444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Wafer Carrier Boxes market is a critical segment within the semiconductor industry, essential for the safe handling, storage, and transportation of delicate wafers used in semiconductor manufacturing processes. These specialized containers are designed to protect semiconductor wafers from contamination, physical damage, and electrostatic discharge (ESD) during various stages of production, testing, and packaging. Wafer carrier boxes ensure the integrity and reliability of semiconductor devices, supporting high-yield manufacturing and stringent quality standards.

Meaning

Wafer Carrier Boxes are precision-engineered containers specifically designed to house semiconductor wafers securely. They feature sophisticated materials such as conductive plastics or polymers with dissipative properties to mitigate ESD risks. These boxes incorporate advanced locking mechanisms and ergonomic designs to facilitate safe handling and efficient storage of wafers within cleanroom environments, ensuring minimal particle generation and maximum protection against environmental hazards.

Executive Summary

The Wafer Carrier Boxes market is witnessing steady growth driven by increasing semiconductor production, advancements in wafer handling technologies, and stringent quality control measures. Key market players are focusing on innovation in box design, material advancements, and customization capabilities to meet diverse customer requirements and maintain competitive advantage.

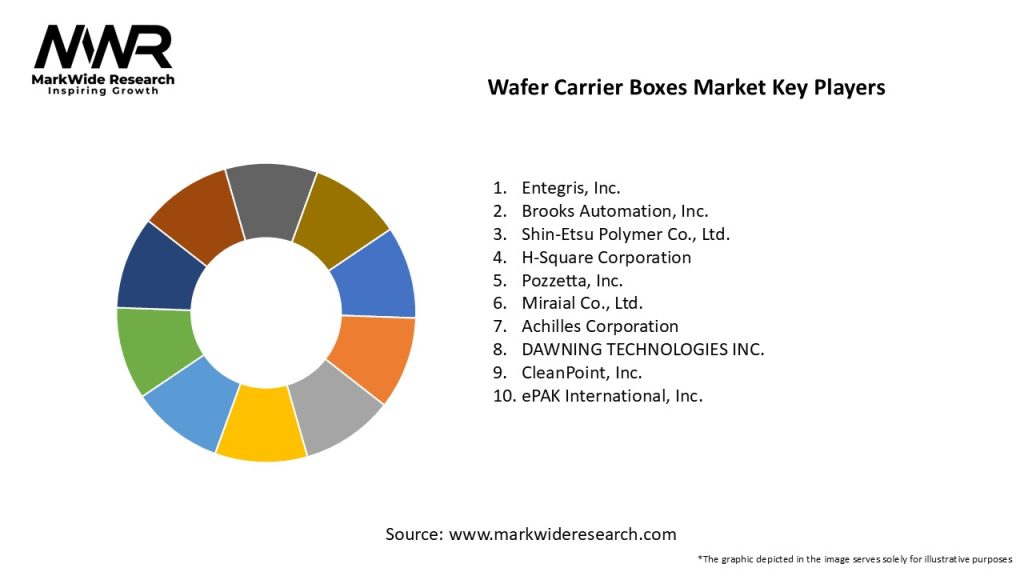

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Wafer Carrier Boxes market is characterized by technological innovation, stringent quality standards, and growing demand for high-performance semiconductor packaging solutions. Market participants are leveraging strategic partnerships, R&D investments, and geographic expansion to capitalize on emerging opportunities and sustain competitive advantage.

Regional Analysis

Competitive Landscape

Leading Companies in the Wafer Carrier Boxes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Wafer Carrier Boxes market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The Wafer Carrier Boxes market is poised for significant growth driven by technological advancements, increasing semiconductor production capacities, and the adoption of smart manufacturing initiatives globally. Market players that innovate, collaborate, and align with sustainability goals will capitalize on emerging opportunities and shape the future of semiconductor packaging solutions.

Conclusion

Wafer Carrier Boxes are indispensable components in semiconductor manufacturing, ensuring the safe handling, storage, and transportation of critical wafers used in electronic devices. With ongoing advancements in materials, technologies, and regulatory compliance, stakeholders are well-positioned to meet evolving industry demands, drive innovation, and foster sustainable growth in the global semiconductor packaging market.

What is Wafer Carrier Boxes?

Wafer carrier boxes are specialized containers designed to hold and protect semiconductor wafers during transportation and storage. They are essential in the semiconductor manufacturing process to prevent contamination and damage to the delicate wafers.

What are the key companies in the Wafer Carrier Boxes Market?

Key companies in the Wafer Carrier Boxes Market include Entegris, Inc., CMC Materials, and Shin-Etsu Chemical Co., Ltd., among others.

What are the growth factors driving the Wafer Carrier Boxes Market?

The growth of the Wafer Carrier Boxes Market is driven by the increasing demand for semiconductors in various applications such as consumer electronics, automotive, and telecommunications. Additionally, advancements in wafer fabrication technologies are contributing to market expansion.

What challenges does the Wafer Carrier Boxes Market face?

The Wafer Carrier Boxes Market faces challenges such as the high cost of advanced materials and the need for stringent quality control measures. Furthermore, fluctuations in semiconductor demand can impact the market stability.

What opportunities exist in the Wafer Carrier Boxes Market?

Opportunities in the Wafer Carrier Boxes Market include the development of innovative materials that enhance wafer protection and the expansion of the semiconductor industry in emerging markets. Additionally, the rise of electric vehicles is expected to increase demand for advanced semiconductor packaging solutions.

What trends are shaping the Wafer Carrier Boxes Market?

Trends in the Wafer Carrier Boxes Market include the shift towards automation in semiconductor manufacturing and the increasing focus on sustainability through the use of recyclable materials. Moreover, the integration of smart technologies in packaging solutions is gaining traction.

Wafer Carrier Boxes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Carrier, Customized Carrier, Stackable Carrier, Anti-Static Carrier |

| Material | Polypropylene, Polycarbonate, Aluminum, Steel |

| End User | Semiconductor Manufacturers, Electronics Companies, Research Institutions, Aerospace Firms |

| Size | 200mm, 300mm, 450mm, 600mm |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Wafer Carrier Boxes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at