solutions in transportation market:

Regulatory pressures constitute the primary driver for water solutions adoption in transportation. International Maritime Organization (IMO) ballast water regulations affect thousands of vessels globally, creating mandatory demand for treatment systems. Environmental regulations across various jurisdictions require transportation operators to implement comprehensive water management strategies, driving market growth and innovation.

Water scarcity concerns increasingly influence transportation industry decisions, particularly in regions experiencing drought conditions or limited freshwater resources. Transportation hubs, airports, and maritime facilities require substantial water quantities for operations, making efficient water management critical for business continuity. Cost reduction initiatives drive adoption as water treatment and recycling systems offer long-term operational savings compared to traditional water sourcing methods.

Technological advancement enables more sophisticated and cost-effective water management solutions, making adoption attractive for transportation companies. Smart monitoring systems, advanced filtration technologies, and automated treatment processes reduce operational complexity while improving efficiency. Corporate sustainability commitments by major transportation companies create additional demand for innovative water solutions that support environmental goals and stakeholder expectations.

High initial investment costs present significant barriers for many transportation operators, particularly smaller companies with limited capital resources. Advanced water treatment systems require substantial upfront expenditure, extended payback periods, and ongoing maintenance investments that may strain operational budgets. Technical complexity associated with sophisticated water management systems creates implementation challenges and requires specialized expertise for operation and maintenance.

Regulatory uncertainty in some regions creates hesitation among potential adopters who prefer to wait for clearer guidelines before investing in water solution technologies. Varying international standards and compliance requirements complicate system selection and implementation for transportation companies operating across multiple jurisdictions. Infrastructure limitations at existing transportation facilities may require significant modifications to accommodate new water management systems.

Operational disruption concerns during system installation and commissioning phases discourage some transportation operators from implementing comprehensive water solutions. The need for specialized training and potential service interruptions during transition periods create additional barriers to adoption. Technology reliability questions regarding newer water treatment technologies may cause conservative operators to delay implementation until proven track records are established.

Emerging markets present substantial growth opportunities as developing regions invest in transportation infrastructure and implement environmental regulations. Countries in Asia-Pacific, Latin America, and Africa are expanding their transportation networks while simultaneously addressing water management challenges, creating significant demand for innovative solutions. Market penetration in these regions remains relatively low, offering considerable expansion potential for solution providers.

Technology convergence opportunities exist at the intersection of water management, digitalization, and sustainability initiatives. Integration of artificial intelligence, machine learning, and IoT technologies with water treatment systems creates new value propositions and competitive advantages. Service-based models including water-as-a-service offerings provide alternative revenue streams and reduce customer investment barriers.

Cross-industry collaboration opportunities enable water solution providers to leverage expertise from other sectors and develop innovative transportation-specific applications. Partnerships between technology companies, transportation operators, and environmental organizations can accelerate solution development and market adoption. Retrofit markets for existing transportation infrastructure represent significant opportunities as operators upgrade aging systems to meet current standards and efficiency requirements.

Supply chain dynamics in the water solutions market are evolving rapidly as demand increases across multiple transportation segments simultaneously. Component suppliers, system integrators, and service providers are expanding capacity and capabilities to meet growing market requirements. Technology transfer from other industries accelerates innovation and reduces development timelines for transportation-specific water management solutions.

Competitive intensity is increasing as established water treatment companies compete with specialized transportation solution providers and emerging technology startups. Market consolidation through acquisitions and strategic partnerships is reshaping the competitive landscape while creating more comprehensive solution offerings. Customer expectations are rising regarding system performance, reliability, and integration capabilities, driving continuous innovation and improvement efforts.

Investment patterns show increasing venture capital and private equity interest in water technology companies serving the transportation sector. According to MarkWide Research analysis, funding for water solution startups has increased by approximately 35% annually over the past three years. Market maturation varies significantly across transportation segments, with maritime applications leading in adoption while aviation and rail segments show accelerating growth rates.

Comprehensive research methodology employed for analyzing the water solutions in transportation market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, technology providers, transportation operators, and regulatory officials across key global markets. Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and technical publications.

Market sizing methodology utilizes bottom-up and top-down approaches to validate findings and ensure consistency across different market segments and regions. Quantitative analysis includes statistical modeling, trend analysis, and forecasting techniques to project market development patterns. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis to understand market dynamics and competitive positioning.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and utilizing industry databases to verify key findings and assumptions. Regional analysis incorporates local market conditions, regulatory environments, and cultural factors that influence adoption patterns. Technology assessment includes evaluation of current solutions, emerging technologies, and innovation pipelines to understand future market direction and opportunities.

