444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Virtual Teller Machines market has experienced remarkable growth in recent years, revolutionizing the banking and financial services industry. As an innovative approach to customer service, Virtual Teller Machines (VTMs) have gained widespread popularity due to their ability to combine the convenience of self-service with the human touch of personalized interactions. These machines enable customers to conduct a variety of banking transactions, including cash withdrawals, deposits, account inquiries, and more, all while engaging with a remote teller through video conferencing.

Meaning

Virtual Teller Machines, also known as Interactive Teller Machines (ITMs) or Assisted Self-Service Machines, are advanced banking devices that merge the advantages of traditional ATMs with the benefits of face-to-face interactions with bank tellers. By incorporating video banking capabilities, VTMs offer users a seamless and secure banking experience, allowing them to perform complex transactions with the guidance of a live teller remotely.

Executive Summary

The Virtual Teller Machines market has witnessed robust growth driven by increasing customer demand for convenient and efficient banking services. As the banking sector strives to enhance customer experiences and optimize operational efficiency, VTMs have emerged as a transformative technology. This report provides a comprehensive analysis of the market, including key trends, drivers, restraints, and opportunities.

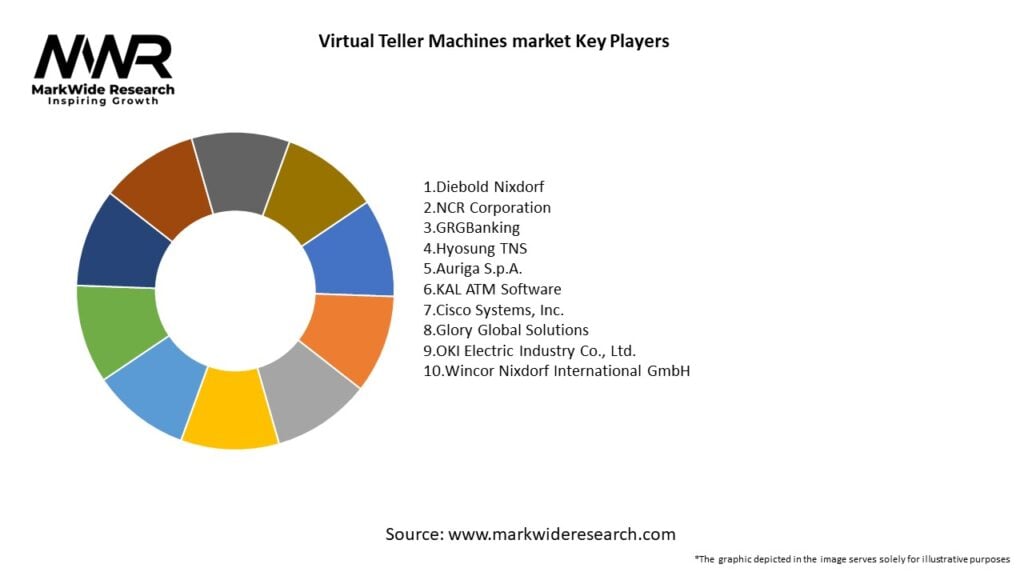

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Virtual Teller Machines market’s growth can be attributed to several crucial factors. First, the rising customer preference for self-service options has driven the adoption of VTMs as they allow users to carry out transactions independently. Second, banks are embracing this technology to optimize their branch networks, reducing costs while still providing personalized services. Third, the integration of advanced technologies like AI and biometrics has bolstered the security and convenience of VTMs, further boosting their adoption.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Virtual Teller Machines market is characterized by dynamic factors that shape its growth and evolution. The integration of cutting-edge technologies, changing customer preferences, regulatory developments, and competition among market players significantly influence this sector.

Regional Analysis

The Virtual Teller Machines market exhibits variations in adoption and demand across different regions. Developed economies have witnessed rapid adoption due to higher technological readiness, while emerging economies are gradually embracing VTMs as they modernize their banking infrastructure.

In North America, the market has flourished, driven by a tech-savvy population and the early adoption of innovative banking solutions. Europe closely follows, with countries like the United Kingdom and Germany leading the VTM adoption. Meanwhile, the Asia-Pacific region presents lucrative opportunities, thanks to the growing banking sector in countries such as China and India.

