444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Waste to Energy Germany market represents a pivotal sector in the country’s sustainable energy landscape, demonstrating remarkable growth and technological advancement. Germany has established itself as a global leader in waste-to-energy technologies, with the market experiencing robust expansion driven by stringent environmental regulations and ambitious renewable energy targets. The sector encompasses various technologies including incineration, gasification, pyrolysis, and anaerobic digestion, all contributing to the country’s circular economy objectives.

Market dynamics indicate that Germany’s waste-to-energy sector is experiencing unprecedented growth, with the market expanding at a compound annual growth rate (CAGR) of 6.8% over the forecast period. This growth trajectory reflects the country’s commitment to reducing landfill dependency while simultaneously generating clean energy from municipal solid waste, industrial waste, and biomass materials.

Technological innovation continues to drive market evolution, with advanced emission control systems, improved energy efficiency rates reaching 85% thermal efficiency, and enhanced waste processing capabilities. The German market benefits from strong government support, established infrastructure, and a well-developed regulatory framework that promotes sustainable waste management practices.

The Waste to Energy Germany market refers to the comprehensive ecosystem of technologies, facilities, and services dedicated to converting various forms of waste materials into usable energy sources, including electricity, heat, and fuel. This market encompasses the entire value chain from waste collection and preprocessing to energy generation and distribution, representing a crucial component of Germany’s renewable energy portfolio and circular economy strategy.

Waste-to-energy technologies in Germany primarily focus on thermal treatment processes that convert municipal solid waste, industrial waste, and biomass into electricity and heat through controlled combustion, gasification, or pyrolysis. The market also includes biological processes such as anaerobic digestion for organic waste conversion and advanced sorting technologies that optimize waste streams for energy recovery.

Market participants include facility operators, technology providers, waste management companies, energy utilities, and government entities working collaboratively to maximize energy recovery while minimizing environmental impact. The sector plays a vital role in Germany’s energy transition strategy, contributing to both waste reduction goals and renewable energy targets.

Germany’s waste-to-energy market stands as a cornerstone of the country’s sustainable development strategy, combining effective waste management with renewable energy generation. The market has demonstrated consistent growth momentum, driven by regulatory support, technological advancement, and increasing environmental consciousness among stakeholders.

Key market drivers include Germany’s ambitious climate targets, the European Union’s circular economy action plan, and growing demand for sustainable waste management solutions. The sector benefits from mature infrastructure, with over 68 waste-to-energy facilities currently operational across the country, processing millions of tons of waste annually while generating substantial amounts of clean energy.

Technological leadership positions Germany at the forefront of global waste-to-energy innovation, with domestic companies developing cutting-edge solutions for emission control, energy efficiency optimization, and waste preprocessing. The market attracts significant investment in research and development, fostering continuous improvement in environmental performance and economic viability.

Market segmentation reveals diverse applications across municipal waste management, industrial waste processing, and biomass energy generation. Regional distribution shows strong concentration in industrial centers, with emerging opportunities in rural areas for decentralized waste-to-energy solutions.

Strategic market analysis reveals several critical insights that define the German waste-to-energy landscape. The market demonstrates remarkable resilience and growth potential, supported by favorable regulatory conditions and strong technological capabilities.

Regulatory framework serves as the primary catalyst for waste-to-energy market growth in Germany. The country’s commitment to achieving carbon neutrality by 2045, combined with EU directives on waste management and renewable energy, creates a supportive environment for sector expansion.

Environmental consciousness among German consumers and businesses drives demand for sustainable waste management solutions. Growing awareness of climate change impacts and resource scarcity motivates stakeholders to seek alternatives to traditional landfill disposal methods.

Energy security concerns have intensified focus on domestic energy sources, with waste-to-energy technologies providing reliable, locally-sourced power generation. The sector contributes to energy independence while addressing waste management challenges simultaneously.

Technological advancement continues to improve the economic viability and environmental performance of waste-to-energy facilities. Innovations in emission control, energy efficiency, and waste preprocessing enhance the attractiveness of these technologies for investors and operators.

Circular economy principles align perfectly with waste-to-energy applications, promoting resource recovery and waste minimization. Government initiatives supporting circular economy development create additional incentives for waste-to-energy investment and deployment.