North America leads the water solutions in transportation market with approximately 38% regional market share, driven by stringent environmental regulations and advanced transportation infrastructure. The United States dominates regional adoption with comprehensive ballast water regulations, airport water management requirements, and corporate sustainability initiatives driving demand. Canadian markets show strong growth in rail and maritime applications, particularly in environmentally sensitive regions.

Europe represents the second-largest regional market with approximately 32% market share, characterized by strict environmental standards and early adoption of sustainable transportation practices. Nordic countries lead in innovation and implementation, while Mediterranean regions focus on water scarcity solutions. European Union regulations create harmonized standards that facilitate market development and technology adoption across member states.

Asia-Pacific demonstrates the highest growth potential with expanding transportation infrastructure and increasing environmental awareness. China and India drive regional demand through massive infrastructure investments and growing regulatory requirements. Southeast Asian markets show particular strength in maritime applications due to extensive shipping activities and port development projects. Japan and South Korea lead in technology innovation and advanced system implementation.

Latin America and Middle East & Africa represent emerging markets with significant long-term potential. Water scarcity issues in these regions create strong demand for efficient water management solutions across all transportation modes. Infrastructure development projects in these regions increasingly incorporate water management requirements from initial planning stages.

Market leadership is distributed among several categories of companies, each bringing unique strengths and capabilities to the water solutions in transportation market:

Strategic positioning varies among competitors, with some focusing on specific transportation segments while others pursue comprehensive multi-modal approaches. Technology differentiation, service capabilities, and regional presence constitute key competitive factors. Innovation leadership is increasingly important as customers demand more sophisticated and integrated water management solutions.

By Transportation Mode:

By Technology Type:

By Application:

Maritime segment dominates the water solutions market with the highest adoption rates driven by international ballast water regulations. Cruise ship applications show particular growth with approximately 28% annual increase in advanced water treatment system installations. Commercial shipping focuses primarily on compliance-driven solutions, while luxury vessels emphasize comprehensive water management for passenger comfort and environmental responsibility.

Aviation sector demonstrates strong growth potential with airports increasingly implementing comprehensive water management strategies. Terminal operations require substantial water quantities for passenger services, maintenance, and safety systems. Aircraft servicing applications focus on efficient water delivery and waste management systems that minimize ground time and operational costs.

Rail transportation shows emerging adoption patterns with high-speed rail networks leading implementation of advanced water management systems. Station facilities require sophisticated water treatment for passenger services and maintenance operations. Freight rail applications focus on maintenance facility water management and locomotive servicing systems.

Road transportation segment encompasses diverse applications from highway service areas to urban transportation hubs. Fleet maintenance facilities drive demand for water recycling and treatment systems that reduce operational costs. Electric vehicle charging infrastructure increasingly incorporates water management considerations for cooling and facility operations.

Transportation operators benefit from reduced operational costs through efficient water management and recycling systems. Advanced water treatment technologies enable compliance with environmental regulations while minimizing regulatory risks and potential penalties. Operational efficiency improvements include reduced water consumption, lower waste disposal costs, and enhanced system reliability.

Technology providers gain access to expanding markets with strong growth potential and increasing demand for innovative solutions. Long-term service contracts and recurring revenue opportunities create stable business models. Market expansion opportunities exist across multiple transportation segments and geographic regions.

Environmental stakeholders benefit from reduced water consumption, improved water quality, and decreased environmental impact from transportation operations. Advanced treatment systems prevent contamination and support ecosystem protection. Regulatory authorities achieve compliance objectives while supporting industry sustainability initiatives.

Financial stakeholders including investors and lenders benefit from stable returns in a growing market with strong regulatory support. Water solution investments often qualify for environmental incentives and sustainability financing programs. Risk mitigation aspects include reduced regulatory exposure and improved operational resilience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing water management in transportation through IoT sensors, cloud-based monitoring, and predictive analytics. Smart water systems enable real-time optimization, predictive maintenance, and automated responses to changing conditions. Data-driven insights help transportation operators optimize water usage patterns and identify efficiency improvement opportunities.

Circular economy principles are driving adoption of comprehensive water recycling and reuse systems across all transportation modes. Advanced treatment technologies enable multiple water recycling cycles, dramatically reducing freshwater consumption. Zero liquid discharge systems are gaining traction in environmentally sensitive areas and water-scarce regions.

