444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The water automation and instrumentation market represents a rapidly evolving sector focused on enhancing water management efficiency through advanced technological solutions. This comprehensive market encompasses sophisticated monitoring systems, control mechanisms, and automated processes designed to optimize water treatment, distribution, and conservation across municipal, industrial, and agricultural applications. Market dynamics indicate substantial growth driven by increasing water scarcity concerns, stringent environmental regulations, and the urgent need for sustainable water management practices.

Global adoption of water automation technologies has accelerated significantly, with the market experiencing robust expansion at a CAGR of 8.2% over recent years. This growth trajectory reflects the critical importance of intelligent water management systems in addressing contemporary challenges including aging infrastructure, population growth, and climate change impacts. Technological advancements in sensor technologies, IoT integration, and artificial intelligence have revolutionized traditional water management approaches, enabling real-time monitoring, predictive maintenance, and optimized resource allocation.

Industry stakeholders recognize the transformative potential of automation and instrumentation solutions in achieving operational excellence and regulatory compliance. The market encompasses diverse applications ranging from municipal water treatment facilities and wastewater management systems to industrial process water optimization and smart irrigation technologies. Regional variations in adoption rates reflect different infrastructure development levels, regulatory frameworks, and investment priorities, with developed markets leading in advanced automation deployment while emerging economies focus on foundational infrastructure improvements.

The water automation and instrumentation market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate, monitor, and control water-related processes across various applications. This market encompasses hardware components including sensors, controllers, actuators, and communication devices, alongside software platforms that enable intelligent decision-making and process optimization. Core functionalities include real-time data collection, automated control systems, remote monitoring capabilities, and predictive analytics for enhanced operational efficiency.

Instrumentation aspects involve sophisticated measurement and monitoring devices that provide critical data on water quality parameters, flow rates, pressure levels, and chemical compositions. These instruments enable precise control and optimization of water treatment processes, ensuring compliance with regulatory standards and operational efficiency. Automation components integrate these measurements with control systems that can automatically adjust processes, trigger alarms, and implement corrective actions without human intervention.

Market scope extends beyond traditional water treatment to include smart water networks, leak detection systems, energy optimization solutions, and integrated water management platforms. The convergence of Internet of Things (IoT) technologies, cloud computing, and advanced analytics has expanded the definition to include intelligent water ecosystems that provide comprehensive visibility and control over entire water management operations.

Strategic market analysis reveals the water automation and instrumentation sector as a critical enabler of sustainable water management practices worldwide. The market demonstrates exceptional resilience and growth potential, driven by fundamental factors including water scarcity challenges, infrastructure modernization needs, and regulatory compliance requirements. Technology integration has emerged as a primary differentiator, with successful market participants leveraging advanced sensor technologies, machine learning algorithms, and cloud-based platforms to deliver comprehensive solutions.

Key market segments show varying growth patterns, with municipal water treatment applications maintaining steady demand while industrial automation solutions experience accelerated adoption. The integration of artificial intelligence and predictive analytics has created new value propositions, enabling proactive maintenance strategies and optimized resource utilization. Regional market dynamics indicate strong growth in Asia-Pacific regions, driven by rapid urbanization and infrastructure development initiatives.

Competitive landscape features a mix of established instrumentation manufacturers, technology innovators, and integrated solution providers. Market consolidation trends have intensified as companies seek to expand their technological capabilities and geographic reach through strategic acquisitions and partnerships. Investment patterns show increased focus on research and development activities, particularly in areas of smart sensors, wireless communication technologies, and advanced data analytics platforms.

Market intelligence reveals several critical insights that shape the water automation and instrumentation landscape. The following key insights provide strategic understanding of market dynamics and growth opportunities:

Primary market drivers propelling the water automation and instrumentation sector encompass both immediate operational needs and long-term strategic imperatives. Water scarcity challenges represent the most significant driver, as global water stress affects approximately 40% of the world’s population, creating urgent demand for efficient water management solutions. This scarcity drives investment in technologies that maximize water recovery, minimize waste, and optimize distribution efficiency.

Regulatory compliance requirements constitute another fundamental driver, with increasingly stringent water quality standards and environmental protection regulations mandating sophisticated monitoring and control capabilities. Utilities and industrial facilities must implement comprehensive instrumentation systems to ensure compliance with evolving regulatory frameworks. Infrastructure aging in developed markets creates substantial replacement and upgrade opportunities, as existing systems require modernization to meet current performance and efficiency standards.

