444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The vitamin fortified and mineral enriched food & beverage market represents a rapidly expanding sector within the global nutrition industry, driven by increasing consumer awareness of health and wellness. This dynamic market encompasses a wide range of products including fortified cereals, enriched dairy products, functional beverages, and nutritionally enhanced snacks that have been supplemented with essential vitamins and minerals to address nutritional deficiencies and promote optimal health outcomes.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% as consumers increasingly prioritize preventive healthcare through nutrition. The market spans multiple product categories, from traditional breakfast cereals fortified with B-vitamins and iron to innovative functional beverages enriched with vitamin D and calcium. Regional adoption rates vary significantly, with North America and Europe leading in market penetration at 42% and 35% respectively, while Asia-Pacific emerges as the fastest-growing region with accelerated adoption rates of 8.2% annually.

Consumer behavior patterns reveal a fundamental shift toward proactive health management, with 73% of consumers actively seeking fortified products to supplement their daily nutritional intake. This trend is particularly pronounced among health-conscious millennials and aging populations who recognize the importance of micronutrient adequacy in maintaining long-term wellness and preventing chronic diseases.

The vitamin fortified and mineral enriched food & beverage market refers to the comprehensive industry segment focused on the production, distribution, and consumption of food and beverage products that have been deliberately enhanced with additional vitamins, minerals, or other essential nutrients beyond their natural content to improve nutritional value and address specific dietary deficiencies.

Fortification processes involve the systematic addition of micronutrients to food products during manufacturing, while enrichment typically refers to the restoration of nutrients lost during processing. These enhancement techniques serve multiple purposes: addressing population-wide nutritional deficiencies, supporting specific demographic health needs, and providing convenient nutrition solutions for busy lifestyles. Product categories within this market include breakfast cereals, dairy products, beverages, baked goods, snack foods, and infant nutrition products.

Regulatory frameworks govern the fortification and enrichment processes, ensuring safety standards and accurate labeling while preventing over-fortification that could lead to nutrient toxicity. The market operates under strict guidelines established by food safety authorities worldwide, creating standardized approaches to nutrient enhancement that protect consumer health while enabling innovation in functional food development.

Market expansion in the vitamin fortified and mineral enriched food & beverage sector reflects a convergence of health awareness trends, demographic shifts, and technological advancement in food processing. The industry has evolved from basic nutrient addition to sophisticated functional food development that targets specific health outcomes and consumer preferences.

Key growth drivers include rising healthcare costs prompting preventive nutrition approaches, increasing prevalence of micronutrient deficiencies globally, and growing consumer sophistication regarding nutritional science. The market benefits from strong regulatory support for public health initiatives, with governments worldwide implementing fortification mandates for staple foods to address population-wide nutritional challenges.

Innovation trends focus on bioavailability enhancement, natural fortification sources, and personalized nutrition solutions. Companies are investing heavily in research and development to create products that not only deliver essential nutrients but also optimize absorption and minimize taste impact. Market penetration rates continue to expand, with fortified products achieving significant market share growth of 12% annually across multiple food categories.

Competitive dynamics feature both established food manufacturers and specialized nutrition companies competing through product innovation, strategic partnerships, and targeted marketing campaigns. The market landscape includes multinational corporations leveraging economies of scale alongside niche players focusing on specific consumer segments or innovative delivery mechanisms.

Consumer preferences are driving significant transformation in product development approaches, with demand shifting toward natural fortification sources and clean label formulations. Market research reveals distinct consumption patterns across demographic segments, with families with children showing highest adoption rates at 68% for fortified breakfast products.

Market segmentation reveals diverse opportunities across product categories, with beverages showing particularly strong growth potential due to consumer preference for liquid nutrition delivery systems. Distribution channels are expanding beyond traditional grocery retail to include online platforms, specialty health stores, and direct-to-consumer models.

