444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Virtual Power Plant (VPP) Software as a Service (SaaS) market is witnessing significant growth and transformation as the energy sector embraces digitization and decentralization. A Virtual Power Plant is a cloud-based energy management system that integrates various distributed energy resources, such as solar panels, wind turbines, battery storage, and electric vehicles, into a unified network. The VPP software allows these resources to be remotely monitored, controlled, and optimized for better grid stability and cost-effectiveness.

Meaning

A Virtual Power Plant (VPP) is an intelligent energy management concept that connects numerous distributed energy resources, aggregating them into a unified and controllable network. The VPP operates as a virtual entity, mimicking the behavior of a traditional power plant but without physical boundaries. Through advanced software and data analytics, it optimizes the dispatch and utilization of diverse energy assets, leading to increased grid flexibility and reliability.

Executive Summary

The Virtual Power Plant Software as a Service market has gained substantial momentum in recent years due to the increasing adoption of renewable energy sources and the growing demand for efficient energy management solutions. The SaaS model has further accelerated this growth by offering cost-effective and easily deployable VPP solutions to a broader range of customers. As businesses and utility companies seek innovative ways to improve grid performance and reduce carbon footprints, the VPP SaaS market is poised for continued expansion.

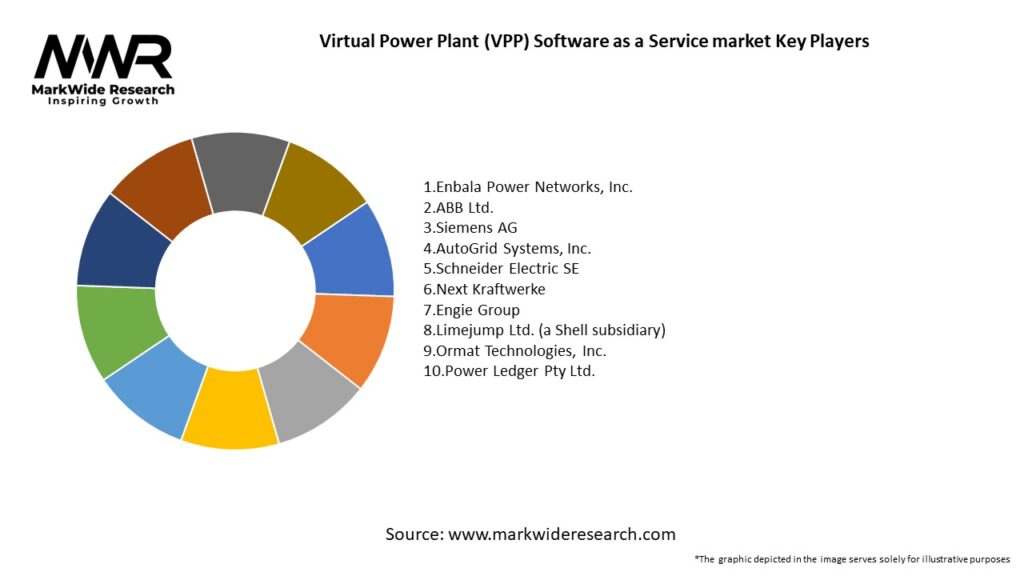

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Virtual Power Plant Software as a Service market is characterized by rapid technological advancements and evolving energy landscape. The growing focus on sustainable energy solutions, coupled with advancements in IoT, AI, and data analytics, has propelled the market forward. Despite challenges related to initial investment and regulatory barriers, the market is witnessing significant opportunities in emerging economies and energy storage innovations.

Regional Analysis

The VPP SaaS market exhibits regional variations driven by energy policies, renewable energy adoption, and market maturity. North America and Europe lead the market due to favorable regulatory frameworks and strong emphasis on sustainability. Asia-Pacific shows promising growth potential, fueled by increasing energy demands in populous countries and supportive government initiatives. Latin America and the Middle East are also expected to witness steady growth as they explore renewable energy integration options.

Competitive Landscape

Leading Companies in Virtual Power Plant (VPP) Software as a Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