Operational efficiency demands drive adoption of automation solutions that reduce manual intervention, minimize human error, and optimize resource utilization. Energy cost considerations have become increasingly important, with water treatment operations seeking to reduce energy consumption through intelligent control systems. Digital transformation initiatives across the water industry create demand for integrated platforms that provide comprehensive visibility and control over water management operations.

Climate change impacts including extreme weather events, changing precipitation patterns, and increased frequency of droughts necessitate adaptive water management strategies supported by advanced monitoring and control technologies. Population growth and urbanization trends increase demand for reliable water services, driving investment in scalable automation solutions.

Market constraints present significant challenges to widespread adoption of water automation and instrumentation technologies. High initial capital investment requirements represent the primary barrier, particularly for smaller utilities and developing market participants. Implementation complexity associated with integrating advanced automation systems into existing infrastructure creates technical and operational challenges that can delay project timelines and increase costs.

Technical expertise limitations constrain market growth, as successful deployment and maintenance of sophisticated automation systems require specialized knowledge and skills that may not be readily available in all markets. The shortage of qualified technicians and engineers capable of managing complex instrumentation systems creates operational risks and increases long-term maintenance costs. Cybersecurity concerns have emerged as a significant restraint, with increased connectivity and digitization creating potential vulnerabilities that require substantial security investments.

Regulatory uncertainties in some markets create hesitation among potential adopters, particularly regarding data privacy, system security, and compliance requirements for connected water systems. Legacy system integration challenges can significantly increase implementation complexity and costs, particularly in facilities with outdated infrastructure. Return on investment concerns affect decision-making processes, as the benefits of automation systems may not be immediately apparent or quantifiable.

Standardization issues across different technology platforms and vendors can create interoperability challenges, limiting flexibility and increasing long-term operational risks. Market fragmentation with numerous technology providers offering incompatible solutions complicates procurement decisions and system integration efforts.

Emerging opportunities in the water automation and instrumentation market present substantial growth potential across multiple dimensions. Smart city initiatives worldwide create comprehensive opportunities for integrated water management solutions that align with broader urban digitization strategies. IoT technology advancement enables cost-effective deployment of extensive sensor networks, creating opportunities for granular monitoring and control capabilities previously considered economically unfeasible.

Artificial intelligence integration represents a transformative opportunity, enabling predictive analytics, automated optimization, and intelligent decision-making capabilities that significantly enhance operational efficiency. Machine learning algorithms can analyze vast amounts of operational data to identify patterns, predict equipment failures, and optimize treatment processes. Cloud computing adoption creates opportunities for scalable, cost-effective solutions that provide advanced analytics and remote monitoring capabilities without substantial on-premise infrastructure investments.

Developing market expansion offers significant growth opportunities as emerging economies invest in water infrastructure development and modernization. These markets often lack legacy system constraints, enabling deployment of state-of-the-art automation solutions from the outset. Industrial water management presents expanding opportunities as manufacturing facilities seek to optimize water usage, reduce waste, and ensure compliance with environmental regulations.

Energy-water nexus optimization creates opportunities for integrated solutions that simultaneously optimize water and energy management, addressing dual sustainability objectives. Advanced sensor technologies, including wireless and battery-free sensors, enable monitoring in previously inaccessible locations and applications.

Market dynamics in the water automation and instrumentation sector reflect complex interactions between technological advancement, regulatory evolution, and operational requirements. The convergence of multiple technology trends including IoT, artificial intelligence, and cloud computing has fundamentally altered market dynamics, creating new value propositions and competitive advantages. Technology adoption cycles have accelerated, with organizations increasingly willing to invest in advanced solutions that demonstrate clear operational benefits and regulatory compliance capabilities.

Competitive dynamics have intensified as traditional instrumentation manufacturers compete with technology companies and integrated solution providers. This competition has driven innovation and reduced costs while expanding the range of available solutions. Customer expectations have evolved significantly, with users demanding comprehensive platforms that provide end-to-end visibility and control rather than point solutions for specific applications.

Supply chain dynamics have been influenced by global semiconductor shortages and component availability challenges, affecting product development timelines and pricing strategies. However, these challenges have also accelerated innovation in alternative technologies and supply chain diversification strategies. Partnership dynamics have become increasingly important, with successful market participants forming strategic alliances to combine complementary technologies and capabilities.

Investment dynamics show increased focus on sustainability and environmental impact, with investors prioritizing solutions that demonstrate clear environmental benefits and long-term sustainability. According to MarkWide Research analysis, market dynamics indicate a shift toward integrated platforms that combine multiple functionalities rather than standalone instrumentation solutions.