Rising health awareness serves as the primary catalyst for market expansion, with consumers increasingly recognizing the connection between nutrition and long-term health outcomes. This awareness is supported by extensive research demonstrating the role of micronutrients in preventing chronic diseases, supporting immune function, and maintaining cognitive health throughout the lifespan.

Demographic transitions create sustained demand for fortified products, particularly aging populations requiring enhanced nutrition support and growing numbers of health-conscious millennials seeking convenient wellness solutions. The increasing prevalence of dietary restrictions and lifestyle-related nutritional gaps further amplifies market demand for targeted fortification approaches.

Government initiatives worldwide promote fortification as a public health strategy, with mandatory fortification programs for staple foods addressing population-wide deficiencies in iron, folic acid, and vitamin D. These regulatory mandates create stable demand while encouraging industry investment in fortification technologies and product development.

Technological advancement enables more sophisticated fortification approaches, including microencapsulation techniques that protect nutrients during processing and storage while improving bioavailability. Innovation in natural fortification sources and sustainable production methods addresses consumer preferences for clean label products without compromising nutritional efficacy.

Healthcare cost pressures drive consumer interest in preventive nutrition approaches, with fortified foods positioned as cost-effective alternatives to dietary supplements. The growing body of evidence supporting the economic benefits of adequate nutrition in preventing healthcare costs creates favorable conditions for market expansion across all demographic segments.

Regulatory complexity presents significant challenges for manufacturers navigating diverse international standards for fortification levels, labeling requirements, and safety protocols. Compliance costs and lengthy approval processes can limit innovation speed and market entry for smaller companies, creating barriers to competition and product diversity.

Consumer skepticism regarding artificial additives and processed foods creates resistance to fortified products among certain demographic segments. The perception that fortification indicates inferior base nutrition or excessive processing can limit market penetration, particularly among consumers preferring whole food nutrition approaches.

Technical challenges in fortification include nutrient stability issues, taste and texture impacts, and bioavailability concerns that can affect product quality and consumer acceptance. Achieving optimal nutrient levels without compromising sensory attributes requires sophisticated formulation expertise and can increase production costs significantly.

Cost considerations impact both manufacturers and consumers, with fortification processes adding to production expenses that must be balanced against price sensitivity in competitive markets. Premium pricing for fortified products can limit accessibility for price-conscious consumers, potentially restricting market growth in certain segments.

Market saturation in developed regions creates intense competition and margin pressure, forcing companies to invest heavily in differentiation strategies and marketing campaigns. The proliferation of fortified products across categories can lead to consumer confusion and decision fatigue, potentially slowing adoption rates for new product launches.

Emerging markets present substantial growth opportunities as rising incomes and health awareness create demand for nutritionally enhanced products. Countries experiencing rapid urbanization and dietary transitions offer particularly attractive prospects for fortified food and beverage companies seeking expansion beyond saturated developed markets.

Personalized nutrition represents a frontier opportunity, with advances in genetic testing and biomarker analysis enabling customized fortification approaches tailored to individual nutritional needs. This trend toward precision nutrition could revolutionize product development and create premium market segments with higher profit margins.

Plant-based fortification addresses growing consumer interest in sustainable and natural nutrition solutions, with opportunities to develop fortified plant-based alternatives to traditional animal-derived products. This intersection of plant-based trends and fortification technology creates innovative product categories with strong growth potential.

Digital integration enables new business models including subscription services, personalized recommendations, and direct-to-consumer distribution channels that can improve customer engagement and lifetime value. Technology platforms can also support education initiatives that increase consumer understanding of fortification benefits.

Functional beverage expansion offers significant opportunities as consumers increasingly prefer liquid nutrition delivery systems for convenience and absorption benefits. The beverage category provides flexibility for innovative formulations and flavor profiles that can attract diverse consumer segments while delivering targeted nutritional benefits.

Supply chain evolution reflects the complex requirements of fortified product manufacturing, with specialized ingredient sourcing, quality control protocols, and distribution networks designed to maintain nutrient integrity throughout the product lifecycle. Ingredient suppliers play crucial roles in providing high-quality vitamins and minerals that meet stability and bioavailability requirements.