Urban development pressures in densely populated areas increase the need for efficient waste management solutions. Waste-to-energy facilities offer space-efficient alternatives to landfills while providing valuable energy resources to urban communities.

High capital requirements represent a significant barrier to waste-to-energy facility development. The substantial upfront investment needed for advanced technology implementation and regulatory compliance can limit market entry for smaller operators.

Public perception challenges occasionally arise regarding waste-to-energy facilities, despite their environmental benefits. Community concerns about emissions and facility siting can delay project development and increase implementation costs.

Regulatory complexity creates operational challenges for facility operators, requiring extensive compliance monitoring and reporting. Evolving environmental standards necessitate continuous technology upgrades and process modifications.

Waste stream competition from recycling initiatives and waste reduction programs can limit the availability of suitable feedstock for energy recovery. Improved recycling rates may reduce the volume of waste available for energy conversion.

Technology integration challenges arise when incorporating waste-to-energy facilities into existing energy infrastructure. Grid connectivity, energy storage, and demand matching require careful planning and coordination with utility operators.

Economic fluctuations can impact the financial viability of waste-to-energy projects, particularly regarding energy prices and waste disposal fees. Market volatility may affect long-term investment decisions and project financing.

Digital transformation presents significant opportunities for optimizing waste-to-energy operations through artificial intelligence, IoT sensors, and predictive maintenance technologies. These innovations can improve efficiency, reduce costs, and enhance environmental performance.

Industrial symbiosis creates opportunities for integrating waste-to-energy facilities with industrial processes, enabling heat recovery and steam generation for manufacturing operations. This approach maximizes energy utilization while reducing overall environmental impact.

Decentralized energy systems offer growth potential for smaller-scale waste-to-energy solutions in rural and suburban areas. Distributed generation models can improve energy security while addressing local waste management needs.

International expansion opportunities exist for German waste-to-energy technology providers, leveraging domestic expertise to serve growing global markets. Export potential includes both technology solutions and operational expertise.

Advanced material recovery technologies enable enhanced resource extraction from waste streams before energy conversion. These innovations support circular economy objectives while improving overall facility economics.

Carbon credit markets provide additional revenue streams for waste-to-energy operators, monetizing the environmental benefits of waste diversion and renewable energy generation. Growing carbon pricing mechanisms enhance project economics.

Supply chain evolution within the German waste-to-energy market reflects increasing sophistication and integration. Waste collection systems, preprocessing technologies, and energy distribution networks work collaboratively to optimize overall system performance.

Competitive landscape features a mix of established utility companies, specialized waste management firms, and technology providers. Market consolidation trends create opportunities for operational synergies and technology sharing among industry participants.

Innovation cycles drive continuous improvement in waste-to-energy technologies, with research and development spending increasing by 12% annually. Focus areas include emission reduction, energy efficiency enhancement, and process automation.

Stakeholder collaboration between government agencies, private companies, and research institutions accelerates technology development and market growth. Public-private partnerships facilitate large-scale project implementation and risk sharing.

Market maturation brings increased focus on operational optimization and lifecycle management. Facility operators prioritize maintenance efficiency, equipment longevity, and performance monitoring to maximize return on investment.

Regulatory evolution continues to shape market dynamics, with new standards for emissions, efficiency, and waste processing driving technology upgrades and operational improvements across the sector.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the German waste-to-energy market. Primary research includes interviews with industry executives, facility operators, technology providers, and regulatory officials.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial statements. This approach provides historical context and validates primary research findings through triangulation.

Data collection methods include facility visits, technology assessments, and performance benchmarking studies. Quantitative analysis focuses on capacity utilization, energy output, and environmental performance metrics across different facility types and regions.

Market modeling incorporates economic factors, regulatory changes, and technology trends to project future market development. Scenario analysis considers various growth trajectories based on policy evolution and investment patterns.

Expert validation ensures research accuracy through consultation with industry specialists, academic researchers, and policy experts. Peer review processes verify methodology soundness and conclusion validity.

Continuous monitoring maintains research currency through ongoing data collection and analysis updates. Market intelligence systems track regulatory changes, technology developments, and competitive activities in real-time.