Research approach for analyzing the water automation and instrumentation market employs comprehensive methodologies combining primary and secondary research techniques. Primary research involves extensive interviews with industry executives, technology providers, end-users, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of industry reports, regulatory documents, patent filings, and financial statements to validate primary findings and identify additional market intelligence.

Data collection methods include structured surveys distributed to key market participants, in-depth interviews with industry experts, and analysis of publicly available information from regulatory agencies and industry associations. Market sizing methodologies employ bottom-up and top-down approaches to ensure accuracy and reliability of market assessments. Technology assessment involves evaluation of emerging technologies, patent landscape analysis, and assessment of technology readiness levels across different application areas.

Validation processes include cross-referencing multiple data sources, expert review panels, and statistical analysis to ensure data accuracy and reliability. Regional analysis incorporates local market experts and regulatory specialists to account for regional variations in market dynamics and regulatory requirements. Forecasting methodologies employ multiple scenario analysis, considering various growth drivers and potential market disruptions to provide comprehensive market projections.

Quality assurance measures include peer review processes, data triangulation techniques, and continuous monitoring of market developments to ensure research findings remain current and accurate throughout the analysis period.

Regional market dynamics reveal significant variations in adoption patterns, growth rates, and technology preferences across different geographic markets. North America maintains market leadership with 35% market share, driven by advanced infrastructure, stringent regulatory requirements, and high technology adoption rates. The region benefits from established water utilities with substantial capital budgets and strong focus on operational efficiency and regulatory compliance.

European markets demonstrate strong growth in automation adoption, particularly in countries with advanced environmental regulations and sustainability initiatives. The European Union’s water framework directive and circular economy policies drive consistent demand for advanced monitoring and control technologies. Germany, Netherlands, and United Kingdom lead regional adoption with comprehensive smart water initiatives and substantial infrastructure investments.

Asia-Pacific region represents the fastest-growing market segment, with 12.5% annual growth rate driven by rapid urbanization, infrastructure development, and increasing water scarcity concerns. China and India lead regional growth through massive infrastructure investments and smart city initiatives. Japan and South Korea focus on advanced technology adoption and energy efficiency optimization in water operations.

Latin American markets show increasing adoption of automation technologies, particularly in Brazil, Mexico, and Chile, driven by regulatory modernization and infrastructure development needs. Middle East and Africa regions demonstrate growing interest in water automation solutions, driven by water scarcity challenges and infrastructure development initiatives. Regional preferences vary significantly, with developed markets focusing on advanced analytics and optimization while emerging markets prioritize foundational monitoring and control capabilities.

Competitive environment in the water automation and instrumentation market features diverse participants ranging from established instrumentation manufacturers to innovative technology companies and integrated solution providers. Market leadership positions are determined by technological capabilities, geographic reach, customer relationships, and ability to provide comprehensive solutions rather than individual products.

Competitive strategies increasingly focus on platform integration, data analytics capabilities, and comprehensive service offerings rather than individual product performance. Strategic partnerships and acquisitions have become common as companies seek to expand their technological capabilities and market reach.

Market segmentation analysis reveals distinct categories based on technology type, application area, end-user industry, and geographic region. Understanding these segments provides critical insights into market dynamics and growth opportunities across different market dimensions.

By Technology:

By Application:

By End-User:

SCADA systems represent the largest market segment, maintaining 42% market share due to their comprehensive monitoring and control capabilities. These systems provide centralized visibility and control over entire water management operations, making them essential for large-scale facilities. Advanced SCADA platforms now incorporate cloud connectivity, mobile access, and advanced analytics capabilities, expanding their value proposition beyond traditional monitoring functions.

Smart sensor technologies demonstrate the highest growth rates, driven by IoT adoption and wireless communication advancements. These sensors enable cost-effective deployment of extensive monitoring networks and provide real-time data for optimization algorithms. Wireless sensor networks have particular appeal in applications where traditional wired connections are impractical or cost-prohibitive.

PLC systems maintain steady demand in industrial applications where reliable, deterministic control is essential. Modern PLCs incorporate advanced communication capabilities and can integrate with higher-level systems for comprehensive automation solutions. Edge computing integration has enhanced PLC capabilities, enabling local data processing and reduced latency in critical control applications.