Competitive intensity drives continuous innovation in product formulations, packaging solutions, and marketing strategies as companies seek differentiation in crowded market segments. The balance between established brands leveraging consumer trust and innovative newcomers offering novel approaches creates dynamic market conditions that benefit consumers through improved product options.

Consumer education remains critical for market development, with companies investing in awareness campaigns that explain fortification benefits and address misconceptions about processed foods. Healthcare professional endorsements and scientific research support help build credibility and drive adoption among health-conscious consumers.

Seasonal variations influence demand patterns, with immune-supporting fortified products experiencing higher sales during cold and flu seasons, while vitamin D-fortified products show increased demand during winter months. Understanding these cyclical patterns enables more effective inventory management and marketing campaign timing.

Cross-category integration creates opportunities for fortification across diverse product types, from traditional food categories to emerging functional food segments. This expansion enables companies to leverage fortification expertise across multiple product lines while addressing varied consumer preferences and consumption occasions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the vitamin fortified and mineral enriched food & beverage market. Primary research includes extensive surveys of consumers, industry stakeholders, and healthcare professionals to understand purchasing behaviors, preferences, and market trends.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic studies to provide comprehensive market context and validate primary research findings. This approach ensures robust data foundation supporting market projections and strategic recommendations.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and regional variations based on historical data and identified trend patterns. Advanced analytics help identify correlations between market drivers and performance outcomes across different product categories and geographic regions.

Qualitative assessment includes in-depth interviews with industry experts, regulatory officials, and key opinion leaders to gain insights into market dynamics, competitive strategies, and future development directions. This qualitative dimension provides context for quantitative findings and helps identify emerging opportunities and challenges.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review panels, and statistical verification methods. Regular updates and revisions maintain data currency and relevance in the rapidly evolving fortified food and beverage market landscape.

North America maintains market leadership with 42% regional market share, driven by established consumer awareness, supportive regulatory frameworks, and strong presence of major food manufacturers. The region benefits from comprehensive fortification mandates for staple foods and high consumer spending on health and wellness products.

Europe represents a mature market with 35% market share, characterized by stringent quality standards and sophisticated consumer preferences for natural and organic fortified products. The region’s focus on sustainability and clean label formulations influences product development trends and creates opportunities for premium positioning.

Asia-Pacific emerges as the fastest-growing region with 8.2% annual growth rate, fueled by rising disposable incomes, urbanization, and increasing health awareness among expanding middle-class populations. Countries like China and India present substantial opportunities for fortified product expansion, particularly in urban centers.

Latin America shows promising growth potential driven by government-supported fortification programs addressing nutritional deficiencies and growing consumer interest in functional foods. The region’s young demographic profile and increasing health consciousness create favorable conditions for market expansion.

Middle East and Africa present emerging opportunities as economic development and urbanization drive demand for convenient nutrition solutions. Government initiatives to address malnutrition and micronutrient deficiencies support market development, particularly for fortified staple foods and beverages.

Market leadership is distributed among several major players who have established strong positions through product innovation, brand recognition, and distribution capabilities. The competitive environment features both multinational corporations with diverse product portfolios and specialized companies focusing on specific fortification technologies or market segments.

Strategic partnerships between food manufacturers and ingredient suppliers enable access to advanced fortification technologies and specialized expertise. These collaborations often focus on developing innovative delivery systems, improving bioavailability, and creating cost-effective fortification solutions.

Innovation competition drives continuous product development, with companies investing heavily in research and development to create differentiated offerings that address specific consumer needs and preferences while maintaining competitive pricing structures.

Product category segmentation reveals diverse market opportunities across multiple food and beverage types, each with distinct growth patterns and consumer preferences. Understanding these segments enables targeted product development and marketing strategies that address specific market needs.