Competitive Landscape

Leading Companies in Virtual Teller Machines Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

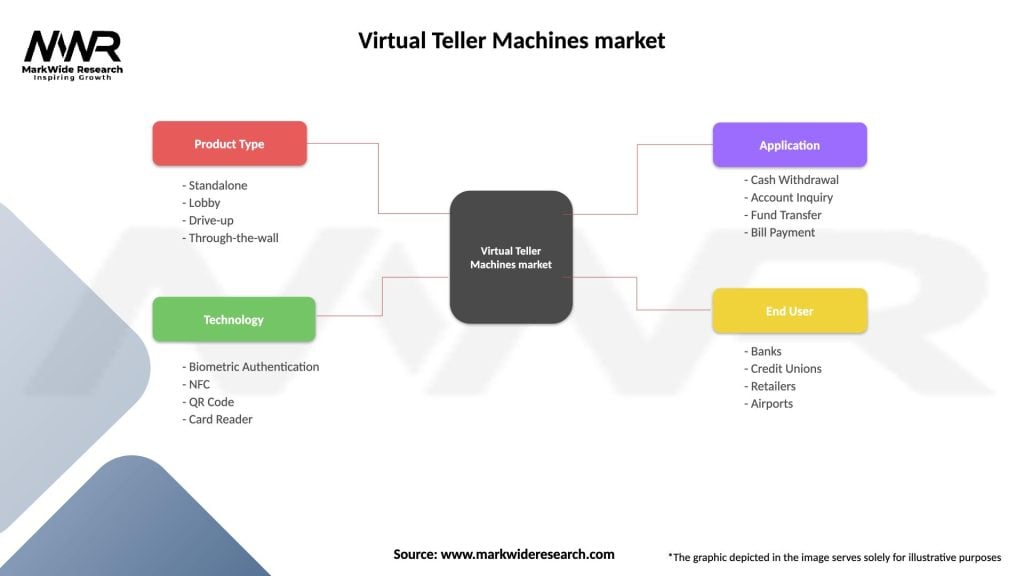

Segmentation

The Virtual Teller Machines market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of Virtual Teller Machines brings several benefits to industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic significantly accelerated the adoption of Virtual Teller Machines. As social distancing became a necessity, traditional banking services faced disruptions, prompting customers to explore alternative banking channels. VTMs emerged as a safe and convenient option, allowing banks to maintain operations and serve customers effectively without compromising safety measures.

Moreover, the pandemic highlighted the need for robust digital banking solutions, leading to increased investment in the development and deployment of VTMs. This trend is likely to continue even post-pandemic, as customers have become accustomed to the ease and efficiency of using VTMs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Virtual Teller Machines market is projected to witness substantial growth in the coming years. As the banking industry continues to embrace digital transformation, VTMs will play a crucial role in redefining customer experiences and streamlining operations. The market is expected to witness innovations in user interfaces, security features, and integration with other financial services, further propelling its growth.

Conclusion

The Virtual Teller Machines market is at the forefront of revolutionizing the banking and financial services sector. With the growing demand for convenience, cost optimization, and enhanced security, VTMs have become a game-changer for the industry. As technology continues to advance, VTMs will evolve to provide even more personalized and efficient services, making them an integral part of the future of banking. The future of VTMs is promising, as they continue to reshape the way customers interact with their banks and redefine the traditional banking experience.

What is Virtual Teller Machines?

Virtual Teller Machines (VTMs) are advanced banking kiosks that allow customers to perform a variety of banking transactions, such as cash deposits, withdrawals, and account inquiries, without the need for a human teller. They combine the functionality of ATMs with video conferencing technology to provide personalized service.

What are the key players in the Virtual Teller Machines market?

Key players in the Virtual Teller Machines market include NCR Corporation, Diebold Nixdorf, and GRG Banking among others. These companies are known for their innovative solutions and technology in the banking sector.

What are the growth factors driving the Virtual Teller Machines market?

The growth of the Virtual Teller Machines market is driven by the increasing demand for self-service banking solutions, the need for enhanced customer experience, and the rise in digital banking trends. Additionally, the convenience and efficiency offered by VTMs are attracting more users.

What challenges does the Virtual Teller Machines market face?

The Virtual Teller Machines market faces challenges such as high initial setup costs, security concerns regarding transactions, and the need for continuous technological upgrades. These factors can hinder the widespread adoption of VTMs in some regions.

What opportunities exist in the Virtual Teller Machines market?

Opportunities in the Virtual Teller Machines market include the expansion of banking services in underserved areas, the integration of advanced technologies like AI and biometrics, and the potential for partnerships with fintech companies. These developments can enhance service offerings and customer engagement.

What trends are shaping the Virtual Teller Machines market?

Trends shaping the Virtual Teller Machines market include the increasing use of contactless transactions, the integration of mobile banking features, and the growing emphasis on customer-centric services. These trends are pushing banks to innovate and improve their VTM offerings.

Virtual Teller Machines market

| Segmentation Details | Description |

|---|---|

| Product Type | Standalone, Lobby, Drive-up, Through-the-wall |

| Technology | Biometric Authentication, NFC, QR Code, Card Reader |

| Application | Cash Withdrawal, Account Inquiry, Fund Transfer, Bill Payment |

| End User | Banks, Credit Unions, Retailers, Airports |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Virtual Teller Machines Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at