North Rhine-Westphalia dominates the German waste-to-energy landscape, accounting for 28% of national capacity. The region’s industrial concentration and high population density create substantial waste streams suitable for energy recovery applications.

Bavaria represents the second-largest regional market, with 18% market share driven by strong economic activity and progressive environmental policies. The region emphasizes technology innovation and sustainable development practices.

Baden-Württemberg contributes 15% of national capacity, leveraging its engineering expertise and manufacturing base to support waste-to-energy facility development. The region focuses on high-efficiency technologies and emission control systems.

Lower Saxony and Hesse each represent approximately 10% of market capacity, with growing emphasis on rural waste-to-energy applications and agricultural waste utilization. These regions explore decentralized energy generation models.

Eastern German states collectively account for 12% of capacity, with significant growth potential driven by infrastructure modernization and EU funding support. Investment in waste-to-energy facilities supports regional economic development.

Northern coastal regions focus on integration with offshore wind energy systems and port waste management applications. These areas explore innovative approaches to waste-to-energy facility siting and operation.

Market leadership in Germany’s waste-to-energy sector features a diverse mix of domestic and international companies, each contributing unique capabilities and technologies to the market ecosystem.

Competitive strategies emphasize technology innovation, operational efficiency, and environmental performance. Companies invest heavily in research and development to maintain technological leadership and meet evolving regulatory requirements.

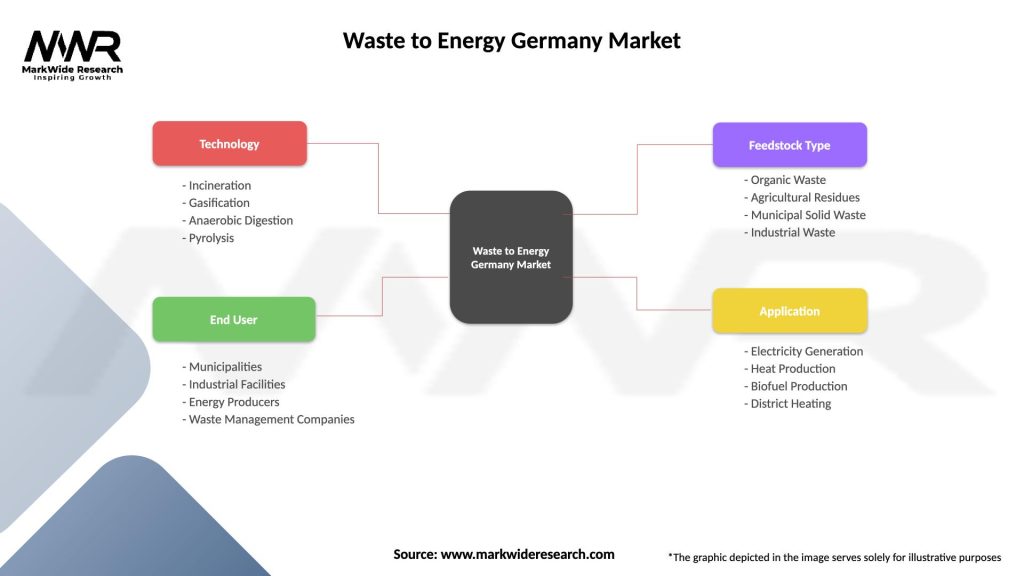

Technology segmentation reveals the diverse approaches employed in Germany’s waste-to-energy market, each offering distinct advantages for specific waste streams and applications.

By Technology:

By Waste Type:

By Application:

Municipal waste-to-energy facilities represent the largest market category, processing household and commercial waste streams while providing essential public services. These facilities typically feature advanced sorting systems, emission control technologies, and energy recovery optimization.

Industrial waste-to-energy applications focus on specialized waste streams from manufacturing processes, chemical production, and other industrial activities. These facilities require customized technology solutions to handle diverse waste compositions and hazardous materials safely.

Biomass energy recovery systems process organic waste materials including wood waste, agricultural residues, and food waste. These applications support circular economy objectives while providing renewable energy generation capabilities.