By Product Type:

By Nutrient Type:

By Distribution Channel:

Breakfast cereals continue to dominate the fortified food market, benefiting from established consumption habits and comprehensive nutrient profiles that address daily vitamin and mineral requirements. This category shows steady growth with innovation focusing on natural ingredients and reduced sugar formulations while maintaining nutritional enhancement.

Fortified beverages represent the fastest-growing category, with consumers increasingly preferring liquid nutrition delivery systems for convenience and perceived better absorption. Functional beverages targeting specific health outcomes like immune support, energy enhancement, and cognitive function show particularly strong growth potential.

Dairy products benefit from natural synergy between base nutrition and fortification, with calcium and vitamin D combinations addressing bone health concerns across age groups. Plant-based dairy alternatives create new opportunities for fortification as consumers seek nutritionally complete alternatives to traditional dairy products.

Infant and children’s nutrition products maintain premium positioning with specialized formulations addressing developmental nutritional needs. This segment shows consistent growth driven by parental concern for optimal child nutrition and willingness to invest in premium fortified products.

Snack foods emerge as an innovative category for fortification, addressing consumer desire for convenient nutrition without compromising taste or texture. Protein bars, fortified nuts, and nutritional crackers represent growing subcategories within this segment.

Manufacturers benefit from premium pricing opportunities and brand differentiation through fortification, with fortified products typically commanding 15-25% price premiums over non-fortified alternatives. The added value proposition enables stronger profit margins while addressing consumer health needs and regulatory requirements.

Retailers gain from increased consumer traffic and higher basket values as health-conscious shoppers seek fortified products across multiple categories. The growing demand for functional foods creates opportunities for category expansion and premium shelf space allocation that drives overall store profitability.

Consumers receive convenient access to essential nutrients through familiar food products, addressing nutritional gaps without requiring significant dietary changes or supplement regimens. Cost-effective nutrition delivery through fortified foods often provides better value than individual vitamin and mineral supplements.

Healthcare systems benefit from reduced costs associated with micronutrient deficiency-related health issues as fortified foods help prevent conditions like anemia, osteoporosis, and neural tube defects. Population health improvements through fortification programs demonstrate measurable public health benefits.

Ingredient suppliers experience growing demand for high-quality vitamins, minerals, and fortification technologies, creating opportunities for innovation and market expansion. Specialized ingredient companies can develop proprietary solutions that provide competitive advantages for food manufacturers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label fortification emerges as a dominant trend, with consumers demanding natural and recognizable ingredients in fortified products. This shift drives innovation toward plant-based vitamin sources, fermentation-derived nutrients, and minimal processing approaches that maintain nutritional enhancement while addressing clean eating preferences.

Personalized nutrition represents a transformative trend enabled by advances in genetic testing, biomarker analysis, and digital health platforms. Companies are developing customized fortification approaches that address individual nutritional needs based on genetic profiles, lifestyle factors, and health goals.

Sustainability integration influences ingredient sourcing, packaging decisions, and production methods as environmentally conscious consumers seek fortified products that align with their values. Sustainable fortification approaches include renewable ingredient sources and eco-friendly packaging solutions.

Functional positioning shifts focus from basic nutrition to targeted health outcomes, with fortified products designed to address specific concerns like immune support, cognitive function, and energy enhancement. This trend creates opportunities for premium positioning and specialized market segments.

Global flavor integration enables fortified products to appeal to diverse cultural preferences while maintaining nutritional benefits. International flavor profiles and ethnic food fortification create opportunities for market expansion and consumer engagement across different demographic groups.

Technological innovations in microencapsulation and nutrient delivery systems improve stability and bioavailability while minimizing taste impact. These advances enable fortification of previously challenging product categories and enhance the effectiveness of nutritional enhancement across diverse food matrices.

Strategic acquisitions and partnerships reshape the competitive landscape as major food companies acquire specialized nutrition firms and ingredient suppliers to strengthen their fortification capabilities. These consolidation trends create opportunities for innovation and market expansion while potentially limiting competition.