Communication systems have evolved significantly with the adoption of industrial IoT protocols and cybersecurity enhancements. These systems now support diverse communication requirements from real-time control to cloud-based analytics platforms. Cybersecurity integration has become a critical requirement, with communication systems incorporating advanced security features to protect against cyber threats.

Operational efficiency improvements represent the primary benefit for industry participants, with automation systems enabling significant reductions in manual labor requirements and operational costs. Advanced monitoring and control capabilities allow operators to optimize processes in real-time, reducing energy consumption and chemical usage while maintaining water quality standards. Predictive maintenance capabilities help prevent equipment failures and extend asset lifecycles, resulting in substantial cost savings and improved system reliability.

Regulatory compliance benefits include automated monitoring and reporting capabilities that ensure consistent adherence to water quality standards and environmental regulations. Comprehensive data logging and analysis capabilities provide the documentation required for regulatory reporting and audit processes. Risk mitigation through early warning systems and automated emergency responses helps prevent environmental incidents and regulatory violations.

Stakeholder benefits extend beyond operational improvements to include enhanced customer service through improved water quality and service reliability. Real-time monitoring capabilities enable rapid response to service disruptions and quality issues. Environmental benefits include reduced water waste, optimized chemical usage, and improved energy efficiency, supporting sustainability objectives and corporate social responsibility initiatives.

Financial benefits encompass both cost reduction and revenue optimization opportunities. Automation systems reduce operational costs through improved efficiency and reduced manual labor requirements while enabling better resource utilization and capacity optimization. Data-driven insights support strategic decision-making and long-term planning initiatives, helping organizations optimize their water management investments and operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the water automation and instrumentation market. Organizations are transitioning from traditional automation approaches to comprehensive digital platforms that integrate IoT sensors, cloud computing, and advanced analytics. This transformation enables new capabilities including predictive maintenance, real-time optimization, and remote operations management. Cloud-based solutions are gaining traction as they provide scalable, cost-effective alternatives to on-premise systems while enabling advanced analytics capabilities.

Artificial intelligence integration has emerged as a transformative trend, with machine learning algorithms being deployed to analyze operational data, predict equipment failures, and optimize treatment processes. AI-powered systems can identify patterns and anomalies that human operators might miss, leading to improved efficiency and reduced operational risks. Predictive analytics capabilities enable proactive maintenance strategies that prevent equipment failures and optimize maintenance schedules.

Cybersecurity enhancement has become a critical trend as water infrastructure becomes increasingly connected and digitized. Organizations are implementing comprehensive security frameworks that include network segmentation, encryption, and continuous monitoring to protect against cyber threats. Zero-trust security models are being adopted to ensure robust protection of critical water infrastructure systems.

Sustainability integration drives adoption of automation solutions that optimize energy consumption, reduce chemical usage, and minimize environmental impact. Water utilities are implementing comprehensive sustainability programs that leverage automation technologies to achieve environmental objectives while maintaining operational efficiency. Circular economy principles are influencing system design and operation strategies.

Recent industry developments demonstrate accelerating innovation and market evolution in water automation and instrumentation technologies. Major technology providers have announced significant investments in research and development activities focused on AI integration, cybersecurity enhancement, and IoT platform development. Strategic partnerships between automation companies and technology providers have intensified, creating comprehensive solution offerings that combine hardware, software, and services.

Product innovation has focused on wireless sensor technologies, edge computing capabilities, and cloud-based analytics platforms. Several companies have launched next-generation SCADA systems that incorporate machine learning algorithms and predictive analytics capabilities. Acquisition activities have increased as companies seek to expand their technological capabilities and market reach through strategic acquisitions of specialized technology providers.

Regulatory developments include updated cybersecurity requirements for water infrastructure and enhanced environmental monitoring standards. These regulatory changes are driving demand for advanced automation and monitoring capabilities. Government initiatives supporting smart city development and infrastructure modernization have created new funding opportunities for water automation projects.

Technology standardization efforts have progressed with industry organizations developing common protocols and standards for water automation systems. These standardization initiatives aim to improve interoperability and reduce integration complexity. MWR analysis indicates that industry consolidation trends are likely to continue as companies seek to achieve scale and technological breadth.

Strategic recommendations for market participants emphasize the importance of platform integration and comprehensive solution development. Companies should focus on developing integrated platforms that combine multiple automation functions rather than standalone products. Technology investment priorities should include AI and machine learning capabilities, cybersecurity enhancements, and cloud-based platform development to remain competitive in the evolving market landscape.