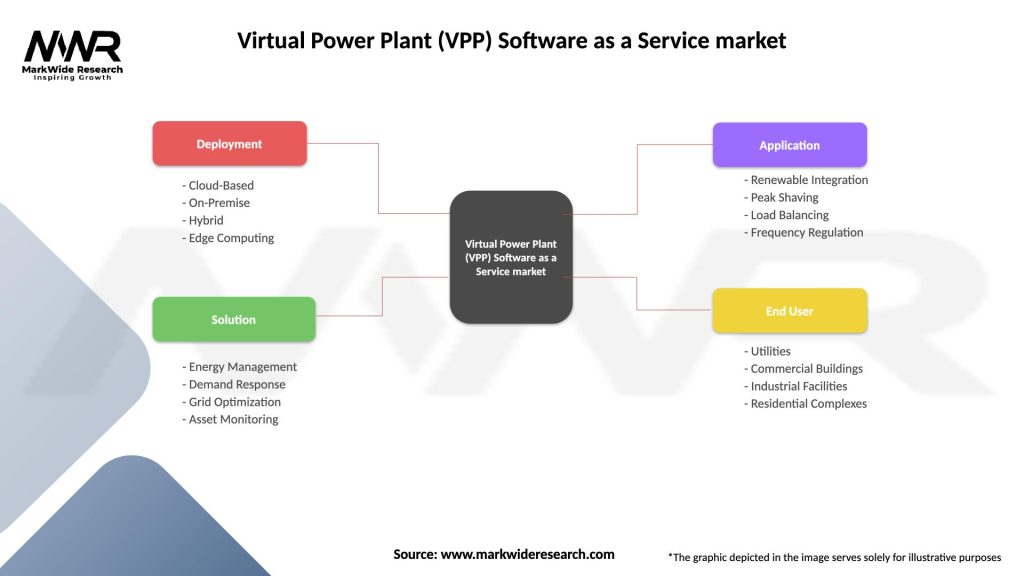

Segmentation

The VPP SaaS market can be segmented based on deployment models (public, private, hybrid), end-users (commercial, industrial, residential), and the type of virtual power plants (renewable-based, mixed asset, demand response-based). Each segment has its unique set of requirements and opportunities, driving the need for tailored VPP solutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had mixed effects on the VPP SaaS market. While initial disruptions in supply chains and workforce availability affected installations, the increased focus on resilient energy systems and remote energy management boosted the demand for VPP solutions. The pandemic accelerated digitalization in the energy sector, leading to greater adoption of cloud-based energy management solutions like VPP SaaS.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Virtual Power Plant Software as a Service market is expected to witness robust growth in the coming years, driven by increasing renewable energy adoption, advancements in IoT and AI technologies, and the need for grid stability. The market will continue to expand globally, with emerging economies playing a pivotal role in driving demand. As VPPs become more commonplace, they will be integral in creating a decentralized, resilient, and sustainable energy future.

Conclusion

The Virtual Power Plant Software as a Service market represents a transformative approach to energy management, enabling the integration of diverse distributed energy resources into a unified and intelligent network. As the world continues to prioritize sustainable energy solutions, VPP SaaS will play a crucial role in enhancing grid stability, reducing carbon emissions, and optimizing energy usage for consumers, utilities, and energy asset owners. With ongoing technological advancements, supportive policies, and collaborative efforts, the future of the VPP SaaS market looks promising and essential for the global energy transition.

What is Virtual Power Plant (VPP) Software as a Service?

Virtual Power Plant (VPP) Software as a Service refers to a cloud-based platform that integrates various distributed energy resources to optimize energy production and consumption. It enables real-time monitoring, management, and coordination of energy assets, enhancing grid reliability and efficiency.

What are the key companies in the Virtual Power Plant (VPP) Software as a Service market?

Key companies in the Virtual Power Plant (VPP) Software as a Service market include Siemens, Enel X, and Next Kraftwerke, among others. These companies are known for their innovative solutions that facilitate the integration of renewable energy sources and improve energy management.

What are the growth factors driving the Virtual Power Plant (VPP) Software as a Service market?

The growth of the Virtual Power Plant (VPP) Software as a Service market is driven by the increasing demand for renewable energy integration, advancements in smart grid technologies, and the need for enhanced energy efficiency. Additionally, regulatory support for clean energy initiatives is also a significant factor.

What challenges does the Virtual Power Plant (VPP) Software as a Service market face?

The Virtual Power Plant (VPP) Software as a Service market faces challenges such as data security concerns, the complexity of integrating diverse energy resources, and regulatory hurdles. These factors can hinder the widespread adoption of VPP solutions.

What opportunities exist in the Virtual Power Plant (VPP) Software as a Service market?

Opportunities in the Virtual Power Plant (VPP) Software as a Service market include the expansion of electric vehicle charging infrastructure, the growth of energy storage solutions, and the increasing focus on decentralized energy systems. These trends can enhance the functionality and appeal of VPP services.

What trends are shaping the Virtual Power Plant (VPP) Software as a Service market?

Trends shaping the Virtual Power Plant (VPP) Software as a Service market include the rise of artificial intelligence for predictive analytics, the integration of blockchain for secure transactions, and the growing emphasis on sustainability. These innovations are transforming how energy resources are managed and optimized.

Virtual Power Plant (VPP) Software as a Service market

| Segmentation Details | Description |

|---|---|

| Deployment | Cloud-Based, On-Premise, Hybrid, Edge Computing |

| Solution | Energy Management, Demand Response, Grid Optimization, Asset Monitoring |

| Application | Renewable Integration, Peak Shaving, Load Balancing, Frequency Regulation |

| End User | Utilities, Commercial Buildings, Industrial Facilities, Residential Complexes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Virtual Power Plant (VPP) Software as a Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at