Regulatory harmonization efforts across international markets aim to standardize fortification requirements and labeling standards, potentially reducing compliance costs and enabling more efficient global product development and distribution strategies.

Research collaborations between food companies, academic institutions, and healthcare organizations advance understanding of optimal fortification approaches and health outcomes. According to MarkWide Research analysis, these partnerships are driving evidence-based product development and supporting regulatory approval processes.

Digital transformation initiatives include blockchain technology for supply chain transparency, artificial intelligence for personalized nutrition recommendations, and direct-to-consumer platforms that enable customized product offerings and enhanced customer engagement.

Innovation focus should prioritize natural fortification sources and clean label formulations that address consumer preferences for minimally processed foods while maintaining nutritional efficacy. Companies investing in plant-based vitamin sources and fermentation technologies are likely to gain competitive advantages in evolving market conditions.

Market expansion strategies should target emerging economies where rising incomes and health awareness create substantial growth opportunities. Localized product development that addresses specific regional nutritional needs and cultural preferences can drive successful market penetration and brand establishment.

Partnership development with healthcare professionals, nutritionists, and wellness influencers can build credibility and drive consumer education about fortification benefits. These relationships support evidence-based marketing approaches and help address consumer skepticism about processed foods.

Technology investment in personalized nutrition platforms and digital engagement tools can create differentiated value propositions and direct customer relationships. Companies developing capabilities in customized fortification and subscription-based delivery models may capture premium market segments.

Sustainability integration should encompass ingredient sourcing, packaging solutions, and production methods to align with environmental consciousness trends. MWR data suggests that sustainability credentials increasingly influence purchasing decisions across demographic segments, particularly among younger consumers.

Market trajectory indicates continued expansion driven by demographic trends, health awareness growth, and technological advancement in fortification approaches. The convergence of personalized nutrition, clean label preferences, and digital engagement creates opportunities for innovative companies to capture market share and build sustainable competitive advantages.

Demographic shifts including aging populations and health-conscious millennials will sustain demand for fortified products across diverse categories. The growing prevalence of dietary restrictions and lifestyle-related nutritional gaps creates opportunities for targeted fortification approaches that address specific consumer needs and preferences.

Technology evolution will enable more sophisticated fortification approaches, including precision nutrition delivery systems, improved bioavailability enhancement, and natural ingredient integration. These advances support product differentiation and premium positioning while addressing consumer concerns about artificial additives.

Regulatory development is expected to support continued market growth through science-based fortification guidelines and international harmonization efforts. Government recognition of fortification’s public health benefits creates favorable policy environments for industry expansion and innovation investment.

Global expansion opportunities remain substantial, particularly in emerging markets where economic development and urbanization drive demand for convenient nutrition solutions. MarkWide Research projects that developing economies will represent increasingly important growth drivers as middle-class populations expand and health awareness increases across diverse cultural contexts.

The vitamin fortified and mineral enriched food & beverage market represents a dynamic and expanding sector positioned at the intersection of nutrition science, consumer health awareness, and food technology innovation. Market growth is supported by strong fundamentals including demographic trends, regulatory support, and technological advancement that enable increasingly sophisticated fortification approaches.

Key success factors for industry participants include innovation in natural fortification sources, development of personalized nutrition solutions, and strategic expansion into emerging markets with growing health consciousness. Companies that effectively balance consumer preferences for clean label products with nutritional efficacy requirements are likely to achieve sustainable competitive advantages.

Future market development will be shaped by continued technological advancement, evolving consumer preferences, and expanding global awareness of nutrition’s role in preventive healthcare. The integration of sustainability considerations, digital engagement platforms, and evidence-based health positioning creates opportunities for differentiation and premium market positioning across diverse product categories and geographic regions.

What is Vitamin Fortified and Mineral Enriched Food & Beverage?

Vitamin Fortified and Mineral Enriched Food & Beverage refers to products that have added vitamins and minerals to enhance their nutritional value. These foods and beverages are designed to provide essential nutrients that may be lacking in a typical diet.