Market entry strategies for new participants should focus on niche applications or geographic markets where established players have limited presence. Partnerships with local system integrators and technology providers can provide market access and implementation capabilities. Customer engagement approaches should emphasize total cost of ownership benefits and long-term value propositions rather than initial product costs.

Investment recommendations include prioritizing research and development activities in emerging technologies while maintaining strong capabilities in core automation functions. Companies should consider strategic acquisitions to acquire specialized technologies or expand geographic reach. Service capabilities development is essential as customers increasingly demand comprehensive support and maintenance services.

Risk management strategies should address cybersecurity threats, technology obsolescence, and regulatory changes through comprehensive planning and investment in adaptive technologies. Organizations should develop robust cybersecurity frameworks and maintain flexibility to adapt to changing regulatory requirements. MarkWide Research recommends focusing on sustainability and environmental benefits as key differentiators in competitive markets.

Market projections indicate continued strong growth in the water automation and instrumentation sector, driven by fundamental trends including water scarcity, infrastructure modernization, and digital transformation initiatives. The market is expected to maintain robust growth rates of 8.5% CAGR over the next five years, with particular strength in emerging markets and advanced technology segments. Technology evolution will continue to drive market expansion as new capabilities enable previously uneconomical applications and use cases.

Emerging technologies including 5G connectivity, edge computing, and advanced AI algorithms will create new market opportunities and value propositions. These technologies will enable more sophisticated monitoring and control capabilities while reducing costs and complexity. Sustainability requirements will become increasingly important drivers of market demand as organizations seek to achieve environmental objectives and regulatory compliance.

Geographic expansion opportunities remain substantial, particularly in developing markets where infrastructure investment is accelerating. Smart city initiatives worldwide will create comprehensive opportunities for integrated water management solutions. Industry consolidation is expected to continue as companies seek to achieve scale and technological breadth necessary to compete in the evolving market.

Long-term outlook suggests transformation of the water industry toward fully integrated, intelligent water management ecosystems that optimize resource utilization, minimize environmental impact, and ensure reliable service delivery. The convergence of water, energy, and environmental management will create new market categories and opportunities for comprehensive solution providers.

Market analysis reveals the water automation and instrumentation sector as a dynamic, rapidly evolving market with substantial growth potential driven by fundamental global trends. The convergence of water scarcity challenges, regulatory requirements, and technological advancement creates a compelling market environment for innovative automation solutions. Technology integration has emerged as the primary differentiator, with successful market participants leveraging IoT, AI, and cloud computing to deliver comprehensive water management platforms.

Strategic opportunities abound for companies that can effectively combine hardware, software, and services into integrated solutions that address the complete spectrum of water management challenges. The market rewards innovation, particularly in areas of predictive analytics, cybersecurity, and sustainability optimization. Regional variations in market development provide diverse opportunities for different strategic approaches and technology solutions.

Future success in the water automation and instrumentation market will depend on the ability to adapt to rapidly evolving technology landscapes while maintaining focus on fundamental customer needs for reliable, efficient, and compliant water management operations. The market presents exceptional opportunities for organizations that can navigate the complex intersection of technology innovation, regulatory compliance, and operational excellence in the critical water infrastructure sector.

What is Water Automation And Instrumentation?

Water Automation And Instrumentation refers to the technologies and systems used to control and monitor water processes, including treatment, distribution, and usage. This encompasses various tools and techniques that enhance efficiency and reliability in water management.