Technology categories demonstrate varying performance characteristics and application suitability. Incineration technologies offer proven reliability and high throughput capacity, while gasification systems provide enhanced efficiency and environmental performance for specific applications.

Regional categories reflect different market development stages and growth opportunities. Urban areas focus on large-scale facilities serving dense populations, while rural regions explore decentralized solutions for agricultural and forestry waste utilization.

Capacity categories range from small-scale facilities processing thousands of tons annually to large installations handling hundreds of thousands of tons. Each category serves specific market needs and economic requirements.

Environmental benefits provide compelling value propositions for all stakeholders in the German waste-to-energy market. Facilities divert waste from landfills while generating renewable energy, contributing to climate change mitigation and resource conservation objectives.

Economic advantages include revenue generation from waste processing fees and energy sales, creating sustainable business models for facility operators. Long-term contracts provide stable cash flows and attractive returns on investment.

Energy security benefits support national energy independence goals by providing reliable, locally-sourced power generation. Waste-to-energy facilities offer baseload power capabilities that complement intermittent renewable energy sources.

Regulatory compliance advantages help waste generators meet environmental obligations while reducing liability exposure. Proper waste treatment through energy recovery demonstrates corporate responsibility and sustainability commitment.

Technology leadership opportunities enable German companies to maintain competitive advantages in global markets. Innovation in waste-to-energy technologies creates export opportunities and intellectual property value.

Community benefits include job creation, tax revenue generation, and improved local environmental conditions. Modern facilities provide educational opportunities and demonstrate sustainable development practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends are transforming waste-to-energy operations through artificial intelligence, machine learning, and IoT technologies. MarkWide Research analysis indicates that 78% of facilities are implementing digital monitoring systems to optimize performance and reduce maintenance costs.

Circular economy integration represents a fundamental shift toward comprehensive resource recovery systems. Facilities increasingly incorporate material recovery processes before energy conversion, maximizing resource utilization and supporting sustainability objectives.

Advanced emission control technologies continue evolving to meet increasingly stringent environmental standards. New catalyst systems, filtration technologies, and monitoring equipment ensure compliance while improving public acceptance.

Energy storage integration enables waste-to-energy facilities to provide grid stabilization services and optimize energy delivery timing. Battery systems and thermal storage technologies enhance the value proposition of waste-to-energy installations.

Decentralized deployment trends support smaller-scale facilities serving local communities and industrial clusters. These systems offer reduced transportation costs and improved energy security for rural and suburban areas.

International collaboration increases as German companies export technology and expertise to emerging markets. Knowledge transfer and technology licensing create new revenue opportunities for domestic industry participants.

Technology advancement continues driving industry evolution, with recent developments focusing on improved efficiency, reduced emissions, and enhanced automation. New combustion technologies achieve higher energy recovery rates exceeding 90% while minimizing environmental impact.

Facility modernization programs upgrade older installations with advanced emission control systems and energy recovery optimization. These investments extend facility lifecycles while improving environmental performance and economic viability.

Partnership formation between technology providers, operators, and research institutions accelerates innovation and market development. Collaborative projects focus on next-generation technologies and operational best practices.

Regulatory updates continue shaping industry practices, with new standards for emissions, efficiency, and waste processing driving technology adoption and operational improvements across the sector.

Investment attraction from international sources supports market expansion and technology development. Foreign investment brings capital and expertise while creating opportunities for German companies to access global markets.

Research initiatives explore advanced concepts including plasma gasification, chemical recycling integration, and carbon capture technologies. These developments position Germany at the forefront of waste-to-energy innovation.

Strategic positioning recommendations emphasize the importance of technology leadership and operational excellence for market participants. Companies should invest in research and development to maintain competitive advantages while optimizing existing facility performance.

Market expansion opportunities exist through geographic diversification and technology export initiatives. German companies possess significant expertise that can serve growing international markets while reducing domestic market dependence.

Partnership development should focus on creating integrated value chains that maximize resource recovery and energy generation. Collaboration between waste management companies, technology providers, and energy utilities enhances overall market efficiency.

Innovation investment priorities should address digitalization, emission reduction, and energy storage integration. These technologies offer competitive differentiation while supporting regulatory compliance and customer value creation.