What are the key players in the Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Key players in the Vitamin Fortified and Mineral Enriched Food & Beverage Market include Nestlé, PepsiCo, and Danone, among others. These companies are known for their innovative product offerings and extensive distribution networks.

What are the growth factors driving the Vitamin Fortified and Mineral Enriched Food & Beverage Market?

The growth of the Vitamin Fortified and Mineral Enriched Food & Beverage Market is driven by increasing consumer awareness of health and wellness, rising demand for functional foods, and the growing prevalence of lifestyle-related diseases. Additionally, the trend towards preventive healthcare is influencing consumer choices.

What challenges does the Vitamin Fortified and Mineral Enriched Food & Beverage Market face?

The Vitamin Fortified and Mineral Enriched Food & Beverage Market faces challenges such as regulatory compliance, potential consumer skepticism regarding health claims, and competition from natural food products. These factors can impact market growth and consumer trust.

What opportunities exist in the Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Opportunities in the Vitamin Fortified and Mineral Enriched Food & Beverage Market include the development of personalized nutrition products, expansion into emerging markets, and the incorporation of innovative ingredients. These trends can help companies cater to diverse consumer needs.

What trends are shaping the Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Trends shaping the Vitamin Fortified and Mineral Enriched Food & Beverage Market include the rise of plant-based products, increased focus on clean label ingredients, and the growing popularity of on-the-go nutrition solutions. These trends reflect changing consumer preferences towards healthier options.

Vitamin Fortified and Mineral Enriched Food & Beverage Market

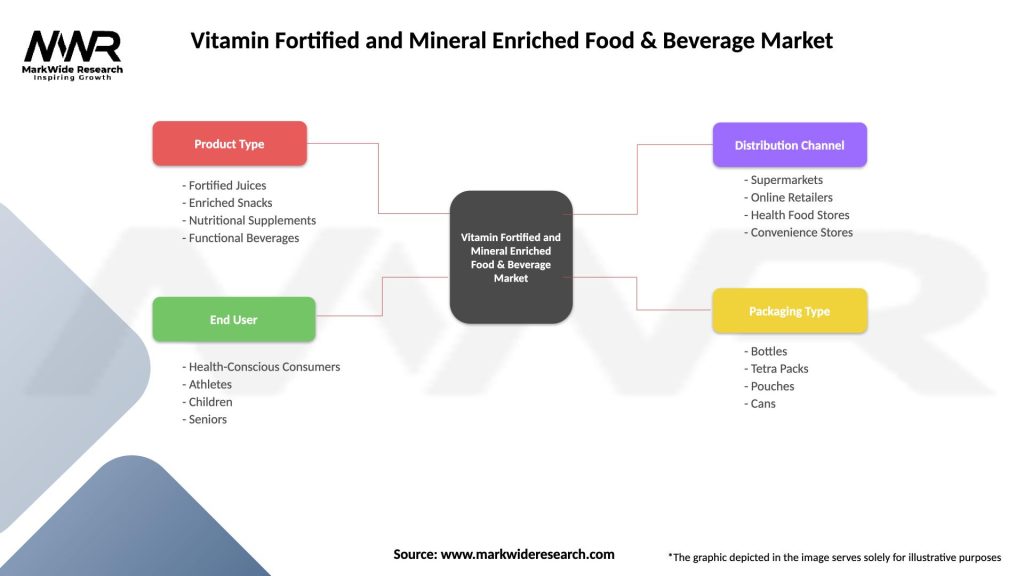

| Segmentation Details | Description |

|---|---|

| Product Type | Fortified Juices, Enriched Snacks, Nutritional Supplements, Functional Beverages |

| End User | Health-Conscious Consumers, Athletes, Children, Seniors |

| Distribution Channel | Supermarkets, Online Retailers, Health Food Stores, Convenience Stores |

| Packaging Type | Bottles, Tetra Packs, Pouches, Cans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vitamin Fortified and Mineral Enriched Food & Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at