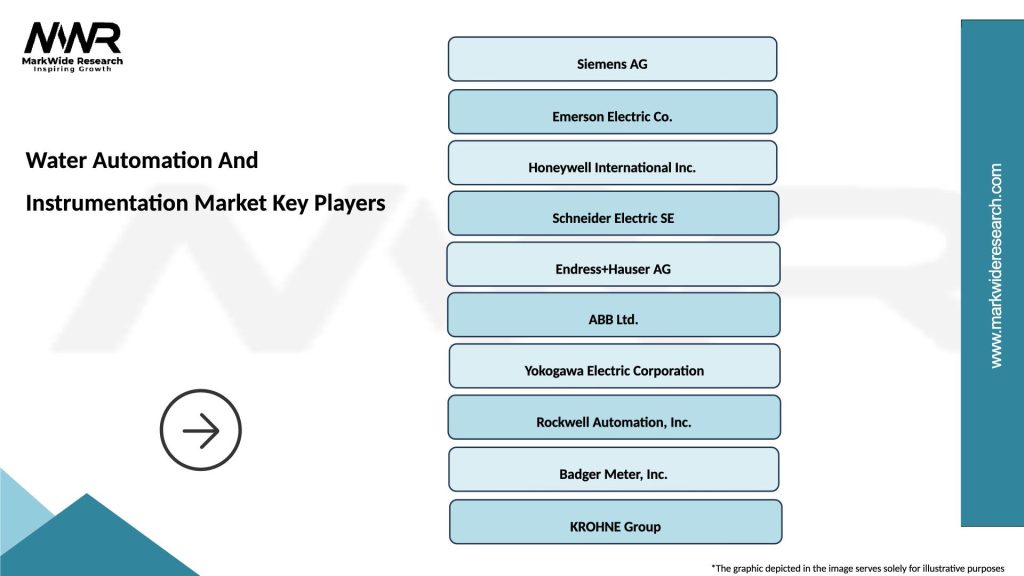

What are the key players in the Water Automation And Instrumentation Market?

Key players in the Water Automation And Instrumentation Market include Siemens AG, Schneider Electric, and Honeywell International Inc. These companies are known for their innovative solutions in water management and automation technologies, among others.

What are the main drivers of the Water Automation And Instrumentation Market?

The main drivers of the Water Automation And Instrumentation Market include the increasing demand for efficient water management solutions, the need for regulatory compliance in water quality, and advancements in IoT technologies that enhance monitoring capabilities.

What challenges does the Water Automation And Instrumentation Market face?

Challenges in the Water Automation And Instrumentation Market include high initial investment costs, the complexity of integrating new technologies with existing systems, and the need for skilled personnel to manage advanced automation solutions.

What opportunities exist in the Water Automation And Instrumentation Market?

Opportunities in the Water Automation And Instrumentation Market include the growing focus on sustainable water practices, the expansion of smart city initiatives, and the increasing adoption of cloud-based solutions for real-time data analytics.

What trends are shaping the Water Automation And Instrumentation Market?

Trends shaping the Water Automation And Instrumentation Market include the rise of smart water networks, the integration of AI and machine learning for predictive maintenance, and the increasing use of remote monitoring technologies to enhance operational efficiency.

Water Automation And Instrumentation Market

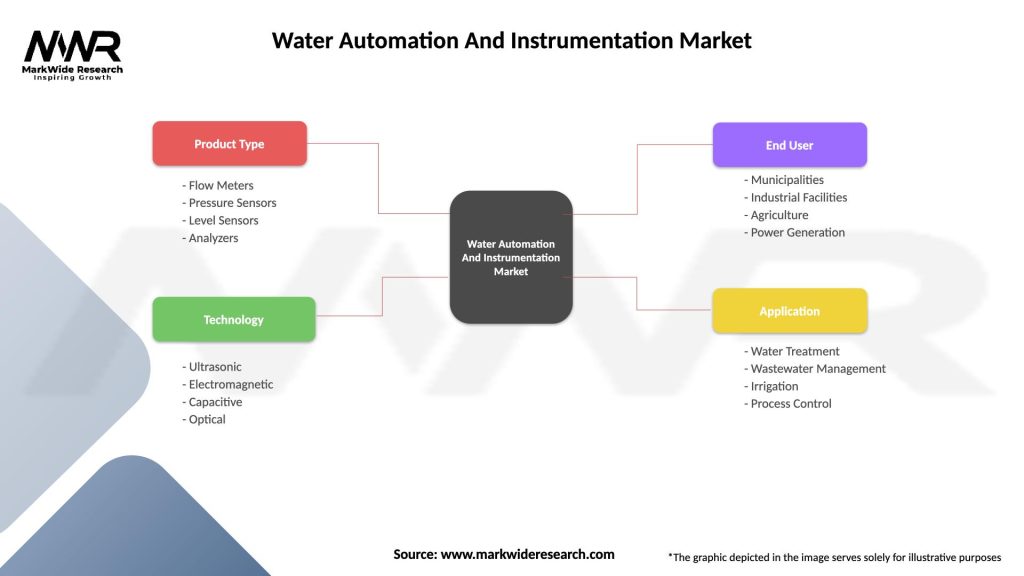

| Segmentation Details | Description |

|---|---|

| Product Type | Flow Meters, Pressure Sensors, Level Sensors, Analyzers |

| Technology | Ultrasonic, Electromagnetic, Capacitive, Optical |

| End User | Municipalities, Industrial Facilities, Agriculture, Power Generation |

| Application | Water Treatment, Wastewater Management, Irrigation, Process Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Water Automation And Instrumentation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at