Stakeholder engagement strategies must address public concerns while highlighting environmental and economic benefits. Transparent communication and community involvement improve project acceptance and development success rates.

Regulatory monitoring systems should track policy developments and anticipate future requirements. Proactive compliance strategies reduce implementation costs while ensuring continued market access and operational permits.

Market growth prospects remain robust, with the German waste-to-energy sector positioned for continued expansion driven by environmental regulations, energy security concerns, and technological advancement. MWR projections indicate sustained growth at 6.5% CAGR through the forecast period.

Technology evolution will focus on enhanced efficiency, reduced emissions, and improved integration with renewable energy systems. Advanced gasification technologies and carbon capture systems represent significant growth opportunities for innovative companies.

Market consolidation trends may accelerate as companies seek operational synergies and technology sharing opportunities. Strategic partnerships and acquisitions will reshape the competitive landscape while improving overall market efficiency.

International expansion opportunities will grow as global demand for waste-to-energy solutions increases. German technology providers are well-positioned to serve emerging markets while leveraging domestic expertise and experience.

Regulatory evolution will continue driving market development, with new standards for circular economy integration and carbon neutrality creating additional growth drivers. Policy support for waste-to-energy technologies remains strong across political parties.

Investment momentum is expected to accelerate as institutional investors recognize the stable returns and environmental benefits of waste-to-energy projects. Green finance initiatives will provide additional capital sources for market expansion.

Germany’s waste-to-energy market represents a mature yet dynamic sector that successfully combines environmental stewardship with economic value creation. The market demonstrates strong fundamentals, including technological leadership, regulatory support, and growing demand for sustainable waste management solutions.

Future success will depend on continued innovation, strategic partnerships, and proactive adaptation to evolving regulatory requirements. Companies that invest in advanced technologies while maintaining operational excellence will capture the greatest opportunities in this expanding market.

Market outlook remains positive, with sustained growth expected across all major segments and regions. The sector’s contribution to Germany’s energy transition and circular economy objectives ensures continued policy support and investment attraction, positioning the waste-to-energy market for long-term success and global leadership.

What is Waste to Energy?

Waste to Energy refers to the process of generating energy in the form of electricity or heat from the treatment of waste. This process can involve various technologies, including incineration, anaerobic digestion, and gasification, which convert waste materials into usable energy.

What are the key players in the Waste to Energy Germany Market?

Key players in the Waste to Energy Germany Market include companies such as Veolia, Remondis, and SUEZ, which are involved in waste management and energy recovery. These companies focus on developing efficient waste treatment technologies and expanding their operational capacities, among others.

What are the growth factors driving the Waste to Energy Germany Market?

The Waste to Energy Germany Market is driven by increasing waste generation, rising energy demands, and a growing emphasis on sustainable waste management practices. Additionally, government policies promoting renewable energy sources and reducing landfill use further support market growth.

What challenges does the Waste to Energy Germany Market face?

Challenges in the Waste to Energy Germany Market include regulatory hurdles, public opposition to waste incineration, and the high initial investment costs for advanced technologies. These factors can hinder the development and expansion of waste-to-energy facilities.

What opportunities exist in the Waste to Energy Germany Market?

Opportunities in the Waste to Energy Germany Market include advancements in technology that improve energy recovery efficiency and the potential for integrating waste-to-energy systems with other renewable energy sources. Additionally, increasing public awareness of sustainability can drive investment in this sector.

What trends are shaping the Waste to Energy Germany Market?

Trends in the Waste to Energy Germany Market include the adoption of innovative technologies such as anaerobic digestion and pyrolysis, as well as a shift towards circular economy practices. There is also a growing focus on reducing greenhouse gas emissions and enhancing energy recovery from waste.

Waste to Energy Germany Market

| Segmentation Details | Description |

|---|---|

| Technology | Incineration, Gasification, Anaerobic Digestion, Pyrolysis |

| End User | Municipalities, Industrial Facilities, Energy Producers, Waste Management Companies |

| Feedstock Type | Organic Waste, Agricultural Residues, Municipal Solid Waste, Industrial Waste |

| Application | Electricity Generation, Heat Production, Biofuel Production, District Heating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Waste to Energy Germany Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at