Modular system design trends enable scalable and flexible water management solutions that can adapt to changing operational requirements. Containerized treatment systems facilitate rapid deployment and easy relocation as transportation infrastructure evolves. Standardization efforts are reducing costs and improving interoperability across different transportation applications.

Integration trends see water management systems becoming part of comprehensive environmental management platforms that address air quality, waste management, and energy efficiency simultaneously. Holistic approaches provide greater value to transportation operators while simplifying system management and maintenance requirements.

Regulatory milestones continue shaping market development with new international standards for ballast water treatment and expanded requirements for transportation facility water management. Recent developments include updated IMO guidelines and regional regulations addressing water quality and conservation. Compliance deadlines create urgent demand for solution implementation across affected transportation segments.

Technology breakthroughs in membrane technology, advanced oxidation processes, and smart monitoring systems are expanding solution capabilities while reducing costs. Recent innovations include self-cleaning filtration systems, AI-powered optimization algorithms, and energy-efficient treatment processes. Commercial deployments of next-generation technologies demonstrate improved performance and reliability.

Strategic partnerships between technology providers, transportation companies, and infrastructure developers are accelerating market development and solution deployment. Recent collaborations focus on integrated system development, financing solutions, and comprehensive service offerings. Industry consolidation through acquisitions is creating larger, more capable solution providers with expanded geographic reach.

Investment activity shows increasing venture capital and private equity interest in water technology companies serving transportation markets. MWR data indicates that funding for transportation water solutions has grown by approximately 45% annually over the past two years, reflecting strong investor confidence in market potential.

Market entry strategies should focus on specific transportation segments where regulatory requirements create immediate demand for water management solutions. Companies entering this market should prioritize building technical expertise and establishing partnerships with transportation operators. Geographic expansion should target regions with strong regulatory frameworks and growing transportation infrastructure investments.

Technology development priorities should emphasize integration capabilities, automation features, and energy efficiency to meet evolving customer requirements. Investment in digital technologies and data analytics capabilities will become increasingly important for competitive differentiation. Service capabilities including maintenance, monitoring, and optimization services represent significant value-creation opportunities.

Partnership strategies should focus on building relationships with transportation operators, infrastructure developers, and regulatory authorities. Collaborative approaches to solution development and deployment can accelerate market penetration and reduce customer adoption barriers. Financial partnerships with leasing companies and infrastructure funds can address customer capital constraints.

Innovation focus should address emerging needs including climate resilience, energy efficiency, and circular economy principles. Companies should invest in research and development to stay ahead of evolving regulatory requirements and customer expectations. Cross-industry collaboration can accelerate innovation and reduce development costs through shared expertise and resources.

Market growth is expected to accelerate over the next decade driven by expanding regulatory requirements, increasing environmental awareness, and continued transportation infrastructure development. The market will benefit from technological advancement, cost reduction, and improved system reliability. Adoption rates are projected to increase significantly across all transportation segments with maritime leading and aviation showing the highest growth potential.

Technology evolution will focus on increased automation, improved efficiency, and enhanced integration capabilities. Artificial intelligence and machine learning will play increasingly important roles in system optimization and predictive maintenance. Cost reduction through technological advancement and economies of scale will make solutions accessible to smaller transportation operators.

Regional development patterns will see continued leadership from developed markets while emerging regions show accelerating adoption rates. Asia-Pacific is expected to become the largest regional market by volume within the next five years. Market maturation in developed regions will shift focus from initial adoption to system upgrades and advanced feature implementation.

Industry transformation will see water management becoming an integral part of transportation operations rather than an auxiliary function. According to MarkWide Research projections, integrated water management systems will account for approximately 60% of new installations by 2030. Sustainability integration will drive demand for comprehensive environmental management platforms that address multiple environmental challenges simultaneously.

The water solutions in transportation market represents a dynamic and rapidly growing sector with substantial potential for continued expansion. Driven by regulatory requirements, environmental consciousness, and technological innovation, this market offers significant opportunities for solution providers, transportation operators, and investors. Market fundamentals remain strong with increasing demand across all transportation segments and geographic regions.

Success factors in this market include technological innovation, regulatory compliance expertise, and comprehensive service capabilities. Companies that can deliver integrated solutions addressing multiple water management challenges while providing ongoing support and optimization services will achieve competitive advantages. Strategic partnerships and collaborative approaches will become increasingly important for market success and customer satisfaction.

Future prospects for the water solutions in transportation market remain highly positive with continued growth expected across all segments and regions. The convergence of regulatory pressure, technological advancement, and sustainability initiatives creates a favorable environment for market expansion and innovation. Long-term outlook suggests that water management will become an essential component of transportation infrastructure, driving sustained demand for advanced solutions and services.

What is Water Solutions in Transportation?

Water Solutions in Transportation refers to various methods and technologies aimed at managing water resources effectively within the transportation sector. This includes systems for water purification, wastewater management, and sustainable water use in transportation infrastructure.

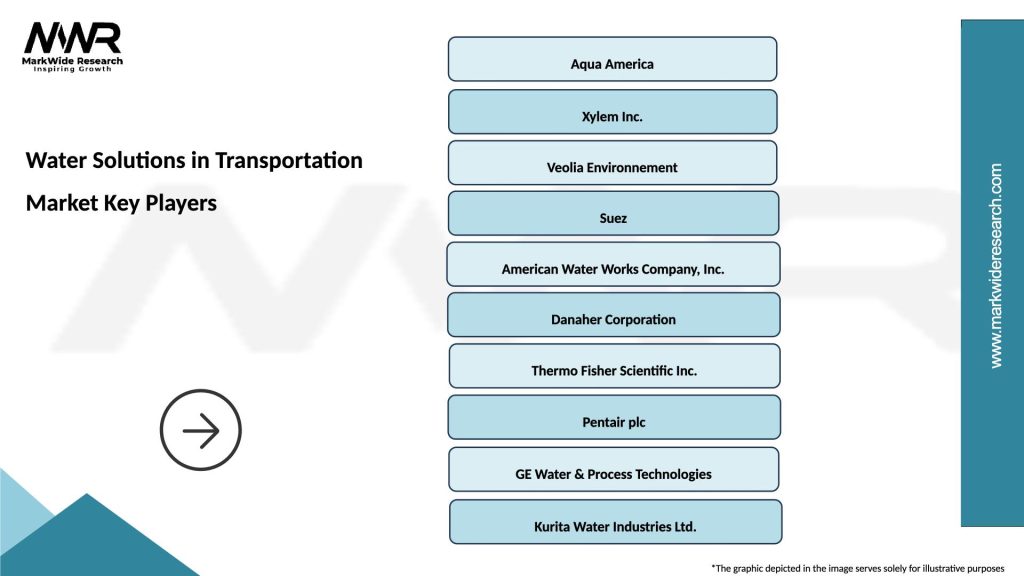

What are the key players in the Water Solutions in Transportation Market?

Key players in the Water Solutions in Transportation Market include companies like Veolia, SUEZ, and Xylem, which provide innovative water management solutions. These companies focus on enhancing water efficiency and sustainability in transportation systems, among others.

What are the growth factors driving the Water Solutions in Transportation Market?

The growth of the Water Solutions in Transportation Market is driven by increasing regulatory pressures for sustainable water use, rising concerns over water scarcity, and the need for efficient water management in transportation infrastructure. Additionally, advancements in technology are facilitating better water solutions.

What challenges does the Water Solutions in Transportation Market face?

Challenges in the Water Solutions in Transportation Market include high initial investment costs for advanced water management systems and the complexity of integrating these solutions into existing transportation infrastructure. Additionally, varying regulations across regions can complicate implementation.

What future opportunities exist in the Water Solutions in Transportation Market?

Future opportunities in the Water Solutions in Transportation Market include the development of smart water management technologies and the integration of renewable energy sources for water treatment. There is also potential for collaboration between public and private sectors to enhance water sustainability in transportation.

What trends are shaping the Water Solutions in Transportation Market?

Trends shaping the Water Solutions in Transportation Market include the increasing adoption of green technologies, the use of IoT for real-time water monitoring, and a growing emphasis on circular economy practices. These trends aim to improve water efficiency and reduce environmental impact in transportation.

Water Solutions in Transportation Market

| Segmentation Details | Description |

|---|---|

| Product Type | Water Purification Systems, Filtration Units, Desalination Equipment, Treatment Chemicals |

| Technology | Reverse Osmosis, UV Treatment, Membrane Filtration, Electrocoagulation |

| End User | Logistics Companies, Public Transport Authorities, Shipping Lines, Freight Forwarders |

| Application | Water Recycling, Wastewater Management, Potable Water Supply, Cooling Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Water Solutions in Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at